Mercado europeo de espesantes de alimentos, por tipo (hidrocoloides, proteínas , almidón, pectina y otros), forma ( polvo , gránulos, gel y otros), naturaleza (sin OGM y con OGM ), fuente (planta, animal, marina y microbiana), aplicación ( alimentos y bebidas), país (Alemania, Reino Unido, Italia, Francia, España, Suiza, Países Bajos, Bélgica, Rusia, Turquía, resto de Europa), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de espesantes alimentarios en Europa

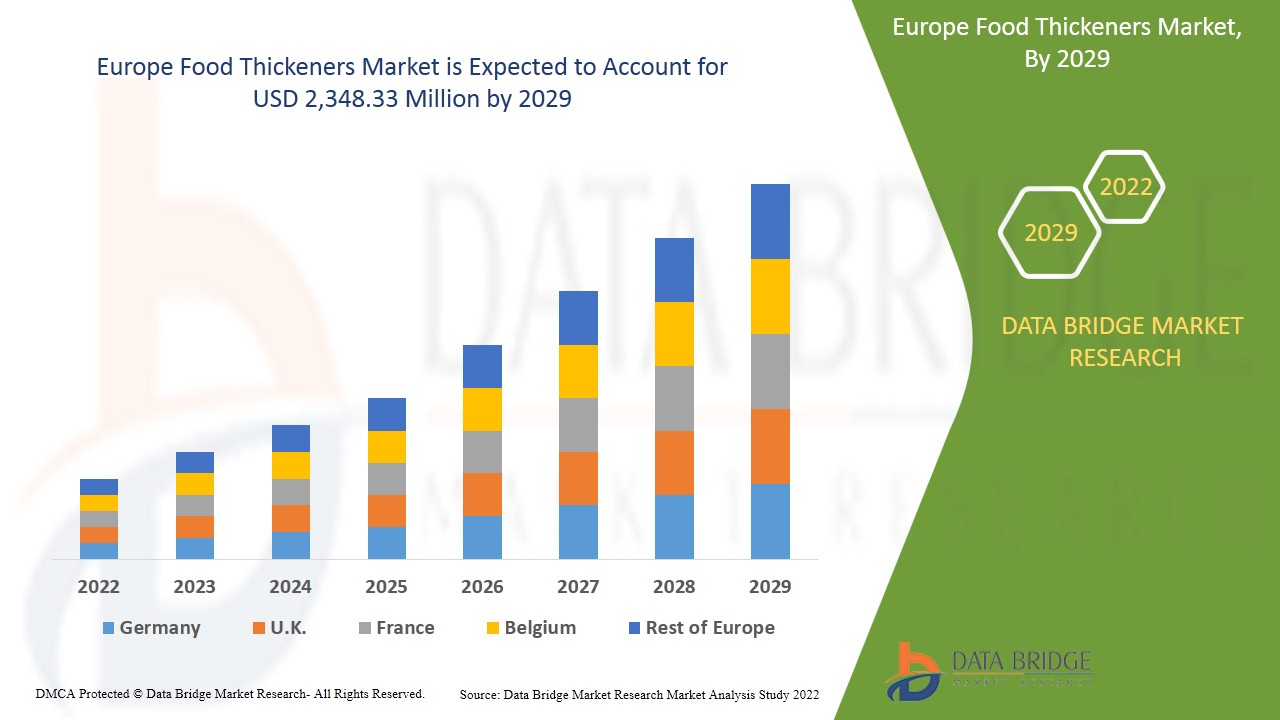

Se espera que el mercado europeo de espesantes de alimentos gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,3% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2.348,33 millones para 2029. Se espera que la creciente demanda de bebidas no alcohólicas, incluidos los jugos de frutas y las bebidas energéticas, impulse el crecimiento del mercado europeo de espesantes de alimentos.

Los espesantes alimentarios se definen como los agentes modificadores de alimentos que se utilizan para modificar la estructura de la textura de los alimentos y bebidas. Se utilizan para aumentar el espesor de los alimentos y bebidas, ayudando a absorber el contenido de agua en los comestibles una vez que se integran en los productos. Estos productos se utilizan principalmente para modificar la viscosidad de estos productos, dándoles una estructura general consistente. Los espesantes alimentarios más utilizados en el mercado son los almidones, seguidos de los hidrocoloides y las proteínas. Los espesantes alimentarios se utilizan en aplicaciones alimentarias como productos de panadería, productos de confitería, salsas, aderezos, adobos, jugos, bebidas, lácteos, postres helados, alimentos preparados, alimentos procesados, entre otros.

