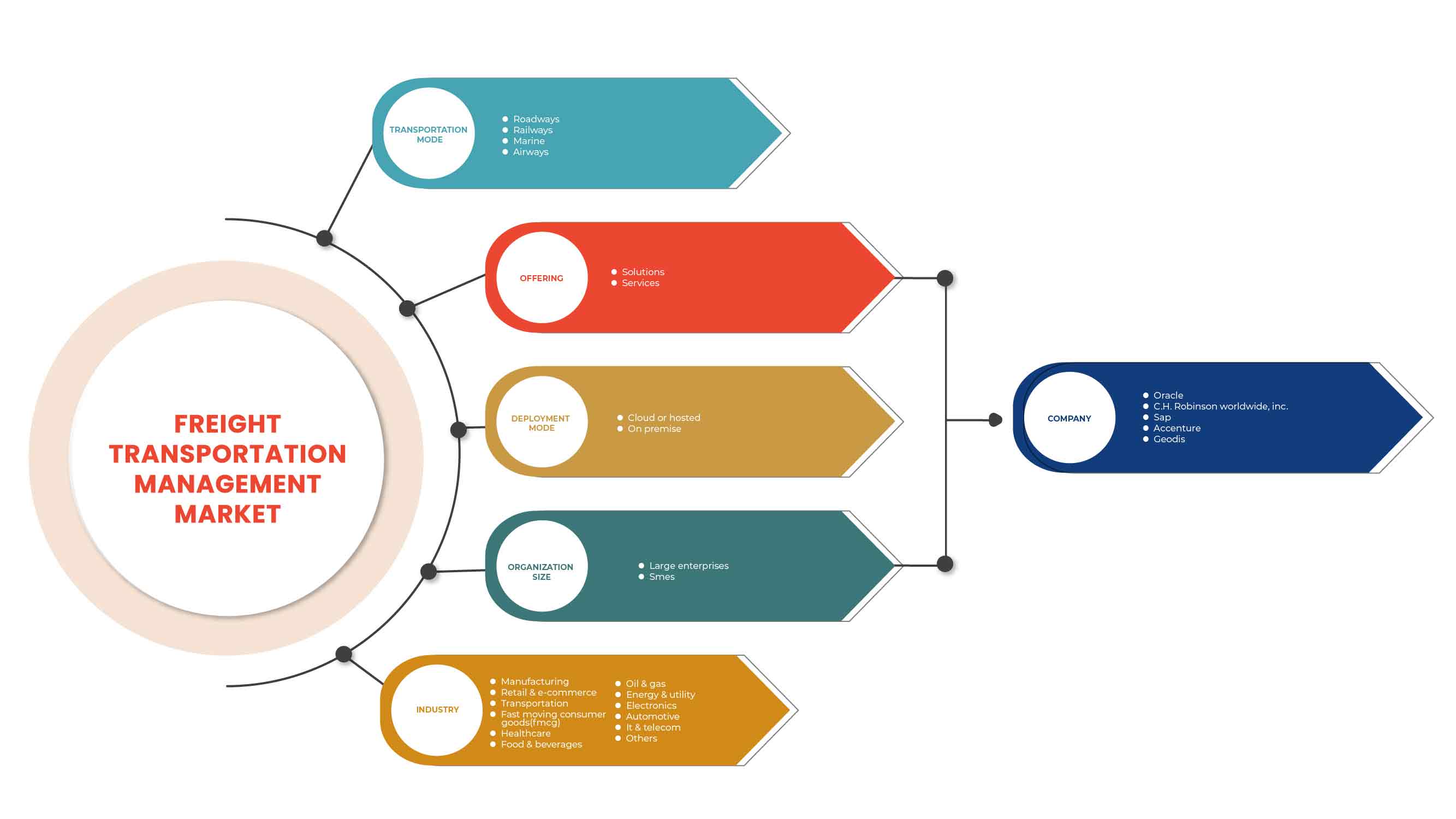

Mercado de gestión del transporte de mercancías en Europa , por modo de transporte (carreteras, ferrocarriles, marítimo y aéreo), oferta (soluciones y servicios), modo de implementación (nube o alojado y local), tamaño de la organización (grandes empresas y pymes), industria (fabricación, venta minorista y comercio electrónico, transporte, bienes de consumo de rápido movimiento (FMCG), atención médica, alimentos y bebidas, petróleo y gas, energía y servicios públicos, electrónica, automotriz, TI y telecomunicaciones y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de gestión del transporte de mercancías en Europa

