Mercado europeo de adhesivos flocados, por producto (poliuretano, acrílico, epoxi y otros), fuente (a base de disolvente y a base de agua), sustrato (textil, plástico, metal, vidrio, madera y otros), aplicación (automotriz, textiles técnicos y prendas de vestir, impresión, papel y embalaje y otros), país (Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza y resto de Europa), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado europeo de adhesivos flocados

Análisis y perspectivas del mercado: mercado europeo de adhesivos flocados

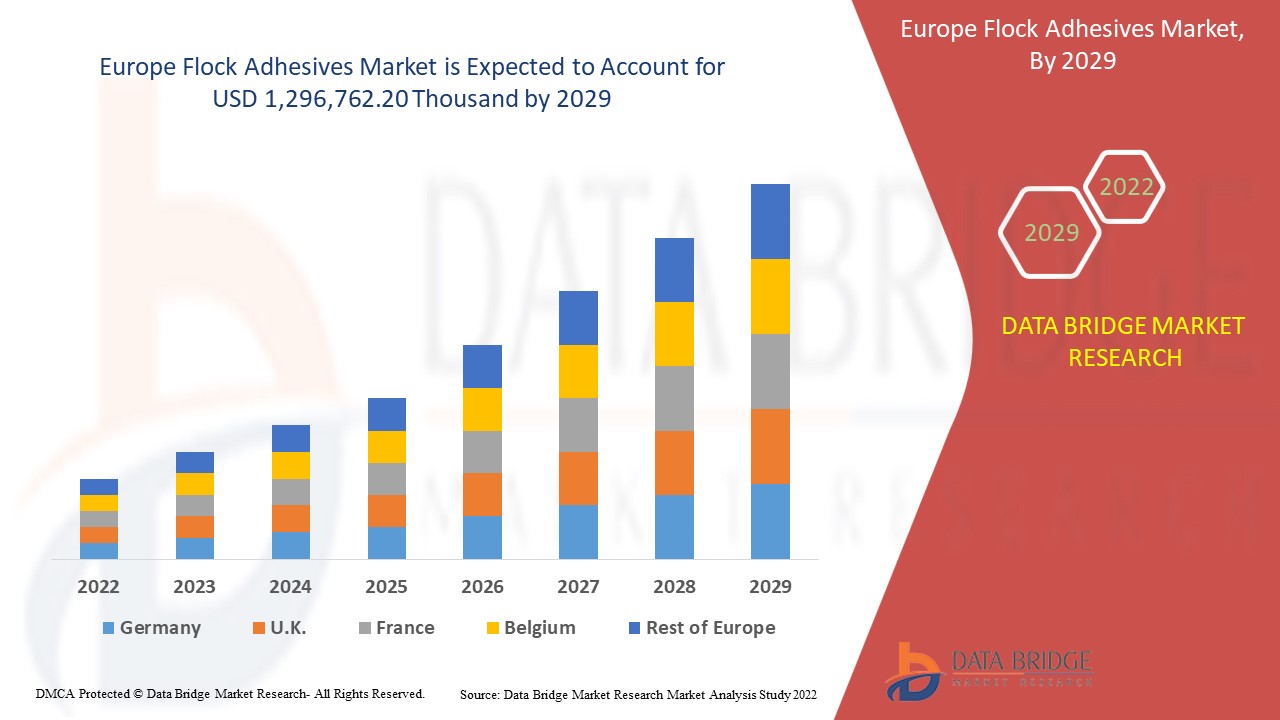

Se espera que el mercado europeo de adhesivos flocados gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 5,3% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1.296.762,20 mil para 2029. Una perspectiva positiva hacia los adhesivos flocados en los sectores automotriz y textil puede impulsar el mercado.

Los adhesivos flocados son materiales aglutinantes que se utilizan para unir diversos sustratos , como caucho, plástico y metal. El flocado adhesivo se produce cuando las partículas de fibra se incorporan electrostáticamente a la capa adhesiva. La mayoría de los flocados utilizan fibras naturales o sintéticas finamente picadas. El exterior flocado le da a la superficie propiedades decorativas y funcionales.

