Mercado europeo de carretillas elevadoras por tipo de producto (almacén y contrapeso), clase (clase I: carretillas elevadoras con motor eléctrico para conductor acompañante, clase II: carretillas elevadoras con motor eléctrico para pasillos estrechos, clase III: carretillas elevadoras con motor eléctrico para peatones, clase IV: carretillas con motor de combustión interna; clase V: carretillas elevadoras con motor de combustión interna, clase VI: tractores eléctricos y con motor de combustión interna, y clase VII: carretillas elevadoras todoterreno), tipo de combustible (diésel, gasolina y GLP/GNC, y eléctrico/híbrido), tipo de motor (potencia del motor de combustión interna (IC) y potencia eléctrica), capacidad de elevación ( 36 toneladas), industria de uso final (venta minorista y mayorista, transporte y logística, ingeniería automotriz y eléctrica, industria alimentaria y otras industrias) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

Las carretillas elevadoras se han utilizado para levantar y trasladar materiales pesados, como cajas, contenedores y otros componentes similares, en distancias cortas. Estas carretillas elevadoras eléctricas de servicio pesado son ideales para operaciones de almacenamiento, operaciones de reciclaje y astilleros para realizar numerosas funciones.

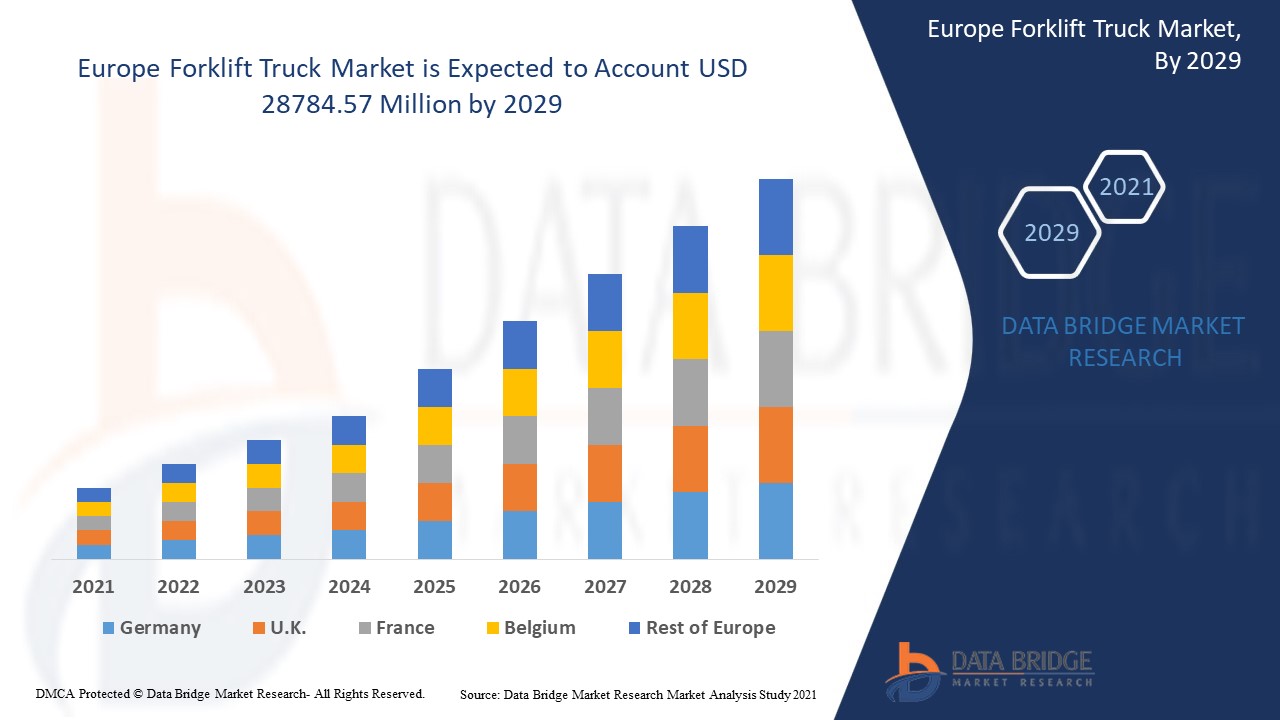

Ayudan a mover mercancías empaquetadas por el área de almacenamiento y a cargar y descargar mercancías de los vehículos. El mercado europeo de carretillas elevadoras se valoró en 37 169,66 millones de dólares en 2021 y se espera que alcance los 28 784,57 millones de dólares en 2029, registrando una CAGR del 6,60 % durante el período de pronóstico de 2022 a 2029. Clase III: las carretillas elevadoras con motor eléctrico representan el segmento de aplicación más grande en el mercado respectivo debido a la alta demanda en los almacenes y centros de distribución. El informe de mercado curado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis de pestle.

