Canada Fleet Management Market, By Offering (Solutions and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engine and Electric vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags, Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles) and Large & Enterprise Fleets (20-50+ Vehicles), Communication Range (Short Range Communication and Long Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Method & Decision Making, RFID, and Others), Functions (Monitoring Driver Behavior, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Business and Large Business), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) – Industry Trends and Forecast to 2030.

Canada Fleet Management Market Analysis and Size

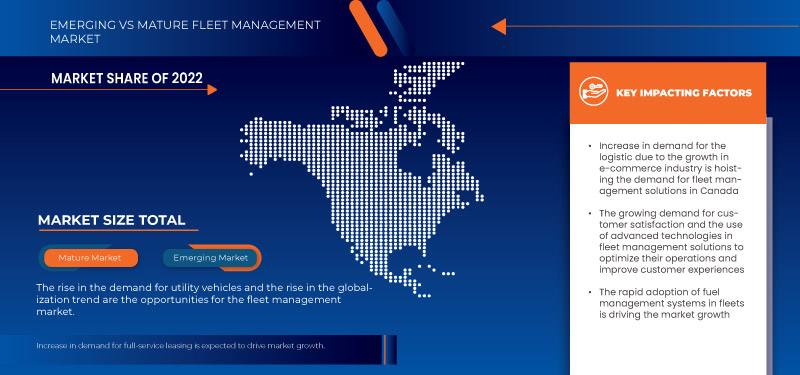

Major factors expected to boost the growth of the fleet management market in the forecast period are the rise in several industrial applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of fleet management, which is further anticipated to propel the growth of the fleet management market.

Data Bridge Market Research analyses that the Canada fleet management market is expected to reach the value of USD 2,204,927.30 thousand by 2030, at a CAGR of 8.1% during the forecast period. The fleet management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Oferta (soluciones y servicios), tipo de arrendamiento (arrendamiento y sin arrendamiento), modo de transporte (automotriz, marítimo, material rodante y aeronave), tipo de vehículo (motor de combustión interna y vehículo eléctrico), hardware ( dispositivos de seguimiento GPS , cámaras de tablero, etiquetas de seguimiento Bluetooth, registradores de datos y otros), tamaño de la flota (flotas pequeñas (1-5 vehículos), flotas medianas (5-20 vehículos) y flotas grandes y empresariales (20-50+ vehículos), alcance de comunicación (comunicación de corto alcance y comunicación de largo alcance), modelo de implementación (local, en la nube e híbrido), tecnología (GNSS, sistemas celulares, intercambio electrónico de datos (EDI), detección remota, método computacional y toma de decisiones, RFID y otros), funciones (monitoreo del comportamiento del conductor, consumo de combustible, administración de activos, quejas ELD, administración de rutas, actualizaciones de mantenimiento del vehículo, cronograma de entrega, prevención de accidentes, ubicación del vehículo en tiempo real, aplicaciones móviles y otros), operaciones (privadas y comerciales), negocios Tipo (pequeñas y grandes empresas), usuario final (automotriz, transporte y logística, comercio minorista, fabricación, alimentos y bebidas, energía y servicios públicos, minería, gobierno, atención médica, agricultura, construcción y otros) |

|

País cubierto |

Canadá |

|

Actores del mercado cubiertos |

Element Fleet Management Corp. (EE. UU.), Verizon. (EE. UU.), Geotab Inc. (Canadá), Motive Technologies, Inc. (EE. UU.), Jim Pattison Lease (Canadá), Holman, Inc. (EE. UU.), Cisco Systems, Inc. (EE. UU.), Donlen (EE. UU.), Omnitracs (una parte de Solera) (EE. UU.), Wheels Inc. (EE. UU.), DENSO CORPORATION (Japón), AT&T (EE. UU.), Continental AG (Alemania), ORBCOMM (EE. UU.), Summit Fleet Leasing and Management (Canadá), Siemens (Alemania), ADDISON LEASING OF CANADA LTD (Canadá), Robert Bosch GmbH (Alemania), RAM Tracking (Reino Unido), TRANSFLO (EE. UU.), Foss National Leasing Ltd. (Canadá), Samsara Inc. (EE. UU.), Sierra Wireless. (EE. UU.), Mendix Technology BV (Países Bajos), ALD Automotive (Francia), IBM (EE. UU.), ADDISON LEASING OF CANADA LTD (Canadá), Robert Bosch GmbH (Alemania), RAM Tracking (Reino Unido), TRANSFLO (EE. UU.), entre otros. |

