Europe Elderly Care Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

352.83 Billion

USD

597.23 Billion

2024

2032

USD

352.83 Billion

USD

597.23 Billion

2024

2032

| 2025 –2032 | |

| USD 352.83 Billion | |

| USD 597.23 Billion | |

|

|

|

|

Segmentación del mercado europeo de atención a personas mayores por tipo de producto (vivienda, dispositivos de asistencia y productos farmacéuticos), servicio (atención domiciliaria, atención institucional y atención diurna para adultos), aplicación (enfermedades cardíacas, respiratorias, diabetes, osteoporosis, neurológicas, cáncer, enfermedades renales, artritis y otras): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado europeo de atención a personas mayores

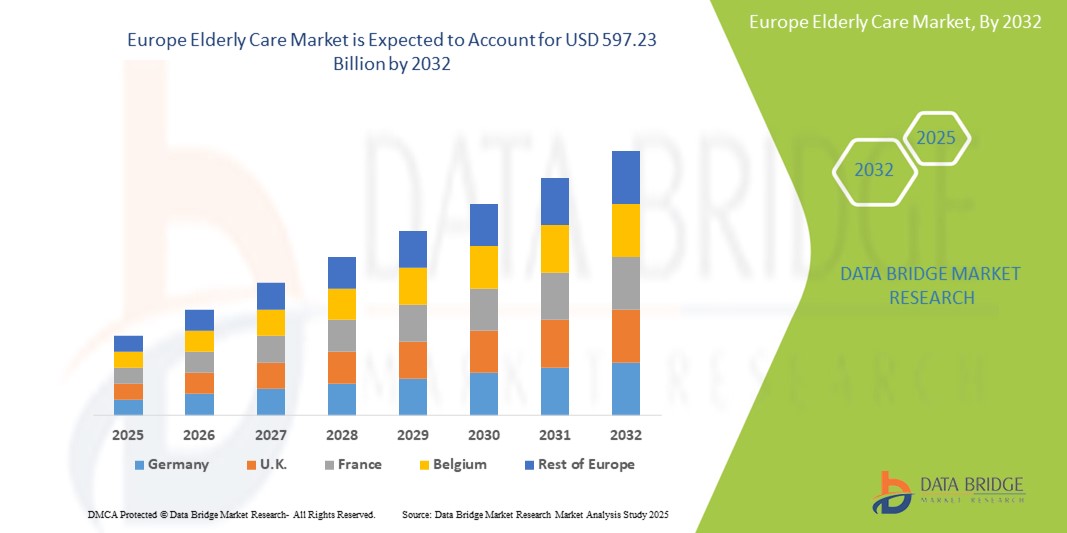

- El tamaño del mercado de atención a personas mayores en Europa se valoró en USD 352,83 mil millones en 2024 y se espera que alcance los USD 597,23 mil millones para 2032 , con una CAGR del 6,80% durante el período de pronóstico.

- La expansión del mercado en Europa se debe principalmente al rápido envejecimiento de la población del continente, lo que ha provocado un aumento significativo del número de personas mayores que requieren atención especializada y servicios de apoyo. Este cambio demográfico ha generado una demanda sustancial de diversos servicios de atención a personas mayores, que abarcan la atención domiciliaria, la atención institucional y la atención diurna para adultos.

- Además, la creciente incidencia de enfermedades crónicas entre las personas mayores, como la diabetes, las enfermedades cardiovasculares y los trastornos neurológicos, está impulsando la necesidad de servicios de atención especializada. La creciente preferencia por las soluciones de atención domiciliaria, sumada a los avances en la tecnología sanitaria, como la telesalud y la monitorización remota, y las iniciativas gubernamentales de apoyo para mejorar la calidad y la accesibilidad de la atención a las personas mayores, están impulsando aún más el crecimiento del mercado.

Análisis del mercado europeo de atención a personas mayores

- El mercado europeo de atención a personas mayores está experimentando un crecimiento significativo, impulsado por cambios demográficos y el aumento de las necesidades de atención médica, lo que lo consolida como un sector vital dentro del panorama económico europeo.

- La creciente demanda de servicios de atención a personas mayores se debe principalmente al rápido envejecimiento de la población en toda Europa, lo que provoca un aumento sustancial del número de personas que requieren atención y apoyo a largo plazo. Esta tendencia demográfica se ve agravada por el aumento de la esperanza de vida y la disminución de la natalidad, lo que ejerce una presión considerable sobre los sistemas de atención existentes y las redes de apoyo familiar.