Definición de mercado

Una carretilla elevadora es una máquina industrial que incorpora dos brazos horizontales para cargar y transportar mercancías y materiales. La máquina suele ser operada por un maquinista capacitado. Esta carretilla funciona con baterías eléctricas o motores de combustión.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (almacén y contrapeso), clase (clase I: carretillas elevadoras con motor eléctrico, clase II: carretillas elevadoras con motor eléctrico para pasillos angostos, clase III: carretillas elevadoras con motor eléctrico para peatones, clase IV: carretillas elevadoras con motor de combustión interna; clase V: carretillas elevadoras con motor de combustión interna, clase VI: tractores eléctricos y con motor de combustión interna, y clase VII: carretillas elevadoras todoterreno), tipo de combustible (diésel, gasolina y GLP/GNC, y eléctrico/híbrido), tipo de motor (potencia del motor de combustión interna (IC) y potencia eléctrica), capacidad de elevación (< 5 toneladas, 5 toneladas - 10 toneladas, 11 toneladas - 36 toneladas y > 36 toneladas), industria de uso final (venta minorista y mayorista, transporte y logística, ingeniería automotriz y eléctrica, industria alimentaria y otras industrias) |

|

Países cubiertos |

Alemania, Francia, Rusia, Reino Unido, Italia, España, Países Bajos, Bélgica, Suiza, Turquía y resto de Europa |

|

Actores del mercado cubiertos |

Jungheinrich AG (Alemania), Hyster-Yale Group, Inc (EE. UU.), KION GROUP AG (Alemania), Lift Technologies, Inc (EE. UU.), Crown Equipment Corporation (EE. UU.), Toyota Industries Corporation (Japón), Mitsubishi Logisnext Co., Ltd (Japón) y Godrej & Boyce Manufacturing (India), entre otros. |

|

Oportunidades de mercado |

|

Dinámica del mercado de carretillas elevadoras en Europa

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Expansión de la industria de la construcción

El auge de la industria de la construcción junto con la rápida industrialización es uno de los principales factores que impulsan el crecimiento del mercado de carretillas elevadoras. Estas carretillas son populares por ser potentes, fáciles de usar, económicas y de fácil mantenimiento. Por lo general, se utilizan en diversas tareas industriales debido a sus características únicas.

- Aumento de almacenes

El aumento de la cantidad de desarrollos de almacenes en los países en desarrollo acelera el crecimiento del mercado. El aumento de la demanda de la industria manufacturera tiene un impacto positivo en el crecimiento del mercado.

- Preocupaciones relacionadas con la seguridad

El aumento de la adopción del mercado de carretillas elevadoras para mejorar la productividad y reducir las lesiones y los desastres influye aún más en el mercado. Además, la tendencia hacia las carretillas elevadoras con motor de combustión interna en las regiones en desarrollo contribuye a la expansión del mercado.

Además, la rápida urbanización, el cambio en el estilo de vida, el aumento de las inversiones y el mayor gasto de los consumidores impactan positivamente en el mercado de carretillas elevadoras.

Oportunidades

Además, el aumento de la demanda de carretillas elevadoras a batería amplía las oportunidades rentables para los actores del mercado en el período de pronóstico de 2022 a 2029. Además, el aumento de las inversiones expandirá aún más el mercado.

Restricciones/Desafíos

Por otro lado, se espera que el aumento de los servicios de logística de terceros (3PL) y el alto costo de las carretillas elevadoras a batería y de celdas de combustible obstaculicen el crecimiento del mercado. Además, se proyecta que las estrictas regulaciones de seguridad y emisiones desafiarán el mercado de carretillas elevadoras en el período de pronóstico de 2022 a 2029.

