Europe Excipients Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.89 Billion

USD

2.96 Billion

2024

2032

USD

1.89 Billion

USD

2.96 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.96 Billion | |

|

|

|

|

Segmentación del mercado europeo de excipientes por origen (orgánico e inorgánico), categoría (excipientes primarios y secundarios), productos (polímeros, azúcares, alcoholes, minerales, gelatina y otros), tipo de química (vegetal, animal, sintético y mineral), síntesis química (lactosa monohidrato, sucralosa, polisorbato, alcohol bencílico, alcohol cetostearílico, lecitina de soja, almidón pregelatinizado y otros), funcionalidad (aglutinantes y adhesivos, disgregantes, recubrimientos, solubilizantes, aromas, edulcorantes, diluyentes, lubricantes, tampones, emulsionantes, conservantes, antioxidantes, sorbentes, disolventes, emolientes, deslizantes, agentes quelantes, antiespumantes y otros), forma farmacéutica (sólida, semisólida y líquida) y vía de administración (oral). Excipientes (excipientes tópicos, excipientes parenterales y otros excipientes), usuario final (empresas farmacéuticas y biofarmacéuticas , formuladores por contrato, organizaciones de investigación y académicas, y otros), canal de distribución (licitación directa, ventas minoristas y otros): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado europeo de excipientes

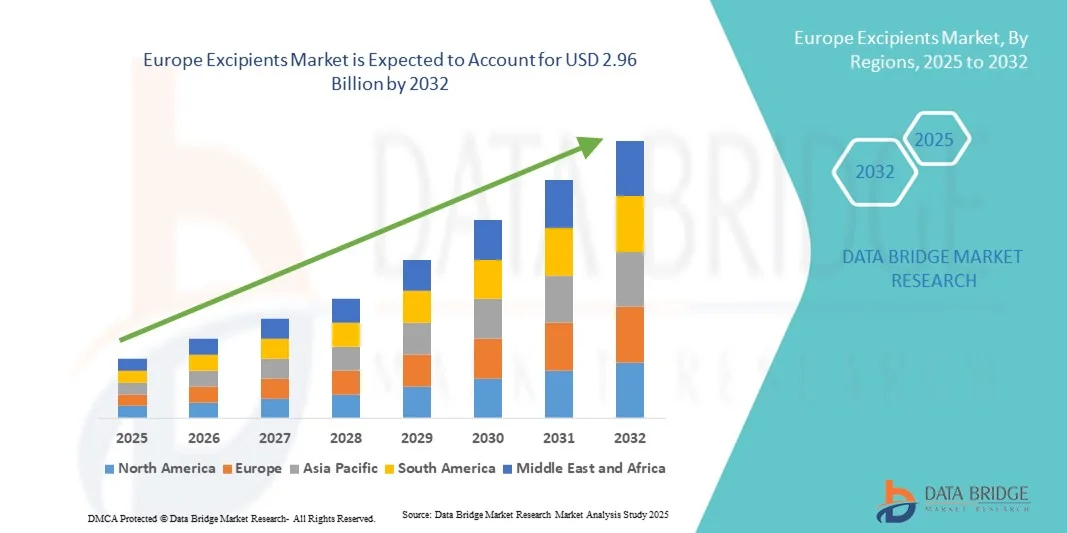

- El tamaño del mercado europeo de excipientes se valoró en 1.890 millones de dólares en 2024 y se espera que alcance los 2.960 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 5,80% durante el período de previsión.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de formulaciones farmacéuticas y a la mayor adopción de tecnologías avanzadas de administración de fármacos tanto en los mercados desarrollados como en los emergentes.

- Además, el creciente énfasis en mejorar la estabilidad, la eficacia y el cumplimiento terapéutico de los fármacos está impulsando la adopción de soluciones de excipientes, lo que a su vez impulsa significativamente el crecimiento del sector.

Análisis del mercado europeo de excipientes

- El mercado de excipientes, que comprende sustancias utilizadas para mejorar la estabilidad, la biodisponibilidad y la eficacia de las formulaciones farmacéuticas, está experimentando un crecimiento significativo debido a la creciente demanda de sistemas optimizados de administración de fármacos y a la expansión de la industria farmacéutica.

- La creciente demanda de excipientes se debe principalmente al aumento de la producción de medicamentos orales e inyectables, al mayor interés en los nuevos sistemas de administración de fármacos y a la creciente necesidad de soluciones de formulación rentables.

- Alemania dominó el mercado de excipientes con la mayor cuota de ingresos (41,5 %) en 2024. Este éxito se debe a su sólida base de fabricación farmacéutica, el elevado gasto sanitario y la presencia de actores clave del sector. El país experimentó un crecimiento sustancial en las aplicaciones de excipientes en formulaciones orales, inyectables y tópicas.

