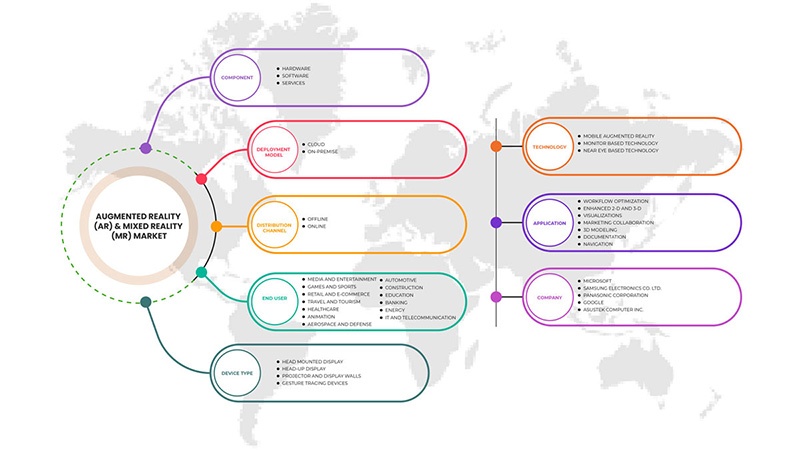

Mercado europeo de realidad aumentada (RA) y realidad mixta (MR), por componente (hardware, software, servicios), modelo de implementación (nube, local), canal de distribución (fuera de línea, en línea), tipo de dispositivo (pantalla frontal, pantalla montada en la cabeza , proyector y pared de pantalla, dispositivos de seguimiento de gestos), tecnología (realidad aumentada móvil, tecnología basada en monitor, tecnología basada en ojos cercanos), aplicación (optimización del flujo de trabajo, colaboración de marketing, 2D y 3D mejorados, visualizaciones, modelado 3D, documentación, navegación), usuario final (venta minorista y comercio electrónico, TI y telecomunicaciones, automoción, aeroespacial y defensa, atención médica, animación, viajes y turismo, energía, medios y entretenimiento, educación, construcción, juegos y deportes, banca): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de realidad aumentada (RA) y realidad mixta (MR) en Europa

La realidad aumentada y la realidad mixta han traído un nuevo cambio a la digitalización. Ahora es más fácil experimentar el mundo real estableciendo diferentes condiciones ambientales. La realidad aumentada y la realidad mixta tienen una amplia gama de aplicaciones, el crecimiento del mercado aumentó enormemente a medida que el uso de la realidad aumentada y la realidad mixta se hizo popular en los simuladores de conducción. La realidad aumentada y la realidad mixta proporcionan al conductor una sensación real de la carretera, las condiciones de conducción, los manuales del automóvil y el tráfico vial que ayuda a evitar accidentes en una etapa inicial de aprendizaje y prepara a los conductores para diversas situaciones. Estos atributos han llevado a un mayor uso de la realidad aumentada y la realidad mixta también en defensa y aeroespacial. El personal del ejército lo utilizó para entrenar en diversas condiciones, como salto en paracaídas, submarinos, situaciones de combate y conducción en diversas condiciones ambientales.

