Europe Fraud Detection Transaction Monitoring Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.11 Billion

USD

24.47 Billion

2024

2032

USD

5.11 Billion

USD

24.47 Billion

2024

2032

| 2025 –2032 | |

| USD 5.11 Billion | |

| USD 24.47 Billion | |

|

|

|

|

Segmentación del mercado europeo de monitoreo de transacciones para detección de fraudes, por oferta (soluciones y servicios), función (KYC/incorporación de clientes, gestión de casos, filtrado de listas de vigilancia, panel de control e informes, entre otros), implementación (local y en la nube), tamaño de la organización (grandes y medianas empresas), aplicación (detección de fraude en pagos, blanqueo de capitales, protección contra el robo de cuentas, prevención del robo de identidad, entre otros), sector vertical (banca, servicios financieros y seguros [BFSI], comercio minorista, TI y telecomunicaciones, gobierno y defensa, sanidad, fabricación, energía y servicios públicos, entre otros): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado europeo de monitoreo de transacciones y detección de fraude

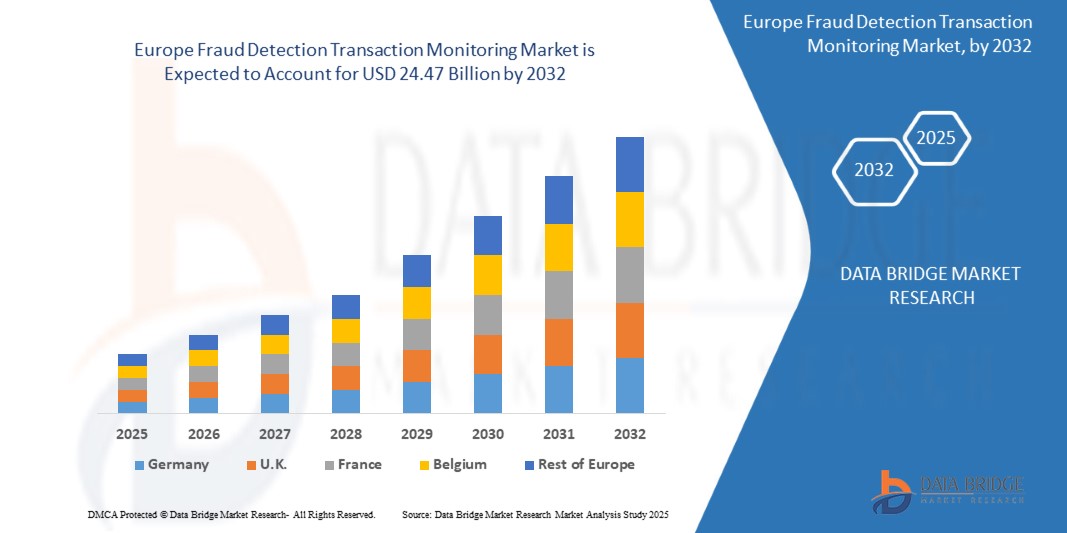

- El tamaño del mercado de monitoreo de transacciones de detección de fraude en Europa se valoró en USD 5.11 mil millones en 2024 y se espera que alcance los USD 24.47 mil millones para 2032 , con una CAGR del 21,6% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente digitalización de las transacciones financieras, la creciente adopción de la banca en línea y las plataformas de pago digital, y la integración de tecnologías de inteligencia artificial y aprendizaje automático para la detección de fraudes en tiempo real en los sectores de BFSI, minorista y comercio electrónico.

- Además, los crecientes requisitos de cumplimiento normativo, como los mandatos KYC, AML y antifraude, junto con la creciente necesidad de sistemas de monitoreo de transacciones seguros, eficientes y automatizados, impulsan a las organizaciones a adoptar soluciones avanzadas de detección de fraude. Estos factores convergentes están acelerando la implementación de plataformas integrales de monitoreo, impulsando así significativamente el crecimiento del sector.

