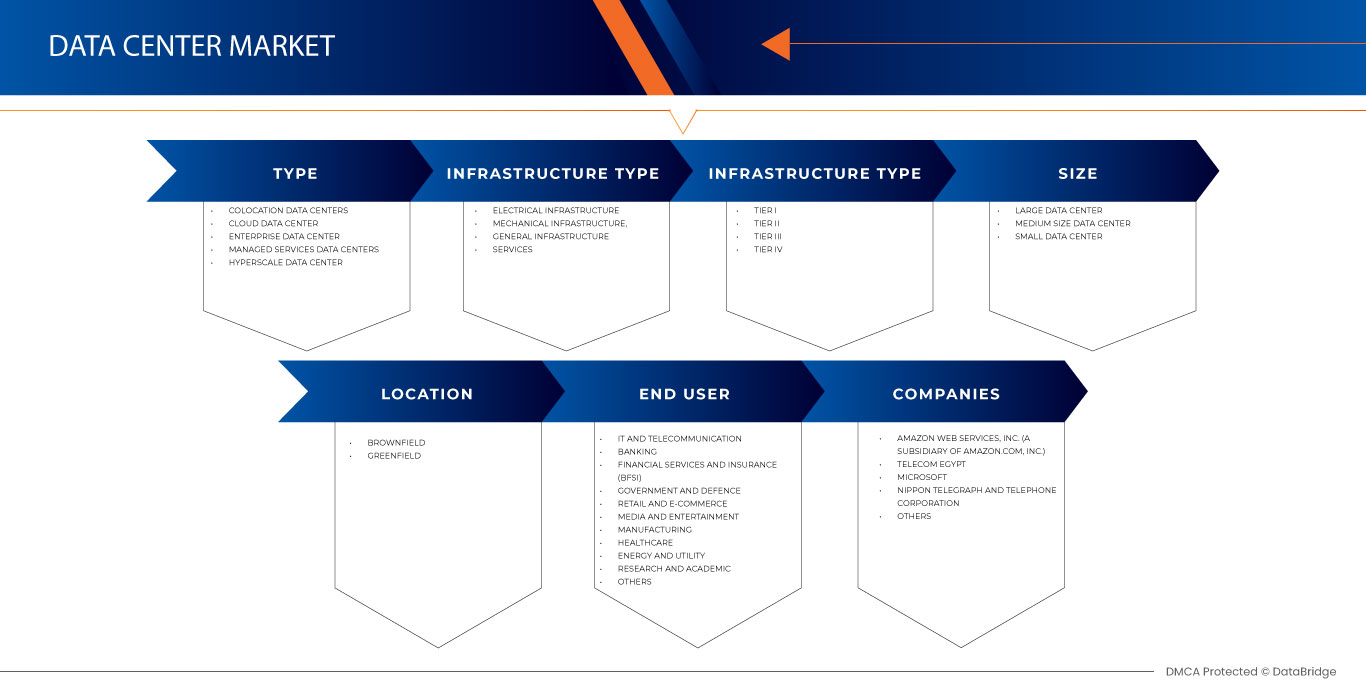

Mercado de centros de datos de Egipto, por tipo (centros de datos de coubicación, centro de datos en la nube, centro de datos empresarial, centros de datos de servicios administrados y centro de datos de hiperescala), tipo de infraestructura (infraestructura eléctrica, infraestructura mecánica, infraestructura general y servicios), estándares de nivel (TIER I, TIER II, TIER III y TIER IV), tamaño (centro de datos grande, centro de datos de tamaño mediano y centro de datos pequeño), ubicación (Brownfield y Greenfield), usuario final (TI y telecomunicaciones, banca, servicios financieros y seguros (BFSI), gobierno y defensa, comercio minorista y comercio electrónico , medios y entretenimiento, fabricación, atención médica, energía y servicios públicos, investigación y academia, y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de centros de datos de Egipto

