Europe Fuel Cards For Commercial Fleet Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

39.13 Billion

USD

64.28 Billion

2024

2032

USD

39.13 Billion

USD

64.28 Billion

2024

2032

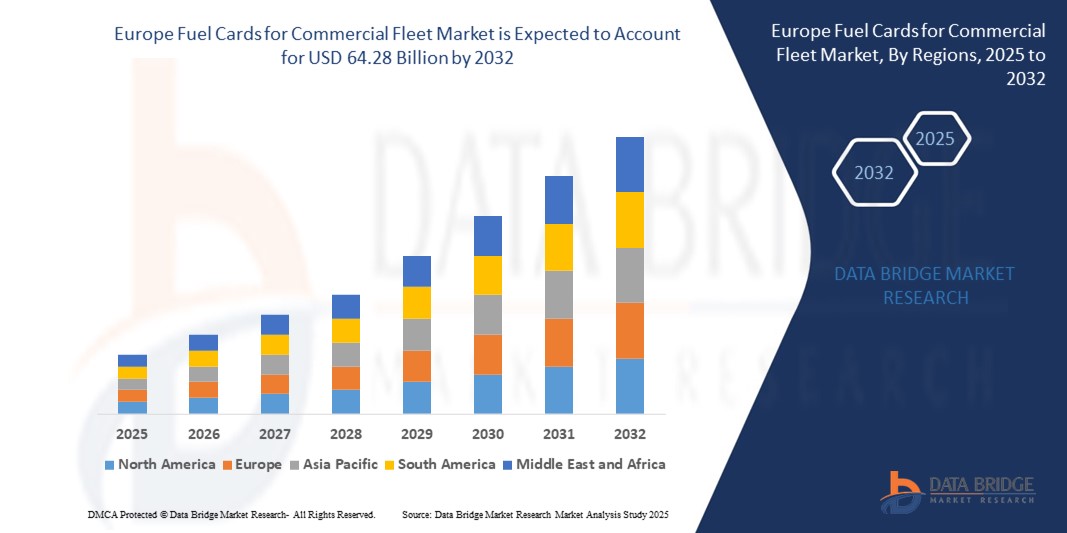

| 2025 –2032 | |

| USD 39.13 Billion | |

| USD 64.28 Billion | |

|

|

|

|

Segmentación del mercado europeo de tarjetas de combustible para flotas comerciales, por tipo de tarjeta (tarjetas de combustible universales, tarjetas de combustible de marca y tarjetas de combustible para comercios), características (pago móvil y transacciones sin tarjeta, informes de vehículos, actualizaciones en tiempo real, compatibilidad con EMV, tokenización, etc.), tipo de suscripción (tarjeta registrada y tarjeta al portador), utilidad (pago de combustible, mantenimiento de flotas, estacionamiento de vehículos, peajes, etc.), tipo de flota (flotas de reparto, flotas de taxis, flotas de alquiler de vehículos, flotas de servicios públicos, etc.), sector (transporte y logística, construcción, sector corporativo, automoción, alimentación y bebidas, sanidad, químico, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado europeo de tarjetas de combustible para flotas comerciales

- El tamaño del mercado de tarjetas de combustible para flotas comerciales en Europa se valoró en USD 39,13 mil millones en 2024 y se espera que alcance los USD 64,28 mil millones para 2032 , con una CAGR del 6,40% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente necesidad de sistemas de gestión de combustible eficientes y medidas de control de costos en las operaciones de flotas comerciales, lo que fomenta la adopción generalizada de tarjetas de combustible entre los administradores de flotas y los proveedores de logística.

- Además, la creciente demanda de seguimiento de combustible en tiempo real, mejores capacidades de generación de informes y soluciones integradas de gestión de gastos está posicionando las tarjetas de combustible como una herramienta estratégica para optimizar la eficiencia de la flota. Esta dinámica está impulsando el mercado y reforzando el papel de las tarjetas de combustible en el cambiante sector del transporte comercial europeo.

