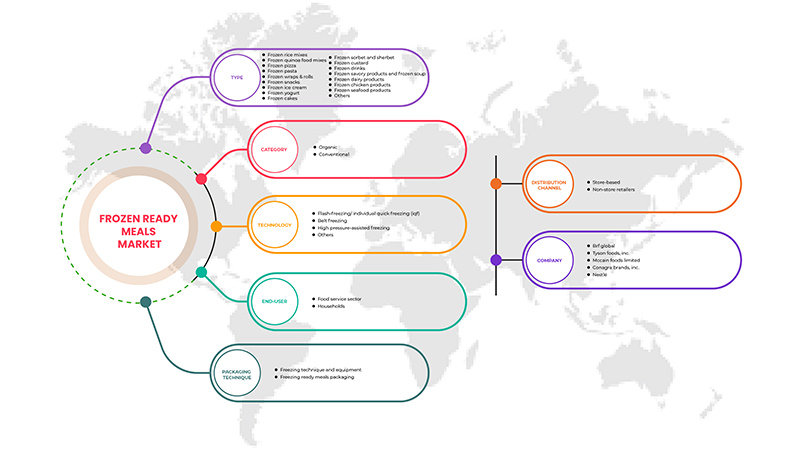

Mercado europeo de comidas preparadas congeladas, por tipo (mezclas de arroz congelado, mezclas de alimentos de quinua congelada, pizza congelada, pasta congelada, wraps y rollitos congelados, snacks congeladoshelado congeladoyogur helado , tartas congeladas, sorbetes y granizados congelados, natillas congeladas, bebidas congeladas, productos salados congelados y sopas congeladas, productos lácteos congelados, productos de pollo congelados , productos de mar congelados y otros), categoría (orgánica y convencional), tecnología (congelación instantánea/ congelación rápida individual (IQF) , congelación en cinta, congelación asistida por alta presión y otras), usuario final (sector de servicios de alimentación y hogares), técnica de envasado (técnica y equipo de congelación y envasado de comidas preparadas congeladas y canal de distribución (minoristas con y sin tienda): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de platos preparados congelados en Europa

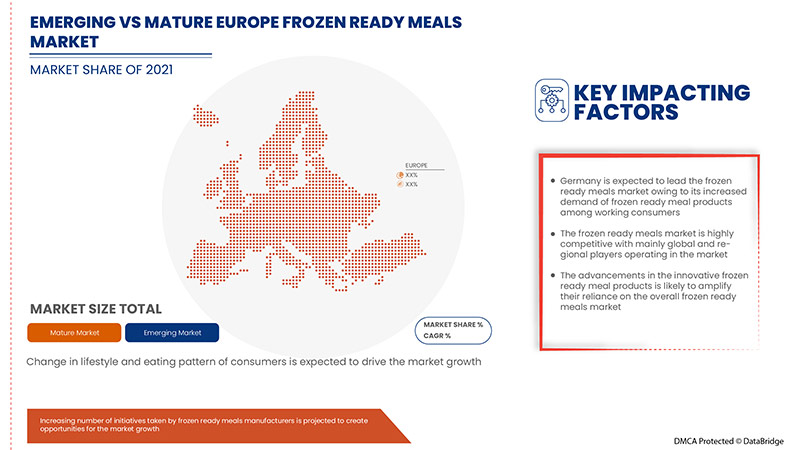

El mercado europeo de platos preparados congelados está creciendo más rápido debido al ajetreado estilo de vida de los consumidores. El creciente número de personas que modifican sus hábitos alimentarios y adoptan una dieta nutricional equilibrada y un estilo de vida activo es un elemento importante que impulsa el crecimiento de la industria de los platos preparados congelados. Las personas de todo el mundo tienen un estilo de vida agitado y, por lo tanto, prefieren los platos preparados para ahorrar energía y tiempo, lo que beneficia el crecimiento del mercado. Sin embargo, los altos precios de los platos preparados congelados pueden obstaculizar el crecimiento del mercado.

Varias empresas están tomando decisiones estratégicas, como lanzar innovadores alimentos preparados congelados y adquirir otras empresas para mejorar su participación en el mercado. Como resultado, el mercado mundial de comidas preparadas congeladas está creciendo rápidamente. El aumento del consumo de pollo, carne de res y mariscos congelados abrirá nuevas oportunidades para el mercado global. Por el contrario, la competencia entre los actores del mercado puede desafiar el crecimiento del mercado.

Varias empresas están tomando decisiones estratégicas, como lanzar innovadores alimentos preparados congelados y adquirir otras empresas para mejorar su participación en el mercado. Como resultado, el mercado mundial de comidas preparadas congeladas está creciendo rápidamente. El aumento del consumo de pollo, carne de res y mariscos congelados abrirá nuevas oportunidades para el mercado global. Por el contrario, la competencia entre los actores del mercado puede desafiar el crecimiento del mercado.