- Se prevé que Francia sea la región de mayor crecimiento en el mercado de excipientes durante el período de pronóstico, debido al aumento de la producción farmacéutica, la adopción de tecnologías avanzadas de administración de fármacos y el incremento de las inversiones en infraestructura sanitaria.

- El segmento de excipientes primarios representó la mayor cuota de ingresos, con un 47,3 % en 2024, debido a su papel esencial en las formulaciones farmacéuticas, incluyendo aglutinantes, diluyentes y desintegrantes. Los excipientes primarios constituyen la base de las formulaciones de medicamentos, aportando estabilidad, facilitando su manipulación y optimizando su biodisponibilidad.

Alcance del informe y segmentación del mercado de excipientes

|

Atributos |

Información clave del mercado de excipientes |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los datos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, epidemiología de pacientes, análisis de proyectos en desarrollo, análisis de precios y marco regulatorio. |

Tendencias del mercado europeo de excipientes

Aumento de la demanda de excipientes funcionales y de alto rendimiento

- Una tendencia significativa y en auge en el mercado mundial de la neuropatía amiloide es el creciente énfasis en el diagnóstico precoz y el desarrollo de terapias personalizadas para mejorar los resultados de los pacientes.

- Por ejemplo, en marzo de 2023, Ionis Pharmaceuticals informó sobre el progreso de sus ensayos de fase 2 para la terapia con oligonucleótidos antisentido dirigida a la neuropatía amiloide hereditaria, lo que destaca el enfoque del mercado en las terapias dirigidas.

- Los avances en tecnologías de diagnóstico, como las pruebas genéticas y la biopsia de tejido, están permitiendo una detección más temprana y una mejor caracterización de las neuropatías amiloides.

- Los enfoques de medicina personalizada están impulsando regímenes de tratamiento adaptados a las necesidades de cada paciente, basados en sus perfiles genéticos y clínicos específicos.

- Los médicos están adoptando cada vez más estrategias de tratamiento multimodal, combinando medicamentos, intervenciones en el estilo de vida y cuidados de apoyo para optimizar los resultados de los pacientes.

- Se observa una tendencia hacia opciones terapéuticas menos invasivas y más seguras que reducen los efectos secundarios y mejoran la adherencia del paciente al tratamiento.

- La I+D en curso se centra en el desarrollo de nuevas moléculas y sistemas de administración de fármacos dirigidos específicamente a la deposición de amiloide y la degeneración nerviosa. La tendencia del mercado también incluye terapias combinadas y protocolos de tratamiento en varias etapas diseñados para mejorar la eficacia en diversas poblaciones de pacientes.

- Los estudios basados en evidencia del mundo real y los datos de ensayos clínicos influyen en las decisiones médicas y fomentan la adopción de opciones de tratamiento avanzadas. Las iniciativas de educación del paciente mejoran la comprensión de la progresión de la enfermedad y la importancia de la intervención oportuna.

- Los proveedores de atención médica están colaborando con las compañías farmacéuticas para integrar las pruebas genéticas y el análisis de biomarcadores en la práctica clínica habitual. Esta tendencia se ve impulsada por el aumento de las inversiones en salud y el desarrollo de centros de neurología especializados en regiones clave.

Dinámica del mercado europeo de excipientes

Conductor

Prevalencia creciente de las neuropatías amiloides y mayor concienciación de los pacientes

- Las mejores capacidades de diagnóstico y el aumento de las actividades de investigación clínica fomentan la detección e intervención tempranas.

- Por ejemplo, en junio de 2022, Alnylam Pharmaceuticals recibió la aprobación de la FDA para Onpattro (patisiran), un tratamiento para la neuropatía amiloide hereditaria mediada por transtiretina, lo que subraya el impacto de las terapias innovadoras en el crecimiento del mercado.

- La expansión de clínicas especializadas y centros de neurología mejora el acceso al tratamiento y la atención para los pacientes. La adopción de terapias avanzadas dirigidas a proteínas amiloides específicas está acelerando el crecimiento del mercado.

- Las políticas sanitarias que fomentan la concienciación sobre las enfermedades raras están contribuyendo a un aumento de las tasas de diagnóstico. El incremento de la renta disponible en las regiones desarrolladas permite a los pacientes acceder con mayor facilidad a tratamientos avanzados. Las compañías farmacéuticas están invirtiendo fuertemente en I+D para desarrollar fármacos más seguros y eficaces.

- La creciente colaboración entre hospitales, institutos de investigación y empresas biotecnológicas fomenta la innovación. Los modelos de atención centrados en el paciente impulsan la demanda de terapias personalizadas. La telemedicina y las soluciones de salud digital facilitan la gestión y el seguimiento de los tratamientos.

