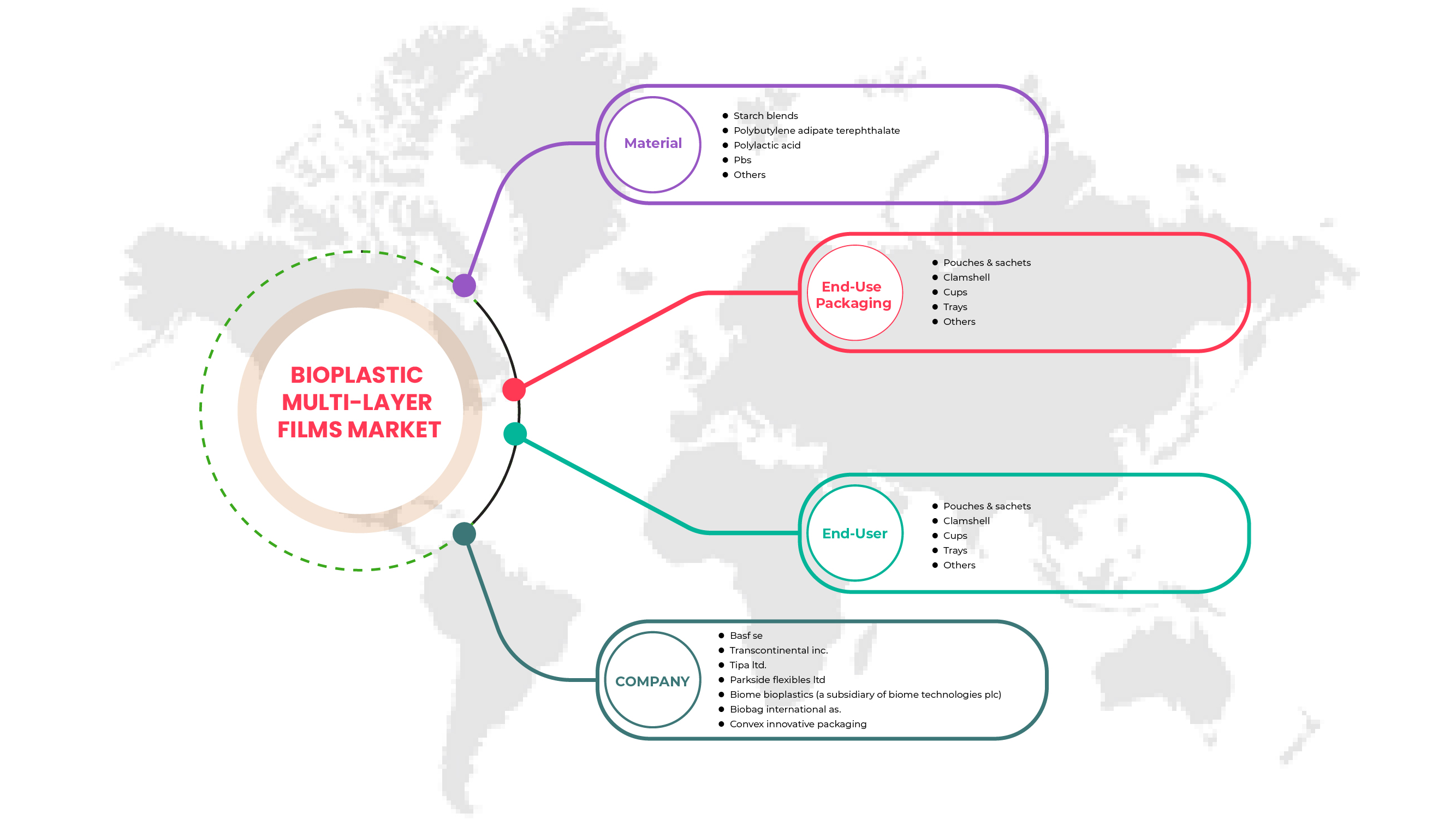

Mercado europeo de películas multicapa bioplásticas para envases de servicios alimentarios compostables, por material (mezclas de almidón, tereftalato de adipato de polibutileno, ácido poliláctico , PBS y otros), envases de uso final (bolsas y sobres, conchas, vasos, bandejas y otros), usuario final (restaurantes de cadena, restaurantes que no son de cadena, cafeterías de cadena, cafeterías que no son de cadena, catering a domicilio, vendedores independientes y quioscos, y otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado europeo de películas multicapa bioplásticas para envases compostables para servicios alimentarios