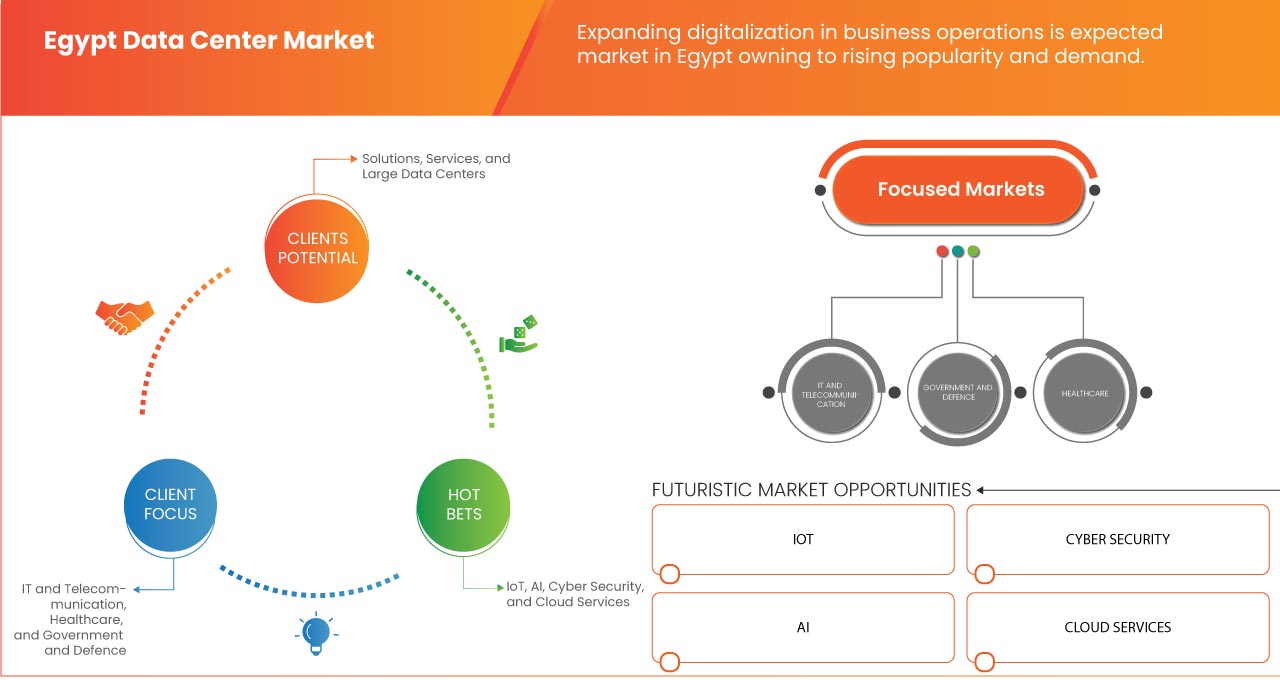

El mercado de centros de datos de Egipto está fragmentado por naturaleza, ya que consta de muchos actores globales y regionales también. La presencia de estas empresas produce soluciones, productos y servicios de centros de datos competitivos con diversas características y prestaciones a un precio competitivo. Los actores del mercado y las empresas involucradas pueden ofrecer productos y servicios para diferentes presupuestos debido a la presencia de estos actores a nivel regional e internacional. Se espera que la expansión de la digitalización en las operaciones comerciales y un aumento en el avance tecnológico en el sector de TI en Egipto impulsen el crecimiento del mercado. Además, se espera que la creciente popularidad de las soluciones basadas en la nube impulse aún más el crecimiento del mercado. Sin embargo, se espera que la infraestructura poco confiable de los centros de datos en el país restrinja el crecimiento del mercado. Además, se espera que la alta complejidad involucrada en la construcción de centros de datos y los obstáculos en la cadena de suministro de centros de datos representen un desafío para el crecimiento del mercado. Sin embargo, se espera que la creciente importancia del análisis de datos en las industrias y el surgimiento de 5G en todo el mundo brinden oportunidades lucrativas para el crecimiento del mercado.

