Europe Aluminum Casting Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

19.43 Billion

USD

35.96 Billion

2024

2032

USD

19.43 Billion

USD

35.96 Billion

2024

2032

| 2025 –2032 | |

| USD 19.43 Billion | |

| USD 35.96 Billion | |

|

|

|

|

Segmentación del mercado europeo de fundición de aluminio por proceso (fundición en molde desechable y fundición en molde no desechable), fuente (primaria (aluminio virgen) y secundaria (aluminio reciclado)), aplicación (colectores de admisión, cárteres de aceite, piezas estructurales, piezas de chasis, culatas, bloques de motor, transmisiones, ruedas y frenos, transferencia de calor y otros), usuario final (automoción, construcción, industria, electrodomésticos, aeroespacial, electrónica y electricidad, herramientas de ingeniería y otros) - Tendencias del sector y previsiones hasta 2032.

Tamaño del mercado europeo de fundición de aluminio

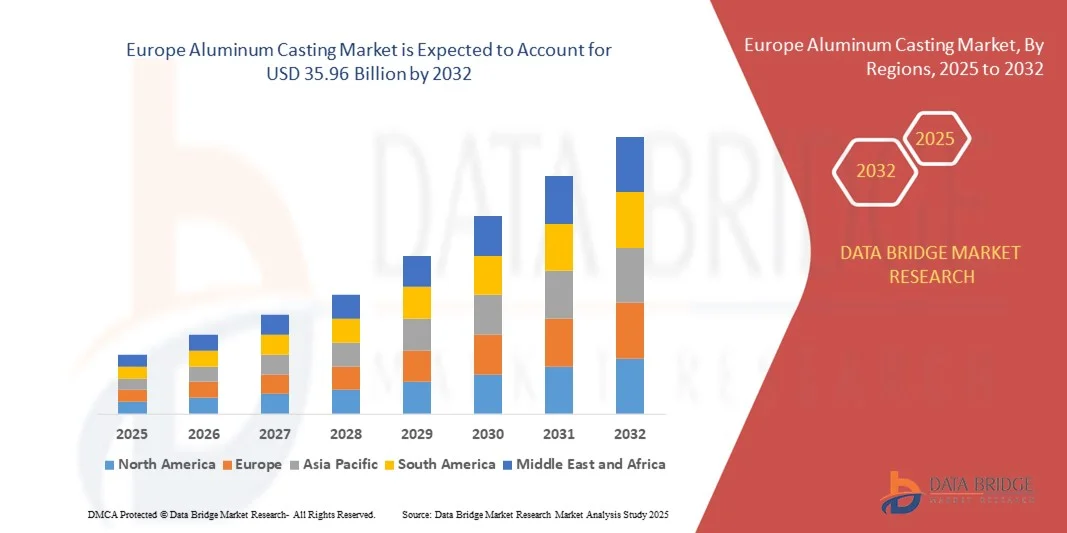

- El tamaño del mercado europeo de fundición de aluminio se valoró en 19.430 millones de dólares en 2024 y se espera que alcance los 35.960 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 8,00% durante el período de previsión.

- El crecimiento del mercado se debe principalmente al aumento de la demanda de componentes ligeros y duraderos en los sectores de automoción, aeroespacial y maquinaria industrial, junto con los avances en las tecnologías de fundición que mejoran la precisión y la eficiencia.

- Además, las estrictas normativas medioambientales y el impulso hacia los vehículos de bajo consumo están fomentando el uso del aluminio frente a los metales tradicionales, lo que a su vez impulsa la adopción de soluciones de fundición de aluminio. Estos factores combinados están impulsando la expansión del mercado y consolidando la trayectoria de crecimiento del sector.

Análisis del mercado europeo de fundición de aluminio

- La fundición de aluminio, que proporciona componentes ligeros y de alta resistencia para aplicaciones automotrices, aeroespaciales e industriales, es cada vez más importante en la fabricación moderna debido a su durabilidad, resistencia a la corrosión y capacidades de producción energéticamente eficientes tanto en el sector comercial como en el industrial.