El aumento de los cambios en el estilo de vida de los consumidores, que se traduce en un mayor enfoque en su dieta, es un factor vital que acelera el crecimiento del mercado. Además, un aumento de los beneficios del producto que ofrece más que solo capacidades espesantes a bajo costo puede impulsar el mercado mundial de espesantes de alimentos. Sin embargo, el aumento de los costos de investigación y desarrollo asociados con el desarrollo y la fabricación de espesantes de alimentos y las fluctuaciones continuas en los precios de las materias primas de los hidrocoloides son los principales factores, entre otros, que se espera que limiten el mercado mundial de espesantes de alimentos en el período de pronóstico.

El aumento de la innovación de nuevos productos y el incremento de las actividades de investigación y desarrollo en el mercado crearán nuevas oportunidades para el mercado mundial de espesantes alimentarios. Por otra parte, las posibles preocupaciones sanitarias relacionadas con la goma xantana y la carragenina pueden suponer un reto para el crecimiento del mercado mundial de espesantes alimentarios.

El informe sobre el mercado de espesantes de alimentos en Europa proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado global de espesantes de alimentos, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de espesantes de alimentos en Europa

El mercado europeo de espesantes de alimentos está segmentado en función del tipo, la forma, la naturaleza, la fuente y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

- Según el tipo, el mercado europeo de espesantes alimentarios se segmenta en proteínas, almidón, hidrocoloides, pectina y otros. En 2022, se espera que el segmento de los hidrocoloides domine el mercado debido a su creciente uso en la industria alimentaria.

- En función de la forma, el mercado europeo de espesantes alimentarios se segmenta en gel, polvo, gránulos y otros. En 2022, se espera que el segmento de polvos domine el mercado, ya que es fácil de mezclar y preparar el producto alimenticio final.

- En función de la naturaleza, el mercado europeo de espesantes alimentarios se segmenta en transgénicos y no transgénicos. En 2022, se espera que el segmento no transgénico domine el mercado debido a la creciente popularidad de los alimentos orgánicos en la región.

- Según la fuente de origen, el mercado europeo de espesantes alimentarios se segmenta en productos de origen vegetal, animal, marino y microbiano. En 2022, se espera que el segmento de origen vegetal domine el mercado debido a la creciente tendencia y el cambio hacia la adopción de productos veganos.

- En función de la aplicación, el mercado europeo de espesantes de alimentos se segmenta en alimentos y bebidas. En 2022, se espera que el segmento de alimentos domine el mercado debido al creciente uso de espesantes de alimentos en diferentes segmentos alimentarios.

Análisis a nivel de país del mercado de espesantes de alimentos en Europa

Se analiza el mercado europeo de espesantes de alimentos y se proporciona información sobre el tamaño del mercado por país, tipo, forma, naturaleza, fuente y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de espesantes de alimentos de Europa son Alemania, Reino Unido, Italia, Francia, España, Suiza, Países Bajos, Bélgica, Rusia, Turquía y el resto de Europa.

Se espera que Francia domine el mercado europeo de espesantes de alimentos debido a la mayor aplicación de espesantes de alimentos en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado están impulsando el crecimiento del mercado de espesantes de alimentos en Europa

El mercado de espesantes de alimentos también le proporciona un análisis detallado del mercado para el crecimiento de cada país en el mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de espesantes alimentarios

El panorama competitivo del mercado de espesantes de alimentos en Europa proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de la empresa relacionado con el mercado de espesantes de alimentos.

Algunas de las principales empresas que comercializan espesantes alimentarios en Europa son Ingredion Incorporated, Cargill, Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., GELITA AG, Solvay, VIKAS WSP LTD., DSM, Medline Industries, LP, Kent Precision Foods Group, Inc., HL Agro Products Pvt. Ltd., Emsland Group, entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos se están iniciando también por parte de empresas de todo el mundo, lo que también está acelerando el mercado de los espesantes de alimentos.

Por ejemplo,

- En febrero de 2020, Jungbunzlauer Suisse AG aumentó su capacidad de producción de goma xantana en Austria. Esto ha ayudado a la empresa a satisfacer la creciente demanda de los clientes en los segmentos alimentario e industrial en todo el mundo.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de espesantes de alimentos, lo que también proporciona el beneficio para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FOOD THICKENERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIENTS CUSTOMIZATION:

4.1.1 WHAT IS THE MAJOR FOOD THICKENER, AND WHAT IS EACH FOOD THICKENER'S ISSUE (OR REQUIREMENT) TO SOLVE?

4.1.2 STARCH

4.1.3 HYDROCOLLOIDS

4.1.4 PECTIN

4.1.5 PROTEIN:

4.2 ANALYSIS OF MAJOR FOOD THICKENERS:

4.3 PRICING ANALYSIS OF FOOD THICKENERS

4.4 EUROPE FOOD THICKENERS MARKET: NEW PRODUCT LAUNCH STRATEGIES

4.4.1 GROWING DEMAND FOR PLANT-BASED SOURCED FOOD THICKENERS

4.4.2 LAUNCHING ORGANIC, CLEAN, AND SUSTAINABLE FOOD THICKENERS

4.4.3 PROMOTING BY HIGHLIGHTING GLUTEN-FREE THICKENERS

4.4.4 LAUNCHES-

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.5.1 VARIETY OF APPLICATIONS CATERED BY FOOD THICKENERS PRODUCTS:

4.5.2 AVAILABILITY OF A VARIETY OF PRODUCT TYPES:

4.5.3 QUALITY OF THE PRODUCTS:

4.6 EUROPE FOOD THICKENERS MARKET: REGULATORY FRAMEWORK

4.6.1 FOOD STANDARDS AUSTRALIA, NEW ZEALAND

4.7 SUPPLY CHAIN ANALYSIS

4.8 VALUE CHAIN ANALYSIS OF EUROPE FOOD THICKENERS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR FRUIT JUICES

5.1.2 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

5.1.3 ADVANTAGES AND SEVERAL FUNCTIONS ASSOCIATED WITH THE USE OF FOOD THICKENERS

5.1.4 RISING DEMAND FOR THICKENING AGENTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.2 RESTRAINTS

5.2.1 POSSIBLE HEALTH CONCERNS REGARDING XANTHAN GUM AND CARRAGEENAN

5.2.2 HIGH R&D COSTS ASSOCIATED WITH THE DEVELOPMENT AND MANUFACTURING OF FOOD THICKENERS

5.2.3 FLUCTUATIONS IN RAW MATERIAL PRICES OF HYDROCOLLOIDS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC DECISIONS BY KEY PLAYERS

5.3.2 ADVANCEMENTS IN THE EXTRACTION AND PROCESSING OF FOOD THICKENERS

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS

5.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6 COVID-19 IMPACT ON THE EUROPE FOOD THICKENERS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE EUROPE FOOD THICKENERS MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE FOOD THICKENERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 HYDROCOLLOIDS

7.2.1 HYDROCOLLOIDS, BY TYPE

7.2.1.1 XANTHAN GUM

7.2.1.2 SODIUM ALGINATE

7.2.1.3 LOCUST BEAN GUM

7.2.1.4 GUM ARABIC

7.2.1.5 GAUR GUM

7.2.1.6 GUM KARAYA

7.2.1.7 GUM TRAGACANTH

7.2.1.8 OTHERS

7.2.2 HYDROCOLLOIDS, BY FORM

7.2.2.1 POWDER

7.2.2.2 GRANULES

7.2.2.3 GEL

7.2.2.4 OTHERS

7.3 PROTEIN

7.3.1 PROTEIN, BY TYPE

7.3.1.1 GELATIN

7.3.1.2 COLLAGEN

7.3.1.3 EGG PROTEIN

7.3.2 PROTEIN, BY FORM

7.3.2.1 POWDER

7.3.2.2 GRANULES

7.3.2.3 GEL

7.3.2.4 OTHERS

7.4 STARCH

7.4.1 STARCH, BY TYPE

7.4.1.1 CORN STARCH

7.4.1.2 WHEAT STARCH

7.4.1.3 ARROWROOT STARCH

7.4.1.4 POTATO STARCH

7.4.1.5 RICE STARCH

7.4.1.6 PEA STARCH

7.4.1.7 OTHERS

7.4.2 STARCH, BY FORM

7.4.2.1 POWDER

7.4.2.2 GRANULES

7.4.2.3 GEL

7.4.2.4 OTHERS

7.5 PECTIN

7.5.1 PECTIN, BY FORM

7.5.1.1 POWDER

7.5.1.2 GRANULES

7.5.1.3 GEL

7.5.1.4 OTHERS

7.6 OTHERS

8 EUROPE FOOD THICKENERS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 GRANULES

8.4 GEL

8.5 OTHERS

9 EUROPE FOOD THICKENERS MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 EUROPE FOOD THICKENERS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PLANT