Definición de mercado

La gestión de flotas son los procesos y prácticas involucrados en la gestión de la flota de vehículos de una empresa. La gestión de flotas incluye automóviles, camiones, furgonetas y otros vehículos utilizados para fines comerciales. También involucra muchas prácticas, como la adquisición de vehículos, el mantenimiento, la gestión del combustible, la gestión de conductores y la seguridad y el cumplimiento. El objetivo de la gestión de flotas es optimizar el uso de los vehículos de la empresa para mejorar la eficiencia, reducir los costos y mejorar la seguridad. Una gestión de flotas eficaz puede ayudar a las empresas a aumentar la productividad, reducir el tiempo de inactividad y extender la vida útil de sus vehículos. También puede ayudar a mejorar el comportamiento del conductor, reducir los accidentes y garantizar el cumplimiento de las regulaciones y políticas. La gestión de flotas se utiliza en varias industrias, incluido el transporte, la logística, los servicios de entrega y la construcción. Las tecnologías avanzadas, como el seguimiento por GPS y la telemática, han hecho que la gestión de flotas sea más efectiva y eficiente en los últimos años.

Dinámica del mercado de gestión de flotas de Canadá

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

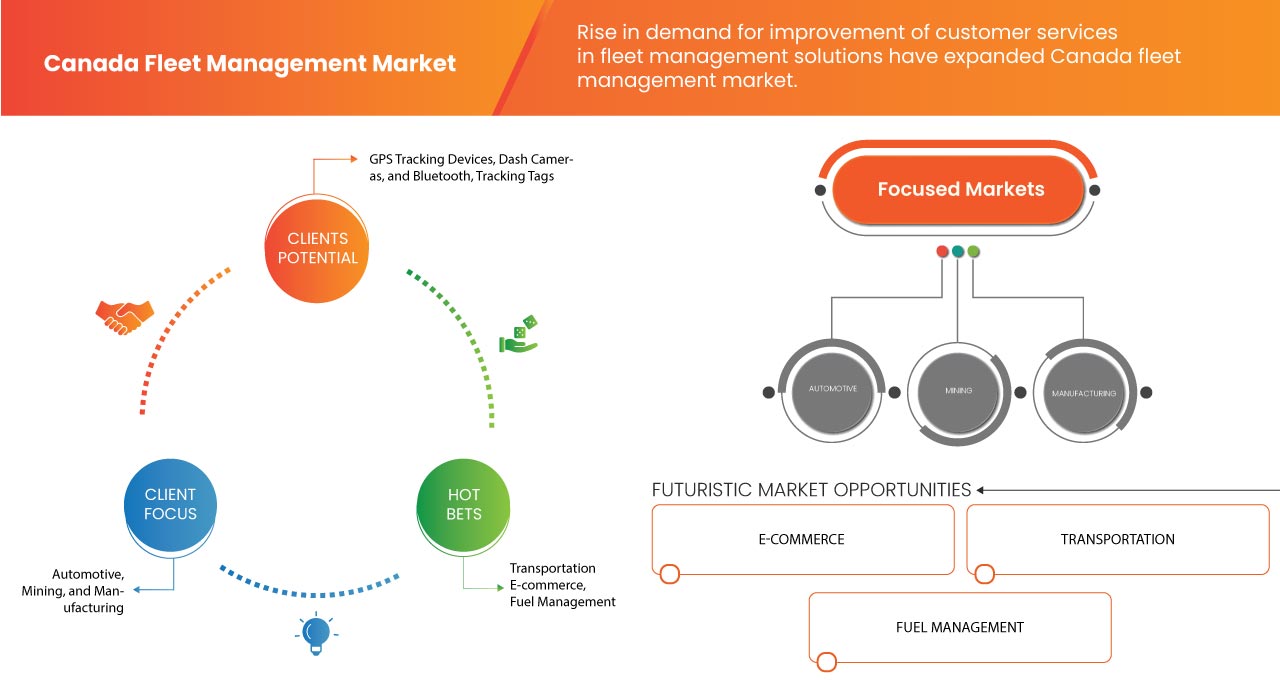

- Aumento de la demanda de logística debido a la industria del comercio electrónico

