Mercado europeo de visión artificial, por componente (hardware, software), aplicación (mantenimiento predictivo, identificación, posicionamiento y guía, garantía de calidad e inspección), vertical (vertical industrial, vertical no industrial), producto (sistemas de visión artificial basados en cámaras inteligentes, sistemas de visión artificial basados en PC), país ( Alemania , Reino Unido, Francia, Suiza, Italia, España, Países Bajos, Rusia, Bélgica, Turquía, resto de Europa), tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado europeo de visión artificial

Análisis y perspectivas del mercado: mercado europeo de visión artificial

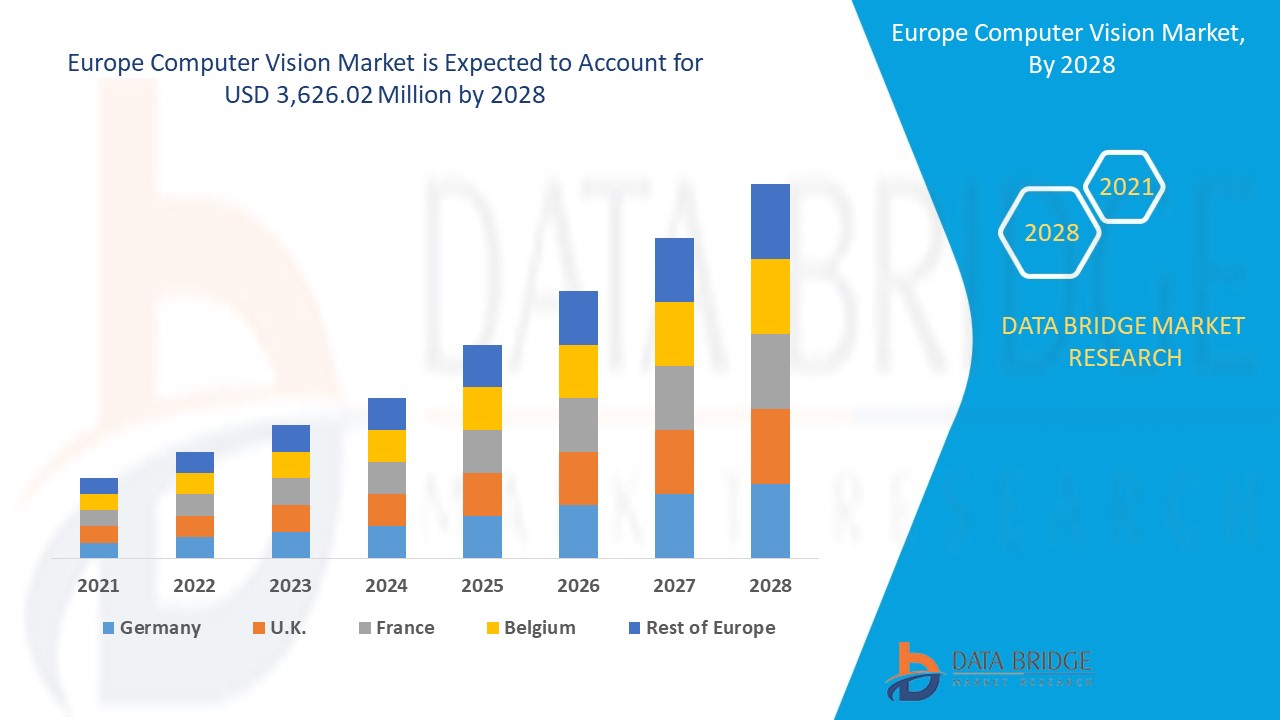

Se espera que el mercado europeo de visión artificial crezca en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,4% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 3626,02 millones para 2028. La creciente demanda de realidad aumentada e integración de aprendizaje profundo con sistemas de visión artificial puede actuar como un factor importante para el crecimiento del mercado.