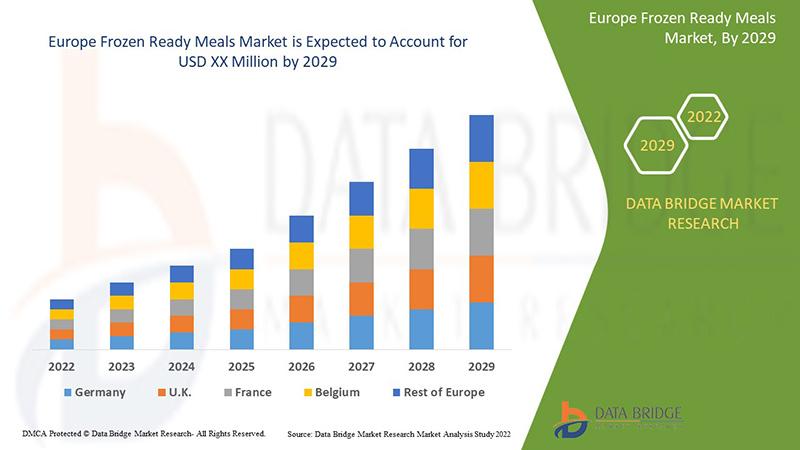

Data Bridge Market Research analiza que el mercado europeo de comidas preparadas congeladas crecerá a una CAGR del 5,6 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (personalizable para 2019-2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (mezclas de arroz congelado, mezclas de alimentos de quinua congelada, pizza congelada, pasta congelada, wraps y rollitos congelados, bocadillos congelados , helado congelado , yogur helado , pasteles congelados, sorbetes y granizados congelados, natillas congeladas, bebidas congeladas, productos salados congelados y sopas congeladas, productos lácteos congelados, productos de pollo congelados , productos de mariscos congelados y otros), categoría (orgánica y convencional), tecnología (congelación instantánea/ congelación rápida individual (IQF) , congelación en cinta, congelación asistida por alta presión y otros), usuario final (sector de servicios de alimentos y hogares), técnica de envasado (técnica y equipo de congelación y envasado de comidas preparadas congeladas y canal de distribución (minoristas en tiendas y fuera de tiendas) |

|

Regiones cubiertas |

Alemania, Reino Unido, Francia, Italia, España, Suecia, Bélgica, Países Bajos, Dinamarca, Suiza, Rusia, Polonia, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

McCain Foods Limited, Nestlé, Tyson Foods, Inc., BRF Global, General Mills Inc., JBS S/A, Nomad Foods, The Kraft Heinz Company, Dr. Oetker, Kellogg Co., Ajinomoto Co., Inc., McCain Foods Limited, Grupo Virto |

Definición de mercado

Las comidas congeladas preparadas suelen cocinarse y envasarse en una fábrica. Este proceso incluye calentar los ingredientes y envasarlos en recipientes. Una vez que la comida está preparada y se coloca en un congelador para que se enfríe, son populares entre los consumidores porque ofrecen un menú variado y son fáciles de preparar. Las comidas congeladas pueden contener un plato principal de carne, una verdura y alimentos a base de almidón, como pasta y salsa. Algunas comidas congeladas se preparan específicamente para vegetarianos o personas con determinadas necesidades dietéticas. La fabricación de un producto de este tipo requiere una atención cuidadosa por parte del procesador de alimentos.

Dinámica del mercado de platos preparados congelados en Europa

Conductores

- Creciente preferencia por alimentos orgánicos listos para consumir

En los últimos años, los alimentos listos para consumir se han convertido en una de las secciones más diversificadas del negocio global de comidas preparadas. Un crecimiento en los patrones de conveniencia y un aumento en la demanda de comidas orgánicas han llevado a una creciente necesidad de comidas envasadas congeladas orgánicas. El sector de alimentos y bebidas congeladas orgánicas es otra parada para los consumidores en movimiento, que ofrece desde dulces congelados hasta aperitivos y comidas. Las comidas preparadas congeladas orgánicas son populares entre los consumidores debido a su falta de contaminación microbiológica y fúngica. Además, los beneficios nutricionales y de salud que ofrecen las comidas preparadas congeladas orgánicas han llevado al crecimiento de la demanda del mercado. Por lo tanto, para atraer a un consumidor más grande que busca salud y sabor, los fabricantes de alimentos envasados congelados también están integrando beneficios nutritivos con el gusto, lo que lleva al crecimiento del mercado global de comidas preparadas congeladas. Las preferencias cambiantes de los consumidores por productos veganos de origen vegetal están allanando el camino para los productos alimenticios orgánicos y convenientes, lo que resulta en una mayor demanda de comidas preparadas congeladas en el mercado global.