Análisis del mercado europeo de detección de fraude y monitoreo de transacciones

- Las soluciones de monitoreo de transacciones para la detección de fraude ayudan a las organizaciones a identificar, prevenir y mitigar actividades fraudulentas mediante el análisis de transacciones en tiempo real mediante IA, aprendizaje automático y análisis predictivo. Estos sistemas proporcionan alertas, calificación automatizada de riesgos e informes de cumplimiento para proteger los activos financieros y operativos.

- La creciente demanda de estas soluciones se ve impulsada principalmente por el aumento de las transacciones en línea, la creciente sofisticación de los esquemas de fraude cibernético y la necesidad crítica de que las organizaciones garanticen el cumplimiento normativo al mismo tiempo que protegen los datos de los clientes y mantienen la confianza.

- Alemania dominó el mercado de monitoreo de transacciones de detección de fraude en 2024, debido a su sector bancario y de servicios financieros maduro, infraestructura digital avanzada y alta adopción de tecnología financiera y soluciones de pago digital.

- Se espera que el Reino Unido sea el país de más rápido crecimiento en el mercado de monitoreo de transacciones de detección de fraude durante el período de pronóstico debido a la creciente adopción de banca digital, pagos móviles y soluciones de detección de fraude habilitadas por IA.

- El segmento de soluciones dominó el mercado con una cuota de mercado del 62,9 % en 2024, debido a la creciente demanda de software avanzado de detección de fraude que integre IA, aprendizaje automático y análisis en tiempo real. Organizaciones de los sectores de BFSI, comercio minorista y telecomunicaciones implementan cada vez más plataformas de detección de fraude para proteger las transacciones, reducir las pérdidas financieras y garantizar el cumplimiento normativo. La escalabilidad de las soluciones, su capacidad para proporcionar información predictiva y su integración fluida con los sistemas empresariales las convierten en la opción preferida de las empresas que priorizan la seguridad y la eficiencia operativa.

Alcance del informe y segmentación del mercado europeo de monitoreo de transacciones de detección de fraude

|

Atributos |

Detección de fraude en Europa: Monitoreo de transacciones: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado europeo de monitoreo de transacciones y detección de fraude

Adopción de IA para la detección de fraudes en tiempo real

- La creciente adopción de la inteligencia artificial para la detección de fraudes en tiempo real está transformando el mercado de monitoreo de transacciones para la detección de fraudes. Las instituciones financieras y las empresas están aprovechando los sistemas basados en IA para identificar actividades sospechosas al instante, reducir los falsos positivos y mejorar la precisión general de la detección en redes de transacciones cada vez más complejas.

- Por ejemplo, Mastercard emplea herramientas de detección de fraude basadas en IA que analizan patrones de transacciones en tiempo real para interceptar actividades fraudulentas antes de que se completen. De igual forma, Featurespace utiliza análisis de comportamiento adaptativo impulsado por aprendizaje automático para que los bancos y las empresas de pago puedan identificar anomalías en transacciones financieras a gran escala con mayor precisión.

- El uso de IA mejora significativamente la capacidad de detección de fraude al analizar enormes volúmenes de datos estructurados y no estructurados en segundos, algo que los sistemas tradicionales basados en reglas tienen dificultades para lograr. Esto permite a las organizaciones contrarrestar eficazmente tácticas de fraude avanzadas, como identidades sintéticas, robo de cuentas y fraude transfronterizo.

- Las tecnologías de IA también ayudan a reducir la tasa de falsos rechazos, que pueden afectar negativamente la experiencia del cliente en el sector financiero. Al mejorar la precisión de la detección, los sistemas de IA en tiempo real protegen a las instituciones de pérdidas monetarias y, además, salvaguardan la confianza y la lealtad de los consumidores.

- La expansión de los ecosistemas de pagos digitales, incluyendo billeteras móviles, plataformas de comercio electrónico y transferencias entre pares, ha aumentado la necesidad de prevención inmediata del fraude. Los sistemas de monitoreo de transacciones basados en IA ofrecen capacidades adaptativas en tiempo real que permiten una integración fluida con redes financieras de alta velocidad.