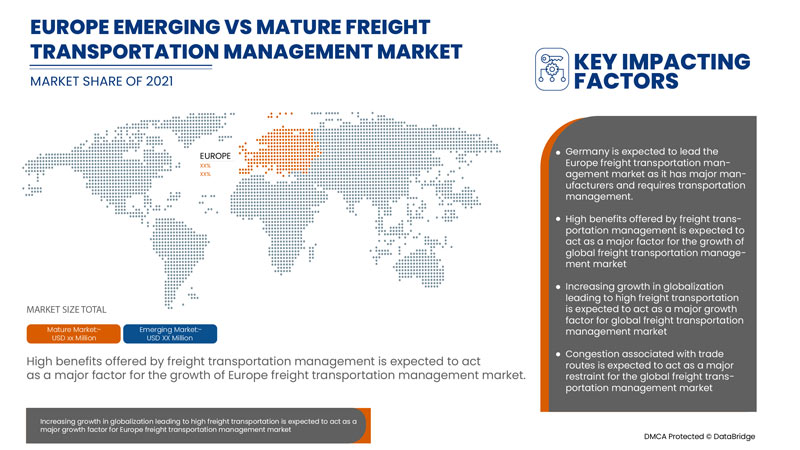

La gestión del transporte de mercancías incorpora la formulación de diversas estrategias para aumentar la eficiencia del transporte de mercancías y comercial. La gestión del transporte de mercancías se centra en la reducción de los costes del transportista teniendo en cuenta los costes sociales, como la congestión o los impactos de la contaminación. Los grandes beneficios que ofrece la gestión del transporte de mercancías están haciendo que aumente la demanda de soluciones de gestión del transporte de mercancías en el mercado. El mercado mundial de la gestión del transporte de mercancías está creciendo rápidamente debido a la creciente globalización que conduce a un transporte de mercancías de gran volumen. Las empresas incluso están lanzando nuevos productos para ganar una mayor cuota de mercado.