- La creciente demanda de fundición de aluminio se debe principalmente al cambio de la industria automotriz hacia los vehículos ligeros, al crecimiento de los sectores aeroespacial y de defensa, y a los avances en las tecnologías de fundición que mejoran la precisión y reducen los costos de producción.

- Alemania dominó el mercado europeo de fundición de aluminio con la mayor cuota de ingresos, un 38,5%, en 2024, caracterizada por una infraestructura de fabricación avanzada, una alta adopción de vehículos eléctricos e híbridos y una fuerte presencia de empresas de fundición clave. Alemania e Italia experimentaron un crecimiento sustancial en aplicaciones automotrices e industriales, impulsado por innovaciones en técnicas de fundición a baja presión y fundición en molde permanente a alta presión.

- Se prevé que el Reino Unido sea la región de mayor crecimiento en el mercado europeo de fundición de aluminio durante el período de pronóstico debido a la rápida industrialización, la expansión del sector automotriz y el aumento de las inversiones en la fabricación aeroespacial.

- El segmento de fundición en molde desechable dominó el mercado con la mayor cuota de ingresos, un 62,4 % en 2024, gracias a su rentabilidad, flexibilidad para producir formas complejas y adecuación tanto para series de producción de bajo como de alto volumen.

Alcance del informe y segmentación del mercado europeo de fundición de aluminio

|

Atributos |

Información clave del mercado de fundición de aluminio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los datos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de la tendencia de los precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado europeo de fundición de aluminio

Avances tecnológicos en la fundición automatizada y de precisión

- Una tendencia significativa y en auge en el mercado europeo de fundición de aluminio es la creciente integración de la automatización, la robótica y la inteligencia artificial (IA) en las operaciones de fundición. Esta convergencia tecnológica está mejorando la precisión, la eficiencia de la producción y el control de calidad general en fundiciones e instalaciones de fabricación.

- Por ejemplo, fabricantes líderes como Rheinmetall Automotive y Constellium están adoptando cada vez más sistemas automatizados de fundición a presión y monitorización de la calidad en tiempo real para optimizar el flujo del metal, reducir los defectos y minimizar el desperdicio de material durante la producción. Del mismo modo, Gränges AB utiliza análisis de datos avanzados para garantizar una composición de aleación y un rendimiento de fundición uniformes.

- La integración de la IA en los procesos de fundición de aluminio permite el mantenimiento predictivo, el control adaptativo de procesos y la detección inteligente de defectos. Los sistemas basados en IA pueden analizar los parámetros de fundición en tiempo real, predecir anomalías y ajustar automáticamente los niveles de temperatura o presión para mantener una producción óptima. Además, la robótica y la automatización garantizan tiempos de ciclo uniformes, mayor seguridad y una menor dependencia de la mano de obra en entornos de producción de alto volumen.

- El uso integrado de gemelos digitales y soluciones de la Industria 4.0 permite a los fabricantes simular procesos de fundición, monitorizar el consumo energético y mejorar la trazabilidad de los procesos. Mediante plataformas digitales centralizadas, las empresas pueden gestionar las líneas de producción, analizar los datos de rendimiento e integrarse con los sistemas de la cadena de suministro, lo que garantiza una mayor transparencia y eficiencia operativa.

- Esta tendencia hacia operaciones de fundición de aluminio más inteligentes, conectadas y basadas en datos está redefiniendo los estándares de fabricación industrial en toda Europa. En consecuencia, empresas como Hydro Aluminium y Nemak están invirtiendo fuertemente en instalaciones de fundición con inteligencia artificial que priorizan la sostenibilidad, la automatización y una producción de calidad constante.

- La demanda de soluciones de fundición tecnológicamente avanzadas y automatizadas está aumentando rápidamente en los sectores automotriz, aeroespacial e industrial, a medida que los fabricantes dan mayor prioridad a los materiales ligeros, la eficiencia y las capacidades de producción digitalizadas.