Restricción/Desafío

Los elevados costes asociados a los diagnósticos avanzados y las terapias dirigidas

- La escasez de centros de neurología especializados en ciertas áreas plantea dificultades de acceso. Los complejos trámites regulatorios para los tratamientos de enfermedades raras pueden retrasar la aprobación de productos. La variabilidad en la respuesta de los pacientes a los tratamientos puede obstaculizar la estandarización de los protocolos de tratamiento.

- Garantizar la adherencia a los tratamientos a largo plazo supone un reto tanto para pacientes como para profesionales sanitarios. El desconocimiento por parte de los médicos de atención primaria puede provocar retrasos en el diagnóstico y el tratamiento. Las dificultades en la cadena de suministro de medicamentos especializados y productos biológicos pueden afectar a su disponibilidad.

- Por ejemplo, en septiembre de 2021, el acceso limitado a tafamidis en varios países europeos debido a su alto costo puso de manifiesto los problemas de asequibilidad y accesibilidad en el mercado de la neuropatía amiloide.

- Las aseguradoras pueden imponer restricciones o exigir pruebas de rentabilidad antes de cubrir nuevas terapias. Los problemas de reembolso de los tratamientos innovadores pueden suponer barreras para los pacientes en algunas regiones. La innovación continua requiere una inversión sustancial en ensayos clínicos y fabricación. La falta de datos epidemiológicos a gran escala en algunas regiones dificulta la previsión del mercado y la planificación de ensayos clínicos.

- Los posibles efectos secundarios y las preocupaciones sobre la seguridad de las nuevas terapias pueden ralentizar su adopción entre pacientes y médicos cautelosos. Los desafíos éticos y logísticos para realizar ensayos clínicos de formas hereditarias raras de neuropatía amiloide pueden retrasar el desarrollo de terapias.

- La escasez de pacientes en los estudios clínicos puede reducir la significación estadística y retrasar la aprobación de medicamentos. Las disparidades en la infraestructura sanitaria entre las zonas urbanas y rurales pueden restringir el acceso al diagnóstico y al tratamiento. Las deficiencias en la cobertura de los seguros y los elevados gastos de bolsillo pueden disuadir a los pacientes de buscar atención médica oportuna.

- La reticencia de los médicos a adoptar las terapias recientemente aprobadas se debe a la insuficiencia de datos de seguridad a largo plazo. La variabilidad en la progresión de la enfermedad dificulta la creación de guías de tratamiento estandarizadas. La coordinación entre equipos de atención multidisciplinarios puede resultar compleja para el manejo de las manifestaciones sistémicas de la enfermedad.

Alcance del mercado de excipientes en Europa

El mercado de excipientes se segmenta en función del origen, la categoría, los productos, el tipo de química, la síntesis química, la funcionalidad, la forma farmacéutica, la vía de administración, el usuario final y el canal de distribución.

- Por origen

Según su origen, el mercado europeo de excipientes se divide en orgánicos e inorgánicos. El segmento orgánico dominó el mercado con una cuota del 45,1 % en 2024, impulsado por la creciente preferencia por los excipientes de origen natural en las formulaciones farmacéuticas. Los fabricantes y formuladores prefieren los excipientes orgánicos por su biocompatibilidad, mínimos efectos secundarios y cumplimiento de las normas de seguridad del paciente. La creciente demanda de productos farmacéuticos sostenibles y con etiqueta limpia refuerza aún más el crecimiento de este segmento. Los excipientes orgánicos también ofrecen versatilidad en diversas formas farmacéuticas, incluyendo formulaciones sólidas, semisólidas y líquidas. El apoyo regulatorio a los ingredientes naturales en los medicamentos ha influido positivamente en su adopción, especialmente en Europa. Además, los excipientes orgánicos contribuyen a mejorar la biodisponibilidad, la estabilidad y la adherencia al tratamiento, lo que los hace muy favorables tanto para medicamentos genéricos como innovadores. Los principales actores del mercado están invirtiendo activamente en I+D para optimizar la extracción y purificación de excipientes de origen vegetal y animal. Esta tendencia es particularmente notable en el desarrollo de formulaciones orales y parenterales. La creciente tendencia hacia formulaciones farmacéuticas centradas en el paciente y respetuosas con el medio ambiente está consolidando el predominio de los excipientes orgánicos. Por ejemplo, en 2023, un proveedor europeo líder amplió su cartera de polímeros orgánicos para satisfacer la demanda farmacéutica.