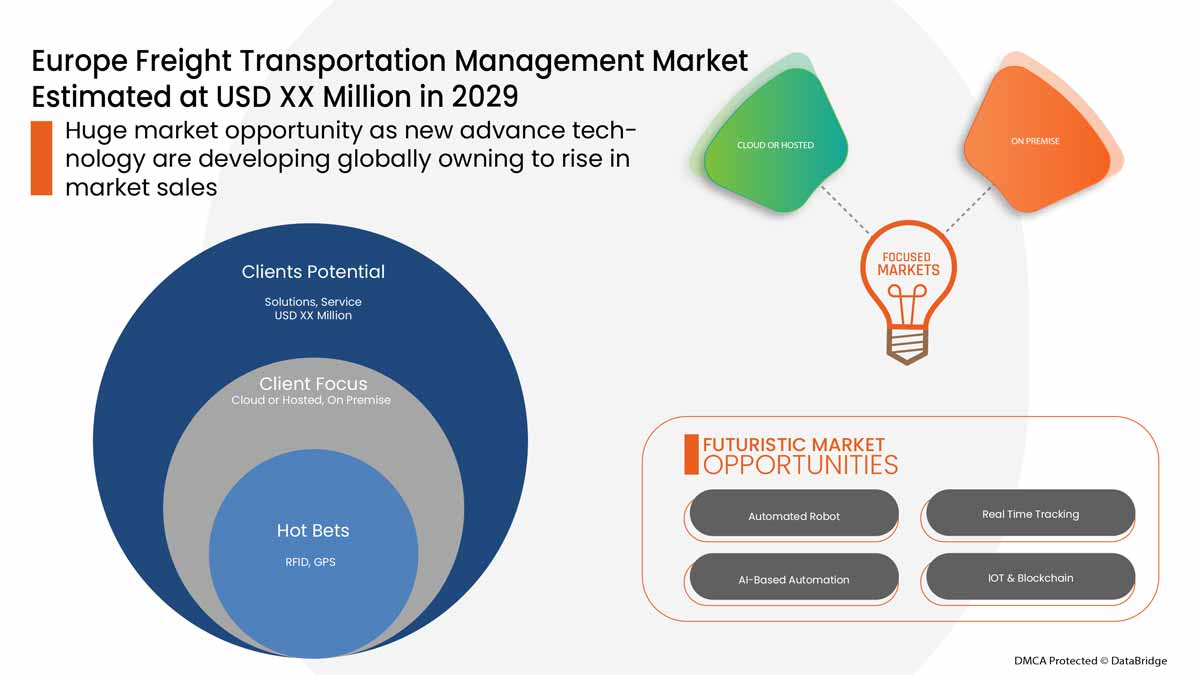

Data Bridge Market Research analiza que se espera que el mercado de gestión del transporte de mercancías alcance un valor de 14.164,76 millones de dólares en 2029, con una tasa compuesta anual del 8,6 % durante el período de previsión. Las "carreteras" representan el segmento de modo de transporte más destacado, ya que requieren una menor inversión de capital y pueden proporcionar una gestión fragmentada de puerta a puerta. El informe del mercado de gestión del transporte de mercancías también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Millones de dólares |

|

Segmentos cubiertos |

Por modo de transporte (carreteras, ferrocarriles, marítimo y aéreo), por oferta (soluciones y servicios), por modo de implementación (nube o alojado y en las instalaciones), por tamaño de la organización (grandes empresas y pymes), por industria (fabricación, venta minorista y comercio electrónico, transporte, bienes de consumo de rápido movimiento (FMCG), atención médica, alimentos y bebidas, petróleo y gas, energía y servicios públicos, electrónica, automoción, TI y telecomunicaciones y otros) |

|

Países cubiertos |

Alemania, Francia, Italia, Reino Unido, España, Países Bajos, Suiza, Bélgica, Rusia, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate, entre otros. |

Definición de mercado

La gestión del transporte de mercancías incorpora la formulación de diversas estrategias para aumentar la eficiencia del transporte de mercancías y comercial. La gestión del transporte de mercancías se centra en la reducción de los costes de los transportistas, teniendo en cuenta los costes sociales, como la congestión o los impactos de la contaminación. Ayuda a los transportistas a utilizar el modo de transporte adecuado. Por ejemplo, el transporte ferroviario y marítimo son muy eficientes para largas distancias en comparación con el uso de camiones para el mismo fin. Ayuda a mejorar la planificación y la programación para aumentar los factores de carga y reducir el kilometraje de los vehículos de carga. Ayuda a implementar programas de gestión de flotas que ayuden a utilizar vehículos de tamaño óptimo para cada viaje, reducir el kilometraje de los vehículos y garantizar que los vehículos de la flota se operen y mantengan de forma que se reduzcan los costes externos.

La gestión del transporte de mercancías se utiliza para diversos modos de transporte, como carreteras, ferrocarriles, vías marítimas y aéreas. El movimiento de mercancías que se realiza a través de la ruta de las carreteras se denomina segmento. Es el tipo de modo de transporte más común, ya que requiere un solo proceso de documento aduanero. El modo de transporte ferroviario es muy eficiente en cuanto al consumo de combustible y puede considerarse un modo de transporte "ecológico". Los envíos marítimos se utilizan para el movimiento de productos a granel, como carbón, productos agrícolas, mineral de hierro y productos húmedos a granel, como petróleo crudo y gas. Las vías aéreas son el modo de transporte más rápido y se utilizan mucho para lograr la reposición de inventario "justo a tiempo" (JIT).

Dinámica del mercado de gestión del transporte de mercancías

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Grandes beneficios que ofrece la gestión del transporte de mercancías

Con el paso de los años, se ha vuelto extremadamente necesario contar con una cadena de suministro altamente eficiente. Este requisito se cumple mediante la gestión del transporte de mercancías. El sistema de gestión del transporte de mercancías ayuda a las empresas a trasladar los productos de un destino a otro de manera rentable, fiable y eficiente. El sistema proporciona una mayor visibilidad y un mejor análisis de los datos, lo que aumenta el crecimiento del mercado mundial de gestión del transporte de mercancías.