- En conclusión, la adopción de la IA para la detección de fraudes en tiempo real está impulsando una rápida transformación en la industria. Esta tendencia subraya la creciente necesidad de marcos de monitoreo ágiles, inteligentes y predictivos que se adapten a las nuevas tácticas de fraude y permitan transacciones financieras seguras y fluidas en todo el mundo.

Dinámica del mercado europeo de monitoreo de transacciones y detección de fraude

Conductor

Mayor enfoque en la verificación y autenticación de identidad

- El creciente énfasis en la verificación y autenticación de identidad es un factor clave que acelera la adopción de sistemas de monitoreo de transacciones. Con el auge de las transacciones digitales, las instituciones financieras priorizan los métodos avanzados de autenticación de identidad para proteger a los usuarios del robo de identidad, el fraude de apropiación de cuentas y el acceso no autorizado.

- Por ejemplo, Experian ha integrado herramientas avanzadas de verificación de identidad en sus soluciones de detección de fraude, utilizando autenticación biométrica y verificación multifactor para reforzar la seguridad de las transacciones. De igual forma, empresas como LexisNexis Risk Solutions utilizan IA y big data para que las organizaciones financieras puedan validar la identidad de los clientes en tiempo real, reduciendo al mismo tiempo la fricción en la experiencia del usuario.

- La integración de factores biométricos como el reconocimiento facial, el escaneo de huellas dactilares y el análisis de comportamiento mejora aún más la mitigación de riesgos en los servicios bancarios, de comercio electrónico y de telecomunicaciones. Estas medidas proporcionan sólidas capacidades de verificación para complementar la monitorización de transacciones y reducir las vulnerabilidades en las cuentas de usuario.

- El panorama regulatorio, en particular con marcos como los requisitos de Conozca a su Cliente (KYC) y la Prevención del Blanqueo de Capitales (AML), también refuerza la necesidad de herramientas robustas de verificación y autenticación de identidad. Las organizaciones financieras deben adoptar soluciones de monitoreo avanzadas para cumplir con las normativas y minimizar las multas regulatorias.

- En general, el mayor énfasis en la verificación y autenticación de identidad está reforzando la confianza global en los canales digitales. Este impulsor garantiza que los sistemas de monitoreo de transacciones para la detección de fraudes sigan evolucionando como herramientas indispensables para proteger los servicios financieros y las relaciones con los clientes.

Restricción/Desafío

Alta inversión inicial y costos de mantenimiento continuo

- Un desafío importante en el mercado de monitoreo de transacciones para la detección de fraude es la alta inversión financiera requerida para la implementación y el mantenimiento continuo. Implementar sistemas avanzados de monitoreo basados en IA exige una inversión sustancial de capital en plataformas de software, tecnologías de integración y personal capacitado, lo que crea barreras para las pequeñas instituciones financieras y empresas.

- Por ejemplo, grandes bancos como JPMorgan Chase pueden permitirse implementar plataformas de monitoreo de fraude en tiempo real basadas en IA con capacidades predictivas. Sin embargo, las instituciones medianas y regionales suelen tener dificultades para afrontar los altos costos de implementación y justificar los gastos, especialmente en mercados con márgenes de beneficio reducidos.

- La complejidad de gestionar y mantener estos sistemas incrementa aún más los costos a largo plazo. Se requieren actualizaciones continuas para mantener los modelos de amenazas al día, mientras que los gastos operativos, como el ajuste de los sistemas, la capacidad de almacenamiento en la nube y las herramientas de análisis avanzado, aumentan la carga financiera de las organizaciones.

- Además, surgen desafíos de escalabilidad cuando el volumen de transacciones se dispara, lo que obliga a las instituciones a invertir más en infraestructura y sistemas de soporte. Esto afecta a las organizaciones con presupuestos limitados que ya están equilibrando los costos de cumplimiento normativo y la presión sobre las ganancias.