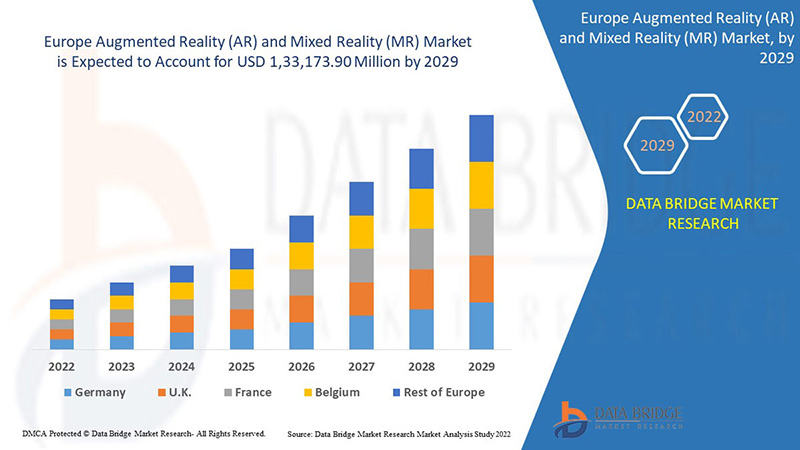

Data Bridge Market Research analiza que se espera que el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) alcance un valor de USD 133 173,90 millones para 2029, con una CAGR del 49,2 % durante el período de pronóstico. El segmento de soluciones representa el segmento de oferta más grande en el mercado europeo de realidad aumentada (RA) y realidad mixta (MR). El mercado europeo de realidad aumentada (RA) y realidad mixta (MR) también cubre análisis de precios, análisis de patentes y avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por componente (hardware, software, servicios), modelo de implementación (nube, local), canal de distribución (fuera de línea, en línea), tipo de dispositivo (pantalla frontal, pantalla montada en la cabeza , proyector y pared de pantalla, dispositivos de seguimiento de gestos), tecnología (realidad aumentada móvil, tecnología basada en monitor, tecnología basada en ojos cercanos), aplicación (optimización del flujo de trabajo, colaboración de marketing, 2D y 3D mejorados, visualizaciones, modelado 3D, documentación, navegación), usuario final (venta minorista y comercio electrónico, TI y telecomunicaciones, automotriz, aeroespacial y defensa, atención médica, animación, viajes y turismo, energía, medios y entretenimiento, educación, construcción, juegos y deportes, banca): tendencias de la industria y pronóstico hasta 2029. |

|

Países cubiertos |

Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Suiza, Rusia, Suecia, Polonia, Bélgica, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

HP Development Company, LP, HTC Corporation, Autodesk Inc., Barco, Intel Corporation, PTC, Seiko Epson Corporation, Ultraleap Limited, ASUSTek Computer Inc., Dell, Google (una subsidiaria de Alphabet Inc.), Sony Corporation, Lenovo, Microsoft, SAMSUNG ELECTRONICS CO., LTD., Panasonic Corporation, RealWear, Inc., Magic Leap, Inc., EON Reality y TeamViewer, entre otros. |

Definición de mercado

La realidad aumentada es una tecnología que utiliza el entorno existente del usuario y superpone el contenido o la información digital o virtual sobre él para ofrecer una experiencia digital inmersiva en un entorno en tiempo real. Las aplicaciones de realidad aumentada se desarrollan en programas especiales en 3D, que permiten a los desarrolladores integrar contenido contextual o digital con el mundo real en tiempo real. La realidad aumentada ofrece experiencias interactivas a través de múltiples modalidades sensoriales, incluidas la háptica, auditiva, visual, somatosensorial y más. La tecnología tiene una amplia gama de aplicaciones en las áreas de entretenimiento, capacitación y educación. Industrias como la manufactura, la atención médica y la logística, entre otras, se están enfocando más en adoptar esta tecnología para aplicaciones de capacitación, mantenimiento, asistencia y monitoreo.

La realidad mixta simboliza la colisión controlada de las tendencias AR/VR e IoT. La realidad mixta (MR), también conocida como realidad híbrida, es la tecnología que se utiliza para fusionar mundos reales y virtuales y producir nuevos entornos y visualizaciones donde los objetos físicos y digitales coexisten e interactúan en tiempo real. La realidad mixta es un campo interdisciplinario que involucra gráficos de computadora, procesamiento de señales, apariencia de computadora, interfaces de usuario, computación móvil, computación ponible, visualización de información y el diseño de pantallas y sensores. Los conceptos de realidad mixta están siendo adoptados cada vez más por varias industrias, incluidas la automotriz, la atención médica y los entornos de oficina, entre otros.

Dinámica del mercado de realidad aumentada (RA) y realidad mixta (MR) en Europa

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente penetración de dispositivos inteligentes y servicios de Internet

Con la introducción de dispositivos inteligentes, la RA ha proporcionado valiosas oportunidades para que los minoristas interactúen con los consumidores, muestren sus productos y creen una ventaja competitiva, lo que se espera que impulse significativamente el mercado europeo de realidad aumentada (RA) y realidad mixta (MR).