Este informe sobre el mercado de carretillas elevadoras proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de carretillas elevadoras, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado europeo de carretillas elevadoras

El COVID-19 tuvo un impacto negativo en el mercado de carretillas elevadoras debido a los estrictos cierres y el distanciamiento social para contener la propagación del virus. La incertidumbre económica, el cierre parcial de las empresas y la baja confianza de los consumidores afectaron la demanda del mercado de carretillas elevadoras. La cadena de suministro se vio obstaculizada durante la pandemia junto con el retraso de las actividades logísticas. Sin embargo, se espera que el mercado de carretillas elevadoras para automóviles recupere su ritmo durante el escenario posterior a la pandemia debido a la flexibilización de las restricciones.

Acontecimientos recientes

- En abril de 2019, KION GROUP AG, empresa dedicada a proporcionar carretillas elevadoras industriales, soluciones para la cadena de suministro, servicios y tecnología de almacenamiento, lanzó cinco nuevas carretillas elevadoras Linde y Baoli en el mercado europeo. Este lanzamiento de producto ha ayudado a la empresa a fortalecer su presencia en América del Norte.

- En junio de 2020, Hyster-Yale Materials Handling, Inc, adquirió Zhejiang Maximal Forklift Co., Ltd. Hyster había adquirido el 75 por ciento de las acciones en circulación. Esta adquisición ha ayudado a la empresa a fortalecer su cartera de productos en equipos de manipulación de materiales.

Alcance y tamaño del mercado de carretillas elevadoras en Europa

El mercado de carretillas elevadoras está segmentado en función del tipo de producto, la fuente de energía, el tipo de combustible, el tonelaje, la clase y la industria. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Contrapeso

- Depósito

En función del tipo de producto, el mercado se segmenta en productos de contrapeso y de almacén. Los de contrapeso representan la mayor cuota de mercado debido al auge del sector del comercio electrónico, que ha aumentado inadvertidamente las actividades de almacenamiento, lo que ha aumentado la demanda de productos de contrapeso en el sector del comercio electrónico .

Fuente de poder

- Carretilla elevadora de combustión interna

- Carretilla elevadora eléctrica

En función de la fuente de energía, el mercado se segmenta en carretillas elevadoras de combustión interna y carretillas elevadoras eléctricas. Las carretillas elevadoras de combustión interna representan la mayor participación de mercado, ya que estas carretillas elevadoras se utilizan ampliamente en entornos hostiles y tienen una gran capacidad para cargar material de un lugar a otro.

Clase

- Clase V (Carretillas elevadoras con motor de combustión interna, neumáticos)

- Clase IV (carretilla elevadora con motor de combustión interna, neumáticos macizos o con amortiguación)

- Clase I (Carretillas elevadoras con motor eléctrico y conductor sentado)

- Clase III (Carretillas elevadoras manuales eléctricas)

- Clase II (Carretilla elevadora de pasillo estrecho con motor eléctrico)

- Clase VI (Tractores eléctricos y con motor de combustión interna)

- Clase VII (Carretilla elevadora todoterreno)

En base a la clase, el mercado está segmentado en clase V (carretilla elevadora con motor de combustión interna, llantas neumáticas), clase IV (carretilla elevadora con motor de combustión interna, llantas sólidas/de amortiguación), clase I (carretilla elevadora con motor eléctrico para conductor a bordo), clase III (carretilla elevadora eléctrica manual), clase II (carretilla elevadora de pasillo estrecho con motor eléctrico), clase VI (tractores eléctricos y con motor de combustión interna) y clase VII (carretilla elevadora todoterreno). La clase V (carretilla elevadora con motor de combustión interna, llantas neumáticas) posee la mayor participación de mercado y se ha utilizado ampliamente para aplicaciones al aire libre.

Tonelaje

- Menos de 5 toneladas

- De 5 a 10 toneladas

- De 11 a 36 toneladas

- 36 toneladas y más

En función del tonelaje, el mercado se segmenta en menos de 5 toneladas, de 5 a 10 toneladas, de 11 a 36 toneladas y de 36 toneladas o más. Los modelos de menos de 5 toneladas representan la mayor participación de mercado debido al creciente uso de carretillas elevadoras en aplicaciones interiores.

Tipo de combustible

En función del tipo de combustible, el mercado se segmenta en eléctrico, GLP/GNC, diésel y gasolina. Las carretillas elevadoras eléctricas representan la mayor participación de mercado, ya que estas carretillas elevadoras no producen emisiones, por lo que se utilizan ampliamente para aplicaciones en interiores.