- Como resultado, los altos costos iniciales, combinados con los gastos de mantenimiento continuo, limitan la adopción generalizada de soluciones de monitoreo de transacciones para la detección de fraude. Superar este desafío requerirá el desarrollo de plataformas rentables, modelos de suscripción basados en la nube y ofertas de servicios compartidos para ampliar la accesibilidad a instituciones de todos los tamaños.

Alcance del mercado europeo de detección de fraude y monitoreo de transacciones

El mercado está segmentado en función de la oferta, la función, la implementación, el tamaño de la organización, la aplicación y la vertical.

- Ofreciendo

Según la oferta, el mercado se segmenta en soluciones y servicios. El segmento de soluciones dominó la mayor cuota de mercado en ingresos, con un 62,9%, en 2024, impulsado por la creciente demanda de software avanzado de detección de fraude que integre IA, aprendizaje automático y análisis en tiempo real. Organizaciones de los sectores de BFSI, comercio minorista y telecomunicaciones implementan cada vez más plataformas de detección de fraude para proteger las transacciones, reducir las pérdidas financieras y garantizar el cumplimiento normativo. La escalabilidad de las soluciones, su capacidad para proporcionar información predictiva y su integración fluida con los sistemas empresariales las convierten en la opción preferida de las empresas que priorizan la seguridad y la eficiencia operativa.

Se prevé que el segmento de servicios experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de servicios gestionados, consultoría y soporte técnico. Las empresas externalizan cada vez más la monitorización del fraude a proveedores de servicios debido a la falta de experiencia interna y a la complejidad de gestionar las ciberamenazas en constante evolución. El auge de las ofertas de detección de fraude por suscripción, los servicios de formación y el soporte de monitorización 24/7 está acelerando aún más su adopción. Los proveedores de servicios que ofrecen soluciones personalizadas de asesoramiento y cumplimiento normativo están ganando terreno, especialmente entre las pymes que buscan una prevención del fraude rentable y escalable.

- Por función

En función de su función, el mercado se segmenta en KYC/Incorporación de clientes, Gestión de casos, Filtrado de listas de vigilancia, Paneles de control e informes, y otros. El segmento KYC/Incorporación de clientes obtuvo la mayor cuota de mercado en 2024, debido a los crecientes mandatos regulatorios y requisitos de cumplimiento en el sector financiero. Las instituciones financieras, las fintechs y los bancos digitales confían en soluciones KYC robustas para autenticar identidades, prevenir la apertura fraudulenta de cuentas y fortalecer la confianza de los clientes. La adopción de la verificación biométrica, el e-KYC y las plataformas de incorporación digital ha impulsado su dominio, garantizando tanto la eficiencia operativa como la reducción de la exposición al riesgo financiero.

Se proyecta que el segmento de análisis de listas de vigilancia registrará su mayor crecimiento entre 2025 y 2032, impulsado por la creciente presión global para cumplir con las regulaciones contra el lavado de dinero (ALD) y el financiamiento del terrorismo (CFT). Las instituciones están implementando herramientas avanzadas de análisis para monitorear las transacciones en relación con sanciones globales, bases de datos de personas expuestas políticamente (PEP) y medios de comunicación desfavorables. El aumento de los pagos transfronterizos y el comercio internacional está impulsando a las empresas a priorizar soluciones de análisis automatizadas en tiempo real que minimicen el riesgo de incumplimiento y las sanciones regulatorias.

- Por implementación

En función de la implementación, el mercado se segmenta en local y en la nube. El segmento local dominó la mayor cuota de mercado en 2024, ya que las grandes empresas y las organizaciones gubernamentales siguen priorizando el máximo control de datos, la personalización de los sistemas y una mayor seguridad. La implementación local sigue siendo popular en sectores altamente regulados, como la banca y la defensa, donde existen estrictos requisitos de soberanía y confidencialidad de los datos. La capacidad de integrar estrechamente las herramientas de monitoreo de fraude locales con los sistemas de TI heredados también contribuye a su uso generalizado.