Análisis del mercado europeo de tarjetas de combustible para flotas comerciales

- Las tarjetas de combustible, que ofrecen soluciones de pago electrónico específicamente para gastos relacionados con el combustible y los vehículos, se están convirtiendo en herramientas esenciales para gestionar la eficiencia operativa en todo el sector de flotas comerciales de Europa debido a su seguimiento optimizado de gastos, control mejorado sobre el uso del combustible e integración con los sistemas de gestión de flotas.

- La creciente demanda de tarjetas de combustible se debe principalmente al aumento del costo del combustible, la creciente presión sobre los operadores de flotas para reducir los gastos generales y la necesidad de obtener información en tiempo real para optimizar la planificación de rutas y el consumo de combustible.

- Alemania dominó el mercado de tarjetas de combustible para flotas comerciales con la mayor participación en los ingresos del 29,9 % en 2024, respaldada por su amplia infraestructura logística, la adopción de telemática avanzada y el énfasis regulatorio en la transparencia de la flota, con los principales proveedores de combustible y empresas de gestión de flotas integrando soluciones de tarjetas de combustible a escala.

- Se espera que Polonia sea el país de más rápido crecimiento en el mercado europeo de tarjetas de combustible para flotas comerciales durante el período de pronóstico debido a su floreciente sector de transporte, el creciente movimiento de carga transfronterizo y la creciente inversión en la digitalización de la flota comercial.

- El segmento de tarjetas de combustible universales dominó el mercado europeo de tarjetas de combustible para flotas comerciales con una participación de mercado del 48,3 % en 2024, impulsado por su versatilidad al permitir compras en múltiples marcas de combustible y su compatibilidad con una gama más amplia de servicios de flotas.

Alcance del informe y segmentación del mercado europeo de tarjetas de combustible para flotas comerciales

|

Atributos |

Perspectivas clave del mercado: Tarjetas de combustible para flotas comerciales en Europa |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado europeo de tarjetas de combustible para flotas comerciales

Integración de gastos y telemática impulsada por IA

- Una tendencia significativa y en auge en el mercado europeo de tarjetas de combustible para flotas comerciales es la integración de soluciones de tarjetas de combustible con inteligencia artificial (IA) y sistemas telemáticos avanzados. Esta convergencia está mejorando significativamente el seguimiento en tiempo real, la eficiencia del combustible y el control de costes para los operadores de flotas de toda la región.

- Por ejemplo, UTA Edenred ha introducido plataformas de flotas con IA que combinan datos de tarjetas de combustible con GPS y análisis del comportamiento del conductor para optimizar rutas y mejorar el kilometraje. De igual forma, la aplicación Fleet de Shell se integra con proveedores de telemática para ofrecer información sobre patrones de consumo de combustible y la gestión de la huella de carbono.

- La integración de IA permite el análisis predictivo para el mantenimiento, la detección de fraudes y la automatización de los procesos de recuperación del IVA. Por ejemplo, las soluciones de DKV Mobility utilizan el aprendizaje automático para detectar transacciones irregulares de combustible y recomendar puntos de repostaje más económicos según el historial de rutas y las tendencias de precios.

- La perfecta combinación de tarjetas de combustible con plataformas telemáticas y de IA facilita el control centralizado de la flota a través de un único panel de control, lo que permite a los administradores monitorear el consumo de combustible, los gastos, las emisiones y el rendimiento del conductor en tiempo real. Esto crea un entorno de flota más inteligente y eficiente.

- Esta tendencia hacia soluciones de tarjetas de combustible inteligentes y automatizadas está transformando radicalmente las expectativas en el sector de las flotas comerciales. Por ello, empresas como WEX Europe Services están invirtiendo en plataformas basadas en IA que ofrecen funciones integradas de peaje, mantenimiento y pago de combustible en múltiples países.

- La demanda de sistemas de tarjetas de combustible conectados y mejorados con IA está creciendo rápidamente en los sectores de logística y transporte, a medida que los operadores priorizan cada vez más la optimización de costos, la transparencia operativa y la eficiencia de la flota transfronteriza.