- Demanda creciente de transporte de mercancías por ferrocarril

El transporte de mercancías por ferrocarril utiliza los ferrocarriles para el transporte de carga por tierra. Se utiliza para transportar diversas cargas, como productos químicos, materias primas de construcción, productos agrícolas, automotrices, energía (carbón, petróleo y turbinas eólicas) y productos forestales. Los ferrocarriles pueden transportar carga pesada rápidamente a través de ellos. Los ferrocarriles son una de las formas de transporte más utilizadas y cuentan con una enorme infraestructura construida en todo el mundo. El uso creciente de los ferrocarriles para el transporte aumenta el crecimiento de la gestión del transporte de mercancías para gestionar el transporte de mercancías por ferrocarril.

- Alta utilización de la gestión del transporte de mercancías en las carreteras

La creciente digitalización ha provocado una transformación en varias industrias y ha dado origen al comercio electrónico. El crecimiento del comercio electrónico ha hecho necesario que las empresas hagan que su cadena de suministro sea altamente eficiente, reduzcan el tiempo de tránsito y proporcionen los productos a los clientes sin demora. Esto ha aumentado el flujo de transporte nacional por carretera, y se está utilizando una gran cantidad de camiones para el mismo. El creciente crecimiento de la tecnología de carreteras está aumentando el crecimiento del mercado de gestión del transporte de mercancías global.

- Congestión asociada a las rutas comerciales

A medida que aumentan los volúmenes de tráfico y la congestión en las carreteras y vías navegables, los operadores de servicios de transporte y carga se enfrentan cada vez más al desafío de mantener horarios confiables. Esto afecta a las cadenas de suministro y a las empresas que dependen de los camiones, cada una de las cuales tiene una importancia cada vez mayor tanto para los operadores de cobertura pública como de regiones privadas. Además, varios accidentes en las carreteras o derrames de petróleo en el mar pueden actuar como un desafío inesperado para los sistemas de transporte, lo que dificulta su gestión. La reciente COVID-19 también ha detenido varias operaciones logísticas causando graves daños a las operaciones de toda la cadena de suministro. Estos parámetros actúan como una importante restricción para el crecimiento del mercado global de gestión del transporte de carga.

- Restricciones y regulaciones gubernamentales sobre el comercio

El comercio internacional ha experimentado varias restricciones y cambios en las regulaciones debido a la guerra comercial entre Estados Unidos y China y la pandemia de COVID-19. El transporte transfronterizo se ve limitado y los costos aumentan, lo que no es posible prever mediante el sistema de gestión del transporte y genera ineficiencia en la cadena de suministro y el inventario, lo que actúa como una importante restricción para el mercado de gestión del transporte de mercancías a nivel mundial.

Impacto posterior al COVID-19 en el mercado de gestión del transporte de mercancías

La COVID-19 ha tenido un gran impacto en el mercado de gestión del transporte de mercancías, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas otras para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de gestión del transporte de mercancías está aumentando debido a las políticas gubernamentales para impulsar el comercio internacional después de la pandemia. Además, los beneficios que ofrece la gestión del transporte de mercancías para optimizar los costos y las rutas están aumentando la demanda de gestión del transporte de mercancías en el mercado. Sin embargo, factores como la congestión asociada a las rutas comerciales y las restricciones comerciales entre algunas naciones están frenando el crecimiento del mercado. El cierre de las instalaciones de producción durante la situación de pandemia ha tenido un impacto significativo en el mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en la gestión del transporte de mercancías. Con esto, las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar el comercio internacional han llevado al crecimiento del mercado.

Desarrollo reciente

- En marzo de 2021, SAP SE anunció su asociación con Sedna Systems. En virtud de esta asociación, las empresas integrarán SAP TMS con la solución de colaboración en equipo y gestión de correo electrónico de Sedna Systems, lo que puede ayudar a los clientes a obtener un control total sobre los datos relacionados con la gestión del transporte. De esta forma, la empresa podrá consolidar su posición en el mercado.