Se prevé que el segmento de la nube experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por su escalabilidad, rentabilidad y capacidad para soportar la monitorización en tiempo real en redes distribuidas. Las soluciones de detección de fraude basadas en la nube ofrecen a las organizaciones actualizaciones de software instantáneas, análisis basados en IA y flexibilidad para adaptarse a la evolución de los patrones de fraude. La rápida adopción de los pagos digitales, el teletrabajo y la banca en línea ha acelerado la adopción de la nube, especialmente entre las pymes que buscan plataformas seguras de monitorización de fraude basadas en suscripción con costes iniciales mínimos de infraestructura.

- Por tamaño de la organización

Según el tamaño de la organización, el mercado se segmenta en grandes empresas y pequeñas y medianas empresas (PYME). El segmento de grandes empresas representó la mayor cuota de mercado en 2024, dado que las corporaciones globales se enfrentan a riesgos significativos derivados de intentos de fraude a gran escala, esquemas de lavado de dinero y ciberataques. Estas organizaciones invierten fuertemente en plataformas de monitoreo de fraude basadas en IA, análisis avanzados y sistemas de gestión de riesgos para toda la empresa. La disponibilidad de mayores presupuestos, las prioridades de cumplimiento normativo y la integración con operaciones multicanal garantizan que las grandes empresas sigan siendo líderes en la adopción de soluciones de detección de fraude.

Se prevé que el segmento de las pymes experimente su mayor crecimiento entre 2025 y 2032, impulsado por su creciente vulnerabilidad al ciberfraude, el phishing y el robo de cuentas. Las pymes están adoptando herramientas de detección de fraude rentables y basadas en la nube que ofrecen protección automatizada sin necesidad de una infraestructura de TI extensa. La creciente adopción de soluciones de pago digital, sumada a una mayor concienciación sobre las obligaciones de cumplimiento normativo, está impulsando a las pymes a adoptar plataformas de monitoreo de fraude. Los modelos de precios basados en suscripciones y los servicios gestionados de detección de fraude hacen que estas soluciones sean muy atractivas para las pequeñas empresas.

- Por aplicación

Según su aplicación, el mercado se segmenta en detección de fraude en pagos, detección de lavado de dinero, protección contra el robo de cuentas, prevención del robo de identidad, entre otros. El segmento de detección de fraude en pagos dominó el mercado en 2024 gracias al rápido crecimiento de los pagos digitales, las transacciones de comercio electrónico y la banca móvil. El aumento de casos de transacciones no autorizadas, fraudes con tarjetas y ataques de phishing ha impulsado a bancos y comercios a adoptar sistemas de detección de fraude basados en IA. El análisis de transacciones en tiempo real, la puntuación predictiva de fraude y la integración con pasarelas de pago han convertido a este segmento en la aplicación más adoptada en todos los sectores.

Se prevé que el segmento de protección contra el robo de cuentas registre la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la creciente sofisticación del robo de credenciales, las estafas de phishing y los ataques de ingeniería social. Los estafadores atacan las cuentas de usuarios en los sectores bancario, minorista y de telecomunicaciones, lo que convierte el robo de cuentas en una preocupación importante. Las empresas están adoptando la autenticación multifactor, la biometría del comportamiento y la monitorización basada en IA para detectar anomalías en los patrones de acceso de los usuarios. El auge de las cuentas en línea, las billeteras digitales y los servicios en la nube impulsa aún más la adopción de soluciones de protección contra el robo de cuentas.

- Por Vertical

Por sector, el mercado se segmenta en banca, servicios financieros y seguros (BFSI), comercio minorista, TI y telecomunicaciones, gobierno y defensa, salud, manufactura, energía y servicios públicos, entre otros. El segmento BFSI obtuvo la mayor cuota de mercado en 2024, ya que los bancos y las instituciones financieras siguen siendo el principal objetivo de los estafadores. El sector invierte fuertemente en plataformas de detección de fraude para proteger las transacciones digitales, combatir el lavado de dinero y cumplir con estrictos marcos regulatorios como AML y KYC. La rápida expansión de la banca en línea y las innovaciones fintech continúa impulsando la adopción de soluciones avanzadas de monitoreo de fraude en el sector BFSI.