Dinámica del mercado europeo de tarjetas de combustible para flotas comerciales

Conductor

Creciente necesidad de optimización de costos y cumplimiento normativo

- La creciente presión sobre los operadores de flotas comerciales para gestionar los costos de manera más efectiva, combinada con la evolución de los requisitos regulatorios en toda Europa, es un impulsor importante de la creciente demanda de tarjetas de combustible.

- Por ejemplo, en marzo de 2024, BP lanzó una versión mejorada de su Tarjeta de Combustible BP Plus en Europa, que integra funciones avanzadas de seguimiento de gastos e informes de emisiones para contribuir al cumplimiento de los mandatos de sostenibilidad de la UE. Se espera que estas innovaciones aceleren el crecimiento del mercado durante el período de pronóstico.

- A medida que las empresas enfrentan precios de combustible fluctuantes e impuestos complejos en múltiples jurisdicciones, las tarjetas de combustible ofrecen beneficios como facturación centralizada, recuperación de IVA simplificada e informes de gastos detallados que proporcionan una clara ventaja sobre los sistemas de reembolso tradicionales.

- Además, la integración de las tarjetas de combustible con el software de gestión de flotas permite el monitoreo en tiempo real de las transacciones de combustible, la optimización de rutas y la prevención del fraude, lo que permite a las empresas mejorar la eficiencia operativa.

- La comodidad de la usabilidad multipaís, la facturación consolidada y la compatibilidad con una amplia red de gasolineras y servicios de peaje hacen que las tarjetas de combustible sean cada vez más esenciales para los operadores logísticos transfronterizos. Esto, sumado a las crecientes inversiones en infraestructura digital para flotas, continúa impulsando su adopción en el mercado en segmentos de flotas pequeñas y grandes.

Restricción/Desafío

Preocupaciones sobre ciberseguridad y limitaciones de compatibilidad transfronteriza

- La preocupación por las vulnerabilidades de ciberseguridad y su aceptación desigual en los países europeos supone un reto importante para la adopción generalizada de las tarjetas de combustible. A medida que los sistemas de tarjetas de combustible se integran más con las plataformas digitales, se exponen a riesgos como filtraciones de datos y transacciones fraudulentas.

- Por ejemplo, los informes sobre uso no autorizado de tarjetas e intrusiones en el sistema han aumentado la cautela entre los administradores de flotas, particularmente en el contexto de plataformas de gestión de flotas cada vez más digitales y basadas en la nube.

- Abordar estas preocupaciones de ciberseguridad mediante la autenticación segura, la monitorización de transacciones y el cifrado avanzado es esencial para garantizar la protección de los datos y la confianza en el sistema. Empresas como TotalEnergies y DKV invierten activamente en herramientas de detección de fraude en tiempo real para abordar estas amenazas.

- Además, la limitada interoperabilidad de ciertas tarjetas de combustible entre las redes de combustible o los sistemas nacionales de peaje sigue siendo un obstáculo clave, especialmente para los operadores que gestionan rutas transfronterizas. Las inconsistencias en la documentación fiscal y la falta de soporte multilingüe dificultan aún más la adopción fluida.

- Si bien los principales proveedores ofrecen cobertura paneuropea, los operadores de flotas más pequeñas pueden encontrar soluciones avanzadas prohibitivas o difíciles de implementar. Superar estos desafíos mediante una mayor compatibilidad de sistemas, sólidas funciones de seguridad y soluciones a medida para pymes será fundamental para mantener el crecimiento a largo plazo en el mercado europeo.

Mercado de tarjetas de combustible para flotas comerciales en Europa

El mercado está segmentado según el tipo de tarjeta, características, tipo de suscripción, utilidad, tipo de flota e industria.

- Por tipo de tarjeta

Según el tipo de tarjeta, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en tarjetas universales, tarjetas de marca y tarjetas comerciales. El segmento de tarjetas universales dominó el mercado con la mayor cuota de mercado, un 48,3%, en 2024, gracias a su flexibilidad para ser aceptadas en una amplia gama de gasolineras de diferentes marcas y países. Estas tarjetas son las preferidas por los operadores de flotas grandes y multinacionales por su facturación centralizada, la simplificación de la declaración de impuestos y su amplia aceptación, especialmente en operaciones transfronterizas.