- En febrero de 2022, Oracle anunció la introducción de nuevas capacidades de gestión logística dentro de Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). La empresa ha actualizado su Oracle Fusion Cloud Transportation Management, que puede ayudar a las organizaciones a reducir los costes y los riesgos, mejorar la experiencia del cliente y ser más adaptables a las disrupciones comerciales. De esta forma, la empresa podrá atraer a más clientes al mercado.

Alcance del mercado de gestión del transporte de mercancías en Europa

El mercado de gestión del transporte de mercancías está segmentado en función del modo de transporte, la oferta, el modo de implementación, el tamaño de la organización y la industria. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por modo de transporte

- Carreteras

- Ferrocarriles

- Marina

- Vías respiratorias

Sobre la base del modo de transporte, el mercado global de gestión del transporte de mercancías se segmenta en carreteras, ferrocarriles, vías marítimas y vías aéreas.

Al ofrecer

- Soluciones

- Servicios

Sobre la base de la oferta, el mercado global de gestión del transporte de mercancías se ha segmentado en soluciones y servicios.

Por modo de implementación

- Nube o alojado

- En las instalaciones

Sobre la base del modo de implementación, el mercado global de gestión del transporte de mercancías se ha segmentado en nube o alojado y en las instalaciones locales.

Por tamaño de la organización

- Grandes empresas

- PYMES

Sobre la base del tamaño de la organización, el mercado global de gestión del transporte de mercancías se ha segmentado en grandes empresas y PYMES.

Por industria

- Fabricación

- Venta minorista y comercio electrónico

- Transporte

- Bienes de consumo de rápido movimiento (FMCG)

- Cuidado de la salud

- Alimentos y bebidas

- Petróleo y gas

- Energía y servicios públicos

- Electrónica

- Automotor

- Informática y telecomunicaciones

- Otros

Sobre la base de la industria, el mercado global de gestión del transporte de mercancías se ha segmentado en fabricación, venta minorista y comercio electrónico, transporte, bienes de consumo de rápido movimiento (FMCG), atención médica, alimentos y bebidas, petróleo y gas, energía y servicios públicos, electrónica, automotriz, TI y telecomunicaciones y otros.

Análisis y perspectivas regionales del mercado de gestión del transporte de mercancías

Se analiza el mercado de gestión del transporte de mercancías y se proporcionan información y tendencias del tamaño del mercado por país, modo de transporte, oferta, modo de implementación, tamaño de la organización e industria como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de gestión del transporte de mercancías son Alemania, Francia, Italia, Reino Unido, España, Países Bajos, Suiza, Bélgica, Rusia, Turquía y el resto de Europa.

Alemania domina el mercado europeo de gestión del transporte de mercancías . Es probable que Alemania sea el país de más rápido crecimiento en este mercado. La región cuenta con importantes fabricantes del sector automotor e industrias relacionadas, lo que genera exportaciones desde la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de la gestión del transporte de mercancías

El panorama competitivo del mercado de gestión del transporte de mercancías proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de gestión del transporte de mercancías.

Some of the major players operating in the freight transportation management market are:CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, Global Tranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc.,E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, C.H. Robinson Worldwide, Inc, TRANSPOREON GmbH, MercuryGate.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe freight transportation management market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- Transportation Modetimeline curve

- MARKET Industry COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing growth in globalization leading to high freight transportation

- high benefits offered by freight transportation management

- Surging demand for rail freight transports

- Increasing growth of logistics through airways and water ways

- High use of freight transportation management in roadways

- RESTRAINTS

- Congestion Associated with Trade Routes

- several government regulations and restrictions

- OPPoRTUNITies

- growing inclination towards digitalization

- Increasing growth in e-commerce

- Increasing use of Green Freight

- Emergence of new advanced technologies

- CHALLENGES

- Lack of Training and Education

- risk associated with cyber-attacks

- LACK OF DIGITAL LITERACY IN VARIOUS REGIONS

- COVID-19 IMPACT ON EUROPE FREIGHT TRANSPORTATION MANAGEMENT MARKET IN INFORMATION & COMMUNICATION TECHNOLOGY

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe freight transportation management market, BY Transportation Mode