- Alemania domina el mercado europeo de atención a personas mayores, con una cuota estimada del 28,5 % en 2025. Este predominio se atribuye a su considerable población de edad avanzada, una infraestructura sanitaria bien desarrollada y una importante inversión gubernamental en la atención a estas personas. La sólida presencia de centros de atención y la prioridad en la atención de alta calidad contribuyen a la posición de liderazgo de Alemania.

- Se espera que Alemania sea la región de más rápido crecimiento en el mercado de atención a personas mayores de Europa, con una CAGR del 10,23 %, debido a su importante población de edad avanzada, su infraestructura de atención médica bien desarrollada y su importante inversión gubernamental en la prestación de servicios de atención a personas mayores.

- La atención institucional, que abarca hogares de ancianos y centros de vida asistida, tuvo la mayor participación de mercado, estimada en un 45,8 % en 2025. Esto se debe a la naturaleza establecida de estas instalaciones en la prestación de atención integral a personas con necesidades médicas complejas y la dependencia histórica de los entornos institucionales para la atención a largo plazo.

Alcance del informe y segmentación del mercado europeo de atención a personas mayores

|

Atributos |

Perspectivas clave del mercado europeo de atención a personas mayores |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado europeo de atención a personas mayores

Mayor independencia y atención personalizada mediante la integración de la tecnología

- Una tendencia significativa y en auge en el mercado europeo de atención a personas mayores es la creciente integración de la tecnología para mejorar la independencia y ofrecer una atención más personalizada. Esta evolución se debe a la necesidad de apoyar a una creciente población de personas mayores, a la vez que se aborda la escasez de personal y el deseo de las personas mayores de envejecer en casa.

- Por ejemplo, las soluciones de telesalud son cada vez más comunes, permitiendo consultas remotas y la monitorización de constantes vitales, como se observa en proyectos como SI4CARE en Italia. Los sensores portátiles y los dispositivos inteligentes, como los utilizados en el proyecto PROCAREFUL, permiten la monitorización continua de la salud y la detección temprana de posibles problemas.

- La integración de la IA también está en auge, con plataformas que pueden analizar los datos de los pacientes para crear planes de atención personalizados y predecir posibles riesgos para la salud. Se están adoptando tecnologías de hogares inteligentes para facilitar las tareas diarias, mejorar la seguridad mediante sistemas de detección de caídas como la lámpara inteligente Nobi y mejorar el bienestar general.

- La integración fluida de estas tecnologías busca crear un ecosistema de atención conectado, que permita a los cuidadores y profesionales sanitarios supervisar y apoyar a las personas mayores de forma más eficaz. Este enfoque centralizado facilita intervenciones proactivas, una mejor comunicación y una experiencia de atención más integral y personalizada.

- Esta tendencia hacia el aprovechamiento de la tecnología para una mayor independencia y una atención personalizada está transformando radicalmente la prestación de servicios de atención a las personas mayores en Europa. En consecuencia, numerosas startups y empresas consolidadas están desarrollando soluciones innovadoras, incluyendo plataformas basadas en IA, asistentes robóticos de cuidado para la movilidad y el acompañamiento, y sistemas de hogar inteligente diseñados específicamente para las necesidades de las personas mayores, como los que destaca la Red Europea de Envejecimiento.

- Esta tendencia hacia sistemas de cierre más inteligentes, intuitivos e interconectados está transformando radicalmente las expectativas de los usuarios en cuanto a seguridad en el hogar. Por ello, empresas como WELOCK están desarrollando residencias para personas mayores en Europa con IA, con funciones como el bloqueo y desbloqueo automático según el acceso autorizado y compatibilidad con el control por voz del Asistente de Google y Amazon Alexa.

- La demanda de servicios de atención para personas mayores que ofrezcan una integración perfecta de inteligencia artificial y control por voz está creciendo rápidamente en los sectores residencial y comercial, ya que los consumidores priorizan cada vez más la comodidad y la funcionalidad integral del hogar inteligente.

Dinámica del mercado europeo de atención a personas mayores

Conductor

Necesidad creciente debido al aumento de la población de personas mayores y las demandas de cuidados complejos.