Se prevé que el segmento de excipientes inorgánicos experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22,4 %, entre 2025 y 2032, impulsada por su creciente uso en formulaciones especializadas como antiácidos, agentes tamponantes y recubrimientos de tabletas. Los excipientes inorgánicos ofrecen una estabilidad química precisa, rentabilidad y ventajas de escalabilidad. El aumento de sus aplicaciones en la producción a gran escala de medicamentos genéricos y nutracéuticos impulsa su adopción. Además, la creciente concienciación sobre la funcionalidad de los excipientes para mejorar la solubilidad y la disolución está impulsando la demanda. Los excipientes inorgánicos son los preferidos en aplicaciones que requieren alta pureza y cumplimiento normativo. Los fabricantes están innovando con minerales y sales modificados para ampliar la funcionalidad en formas farmacéuticas sólidas y semisólidas. El aumento de la producción farmacéutica en los países europeos emergentes contribuye aún más al crecimiento. Las aprobaciones regulatorias y la estandarización de los excipientes inorgánicos para uso terapéutico aumentan la confianza y la aceptación entre los formuladores.

- Por categoría

Según su categoría, el mercado se segmenta en excipientes primarios y secundarios. El segmento de excipientes primarios representó la mayor cuota de ingresos, con un 47,3 % en 2024, debido a su papel fundamental en las formulaciones farmacéuticas, incluyendo aglutinantes, diluyentes y desintegrantes. Los excipientes primarios constituyen la base de las formulaciones de medicamentos, aportando estabilidad, facilitando su manipulación y optimizando su biodisponibilidad. Los fabricantes confían en los excipientes primarios para garantizar la consistencia, la eficacia y la vida útil de los productos. La creciente demanda de formas farmacéuticas sólidas, como comprimidos y cápsulas, ha fortalecido este segmento. Los excipientes primarios también contribuyen al desarrollo de formulaciones de liberación controlada e inmediata. Este segmento se beneficia del enfoque regulatorio en materias primas de alta calidad. Las empresas farmacéuticas priorizan los excipientes primarios para cumplir con las Buenas Prácticas de Fabricación (BPF). Las innovaciones en excipientes a base de polímeros y aglutinantes de origen natural impulsan aún más el crecimiento. Por ejemplo, en 2022, un proveedor europeo de polímeros amplió su cartera de productos para formulaciones orales sólidas.

Se prevé que el segmento de excipientes secundarios experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 21,9 %, entre 2025 y 2032, impulsada por su creciente uso en formulaciones avanzadas como recubrimientos, solubilizantes, saborizantes y conservantes. Los excipientes secundarios permiten una mayor estabilidad, una mejor aceptación por parte del paciente y una liberación controlada del fármaco. El crecimiento se ve impulsado por las innovaciones en excipientes funcionales para enmascarar el sabor y mejorar la solubilidad. Los fabricantes por contrato y las empresas biofarmacéuticas están incorporando excipientes secundarios para mejorar la diferenciación de sus productos. Su uso cada vez mayor en formulaciones pediátricas y geriátricas contribuye al aumento de la demanda. La aprobación regulatoria y la necesidad de datos de seguridad sobre los excipientes aceleran su adopción. Las nuevas tendencias en terapias combinadas y formas farmacéuticas multicomponentes impulsan aún más el segmento. Por ejemplo, en marzo de 2023, una empresa europea presentó un nuevo excipiente para recubrimientos que mejora la estabilidad en comprimidos pediátricos.

- Por productos

Según el tipo de producto, el mercado se segmenta en polímeros, azúcares, alcoholes, minerales, gelatina y otros. El segmento de polímeros dominó el mercado con la mayor cuota de ingresos, un 44,7 % en 2024, debido a su multifuncionalidad como aglutinantes, recubrimientos y matrices de liberación controlada. Los polímeros mejoran la estabilidad, la solubilidad y la facilidad de fabricación de las formulaciones, lo que los convierte en productos muy demandados por las empresas farmacéuticas. Su creciente adopción en formas farmacéuticas orales, tópicas y parenterales impulsa este segmento. Los excipientes poliméricos también facilitan el desarrollo de sistemas de administración innovadores, como nanopartículas e hidrogeles. La sólida inversión en I+D en polímeros biocompatibles respalda su demanda sostenida. La aprobación regulatoria de los polímeros de grado farmacéutico fomenta aún más su adopción. La capacidad de adaptar las características de los polímeros a las propiedades de los fármacos aumenta la flexibilidad de las formulaciones. Los polímeros se utilizan cada vez más en terapias de alto valor, incluidos los productos biológicos. Por ejemplo, en 2022, un proveedor europeo amplió su cartera de hidroxipropilmetilcelulosa para aplicaciones orales y tópicas.