La creciente adopción de adhesivos flocados en la fabricación de aislamiento térmico y el cambio en las preferencias de los consumidores por el nivel de calidad del interior del automóvil son algunos de los determinantes clave que pueden favorecer el crecimiento del mercado de adhesivos flocados en Europa durante el período de pronóstico.

Sin embargo, la volatilidad de los precios de las materias primas y la reacción de las diferentes estructuras de composición pueden actuar como restricciones importantes en la tasa de crecimiento del mercado europeo de adhesivos flocados. Además, las estrictas regulaciones asociadas con el proceso de aprobación de la comercialización pueden desafiar el crecimiento del mercado durante el período de pronóstico.

El aumento en la utilización de adhesivos flocados en los sectores de impresión y embalaje puede crear oportunidades lucrativas para el mercado.

Este informe sobre el mercado de adhesivos flocados en Europa proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevas oportunidades de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de adhesivos flocados en Europa

Alcance y tamaño del mercado de adhesivos flocados en Europa

El mercado europeo de adhesivos flocados se divide en cuatro segmentos importantes según la fuente, el sustrato, el producto y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

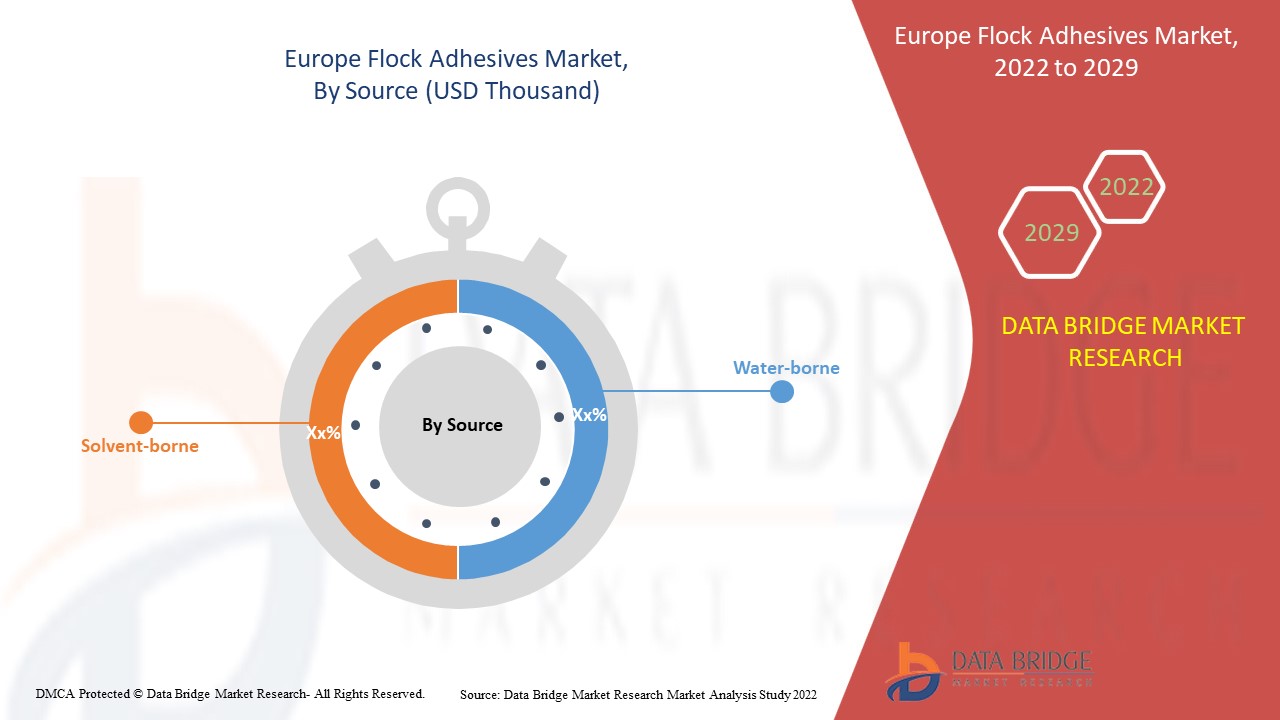

- Según la fuente de origen, el mercado europeo de adhesivos flocados se segmenta en adhesivos a base de agua y adhesivos a base de disolvente . En 2022, se prevé que el segmento a base de agua domine la región europea, ya que los adhesivos a base de agua tienen una alta densidad energética, lo que aumenta su demanda en el mercado.

- En función del sustrato, el mercado europeo de adhesivos flocados se segmenta en textiles, plásticos, metales, vidrios, maderas y otros. En 2022, se prevé que el segmento de plásticos domine la región europea, ya que el plástico tiene un buen poder de estabilidad, lo que aumenta su demanda en el mercado.

- En función del producto, el mercado europeo de adhesivos flocados se segmenta en poliuretano, acrílico, epoxi y otros. En 2022, se prevé que el segmento acrílico domine la región europea, ya que el acrílico tiene buenas propiedades mecánicas, lo que aumenta su demanda en el mercado.

- En función de la aplicación, el mercado europeo de adhesivos flocados se segmenta en automoción, textiles técnicos y prendas de vestir, impresión, papel y embalaje, entre otros. En 2022, se prevé que el segmento de la automoción domine la región europea, ya que los adhesivos flocados tienen una alta conductividad, lo que aumenta la durabilidad de las piezas del vehículo y, por lo tanto, aumenta su demanda en el mercado.