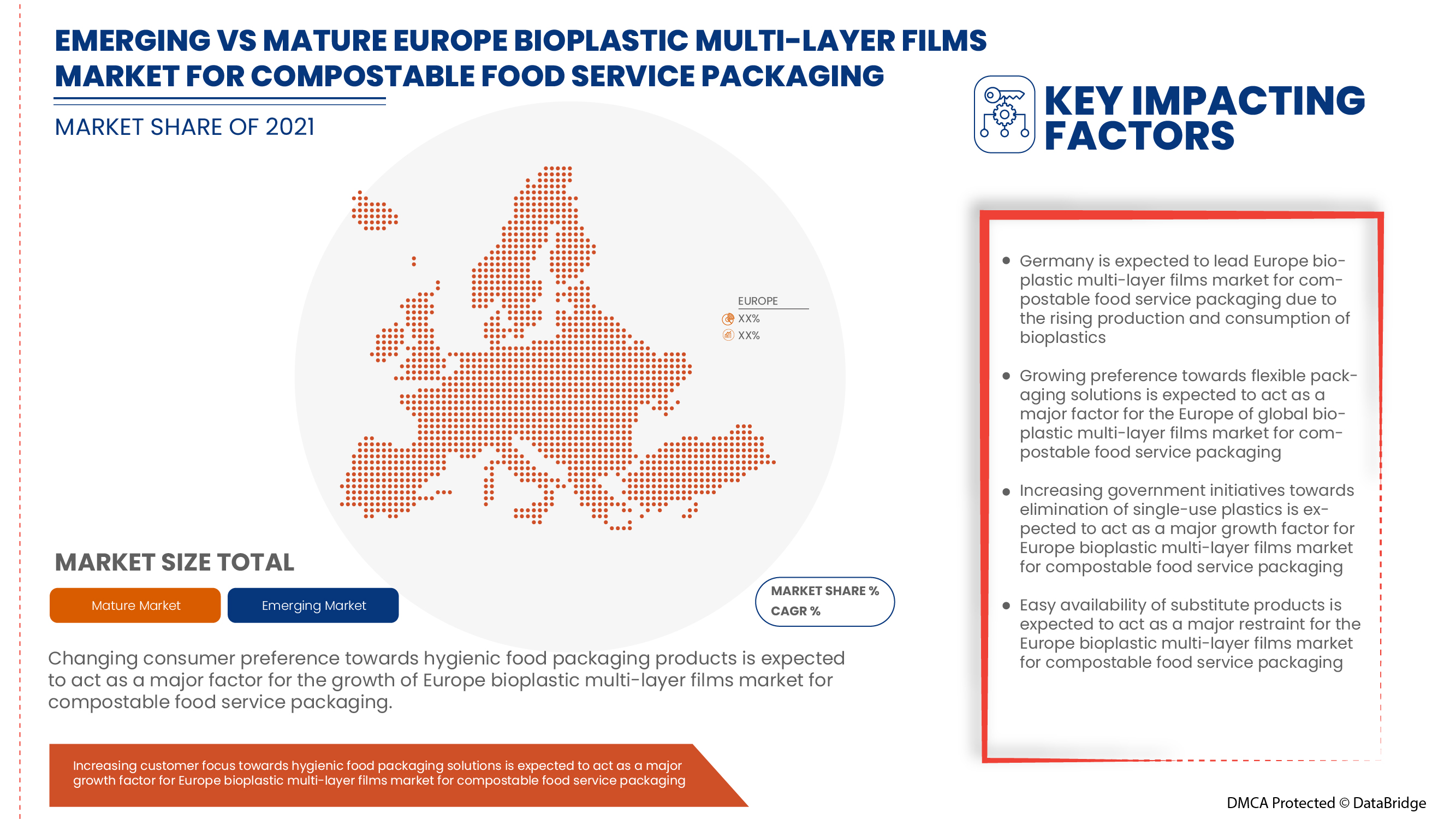

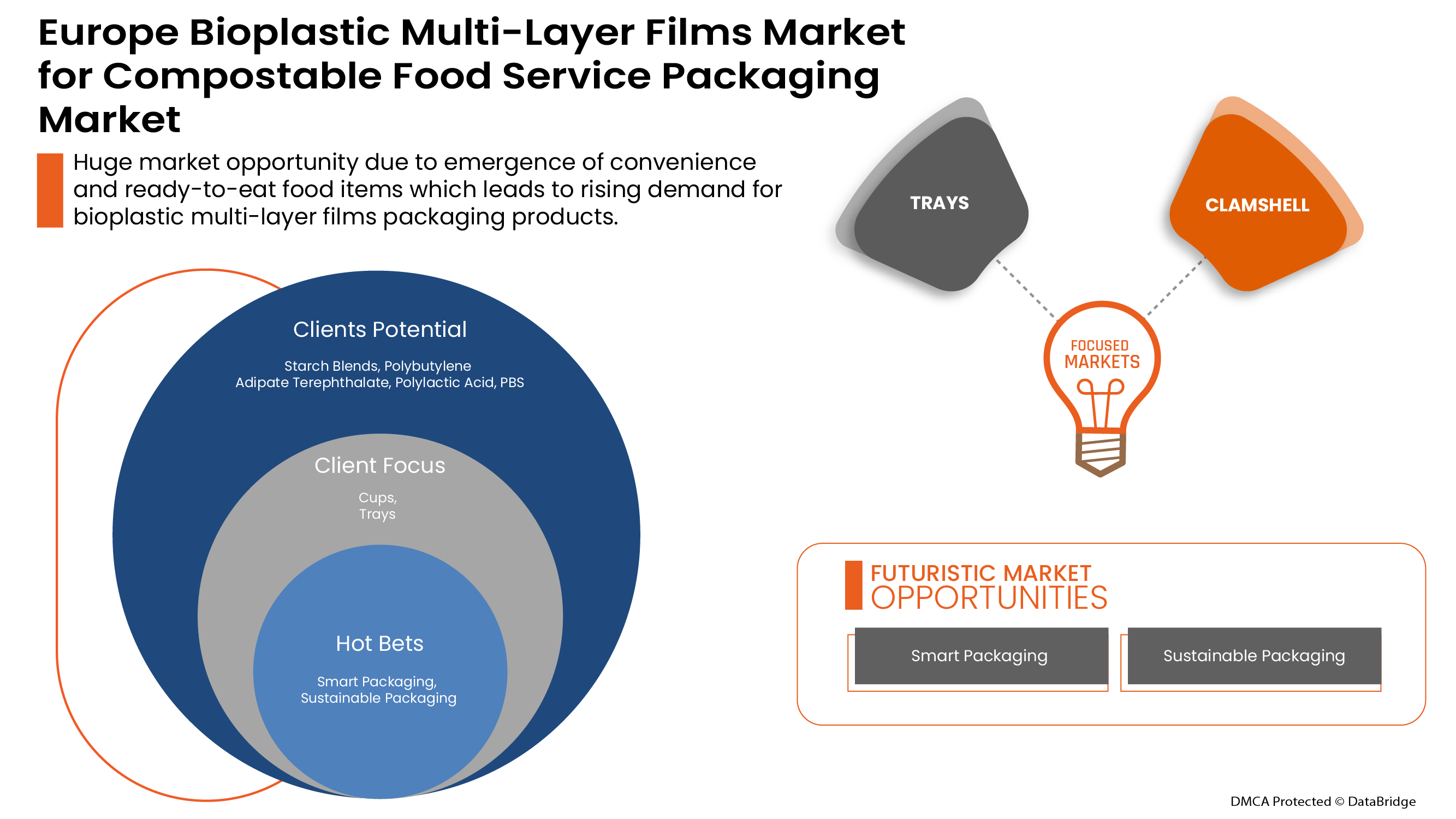

Se espera que la tendencia hacia el consumo de alimentos preparados y la creciente popularidad de las soluciones de envasado flexible impulsen la demanda de películas multicapa de bioplástico para envases compostables para servicios alimentarios en el mercado europeo. Sin embargo, los altos costos asociados con las películas biodegradables y la disponibilidad de productos sustitutos pueden restringir aún más el crecimiento del mercado.

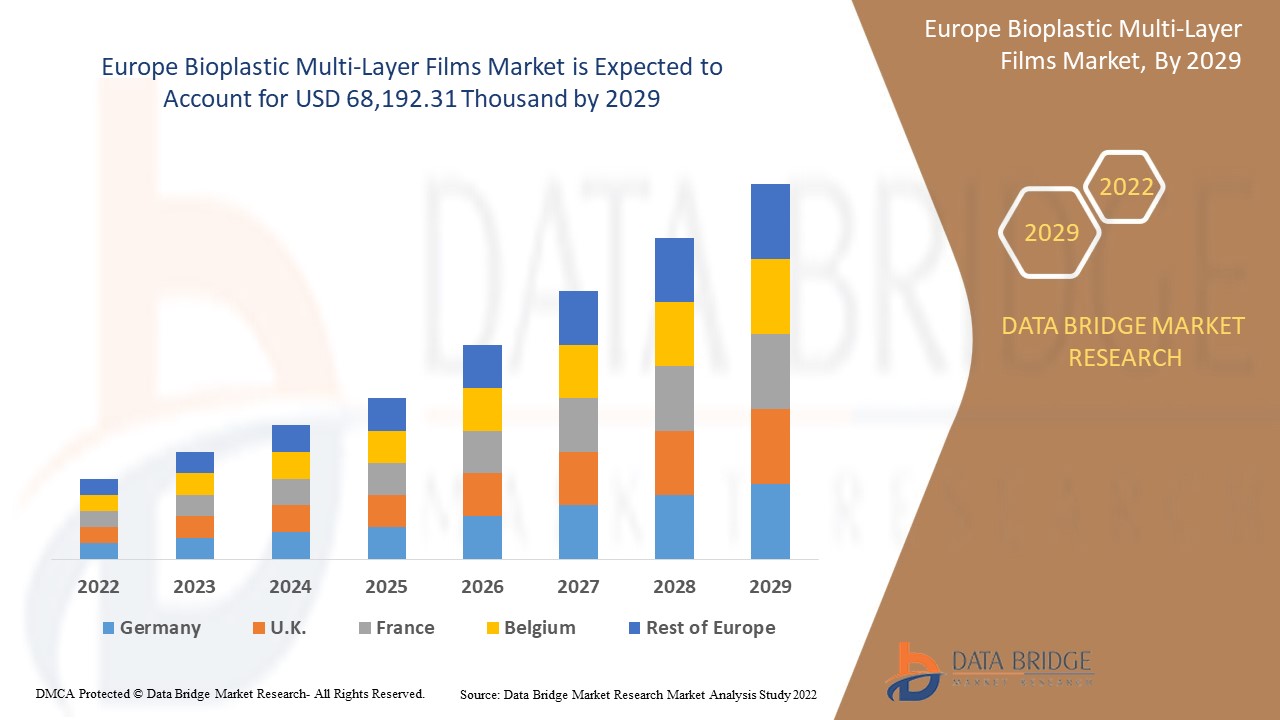

Data Bridge Market Research analiza que se espera que el mercado europeo de películas multicapa bioplásticas para envases compostables para servicios de alimentos alcance un valor de USD 68.192,31 mil para 2029, con una CAGR del 7,6% durante el período de pronóstico. "Las mezclas de almidón representan el segmento de material más grande en el mercado europeo de películas multicapa bioplásticas para envases compostables para servicios de alimentos. El informe del mercado europeo de películas multicapa bioplásticas para envases compostables para servicios de alimentos también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD, volúmenes en toneladas, precios en USD |