Los sistemas de visión artificial son aquellos sistemas que pueden ver y comprender el mundo que los rodea al igual que los humanos, es decir, las computadoras capaces de comprender imágenes y videos digitales. Esto es posible gracias al avance en la tecnología de los sistemas de visión, la inteligencia artificial y el poder computacional. Los principios fundamentales utilizados en los sistemas son la adquisición de datos o imágenes, el procesamiento de datos o imágenes y la clasificación de datos o imágenes. Los datos adquiridos pueden estar en forma de imágenes o videos que se capturan utilizando cámaras de alta definición, cámaras inteligentes, sensores, entre otros. El procesamiento de datos se realiza a través de varios modelos entrenados de algoritmos de aprendizaje automático, algoritmos de aprendizaje profundo y algoritmos de IA. Se puede utilizar para abundantes aplicaciones como detección de objetos, reconocimiento facial, detección de patrones, entre otros, en varias verticales como la automotriz, la fabricación, la atención médica, los servicios financieros, la agricultura, entre otros.

Algunos de los factores que impulsan el mercado son la precisión y la fiabilidad que ofrecen los sistemas de visión artificial. Sin embargo, las amenazas de virus y malware en los sistemas de visión artificial pueden ser un factor limitante para el crecimiento del mercado europeo de la visión artificial. El creciente interés por los servicios financieros y el sector agrícola se encuentran entre algunos de los factores que pueden representar una oportunidad para la penetración en el mercado. La falta de trabajadores cualificados potenciales para operar y mantener el sistema puede ser un gran desafío para el crecimiento del mercado.

Este informe sobre el mercado de la visión artificial proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevos segmentos de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de visión artificial en Europa

Alcance y tamaño del mercado de visión artificial en Europa

El mercado europeo de visión artificial está segmentado en función de los componentes, las aplicaciones, los sectores verticales y los productos. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

- En función de los componentes, el mercado europeo de visión artificial se segmenta en hardware y software. El segmento de hardware se subdivide a su vez en cámaras, capturadores de fotogramas, óptica, iluminación LED y procesadores. El segmento de cámaras se divide a su vez por estándares de interfaz en USB 2.0, USB 3.0, enlace de cámara, enlace de cámara HS, GIGE y otros, por velocidad de fotogramas en menos de 25 FPS, 25-125 FPS y más de 125 FPS, por formato en escaneo de línea y escaneo de área, por tipo de sensor en CMOS y CCD. El segmento de procesadores se subdivide a su vez en FPGAS, DSPS, microcontroladores y microprocesadores y VPUS. El segmento de software se subdivide a su vez en visión artificial tradicional y aprendizaje profundo. En 2021, el hardware tuvo una participación importante en el mercado, debido a factores como la creciente adaptación para la IA mediante el uso de sistemas de visión artificial y la creciente demanda de realidad aumentada en varias industrias en Europa.

- En función de la aplicación, el mercado europeo de visión artificial se ha segmentado en mantenimiento predictivo, identificación, posicionamiento y guía, control de calidad e inspección. En 2021, el control de calidad y la inspección tuvieron la máxima participación en el mercado debido a factores como la creciente demanda de verificación de identidad, detección de objetos, clasificación, detección de errores, detección de defectos, entre otros en diversas industrias como la automotriz, la fabricación, la atención médica, entre otras en países como Reino Unido, Francia, Suiza, etc.

- Sobre la base de la vertical, el mercado europeo de visión artificial se ha segmentado en vertical industrial y vertical no industrial. El segmento vertical industrial se subsegmenta a su vez en automoción, fabricación de paneles solares, textiles, alimentos y envases, caucho y plásticos, impresión, maquinaria, madera y papel, productos farmacéuticos, metales, vidrio, electrónica y semiconductores, electrónica de consumo. El segmento vertical no industrial se subsegmenta a su vez en atención sanitaria, deportes y entretenimiento, comercio minorista, sistemas de transporte inteligentes, agricultura, vehículos autónomos y semiautónomos, electrónica de consumo, seguridad y vigilancia, correos y logística. En 2021, la vertical industrial tuvo una participación importante en el mercado. Esto se debe principalmente a la creciente demanda de integración del aprendizaje profundo con la visión artificial que se puede utilizar para la detección de objetos, clasificación, detección de errores, detección de defectos, entre otros, en varias industrias como la automotriz, la fabricación, la electrónica de consumo, entre otras en toda Europa.