Data Bridge Market Research analiza que se espera que el mercado de centros de datos de Egipto alcance los USD 1.138,67 millones para 2030 desde USD 490,62 millones en 2022, creciendo con una CAGR sustancial del 12,8% en el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo (centros de datos de coubicación, centro de datos en la nube, centro de datos empresarial, centros de datos de servicios administrados y centro de datos de hiperescala ), tipo de infraestructura (infraestructura eléctrica, infraestructura mecánica, infraestructura general y servicios), estándares de nivel (TIER I, TIER II, TIER III y TIER IV), tamaño (centro de datos grande, centro de datos de tamaño mediano y centro de datos pequeño), ubicación (Brownfield y Greenfield), usuario final (TI y telecomunicaciones, banca, servicios financieros y seguros (BFSI), gobierno y defensa, comercio minorista y comercio electrónico, medios y entretenimiento, fabricación, atención médica, energía y servicios públicos, investigación y academia, y otros) |

|

Países cubiertos |

Egipto |

|

Actores del mercado cubiertos |

Oracle, IBM, SAP SE, Nippon Telegraph and Telephone Corporation, Hewlett Packard Enterprise Development LP, Microsoft, Amazon Web Services, Inc., Cisco Systems, Inc, Huawei Technologies Co., Ltd., Dell Inc., ABB, Lenovo, Telecom Egypt, Link Datacenter y Raya Data Center, entre otros. |

Definición de mercado

Un centro de datos es una instalación compuesta por computadoras en red, sistemas de almacenamiento y equipos de procesamiento. Es un activo crucial para las operaciones diarias, ya que una corporación a menudo depende en gran medida de las aplicaciones, los servicios y los datos que contiene. Las organizaciones utilizan centros de datos para recopilar, analizar, almacenar y distribuir cantidades masivas de datos. En los últimos años, los centros de datos han experimentado un cambio tremendo a medida que los requisitos de TI de la empresa continúan cambiando hacia servicios a pedido. Las empresas están actualizando sus centros de datos con una arquitectura moderna para permitir este nivel de agilidad y movilidad de las aplicaciones. Un centro de datos moderno utiliza la virtualización, la nube y las redes definidas por software para proporcionar cargas de trabajo de aplicaciones en todas partes, incluidos centros de datos físicos, entornos multicloud y entornos híbridos. Esta evolución permite un escalamiento flexible para manejar la creciente demanda de red, almacenamiento y computación.

Dinámica del mercado de centros de datos en Egipto

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Ampliando la digitalización en las operaciones comerciales

La digitalización o el uso de procesos digitales para mejorar las operaciones comerciales está aumentando con el uso de componentes relevantes para modernizar el negocio, lo que lleva a la evolución del proceso de trabajo y al crecimiento de los ingresos para lograr el éxito futuro. La conversión de elementos no digitales a formatos digitales facilita compartir, guardar y buscar información, lo que conduce a la automatización de las operaciones comerciales mediante el desarrollo de flujos de trabajo automáticos o secuencias de difusión de marketing.

La digitalización tiene una amplia gama de beneficios y requiere un mantenimiento adecuado y equipos e infraestructura adicionales para gestionar correctamente el sistema de trabajo.

- Aumento del avance tecnológico en el sector de TI en Egipto

Los avances tecnológicos han aumentado y han adquirido un papel destacado en el crecimiento económico, la seguridad nacional y la competitividad internacional. Los avances tecnológicos están haciendo evolucionar la automatización, la reorientación y muchos otros avances en el sector de TI. La adopción de tecnología robótica conectada con las instalaciones de Internet está cobrando una nueva tendencia.

Además, los actores clave del mercado en el sector de TI están desarrollando activamente diversas soluciones y nuevos productos de acuerdo con la evolución de la tecnología. Además, la interacción entre los seres humanos y la tecnología está ganando un mayor interés en el mercado, lo que da como resultado la importancia predominante y el papel principal en el sector de TI de la inteligencia artificial (IA), las soluciones en la nube, el aprendizaje automático (ML), la seguridad cibernética , el asistente de voz y muchos otros.

Restricción/Desafío

- Infraestructura poco confiable de los centros de datos del país

El centro de datos desempeña un papel importante en las necesidades de TI para supervisar y almacenar los enormes recursos que son importantes para el trabajo constante de cualquier asociación. Como suena el nombre, parece que el centro de datos es un elemento solitario pero desempeña un papel colosal en el negocio actual. Los diversos componentes especializados lo han hecho. La función principal del centro de datos es calcular, almacenar y organizar. Si bien muchas personas se ocupan de la información y la organización, estos centros de datos hacen que ese trabajo sea más sencillo, cómodo y confiable. La confiabilidad, la eficiencia, la seguridad y el desarrollo constante son las funciones principales de los centros de datos.