|

Segmentos cubiertos |

Por material (mezclas de almidón, tereftalato de adipato de polibutileno, ácido poliláctico, PBS y otros), envases para uso final (bolsas y sobres, envases tipo concha, vasos, bandejas y otros), usuario final (restaurantes de cadena, restaurantes que no son de cadena, cafeterías de cadena, cafeterías que no son de cadena, servicios de catering a domicilio, vendedores independientes y quioscos, y otros) |

|

Países cubiertos |

Alemania, Reino Unido, Italia, Francia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Resto de Europa |

|

Actores del mercado cubiertos |

BASF SE, TIPA LTD, Biome Bioplastics (una subsidiaria de Biome Technologies plc), BioBag International AS., Transcontinental Inc. y Parkside Flexibles Ltd, entre otros. |

Definición de mercado

Los bioplásticos se originan a partir de un recurso renovable, son biodegradables o ambas cosas. Los materiales derivados de recursos renovables y polímeros biodegradables son bioplásticos, como mezclas de almidón, tereftalato de adipato de polibutileno , ácido poliláctico y PBS, entre otros. En la tecnología de película multicapa, se combinan dos o más materiales con propiedades específicas y complementarias, mejorando así el rendimiento general del bioplástico. Los materiales ofrecen un rendimiento competitivo en términos de embalajes flexibles y rígidos, al tiempo que minimizan el impacto negativo de los plásticos convencionales derivados del petróleo.

En el sector de los envases para servicios alimentarios, las películas multicapa compostables ofrecen una excelente protección tanto para los productos frescos como para los alimentos secos. Los productos de envasado para uso final fabricados con este material se pueden imprimir fácilmente mediante tecnologías de impresión tradicionales y digitales. Las películas multicapa compostables permiten a los proveedores de servicios alimentarios alejarse de los envases convencionales y estar a la vanguardia de la iniciativa para crear una economía circular.

Dinámica del mercado europeo de películas multicapa bioplásticas para envases compostables para servicios alimentarios

Conductores

- Inclinación hacia el consumo de alimentos preparados

Los alimentos precocinados incluyen alimentos prelavados, cocinados, en su mayoría envasados y listos para comer. La cultura occidental influye fuertemente en los consumidores debido a los horarios ajustados. Además, los cambios rápidos en el estilo de vida han aumentado el interés por la salud y el bienestar, y las necesidades cambiantes de los consumidores han aumentado la demanda de comidas cocinadas. Las personas quieren reducir la cantidad de veces que visitan las tiendas de comestibles, lo que las lleva a comprar productos alimenticios congelados y diferentes bebidas a granel y almacenarlos en envases flexibles para mantener la vida útil de los alimentos y bebidas. Además, los alimentos precocinados requieren la temperatura perfecta para protegerlos de la contaminación biológica y el daño físico. Como resultado, esto aumenta la demanda de productos de envasado de película multicapa de bioplástico.

- Creciente popularidad de las soluciones de embalaje flexible

La industria del embalaje está adoptando soluciones inteligentes y sostenibles para que los envases de los productos sean más respetuosos con el consumidor, la marca y el medio ambiente, lo que permite a la industria del embalaje desarrollar envases inteligentes que involucren la Internet del embalaje, el embalaje activo y la nanotecnología. Los productos de embalaje flexible hechos de películas de bioplástico son livianos y convenientes, lo que permite un movimiento sin complicaciones y son rentables. Los materiales utilizados para fabricar envases flexibles permiten envasar productos de cualquier forma, diseño y combinación de colores, tamaño y volumen. Los envases flexibles compostables están compuestos de celulosa u otros materiales derivados de plantas. Estos plásticos de origen biológico, o bioplásticos, son materiales de origen vegetal que reemplazan a los plásticos tradicionales derivados del petróleo.

- Cambio de preferencia del consumidor hacia productos de envasado de alimentos higiénicos

El embalaje de alimentos cumple múltiples propósitos, ya que protege los alimentos de la contaminación o el deterioro, hace que el paquete tenga un aspecto atractivo y permite el transporte de mercancías. El embalaje conserva la frescura del producto y evita que se exponga a la contaminación química o biológica. El embalaje de alimentos utiliza diversos materiales, como bioplásticos, películas y aluminio, que protegen los alimentos de diferentes tipos de exposición, incluida la luz solar, los gases y la humedad. Un material de embalaje hecho de películas de bioplástico protege los alimentos de los patógenos y los productos químicos. Los materiales de embalaje biológicos incluyen plástico y materiales de amortiguación, que evitan que los alimentos se desprendan y se aplasten durante el embalaje, el transporte y el almacenamiento en estanterías.