- Aumento de la adopción de la realidad aumentada por parte de los institutos educativos

La RA en la educación permite a los estudiantes adquirir conocimientos a través de imágenes enriquecidas y una inmersión total en el tema. Además, la tecnología de voz también involucra a los estudiantes al brindarles detalles completos sobre el tema en formato de voz. Por lo tanto, el concepto de aprendizaje electrónico con RA se ha convertido en una estrategia esencial para recopilar información, lo que se espera que impulse significativamente el mercado europeo de realidad aumentada (RA) y realidad mixta (MR).

- Mayor atención a los sistemas ciberfísicos

La realidad aumentada (RA) permite interacciones hombre-máquina intuitivas y eficientes entre humanos y CPMT (máquina herramienta ciberfísica). A medida que los sistemas de seguridad ciberfísica se basan en modelos y aprovechan la realidad aumentada, virtual o mixta, desaparecen las brechas entre la capacitación, la planificación/análisis y las simulaciones de conocimiento de la situación. A través de una interfaz contextual basada en modelos, los usuarios pueden experimentar una representación virtual de una instalación del mundo real.

- Más avances tecnológicos y digitalización

La continua convergencia de la digitalización en los mundos real y virtual se ha convertido en el principal factor de innovación y cambio en todos los sectores de nuestra economía. La tecnología de realidad aumentada (RA) se ha convertido en una de las tecnologías de transformación digital críticas en áreas industriales y no industriales. El auge de la realidad aumentada ha transformado las vidas y las operaciones diarias en la tecnología, la hospitalidad, la atención médica y otros sectores. El uso de la realidad aumentada ayuda a los clientes a comprender el producto o el servicio con mayor facilidad y les ayuda a tomar decisiones más fácilmente. Además, la realidad aumentada también puede ayudar a construir y mejorar la imagen de marca de la organización al brindarles a los clientes una experiencia de compra perfecta.

Oportunidades

-

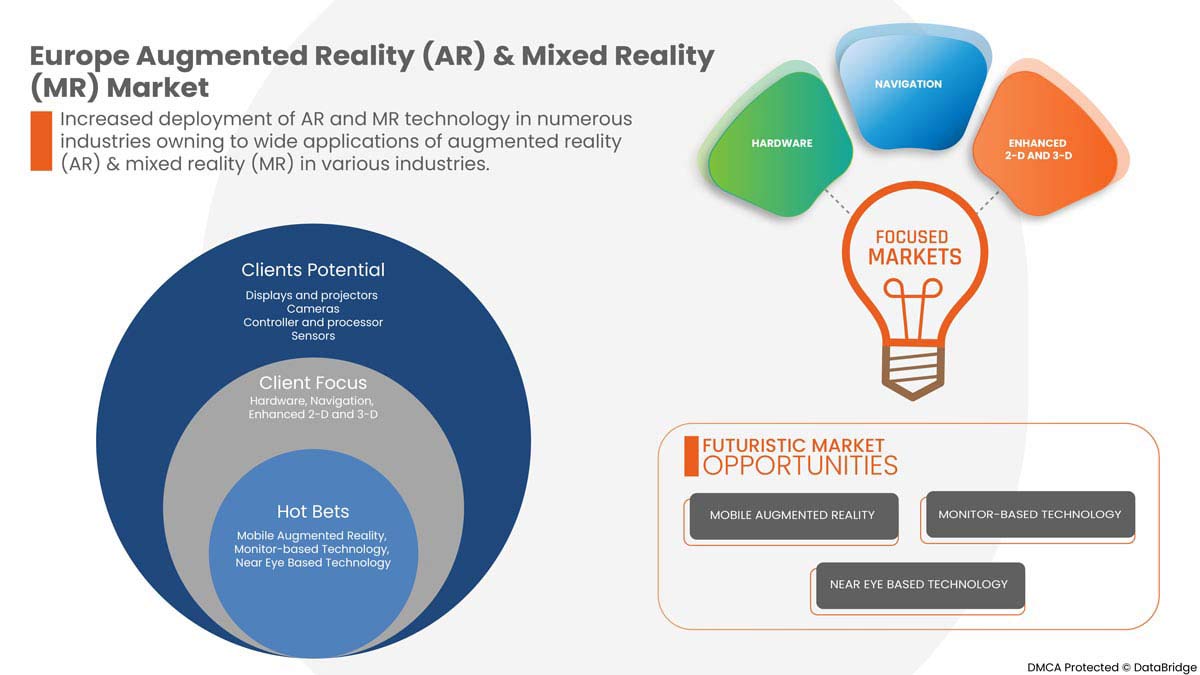

Mayor implementación de tecnología AR y MR en numerosas industrias

Las aplicaciones en diversos sectores industriales, especialmente en la industria de defensa, utilizan ampliamente la realidad aumentada y mixta. Se espera que esto genere oportunidades para el mercado europeo de realidad aumentada (RA) y realidad mixta (MR).

