Europe Foot And Ankle Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

973.60 Million

USD

1,749.70 Million

2024

2032

USD

973.60 Million

USD

1,749.70 Million

2024

2032

| 2025 –2032 | |

| USD 973.60 Million | |

| USD 1,749.70 Million | |

|

|

|

|

Segmentación del mercado europeo de dispositivos para pie y tobillo, por tipo de producto (implantes y dispositivos ortopédicos, dispositivos de soporte y ortesis, prótesis), aplicación (traumatismos, dedo en martillo, osteoartritis, artritis reumatoide, juanetes, trastornos neurológicos, osteoporosis, otros), usuario final (hospitales, centros de traumatología, centros de cirugía ambulatoria, clínicas especializadas, otros): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de dispositivos para pie y tobillo

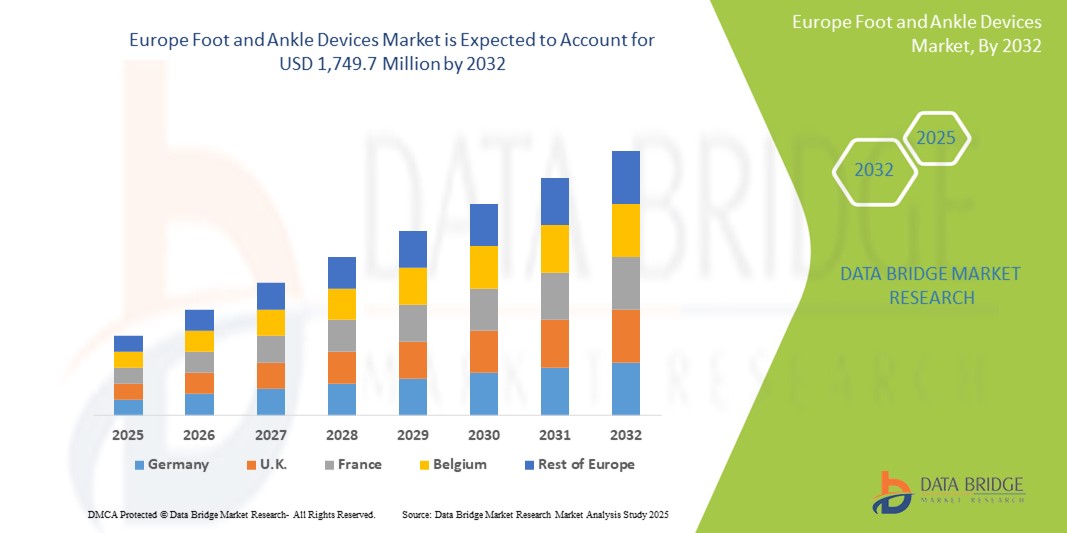

- El tamaño del mercado europeo de dispositivos para pies y tobillos se valoró en USD 973,6 millones en 2024 y se espera que alcance los USD 1.749,7 millones para 2032 , con una CAGR del 7,6 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente prevalencia de trastornos del pie y el tobillo, un número cada vez mayor de lesiones por accidentes de tráfico y lesiones deportivas, y la creciente población geriátrica en toda Europa.

- Además, los avances tecnológicos en dispositivos para pie y tobillo, como biomateriales mejorados, técnicas quirúrgicas mínimamente invasivas y órtesis y prótesis personalizadas impresas en 3D, están impulsando la expansión del mercado. Estos factores convergentes están acelerando la adopción de dispositivos para pie y tobillo, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de dispositivos para pie y tobillo

- El mercado de dispositivos para pie y tobillo abarca una amplia gama de dispositivos médicos diseñados para el diagnóstico, tratamiento y rehabilitación de afecciones que afectan al pie y al tobillo. Esto incluye implantes y dispositivos ortopédicos (como implantes articulares y dispositivos de fijación), dispositivos de soporte y ortesis, y prótesis. Estos dispositivos son cruciales para abordar diversos problemas, como traumatismos, lesiones deportivas, complicaciones del pie diabético, artritis (osteoartritis y artritis reumatoide) y diversas deformidades. El mercado está impulsado por la creciente incidencia de estas afecciones, el envejecimiento de la población y los continuos avances en técnicas quirúrgicas y tecnología de dispositivos.