- Tendencia creciente hacia la eliminación del plástico de un solo uso

La creciente cantidad de plásticos no reciclables ha creado una enorme cantidad de vertederos en todo el mundo. Este tipo de desechos ha estado contaminando los recursos naturales de la Tierra hasta el punto de que los ecosistemas acuáticos se enfrentan a su impacto adverso, además de los otros efectos nocivos palpables de los productos químicos que contienen. Los materiales bioplásticos multicapa se utilizan ampliamente en el envasado de productos alimenticios para que los productos puedan llevarse de un lugar a otro. Los materiales bioplásticos multicapa se utilizan para envases flexibles, incluidos plásticos y polímeros a partir de los cuales se fabrican diferentes tipos de envases flexibles, como bolsas, sobres, bolsas, celulosa y láminas de aluminio. El aumento de la población en las regiones y la prohibición de los productos plásticos de un solo uso dan como resultado una creciente demanda de envases de materiales bioplásticos.

Oportunidades

- Creciente demanda del sector del comercio electrónico

Diversos factores, como la penetración de Internet, el aumento de usuarios de teléfonos inteligentes, la influencia de las redes sociales y las iniciativas gubernamentales han impulsado el sector del comercio electrónico. La creciente adopción de plataformas de comercio electrónico resalta la importancia de las ventas minoristas en línea para la economía moderna. Las cajas de envío de los principales minoristas en línea y otros minoristas simbolizan el comercio electrónico. También representan una de las fuentes más importantes de crecimiento de la demanda de envases de película multicapa de bioplástico. También existe una tendencia creciente a hacer que los envases de película multicapa de bioplástico sean atractivos y agradables para mejorar la experiencia del consumidor en las plataformas de comercio electrónico.

- Aumento de soluciones de embalaje innovadoras con nuevo diseño

Las nuevas e innovadoras soluciones de embalaje, como los embalajes impresos digitalmente, ofrecen un considerable ahorro potencial en comparación con otros procesos de impresión y unos costes de instalación reducidos. Los fabricantes pueden prescindir de los pedidos en grandes cantidades con grandes tiradas de impresión y existencias. La solución de embalaje avanzada permite a los envasadores una mayor libertad en cuanto a opciones de personalización que los procesos mecánicos como la composición tipográfica. Muchas de las principales marcas de productos han explorado el embalaje personalizado y han obtenido un importante rendimiento de esta innovadora inversión en marketing. Por tanto, la adopción de nuevas y avanzadas tecnologías de impresión está en auge para ofrecer a los consumidores soluciones de embalaje personalizadas. Esto ha ayudado a las empresas a aumentar el valor de su marca en el mercado y a mejorar la relación del cliente con el embalaje del producto.

Restricciones/Desafíos

- Altos costos asociados con películas biodegradables

El coste de fabricación de productos a base de películas de bioplástico depende de la cantidad de materias primas utilizadas para la producción, ya que las materias primas respetuosas con el medio ambiente son más caras que los materiales convencionales. Además, factores como el tamaño y las características del producto de los productos de envasado influyen en el precio de los productos utilizados en el sector del envasado de alimentos. Debido a la cantidad limitada de buenos envases biodegradables en el mundo, cualquier producto de envasado biodegradable será un poco más caro que los productos de envasado estándar. Las bolsas de bioplástico son más caras que las de plástico tradicional porque las materias primas son más caras, están menos disponibles y los procesos de fabricación cuestan más con lotes más pequeños.

- Disponibilidad de productos sustitutos

Los plásticos convencionales son el tercer derivado del petróleo más utilizado que puede utilizarse en lugar de los materiales bioplásticos y se conocen como plásticos de combustibles fósiles. Debido a su coste relativamente bajo, facilidad de fabricación, versatilidad e impermeabilidad al agua, se utilizan en muchos productos. Han sido un buen sustituto de la madera, el cuero y el papel, entre otros. Por otro lado, los productos bioplásticos son materiales producidos a partir de fuentes de biomasa renovables, como grasas y aceites vegetales, almidón de maíz, paja, virutas de madera y residuos alimentarios reciclados, que son más caros que los productos convencionales. Además, a bajas temperaturas, la producción de bioplásticos puede verse afectada por el uso de diferentes productos químicos duros, lo que altera la flexibilidad de los productos.

- Cuestiones relacionadas con las películas biodegradables

Los bioplásticos se han utilizado cada vez más para crear productos de embalaje que funcionan mejor que los plásticos tradicionales en muchas aplicaciones. Los bioplásticos suelen acabar en vertederos y, debido a la ausencia de oxígeno, liberan metano, un gas de efecto invernadero. Cuando los bioplásticos no se desechan correctamente, contaminan los lotes de plástico reciclado y dañan el marco de reciclaje. Los diferentes biopolímeros utilizados para productos de embalaje tienen desventajas como alta permeabilidad al vapor de agua, permeabilidad al oxígeno, fragilidad, baja resistencia térmica, bajas propiedades mecánicas, vulnerabilidad a la degradación y baja procesabilidad. Estas, a su vez, reducen la demanda de productos de embalaje basados en películas de bioplástico. Además, las películas de bioplástico tienen bajas propiedades de barrera al aire, al agua y al oxígeno y baja resistencia al calor en comparación con las películas de plástico convencionales.