- La creciente prevalencia de una población que envejece rápidamente en toda Europa, junto con la creciente incidencia de enfermedades complejas entre las personas mayores, es un factor importante que impulsa la mayor demanda de servicios de atención a personas mayores.

- Por ejemplo, las proyecciones demográficas de Eurostat indican sistemáticamente una proporción creciente de personas mayores de 65 años, lo que genera una mayor presión sobre los sistemas de atención sanitaria y social. Esta tendencia exige soluciones innovadoras y una mayor inversión en el sector de la atención a las personas mayores.

- A medida que aumenta el número de adultos mayores, también aumenta la necesidad de atención especializada para el manejo de enfermedades crónicas, limitaciones de movilidad y deterioro cognitivo. Las tecnologías inteligentes y los modelos de atención avanzados ofrecen un mejor seguimiento, apoyo personalizado y una mejor calidad de vida para las personas mayores, lo que supone una mejora significativa respecto a los enfoques de atención tradicionales.

- Además, la creciente preferencia por la vida independiente y el deseo de permanecer en entornos domésticos familiares están haciendo que las soluciones de atención domiciliaria basadas en tecnología sean un componente integral del ecosistema de atención, ofreciendo una integración perfecta con servicios de soporte y monitoreo remoto.

- La comodidad de recibir atención en el propio domicilio, la monitorización remota de la salud para la intervención temprana y la posibilidad de gestionar la atención mediante plataformas digitales son factores clave que impulsan la adopción de tecnología y servicios innovadores en los sectores de la atención a personas mayores, tanto residenciales como institucionales. La tendencia hacia planes de atención personalizados y la creciente disponibilidad de tecnologías de asistencia fáciles de usar contribuyen aún más al crecimiento del mercado.

Restricción/Desafío

Preocupaciones sobre la ciberseguridad y los altos costos iniciales

- La preocupación por la seguridad y la privacidad de los datos sensibles de los pacientes, junto con los altos costes asociados a la prestación de una atención de calidad, plantea importantes desafíos para el desarrollo del mercado en el sector de la atención a personas mayores en Europa. A medida que aumenta la adopción de historiales clínicos digitales, sistemas de monitorización remota y plataformas de atención basadas en IA, el riesgo de filtraciones de datos y accesos no autorizados genera inquietud entre pacientes y profesionales sanitarios sobre la confidencialidad e integridad de la información sanitaria personal.

- Por ejemplo, los incidentes notificados de ciberataques a instituciones sanitarias en toda Europa han hecho que las partes interesadas duden en adoptar plenamente soluciones digitales interconectadas sin protocolos de seguridad sólidos y medidas de protección de datos.

- Abordar estas preocupaciones sobre la seguridad de los datos mediante un cifrado riguroso, protocolos de autenticación seguros que cumplan con el RGPD y auditorías periódicas de los sistemas es crucial para generar confianza y garantizar el uso ético de la tecnología en el cuidado de personas mayores. Organizaciones como la Agencia de la Unión Europea para la Ciberseguridad (ENISA) proporcionan directrices y buenas prácticas para proteger los servicios de salud digital. Además, los costos operativos relativamente altos asociados con la prestación de una atención integral y de calidad a las personas mayores, incluyendo personal, capacitación y equipos especializados, pueden ser un obstáculo para la accesibilidad y la asequibilidad, especialmente para personas con recursos económicos limitados o en regiones con infraestructura sanitaria menos desarrollada. Si bien la atención domiciliaria y los servicios comunitarios pueden ofrecer alternativas más rentables a la atención institucional, garantizar la calidad y el apoyo adecuado sigue siendo un desafío financiero.

- Si bien los avances tecnológicos y los modelos de atención innovadores apuntan a mejorar la eficiencia, el alto costo percibido de la atención especializada y las tecnologías avanzadas aún puede obstaculizar su adopción generalizada, especialmente para los sistemas de salud financiados con fondos públicos y las personas conscientes de su presupuesto.

- Superar estos desafíos mediante la implementación de marcos sólidos de seguridad de datos, la promoción de la alfabetización digital entre usuarios y proveedores, la optimización de la asignación de recursos y la exploración de modelos de financiación sostenibles será vital para el crecimiento sostenido y equitativo del mercado de atención a las personas mayores en Europa.