La gestión de flotas es una práctica que permite a las organizaciones gestionar y coordinar los vehículos de reparto para lograr una eficiencia óptima y reducir los costes. La práctica de la gestión de flotas se utiliza para supervisar y registrar a los mensajeros y al personal de reparto. Requiere un sistema de tecnologías que faciliten al gestor de la flota la coordinación de las actividades, desde la gestión del combustible hasta la planificación de las rutas, y se puede gestionar fácilmente mediante un software de gestión de flotas. La expansión de la industria del comercio electrónico ha tenido un impacto significativo en la industria de la logística. La logística se ha considerado la columna vertebral de la industria del comercio electrónico, ya que afecta de forma inmediata a las operaciones planificadas, los almacenes y las organizaciones de la red de producción. Dependerán progresivamente de la reevaluación para hacer frente a las crecientes solicitudes relacionadas con el desarrollo de la parte comercial de Internet. La adopción de este curso, ya sea para el transporte de última milla o para la satisfacción de los pedidos, les permitirá garantizar un transporte predecible, fiable, productivo y sin fallos. Por tanto, esto puede ser un gran factor a la hora de gestionar y ampliar la presión debido al crecimiento previsto de la industria comercial del comercio electrónico.

- Aumento de la demanda de mejoras en los servicios al cliente

Los clientes de hoy son más inteligentes y tienen mayores expectativas que nunca. La satisfacción y la felicidad del cliente son dos de los aspectos más importantes para cualquier empresa. Independientemente del sector empresarial, los clientes insatisfechos no lo serán por mucho tiempo, por lo que es importante mantenerlos felices y hacer que se sientan valorados. Esto también es cierto para la logística y la gestión de flotas, donde la retención de los clientes es clave para el éxito a largo plazo. Mejorar los servicios y la satisfacción del cliente mediante un mejor rendimiento de la gestión de flotas es un factor clave que se espera que impulse el mercado de gestión de flotas de Canadá. En el competitivo mercado actual, las empresas reconocen la importancia de la satisfacción del cliente y utilizan tecnologías avanzadas en soluciones de gestión de flotas para optimizar sus operaciones y mejorar las experiencias de los clientes.

Oportunidad

- Aumento de la demanda de vehículos utilitarios

Los vehículos utilitarios son vehículos diseñados y utilizados para transportar mercancías o pasajeros. Estos vehículos incluyen camiones, furgonetas, autobuses y vehículos similares utilizados con fines comerciales. El mercado de vehículos utilitarios es un componente crucial de la industria automotriz de Canadá y ha experimentado un crecimiento significativo en las últimas décadas. El aumento de la demanda de vehículos utilitarios se puede atribuir a varios factores, incluido el crecimiento de la industria del comercio electrónico, la creciente urbanización y la necesidad de sistemas de transporte eficientes. También se espera que aumente la demanda de servicios y software de gestión de flotas a medida que más y más empresas dependan de los vehículos utilitarios para sus necesidades de transporte. Una de las razones del aumento de la demanda de vehículos utilitarios es el crecimiento de la industria del comercio electrónico. La demanda de servicios de transporte ha aumentado con el creciente número de plataformas de compras en línea. El uso de vehículos utilitarios se ha vuelto más común y la gestión de flotas se ha vuelto más crítica.