Se prevé que el segmento de tarjetas de combustible de marca experimente la tasa de crecimiento más rápida, del 19,4 %, entre 2025 y 2032, impulsada por programas de fidelización, descuentos en combustible y servicios exclusivos de los principales proveedores. Las tarjetas de marca son atractivas para los operadores de flotas regionales que priorizan la rentabilidad, los puntos de recompensa y una cobertura de red confiable dentro de cadenas de combustible específicas.

- Por características

En función de sus características, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en pagos móviles y transacciones sin tarjeta, informes de vehículos, actualizaciones en tiempo real, compatibilidad con EMV, tokenización, entre otros. El segmento de informes de vehículos registró la mayor cuota de mercado en 2024, impulsado por la creciente demanda de análisis telemáticos y seguimiento del consumo de combustible a nivel de conductor. Los operadores de flotas recurren cada vez más a informes detallados para supervisar el consumo de combustible, detectar irregularidades y mejorar la eficiencia operativa.

Se prevé que el segmento de pagos móviles y transacciones sin tarjeta experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la adopción de billeteras digitales, aplicaciones para smartphones y soluciones de pago sin contacto. Estas características mejoran la seguridad y la comodidad del usuario, en línea con las tendencias más amplias en gestión de flotas sin contacto y autorización remota.

- Por tipo de suscripción

Según el tipo de suscripción, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en tarjetas registradas y tarjetas al portador. El segmento de tarjetas registradas dominó el mercado con la mayor cuota de ingresos en 2024, gracias a sus funciones de seguridad mejoradas, el seguimiento del uso específico del conductor y las funciones de control de acceso. Los gestores de flotas prefieren las tarjetas registradas para supervisar el gasto individual de cada conductor, garantizar el cumplimiento de las políticas y generar informes personalizados.

Se proyecta que el segmento de tarjetas al portador crezca a un ritmo constante durante el período de pronóstico gracias a su flexibilidad y facilidad de emisión. Estas tarjetas son especialmente útiles para conductores temporales o flotas pequeñas que requieren opciones de pago de combustible rápidas y de bajo mantenimiento, sin vinculación a perfiles individuales.

- Por utilidad

En función de su utilidad, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en pago de tasas de combustible, mantenimiento de flotas, tarifas de estacionamiento de vehículos, pago de peajes, etc. El segmento de pago de tasas de combustible representó la mayor cuota de mercado en 2024, ya que el combustible sigue siendo el principal gasto para la mayoría de las flotas comerciales. Las tarjetas de combustible simplifican el proceso de repostaje, a la vez que ofrecen transparencia en las transacciones, control de costes y una gestión centralizada de gastos.

Se prevé que el segmento de mantenimiento de flotas experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente adopción de servicios de mantenimiento predictivo y la integración de los costos de reparación y mantenimiento en las plataformas de tarjetas de combustible. Los operadores de flotas utilizan cada vez más las tarjetas de combustible para gastos más amplios relacionados con los vehículos, optimizando así las operaciones y mejorando la precisión presupuestaria.

- Por tipo de flota

Según el tipo de flota, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en flotas de reparto, flotas de taxis, flotas de alquiler de vehículos, flotas de servicios públicos, entre otras. El segmento de flotas de reparto registró la mayor cuota de mercado en 2024, impulsado por el auge de la logística de última milla y el comercio electrónico. La alta frecuencia de repostaje y las operaciones con gran volumen de rutas hacen que las tarjetas de combustible sean esenciales para optimizar el gasto en combustible y garantizar entregas puntuales.

Se prevé que el segmento de flotas de alquiler de vehículos registre la tasa de crecimiento más rápida, del 21,3 %, entre 2025 y 2032, impulsada por la creciente demanda de servicios de seguimiento de combustible y movilidad rentables en los mercados de alquiler a corto plazo y leasing corporativo. Las tarjetas de combustible ofrecen a los operadores de alquiler una gestión simplificada de la flota y una menor carga administrativa.