- La creciente demanda de dispositivos para el pie y el tobillo se debe principalmente a la creciente conciencia sobre la salud del pie y el tobillo, la creciente demanda de rehabilitación efectiva y atención preventiva y el aumento del gasto sanitario en la región.

- Alemania domina el mercado europeo de dispositivos para pie y tobillo, con la mayor cuota de ingresos, un 26,7 % en 2025. Esto se debe a una sólida infraestructura de atención ortopédica, un alto volumen de cirugías y una fuerte demanda de implantes y dispositivos de fijación tecnológicamente avanzados. El consolidado sistema de reembolso del país y la temprana adopción de procedimientos mínimamente invasivos para pie y tobillo han contribuido al creciente uso de placas, tornillos y sistemas de reemplazo articular en hospitales públicos y privados.

- También se prevé que Alemania sea el país con mayor crecimiento en el mercado europeo de dispositivos para pie y tobillo durante el período de pronóstico, impulsado por el envejecimiento de su población, la creciente prevalencia de osteoartritis y lesiones deportivas, y el gran énfasis en la rehabilitación postraumática. La inversión continua en innovación ortopédica y la expansión de centros ortopédicos especializados impulsan aún más el crecimiento del mercado, junto con las colaboraciones entre instituciones de investigación y fabricantes de tecnología médica.

- Se prevé que los implantes y dispositivos ortopédicos, incluyendo placas, tornillos y clavos intramedulares, dominen el mercado europeo de dispositivos para pie y tobillo con una cuota de mercado del 39,2 % en 2025, gracias a su amplio uso en el tratamiento de fracturas, deformidades y procedimientos reconstructivos complejos. Este segmento se beneficia de los avances continuos en biomateriales, como el titanio y los polímeros biorreabsorbibles, y de la creciente adopción de herramientas de planificación quirúrgica específicas para cada paciente que mejoran los resultados de los procedimientos y reducen los tiempos de recuperación.

Alcance del informe y segmentación del mercado de dispositivos para pie y tobillo

|

Atributos |

Perspectivas clave del mercado de dispositivos para pie y tobillo |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de dispositivos para pie y tobillo

Avances en técnicas quirúrgicas mínimamente invasivas

- Avances tecnológicos en procedimientos mínimamente invasivos y dispositivos personalizados: Una tendencia significativa y en auge en el mercado europeo de dispositivos para pie y tobillo es el continuo avance tecnológico, en particular en técnicas quirúrgicas mínimamente invasivas y el desarrollo de dispositivos personalizados. Esta evolución está mejorando significativamente los resultados de los pacientes, reduciendo los tiempos de recuperación y mejorando la eficacia general del tratamiento.

- Por ejemplo, las innovaciones en implantes ortopédicos y dispositivos de fijación permiten a los cirujanos realizar procedimientos complejos con menos complicaciones y una recuperación más rápida. La creciente adopción de procedimientos mínimamente invasivos, que ofrecen beneficios como la reducción del dolor y la cicatrización, está expandiendo el uso de dispositivos especializados para el pie y el tobillo.

- El mercado también está experimentando una creciente tendencia hacia los dispositivos personalizados, impulsada por la tecnología de impresión 3D. Esto permite la creación de órtesis y prótesis personalizadas, adaptadas a las necesidades específicas de cada paciente, ofreciendo un mejor ajuste, soporte y funcionalidad.

- Además, existe un mayor enfoque en la rehabilitación y la atención preventiva, lo que genera una demanda de dispositivos ortopédicos, aparatos ortopédicos y herramientas de rehabilitación inteligentes que facilitan la recuperación y previenen futuras lesiones. La tecnología portátil desempeña un papel fundamental en este ámbito, proporcionando retroalimentación y monitorización en tiempo real.