Restricciones/Desafíos

- Normas gubernamentales estrictas para diversas organizaciones

Los dispositivos y aplicaciones de realidad aumentada (RA) y realidad mixta (MR) ya están sujetos a varias leyes y regulaciones que rigen la privacidad individual y los datos de los usuarios en los distintos países. Sin embargo, el panorama regulatorio actual solo aborda algunos de los riesgos del uso de dispositivos de realidad aumentada. Los requisitos específicos complican la recopilación de datos necesaria para brindar experiencias inmersivas sólidas y seguras en todos los sectores.

Impacto de la COVID-19 en el mercado europeo de realidad aumentada (RA) y realidad mixta (MR)

La COVID-19 ha tenido un gran impacto en varias industrias, ya que casi todos los países han optado por cerrar todas las instalaciones, excepto las que se dedican al segmento de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de instalaciones y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se ocupan de esta situación de pandemia son las de servicios esenciales a las que se les permite abrir y ejecutar sus procesos.

El aumento del uso de dispositivos basados en realidad aumentada ha brindado oportunidades significativas en medio de la pandemia de covid-19. Aunque el poder adquisitivo de los consumidores se ha reducido en gran medida como resultado de la crisis económica inducida por el coronavirus, lo que resultó en la disminución de los márgenes de ganancia en las organizaciones. Si bien muchos líderes y especialistas en marketing clave vieron signos de mejora con respecto a años anteriores, sigue siendo difícil determinar la situación real del mercado, ya que la demanda acumulada puede estar encubriendo un nivel intrínseco más bajo de demanda de dispositivos basados en RA. El aumento de las aplicaciones de RA para teléfonos inteligentes, el aumento de la demanda de colaboración remota y los avances tecnológicos en aplicaciones médicas son algunos de los factores que impulsan el crecimiento del mercado de realidad aumentada y realidad mixta.

Los fabricantes están tomando diversas decisiones estratégicas para satisfacer la creciente demanda en el período de COVID-19. Los actores participaron en actividades estratégicas como asociaciones, colaboraciones, adquisiciones y otras para mejorar la tecnología involucrada en el mercado de realidad aumentada (RA) y realidad mixta (MR). Con esto, las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar la digitalización en todas las industrias han llevado al crecimiento del mercado.

Acontecimientos recientes

- En abril de 2021, Microsoft anunció un contrato entre el Pentágono y el ejército estadounidense para la fabricación de cascos de realidad aumentada para soldados por valor de 21.880 millones de dólares. Este HoloLens ofrecerá a los soldados una visibilidad más eficiente, visión nocturna de última generación y conocimiento de la situación para cualquier guerra. Esto también ha ayudado a la empresa a trascender los límites tradicionales del espacio y el tiempo en el campo de la RA, ampliando así sus productos en el mercado.

- En julio de 2021, SAMSUNG ELECTRONICS CO., LTD. amplió su oferta de productos sin contacto para consumidores con un nuevo servicio habilitado con Realidad Aumentada (RA) para sus productos estrella. Con esto, los consumidores pueden experimentar virtualmente un producto en sus hogares, verificar las dimensiones del producto y hacer una selección informada con el servicio de RA. Esto también ha ayudado a la empresa a ampliar su cartera de productos en el mercado de la realidad aumentada.

Alcance del mercado europeo de realidad aumentada (RA) y realidad mixta (MR)

El mercado europeo de realidad aumentada (RA) y realidad mixta (MR) está segmentado en función de los componentes, el modelo de implementación, el canal de distribución, el tipo de dispositivo, la tecnología, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por componente

- Hardware

- Software

- Servicios

Sobre la base de los componentes, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) está segmentado en hardware, software y servicios.

Por modelo de implementación

- En las instalaciones

- Nube

Sobre la base del modelo de implementación, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) está segmentado en local y en la nube.