Por lo tanto, un aumento en la demanda de productos alimenticios orgánicos congelados con beneficios nutricionales y productos congelados listos para cocinar o listos para comer que estén convenientemente disponibles impulsará el mercado de comidas preparadas congeladas durante el período previsto.

- El cambio en el estilo de vida y los patrones de alimentación de los consumidores

En el mundo acelerado y en constante movimiento, la mitad de la población prefiere la comida preparada, que ayuda a los consumidores a ahorrar tiempo y esfuerzo en la preparación de las comidas. Debido a la vida rápida y ajetreada, el patrón de consumo de los consumidores cambia de alimentos crudos a alimentos preparados. Además, la rápida urbanización y el estilo de vida cambiante de las personas están aumentando la demanda de comidas preparadas congeladas. Debido a la constante evolución en el patrón de consumo de los consumidores, la comida preparada ha crecido sustancialmente a nivel mundial debido a la creciente conciencia de la salud del consumidor y al aumento de los estilos de vida urbanos. Junto con eso, los consumidores están avanzando hacia una configuración corporativa de rápido movimiento que diversifica sus patrones de alimentación debido a la menor disponibilidad de tiempo y una mayor carga de trabajo. Las comidas preparadas congeladas son fáciles de cocinar, están disponibles de inmediato, son asequibles y accesibles, lo que las convierte en una solución inteligente para satisfacer las necesidades nutricionales diarias de los consumidores. La creciente conciencia de la salud y el bienestar de los consumidores está acelerando la adopción de un estilo de vida saludable, aumentando la aceptación de estilos de vida positivos y el consumo de alimentos congelados saludables, que han conservado los nutrientes, está haciendo avanzar el mercado de comidas preparadas congeladas de Europa.

Además, el aumento de los ingresos disponibles también está influyendo en la demanda de alimentos preparados en los hogares. A nivel mundial, el número de restaurantes de comida rápida está aumentando rápidamente, lo que aumenta la demanda de alimentos preparados. En consecuencia, el creciente consumo de alimentos preparados aumenta la demanda de productos alimenticios congelados. Como resultado, mejora el crecimiento de los alimentos congelados e impulsa el mercado europeo de comidas preparadas congeladas.

Oportunidades

-

Un número cada vez mayor de iniciativas adoptadas por los fabricantes de aminoácidos

El aumento de las iniciativas que toman los fabricantes de platos preparados congelados, como lanzamientos de productos, expansión, obtención de fondos y otros, creará una gran oportunidad para el crecimiento del mercado mundial de platos preparados congelados. La demanda de platos preparados congelados está aumentando entre los consumidores debido a la apretada agenda, el aumento de los ingresos disponibles y la creciente demanda de productos alimenticios listos para consumir que les permitan ahorrar tiempo para cocinar. La creciente demanda de platos preparados congelados por parte de los consumidores permite a los fabricantes lanzar nuevos productos al mercado, ampliar sus instalaciones de fabricación y obtener inversiones para fabricar diferentes productos de platos preparados congelados para distintos usuarios finales.

Por ejemplo,

-

En abril de 2022, Nomad Foods lanzó un portal de innovación abierta que invita a los socios a compartir soluciones innovadoras. El lanzamiento del nuevo portal ayudó a la empresa a aumentar la escalabilidad de los mejillones congelados y otros productos bivalvos.

Por lo tanto, se espera que el aumento en el número de lanzamientos de comidas preparadas congeladas, la expansión, la inversión para expandir el negocio de alimentos congelados y otras iniciativas de los fabricantes, junto con la creciente demanda de comidas preparadas congeladas entre los consumidores y el sector de servicios de alimentos, creen una enorme oportunidad para los fabricantes de comidas preparadas congeladas en el mercado a nivel mundial.

Restricciones/Desafíos

- Alta competencia entre los actores del mercado

La alta competencia entre los actores existentes en el mercado plantea un desafío significativo para los nuevos actores que desean ingresar al mercado, ya que varios actores ofrecen diversos productos de comidas preparadas congeladas de alta calidad para satisfacer la demanda de los usuarios finales. Los actores existentes en el mercado, como Nestlé, General Mills Inc., Conagra Brands, Inc., The Kraft Heinz Company, Nomad Foods, JBS S/A y otros, ofrecen una gran cantidad de diferentes productos de comidas preparadas congeladas y se dedican constantemente al lanzamiento de nuevos productos de alta calidad, lo que provoca una gran competencia en el mercado. Además, los actores locales y los fabricantes a pequeña escala ofrecen productos de baja calidad a precios más bajos, lo que afecta al mercado mundial de comidas preparadas congeladas. Además, un aumento en la oferta de fabricantes de una amplia gama de comidas preparadas congeladas provocará una dura competencia para los demás actores del mercado.