- Esta tendencia hacia soluciones más precisas, menos invasivas y específicas para cada paciente está transformando fundamentalmente el panorama del tratamiento de las afecciones del pie y el tobillo en Europa.

Dinámica del mercado de dispositivos para pie y tobillo

Conductor

Aumento de la prevalencia de trastornos del pie y el tobillo (traumatismos, diabetes, artritis)

- Aumento de la incidencia de trastornos del pie y el tobillo y envejecimiento de la población: la creciente prevalencia de trastornos del pie y el tobillo, incluidos los causados por traumatismos, diabetes y afecciones relacionadas con la edad, como la artritis y la osteoporosis, es un impulsor importante del crecimiento del mercado de dispositivos para el pie y el tobillo en Europa.

- Por ejemplo, la creciente población geriátrica en la región europea es más propensa a sufrir problemas relacionados con los pies y los tobillos, como artritis y fracturas, lo que aumenta directamente la demanda de estos dispositivos.

- El creciente número de lesiones deportivas y accidentes de tráfico también contribuye significativamente a la demanda de dispositivos para el pie y el tobillo para su tratamiento y rehabilitación.

- Además, la creciente conciencia sobre la salud del pie y el tobillo entre la población general y los profesionales de la salud está conduciendo a un diagnóstico e intervención más tempranos, lo que impulsa aún más el crecimiento del mercado.

- Los avances tecnológicos que hacen que los dispositivos sean más efectivos, cómodos y fáciles de usar, junto con el aumento del gasto en atención médica, también actúan como impulsores clave.

Restricción/Desafío

“ El alto costo de los dispositivos avanzados para el pie y el tobillo ”

- Alto costo de los dispositivos y regulaciones estrictas: el alto costo de algunos dispositivos avanzados para el pie y el tobillo, sumado a pautas regulatorias estrictas, presenta un desafío importante para su adopción generalizada en el mercado europeo.

- Por ejemplo, la fabricación de diversos productos para el pie y el tobillo puede aumentar significativamente el coste de capital de las empresas de dispositivos médicos. La elevada inversión inicial en implantes y prótesis avanzados puede limitar su accesibilidad, especialmente en sistemas de salud públicos o para pacientes sin cobertura de seguro integral.

- Los marcos regulatorios estrictos, como el Reglamento sobre Dispositivos Médicos (MDR) de la UE, están reemplazando directivas más antiguas, lo que genera cambios importantes en el acceso al mercado y requiere una validación y documentación exhaustivas, lo que aumenta el tiempo y los costos para los fabricantes.

- Además, la escasez de profesionales cualificados especializados en cirugía y rehabilitación de pie y tobillo puede dificultar el uso y la adopción eficaces de estos dispositivos avanzados. La preocupación por el aflojamiento de las placas óseas con el tiempo, que requiere reemplazo, también supone un desafío.

Alcance del mercado de dispositivos para pie y tobillo

El mercado está segmentado según el tipo de producto, la aplicación y el usuario final.

- Por producto

En cuanto a productos, el mercado de dispositivos para pie y tobillo se divide en dispositivos de fijación ortopédica, implantes articulares, dispositivos ortopédicos para tejidos blandos, dispositivos de soporte y ortesis, y prótesis. Se prevé que el segmento de dispositivos de fijación ortopédica domine el mercado con la mayor cuota de mercado, un 39,2%, en 2025, gracias a su amplio uso en la reparación de fracturas, la corrección de deformidades y la cirugía reconstructiva. Estos dispositivos —que incluyen placas, tornillos, alambres y clavos intramedulares— se utilizan frecuentemente en procedimientos traumatológicos y electivos. Los avances tecnológicos, como los implantes anatómicos y los materiales bioabsorbibles, han mejorado los resultados clínicos y la recuperación de los pacientes, consolidando el liderazgo de este segmento.