- overview

- Roadways

- Railways

- Marine

- Airways

- Europe freight transportation management market, BY Offering

- overview

- Solutions

- Freight 3PL Solutions

- CROSS DOCK OPERATION

- LOAD OPTIMIZATION PLATFORM

- FREIGHT ORDER MANAGEMENT

- BROKERAGE OPERATIONAL MANAGEMENT

- BUSINESS INTELLIGENCE SOLUTION

- OTHERS

- Freight Transportation Cost Management System

- Freight Mobility Solution

- GPS

- RFID

- Freight Security Solutions

- CARGO TRACKING

- INTRUSION DETECTION

- VIDEO SURVEILLANCE

- Freight information Management System

- Fleet Tracking Solution

- Fleet Maintenance Solution

- Freight Operation Management Solution

- AUDIT AND PAYMENT SOLUTION

- SUPPLIER AND VENDOR MANAGEMENT

- CRM

- OTHERS

- Warehouse Management System

- Services

- Integration Services

- Managed Services

- Business Services

- Europe freight transportation management market, BY Deployment Mode

- overview

- Cloud or Hosted

- Subscription Based

- Transaction Based

- On Premise

- Europe freight transportation management market, BY Organization Size

- overview

- Large Enterprises

- SME's

- Europe freight transportation management market, BY Industry

- overview

- Manufacturing

- Retail & E-commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- IT & Telecom

- Others

- Europe freight transportation management market, by country

- EUROPE

- GERMANY

- FRANCE

- Italy

- U.K.

- Spain

- Netherlands

- Switzerland

- Belgium

- Russia

- Turkey

- Rest of Europe

- Europe freight transportation management market, COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- company profile

- SAP SE

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Oracle

- COMPANY snapshot

- REVENUE ANALYSIS

- Application PORTFOLIO

- recent DEVELOPMENTS

- C.H. Robinson Worldwide, Inc.

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Accenture

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- GEODIS

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Blue Yonder Group, Inc.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- BluJay Solutions Ltd.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- TRANSPOREON GmbH

- COMPANY snapshot

- Platform PORTFOLIO

- recent DEVELOPMENTS

- Manhattan Associates

- COMPANY snapshot

- REVENUE ANALYSIS

- solution PORTFOLIO

- recent DEVELOPMENT

- CTSI-GLOBAL

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- 3Gtms

- COMPANY snapshot

- Platform PORTFOLIO

- recent DEVELOPMENTS

- Cloud Logistics

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- MercuryGate

- COMPANY snapshot

- Solutions PORTFOLIO

- recent DEVELOPMENT

- THE DESCARTES SYSTEMS GROUP INC

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Transplace

- COMPANY snapshot

- solution PORTFOLIO

- recent DEVELOPMENTS

- questionnaire

- related reports

Lista de Tablas

TABLE 1 Europe freight transportation management market, By TRANSPORTATION MODE, Market Forecast 2021-2028 (USD Million)

TABLE 2 Europe freight transportation management market, By Offering, Market Forecast 2021-2028 (USD Million)

TABLE 3 Europe Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 4 Europe 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 5 Europe Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 6 Europe Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 7 Europe Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 8 Europe Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 9 Europe freight transportation management market, By deployment mode, Market Forecast 2021-2028 (USD Million)

TABLE 10 Europe Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 11 Europe freight transportation management market, By organization size, Market Forecast 2021-2028 (USD Million)

TABLE 12 Europe freight transportation management market, By industry, Market Forecast 2021-2028 (USD Million)

TABLE 13 Europe Freight Transportation Management Market, By Country, 2019-2028 (USD Million)