Análisis a nivel de país del mercado de adhesivos flocados en Europa

El mercado europeo de adhesivos flocados está segmentado en cuatro segmentos notables según la fuente, el sustrato, el producto y la aplicación.

Los países que abarca el mercado europeo de adhesivos flocados son Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza y el resto de Europa. Se espera que Alemania domine el mercado europeo debido al cambio en la preferencia de los consumidores por el nivel de calidad del interior de los automóviles, lo que aumenta la demanda de adhesivos flocados en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Tendencia creciente de vehículos ligeros y con bajas emisiones de carbono

Los materiales ligeros utilizados en la fabricación de automóviles ofrecen grandes oportunidades de reducción de peso y otros beneficios cuando se utilizan en acero estructural y hierro fundido en aplicaciones automotrices. Los vehículos eléctricos tienen el impacto más significativo en la reducción de las emisiones de gases de efecto invernadero en la mayoría de los países, y los vehículos de gasolina ligeros logran reducciones significativas. Una reducción del 10% en el peso del vehículo puede mejorar el consumo de combustible en un 6% y un 8%.

Los materiales avanzados para la fabricación de vehículos eléctricos son esenciales para impulsar el mercado automotriz y, al mismo tiempo, mantener la seguridad y el rendimiento. Los materiales livianos ofrecen un gran potencial para aumentar la eficiencia del vehículo, ya que los objetos más livianos requieren menos energía para acelerar que los más pesados. Reemplazar las piezas de hierro fundido y de acero tradicionales por materiales livianos como acero de alta resistencia y aleaciones de magnesio puede reducir el peso de la carrocería y el chasis del vehículo hasta en un 50%, lo que reduce el consumo de combustible.

- En conclusión, los vehículos ligeros están fabricados principalmente de aluminio o acero ligero especial y emiten menos gases contaminantes que otros vehículos. Por este motivo, se espera que la creciente tendencia de los vehículos ligeros y con bajas emisiones de carbono actúe como un factor impulsor de la demanda del mercado europeo de adhesivos flocados.

El mercado europeo de adhesivos flocados también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los adhesivos flocados en Europa

El panorama competitivo del mercado de adhesivos flocados en Europa proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de adhesivos flocados en Europa.