Se prevé que el segmento de dispositivos de soporte y órtesis registre la tasa de crecimiento más rápida, del 5,2 %, entre 2025 y 2032, impulsada por la creciente incidencia de osteoartritis y artritis reumatoide en la población de edad avanzada. La creciente demanda de reemplazo total de tobillo y los avances en el diseño de implantes, como componentes impresos en 3D y soluciones personalizadas, están impulsando su adopción en centros quirúrgicos de Alemania, el Reino Unido y Francia.

- Por aplicación

En función de su aplicación, el mercado de dispositivos para pie y tobillo se segmenta en traumatismos, osteoartritis, corrección de deformidades, artritis reumatoide y otros. El sector de traumatismos registró la mayor cuota de mercado en 2025 debido al elevado número de lesiones de pie y tobillo asociadas a deportes, accidentes de tráfico e incidentes laborales. La intervención quirúrgica rápida con dispositivos de fijación e implantes es fundamental para una recuperación y movilidad óptimas, lo que convierte a los traumatismos en el área de aplicación predominante en toda Europa.

Se prevé que la osteoartritis experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el envejecimiento de la población europea y la mayor prevalencia de trastornos articulares degenerativos. Las técnicas quirúrgicas mínimamente invasivas y las innovaciones en dispositivos de reemplazo articular están impulsando la adopción de soluciones para el pie y el tobillo adaptadas a la movilidad a largo plazo y al manejo del dolor.

- Por los usuarios finales

En función de los usuarios finales, el mercado de dispositivos para pie y tobillo se segmenta en hospitales, centros de cirugía ambulatoria (CAA) y clínicas ortopédicas. El segmento de hospitales representó la mayor cuota de mercado en 2024, gracias al alto volumen de procedimientos, los entornos de atención multidisciplinarios y el acceso a herramientas avanzadas de imagenología y navegación quirúrgica. Los hospitales públicos de países como Alemania, Italia y los Países Bajos se benefician de políticas de adquisición centralizadas e inversiones gubernamentales en infraestructura ortopédica.

Se prevé que el segmento de Centros de Cirugía Ambulatoria (CASC) experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, a medida que las cirugías ambulatorias se vuelven más comunes en Europa. Los CASC están cada vez más equipados para realizar procedimientos mínimamente invasivos de pie y tobillo, ofreciendo una atención rentable, tiempos de recuperación más cortos y eficiencia operativa. La transición hacia la cirugía ortopédica ambulatoria es especialmente notable en el Reino Unido, España y los países nórdicos.

Análisis regional del mercado de dispositivos para pie y tobillo

- Alemania domina el mercado europeo de dispositivos para pie y tobillo, con la mayor cuota de ingresos, un 26,7 % en 2025. Esto se debe a su avanzada infraestructura de atención ortopédica, el alto volumen de cirugías traumatológicas y reconstructivas, y un sólido panorama de reembolsos para implantes articulares y dispositivos de fijación. El país lidera la adopción de soluciones ortopédicas innovadoras, incluyendo implantes específicos para cada paciente y tecnologías de fijación mínimamente invasivas.

- La excelencia ortopédica de Alemania se sustenta en una sólida red de centros quirúrgicos especializados, hospitales académicos y colaboraciones con fabricantes globales de tecnología médica como Zimmer Biomet, Stryker y Waldemar Link. Estas alianzas garantizan un acceso constante a dispositivos y sistemas quirúrgicos de vanguardia.

- Además, el envejecimiento de la población y la creciente prevalencia de la osteoartritis y las complicaciones del pie diabético impulsan el crecimiento de los procedimientos. El énfasis que Alemania pone en la rehabilitación postoperatoria y la preservación de la movilidad también fomenta la demanda de implantes de pie y tobillo de alto rendimiento.