El aumento de la oferta de platos preparados congelados de alta calidad es un gran desafío para los nuevos participantes en el mercado mundial de platos preparados congelados. Además, la presencia de un gran número de grandes participantes que ofrecen una amplia gama de productos, como pasta congelada, pizza, productos de pollo, productos del mar y otros, para satisfacer la demanda de los consumidores dificultará el crecimiento en el mercado de los pequeños fabricantes, los participantes locales o los nuevos participantes.

- Presencia de grasas en platos preparados congelados

Las grasas trans, que se han relacionado con enfermedades cardíacas y arterias obstruidas, se encuentran en alimentos envasados o congelados. Este lípido aumenta el colesterol malo (LDL) mientras que disminuye el colesterol bueno (HDL). Todo esto contribuye a las enfermedades cardíacas. Estos alimentos también tienen un alto contenido de sodio, lo que puede aumentar los niveles de colesterol en el cuerpo. Además, los alimentos congelados son increíblemente ricos en grasas. Estos alimentos tienen una proporción de grasas, carbohidratos y proteínas de casi el doble, lo que explica por qué son altos en calorías, lo que limita la demanda de alimentos congelados entre los consumidores preocupados por la salud.

Además, debido a que las comidas congeladas tienen un alto nivel de sal, pueden aumentar la presión arterial. El consumo excesivo de sal también aumenta el riesgo de diversos trastornos médicos, como accidentes cerebrovasculares y enfermedades cardíacas. A medida que más personas se vuelven más conscientes de estos efectos de los alimentos congelados, prefieren más los alimentos frescos a los congelados, lo que obstaculiza el crecimiento del mercado de las comidas preparadas congeladas.

Por lo tanto, como se mencionó anteriormente, la presencia de grasas en exceso y no saludables en la mayoría de las comidas preparadas congeladas puede actuar como un factor restrictivo para el crecimiento del mercado mundial de comidas preparadas congeladas.

Impacto post COVID-19 en el mercado europeo de platos preparados congelados

Después de la pandemia, la demanda de productos alimenticios congelados ha aumentado, ya que no habrá restricciones de movimiento; por lo tanto, el suministro de productos será fácil. La persistencia de COVID-19 durante un período más largo ha afectado a la cadena de suministro, ya que se vio interrumpida y se volvió difícil suministrar productos alimenticios a los consumidores, lo que inicialmente aumentó la demanda de productos. Sin embargo, después de COVID, la demanda de productos alimenticios congelados ha aumentado significativamente debido a la mayor vida útil de los alimentos congelados, lo que aumenta la demanda de productos alimenticios de conveniencia.

Acontecimientos recientes

- En abril de 2022, Nomad Foods lanzó un portal de innovación abierta que invita a los socios a compartir soluciones innovadoras. El lanzamiento del nuevo portal ayudó a la empresa a aumentar la escalabilidad de los mejillones congelados y otros productos bivalvos.

- En julio de 2020, Tyson Foods presentó una nueva línea de productos de pollo bajo la marca Tyson en la industria de servicios de alimentación europea, que incluye restaurantes, cafeterías y empresas de catering. Esto ayudó a la empresa a aumentar sus ingresos en la industria de servicios de alimentación.

Panorama del mercado de platos preparados congelados en Europa

El mercado europeo de comidas preparadas congeladas está segmentado en seis segmentos según el tipo, la categoría, la tecnología, el usuario final, la técnica de envasado y el canal de distribución.

El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar aplicaciones centrales del mercado.

Tipos

- Snacks congelados

- Pizza congelada

- Helado congelado

- Productos del mar congelados

- Productos de pollo congelados

- Yogur helado

- Productos lácteos congelados

- Pasta congelada

- Bebidas congeladas

- Comidas vegetarianas congeladas

- Sorbete y granizado helado

- Tortas congeladas

- Rollos y wraps congelados

- Nata congelada

- Sopa congelada

- Mezclas de alimentos a base de quinua congelada

- Mezclas de arroz congelado

- Otros

Según el tipo, el mercado mundial de comidas preparadas congeladas se segmenta en mezclas de arroz congelado, mezclas de alimentos de quinua congelada, pizza congelada, pasta congelada, wraps y rollitos congelados, snacks congelados, helado congelado, yogur helado, pasteles congelados, sorbetes y granizados congelados, natillas congeladas, bebidas congeladas, productos salados congelados y sopas congeladas, productos lácteos congelados, productos de pollo congelados, productos de mariscos congelados y otros.