Oportunidad

- Aumento de la adopción de la inteligencia artificial y el aprendizaje automático

Las empresas de Oriente Medio han comenzado a centrar su atención en innovaciones en auge y de gran popularidad, como la inteligencia artificial y el aprendizaje automático. Es posible que puedan seguir adelante con los tiempos cambiantes o que se abandonen. La IA representa una oportunidad no solo para transformar los espacios públicos y privados, sino que también garantiza ventajas para los ciudadanos que podrían ser significativas para satisfacer las necesidades individuales de manera moderada y a gran escala.

Acontecimientos recientes

- En diciembre de 2022, Amazon Web Services, Inc. anunció la disponibilidad de AWS Outposts en Egipto, lo que ofrece a las empresas una solución potente para ampliar su infraestructura y servicios de AWS a ubicaciones locales y de borde. AWS Outposts ofrece una experiencia híbrida consistente y totalmente administrada, que permite que las cargas de trabajo se beneficien del acceso de baja latencia al procesamiento de datos locales y la migración sin inconvenientes de aplicaciones con interdependencias del sistema. Con Outposts, las organizaciones en Egipto ahora pueden cumplir con los requisitos de residencia de datos al ejecutar sus cargas de trabajo y datos dentro de las instalaciones locales del país mientras se conectan a la región de AWS más cercana para la administración y las operaciones. Este desarrollo mejora significativamente la presencia de AWS en el mercado de centros de datos de Egipto, lo que brinda a las empresas una mayor flexibilidad y escalabilidad para sus necesidades de computación en la nube.

- En abril de 2022, Telecom Egypt presentó EG-IX, el primer punto de intercambio de Internet de acceso abierto de Egipto, ubicado en su centro de datos de nivel III certificado de primer nivel en Smart Village, en el oeste de El Cairo. Aprovechando los más de 25 años de experiencia de AMS-IX, EG-IX posiciona a Telecom Egypt como un actor líder en el panorama digital del país. Este movimiento estratégico fortalece la conectividad de Egipto y marca un salto significativo hacia los servicios avanzados de intercambio de Internet. Este desarrollo aumenta el potencial de la empresa para el creciente sector digital en la región.

Alcance del mercado de centros de datos de Egipto

El mercado de centros de datos de Egipto se divide en seis segmentos importantes según el tipo, el tipo de infraestructura, el nivel de servicio, el tamaño, la ubicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Centros de datos de coubicación

- Centro de datos en la nube

- Centro de datos empresarial

- Centros de datos con servicios gestionados

- Centro de datos a hiperescala

Según el tipo, el mercado está segmentado en centros de datos de colocación, centros de datos en la nube, centros de datos empresariales, centros de datos de servicios gestionados y centros de datos de hiperescala.

Tipo de infraestructura

- Infraestructura eléctrica

- Infraestructura mecánica

- Infraestructura general

- Servicios

Según el tipo de infraestructura, el mercado se segmenta en infraestructura eléctrica, infraestructura mecánica, infraestructura general y servicios.

Estándares de niveles

- Nivel I

- Nivel II

- Nivel III

- Nivel IV

Sobre la base de los estándares de niveles, el mercado se segmenta en nivel III, nivel IV, nivel II y nivel I.

Tamaño

- Centro de datos de gran tamaño

- Centro de datos de tamaño mediano

- Pequeño centro de datos

En función del tamaño, el mercado se segmenta en centros de datos grandes, centros de datos de tamaño mediano y centros de datos pequeños.

Ubicación

- Terreno baldío

- Campo verde

En función de la ubicación, el mercado se segmenta en zonas industriales abandonadas y zonas verdes.

Usuario final

- Informática y telecomunicaciones

- Banca, servicios financieros y seguros (BFSI)

- Gobierno y Defensa

- Comercio minorista y comercio electrónico

- Medios y entretenimiento

- Fabricación

- Cuidado de la salud

- Energía y servicios públicos

- Investigación y Académica

- Otros

Sobre la base del usuario final, el mercado está segmentado en TI y telecomunicaciones, banca, servicios financieros y seguros (BFSI), gobierno y defensa, comercio minorista y comercio electrónico, medios y entretenimiento, manufactura, atención médica, energía y servicios públicos, investigación y academia, y otros.