Dinámica del mercado europeo de fundición de aluminio

Conductor

El aumento de la demanda está impulsado por la producción de vehículos ligeros y la expansión industrial.

- El creciente énfasis en la eficiencia del combustible, la reducción de emisiones de carbono y las prácticas de fabricación sostenibles en toda Europa impulsa significativamente la mayor demanda de fundición de aluminio. Los componentes ligeros de aluminio se están convirtiendo en esenciales en aplicaciones automotrices, aeroespaciales e industriales para mejorar el rendimiento y la eficiencia energética.

- Por ejemplo, en marzo de 2024, Constellium SE anunció la ampliación de sus operaciones de fundición de aluminio en Francia para dar soporte a la creciente producción de vehículos eléctricos y estructuras automotrices ligeras. Se prevé que estas iniciativas estratégicas de los principales actores impulsen el crecimiento del mercado durante todo el período de previsión.

- A medida que los fabricantes de automóviles se orientan hacia los vehículos eléctricos e híbridos, la fundición de aluminio ofrece ventajas como una alta relación resistencia-peso, resistencia a la corrosión y reciclabilidad, lo que la convierte en una opción preferida sobre materiales más pesados como el acero o el hierro.

- Además, la rápida expansión industrial y la adopción de tecnologías de automatización y fundición de precisión están impulsando la demanda en los sectores de maquinaria, construcción y aeroespacial. La capacidad de producir geometrías complejas y componentes de alto rendimiento de manera eficiente está fomentando una mayor integración de la fundición de aluminio en diversas aplicaciones.

- Las ventajas de un menor consumo energético durante la producción, la reciclabilidad y la reducción de residuos de material son factores clave que impulsan la adopción de la fundición de aluminio. Además, las continuas innovaciones en los métodos de fundición a presión, fundición en arena y fundición a la cera perdida están mejorando aún más la eficiencia y el rendimiento en todos los sectores.

Restricción/Desafío

Altos costos de energía y precios fluctuantes de materias primas

- El elevado consumo energético y la volatilidad de los precios de las materias primas, en particular los lingotes de aluminio, suponen importantes desafíos para la rentabilidad sostenida del mercado europeo de fundición de aluminio. Dado que los procesos de producción y fusión del aluminio requieren un alto consumo energético, el aumento de los costes de electricidad en toda Europa repercute directamente en los gastos de producción.

- Por ejemplo, la crisis energética de 2023-2024 provocó paradas temporales de la producción y aumentos de costes en varias fundiciones europeas, afectando a su capacidad para satisfacer la creciente demanda.

- Para que los fabricantes mantengan su competitividad, abordar estos desafíos relacionados con los costos mediante tecnologías de hornos energéticamente eficientes, la adopción de energías renovables y la mejora de los procesos de reciclaje se está volviendo crucial. Empresas líderes como Hydro Aluminium y Rheinmetall Automotive se centran cada vez más en modelos de producción circular y soluciones de fundición con bajas emisiones de carbono para mitigar estos riesgos.

- Además, la fluctuación de los precios del aluminio en el mercado mundial, impulsada por las incertidumbres geopolíticas y las interrupciones en la cadena de suministro, puede afectar los márgenes de beneficio y limitar las inversiones a gran escala en nuevas instalaciones de fundición.

- Superar estos desafíos mediante el abastecimiento sostenible, la optimización energética y la innovación tecnológica será esencial para garantizar el crecimiento y la resiliencia a largo plazo en el mercado europeo de fundición de aluminio.

Alcance del mercado europeo de fundición de aluminio

El mercado europeo de fundición de aluminio se segmenta en función del proceso, la fuente, la aplicación y el usuario final.

- Por proceso

Según el proceso, el mercado europeo de fundición de aluminio se divide en fundición en molde desechable y fundición en molde no desechable. El segmento de fundición en molde desechable dominó el mercado con la mayor cuota de ingresos (62,4%) en 2024, gracias a su rentabilidad, flexibilidad para producir formas complejas y su idoneidad tanto para series de producción de bajo como de alto volumen. Procesos como la fundición en arena y la fundición a la cera perdida se utilizan ampliamente en los sectores automotriz e industrial debido a su capacidad para producir geometrías intrincadas con un excelente acabado superficial.