Alcance del mercado europeo de atención a personas mayores

El mercado está segmentado según el tipo de producto, servicios y aplicación.

- Por tipo de producto

Según el tipo de producto, el mercado europeo de atención a personas mayores se segmenta en vivienda y dispositivos de asistencia, y productos farmacéuticos. El segmento de vivienda y dispositivos de asistencia obtuvo la mayor cuota de mercado en 2025, impulsado por la creciente necesidad de viviendas especializadas y tecnologías de asistencia que fomenten la independencia y la seguridad de las personas mayores. Esto se ve reforzado por la infraestructura consolidada de centros de atención y la creciente adopción de modificaciones en el hogar y ayudas técnicas.

Se prevé que el segmento farmacéutico experimente un crecimiento significativo, impulsado por la creciente prevalencia de enfermedades crónicas en la tercera edad y la creciente demanda de medicamentos para su tratamiento. Los avances en farmacología geriátrica y el desarrollo de nuevos fármacos adaptados a la población de edad avanzada también contribuyen a este crecimiento.

- Por Servicios

En cuanto al servicio, el mercado europeo de atención a personas mayores se segmenta en atención domiciliaria, atención institucional y atención diurna para adultos. La atención institucional representó la mayor cuota de mercado en ingresos, con un 45,8 % en 2025, impulsada por la infraestructura consolidada de residencias de ancianos y centros de vida asistida que ofrecen atención integral a personas con necesidades complejas.

Se prevé que el segmento de atención domiciliaria experimente el mayor crecimiento, impulsado por la creciente preferencia de las personas mayores por envejecer en casa, los avances en la monitorización remota y las tecnologías de telesalud que permiten la atención domiciliaria, y el deseo de soluciones de atención personalizadas. También se espera que el segmento de atención diurna para adultos experimente un crecimiento sustancial, ofreciendo una opción rentable y socialmente atractiva para las personas mayores que necesitan atención y apoyo durante el día.

- Por aplicación

Según la aplicación, el mercado europeo de atención a personas mayores se segmenta en enfermedades cardíacas, respiratorias, diabetes, osteoporosis, neurológicas, cáncer, enfermedades renales y artritis, entre otras. Las enfermedades cardíacas representaron la mayor cuota de mercado en 2025, debido a la alta prevalencia de enfermedades cardiovasculares entre la población de edad avanzada.

Se prevé que las enfermedades neurológicas experimenten el mayor crecimiento, impulsado por la creciente incidencia de la demencia y otros trastornos neurodegenerativos que requieren atención especializada y a largo plazo. Otras áreas de aplicación importantes incluyen la diabetes, la artritis y el cáncer, lo que refleja los desafíos de salud comunes que enfrenta la población envejeciente en Europa.

Análisis regional del mercado europeo de atención a personas mayores

- Alemania domina el mercado europeo de atención a personas mayores con la mayor cuota de ingresos, estimada en un 28,5 % en 2025, gracias a su considerable población de personas mayores, su sofisticado sistema de salud y el sólido respaldo gubernamental a los servicios de atención a personas mayores. La dedicación del país a unos servicios de atención integrales y de alta calidad lo ha posicionado como un mercado preeminente en la región.

- La creciente demanda de opciones de atención para personas mayores diversas y de alta calidad es muy valorada por la población mayor y sus familias en toda Europa. Factores como la creciente prevalencia de enfermedades crónicas, el deseo de una atención personalizada y la necesidad de entornos de vida con apoyo impulsan el crecimiento del mercado.

- Esta demanda generalizada se ve respaldada por el aumento del gasto sanitario, la creciente concienciación sobre la importancia de la atención especializada a las personas mayores y la preferencia por entornos de atención domiciliaria e institucional que ofrecen un apoyo integral y compasivo. Esto consolida la atención a las personas mayores como un sector vital y en expansión en todos los países europeos.

Perspectivas del mercado de atención a personas mayores en el Reino Unido y Europa

Se prevé que el mercado británico de atención a personas mayores crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente tendencia a envejecer en casa y el deseo de mayor seguridad y comodidad en la atención. Además, la preocupación por el bienestar y la seguridad de las personas mayores anima tanto a las familias como al gobierno a optar por soluciones de atención integrales y supervisadas. Se espera que la adopción de la tecnología en el sector sanitario por parte del Reino Unido, junto con su sólida infraestructura sanitaria, siga impulsando el crecimiento del mercado.