Análisis y perspectivas del mercado de centros de datos de Egipto

Se analiza el mercado de centros de datos de Egipto y se proporcionan información y tendencias del tamaño del mercado por país, tipo, tipo de infraestructura, estándar de nivel, tamaño, ubicación y usuario final como se menciona anteriormente.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de país y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los centros de datos en Egipto

El panorama competitivo del mercado de centros de datos de Egipto proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en el país, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores que operan en el mercado de centros de datos de Egipto son Oracle, IBM, SAP SE, Nippon Telegraph and Telephone Corporation, Hewlett Packard Enterprise Development LP, Microsoft, Amazon Web Services, Inc., Cisco Systems, Inc, Huawei Technologies Co., Ltd., Dell Inc.; ABB, Lenovo, Telecom Egypt, Link Datacenter y Raya Data Center, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EGYPT DATA CENTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF CARRIER DATA CENTER IN EGYPT

4.1.1 MARKET SHARE FOR CARRIER DATA CENTER PROVIDERS (TELECOM OPERATORS) IN EGYPT

4.1.2 STRATEGIC INITIATIVES BY DIFFERENT COMPANIES FOR EXPANDING DATA CENTER IN EGYPT

4.1.3 ADVANTAGES OF CARRIER’S DATA CENTER CONSTRUCTION

4.1.4 COMPANY’S OWNERSHIP REGARDING THE UTILIZATION OF EQUIPMENT

4.2 SMES’ REQUIREMENT FOR LEASING DATA CENTER SERVICES

4.3 CHARACTERISTICS OF DATA CENTER BASED ON MODULAR TYPE (INDOOR OR OUTDOOR) AND LOCATION (FLOOR OR SEPARATE DATA CENTER)

4.4 LIST OF MAJOR PLAYERS ALONG WITH STRENGTH AND WEAKNESS

4.5 OBSTACLE TO BUILD DATA CENTER FOR OPERATORS

4.6 FACTORS CONTRIBUTING TOWARDS THE FUTURE CLOUD SERVICE DEVELOPMENT SPACE FOR DATA CENTER IN EGYPT

4.7 COMPUTING POWER POLICIES AND REQUIREMENT FOR DATA CENTER CONSTRUCTION IN EGYPT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXPANDING DIGITALIZATION IN BUSINESS OPERATIONS

5.1.2 INCREASE IN TECHNOLOGICAL ADVANCEMENT ACROSS IT SECTOR IN EGYPT

5.1.3 GROWING POPULARITY OF CLOUD-BASED SOLUTIONS

5.2 RESTRAINT

5.2.1 UNRELIABLE INFRASTRUCTURE OF DATA CENTERS IN THE COUNTRY

5.3 OPPORTUNITIES

5.3.1 SURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.3.2 EMERGENCE OF 5G ACROSS THE GLOBE

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND EXPANSION BY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 HINDRANCE IN DATA CENTER SUPPLY CHAIN