Por canal de distribución

- Desconectado

- En línea

En función del tamaño de la organización, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) se segmenta en online y offline.

Por tipo de dispositivo

- De oficina

- Pantalla de visualización frontal

- Pantalla montada en la cabeza

- Proyector y pantalla de pared

- Dispositivos de seguimiento de gestos

Sobre la base del tipo de dispositivo, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) se ha segmentado en pantallas de visualización frontal, pantallas montadas en la cabeza, proyectores y paredes de visualización y dispositivos de seguimiento de gestos.

Por tecnología

- Realidad aumentada móvil

- Tecnología basada en monitores

- Tecnología basada en Near Eye

Sobre la base de la tecnología, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) se ha segmentado en realidad aumentada móvil, tecnología basada en monitor y tecnología basada en visión cercana.

Por aplicación

- Banca, servicios financieros y seguros (BFSI)

- Optimización del flujo de trabajo

- Colaboración de marketing

- 2-D y 3-D mejorados

- Visualizaciones

- Modelado 3D

- Documentación

- Navegación

Sobre la base de la aplicación, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) se ha segmentado en optimización del flujo de trabajo, colaboración de marketing, mejora de 2D y 3D, visualizaciones, modelado 3D, documentación y navegación.

Por el usuario final

- Banca, servicios financieros y seguros (BFSI)

- Comercio minorista y comercio electrónico

- Informática y telecomunicaciones

- Automotor

- Aeroespacial y defensa

- Cuidado de la salud

- Animación

- Viajes y turismo

- Energía

- Medios y entretenimiento

- Educación

- Construcción

- Juegos y deportes

- Bancario

- Otros

Sobre la base del usuario final, el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) está segmentado en comercio minorista y comercio electrónico, TI y telecomunicaciones, automoción, aeroespacial y defensa, atención médica, viajes y turismo, energía, medios y entretenimiento, educación, construcción, juegos y deportes, banca y otros.

Análisis y perspectivas regionales del mercado de realidad aumentada (RA) y realidad mixta (MR)

Se analiza el mercado europeo de realidad aumentada (AR) y realidad mixta (MR) y se proporcionan información y tendencias sobre el tamaño del mercado por país, componente, modelo de implementación, canal de distribución, tipo de dispositivo, tecnología, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de realidad aumentada (AR) y realidad mixta (MR) de Europa son Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Suiza, Rusia, Suecia, Polonia, Bélgica, Turquía y el resto de Europa.