Algunos de los principales actores del mercado de adhesivos flocados en Europa son Sika AG, CHT Group, SwissFlock AG, Arkema, HB Fuller Company, Dow, PARKER HANNIFIN CORP, Henkel AG & Co. KGaA, Stahl Holdings BV, Avient Corporation, Kissel + Wolf GmbH, entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Las empresas también inician numerosos contratos y acuerdos, lo que acelera el mercado europeo de adhesivos flocados.

Por ejemplo,

- En julio de 2021, Stahl Holdings BV anunció que Ecovadis le había otorgado la calificación Gold. El premio subraya el compromiso de Stahl de garantizar la transparencia en la cadena de valor y colaborar con los socios para mejorar la sostenibilidad de las operaciones y los productos.

- En agosto de 2021, Avient anunció las últimas incorporaciones a su creciente cartera de elastómeros termoplásticos (TPE) con contenido reciclado reSound R. El producto se lanzó para aportar variedad a su división de productos automotrices.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE FLOCK ADHESIVES MARKET

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- The product LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET application COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Regional Summary

- Europe

- NORTH AMERICA

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

- market overview

- drivers

- Growing trend of lightweight and low carbon-emitting vehicles

- Positive outlook towards flock adhesives in automotive and textile sectors

- Rising adoption of flock adhesives to manufacturE thermal insulation

- Shifting consumer preference towards quality level of automotive interior

- restraints

- Volatility in Raw Material Prices

- Reaction of different composition structure

- Restricted supply of raw materials for producing flock adhesives

- opportunities

- Increasing R&D activities investments for the development of new products

- Upsurge in utilization of flock adhesives in printing and packaging sectors

- Flame retarding and high washability qualities based flock adhesives products creates lucrative opportunities

- challenges

- Stringent regulations associateD with the commercialization approval process

- Lack of awareness regarding Flock Adhesives in several emerging economies

- IMPACT OF COVID 19 IMPACT ON THE Europe flock adhesives market

- ANALYSIS ON IMPACT OF COVID-19 ON THE Europe flock adhesives market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE FLOCK ADHESIVES MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT on PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe Flock Adhesives Market, BY PRODUCT

- overview

- acrylic

- POLYURETHANE

- EPOXY

- others

- Europe Flock Adhesives Market, source

- OVERVIEW

- water-borne

- solvent-borne

- Europe Flock Adhesives Market, BY substrate

- overview

- plastic

- metal

- textile

- wood

- glass

- OTHERS

- Europe Flock Adhesives Market, BY application

- overview

- automotive

- acrylic

- polyurethane

- epoxy

- others

- Technical Textile & Clothing

- acrylic

- polyurethane

- epoxy

- others

- Paper & Packaging

- acrylic

- polyurethane

- epoxy

- others

- Printing

- acrylic

- polyurethane

- epoxy

- others

- others

- acrylic

- polyurethane

- epoxy

- others

- EUROPE Flock adhesive market, BY region

- Europe

- germany

- u.k

- russia

- france

- italy

- turkey

- spain

- netherlands

- belgium

- switzerland

- rest of europe

- EUROPE FLOCK ADHESIVES MARKET: COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- company profiles

- Dow

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT update

- Sika AG

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT updates

- Henkel AG & Co. KGaA

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT update

- PARKER HANNIFIN CORP

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT update

- Arkema

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT updates

- Avient Corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- H.B. Fuller Company

- COMPANY SNAPSHOT

- revenue analysis

- Product Portfolio

- RECENT updates

- CHT Group

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPdates

- Kissel + Wolf Gmbh

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- NANPAO RESINS CHEMICAL GROUP

- COMPANY SNAPSHOT

- revenue analysis

- Product Portfolio

- RECENT update

- NYATEX

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPdate

- Stahl Holdings B.V

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT Update

- SwissFlock AG

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPdate

- QUESTIONNAIRE

- related reports

Lista de Tablas

TABLE 1 export DATA of Glues, prepared, and other prepared adhesives, n.e.s., HS 350699 (USD Thousand)