Perspectiva del mercado de atención a personas mayores en Alemania y Europa

Se espera que el mercado alemán de atención a personas mayores se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por una mayor concienciación sobre las necesidades de las personas mayores y la demanda de soluciones tecnológicamente avanzadas y centradas en la persona. La sólida infraestructura de Alemania, combinada con su énfasis en la innovación y la calidad de vida de sus ciudadanos mayores, promueve la adopción de diversos servicios de atención a personas mayores, especialmente en residencias y centros de vida asistida. La integración de la tecnología con los servicios de atención a personas mayores, como la monitorización remota y la telesalud, también es cada vez más frecuente, con una fuerte preferencia por soluciones seguras y centradas en la privacidad, en línea con las expectativas de los consumidores locales.

Cuota de mercado del cuidado de personas mayores en Europa

La industria del cuidado de personas mayores en Europa está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Clariane (Francia)

- DomusVi SAS ( Francia)

- Attendo Group AB (Suecia)

- HC-One (Reino Unido)

- Victor's Group GmbH (Alemania)

- Maisons de Famille SAS (Francia)

- Bupa (Reino Unido) (opera Bupa Care Homes)

- Deutsche Wohnen SE (Alemania)

- Kursana Residenzen GmbH (Alemania)

- KOS Group SpA (Italia)

- LNA Salud (Francia)

- Care UK Limited (Reino Unido)

- Vitalia Home SLU (España)

- Azurit Hansa GmbH (Alemania)

- EMVIA Living GmbH (Alemania)

- Emera SAS (Francia)

- Ambea AB (Suecia

Últimos avances en el mercado europeo de atención a personas mayores

- En abril de 2024, el Grupo Korian (Francia) anunció una importante expansión de sus servicios de teleasistencia en toda Europa, con el objetivo de mejorar la monitorización y el apoyo remotos a las personas mayores que viven en sus hogares. Esta iniciativa aprovecha las tecnologías digitales para ofrecer atención personalizada e intervenciones oportunas, respondiendo a la creciente demanda de soluciones de atención domiciliaria y mejorando la seguridad y el bienestar de las personas mayores. Esta estrategia subraya el compromiso de Korian con la innovación y su posición en el cambiante panorama europeo de la atención a las personas mayores.

- En marzo de 2024, Lottie (Reino Unido), una plataforma de residencias de ancianos, obtuvo una financiación sustancial para seguir desarrollando su plataforma y expandir su alcance en el Reino Unido y otros mercados europeos. La financiación se utilizará para mejorar la experiencia de usuario de las familias que buscan residencias y para brindar un mejor apoyo a los cuidadores a la hora de cubrir vacantes. Esta inversión pone de relieve el creciente interés en las soluciones digitales para mejorar el acceso y la eficiencia en el sector de la atención a personas mayores.

- En marzo de 2024, la Comisión Europea lanzó una nueva iniciativa centrada en promover la alfabetización y las habilidades digitales entre las personas mayores para mejorar su acceso a los servicios de salud en línea y sus conexiones sociales. Este programa busca reducir la exclusión digital y empoderar a las personas mayores para que utilicen la tecnología para gestionar su salud y bienestar, reconociendo el papel cada vez más importante de las herramientas digitales en la atención moderna a las personas mayores.

- En febrero de 2024, una colaboración entre varias instituciones de investigación alemanas y proveedores de atención anunció el éxito de la prueba piloto de sistemas de detección de caídas basados en IA en centros de atención residencial. Esta tecnología utiliza sensores e inteligencia artificial para detectar automáticamente las caídas y alertar a los cuidadores, lo que se traduce en tiempos de respuesta más rápidos y una mayor seguridad para los residentes. Este desarrollo demuestra la creciente integración de la IA para mejorar la seguridad y la monitorización en entornos de atención institucional.

- En enero de 2024, el gobierno sueco anunció un aumento de la financiación para los servicios de atención domiciliaria, con el objetivo de apoyar a un mayor número de personas mayores que prefieren envejecer en casa. Este cambio de política refleja una tendencia creciente en Europa a priorizar la atención comunitaria y a proporcionar los recursos necesarios para que las personas mayores puedan vivir de forma independiente durante más tiempo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.