Categoría

- Orgánico

- Convencional

Sobre la base de la categoría, el mercado mundial de comidas preparadas congeladas se segmenta en orgánico y convencional.

Tecnología

- Congelación rápida individual (IQF)

- Congelación del cinturón

- Congelación asistida por alta presión

- Otros

Sobre la base de la tecnología, el mercado mundial de comidas preparadas congeladas está segmentado en congelación instantánea/congelación rápida individual (IQF), congelación en cinta, congelación asistida por alta presión y otros.

Usuario final

- Sector doméstico/minorista

- Sector de servicios de alimentación

En función del usuario final, el mercado mundial de comidas preparadas congeladas se segmenta en el sector de servicios de alimentación y los hogares.

Técnica de embalaje

- Envasado de platos preparados congelados

- Técnica y equipo de congelación

Sobre la base de la técnica de envasado, el mercado mundial de comidas preparadas congeladas se segmenta en técnicas y equipos de congelación y envasado de comidas preparadas congeladas.

Canal de distribución

- Minoristas con sede en tiendas

- Minoristas que no tienen tiendas físicas

Sobre la base del canal de distribución, el mercado mundial de comidas preparadas congeladas se segmenta en minoristas con sede en tiendas y minoristas sin sede en tiendas.

Análisis y perspectivas regionales del mercado de comidas preparadas congeladas en Europa

Se analiza el mercado europeo de comidas preparadas congeladas y se proporcionan información y tendencias sobre el tamaño del mercado según lo mencionado anteriormente.

Los países cubiertos en el informe del mercado de comidas preparadas congeladas de Europa son Alemania, Reino Unido, Francia, Italia, España, Suecia, Bélgica, Países Bajos, Dinamarca, Suiza, Rusia, Polonia, Turquía y el resto de Europa.

Alemania domina el mercado europeo de platos preparados congelados en términos de participación de mercado e ingresos de mercado. Sin embargo, el Reino Unido tendrá la tasa de crecimiento más alta durante el período de pronóstico. Esto se debe a la industrialización de la industria de servicios de alimentos y al crecimiento económico del país. La demanda de alimentos preparados y de conveniencia en la región europea está aumentando, lo que impulsa el mercado de platos preparados congelados de la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas, sus desafíos enfrentados debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de platos preparados congelados en Europa

El competitivo mercado europeo de platos preparados congelados detalla a los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de las empresas en el mercado europeo de platos preparados congelados.

Algunos de los principales actores que operan en el mercado europeo de comidas preparadas congeladas son McCain Foods Limited, Nestlé, Tyson Foods, Inc., BRF Global, General Mills Inc., JBS S/A, Nomad Foods, The Kraft Heinz Company, Dr. Oetker, Kellogg Co., Ajinomoto Co., Inc., McCain Foods Limited, Virto Group, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, análisis global versus regional y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FROZEN READY MEALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER TYPE AND THEIR BUYING PERCEPTIONS

4.3.1 OVERVIEW

4.3.2 MILLENNIALS

4.3.3 GEN X

4.3.4 BABY BOOMERS

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 PRICING OF FROZEN READY MEALS PRODUCTS