TABLE 2 import DATA OF GLUES, PREPARED, AND OTHER PREPARED ADHESIVES, N.E.S., HS 350699 (USD THOUSAND)

TABLE 3 Europe Flock adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 4 Europe Flock adhesives Market, By product, 2020-2029 (tons)

TABLE 5 Europe Acrylic in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 6 Europe acrylic in FLOCK ADHESIVES market, BY region, 2020-2029 (Tons)

TABLE 7 Europe Polyurethane in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 8 Europe Polyurethane in FLOCK ADHESIVES market, BY region, 2020-2029 (TONS)

TABLE 9 Europe Epoxy in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 10 Europe Epoxy in FLOCK ADHESIVES market, BY region, 2020-2029 (tons)

TABLE 11 Europe others in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 12 Europe others in FLOCK ADHESIVES market, BY region, 2020-2029 (Tons)

TABLE 13 Europe FLOCK ADHESIVES market, BY SOurce, 2022-2029 (USD Thousand)

TABLE 14 Europe water-borne IN FLOCK ADHESIVES market, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 Europe Solvent-borne IN FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 16 Europe Flock adhesives Market, By Substrate, 2020-2029 (usd thousand)

TABLE 17 Europe plastic in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 18 Europe metal in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 19 Europe textile in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 20 Europe wood in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 21 Europe glass in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 22 Europe others in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 23 Europe Flock adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 24 Europe Automotive in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 25 Europe Automotive in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 26 Europe Technical Textile & Clothing in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 27 Europe Technical Textile & Clothing in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 28 Europe Paper & Packaging in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 29 Europe Paper & Packaging in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 30 Europe Printing in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 31 Europe Printing in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 32 Europe others in FLOCK ADHESIVES market, BY region, 2020-2029 (USD thousand)

TABLE 33 Europe OTHERS in FLOCK ADHESIVES market, BY Product, 2020-2029 (USD thousand)

TABLE 34 Europe Flock Adhesives Market, BY COUNTRY, 2020-2029 (USD Thousand)

TABLE 35 Europe Flock Adhesives Market, BY COUNTRY, 2020-2029 (tons)

TABLE 36 Europe Flock Adhesives Market, By Product, 2020-2029 (USD THOUSAND)

TABLE 37 Europe Flock Adhesives Market, By Product, 2020-2029 (Tons)

TABLE 38 Europe flock adhesives Market, BY SOURCE, 2020-2029 (USD Thousand)

TABLE 39 Europe flock adhesives Market, By Substrate, 2020-2029 (USD Thousand)

TABLE 40 Europe Flock Adhesives Market, BY application, 2020-2029 (USD Thousand)

TABLE 41 EUROPE AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 42 EUROPE Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 43 EUROPE Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 44 EUROPE printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 45 EUROPE others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 46 germany Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 47 germany Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 48 germany Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 49 germany Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 50 germany Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 51 germany AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 52 germany Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 53 germany Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 54 germany printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 55 germany others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 56 U.K. Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 57 U.K. Flock Adhesives Market, BY product, 2020-2029 (tons)

TABLE 58 U.K. Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 59 U.K. Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 60 U.K. Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 61 U.K. AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 62 U.K. Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 63 U.K. Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 64 U.K. printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 65 U.K. others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 66 Russia Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 67 Russia Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 68 Russia Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 69 Russia Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 70 Russia Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 71 Russia AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 72 Russia Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 73 Russia Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 74 Russia printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 75 Russia others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 76 France Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 77 France Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 78 France Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 79 France Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 80 France Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 81 France AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 82 France Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 83 France Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 84 France printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 85 France others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 86 Italy Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 87 Italy Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 88 Italy Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 89 Italy Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 90 Italy Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 91 Italy AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 92 Italy Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 93 Italy Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 94 Italy printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 95 Italy others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 96 Turkey Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 97 Turkey Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 98 Turkey Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 99 Turkey Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 100 Turkey Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 101 Turkey AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 102 Turkey Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 103 Turkey Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 104 Turkey printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 105 Turkey others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 106 Spain Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 107 Spain Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 108 Spain Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 109 Spain Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 110 Spain Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 111 Spain AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 112 Spain Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 113 Spain Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 114 Spain printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 115 Spain others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 116 Netherlands Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 117 Netherlands Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 118 Netherlands Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 119 Netherlands Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 120 Netherlands Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 121 Netherlands AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 122 Netherlands Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 123 Netherlands Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 124 Netherlands printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 125 Netherlands others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 126 Belgium Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 127 Belgium Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 128 Belgium Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 129 Belgium Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 130 Belgium Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 131 Belgium AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 132 Belgium Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 133 Belgium Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 134 Belgium printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 135 Belgium others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 136 Switzerland Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 137 Switzerland Flock Adhesives Market, By product, 2020-2029 (tons)