Se prevé que el segmento de fundición en moldes no consumibles experimente la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por la creciente adopción de técnicas de moldeo permanente y fundición a presión que ofrecen alta precisión dimensional, tiempos de ciclo reducidos y propiedades mecánicas superiores. La creciente automatización y los avances tecnológicos en la fundición a presión de alta presión impulsan aún más el crecimiento de este segmento.

- Por fuente

Según su origen, el mercado europeo de fundición de aluminio se divide en primario (aluminio virgen) y secundario (aluminio reciclado). El segmento secundario (aluminio reciclado) dominó el mercado con una cuota de ingresos del 57,8 % en 2024, impulsado por el creciente énfasis en la sostenibilidad, la eficiencia energética y la reducción de costes. El aluminio reciclado requiere mucha menos energía que la producción primaria, lo que se ajusta a las estrictas normativas medioambientales y los objetivos de reducción de carbono de Europa.

Se prevé que el segmento del aluminio primario registre la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por la creciente demanda de aleaciones de aluminio de alta pureza en aplicaciones aeroespaciales y automotrices. Se espera que las continuas mejoras en las tecnologías de fundición y la disponibilidad de materias primas de alta calidad potencien aún más el mercado del aluminio primario durante el período de pronóstico.

- Mediante solicitud

Según su aplicación, el mercado europeo de fundición de aluminio se segmenta en colectores de admisión, carcasas de cárter de aceite, piezas estructurales, piezas de chasis, culatas, bloques de motor, transmisiones, ruedas y frenos, sistemas de transferencia de calor y otros. El segmento de bloques de motor dominó el mercado con la mayor cuota de ingresos, un 24,6 % en 2024, ya que los componentes de aluminio para motores ofrecen una excelente relación resistencia-peso, conductividad térmica y resistencia a la corrosión. Los fabricantes de automóviles están sustituyendo cada vez más el hierro fundido por aluminio para mejorar el rendimiento de los vehículos y la eficiencia de combustible.

Se prevé que el segmento de piezas estructurales experimente la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por la creciente demanda de materiales ligeros en vehículos eléctricos y componentes aeroespaciales. Los avances en fundición de precisión y desarrollo de aleaciones permiten la producción de componentes estructurales más resistentes, ligeros y duraderos.

- Por el usuario final

Según el usuario final, el mercado europeo de fundición de aluminio se segmenta en automoción, construcción, industria, electrodomésticos, aeroespacial, electrónica y electricidad, herramientas de ingeniería y otros. El segmento de automoción dominó el mercado con una cuota de ingresos del 46,3 % en 2024, impulsado por el creciente interés de la región en la reducción del peso de los vehículos, la mejora de la eficiencia del combustible y el cumplimiento de las normativas sobre emisiones. La fundición de aluminio se utiliza ampliamente en componentes de motores, chasis y transmisiones.

Se prevé que el sector aeroespacial registre la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por el creciente uso de aleaciones de aluminio ligeras y de alta resistencia en estructuras de aeronaves y piezas de motores. El aumento de la demanda de viajes aéreos, junto con las inversiones en la fabricación de aeronaves de última generación, acelerará aún más el crecimiento de este sector.

Análisis regional del mercado europeo de fundición de aluminio

- Alemania dominó el mercado europeo de fundición de aluminio con la mayor cuota de ingresos, un 38,5%, en 2024, impulsada por la fuerte presencia de centros de fabricación de automóviles y aeroespaciales en países como Alemania, Francia e Italia, junto con la creciente adopción de materiales ligeros para cumplir con las estrictas normas de emisiones y eficiencia.

- Los fabricantes de la región hacen hincapié en la ingeniería de precisión, la automatización y la sostenibilidad, utilizando tecnologías avanzadas de fundición de aluminio para la producción de piezas críticas de motores de automóviles, componentes estructurales y maquinaria industrial.