4.4.2 CERTIFIED FROZEN READY MEALS PRODUCTS

4.4.3 QUALITY OF READY MEAL PRODUCTS

4.5 PRICING ANALYSIS FOR FROZEN READY MEALS MARKET

4.6 EXPORT & IMPORT ANALYSIS

4.7 LABELING AND CLAIMS

4.7.1 UNITED NATIONS ENVIRONMENT PROGRAMME SALE OF FROZEN FOODS REGULATIONS

4.7.2 DIRECTIVE 89/108/EEC ON QUICK-FROZEN FOODSTUFFS FOR HUMAN CONSUMPTION

4.7.3 FOOD CLAIMS ON LABELS – THE EUROPEAN PERSPECTIVE

4.8 LIST OF TOP EXPORTING COMPANIES OF EUROPE FROZEN READY MEALS MARKET

4.9 LIST OF TOP IMPORTING COMPANIES FOR FROZEN READY MEALS MARKET

4.1 MARKET TRENDS

4.11 NEW PRODUCT LAUNCH STRATEGY

4.11.1 OVERVIEW

4.11.2 NUMBER OF PRODUCT LAUNCHES

4.11.2.1 LINE EXTENSION

4.11.2.2 NEW PACKAGING

4.11.2.3 RELAUNCHED

4.11.2.4 NEW FORMULATION

4.11.3 DIFFERENTIAL PRODUCT OFFERING

4.11.4 MEETING CONSUMER REQUIREMENT

4.11.5 PACKAGE DESIGNING

4.11.6 PRICING ANALYSIS

4.11.7 PRODUCT POSITIONING

4.11.8 CONCLUSION

4.12 BRAND LABEL

4.13 PROMOTIONAL ACTIVITIES

4.14 SHOPPING BEHAVIOUR AND DYNAMICS

4.14.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

4.14.2 RESEARCH

4.14.3 IMPULSIVE

4.14.4 ADVERTISEMENT

4.14.5 TELEVISION ADVERTISEMENT

4.14.6 ONLINE ADVERTISEMENT

4.14.7 IN-STORE ADVERTISEMENT

4.14.8 OUTDOOR ADVERTISEMENT

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 RAW MATERIAL PROCUREMENT

4.15.2 MANUFACTURING PROCESS

4.15.3 INDIVIDUAL QUICK FREEZER

4.15.4 INSPECTION OF FROZEN FOOD

4.15.5 PACKING OF FROZEN FOOD

4.15.6 AUTOMATIC PACKAGING UNIT

4.15.7 MARKETING AND DISTRIBUTION

4.15.8 END-USERS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY

6.1.2 RISING PREFERENCE FOR READY-TO-EAT ORGANIC FOODS

6.1.3 EXPANSIONS OF CONVENIENCE STORES

6.1.4 CHANGE IN LIFESTYLE AND EATING PATTERN OF CONSUMERS

6.2 RESTRAINTS

6.2.1 PRESENCE OF FATS IN FROZEN READY MEALS

6.2.2 LACK OF COLD CHAIN INFRASTRUCTURE

6.2.3 LIMITED SELF-LIFE OF FROZEN FOOD

6.3 OPPORTUNITIES

6.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

6.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN READY MEALS MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING PREFERENCE FOR FRESH AND NATURAL FOOD PRODUCTS