Industria

- Construcción

- Transporte y logística

- Industria alimentaria

- Minorista

- Químico

- Papel y madera

- Otro

En función de la industria, el mercado de carretillas elevadoras se segmenta en construcción, transporte y logística, industria alimentaria, venta minorista, química, papel y madera, entre otros. La construcción representó la mayor participación de mercado debido a que el aumento de la población ha aumentado aún más la demanda de refugios, lo que da como resultado un aumento de las actividades de construcción en los países.

Análisis y perspectivas regionales del mercado de carretillas elevadoras en Europa

Se analiza el mercado de carretillas elevadoras y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, fuente de energía, tipo de combustible, tonelaje, clase e industria.

Los países cubiertos en el informe del mercado de carretillas elevadoras de Europa son Alemania, Italia, Reino Unido, Francia, España, Países Bajos, Bélgica, Suiza, Turquía, Rusia y el resto de Europa.

Alemania domina el mercado europeo de carretillas elevadoras debido a los avances tecnológicos y la presencia de actores clave en la región.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Forklift Truck Market

The forklift truck market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to forklift truck market.

Some of the major players operating in the forklift truck market are

- Jungheinrich AG (Germany)

- Hyster-Yale Group, Inc (US)

- KION GROUP AG (Germany)

- Lift Technologies, Inc (US)

- Crown Equipment Corporation (US)

- Toyota Industries Corporation (Japan)

- Mitsubishi Logisnext Co., Ltd (Japan)

- Godrej & Boyce Manufacturing (India)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FORKLIFT TRUCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR E-COMMERCE INDUSTRY

5.1.2 INCREASING INVESTMENTS IN THE INFRASTRUCTURE INDUSTRY

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN FORKLIFT TRUCKS

5.1.4 INCREASING DEMAND FOR ELECTRIC-POWERED FORKLIFT TRUCKS

5.2 RESTRAINTS

5.2.1 INCREASE IN THIRD PARTY LOGISTICS (3PL) SERVICES

5.2.2 INCREASING SAFETY ISSUES RELATED TO FORKLIFT TRUCKS

5.2.3 HIGH COST OF BATTERY OPERATED AND FUEL CELL FORKLIFT

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF HYDROGEN FUEL CELL FORKLIFT

5.3.2 DEVELOPMENT OF AUTONOMOUS FORKLIFTS TRUCKS

5.3.3 INCREASING DEMAND FOR BATTERY-OPERATED FORKLIFTS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED WORKFORCE

5.4.2 INCREASING SAFETY AND EMISSION REGULATIONS

6 EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 COUNTERBALANCE

6.3 WAREHOUSE

7 EUROPE FORKLIFT TRUCK MARKET, BY POWER SOURCE

7.1 OVERVIEW

7.2 INTERNAL COMBUSTION FORKLIFT TRUCK

7.3 ELECTRIC FORKLIFT TRUCK

8 EUROPE FORKLIFT TRUCK MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS V (IC ENGINE FORKLIFT TRUCKS, PNEUMATIC TIRE)