- Incertidumbres en los procesos de producción y opciones de fin de vida útil de los bioplásticos

Las unidades de fabricación de productos de envasado en película de bioplástico se caracterizan por ciclos de vida cortos, con mayores variaciones de producto y tiempos de respuesta rápidos a las demandas de los clientes. Para satisfacer los requisitos de los clientes, los fabricantes necesitan una mayor flexibilidad en sus procesos de producción, lo que genera mayores niveles de complejidad e incertidumbre. Esto requiere una planificación y programación efectivas de las diversas actividades de producción, por lo que un plan rígido ya no es válido para satisfacer todas las limitaciones y cambios en el proceso de fabricación. Además, la falta de desarrollo tecnológico y la menor inversión de capital para la fabricación de productos de envasado en película de bioplástico están reduciendo aún más la demanda de estos productos en los países en desarrollo.

Impacto de la COVID-19 en el mercado europeo de películas multicapa bioplásticas para envases compostables para servicios alimentarios

La COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y restricciones en el transporte. Debido al confinamiento, el mercado de películas multicapa bioplásticas para envases compostables para servicios alimentarios ha experimentado un impacto significativo en la importación y exportación de productos de películas multicapa bioplásticas en los últimos años.

Sin embargo, el crecimiento del mercado de películas multicapa de bioplástico para envases de alimentos compostables durante el período posterior a la pandemia se atribuye a la apertura de establecimientos de comida y al aumento del gasto de los consumidores. Los proveedores de servicios de comida están tomando varias decisiones estratégicas para recuperarse después de la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar sus servicios a través de productos de envasado de alimentos higiénicos.

Acontecimientos recientes

- En junio de 2022, BASF SE y Confoil (un fabricante australiano de envases para alimentos) colaboraron para desarrollar una bandeja de papel compostable certificada y apta para horno dual para preparar comidas listas para comer. Las bandejas amplían las opciones de fin de vida útil de los envases de papel al ser reciclables orgánicamente. Se pueden convertir en abono comercial con los desechos orgánicos recolectados en contenedores de desechos orgánicos. Esto ayudará a la empresa a obtener reconocimiento en el mercado australiano.

- En noviembre de 2021, Transcontinental Inc. adquirió HS Crocker Co., Inc., un fabricante líder de tapas troqueladas para la industria alimentaria y etiquetas para la industria farmacéutica en América del Norte. Esta adquisición fortalecerá la cartera de soluciones de envasado, especialmente en los mercados de productos lácteos, tapas para café, postres refrigerados y productos no perecederos, y brindará importantes oportunidades de venta cruzada.

Alcance del mercado europeo de películas multicapa bioplásticas para envases de servicios alimentarios compostables

El mercado europeo de películas multicapa de bioplástico para envases compostables para servicios alimentarios está segmentado en función del material, el envase de uso final y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Material

- Mezclas de almidones

- Tereftalato de adipato de polibutileno

- Ácido poliláctico

- PBS

- Otros

Sobre la base del material, el mercado europeo de películas multicapa bioplásticas para envases de servicios alimentarios compostables está segmentado en mezclas de almidón, tereftalato de adipato de polibutileno, ácido poliláctico, PBS y otros.

Embalaje de uso final

- Bolsas y sobres

- Casa de molusco

- tazas

- Bandejas

- Otros

Sobre la base del embalaje de uso final, el mercado europeo de películas multicapa bioplásticas para embalajes de servicios de alimentos compostables se segmenta en bolsas y sobres, almejas, vasos, bandejas y otros.

Usuario final

- Cadenas de restaurantes

- Restaurantes que no son de cadena

- Cafetería de cadena

- Cafetería que no pertenece a una cadena

- Servicio de catering a domicilio

- Vendedores independientes y quioscos

- Otros

Sobre la base del usuario final, el mercado europeo de películas multicapa bioplásticas para envases de servicios de alimentos compostables se segmenta en cadenas de restaurantes, restaurantes que no son de cadena, cafeterías de cadena, cafeterías que no son de cadena, catering a domicilio, vendedores independientes y quioscos, y otros.

Mercado europeo de películas multicapa bioplásticas para envases compostables para servicios alimentarios

Se analiza el mercado europeo de películas multicapa bioplásticas para envases de servicios de alimentos compostables y se proporcionan información y tendencias sobre el tamaño del mercado por país, material, envase de uso final y usuario final, como se mencionó anteriormente.

El mercado europeo de películas multicapa bioplásticas para envases de servicios de alimentos compostables cubre países como Alemania, Reino Unido, Italia, Francia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos y el resto de Europa.

Se espera que Alemania domine el mercado europeo de películas multicapa de bioplástico para envases compostables para servicios alimentarios debido al creciente interés de los consumidores por los productos de envasado higiénicos para alimentos. Muchas empresas europeas han cambiado su enfoque hacia nichos de mercado con productos de alta calidad y valor añadido.

La sección de países del informe sobre el mercado europeo de películas multicapa bioplásticas para envases compostables para servicios alimentarios también proporciona factores de impacto individuales en el mercado y cambios en la normativa nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación son algunos de los indicadores importantes que se utilizan para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de las marcas europeas y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y análisis de la cuota de mercado de películas multicapa bioplásticas para envases compostables para servicios alimentarios en Europa

El panorama competitivo del mercado europeo de películas multicapa bioplásticas para envases compostables para servicios de alimentos proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de soluciones, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado europeo de películas multicapa bioplásticas para envases compostables para servicios de alimentos.