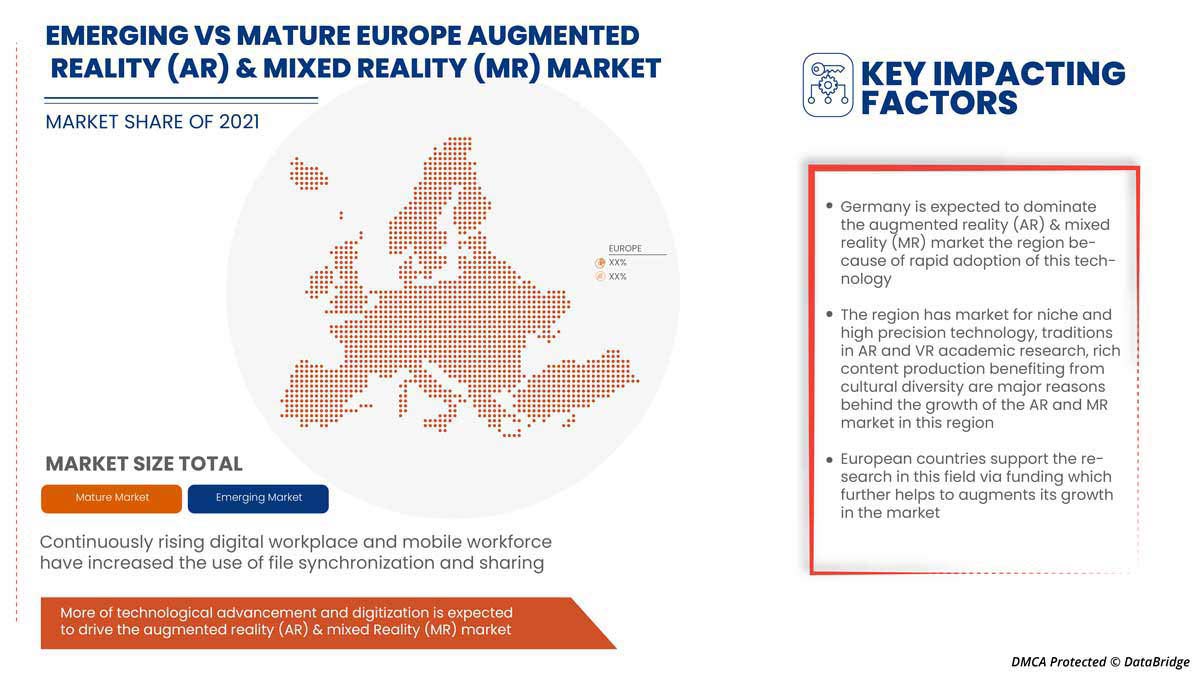

Se espera que Alemania domine el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) y es probable que sea el que crezca más rápido en Europa debido al crecimiento continuo del lugar de trabajo digital y la fuerza laboral móvil. Además, el Reino Unido ha sido extremadamente receptivo a la adopción de los últimos avances tecnológicos, incluidos los dispositivos móviles, la computación en la nube y la IoT, dentro de las empresas, lo que está impulsando el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la realidad aumentada (RA) y la realidad mixta (MR)

El panorama competitivo del mercado europeo de realidad aumentada (RA) y realidad mixta (RM) proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado europeo de realidad aumentada (RA) y realidad mixta (RM).

Algunos de los principales actores que operan en el mercado europeo de realidad aumentada (RA) y realidad mixta (MR) son HP Development Company, LP, HTC Corporation, Autodesk Inc., Barco, Intel Corporation, PTC, Seiko Epson Corporation, Ultraleap Limited, ASUSTek Computer Inc., Dell, Google (una subsidiaria de Alphabet Inc.), Sony Corporation, Lenovo, Microsoft, SAMSUNG ELECTRONICS CO., LTD., Panasonic Corporation, RealWear, Inc., Magic Leap, Inc., EON Reality y TeamViewer, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 IEEE STANDARDS

4.2 POST COVID

4.3 MARKETING

4.4 PRICING ANALYSIS/PRICE SENSITIVITY

4.5 KOREAN CONTENT'S POPULARITY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.2 RISE IN ADOPTION OF AUGMENTED REALITY BY EDUCATIONAL INSTITUTES

5.1.3 INCREASING FOCUS ON CYBER-PHYSICAL SYSTEMS

5.1.4 MORE OF TECHNOLOGICAL ADVANCEMENT AND DIGITIZATION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS OF GOVERNMENT FOR VARIED ORGANIZATIONS

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASED DEPLOYMENT OF AR AND MR TECHNOLOGY IN NUMEROUS INDUSTRIES

5.3.2 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.3 DEVELOPMENT OF HARDWARE WITH FASTER PROCESSING SPEEDS

5.3.4 RISE IN INVESTMENT AND FUNDING BY DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 EUROPE ECONOMIC SLOWDOWN LIMITS THE MARKET DEVELOPMENT