Se prevé que el segmento de azúcares experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 23,1 %, entre 2025 y 2032, debido a su creciente uso como edulcorantes, excipientes y estabilizadores en formas farmacéuticas orales. La creciente demanda de formulaciones fáciles de usar para el paciente, como comprimidos masticables y jarabes, impulsa este crecimiento. Los azúcares también mejoran la palatabilidad y la estabilidad de los principios activos. La mayor prevalencia de medicamentos pediátricos y geriátricos contribuye a la expansión del segmento. Las compañías farmacéuticas europeas se están centrando en azúcares de origen natural debido a las tendencias de sostenibilidad. Los azúcares funcionales están ganando popularidad por su capacidad para modular la liberación y mejorar la solubilidad. El crecimiento del mercado también se ve impulsado por el uso de azúcares en nutracéuticos y suplementos dietéticos. En 2023, un fabricante lanzó un excipiente de azúcar pregelatinizado diseñado específicamente para comprimidos masticables.

- Por tipo de química

Según su tipo químico, el mercado se segmenta en excipientes de origen vegetal, animal, sintético y mineral. El segmento de origen vegetal representó la mayor cuota de ingresos, con un 45,8 % en 2024, debido a la creciente preferencia por excipientes naturales y biocompatibles en formulaciones farmacéuticas y nutracéuticas. Los excipientes de origen vegetal ofrecen seguridad, facilidad de cumplimiento normativo y compatibilidad con diversas formas farmacéuticas. La alta preferencia de los consumidores por ingredientes ecológicos y con etiquetas limpias impulsa el crecimiento. Una sólida inversión en I+D en técnicas de extracción y estabilización mejora la usabilidad. Las aplicaciones en tabletas, cápsulas y formas semisólidas refuerzan su adopción. La creciente concienciación sobre la seguridad del paciente y la reducción de las reacciones adversas respaldan el uso de excipientes de origen vegetal. El apoyo gubernamental y regulatorio a los excipientes naturales impulsa su aceptación. Por ejemplo, en 2023, una empresa europea amplió su cartera de polímeros de origen vegetal para formulaciones orales.

Se prevé que el segmento de excipientes sintéticos experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22,7 %, entre 2025 y 2032, impulsada por ventajas como la escalabilidad, la estabilidad química y la rentabilidad. Los excipientes sintéticos se utilizan ampliamente en la producción a gran escala y en formulaciones de liberación controlada. Las innovaciones en polímeros y tensioactivos sintéticos impulsan aún más este crecimiento. Su adopción se ve acelerada por las empresas farmacéuticas que buscan un rendimiento preciso en sus formulaciones. La aprobación regulatoria de excipientes sintéticos para nuevas terapias respalda su expansión. Los excipientes sintéticos se aplican cada vez más tanto en formas farmacéuticas sólidas como líquidas. El aumento de la demanda en las organizaciones de fabricación por contrato también contribuye a este crecimiento. Por ejemplo, en 2024 se lanzó en Europa un excipiente de polímero sintético para comprimidos de liberación inmediata.

- Mediante síntesis química

Según su síntesis química, el mercado se segmenta en lactosa monohidrato, sucralosa, polisorbato, alcohol bencílico, alcohol cetostearílico, lecitina de soja, almidón pregelatinizado y otros. El segmento de lactosa monohidrato representó la mayor cuota de ingresos, con un 43,5 % en 2024, debido a su amplia aplicación como excipiente, diluyente y estabilizador en comprimidos y cápsulas. Su compatibilidad con diversos fármacos y sus excelentes propiedades de flujo la convierten en la opción preferida de los fabricantes farmacéuticos. La lactosa monohidrato también es muy valorada por su capacidad para mejorar la compresibilidad, garantizar una dosificación uniforme y aumentar la estabilidad del producto. Este segmento se beneficia de la aprobación regulatoria en Europa, lo que reduce los riesgos de formulación. Su versatilidad en formas farmacéuticas sólidas y semisólidas impulsa aún más su adopción. Los fabricantes también prefieren la lactosa monohidrato para medicamentos pediátricos y geriátricos debido a su baja toxicidad y alta palatabilidad. Por ejemplo, en 2023, un proveedor europeo líder amplió su cartera de monohidrato de lactosa para respaldar la producción de dosis orales de gran volumen.

Se prevé que el segmento de la sucralosa experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 24,0 %, entre 2025 y 2032, impulsada por su creciente uso en formulaciones edulcoradas, tabletas masticables y jarabes. La sucralosa ofrece ventajas funcionales como el enmascaramiento del sabor, una mayor adherencia al tratamiento y estabilidad en diversas condiciones de procesamiento. La creciente demanda de formulaciones pediátricas y geriátricas impulsa aún más su adopción. Los fabricantes europeos están incorporando cada vez más la sucralosa en nutracéuticos y productos de venta libre. Las innovaciones en los derivados de la sucralosa permiten una mejor solubilidad y una liberación controlada en formas farmacéuticas orales. La aprobación regulatoria para su uso en formulaciones farmacéuticas refuerza la confianza del mercado. La expansión de sus aplicaciones en alimentos funcionales y suplementos dietéticos también impulsa el crecimiento. Por ejemplo, en 2024, una empresa europea de excipientes lanzó un excipiente edulcorante a base de sucralosa, especialmente formulado para tabletas masticables.