- En función del producto, el mercado europeo de visión artificial se ha segmentado en sistemas de visión artificial basados en cámaras inteligentes y sistemas de visión artificial basados en PC. En 2021, los sistemas de visión artificial basados en cámaras inteligentes tuvieron la mayor participación en el mercado, debido a factores como la creciente demanda de sistemas inteligentes que cuentan con la ayuda de IA y aprendizaje profundo, que demuestran ser altamente precisos y exactos en la toma de decisiones. Debido a estas características, los sistemas de visión artificial basados en cámaras inteligentes están ganando mucha popularidad en toda Europa.

Análisis a nivel de país del mercado de visión artificial en Europa

Se analiza el mercado europeo de visión artificial y se proporciona información sobre el tamaño del mercado por componente, aplicación, vertical y producto.

Los países cubiertos en el informe del mercado de visión artificial en Europa son: Reino Unido, Alemania, Francia, Suiza, Italia, España, Países Bajos, Rusia, Bélgica, Turquía y el resto de Europa.

El Reino Unido domina el mercado europeo de visión artificial debido a diversos factores, como la creciente adopción de IA mediante visión artificial y la creciente demanda de realidad aumentada.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Demanda creciente de sistemas de visión artificial

El mercado europeo de visión artificial también le ofrece un análisis detallado del mercado para cada país, el crecimiento de la industria con ventas, ventas de componentes, impacto del desarrollo tecnológico en visión artificial y cambios en los escenarios regulatorios con su apoyo al mercado de visión artificial. Los datos están disponibles para el período histórico de 2019.

Análisis del panorama competitivo y de la cuota de mercado de la visión artificial en Europa

El panorama competitivo del mercado de visión artificial en Europa ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de visión artificial en Europa.

Los principales actores cubiertos en el informe son Texas Instruments Incorporated, Cognex Corporation, KEYENCE CORPORATION, AMETEK, Inc OMRON Corporation, Teledyne Technologies Incorporated, Intel Corporation, ISRA VISION AG, Baumer, MVTEC SOFTWARE GMBH, Clarifai Inc., Tordivel AS, SICK AG, JAI A/S, SONY CORPORATION, CEVA, Inc., Synopsys, Inc., Cadence Design Systems, Inc., NATIONAL INSTRUMENTS CORP., Basler AG, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado. Las empresas de todo el mundo también inician muchos desarrollos de productos, lo que también está acelerando el crecimiento del mercado de visión artificial en Europa.

Por ejemplo,

- En mayo de 2021, Teledyne Technologies Incorporated lanzó una nueva cámara de escaneo lineal de 2k y 4k, que fue diseñada teniendo en cuenta la compacidad y el tamaño. Era un 45 % más pequeña que la cámara de línea original. Las cámaras están disponibles en resoluciones de 2k y 4k en monocromo y color bilineal; este producto era único y confiable.

- En agosto de 2020, Cognex Corporation lanzó 3D-A1000, un sistema de detección capaz de identificar objetos en un paquete con una precisión inigualable. Las características clave de este producto eran una cámara inteligente con capacidad de detección de movimiento que ayuda a detectar objetos en los que se enfoca de manera confiable y con una entrega rápida. Los minoristas pueden usarlo para una entrega mejor y más precisa de los productos. La precisión incomparable que ofrece este producto lo hace único.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la cuota de mercado de la empresa con una mayor cobertura y presencia. También ofrecen a las organizaciones la ventaja de mejorar su oferta para el mercado europeo de visión artificial a través de una gama más amplia de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE COMPUTER VISION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENTS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT OF COVID-19 ON THE EUROPE COMPUTER VISION MARKET