7 EUROPE FROZEN READY MEALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FROZEN SNACKS

7.2.1 FRENCH FRIES

7.2.2 NUGGETS

7.2.3 BITES

7.2.4 WEDGES

7.2.5 OTHERS

7.3 FROZEN PIZZA

7.3.1 FROZEN VEG PIZZA

7.3.1.1 WITH CHEESE

7.3.1.2 WITHOUT CHEESE

7.3.2 FROZEN NON-VEG PIZZA

7.3.2.1 FROZEN NON-VEG PIZZA, BY MEAT TYPE

7.3.2.1.1 PEPPERONI PIZZA

7.3.2.1.2 CHICKEN PIZZA

7.3.2.1.3 BEEF PIZZA

7.3.2.1.4 OTHERS

7.3.2.2 FROZEN NON-VEG PIZZA, BY BASE TYPE

7.3.2.2.1 WITH CHEESE

7.3.2.2.2 WITHOUT CHEESE

7.4 FROZEN ICE CREAM

7.4.1 FROZEN SOFT SERVE

7.4.2 FROZEN GELATO

7.4.3 OTHERS

7.5 FROZEN SEAFOOD PRODUCTS

7.5.1 FROZEN FISH FILLETS

7.5.2 FROZEN SHRIMP POPCORN

7.5.3 FROZEN FISH NUGGETS

7.5.4 FROZEN FISH BITES

7.5.5 OTHERS

7.6 FROZEN CHICKEN PRODUCTS

7.6.1 FROZEN CHICKEN NUGGETS

7.6.2 FROZEN CHICKEN STRIPS

7.6.3 FROZEN CHICKEN BITES

7.6.4 FROZEN CHICKEN WINGS

7.6.5 FROZEN CHICKEN POPCORN

7.6.6 OTHERS

7.7 FROZEN YOGHURT

7.7.1 LOW FAT

7.7.2 FAT FREE

7.7.3 FULL FAT

7.8 FROZEN DAIRY PRODUCTS

7.8.1 FROZEN DAIRY PRODUCTS, BY SOURCE

7.8.1.1 ANIMAL-BASED DAIRY

7.8.1.2 PLANT-BASED DAIRY

7.8.1.2.1 ALMOND MILK

7.8.1.2.2 SOY MILK

7.8.1.2.3 COCONUT MILK

7.8.1.2.4 OAT MILK

7.8.1.2.5 OTHERS

7.8.2 FROZEN DAIRY PRODUCTS, BY FLAVOR

7.8.2.1 REGULAR

7.8.2.2 FLAVOR

7.8.2.2.1 CHOCOLATES

7.8.2.2.2 VANILLA

7.8.2.2.3 STRAWBERRY

7.8.2.2.4 CARAMEL

7.8.2.2.5 BLACKBERRY

7.8.2.2.6 NUTS

7.8.2.2.7 BUTTERSCOTCH

7.8.2.2.8 PEPPERMINT

7.8.2.2.9 MOCHA

7.8.2.2.10 BLUEBERRY

7.8.2.2.11 BANANA

7.8.2.2.12 CHERRY

7.8.2.2.13 PEACH

7.8.2.2.14 AMARETTO

7.8.2.2.15 POMEGRANATE

7.8.2.2.16 PUMPKIN

7.8.2.2.17 COTTON CANDY

7.8.2.2.18 ORCHARD CHERRY

7.8.2.2.19 COCONUT

7.8.2.2.20 HONEY

7.8.2.2.21 HERBAL

7.8.2.2.22 OTHERS

7.9 FROZEN PASTA

7.9.1 SPAGHETTI

7.9.2 PENNE

7.9.3 RAVIOLI

7.9.4 MACARONI / MACCHERONI / ELBOW

7.9.5 LASAGNA

7.9.6 FETTUCCINE

7.9.7 GNOCCHI

7.9.8 OTHERS

7.1 FROZEN DRINKS

7.11 FROZEN VEGETARIAN MEALS

7.11.1 POWER BOWL

7.11.2 BUDDHA BOWL

7.11.3 SOUP BOWL

7.11.4 CURRY BOWL

7.12 FROZEN SORBET AND SHERBET

7.13 FROZEN CAKES

7.13.1 FLAVORED CAKES

7.13.2 PLUM CAKES

7.13.3 SPONGE CAKES

7.13.4 CHEESE CAKES

7.13.5 CUP CAKES

7.13.6 OTHERS

7.14 FROZEN WRAPS & ROLLS

7.14.1 FROZEN VEG WRAPS & ROLLS

7.14.2 FROZEN NON-VEG WRAPS & ROLLS

7.15 FROZEN CUSTARD

7.16 FROZEN SOUP

7.17 FROZEN QUINOA FOOD MIXES

7.17.1 QUINOA WITH VEGETABLES

7.17.2 QUINOA WITH CHICKEN

7.17.3 QUINOA WITH PORK

7.17.4 QUINOA WITH SEAFOOD

7.17.5 OTHERS

7.18 FROZEN RICE MIXES

7.18.1 FROZEN RICE MIXES, BY TYPE

7.18.1.1 WHITE RICE

7.18.1.2 BROWN RICE

7.18.1.3 BLACK RICE

7.18.1.4 WILD RICE

7.18.1.5 OTHERS

7.18.2 FROZEN RICE MIXES, BY RICE MIX CATEGORY

7.18.2.1 RICE WITH CHICKEN

7.18.2.1.1 WHITE RICE

7.18.2.1.2 BROWN RICE

7.18.2.1.3 BLACK RICE

7.18.2.1.4 WILD RICE

7.18.2.1.5 OTHERS

7.18.2.2 RICE WITH BEEF

7.18.2.2.1 WHITE RICE

7.18.2.2.2 BROWN RICE

7.18.2.2.3 BLACK RICE

7.18.2.2.4 WILD RICE

7.18.2.2.5 OTHERS

7.18.2.3 RICE WITH PORK

7.18.2.3.1 WHITE RICE

7.18.2.3.2 BROWN RICE

7.18.2.3.3 BLACK RICE

7.18.2.3.4 WILD RICE

7.18.2.3.5 OTHERS

7.18.2.4 RICE WITH SEAFOOD

7.18.2.4.1 WHITE RICE

7.18.2.4.2 BROWN RICE

7.18.2.4.3 BLACK RICE

7.18.2.4.4 WILD RICE

7.18.2.4.5 OTHERS

7.18.2.5 RICE WITH VEGETABLES

7.18.2.5.1 WHITE RICE

7.18.2.5.2 BROWN RICE

7.18.2.5.3 BLACK RICE

7.18.2.5.4 WILD RICE

7.18.2.5.5 OTHERS

7.18.2.6 OTHERS

7.19 OTHERS

8 EUROPE FROZEN READY MEALS MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 EUROPE FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

9.1 OVERVIEW

9.2 FROZEN READY MEALS PACKAGING

9.2.1 FROZEN READY MEALS PACKAGING, BY TYPE

9.2.1.1 OXYGEN SCAVENGERS

9.2.1.2 MOISTURE CONTROL

9.2.1.3 ANTIMICROBIALS

9.2.1.4 TIME TEMPERATURE INDICATORS

9.2.1.5 EDIBLE FILMS

9.3 FREEZING TECHNIQUE & EQUIPMENT

9.3.1 FREEZING TECHNIQUE & EQUIPMENT, BY TYPE

9.3.1.1 AIR BLAST FREEZERS

9.3.1.2 TUNNEL FREEZERS

9.3.1.3 BELT FREEZERS

9.3.1.4 CONTACT FREEZERS

10 EUROPE FROZEN READY MEALS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 FLASH-FREEZING/ INDIVIDUAL QUICK FREEZING (IQF)