- Por funcionalidad

En función de su funcionalidad, el mercado se segmenta en aglutinantes y adhesivos, desintegrantes, materiales de recubrimiento, solubilizantes, saborizantes, edulcorantes, diluyentes, lubricantes, tampones, emulsionantes, conservantes, antioxidantes, sorbentes, disolventes, emolientes, deslizantes, agentes quelantes, antiespumantes y otros. El segmento de aglutinantes y adhesivos representó la mayor cuota de ingresos, con un 44,9 % en 2024, debido a su papel fundamental en el mantenimiento de la integridad de los comprimidos, el control de la liberación del fármaco y la mejora de la estabilidad de la formulación. Los aglutinantes garantizan una compactación y cohesión óptimas, cruciales para la producción de comprimidos a gran escala. La creciente adopción de formas farmacéuticas orales sólidas, junto con el cumplimiento normativo en materia de calidad de los excipientes, impulsa este segmento. Las empresas farmacéuticas se centran en los aglutinantes poliméricos para lograr una liberación controlada y una mayor biodisponibilidad. La creciente preferencia por las formulaciones orales sólidas en Europa refuerza la demanda. Por ejemplo, en 2023, un proveedor europeo líder amplió su cartera de aglutinantes para comprimidos de liberación inmediata y modificada.

Se prevé que el segmento de disgregantes experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 23,5 %, entre 2025 y 2032, impulsada por la creciente demanda de disolución rápida de fármacos y una mayor biodisponibilidad en formulaciones orales. Los disgregantes facilitan la rápida desintegración y absorción de los comprimidos, lo que mejora la eficacia terapéutica. El crecimiento se ve impulsado por la creciente prevalencia de enfermedades crónicas que requieren terapias orales y la necesidad de formulaciones fáciles de usar para el paciente. Los formuladores europeos están adoptando superdisgregantes innovadores para un mejor rendimiento. Su uso cada vez mayor en comprimidos masticables, efervescentes y de disolución rápida acelera el crecimiento. El cumplimiento normativo y la calidad constante impulsan aún más su adopción. En 2024, un importante fabricante de excipientes lanzó un nuevo disgregante optimizado para comprimidos pediátricos.

- Por forma farmacéutica

Según su forma farmacéutica, el mercado se segmenta en sólidas, semisólidas y líquidas. El segmento de formas farmacéuticas sólidas dominó el mercado con la mayor cuota de ingresos, un 46,2 % en 2024, debido a su uso generalizado, su rentabilidad y la facilidad de almacenamiento, transporte y administración. Los comprimidos y las cápsulas son las opciones preferidas por los profesionales sanitarios y los pacientes por su facilidad de dosificación y la buena adherencia al tratamiento. Las formas farmacéuticas sólidas ofrecen una vida útil estable y una producción escalable, lo que las hace idóneas para formulaciones de medicamentos genéricos e innovadores. La fuerte demanda de medicamentos orales y terapias para el manejo de enfermedades crónicas respalda el dominio de este segmento. Por ejemplo, en 2023, un proveedor europeo de excipientes amplió sus líneas de producción de excipientes de polímeros y azúcares para la fabricación de comprimidos.

Se prevé que el segmento de formas farmacéuticas líquidas experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 24,1 %, entre 2025 y 2032, impulsada por la creciente demanda de jarabes pediátricos, soluciones inyectables y suspensiones orales. Las formulaciones líquidas mejoran la adherencia al tratamiento, especialmente entre niños y ancianos. El aumento de su uso en medicamentos parenterales y tópicos contribuye a este crecimiento. Las innovaciones en solubilizantes, edulcorantes y estabilizantes potencian aún más el mercado. La aprobación regulatoria de excipientes seguros para líquidos acelera su adopción. La expansión del mercado también se ve favorecida por la creciente prevalencia de enfermedades crónicas y suplementos nutricionales en forma líquida. A principios de 2024, una empresa europea lanzó un nuevo excipiente solubilizante optimizado para jarabes y suspensiones orales.

- Por vía administrativa

Según la vía de administración, el mercado se segmenta en excipientes orales, tópicos, parenterales y otros. El segmento de excipientes orales representó la mayor cuota de ingresos, con un 45,6 % en 2024, impulsado por la preferencia generalizada por medicamentos orales, comprimidos, cápsulas y jarabes. Los excipientes orales contribuyen a enmascarar el sabor, mejorar la estabilidad, controlar la liberación y aumentar la biodisponibilidad. El incremento de la prevalencia de enfermedades crónicas y la preocupación por la adherencia al tratamiento impulsan el dominio de este segmento. Las innovaciones en polímeros, azúcares y disgregantes mejoran la calidad de las formulaciones orales. Por ejemplo, en 2023, una empresa europea lanzó un excipiente oral a base de polímeros que mejora la solubilidad en comprimidos.