- Por industria

Por industria, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en transporte y logística, construcción, sector corporativo, automoción, alimentación y bebidas, sanidad, química, entre otros. El segmento de transporte y logística dominó el mercado con la mayor cuota de ingresos en 2024, debido a la gran dependencia del sector del combustible y al movimiento transfronterizo de flotas. Las tarjetas de combustible apoyan a este sector ofreciendo una compra simplificada de combustible, asistencia para la devolución del IVA y un análisis exhaustivo de datos.

Se proyecta que el segmento corporativo experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el creciente uso de vehículos propios o alquilados para la movilidad de los empleados y los viajes de negocios. Las empresas están adoptando tarjetas de combustible para gestionar gastos, garantizar el cumplimiento de las políticas e integrar los datos de consumo de combustible con sistemas más amplios de planificación de recursos empresariales (ERP).

Análisis regional del mercado europeo de tarjetas de combustible para flotas comerciales

- Alemania dominó el mercado de tarjetas de combustible para flotas comerciales con la mayor participación en los ingresos del 29,9 % en 2024, respaldada por su amplia infraestructura logística, la adopción de telemática avanzada y el énfasis regulatorio en la transparencia de la flota, con los principales proveedores de combustible y empresas de gestión de flotas integrando soluciones de tarjetas de combustible a escala.

- Los operadores de flotas del país priorizan la eficiencia operativa, la transparencia de costos y las herramientas digitales que agilizan el seguimiento de gastos, haciendo de las tarjetas de combustible un componente esencial de las operaciones de flotas modernas.

- Esta adopción generalizada está respaldada además por una infraestructura sólida, una alta densidad de redes de estaciones de combustible y crecientes requisitos regulatorios para informes de combustible y emisiones, lo que posiciona a Alemania como un mercado líder para sistemas avanzados de tarjetas de combustible en flotas logísticas nacionales y transfronterizas.

Perspectiva del mercado alemán de tarjetas de combustible para flotas comerciales

El mercado alemán de tarjetas de combustible para flotas comerciales capturó la mayor cuota de mercado en Europa en 2024, gracias a su avanzada infraestructura logística, el alto uso de vehículos comerciales y una sólida red de gasolineras. El fuerte énfasis del país en las operaciones digitales de flotas y el cumplimiento normativo impulsa la adopción generalizada de tarjetas de combustible entre las empresas de transporte nacionales e internacionales. Los gestores de flotas alemanes apuestan cada vez más por soluciones integradas con IA que combinan el control de gastos de combustible con el seguimiento de emisiones y los servicios de peaje. Además, los proveedores innovadores ofrecen funciones de valor añadido como análisis de combustible en tiempo real, pagos móviles seguros y funciones automatizadas de recuperación de impuestos.

Análisis del mercado de tarjetas de combustible para flotas comerciales del Reino Unido

Se prevé que el mercado británico de tarjetas de combustible para flotas comerciales crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la expansión del sector logístico y la creciente demanda de operaciones de flota digitalizadas. Los operadores de flotas británicos están adoptando tarjetas de combustible para mejorar el control de transacciones, la previsión de costes y la integración con sistemas de flota móviles y GPS. El aumento de los precios del combustible y la evolución de las normativas de reducción de emisiones de carbono están impulsando a las empresas hacia soluciones de bajo consumo de combustible, lo que hace esenciales las plataformas de tarjetas con gran cantidad de datos. La tendencia hacia la adopción de vehículos eléctricos también abre oportunidades para servicios de tarjetas multienergía que abarcan tanto el combustible como la carga de vehículos eléctricos.

Análisis del mercado de tarjetas de combustible para flotas comerciales en Francia

El mercado francés de tarjetas de combustible para flotas comerciales está cobrando impulso gracias al enfoque del país en la sostenibilidad de las flotas y las iniciativas de transporte inteligente. Las empresas francesas de transporte y logística están invirtiendo en sistemas de tarjetas de combustible con conectividad telemática que ofrecen monitorización integral de la flota y control de costes. Los incentivos gubernamentales para la movilidad limpia y la implantación de zonas de bajas emisiones están impulsando la demanda de soluciones de tarjetas de combustible basadas en datos. Además, el creciente sector del comercio electrónico en Francia está impulsando la demanda de flotas de reparto con tarjetas de combustible, con un fuerte enfoque en controles de acceso específicos para cada usuario y plataformas digitales multilingües.