5.4.2 HIGH COMPLEXITY INVOLVED IN DATA CENTER CONSTRUCTION

6 EGYPT DATA CENTER MARKET, BY TYPE

6.1 OVERVIEW

6.2 COLOCATION DATA CENTERS

6.3 CLOUD DATA CENTER

6.4 ENTERPRISE DATA CENTER

6.5 MANAGED SERVICES DATA CENTERS

6.6 HYPERSCALE DATA CENTER

7 EGYPT DATA CENTER MARKET, BY INFRASTRUCTURE TYPE

7.1 OVERVIEW

7.2 ELECTRICAL INFRASTRUCTURE

7.2.1 BY POWER

7.2.1.1 UPS SYSTEMS

7.2.1.2 POWER DISTRIBUTION AND MEASUREMENT

7.2.1.3 POWER BACK UP

7.2.1.4 GENERATORS

7.2.1.5 TRANSFER SWITCHES & SWITCHGEAR

7.2.1.6 CABLING INFRASTRUCTURE

7.2.1.7 OTHERS

7.2.2 BY NETWORK

7.2.2.1 ROUTER

7.2.2.2 ETHERNET SWITCH

7.2.2.3 APPLICATION DELIVERY CONTROLLER (ADC)

7.2.2.4 NETWORK SECURITY EQUIPMENT

7.2.2.5 STORAGE AREA NETWORK (SAN)

7.2.2.6 SERVER

7.2.2.6.1 BY TYPE

7.2.2.6.1.1 RACK

7.2.2.6.1.1.1 RACK, BY TYPE

7.2.2.6.1.1.1.1 CABINET

7.2.2.6.1.1.1.2 OPEN TYPE

7.2.2.6.1.2 BLADE

7.2.2.6.1.3 MICRO

7.2.2.6.1.4 TOWER

7.3 MECHANICAL INFRASTRUCTURE

7.3.1 BY TYPE

7.3.1.1 AIR COOLING (CRAH)

7.3.1.2 CHILLING UNITS

7.3.1.2.1 BY TYPE

7.3.1.2.1.1 WATER-COOLED CHILLER

7.3.1.2.1.2 AIR-COOLED CHILLER

7.3.1.2.1.3 GLYCOL-COOLED CHILLER

7.3.1.3 COOLING TOWERS

7.3.1.4 LIQUID COOLING SYSTEM

7.3.1.4.1 BY TYPE

7.3.1.4.1.1 DIRECT-TO-CHIP LIQUID COOLING

7.3.1.4.1.2 IMMERSION COOLING TECHNIQUES

7.3.1.4.1.3 REAR-DOOR HEAT EXCHANGER (RDHX)

7.3.1.5 ECONOMIZER SYSTEM

7.3.1.5.1 BY TYPE

7.3.1.5.1.1 AIR- SIDE ECONOMIZER

7.3.1.5.1.2 WATER- SIDE ECONOMIZER

7.3.1.6 CONTROL UNITS

7.3.1.7 OTHERS

7.4 GENERAL INFRASTRUCTURE

7.4.1 BY TYPE

7.4.1.1 BUILDING DEVELOPMENT

7.4.1.2 INSTALLATION

7.4.1.3 COMMISSIONING SERVICES

7.5 SERVICES

7.5.1 BY TYPE

7.5.1.1 MANAGED SERVICES

7.5.1.2 PROFESSIONAL SERVICES

7.5.1.2.1 BY TYPE

7.5.1.2.1.1 INSTALLATION AND INTEGRATION

7.5.1.2.1.2 DESIGN AND CONSULTING

7.5.1.2.1.3 SUPPORT AND MAINTENANCE

7.5.1.2.1.4 TRAINING AND EDUCATION

8 EGYPT DATA CENTER MARKET, BY TIER STANDARDS

8.1 OVERVIEW

8.2 TIER III

8.3 TIER IV

8.4 TIER II

8.5 TIER I

9 EGYPT DATA CENTER MARKET, BY SIZE

9.1 OVERVIEW

9.2 LARGE DATA CENTER

9.2.1 RACK-BASED COOLING

9.2.2 ROW-BASED COOLING

9.2.3 ROOM-BASED COOLING

9.3 MEDIUM SIZE DATA CENTER

9.3.1 RACK-BASED COOLING

9.3.2 ROW-BASED COOLING

9.3.3 ROOM-BASED COOLING

9.4 SMALL DATA CENTER

9.4.1 RACK-BASED COOLING

9.4.2 ROW-BASED COOLING

9.4.3 ROOM-BASED COOLING

10 EGYPT DATA CENTER MARKET, BY LOCATION

10.1 OVERVIEW

10.2 BROWNFIELD

10.3 GREENFIELD

11 EGYPT DATA CENTER MARKET, BY END USER

11.1 OVERVIEW

11.2 IT AND TELECOMMUNICATION

11.3 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.4 GOVERNMENT AND DEFENCE

11.5 RETAIL AND E-COMMERCE

11.6 MEDIA AND ENTERTAINMENT

11.7 MANUFACTURING

11.8 HEALTHCARE

11.9 ENERGY AND UTILITY

11.1 RESEARCH AND ACADEMIC

11.11 OTHERS

12 EGYPT DATA CENTER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EGYPT

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 AMAZON WEB SERVICES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 TELECOM EGYPT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 MICROSOFT

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SOLUTION PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 NIPPON TELEGRAPH AND TELEPHONE CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SOLUTION PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 LINK DATACENTER

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SOLUTION PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CISCO SYSTEMS, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SOLUTION PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 DELL INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SOLUTION PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 HUAWEI TECHNOLOGIES CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 IBM