Perspectiva del mercado de dispositivos para pie y tobillo en Francia

Se proyecta que el mercado francés de dispositivos para pie y tobillo crezca a una tasa de crecimiento anual compuesta (TCAC) significativa durante el período de pronóstico, gracias a un sistema de salud pública consolidado y a estrategias nacionales orientadas a mejorar la salud musculoesquelética. Francia está experimentando una mayor demanda de intervenciones quirúrgicas en traumatismos, lesiones deportivas y trastornos degenerativos del pie y el tobillo, especialmente entre las personas mayores. Los hospitales públicos y las unidades de ortopedia francesas integran cada vez más la imagenología 3D y la navegación quirúrgica para una colocación precisa de implantes y mejores resultados en la corrección de deformidades y la reconstrucción articular. El apoyo regulatorio de la Agencia Nacional para la Seguridad de los Medicamentos y Productos Sanitarios (ANSM) y los proyectos de I+D colaborativos entre cirujanos ortopédicos y fabricantes locales están facilitando un acceso más rápido al mercado para dispositivos e implantes avanzados.

Perspectiva del mercado de dispositivos para pie y tobillo en el Reino Unido

El mercado británico de dispositivos para pie y tobillo está a punto de experimentar un sólido crecimiento, impulsado por las iniciativas del NHS centradas en reducir la acumulación de pacientes en cirugías, mejorar los tiempos de espera en ortopedia y ampliar el acceso a cirugías mínimamente invasivas en centros de salud públicos y privados. La creciente incidencia de complicaciones del pie relacionadas con la diabetes, lesiones deportivas y osteoartritis está incrementando significativamente la demanda de implantes, dispositivos de fijación y sistemas de ortesis. Los procedimientos de pie y tobillo se realizan cada vez más en centros de cirugía ambulatoria y clínicas externas, lo que impulsa la adopción de herramientas quirúrgicas compactas y eficientes. La Sociedad Británica de Ortopedia del Pie y el Tobillo (BOFAS) y las organizaciones profesionales relacionadas desempeñan un papel fundamental en la promoción de las mejores prácticas, la formación quirúrgica y la adopción de tecnologías innovadoras como implantes personalizados, sistemas de navegación y productos ortopédicos regenerativos.

Cuota de mercado de dispositivos para pie y tobillo

La industria de dispositivos para pie y tobillo está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Stryker Corporation (EE. UU.)

- Johnson & Johnson (DePuy Synthes) (EE. UU.)

- Zimmer Biomet Holdings, Inc. (EE. UU.)

- Smith & Nephew plc (Reino Unido)

- Enovis Corporation (EE. UU.)

- Acumed, LLC (EE. UU.)

- Arthrex, Inc. (EE. UU.)

- Paragon 28 Inc. (EE. UU.)

- Orthofix Medical Inc. (EE. UU.)

- Medtronic plc (Irlanda)

- DJO LLC (EE. UU.)

- Estación de esquí Össur (Islandia)

- B. Braun Melsungen AG (Alemania)

- Bauerfeind AG (Alemania)

- Otto Bock Healthcare GmbH (Alemania)

- Grupo Thuasne (Francia)

- Fillauer LLC (EE. UU.)

Últimos avances en el mercado europeo de dispositivos para pie y tobillo

- En mayo de 2023, Paragon 28 lanzó su sistema de placas para osteotomía supramaleolar (SMO) Gorilla y aloinjerto PRESERVE SMO, que ofrece a los cirujanos configuraciones de placas personalizables y opciones de injerto para mejorar los resultados y la flexibilidad en las osteotomías supramaleolares para correcciones complejas de deformidades del pie y el tobillo.

- En diciembre de 2022, Enovis Corporation recibió la aprobación de la FDA para su sistema STAR PSI, que permite a los cirujanos crear planes preoperatorios 3D personalizados para reemplazos totales de tobillo, mejorando la precisión del posicionamiento del implante, la eficiencia quirúrgica y los resultados específicos del paciente en procedimientos ortopédicos.

- En febrero de 2022, DePuy Synthes, parte de Johnson & Johnson, adquirió CrossRoads Extremity Systems para ampliar su portafolio de productos para pie y tobillo. Esta adquisición fortalece su posición en el sector ortopédico con tecnologías avanzadas para la fusión articular, la corrección de juanetes y la reconstrucción de tejidos blandos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.