Se proyecta que el sector de la salud experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente incidencia del robo de identidad médica, el fraude de seguros y las filtraciones de datos. Con la creciente digitalización de los historiales médicos y los sistemas de facturación de pacientes, los proveedores de servicios de salud están implementando plataformas de detección de fraude para proteger los datos confidenciales. Se están adoptando sistemas de análisis y monitoreo basados en IA para detectar reclamaciones fraudulentas y prevenir el acceso no autorizado a la información médica. El creciente impulso regulatorio para proteger los datos de los pacientes también está acelerando la adopción de sistemas de monitoreo de fraude en este sector.

Análisis regional del mercado europeo de monitoreo de transacciones y detección de fraude

- Alemania dominó el mercado de monitoreo de transacciones de detección de fraude con la mayor participación en los ingresos en 2024, impulsada por su sector bancario y de servicios financieros maduro, infraestructura digital avanzada y alta adopción de tecnología financiera y soluciones de pago digital.

- El liderazgo de Alemania se ve reforzado por la creciente adopción de sistemas de monitoreo de fraude basados en IA, el aumento de las transacciones digitales y la integración de análisis automatizados en tiempo real para el cumplimiento normativo y la mitigación de riesgos. El énfasis del país en la ciberseguridad, la inversión en tecnologías analíticas avanzadas y la colaboración entre instituciones financieras y proveedores de tecnología están acelerando aún más la adopción en el mercado.

- La posición de Alemania se fortalece aún más con las inversiones continuas en plataformas de monitoreo locales y basadas en la nube, el enfoque en modelos de detección predictiva de fraude y la expansión continua de ecosistemas de pago digital y soluciones de verificación de identidad en aplicaciones empresariales y gubernamentales.

Análisis del mercado de monitoreo de transacciones de detección de fraude en el Reino Unido

Se proyecta que el mercado del Reino Unido registre la tasa de crecimiento anual compuesta (TCAC) más rápida de Europa entre 2025 y 2032, impulsada por la creciente adopción de la banca digital, los pagos móviles y las soluciones de detección de fraude basadas en IA. La creciente demanda de sistemas de monitorización en tiempo real, la preferencia de los consumidores por transacciones digitales seguras y fluidas, y la sólida penetración de las plataformas fintech están acelerando la implementación de estas soluciones. La expansión de las iniciativas de banca abierta, las colaboraciones entre bancos y proveedores de tecnología, y las inversiones en análisis predictivo y modelos de aprendizaje automático impulsan aún más el crecimiento del mercado.

Detección de fraude en Francia: Monitoreo de transacciones y perspectivas del mercado

Se prevé que Francia experimente un crecimiento sostenido entre 2025 y 2032, impulsado por un sector financiero sólido, un mayor enfoque en la prevención del fraude y un énfasis regulatorio en el cumplimiento de las normas KYC y AML. La creciente integración de software avanzado de detección de fraude en los sectores bancario y de comercio electrónico, las inversiones en herramientas de monitorización basadas en IA y aprendizaje automático, y la promoción de sistemas de transacciones seguras impulsan la demanda del mercado. La I+D local, las colaboraciones con proveedores de tecnología y la priorización de soluciones de detección de fraude fiables y de alta calidad impulsan aún más la expansión del mercado.

Cuota de mercado de monitoreo de transacciones de detección de fraude en Europa

La industria del monitoreo de transacciones para detección de fraude está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Amazon Web Services, Inc. (EE. UU.)

- LexisNexis (EE. UU.)

- Mastercard (EE. UU.)

- Servicios de consultoría TATA Limited (India)

- Fiserv, Inc. (EE. UU.)

- SAS Institute Inc. (EE. UU.)

- ACI Worldwide (EE. UU.)