Algunos de los principales actores que operan en el mercado europeo de películas multicapa bioplásticas para envases compostables para servicios de alimentos son BASF SE, TIPA LTD, Biome Bioplastics (una subsidiaria de Biome Technologies plc), BioBag International AS., Transcontinental Inc. y Parkside Flexibles Ltd, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 WESTERN FOOD MARKET

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 PORTER'S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 CLIMATE CHANGE SCENARIO

4.4.1 CLIMATE CHANGE SCENARIO

4.5 BUYER'S LIST

4.6 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

4.6.1 REGULATION COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 MANUFACTURING AND PACKING

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 END USERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 PRODUCTION AND CONSUMPTION ANALYSIS

4.9.1 OVERVIEW

4.1 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 EUROPE

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCLINATION TOWARDS THE CONSUMPTION OF CONVENIENCE FOOD

6.1.2 RISING POPULARITY OF FLEXIBLE PACKAGING SOLUTIONS

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE HYGIENIC FOOD PACKAGING PRODUCTS

6.1.4 GROWING TREND TOWARD THE ELIMINATION OF THE SINGLE-USE PLASTIC

6.2 RESTRAINTS

6.2.1 HIGH COSTS ASSOCIATED WITH BIODEGRADABLE FILMS

6.2.2 AVAILABILITY OF SUBSTITUTE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FROM THE E-COMMERCE SECTOR

6.3.2 SURGE IN INNOVATIVE PACKAGING SOLUTIONS WITH NEW DESIGN

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO BIODEGRADABLE FILMS

6.4.2 UNCERTAINTIES IN PRODUCTION PROCESSES AND END-OF-LIFE OPTIONS FOR BIOPLASTICS

7 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL

7.1 OVERVIEW

7.2 STARCH BLENDS

7.3 POLYBUTYLENE ADIPATE TEREPHTHALATE

7.4 POLYLACTIC ACID

7.5 PBS

7.6 OTHERS

8 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING

8.1 OVERVIEW

8.2 POUCHES & SACHETS

8.3 CLAMSHELL

8.4 CUPS

8.5 TRAYS

8.6 OTHERS

9 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER

9.1 OVERVIEW

9.2 DELIVERY CATERING

9.2.1 DELIVERY CATERING, BY END-USE PACKAGING

9.2.1.1 POUCHES & SACHETS

9.2.1.2 CLAMSHELL

9.2.1.3 CUPS

9.2.1.4 TRAYS

9.2.1.5 OTHERS

9.3 CHAIN RESTAURANTS

9.3.1 CHAIN RESTAURANTS, BY END-USE PACKAGING

9.3.1.1 POUCHES & SACHETS

9.3.1.2 CLAMSHELL

9.3.1.3 CUPS

9.3.1.4 TRAYS

9.3.1.5 OTHERS

9.4 CHAIN CAFÉ

9.4.1 CHAIN CAFÉ, BY END-USE PACKAGING

9.4.1.1 POUCHES & SACHETS

9.4.1.2 CLAMSHELL

9.4.1.3 CUPS

9.4.1.4 TRAYS

9.4.1.5 OTHERS

9.5 NON-CHAIN RESTAURANTS

9.5.1 NON-CHAIN RESTAURANTS, BY END-USE PACKAGING

9.5.1.1 POUCHES & SACHETS

9.5.1.2 CLAMSHELL

9.5.1.3 CUPS

9.5.1.4 TRAYS

9.5.1.5 OTHERS

9.6 NON-CHAIN CAFÉ

9.6.1 NON-CHAIN CAFÉ, BY END-USE PACKAGING

9.6.1.1 POUCHES & SACHETS

9.6.1.2 CLAMSHELL

9.6.1.3 CUPS

9.6.1.4 TRAYS

9.6.1.5 OTHERS

9.7 INDEPENDENT SELLERS & KIOSKS

9.7.1 INDEPENDENT SELLERS & KIOSKS, BY END-USE PACKAGING

9.7.1.1 POUCHES & SACHETS

9.7.1.2 CLAMSHELL

9.7.1.3 CUPS

9.7.1.4 TRAYS

9.7.1.5 OTHERS

9.8 OTHERS

9.8.1 OTHERS, BY END-USE PACKAGING

9.8.1.1 POUCHES & SACHETS

9.8.1.2 CLAMSHELL

9.8.1.3 CUPS

9.8.1.4 TRAYS

9.8.1.5 OTHERS

10 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K.

10.1.3 ITALY

10.1.4 FRANCE

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 SWITZERLAND

10.1.8 TURKEY

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 REST OF EUROPE

11 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.1.1 COLLABORATION

11.1.2 ACQUISITIONS

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 BASF SE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 TRANSCONTINENTAL INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 TIPA LTD

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATE

13.4 PARKSIDE FLEXIBLES LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 BIOME BIOPLASTICS (A SUBSIDIARY OF BIOME TECHNOLOGIES PLC)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 BIOBAG INTERNATIONAL AS.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 CONVEX INNOVATIVE PACKAGING

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF POLY LACTIC ACID, IN PRIMARY FORMS; HS CODE – 39077000 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLY LACTIC ACID, IN PRIMARY FORMS; HS CODE – 39077000 (USD THOUSAND)

TABLE 3 BUYER’S LIST EUROPELY (POTENTIAL BUYERS/CURRENT BUYERS)