8.3 CLASS IV (IC ENGINE FORKLIFT TRUCKS, SOLID/CUSHION TIRES)

8.4 CLASS I (ELECTRIC MOTOR RIDER FORKLIFT TRUCKS)

8.5 CLASS III (ELECTRIC HAND FORKLIFT TRUCKS)

8.6 CLASS II (ELECTRIC MOTOR NARROW AISLE FORKLIFT TRUCK)

8.7 CLASS VI (ELECTRIC AND IC ENGINE TRACTORS)

8.8 CLASS VII (ROUGH TERRAIN FORKLIFT TRUCK)

9 EUROPE FORKLIFT TRUCK MARKET, BY FUEL TYPE

9.1 OVERVIEW

9.2 ELECTRIC

9.3 LPG/CNG

9.4 DIESEL

9.5 GASOLINE

10 EUROPE FORKLIFT TRUCK MARKET, BY TONNAGE

10.1 OVERVIEW

10.2 BELOW 5 TON

10.3 5 TON TO 10 TON

10.4 TO 36 TON

10.5 TON AND ABOVE

11 EUROPE FORKLIFT TRUCK MARKET, BY END-USER

11.1 OVERVIEW

11.2 CONSTRUCTION

11.2.1 COUNTERBALANCE

11.2.2 WAREHOUSE

11.3 FREIGHT AND LOGISTIC

11.3.1 COUNTERBALANCE

11.3.2 WAREHOUSE

11.4 FOOD INDUSTRY

11.4.1 COUNTERBALANCE

11.4.2 WAREHOUSE

11.5 RETAIL

11.5.1 COUNTERBALANCE

11.5.2 WAREHOUSE

11.6 CHEMICAL

11.6.1 COUNTERBALANCE

11.6.2 WAREHOUSE

11.7 PAPER & WOOD

11.7.1 COUNTERBALANCE

11.7.2 WAREHOUSE

11.8 OTHERS

12 EUROPE FORKLIFT TRUCK MARKET, BY GEOGRAPHY

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K

12.1.3 FRANCE

12.1.4 SPAIN

12.1.5 ITALY

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 SWITZERLAND

12.1.9 TURKEY

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE FORKLIFT TRUCK MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 EUROPE FORKLIFT TRUCK MARKET: SWOT ANALYSIS

14.1 EUROPE FORKLIFT TRUCK MARKET: DATA BRIDGE MARKET RESEARCH ANALYSIS

15 COMPANY PROFILES

15.1 TOYOTA INDUSTRIES CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 KION GROUP AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 BRAND PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JUNGHEINRICH AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 MITSUBISHI LOGISNEXT CO.,LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 CROWN EQUIPMENT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ANHUI HELI CO., LTD

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CLARK

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COMBILIFT MATERIAL HANDLING SOLUTIONS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DOOSAN INDUSTRIAL VEHICLE AMERICA CORP.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 EP EQUIPMENT, CO.,LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GODREJ MATERIAL HANDLING

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 HANGCHA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HUBTEX MASCHINENBAU GMBH & CO. KG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HYSTER-YALE GROUP, INC. (A SUBSIDIARY OF HYSTER-YALE MATERIALS HANDLING, INC.)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 KOMATSU LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 KONECRANES

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 LIFT TECHNOLOGIES, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 LONKING MACHINERY CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MANITOU GROUP