Se prevé que el segmento de excipientes parenterales experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 23,8 %, entre 2025 y 2032, impulsada por la creciente demanda de productos biológicos inyectables, vacunas y terapias de alto valor. Los excipientes parenterales garantizan la esterilidad, la estabilidad y la compatibilidad de las formulaciones. Este crecimiento se ve respaldado por el aumento de la inversión en I+D biofarmacéutica y fabricación por contrato. Las directrices regulatorias sobre la seguridad de los excipientes inyectables refuerzan la confianza del mercado. Su creciente adopción en hospitales, clínicas especializadas y atención domiciliaria impulsa aún más la expansión del segmento. A principios de 2024, un proveedor europeo presentó un nuevo excipiente estabilizante optimizado para productos biológicos parenterales.

- Por el usuario final

Según el usuario final, el mercado europeo de excipientes se segmenta en empresas farmacéuticas y biofarmacéuticas, formuladores por contrato, organizaciones de investigación y académicas, y otros. El segmento de empresas farmacéuticas y biofarmacéuticas ostentó la mayor cuota de ingresos, con un 47,0 % en 2024, lo que refleja su papel dominante en la producción de medicamentos a gran escala, incluidas las formulaciones orales, inyectables y tópicas. Estas empresas dependen en gran medida de excipientes de alta calidad para garantizar la estabilidad del producto, el cumplimiento normativo y una biodisponibilidad óptima, factores críticos tanto para los medicamentos genéricos como para los innovadores. La creciente demanda mundial de genéricos, junto con el auge de las terapias innovadoras, refuerza aún más el liderazgo de este segmento. Las inversiones continuas en investigación y desarrollo, en particular en sistemas avanzados de administración de fármacos y tecnologías de formulación, han impulsado la adopción de excipientes especializados. Por ejemplo, en 2023, una importante empresa farmacéutica europea amplió estratégicamente su suministro de excipientes para mejorar la calidad y el rendimiento de las formas farmacéuticas sólidas orales.

Se prevé que el segmento de formuladores por contrato experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22,9 %, entre 2025 y 2032, impulsada por la creciente tendencia a externalizar el desarrollo y la fabricación farmacéutica. Los formuladores por contrato requieren excipientes versátiles y multifuncionales para satisfacer las diversas necesidades de formulación específicas de cada cliente, incluyendo funciones estabilizadoras, solubilizantes y otras funcionales. La expansión de las operaciones de fabricación por contrato en toda Europa, respaldada por marcos regulatorios favorables y estrictos estándares de calidad, impulsa aún más el crecimiento del segmento. Además, la creciente demanda de soluciones con tiempos de comercialización más rápidos, junto con el énfasis de la industria en formas farmacéuticas innovadoras y medicina personalizada, está alentando a los formuladores por contrato a adoptar soluciones de excipientes avanzadas. En conjunto, estos factores posicionan a los formuladores por contrato como el segmento de usuarios finales de mayor crecimiento en el mercado europeo de excipientes.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en Licitación Directa, Venta Minorista y Otros. El segmento de Licitación Directa representó la mayor cuota de ingresos, con un 46,5 % en 2024, principalmente debido a las compras al por mayor realizadas por empresas farmacéuticas y biofarmacéuticas. Este enfoque garantiza un suministro constante, reduce costes gracias a las economías de escala y permite un control de calidad riguroso. Los contratos a largo plazo con fabricantes de excipientes de confianza refuerzan aún más la estabilidad de las cadenas de suministro. El aumento de la producción farmacéutica y la expansión de las empresas europeas en los mercados emergentes consolidan el predominio de este canal. Por ejemplo, en 2023, un destacado fabricante europeo de excipientes firmó varios acuerdos de suministro directo con importantes empresas farmacéuticas, reforzando así su posición en el mercado y su fiabilidad.

Se prevé que el segmento de ventas minoristas alcance la tasa de crecimiento anual compuesto (TCAC) más rápida, del 23,3 %, entre 2025 y 2032, impulsada por la creciente demanda de medicamentos de venta libre, nutracéuticos y aplicaciones de investigación. Los canales minoristas facilitan el acceso a excipientes funcionales para la producción a pequeña escala, la investigación académica y las formulaciones especializadas. El rápido crecimiento de las plataformas de comercio electrónico y los distribuidores especializados ha ampliado aún más el alcance de los canales minoristas, lo que permite que los excipientes estén más disponibles para los pequeños actores del ecosistema farmacéutico. Las aprobaciones regulatorias de excipientes para productos de consumo para el cuidado de la salud y productos de venta libre también impulsan la confianza y su adopción. A principios de 2024, un proveedor europeo lanzó una línea de excipientes orientada al mercado minorista, diseñada específicamente para laboratorios de investigación y desarrolladores de formulaciones a pequeña escala, lo que pone de manifiesto la creciente importancia de la distribución minorista en el mercado.