TABLE 138 Switzerland Flock Adhesives Market, By source, 2020-2029 (usd thousand)

TABLE 139 Switzerland Flock Adhesives Market, By substrate, 2020-2029 (usd thousand)

TABLE 140 Switzerland Flock Adhesives Market, By application, 2020-2029 (usd thousand)

TABLE 141 Switzerland AUTOMOTIVE in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 142 Switzerland Technical Textile and Clothing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 143 Switzerland Paper and packaging in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 144 Switzerland printing in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 145 Switzerland others in Flock Adhesives Market, BY product, 2020-2029 (USD Thousand)

TABLE 146 Rest of Europe Flock Adhesives Market, By product, 2020-2029 (usd thousand)

TABLE 147 Rest of Europe Flock Adhesives Market, By product, 2020-2029 (tons)

Lista de figuras

FIGURE 1 EUROPE FLOCK ADHESIVES MARKET: segmentation

FIGURE 2 EUROPE FLOCK ADHESIVES MARKET: data triangulation

FIGURE 3 EUROPE FLOCK ADHESIVES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FLOCK ADHESIVES MARKET: Europe VS regional MARKET analysis

FIGURE 5 EUROPE FLOCK ADHESIVES MARKET: company research analysis

FIGURE 6 EUROPE FLOCK ADHESIVES MARKET: THE product LIFE LINE CURVE

FIGURE 7 EUROPE FLOCK ADHESIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE FLOCK ADHESIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE FLOCK ADHESIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE FLOCK ADHESIVES MARKET: MARKET application COVERAGE GRID

FIGURE 11 EUROPE FLOCK ADHESIVES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE FLOCK ADHESIVES MARKET: vendor share analysis

FIGURE 13 EUROPE FLOCK ADHESIVES MARKET: SEGMENTATION

FIGURE 14 A Positive outlook towards flock adhesives in THE automotive and textile sectors is EXPECTED TO DRIVE the EUROPE FLOCK ADHESIVES MARKET in the forecast period of 2022 to 2029

FIGURE 15 Acrylic SEGMENT is expected to account for the largest share of the EUROPE FLOCK ADHESIVES MARKET in 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTs, OPPORTUNITies, AND CHALLENGEs OF Europe Flock Adhesives Market

FIGURE 17 Percentage of Lightweight Materials Present In Typical Vehicles (Approximate Value)

FIGURE 18 Europe FLOCK ADHESIVES market, BY product, 2021

FIGURE 19 Europe FLOCK ADHESIVES MARKET, BY source, 2021

FIGURE 20 Europe FLOCK ADHESIVES market, BY substrate, 2021

FIGURE 21 Europe FLOCK ADHESIVES market, BY application, 2021

FIGURE 22 Europe Flock Adhesives Market: SNAPSHOT (2021)

FIGURE 23 Europe Flock Adhesives Market: by COUNTRY (2021)

FIGURE 24 Europe Flock Adhesives Market: by COUNTRY (2022 & 2029)

FIGURE 25 Europe Flock Adhesives Market: by COUNTRY (2021 & 2029)

FIGURE 26 Europe Flock Adhesives Market: by PRODUCT (2022-2029)

FIGURE 27 EUROPE FLOCK ADHESIVES MARKET: company share 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.