Análisis del mercado de tarjetas de combustible para flotas comerciales en Polonia

Se espera que el mercado polaco de tarjetas de combustible para flotas comerciales crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida de Europa durante el período de pronóstico, impulsado por la ubicación estratégica del país en los corredores comerciales europeos y la expansión de las actividades de transporte transfronterizo. El auge de los servicios logísticos organizados y la creciente adopción digital por parte de los operadores de flotas impulsan la demanda de soluciones flexibles y paneuropeas de tarjetas de combustible. Los gestores de flotas polacos valoran las herramientas que ofrecen seguimiento en tiempo real, procesamiento automatizado de impuestos y compatibilidad con múltiples divisas y redes de peajes. Los proveedores de tarjetas de combustible que ofrecen soluciones a medida para pymes y operadores de transporte están ganando terreno en el mercado.

Cuota de mercado de las tarjetas de combustible para flotas comerciales en Europa

La industria europea de tarjetas de combustible para flotas comerciales está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Shell plc (Reino Unido)

- BP plc (Reino Unido)

- TotalEnergies SE (Francia)

- DKV Mobility Service Group GmbH (Alemania)

- WEX Inc. (EE. UU.)

- Eurowag (República Checa)

- Radius Payment Solutions Limited (Reino Unido)

- Fleetcor Technologies, Inc. (EE. UU.)

- Aral AG (Alemania)

- UTA Edenred (Alemania)

- Allstar Business Solutions Limited (Reino Unido)

- Eni SpA (Italia)

- OMV Aktiengesellschaft (Austria)

- Repsol SA (España)

- AVIA International (Suiza)

- Neste Oyj (Finlandia)

- Esso (ExxonMobil) (EE. UU.)

- Circle K AS (Noruega)

- AS 24 (Francia)

- OKQ8 AB (Suecia)

¿Cuáles son los últimos avances en el mercado europeo de tarjetas de combustible para flotas comerciales?

- En mayo de 2025, DKV Mobility, líder europeo en soluciones de pago para flotas, anunció una alianza estratégica con Fuuse, una plataforma de gestión de puntos de recarga para vehículos eléctricos con sede en el Reino Unido. Esta colaboración añade más de 2400 puntos de recarga para vehículos eléctricos a la red de DKV, accesibles mediante la Tarjeta DKV +Carga y la app de DKV Mobility, lo que mejora la disponibilidad y la facilidad de recarga para las flotas.

- En abril de 2025, cuatro operadores líderes en carga de vehículos eléctricos (Atlante (Italia), IONITY (Alemania), Fastned (Países Bajos) y Electra (Francia)) anunciaron la formación de Spark Alliance. Este consorcio establecerá una red unificada de 11.000 puntos de carga ultrarrápida en 25 países europeos, que permitirá a los conductores acceder y pagar las sesiones de carga a través de cualquier aplicación de los miembros.

- En febrero de 2023, DKV Mobility, la plataforma B2B líder en Europa para pagos y soluciones en carretera, firmó un acuerdo de colaboración con TotalEnergies para incorporar más de 2000 nuevos puntos de recarga públicos en el Reino Unido. Estos nuevos puntos forman parte de la red de recarga pública Source London, operada por TotalEnergies. Se podrá acceder a estos puntos de recarga a través de la Tarjeta DKV +Charge y la app de DKV Mobility.

- En abril de 2022, el Grupo Volkswagen y BP lanzaron una alianza estratégica para implementar rápidamente cargadores ultrarrápidos para vehículos eléctricos en toda Europa. La iniciativa tenía como objetivo desplegar hasta 4.000 puntos de carga en Alemania y el Reino Unido en un plazo de 24 meses, con el potencial de alcanzar los 8.000 en toda Europa.

- En febrero de 2021, la división alemana de venta minorista de combustible de Aral BP aceleró la expansión de su red de carga ultrarrápida Aral Pulse, implementando 500 puntos de carga en más de 120 ubicaciones.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.