10.3 BELT FREEZING

10.4 HIGH PRESSURE-ASSISTED FREEZING

10.5 OTHERS

11 EUROPE FROZEN READY MEALS MARKET, BY END-USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL SECTOR

11.3 FOOD SERVICE SECTOR

11.3.1 RESTAURANTS

11.3.2 QUICK SERVICE RESTAURANTS

11.3.3 DINING RESTAURANTS

11.3.4 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

11.3.5 OTHERS

11.3.6 CAFES

11.3.7 HOTEL

11.3.8 OTHERS

12 EUROPE FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 GROCERY RETAILERS

12.2.2 SUPERMARKETS/HYPERMARKETS

12.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

12.2.4 CONVENIENCE STORES

12.2.5 SPECIALTY STORES

12.2.6 WHOLESALERS

12.2.7 OTHERS

12.3 NON- STORE BASED RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITE

13 EUROPE FROZEN READY MEALS MARKET BY GEOGRAPHY

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K

13.1.3 FRANCE

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 SWEDEN

13.1.7 BELGIUM

13.1.8 NETHERLANDS

13.1.9 DENMARK

13.1.10 SWITZERLAND

13.1.11 RUSSIA

13.1.12 POLAND

13.1.13 TURKEY

13.1.14 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BRF EUROPE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TYSON FOODS, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MCCAIN FOODS LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 CONAGRA BRANDS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NESTLÉ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCE PIERRE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AJINOMOTO CO., INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AL KABEER GROUP ME

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMY’S KITCHEN

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL MILLS INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 EUROPE FOOD INDUSTRIES LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIRTO GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GULF WEST COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HAKAN AGRO DMCC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 JBS S/A

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 KELLOGG CO. (2021)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MOSAIC FOODS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NOMAD FOODS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SAFCO INTERNATIONAL GEN. TRADING CO. L.L.C.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SCHWAN'S HOME DELIVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SIDCO FOODS TRADING L.L.C.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 THE KRAFT HEINZ COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 WAWONA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE:

18 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE AVERAGE SELLING PRICES OF FROZEN READY MEALS:

TABLE 2 IMPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 3 EXPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 4 IMPORT OF CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 5 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 6 IMPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 7 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 8 IMPORT OF FROZEN CRABS (2020)

TABLE 9 EXPORT OF FROZEN CRABS (2020)

TABLE 10 IMPORT OF FROZEN VEGETABLES (2020)

TABLE 11 EXPORT OF FROZEN VEGETABLES (2020)

TABLE 12 IMPORT OF FROZEN EELS, WHOLE (2020)

TABLE 13 EXPORT OF FROZEN EELS, WHOLE (2020)

TABLE 14 IMPORT OF FROZEN FISH FILLETS (2020)

TABLE 15 EXPORT OF FROZEN FISH FILLETS (2020)

Lista de figuras

FIGURE 1 EUROPE FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 2 EUROPE FROZEN READY MEALS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE FROZEN READY MEALS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FROZEN READY MEALS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE FROZEN READY MEALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FROZEN READY MEALS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FROZEN READY MEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FROZEN READY MEALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE EUROPE FROZEN READY MEALS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY IS EXPECTED TO DRIVE THE EUROPE FROZEN READY MEALS MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE FROZEN READY MEALS MARKET IN 2022 & 2029

FIGURE 13 EUROPE FROZEN READY MEALS MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 EUROPE FROZEN READY MEALS MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 15 SUPPLY CHAIN ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE FROZEN READY MEALS MARKET

FIGURE 17 EUROPE FROZEN READY MEALS MARKET, BY TYPE

FIGURE 18 EUROPE FROZEN READY MEALS MARKET, BY CATEGORY

FIGURE 19 EUROPE FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

FIGURE 20 EUROPE FROZEN READY MEALS MARKET, BY TECHNOLOGY

FIGURE 21 EUROPE FROZEN READY MEALS MARKET, BY END USER

FIGURE 22 EUROPE FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 23 EUROPE FROZEN READY MEALS MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE FROZEN READY MEALS MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE FROZEN READY MEALS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE FROZEN READY MEALS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE FROZEN READY MEALS MARKET: BY TYPE (2022 & 2029)

FIGURE 28 EUROPE FROZEN READY MEALS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.