5.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

5.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.3 IMPACT ON PRICE

5.4 IMPACT ON DEMAND AND SUPPLY CHAIN

5.5 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ACCURACY AND RELIABILITY OFFERED BY COMPUTER VISION SYSTEM

6.1.2 INTEGRATION OF DEEP LEARNING WITH COMPUTER VISION

6.1.3 RISE IN ADOPTION OF AI USING COMPUTER VISION

6.1.4 RISE IN DEMAND FOR AUGMENTED REALITY

6.1.5 INCREASE IN DEMAND FOR IDENTITY VERIFICATION

6.2 RESTRAINTS

6.2.1 THREATS OF CYBER-ATTACKS IN AI-BASED COMPUTER VISION

6.2.2 THREATS FROM VIRUS AND MALWARE IN COMPUTER VISION SYSTEM

6.2.3 DIFFICULTY IN OBJECT LOCALIZATION AND DETECTION

6.3 OPPORTUNITIES

6.3.1 RISE IN NEED FOR COMPUTER VISION IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

6.3.2 RISE IN ADOPTION OF COMPUTER VISION ACROSS RETAILS AND HEALTHCARE SECTOR

6.3.3 INCREASE INTEREST TOWARDS FINANCIAL SERVICES AND AGRICULTURE SECTOR

6.4 CHALLENGES

6.4.1 COMPLEXITIES INVOLVED IN DESIGNING OF COMPUTER VISION SYSTEM

6.4.2 MALFUNCTIONING IN EQUIPMENT OF COMPUTER VISION SYSTEMS DUE TO HARSH IN ENVIRONMENT

6.4.3 LACK OF POTENTIAL SKILLED WORKERS TO OPERATE AND MAINTAIN THE SYSTEM

7 EUROPE COMPUTER VISION MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 CAMERAS

7.2.1.1 BY INTERFACE STANDARDS

7.2.1.1.1 USB 3.0

7.2.1.1.2 GIGE

7.2.1.1.3 CAMERA LINK HS

7.2.1.1.4 CAMERA LINK

7.2.1.1.5 USB 2.0

7.2.1.1.6 OTHERS

7.2.1.2 BY FRAME RATE

7.2.1.2.1-125 FPS

7.2.1.2.2 LESS THAN 25 FPS

7.2.1.2.3 MORE THAN 125 FPS

7.2.1.3 BY FORMAT

7.2.1.3.1 AREA SCAN

7.2.1.3.2 LINE SCAN

7.2.1.4 BY SENSOR TYPE

7.2.1.4.1 CCD

7.2.1.4.2 CMOS

7.2.2 PROCESSORS

7.2.2.1 MICROCONTROLLER AND MICROPROCESSORS

7.2.2.2 VPUS

7.2.2.3 FPGAS

7.2.2.4 DSPS

7.2.3 FRAME GRABBERS

7.2.4 OPTICS

7.2.5 LED LIGHTING

7.3 SOFTWARE

7.3.1 DEEP LEARNING

7.3.2 TRADITIONAL COMPUTER VISION

8 EUROPE COMPUTER VISION MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 QUALITY ASSURANCE & INSPECTION

8.3 POSITIONING & GUIDANCE

8.4 PREDICTIVE MAINTENANCE

8.5 IDENTIFICATION

9 EUROPE COMPUTER VISION MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 INDUSTRIAL

9.2.1 ELECTRONIC AND SEMICONDUCTOR

9.2.2 CONSUMER ELECTRONICS

9.2.3 PHARMACEUTICALS

9.2.4 FOOD AND PACKAGING

9.2.5 AUTOMOTIVE

9.2.6 MACHINERY

9.2.7 TEXTILES

9.2.8 METALS

9.2.9 SOLAR PANEL MANUFACTURING

9.2.10 PRINTING

9.2.11 GLASS

9.2.12 RUBBER AND PLASTICS

9.2.13 WOOD AND PAPER

9.3 NON INDUSTRIAL

9.3.1 HEALTHCARE

9.3.2 RETAIL

9.3.3 CONSUMER ELECTRONICS

9.3.4 AUTONOMOUS AND SEMI AUTONOMOUS VEHICLES

9.3.5 INTELLIGENT TRANSPORTATION SYSTEMS

9.3.6 SECURITY AND SURVEILLANCE

9.3.7 SPORTS & ENTERTAINMENT

9.3.8 POSTAL AND LOGISTICS

9.3.9 AGRICULTURE

10 EUROPE COMPUTER VISION MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 SMART CAMERAS-BASED COMPUTER VISION SYSTEMS