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 LENOVO

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 ORACLE

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 RAYA DATA CENTER

14.14.1 COMPAY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAP SE

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPANY’S OWNERSHIP REGARDING THE UTILIZATION OF EQUIPMENT

TABLE 2 CHARACTERISTIC OF DATA CENTER BASED ON MODULAR TYPE AND LOCATION

TABLE 3 MAJOR PLAYERS IN EGYPT DATA CENTER MARKET

TABLE 4 EQUIPMENT MANUFACTURER

TABLE 5 EGYPT DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 EGYPT DATA CENTER MARKET, BY INFRASTRUCTURE TYPE, 2021-2030 (USD MILLION)

TABLE 7 EGYPT ELECTRICAL INFRASTRUCTURE IN DATA CENTER MARKET, BY POWER, 2021-2030 (USD MILLION)

TABLE 8 EGYPT ELECTRICAL INFRASTRUCTURE IN DATA CENTER MARKET, BY NETWORK, 2021-2030 (USD MILLION)

TABLE 9 EGYPT SERVER IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 EGYPT RACK IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 EGYPT MECHANICAL INFRASTRUCTURE IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 EGYPT CHILLING UNITS IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 EGYPT LIQUID COOLING SYSTEM IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 EGYPT ECONOMIZER SYSTEM IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 EGYPT GENERAL INFRASTRUCTURE IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 EGYPT SERVICES IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 EGYPT PROFESSIONAL SERVICES IN DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 EGYPT DATA CENTER MARKET, BY TIER STANDARDS, 2021-2030 (USD MILLION)

TABLE 19 EGYPT DATA CENTER MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 20 EGYPT LARGE DATA CENTER IN DATA CENTER MARKET, BY TECHNIQUE, 2021-2030 (USD MILLION)

TABLE 21 EGYPT MEDIUM SIZE DATA CENTER IN DATA CENTER MARKET, BY TECHNIQUE, 2021-2030 (USD MILLION)

TABLE 22 EGYPT SMALL DATA CENTER IN DATA CENTER MARKET, BY TECHNIQUE, 2021-2030 (USD MILLION)

TABLE 23 EGYPT DATA CENTRE MARKET, BY LOCATION, 2021-2030 (USD MILLION)

TABLE 24 EGYPT DATA CENTRE MARKET, BY END USER, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 EGYPT DATA CENTER MARKET: SEGMENTATION

FIGURE 2 EGYPT DATA CENTER MARKET: DATA TRIANGULATION

FIGURE 3 EGYPT DATA CENTER MARKET: DROC ANALYSIS

FIGURE 4 EGYPT DATA CENTER MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EGYPT DATA CENTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EGYPT DATA CENTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EGYPT DATA CENTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EGYPT DATA CENTER MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 EGYPT DATA CENTER MARKET: MULTIVARIATE MODELLING

FIGURE 10 EGYPT DATA CENTER MARKET: TYPE

FIGURE 11 EGYPT DATA CENTER MARKET: SEGMENTATION

FIGURE 12 EXPANDING DIGITALIZATION IN BUSINESS OPERATIONS IS EXPECTED TO BE A KEY DRIVER FOR THE GROWTH OF THE EGYPT DATA CENTER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 COLOCATION DATA CENTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EGYPT DATA CENTER MARKET IN 2023 TO 2030

FIGURE 14 CARRIER DATA CENTER PROVIDER (TELECOM OPERATORS) IN EGYPT

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EGYPT DATA CENTER MARKET

FIGURE 16 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 17 PENETRATION OF 3G-OR-GREATER MOBILE INTERNET IN THE MIDDLE EAST

FIGURE 18 SIZING CLOUD SHIFT, WORLDWIDE, 2019-2025

FIGURE 19 EGYPT DATA CENTER MARKET: BY TYPE, 2022

FIGURE 20 EGYPT DATA CENTER MARKET: BY INFRASTRUCTURE TYPE, 2022

FIGURE 21 EGYPT DATA CENTER MARKET: BY TIER STANDARDS, 2022

FIGURE 22 EGYPT DATA CENTER MARKET: BY SIZE, 2022

FIGURE 23 EGYPT DATA CENTRE MARKET: BY LOCATION, 2022

FIGURE 24 EGYPT DATA CENTRE MARKET: BY END USER, 2022

FIGURE 25 EGYPT DATA CENTER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.