- Oracle (EE. UU.)

- NIZA (Israel)

- FICO (EE. UU.)

- SymphonyAI (EE. UU.)

- UBICUIDAD (EE. UU.)

- Verafin Solutions ULC (Canadá)

- GB Group plc ('GBG') (Reino Unido)

- INFORM SOFTWARE (Alemania)

- Quantexa (Reino Unido)

- Sum and Substance Ltd (Reino Unido)

- DataVisor, Inc. (EE. UU.)

- Halcón (Alemania)

- Featurespace Limited (Inglaterra)

- INETCO Systems Ltd. (Canadá)

- Abra Innovations, Inc. (EE. UU.)

- Seon Technologies Ltd. (Hungría)

- Feedzai (Portugal)

- Escáner de sanciones (Reino Unido)

Últimos avances en el mercado europeo de detección de fraude y monitoreo de transacciones

- En junio de 2024, American Express aceleró la detección de fraudes mediante modelos de memoria a largo plazo (LSTM) basados en IA. Al aprovechar la computación paralela en GPU, la compañía procesó y analizó rápidamente grandes cantidades de datos transaccionales, lo que permitió la detección de fraudes en tiempo real. Este enfoque ayudó a American Express a gestionar las complejidades derivadas de su alto volumen de transacciones. La integración de la computación acelerada y la IA mejoró su capacidad para detectar anomalías con rapidez, mejorando la eficiencia operativa y reduciendo las posibles pérdidas por fraude.

- En junio de 2024, DataVisor, Inc. mejoró sus capacidades multiinquilino para ofrecer soluciones escalables, seguras y flexibles de prevención del fraude y lucha contra el blanqueo de capitales. La actualización permitió a las organizaciones personalizar sus estrategias contra el fraude y la lucha contra el blanqueo de capitales e implementarlas en subinquilinos con funciones como modelos de aprendizaje automático y reglas de negocio. Estas mejoras facilitaron el cumplimiento normativo de los bancos patrocinadores y permitieron a las grandes instituciones financieras centralizar los datos, a la vez que facilitaban la toma de decisiones sobre subinquilinos. Este desarrollo benefició a DataVisor, fortaleciendo su posición en el mercado y aumentando la adopción de sus soluciones entre las instituciones bancarias y financieras, lo que mejoró la satisfacción y la retención de clientes.

- En junio de 2024, ACI Worldwide y RS2 lanzaron una solución integral de pagos en Brasil, combinando sus tecnologías de adquirente y emisor. Esta plataforma en la nube permitió a las instituciones financieras y proveedores de servicios de pago introducir nuevos productos y servicios de forma eficiente, mejorando la seguridad y reduciendo costos. La integración de la gestión avanzada del fraude y el análisis en tiempo real benefició a las empresas, ampliando su alcance de mercado y aumentando sus oportunidades de ingresos.

- En octubre de 2023, ACI Worldwide se asoció con Nymcard para mejorar sus capacidades contra el fraude y el blanqueo de capitales. Esta alianza permitió a Nymcard detectar y prevenir el fraude financiero de forma rápida y eficiente mediante aprendizaje automático y análisis avanzados. La implementación a través de la nube pública de ACI mejoró la escalabilidad, la seguridad y la eficiencia operativa, fortaleciendo significativamente la posición de Nymcard en el mercado de Oriente Medio y Norte de África.

- En julio de 2023, según el blog publicado por BluEnt, las empresas se enfrentaron a mayores desafíos en la detección del fraude debido al alto volumen de transacciones. Se adoptaron tecnologías avanzadas y sistemas automatizados para analizar grandes conjuntos de datos e identificar tendencias y anomalías de alto riesgo. A pesar de las dificultades para gestionar los datos no estructurados, donde se produce la mayor parte del fraude, el análisis de datos sobre delitos financieros permitió la revisión eficaz de datos estructurados y no estructurados. Este enfoque ayudó a prevenir actividades fraudulentas e integrar diversas fuentes de datos para una mejor detección.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.