10.3 PC-BASED COMPUTER VISION SYSTEMS

11 EUROPE COMPUTER VISION MARKET, BY REGION

11.1 EUROPE

11.1.1 U.K.

11.1.2 GERMANY

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 NETHERLANDS

11.1.7 SWITZERLAND

11.1.8 BELGIUM

11.1.9 RUSSIA

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE COMPUTER VISION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 TEXAS INSTRUMENTS INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 APPLICATION PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 COGNEX CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 TELEDYNE TECHNOLOGIES INCORPORATED

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 KEYENCE CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 AMETEK, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BASLER AG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 BAUMER

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CADENCE DESIGN SYSTEMS

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 CEVA, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 APPLICATION & PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 CLARIFAI, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT & SOLUTION PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INTEL CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 ISRA VISION AG

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 JAI A/S

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MVTEC SOFTWARE GMBH

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NATIONAL INSTRUMENTS CORP.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 OMRON CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 SICK AG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SONY GROUP CORPORATION

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SYNOPSYS, INC

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TORDIVEL AS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT & SOLUTION PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 2 EUROPE HARDWARE IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 EUROPE HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 4 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 5 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 6 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 7 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 8 EUROPE PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 9 EUROPE SOFTWARE IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 EUROPE SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 11 EUROPE COMPUTER VISION MARKET, BY APPLICATION,2019-2028 (USD MILLION)

TABLE 12 EUROPE QUALITY ASSURANCE & INSPECTION IN COMPUTER VISION MARKET, BY REGION,2019-2028 (USD MILLION)

TABLE 13 EUROPE POSITIONING & GUIDANCE IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 EUROPE PREDICTIVE MAINTENANCE IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 EUROPE IDENTIFICATION IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 EUROPE COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 17 EUROPE INDUSTRIAL IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 EUROPE INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 19 EUROPE NON INDUSTRIAL IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 EUROPE NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 21 EUROPE COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 22 EUROPE SMART CAMERAS-BASED COMPUTER VISION SYSTEMS IN COMPUTER VISION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 EUROPE PC-BASED COMPUTER VISION SYSTEMS IN COMPUTER VISION MARKET, BY REGION,2019-2028 (USD MILLION)

TABLE 24 EUROPE COMPUTER VISION MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 25 EUROPE COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 26 EUROPE SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 27 EUROPE HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 28 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 29 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 30 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 31 EUROPE CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 32 EUROPE PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 33 EUROPE COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 34 EUROPE COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 35 EUROPE INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 36 EUROPE NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 37 EUROPE COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 38 U.K. COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 39 U.K. SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 40 U.K. HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 41 U.K. CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 42 U.K. CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 43 U.K. CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 44 U.K. CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 45 U.K. PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 46 U.K. COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 47 U.K. COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 48 U.K. INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 49 U.K. NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 50 U.K. COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 51 GERMANY COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 52 GERMANY SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 53 GERMANY HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 54 GERMANY CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 55 GERMANY CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 56 GERMANY CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 57 GERMANY CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 58 GERMANY PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 59 GERMANY COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 60 GERMANY COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 61 GERMANY INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 62 GERMANY NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 63 GERMANY COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 64 FRANCE COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 65 FRANCE SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 66 FRANCE HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 67 FRANCE CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 68 FRANCE CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 69 FRANCE CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 70 FRANCE CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 71 FRANCE PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 72 FRANCE COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 73 FRANCE COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 74 FRANCE INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 75 FRANCE NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 76 FRANCE COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 77 ITALY COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 78 ITALY SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 79 ITALY HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 80 ITALY CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 81 ITALY CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 82 ITALY CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 83 ITALY CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 84 ITALY PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 85 ITALY COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 ITALY COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 87 ITALY INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 88 ITALY NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 89 ITALY COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 90 SPAIN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 91 SPAIN SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 92 SPAIN HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 93 SPAIN CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 94 SPAIN CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 95 SPAIN CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 96 SPAIN CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 97 SPAIN PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 98 SPAIN COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 SPAIN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 100 SPAIN INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 101 SPAIN NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 102 SPAIN COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 103 NETHERLANDS COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 104 NETHERLANDS SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 105 NETHERLANDS HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 106 NETHERLANDS CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 107 NETHERLANDS CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 108 NETHERLANDS CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 109 NETHERLANDS CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 110 NETHERLANDS PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 111 NETHERLANDS COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 112 NETHERLANDS COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 113 NETHERLANDS INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 114 NETHERLANDS NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 115 NETHERLANDS COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 116 SWITZERLAND COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 117 SWITZERLAND SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 118 SWITZERLAND HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 119 SWITZERLAND CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 120 SWITZERLAND CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 121 SWITZERLAND CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 122 SWITZERLAND CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 123 SWITZERLAND PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 124 SWITZERLAND COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 SWITZERLAND COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 126 SWITZERLAND INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 127 SWITZERLAND NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 128 SWITZERLAND COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 129 BELGIUM COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 130 BELGIUM SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 131 BELGIUM HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 132 BELGIUM CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 133 BELGIUM CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 134 BELGIUM CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 135 BELGIUM CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 136 BELGIUM PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 137 BELGIUM COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 138 BELGIUM COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 139 BELGIUM INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 140 BELGIUM NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 141 BELGIUM COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 142 RUSSIA COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 143 RUSSIA SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 144 RUSSIA HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 145 RUSSIA CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 146 RUSSIA CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 147 RUSSIA CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 148 RUSSIA CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 149 RUSSIA PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 150 RUSSIA COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 151 RUSSIA COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 152 RUSSIA INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 153 RUSSIA NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 154 RUSSIA COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 155 TURKEY COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 156 TURKEY SOFTWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 157 TURKEY HARDWARE IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 158 TURKEY CAMERAS IN COMPUTER VISION MARKET, BY INTERFACE STANDARDS, 2019-2028 (USD MILLION)