10.3 ANIMAL

10.4 MARINE

10.5 MICROBIAL

10.5.1 BACTERIA

10.5.2 YEAST

10.5.3 FUNGI

11 EUROPE FOOD THICKENERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FROZEN DESSERTS

11.2.2 DAIRY PRODUCTS

11.2.3 FRUIT PREPARATIONS

11.2.4 BAKERY

11.2.5 CONFECTIONERY

11.2.6 MEAT PRODUCTS

11.2.7 CONVENIENCE FOOD

11.2.8 PROCESSED FOOD

11.2.9 DAIRY ALTERNATIVE PRODUCTS

11.2.10 FUNCTIONAL FOOD

11.2.11 SEAFOOD PRODUCTS

11.2.12 SPORTS NUTRITION

11.2.13 MEAT ALTERNATIVE PRODUCTS

11.3 BEVERAGES

11.3.1 JUICES

11.3.2 DAIRY BASED DRINKS

11.3.3 CARBONATED SOFT DRINKS

11.3.4 SMOOTHIES

11.3.5 RTD TEA & COFFEE

11.3.6 SPORTS DRINKS

11.3.7 ENERGY DRINKS

11.3.8 OTHERS

12 EUROPE FOOD THICKENERS MARKET, BY REGION

12.1 EUROPE

12.1.1 FRANCE

12.1.2 GERMANY

12.1.3 ITALY

12.1.4 SPAIN

12.1.5 U.K.

12.1.6 NETHERLANDS

12.1.7 BELGIUM

12.1.8 RUSSIA

12.1.9 SWITZERLAND

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 EUROPE FOOD THICKENERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 INGREDION INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARGILL, INCORPORATED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 TATE & LYLE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 REVENUE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASHLAND

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CP KELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 DSM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 SOLVAY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DUPONT NUTRITION BIOSCIENCE APS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 CHIMIQUE (INDIA) LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DEOSEN BIOCHEMICAL (ORDOS) LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EMSLAND GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 FOODING GROUP LIMITED

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 GELITA AG

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GUAR RESOURCES, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 HL AGRO PRODUCTS PVT. LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 JUNGBUNZLAUER SUISSE AG

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KENT PRECISION FOODS GROUP, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 VIKAS WSP LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATIONS BY HEALTH CANADA-

TABLE 2 HEALTH CANADA REGULATIONS-

TABLE 3 EUROPE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 5 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 8 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 9 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 10 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 13 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 14 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 15 EUROPE STARCH IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 18 EUROPE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 EUROPE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 20 EUROPE PECTIN IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 23 EUROPE OTHERS IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 25 EUROPE POWDER IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE GRANULES IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE GEL IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE OTHERS IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NON-GMO IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE GMO IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE PLANT IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE ANIMAL IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE MARINE IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MICROBIAL IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE FOOD IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE BEVERAGES IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 EUROPE FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONS)