- Esta adopción generalizada se ve respaldada además por las iniciativas gubernamentales que promueven la producción de vehículos eléctricos, una base industrial bien establecida y las crecientes inversiones en materiales reciclables y energéticamente eficientes, lo que posiciona la fundición de aluminio como una solución preferida para la movilidad de próxima generación y las aplicaciones industriales en toda Europa.

Perspectivas del mercado alemán de fundición de aluminio

En 2024, el mercado alemán de fundición de aluminio obtuvo la mayor cuota de ingresos en Europa, impulsado por la sólida base manufacturera automotriz e industrial del país. El marcado enfoque de Alemania en la excelencia en ingeniería, la fabricación de precisión y la innovación favorece la adopción generalizada de técnicas avanzadas de fundición, como la fundición a presión y la fundición asistida por vacío. La creciente demanda de vehículos ligeros y de bajo consumo, junto con el impulso del país hacia la movilidad eléctrica, está fomentando el uso de componentes de aluminio en motores, chasis y carcasas de baterías. Además, el énfasis de Alemania en la sostenibilidad y el reciclaje se alinea con el creciente uso de aluminio secundario (reciclado) en la producción, lo que garantiza tanto la rentabilidad como la responsabilidad ambiental.

Perspectivas del mercado de fundición de aluminio en Francia

Se prevé que el mercado francés de fundición de aluminio experimente un crecimiento anual compuesto (CAGR) constante durante todo el período de pronóstico, impulsado por la creciente demanda de las industrias automotriz, aeroespacial y de defensa. El consolidado sector aeroespacial francés, liderado por importantes empresas como Airbus, es un gran consumidor de piezas fundidas de aluminio de alto rendimiento para estructuras de aeronaves y componentes de motores. La transición a los vehículos eléctricos (VE) y las iniciativas gubernamentales que promueven la fabricación con bajas emisiones están impulsando el uso de aluminio en la industria automotriz. Asimismo, las inversiones en la modernización de fundiciones y la adopción de sistemas de automatización y control de calidad basados en inteligencia artificial están mejorando la eficiencia de la producción y la precisión de la fundición en las plantas de fabricación francesas.

Perspectivas del mercado de fundición de aluminio en el Reino Unido

Se prevé que el mercado británico de fundición de aluminio experimente un notable crecimiento anual compuesto durante el período de pronóstico, impulsado por la creciente demanda de materiales ligeros en aplicaciones para la automoción, la construcción y la industria aeroespacial. Con el creciente enfoque del país en la sostenibilidad y la reducción de emisiones, los fabricantes están sustituyendo los materiales ferrosos tradicionales por aleaciones de aluminio que ofrecen un mejor rendimiento y reciclabilidad. La presencia de instalaciones avanzadas de ingeniería e I+D, junto con las inversiones en fundición a presión y fabricación aditiva, está acelerando el crecimiento del mercado. Además, se espera que el creciente ecosistema de fabricación de vehículos eléctricos del Reino Unido y su sólido potencial exportador de componentes de aluminio consoliden su posición como un centro clave europeo de fundición de aluminio.

Perspectivas del mercado de fundición de aluminio en los Países Bajos

Se prevé que el mercado neerlandés de fundición de aluminio experimente un sólido crecimiento durante el período de pronóstico, impulsado por su avanzada infraestructura industrial y su compromiso con la fabricación sostenible. La posición estratégica del país como centro logístico y manufacturero en Europa facilita la exportación de componentes de aluminio de alta calidad a los países vecinos. El aumento de las inversiones en energías renovables, movilidad eléctrica y automatización industrial está impulsando la demanda de piezas de aluminio fundidas con precisión. Los fabricantes neerlandeses se centran en la implementación de tecnologías de fundición energéticamente eficientes, iniciativas de reciclaje y soluciones digitales para fundiciones con el fin de optimizar la productividad y reducir las emisiones de carbono. La combinación de innovación tecnológica, enfoque en la sostenibilidad y una sólida integración de la cadena de suministro posiciona a los Países Bajos como un actor emergente en el mercado regional de fundición de aluminio.