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 PALLETRANS FORKLIFTS

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 2 EUROPE COUNTERBALANCE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 EUROPE WAREHOUSE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 EUROPE FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 5 EUROPE INTERNAL COMBUSTION FORKLIFT TRUCK IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 EUROPE ELECTRIC FORKLIFT TRUCK IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 EUROPE FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 8 EUROPE CLASS V (IC ENGINE FORKLIFT TRUCKS, PNEUMATIC TIRE) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 EUROPE CLASS IV (IC ENGINE FORKLIFT TRUCKS, SOLID/CUSHION TIRES) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 EUROPE CLASS I (ELECTRIC MOTOR RIDER FORKLIFT TRUCKS) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 EUROPE CLASS III (ELECTRIC HAND FORKLIFT TRUCKS) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 EUROPE CLASS II (ELECTRIC MOTOR NARROW AISLE FORKLIFT TRUCK) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 EUROPE CLASS VI (ELECTRIC AND IC ENGINE TRACTORS) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 EUROPE CLASS VII (ROUGH TERRAIN FORKLIFT TRUCK) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 EUROPE FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 16 EUROPE ELECTRIC IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 EUROPE LPG/CNG IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 EUROPE DIESEL IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 EUROPE GASOLINE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 EUROPE FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 21 EUROPE BELOW 5 TON IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 EUROPE 5 TON TO 10 TON IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 EUROPE 11 TO 36 TON IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 EUROPE 36 TON AND ABOVE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 EUROPE FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 26 EUROPE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 EUROPE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 28 EUROPE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 EUROPE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 30 EUROPE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 EUROPE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 32 EUROPE RETAIL IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 EUROPE RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 34 EUROPE CHEMICAL IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 EUROPE CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 36 EUROPE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 EUROPE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 38 EUROPE OTHERS IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 EUROPE FORKLIFT TRUCK MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 40 EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 41 EUROPE FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 42 EUROPE FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 43 EUROPE FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 44 EUROPE FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 45 EUROPE FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 46 EUROPE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 EUROPE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 48 EUROPE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 EUROPE RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 50 EUROPE CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 EUROPE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 52 GERMANY FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 GERMANY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 54 GERMANY FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 55 GERMANY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 56 GERMANY FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 57 GERMANY FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 58 GERMANY CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 GERMANY FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 60 GERMANY FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 GERMANY RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 62 GERMANY CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 GERMANY PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 64 U.K FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 65 U.K FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 66 U.K FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 67 U.K FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 68 U.K FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 69 U.K FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 70 U.K CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 71 U.K FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 72 U.K FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 73 U.K RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 U.K CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 75 U.K PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 76 FRANCE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 FRANCE FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 78 FRANCE FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 79 FRANCE FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 80 FRANCE FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 81 FRANCE FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 82 FRANCE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 FRANCE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 FRANCE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 FRANCE RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 FRANCE CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 87 FRANCE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 88 SPAIN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 89 SPAIN FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 90 SPAIN FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 91 SPAIN FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 92 SPAIN FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 93 SPAIN FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 94 SPAIN CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 SPAIN FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 96 SPAIN FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 97 SPAIN RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 SPAIN CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 SPAIN PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 ITALY FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 ITALY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 102 ITALY FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 103 ITALY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 104 ITALY FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 105 ITALY FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 106 ITALY CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 ITALY FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 108 ITALY FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 109 ITALY RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 110 ITALY CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 111 ITALY PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 112 RUSSIA FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 113 RUSSIA FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 114 RUSSIA FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 115 RUSSIA FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 116 RUSSIA FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 117 RUSSIA FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 118 RUSSIA CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 RUSSIA FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 RUSSIA FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 RUSSIA RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 RUSSIA CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 RUSSIA PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 NETHERLANDS FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 NETHERLANDS FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 126 NETHERLANDS FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 127 NETHERLANDS FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 128 NETHERLANDS FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 129 NETHERLANDS FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 130 NETHERLANDS CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 131 NETHERLANDS FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 132 NETHERLANDS FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 133 NETHERLANDS RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 134 NETHERLANDS CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 135 NETHERLANDS PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 136 SWITZERLAND FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 SWITZERLAND FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 138 SWITZERLAND FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 139 SWITZERLAND FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 140 SWITZERLAND FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 141 SWITZERLAND FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 142 SWITZERLAND CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 SWITZERLAND FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 SWITZERLAND FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 SWITZERLAND RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 SWITZERLAND CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 SWITZERLAND PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 TURKEY FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 149 TURKEY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 150 TURKEY FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 151 TURKEY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 152 TURKEY FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 153 TURKEY FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 154 TURKEY CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 155 TURKEY FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 156 TURKEY FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 157 TURKEY RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 158 TURKEY CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 159 TURKEY PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 160 BELGIUM FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 161 BELGIUM FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 162 BELGIUM FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 163 BELGIUM FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 164 BELGIUM FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 165 BELGIUM FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 166 BELGIUM CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 167 BELGIUM FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 168 BELGIUM FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 169 BELGIUM RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 170 BELGIUM CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 171 BELGIUM PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 172 REST OF EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 EUROPE FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 2 EUROPE FORKLIFT TRUCK MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE FORKLIFT TRUCK MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FORKLIFT TRUCK MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE FORKLIFT TRUCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FORKLIFT TRUCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FORKLIFT TRUCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FORKLIFT TRUCK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR E-COMMERCE INDUSTRY IS EXPECTED TO DRIVE EUROPE FORKLIFT TRUCK MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 COUNTERBALANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE FORKLIFT TRUCK MARKET IN 2020 & 2027

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE EUROPE FORKLIFT TRUCK MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF EUROPE FORKLIFT TRUCK MARKET

FIGURE 14 EUROPE FORKLIFT TRUCK MARKET: BY PRODUCT TYPE, 2019

FIGURE 15 EUROPE FORKLIFT TRUCK MARKET: BY POWER SOURCE, 2019

FIGURE 16 EUROPE FORKLIFT TRUCK MARKET: BY CLASS, 2019

FIGURE 17 EUROPE FORKLIFT TRUCK MARKET: BY FUEL TYPE, 2019

FIGURE 18 EUROPE FORKLIFT TRUCK MARKET: BY TONNAGE, 2019

FIGURE 19 EUROPE FORKLIFT TRUCK MARKET: BY END-USER, 2019

FIGURE 20 EUROPE FORKLIFT TRUCK MARKET: SNAPSHOT (2019)

FIGURE 21 EUROPE FORKLIFT TRUCK MARKET: BY COUNTRY (2019)

FIGURE 22 EUROPE FORKLIFT TRUCK MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 EUROPE FORKLIFT TRUCK MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 EUROPE FORKLIFT TRUCK MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 25 EUROPE FORKLIFT TRUCK MARKET: COMPANY SHARE 2019(%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.