TABLE 45 EUROPE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 47 EUROPE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 49 EUROPE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 50 EUROPE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 51 EUROPE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 53 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 55 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 EUROPE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 57 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 59 EUROPE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 EUROPE FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 61 EUROPE FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 EUROPE FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 63 EUROPE MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 64 EUROPE FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 EUROPE FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 EUROPE BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 FRANCE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 69 FRANCE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 71 FRANCE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 FRANCE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 73 FRANCE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 74 FRANCE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 75 FRANCE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 77 FRANCE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 78 FRANCE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 79 FRANCE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 81 FRANCE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 82 FRANCE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 83 FRANCE FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 84 FRANCE FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 87 FRANCE FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 FRANCE FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 FRANCE BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 GERMANY FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 GERMANY FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 92 GERMANY STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 GERMANY STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 94 GERMANY STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 GERMANY STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 96 GERMANY PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 97 GERMANY PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 98 GERMANY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 GERMANY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 100 GERMANY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 101 GERMANY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 102 GERMANY PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 GERMANY PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 104 GERMANY PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 105 GERMANY PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 106 GERMANY FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 107 GERMANY FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 108 GERMANY FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 109 GERMANY MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 110 GERMANY FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 GERMANY FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 GERMANY BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 ITALY FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 115 ITALY STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 ITALY STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 117 ITALY STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 118 ITALY STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 119 ITALY PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 120 ITALY PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 121 ITALY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 ITALY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 123 ITALY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 124 ITALY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 125 ITALY PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 ITALY PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 127 ITALY PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 128 ITALY PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 129 ITALY FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 130 ITALY FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 131 ITALY FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 132 ITALY MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 133 ITALY FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 ITALY FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 ITALY BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 SPAIN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SPAIN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 138 SPAIN STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SPAIN STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 140 SPAIN STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 141 SPAIN STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 142 SPAIN PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 143 SPAIN PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 144 SPAIN HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 146 SPAIN HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 147 SPAIN HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 148 SPAIN PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SPAIN PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 150 SPAIN PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 151 SPAIN PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 152 SPAIN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 153 SPAIN FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 154 SPAIN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 155 SPAIN MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 156 SPAIN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 SPAIN FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 SPAIN BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 U.K. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.K. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 161 U.K. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.K. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 163 U.K. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 164 U.K. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 165 U.K. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 166 U.K. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 167 U.K. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.K. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 169 U.K. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 170 U.K. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 171 U.K. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.K. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 173 U.K. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 174 U.K. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 175 U.K. FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 176 U.K. FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 177 U.K. FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 178 U.K. MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 179 U.K. FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 U.K. FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 U.K. BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 184 NETHERLANDS STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 186 NETHERLANDS STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 188 NETHERLANDS PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 190 NETHERLANDS HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 192 NETHERLANDS HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 194 NETHERLANDS PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 196 NETHERLANDS PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 197 NETHERLANDS PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 198 NETHERLANDS FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 199 NETHERLANDS FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 200 NETHERLANDS FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLANDS MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 202 NETHERLANDS FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 NETHERLANDS FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 204 NETHERLANDS BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 207 BELGIUM STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 209 BELGIUM STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 211 BELGIUM PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 213 BELGIUM HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 215 BELGIUM HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 217 BELGIUM PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 BELGIUM PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 219 BELGIUM PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 221 BELGIUM FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 RUSSIA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 RUSSIA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 230 RUSSIA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 RUSSIA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 232 RUSSIA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 233 RUSSIA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 234 RUSSIA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 235 RUSSIA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 236 RUSSIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 RUSSIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 238 RUSSIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 239 RUSSIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 240 RUSSIA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 RUSSIA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 242 RUSSIA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 243 RUSSIA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 244 RUSSIA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 245 RUSSIA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 246 RUSSIA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 247 RUSSIA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 248 RUSSIA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 249 RUSSIA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 250 RUSSIA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 251 SWITZERLAND FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 SWITZERLAND FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 253 SWITZERLAND STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 SWITZERLAND STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 255 SWITZERLAND STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 256 SWITZERLAND STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 257 SWITZERLAND PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 258 SWITZERLAND PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 259 SWITZERLAND HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 SWITZERLAND HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 261 SWITZERLAND HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 262 SWITZERLAND HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 263 SWITZERLAND PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 SWITZERLAND PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 265 SWITZERLAND PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 266 SWITZERLAND PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 267 SWITZERLAND FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 268 SWITZERLAND FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 269 SWITZERLAND FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 270 SWITZERLAND MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 271 SWITZERLAND FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 SWITZERLAND FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 SWITZERLAND BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 274 TURKEY FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 TURKEY FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 276 TURKEY STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 TURKEY STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 278 TURKEY STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 279 TURKEY STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 280 TURKEY PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 281 TURKEY PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 282 TURKEY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 TURKEY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 284 TURKEY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 285 TURKEY HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 286 TURKEY PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 TURKEY PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 288 TURKEY PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 289 TURKEY PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 290 TURKEY FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 291 TURKEY FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 292 TURKEY FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 293 TURKEY MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 294 TURKEY FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 295 TURKEY FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 296 TURKEY BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 297 REST OF EUROPE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 REST OF EUROPE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

Lista de figuras

FIGURE 1 EUROPE FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 2 EUROPE FOOD THICKENERS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE FOOD THICKENERS MARKET : DROC ANALYSIS

FIGURE 4 EUROPE FOOD THICKENERS MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE FOOD THICKENERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FOOD THICKENERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE FOOD THICKENERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND FOR FRUIT JUICES IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE FOOD THICKENERS MARKET IN THE FORECAST PERIOD

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE FOOD THICKENERS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE FOOD THICKENERS MARKET

FIGURE 13 EUROPE FOOD THICKENERS MARKET: BY TYPE, 2021

FIGURE 14 EUROPE FOOD THICKENERS MARKET: BY FORM, 2021

FIGURE 15 EUROPE FOOD THICKENERS MARKET: BY NATURE, 2021

FIGURE 16 EUROPE FOOD THICKENERS MARKET, BY SOURCE, 2021

FIGURE 17 EUROPE FAT REPLACERS MARKET: BY APPLICATION, 2021

FIGURE 18 EUROPE FOOD THICKENERS MARKET: SNAPSHOT (2021)

FIGURE 19 EUROPE FOOD THICKENERS MARKET: BY COUNTRY (2021)

FIGURE 20 EUROPE FOOD THICKENERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 EUROPE FOOD THICKENERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 EUROPE FOOD THICKENERS MARKET: BY TYPE (2022 & 2029)

FIGURE 23 EUROPE FOOD THICKENERS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.