Cuota de mercado de fundición de aluminio en Europa

La industria de la fundición de aluminio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Gränges AB (Suecia)

• Nemak (México)

• Constellium (Francia)

• Rheinmetall Automotive (Alemania)

• Grupo Sapa (Suecia)

• Novelis Inc. (EE. UU.)

• Aluminio Rheinfelden GmbH (Alemania)

• Kaiser Aluminum (EE. UU.)

• Corporación ALCOA (EE. UU.)

• Aleris (EE. UU.)

• Novelis Europe (Alemania)

• Conalcast Europa (Bélgica)

• Foseco International (Reino Unido)

• Sidenor (España)

• Hydro Aluminium (Noruega)

• SLM Solutions (Alemania)

• Corporación Arconic (EE. UU.)

• Metalúrgica de Castromil (España)

• Alumeco (Polonia)

• Productos enrollados Aleris (Alemania)

¿Cuáles son los últimos avances en el mercado europeo de fundición de aluminio?

- En abril de 2024, Constellium SE, fabricante líder mundial de productos de aluminio con sede en Francia, anunció la ampliación de su planta de fundición de aluminio en Singen, Alemania, para satisfacer la creciente demanda de componentes ligeros para vehículos eléctricos. La ampliación se centra en aumentar la capacidad de fundición a presión y mejorar la sostenibilidad mediante hornos de alta eficiencia energética. Esta iniciativa subraya el compromiso de Constellium con la transición de Europa hacia soluciones de movilidad más limpias, al tiempo que refuerza su posición en el mercado europeo de fundición de aluminio.

- En marzo de 2024, Rheinmetall Automotive AG (Alemania) inauguró una nueva línea de producción de fundición a presión de última generación en su planta de Neckarsulm. El nuevo sistema está diseñado para producir componentes estructurales y de motor de aluminio complejos para vehículos híbridos y eléctricos, con mayor resistencia y menor peso. Este desarrollo refleja el compromiso de Rheinmetall con la mejora de la eficiencia, la precisión y la sostenibilidad en la fabricación, reforzando su liderazgo en la industria europea de la fundición de aluminio.

- En febrero de 2024, Hydro Aluminium ASA (Noruega) presentó un importante programa de inversión centrado en las operaciones de fundición de aluminio reciclado en su planta de Clervaux, Luxemburgo. El proyecto tiene como objetivo aumentar el uso de chatarra posconsumo y reducir las emisiones de carbono a lo largo de la cadena de producción. Esta inversión estratégica subraya el compromiso de Hydro con la promoción de los principios de la economía circular en la producción de metales, en consonancia con los objetivos europeos de sostenibilidad y neutralidad de carbono para 2030.

- En enero de 2024, Nemak SAB de CV (operaciones en México y Europa) inauguró un centro avanzado de I+D de fundición de aluminio en la República Checa. El centro se dedica al desarrollo de aleaciones de fundición de última generación y soluciones ligeras para carcasas de baterías de vehículos eléctricos y piezas estructurales. Mediante la integración de tecnologías de simulación y control de calidad basado en inteligencia artificial, Nemak busca acelerar la innovación en fundición sostenible y consolidar su presencia en el mercado europeo.

- En diciembre de 2023, Gränges AB (Suecia) anunció la finalización de su proyecto de modernización de la fundición en su planta de Konin, Polonia. El proyecto se centra en mejorar la eficiencia energética y aumentar la capacidad de producción de productos de aluminio laminado y fundido utilizados en intercambiadores de calor para la industria automotriz y otras aplicaciones industriales. Esta modernización refleja el compromiso continuo de Gränges con la mejora del rendimiento, la reducción de emisiones y la satisfacción de la creciente demanda de productos de fundición de aluminio de alta calidad en toda Europa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.