TABLE 14 Europe Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 15 Europe Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 16 Europe Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 17 Europe 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 18 Europe Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 19 Europe Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 20 Europe Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 21 Europe Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 22 Europe Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 23 Europe Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 24 Europe Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 25 Europe Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 26 GERMANY Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 27 GERMANY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 28 GERMANY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 29 GERMANY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 30 GERMANY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 31 GERMANY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 32 GERMANY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 33 GERMANY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 34 GERMANY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 35 GERMANY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 36 GERMANY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 37 GERMANY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 38 FRANCE Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 39 FRANCE Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 40 FRANCE Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 41 FRANCE 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 42 FRANCE Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 43 FRANCE Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 44 fRANCE Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 45 FRANCE Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 46 FRANCE Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 47 FRANCE Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 48 FRANCE Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 49 FRANCE Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 50 Italy Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 51 ITALY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 52 iTALY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 53 ITALY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 54 ITALY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 55 ITALY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 56 ITALY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 57 ITALY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 58 ITALY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 59 ITALY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 60 ITALY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 61 ITALY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 62 U.K. Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 63 U.K. Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 64 U.K. Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 65 U.K. 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 66 U.K. Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 67 U.K. Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 68 U.K. Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 69 U.K. Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 70 U.K. Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 71 U.K. Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 72 U.K. Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 73 U.K. Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 74 Spain Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 75 SPAIN Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 76 SPAIN Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 77 SPAIN 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 78 SPAIN Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 79 SPAIN Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 80 SPAIN Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 81 SPAIN Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 82 SPAIN Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 83 SPAIN Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 84 SPAIN Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 85 SPAIN Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 86 Netherlands Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 87 NETHERLANDS Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 88 NETHERLANDS Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 89 NETHERLANDS 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 90 NETHERLANDS Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 91 NETHERLANDS Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 92 NETHERLANDS Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 93 NETHERLANDS Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 94 NETHERLANDS Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 95 NETHERLANDS Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 96 NETHERLANDS Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 97 NETHERLANDS Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 98 Switzerland Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 99 SWITZERLAND Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 100 SWITZERLAND Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 101 SWITZERLAND 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 102 SWITZERLAND Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 103 sWITZERLAND Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 104 SWITZERLAND Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 105 SWITZERLAND Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 106 SWITZERLAND Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 107 SWITZERLAND Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 108 SWITZERLAND Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 109 SWITZERLAND Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 110 Belgium Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 111 BELGIUM Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 112 BELGIUM Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 113 BELGIUM 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 114 BELGIUM Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 115 BELGIUM Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 116 BELGIUM Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 117 BELGIUM Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 118 BELGIUM Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 119 BELGIUM Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 120 BELGIUM Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 121 BELGIUM Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 122 Russia Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 123 RUSSIA Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 124 RUSSIA Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 125 RUSSIA 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 126 RUSSIA Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 127 RUSSIA Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 128 RUSSIA Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 129 RUSSIA Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 130 RUSSIA Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 131 RUSSIA Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 132 RUSSIA Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 133 RUSSIA Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 134 Turkey Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 135 TURKEY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 136 TURKEY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 137 TURKEY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 138 TURKEY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 139 TURKEY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 140 TURKEY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 141 TURKEY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 142 TURKEY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 143 TURKEY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 144 TURKEY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 145 TURKEY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 146 Rest of Europe Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

Lista de figuras

FIGURE 1 Europe freight transportation management market: segmentation

FIGURE 2 Europe freight transportation management market: data triangulation

FIGURE 3 Europe freight transportation management market: DROC ANALYSIS

FIGURE 4 Europe freight transportation management market: REGIONAL VS. GLOBAL MARKET ANALYSIS

FIGURE 5 Europe freight transportation management market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe freight transportation management market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe freight transportation management market: DBMR MARKET POSITION GRID

FIGURE 8 Europe freight transportation management market: vendor share analysis

FIGURE 9 Europe freight transportation management MARKET: MARKET IndustryCOVERAGE GRID

FIGURE 10 Europe freight transportation management market: SEGMENTATION

FIGURE 11 Increasing growth in globalization leading to high freight transportation is EXPECTED TO DRIVE Europe freight transportation management market IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 12 Roadways is expected to account for the largest share of Europe freight transportation management market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF Europe freight transportation management market

FIGURE 14 Europe freight transportation management market: BY Transportation Mode, 2020

FIGURE 15 Europe freight transportation management market: BY Offering, 2020

FIGURE 16 Europe freight transportation management market: BY deployment mode, 2020

FIGURE 17 Europe freight transportation management market: BY organization size, 2020

FIGURE 18 Europe freight transportation management market: BY industry, 2020

FIGURE 19 Europe Freight transportation management MARKET: SNAPSHOT (2020)

FIGURE 20 Europe Freight transportation management MARKET: by Country (2020)

FIGURE 21 Europe Freight transportation management MARKET: by Country (2021 & 2028)

FIGURE 22 Europe Freight transportation management MARKET: by Country (2021 & 2028)

FIGURE 23 Europe Freight transportation management MARKET: by type (2021-2028)

FIGURE 24 Europe Freight Transportation Management Market: company share 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.