Análisis regional del mercado europeo de excipientes

- Se prevé que el mercado europeo de excipientes experimente un crecimiento sustancial durante el período de pronóstico, impulsado por el aumento de la actividad farmacéutica, la creciente demanda de excipientes de alta calidad en formulaciones orales, inyectables y tópicas, y la creciente adopción de tecnologías avanzadas de administración de fármacos.

- La región se beneficia de una sólida infraestructura sanitaria, marcos regulatorios bien establecidos y un fuerte enfoque en la investigación y el desarrollo, lo que apoya la innovación en aplicaciones de excipientes en diversas formas farmacéuticas.

- Los países europeos están presenciando importantes inversiones en excipientes especiales para la liberación controlada, la mejora de la solubilidad y la mejora de la estabilidad, lo que está impulsando aún más el crecimiento del mercado.

Análisis del mercado de excipientes en Alemania:

Alemania dominó el mercado de excipientes en 2024 con la mayor cuota de ingresos (41,5%), gracias a una sólida base de fabricación farmacéutica, un elevado gasto sanitario y la presencia de actores clave del sector. El país experimenta un crecimiento sustancial en las aplicaciones de excipientes en formulaciones orales, inyectables y tópicas. El énfasis de Alemania en el cumplimiento de las normas de calidad, la innovación continua en tecnologías de formulación y unas cadenas de suministro bien establecidas refuerzan aún más su posición en el mercado. La creciente demanda de excipientes especializados en terapias avanzadas, junto con las alianzas estratégicas y la colaboración entre empresas farmacéuticas, acelera la adopción de soluciones innovadoras en excipientes.

Análisis del mercado de excipientes en Francia:

Se prevé que Francia sea la región de mayor crecimiento en el mercado de excipientes durante el período de pronóstico, impulsada por el aumento de la producción farmacéutica, la creciente adopción de tecnologías avanzadas de administración de fármacos y la expansión de las inversiones en infraestructura sanitaria. El enfoque del país en la innovación y el desarrollo de nuevos excipientes para formulaciones de alto valor está impulsando la penetración en el mercado. Además, el apoyo gubernamental a la investigación biotecnológica y farmacéutica, junto con la creciente demanda de formulaciones genéricas y especializadas, impulsa el crecimiento. Francia está experimentando un rápido crecimiento en las aplicaciones de excipientes para la liberación controlada, la administración dirigida y la mejora de la biodisponibilidad, lo que la posiciona como un mercado emergente clave en Europa.

Cuota de mercado de excipientes en Europa

La industria de los excipientes está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Croda International (Reino Unido)

- Corporación ABITEC (Países Bajos)

- Roquette Frères (Francia)

- DuPont Nutrición y Biociencias (Francia)

- BASF SE (Alemania)

- Productos nutricionales DSM (Países Bajos)

- Ingredion Incorporated (Alemania)

- Corporación FMC (Alemania)

- Corporación química Signet (Reino Unido)

- JRS Pharma GmbH & Co. KG (Alemania)

- Merck KGaA (Alemania)

- Azelis (Bélgica)

- Gattefossé (Francia)

- Grupo IMCD (Países Bajos)

- Ingredion Deutschland GmbH (Alemania)

Últimos avances en el mercado europeo de excipientes

- En octubre de 2025, la Organización Central de Control de Estándares de Medicamentos de la India (CDSCO) emitió una directiva a todos los controladores estatales de medicamentos para garantizar que las materias primas utilizadas en la fabricación de medicamentos, incluidos los excipientes y los ingredientes activos, cumplan con los estándares prescritos. Esta medida se tomó tras la muerte de varios niños relacionada con jarabes para la tos tóxicos, lo que puso de relieve la importancia de realizar controles de calidad rigurosos en los excipientes.

- En octubre de 2025, Asahi Kasei anunció sus planes para suministrar excipientes farmacéuticos fabricados conforme a las Buenas Prácticas de Fabricación (BPF) para 2027. La empresa tiene como objetivo cumplir con las directrices internacionales para excipientes e impurezas farmacéuticas, lo que respalda las formulaciones de medicamentos inyectables. Ya se encuentran disponibles muestras de ambos grados con valores analíticos garantizados para el desarrollo preclínico, lo que sienta las bases para una mayor adopción en el desarrollo clínico.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.