TABLE 4 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 6 EUROPE STARCH BLENDS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE STARCH BLENDS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 8 EUROPE POLYBUTYLENE ADIPATE TEREPHTHALATE IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE POLYBUTYLENE ADIPATE TEREPHTHALATE IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 10 EUROPE POLYLACTIC ACID IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE POLYLACTIC ACID IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 12 EUROPE PBS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE PBS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 14 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 16 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 18 EUROPE POUCHES & SACHETS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE POUCHES & SACHETS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 20 EUROPE CLAMSHELL IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE CLAMSHELL IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 22 EUROPE CUPS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE CUPS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 24 EUROPE TRAYS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE TRAYS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 26 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 28 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 30 EUROPE DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 32 EUROPE DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 35 EUROPE CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 38 EUROPE CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 41 EUROPE NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 44 EUROPE NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE INDEPENDENT SELLERS & KIOSKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE INDEPENDENT SELLERS & KIOSKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 47 EUROPE INDEPENDENT SELLERS & KIOSKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 50 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY COUNTRY, 2020-2029 (TONS)

TABLE 53 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 54 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 55 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 56 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 57 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 58 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 59 EUROPE DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 60 EUROPE CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 61 EUROPE CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 62 EUROPE NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 63 EUROPE NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 64 EUROPE INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 65 EUROPE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 66 GERMANY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 67 GERMANY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 68 GERMANY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 69 GERMANY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 70 GERMANY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 71 GERMANY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 72 GERMANY DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 73 GERMANY CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 74 GERMANY CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 75 GERMANY NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 76 GERMANY NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 77 GERMANY INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 78 GERMANY OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 81 U.K. BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 82 U.K. BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 83 U.K. BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 84 U.K. BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 85 U.K. DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 86 U.K. CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 87 U.K. CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 88 U.K. NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 89 U.K. NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 90 U.K. INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 91 U.K. OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 94 ITALY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 96 ITALY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 98 ITALY DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 104 ITALY OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 105 FRANCE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 106 FRANCE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 107 FRANCE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 108 FRANCE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 109 FRANCE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 110 FRANCE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 111 FRANCE DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 112 FRANCE CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 113 FRANCE CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 114 FRANCE NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 115 FRANCE NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 116 FRANCE INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 117 FRANCE OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 118 SPAIN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 119 SPAIN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 120 SPAIN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 121 SPAIN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 122 SPAIN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 123 SPAIN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 124 SPAIN DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 125 SPAIN CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 126 SPAIN CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 127 SPAIN NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 128 SPAIN NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 129 SPAIN INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 130 SPAIN OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 131 RUSSIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 132 RUSSIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 133 RUSSIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 134 RUSSIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 135 RUSSIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 137 RUSSIA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 138 RUSSIA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 144 SWITZERLAND BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 145 SWITZERLAND BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 146 SWITZERLAND BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 147 SWITZERLAND BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 148 SWITZERLAND BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 149 SWITZERLAND BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 150 SWITZERLAND DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 151 SWITZERLAND CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 152 SWITZERLAND CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 153 SWITZERLAND NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 154 SWITZERLAND NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 155 SWITZERLAND INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 156 SWITZERLAND OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 157 TURKEY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 158 TURKEY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 159 TURKEY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 160 TURKEY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 161 TURKEY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 162 TURKEY BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 163 TURKEY DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 164 TURKEY CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 165 TURKEY CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 166 TURKEY NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 167 TURKEY NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 168 TURKEY INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 169 TURKEY OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 170 BELGIUM BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 172 BELGIUM BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 174 BELGIUM BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 175 BELGIUM BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 176 BELGIUM DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 177 BELGIUM CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 178 BELGIUM CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 179 BELGIUM NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 180 BELGIUM NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 181 BELGIUM INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 182 BELGIUM OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 183 NETHERLANDS BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 184 NETHERLANDS BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 185 NETHERLANDS BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 186 NETHERLANDS BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 187 NETHERLANDS BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 188 NETHERLANDS BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 189 NETHERLANDS DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 190 NETHERLANDS CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 191 NETHERLANDS CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 192 NETHERLANDS NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 193 NETHERLANDS NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 194 NETHERLANDS INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 195 NETHERLANDS OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 196 REST OF EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 197 REST OF EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

Lista de figuras

FIGURE 1 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: SEGMENTATION

FIGURE 2 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: DATA TRIANGULATION

FIGURE 3 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: DROC ANALYSIS

FIGURE 4 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: THE MATERIAL LIFE LINE CURVE

FIGURE 7 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING AND EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 INCREASING FOCUS OF THE CONSUMERS ON HYGIENIC FOOD PACKAGING PRODUCTS IS EXPECTED TO DRIVE THE EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING IN THE FORECAST PERIOD

FIGURE 15 STARCH BLENDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS – EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

FIGURE 17 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: PRODUCTION AND CONSUMPTION ANALYSIS, 2020-2022 (TONS)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

FIGURE 19 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY MATERIAL, 2021

FIGURE 20 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY END-USE PACKAGING, 2021

FIGURE 21 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY END-USER, 2021

FIGURE 22 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING: SNAPSHOT (2021)

FIGURE 23 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY COUNTRY (2021)

FIGURE 24 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE BIOPLASTIC MULTI-LAYER FILMS FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY MATERIAL (2022 - 2029)

FIGURE 27 EUROPE BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.