5.4.2 COMPLICATIONS WHILE OPERATING AUGMENTED REALITY (AR) & MIXED REALITY (MR) BASED PRODUCT

6 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DISPLAYS AND PROJECTORS

6.2.2 CAMERAS

6.2.3 CONTROLLER AND PROCESSOR

6.2.4 SENSORS

6.2.4.1 ACCELEROMETERS

6.2.4.2 GYROSCOPES

6.2.5 PROXIMITY SENSORS

6.2.6 MAGNETOMETERS

6.2.7 OTHERS

6.2.8 POSITION TRACKERS

6.2.9 OTHERS

6.3 SOFTWARE

6.4 SERVICES

6.4.1 IMPLEMENTATION

6.4.2 SUPPORT AND MAINTENANCE

6.4.3 TRAINING

7 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE

8.1 OVERVIEW

8.2 HEAD MOUNTED DISPLAY

8.2.1 SMART GLASSES

8.2.2 SMART HELMET

8.3 HEAD UP DISPLAY

8.4 PROJECTOR & DISPLAY WALLS

8.5 GESTURE-TRACKING DEVICES

9 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 MOBILE AUGMENTED REALITY

9.3 MONITOR-BASED TECHNOLOGY

9.4 NEAR EYE BASED TECHNOLOGY

10 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 WORKFLOW OPTIMIZATION

11.3 ENHANCED 2-D AND 3-D

11.4 VISUALIZATIONS

11.5 MARKETING COLLABORATION

11.6 3D MODELING

11.7 DOCUMENTATION

11.8 NAVIGATION

12 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDIA AND ENTERTAINMENT

12.2.1 BROADCAST

12.2.2 MUSIC

12.2.3 ART GALLERIES AND EXHIBITIONS

12.2.4 MUSEUMS

12.2.5 THEME PARKS

12.3 GAMES AND SPORTS

12.4 RETAIL AND E-COMMERCE

12.4.1 JEWELLERY

12.4.2 BEAUTY AND COSMETICS

12.4.3 APPAREL FITTING

12.4.4 GROCERY SHOPPING

12.4.5 FOOTWEAR

12.4.6 FURNITURE AND LIGHTING DESIGN

12.5 TRAVEL AND TOURISM

12.6 HEALTHCARE

12.6.1 SURGERY

12.6.2 FITNESS MANAGEMENT

12.6.3 PATIENT CARE MANAGEMENT

12.6.4 PHARMACY MANAGEMENT

12.6.5 OTHERS

12.7 ANIMATION

12.7.1 CHARACTER

12.7.2 CARTOON

12.8 AEROSPACE AND DEFENSE

12.9 AUTOMOTIVE

12.1 CONSTRUCTION

12.11 EDUCATION

12.12 BANKING

12.13 ENERGY

12.14 IT AND TELECOMMUNICATION

12.15 OTHERS

13 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION

13.1 EUROPE

14 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MICROSOFT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SAMSUNG ELECTRONICS CO., LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 PANASONIC CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DELL

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCTS PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 LENOVO

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCTS PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AUTODESK INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUSTEK COMPUTER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 EON REALITY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HP DEVELOPMENT COMPANY, L.P.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCTS PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 HTC CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 INTEL CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 MAGIC LEAP, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 PTC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTS PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 REALWEAR, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SEIKO EPSON CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SONY CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCTS PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 TEAMVIEWER

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 ULTRALEAP LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 AVERAGE DEVELOPMENT TIME AND COST FOR AR:

TABLE 2 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 3 EUROPE HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 5 EUROPE SENSORS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 6 EUROPE SOFTWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 9 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 10 EUROPE CLOUD IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ON-PREMISE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE HEAD UP DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PROJECTORS & DISPLAY WALLS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE GESTURE-TRACKING DEVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 19 EUROPE MOBILE AUGMENTED REALITY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE MONITOR-BASED TECHNOLOGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE NEAR EYE BASED TECHNOLOGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 EUROPE OFFLINE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE ONLINE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE WORKFLOW OPTIMIZATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ENHANCED 2-D AND 3-D IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE VISUALIZATIONS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE MARKETING COLLABORATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE 3D MODELING IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE DOCUMENTATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE NAVIGATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 EUROPE MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE GAMES AND SPORTS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TRAVEL AND TOURISM IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE AEROSPACE AND DEFENSE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE AUTOMOTIVE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE CONSTRUCTION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE EDUCATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE BANKING IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE ENERGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE IT AND TELECOMMUNICATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE OTHERS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 53 EUROPE HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE SENSORS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 EUROPE SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 57 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 59 EUROPE HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 EUROPE MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 EUROPE RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 EUROPE HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 EUROPE ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SEGMENTATION

FIGURE 2 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: MULTIVARIATE MODELING

FIGURE 10 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES IS EXPECTED TO DRIVE EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET FROM 2022 TO 2029

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET

FIGURE 17 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 19 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DEVICE TYPE, 2021

FIGURE 20 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY TECHNOLOGY, 2021

FIGURE 21 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY APPLICATION, 2021

FIGURE 23 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY END USER, 2021

FIGURE 24 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SNAPSHOT (2021)

FIGURE 25 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY COMPONENT (2022 & 2029)

FIGURE 26 EUROPE AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPANY SHARE 2021(%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.