TABLE 159 TURKEY CAMERAS IN COMPUTER VISION MARKET, BY FRAME RATE, 2019-2028 (USD MILLION)

TABLE 160 TURKEY CAMERAS IN COMPUTER VISION MARKET, BY FORMAT, 2019-2028 (USD MILLION)

TABLE 161 TURKEY CAMERAS IN COMPUTER VISION MARKET, BY SENSOR TYPE, 2019-2028 (USD MILLION)

TABLE 162 TURKEY PROCESSORS IN COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 163 TURKEY COMPUTER VISION MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 164 TURKEY COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 165 TURKEY INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 166 TURKEY NON INDUSTRIAL IN COMPUTER VISION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 167 TURKEY COMPUTER VISION MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 168 REST OF EUROPE COMPUTER VISION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE COMPUTER VISION MARKET: SEGMENTATION

FIGURE 2 EUROPE COMPUTER VISION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE COMPUTER VISION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE COMPUTER VISION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE COMPUTER VISION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE COMPUTER VISION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE COMPUTER VISION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE COMPUTER VISION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE COMPUTER VISION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE COMPUTER VISION MARKET: SEGMENTATION

FIGURE 11 RISING ADOPTION OF AI USING COMPUTER VISION IS EXPECTED TO DRIVE EUROPE COMPUTER VISION MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE COMPUTER VISION MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE COMPUTER VISION MARKET

FIGURE 14 EUROPE COMPUTER VISION MARKET, BY COMPONENT, 2020

FIGURE 15 EUROPE COMPUTER VISION MARKET, BY APPLICATION, 2020

FIGURE 16 EUROPE COMPUTER VISION MARKET, BY VERTICAL, 2020

FIGURE 17 EUROPE COMPUTER VISION MARKET: BY PRODUCT, 2020

FIGURE 18 EUROPE COMPUTER VISION MARKET: SNAPSHOT (2020)

FIGURE 19 EUROPE COMPUTER VISION MARKET: BY COUNTRY (2020)

FIGURE 20 EUROPE COMPUTER VISION MARKET: BY COUNTRY (2021 & 2028)

FIGURE 21 EUROPE COMPUTER VISION MARKET: BY COUNTRY (2020 & 2028)

FIGURE 22 EUROPE COMPUTER VISION MARKET: BY COMPONENT (2021-2028)

FIGURE 23 EUROPE COMPUTER VISION MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.