Restricciones/Desafíos

- Menor eficiencia en la conectividad

La industria de la logística y el transporte ha cambiado significativamente en los últimos años. Se han introducido conceptos como la digitalización, la aparición del big data y la conectividad, y muchas flotas están utilizando ahora las primeras versiones de estas nuevas tecnologías. En muchos casos, están cambiando la forma en que los administradores de flotas operan a diario. La conectividad es uno de los conceptos más importantes y efectivos. Aquí es donde un administrador de flota puede tener una visión general de toda la flota y mantenerse en contacto con los conductores, camiones y remolques a través de procesos automatizados que brindan datos procesables desde dispositivos a bordo. A través de dispositivos telemáticos y soluciones de software conectadas, se pueden alertar los problemas de la flota sobre problemas menores del vehículo a medida que surgen, lo que les permite abordar los problemas antes y lidiar con los problemas antes de que se produzcan averías. Esto brinda la flexibilidad de realizar reparaciones en curso o mantenimiento programado con anticipación, lo que permite que los camiones permanezcan en la carretera con más frecuencia y pasen más tiempo entregando mercancías.

- Orientación inadecuada para habilitar la ruta

Un sistema de seguimiento de vehículos puede definirse como una parte de un sistema de gestión de flotas, que permite al operador de la flota conocer la ubicación del vehículo a lo largo de su recorrido en función del tiempo. Además de utilizar los datos generados por el sistema de seguimiento de vehículos para hacer cumplir el horario de los autobuses, estos datos también proporcionan información importante para la toma de decisiones. El sistema facilita el cálculo de la distancia exacta recorrida en un período determinado, el cálculo de la velocidad del autobús en una ubicación determinada, el análisis del tiempo que tarda el vehículo en cubrir una determinada distancia, etc. Se convierte en una herramienta muy poderosa en el caso de las agencias operativas.

Acontecimientos recientes

- En junio de 2023, la alianza de Siemens Xcelerator con Helixx marca un paso crucial en su búsqueda de revolucionar la fabricación de vehículos eléctricos. Al integrar el software y los servicios industriales de Siemens, Helixx pretende implementar rápidamente su innovador sistema de fabricación de vehículos eléctricos en todo el mundo, fomentando el crecimiento económico sostenible a través de soluciones de movilidad urbana accesibles y sin emisiones. Esta colaboración subraya el concepto innovador de Helixx de Helixx Mobility Hubs, que permitirá a las fábricas con licencia global producir una amplia gama de vehículos eléctricos, amplificando su impacto mucho más allá de las proyecciones de producción iniciales.

- En junio de 2023, Foss National Leasing Ltd. realizó una actualización de un año del Programa Piloto de Vehículos Eléctricos de Foss, la integración de vehículos eléctricos (VE) en la flota de la empresa, que ha generado datos operativos esclarecedores que ayudan a los clientes en su proceso de adopción de vehículos eléctricos. Este programa contribuye de manera eficaz a facilitar las transiciones hacia soluciones de gestión de flotas sostenibles al abordar las incertidumbres. En conclusión, los esfuerzos continuos de la empresa demuestran el papel fundamental del programa a la hora de facilitar la toma de decisiones informadas para un futuro más ecológico y eficiente.

Alcance del mercado de gestión de flotas de Canadá

El mercado de gestión de flotas de Canadá está segmentado en función de la oferta, el tipo de arrendamiento, el modo de transporte, el tipo de vehículo, el hardware, el tamaño de la flota, el alcance de las comunicaciones, el modelo de implementación, la tecnología, las funciones, las operaciones, el tipo de negocio y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Soluciones

- Servicios

En función de la oferta, el mercado se segmenta en soluciones y servicios.

Tipo de arrendamiento

- En arrendamiento

- Sin contrato de arrendamiento

En función del tipo de arrendamiento, el mercado se segmenta en arrendamiento con y sin arrendamiento.

Modo de transporte

- Automotor

- Marina

- Material rodante

- Aeronave

Según el modo de transporte, el mercado está segmentado en automoción, marítimo, material rodante y aeronáutica.

Tipo de vehículo

- Motor de combustión interna

- Vehículo eléctrico

Según el tipo de vehículo, el mercado está segmentado en motor de combustión interna y vehículo eléctrico.

Hardware

- Dispositivos de seguimiento GPS

- Cámaras de tablero

- Etiquetas de seguimiento por Bluetooth

- Registradores de datos

- Otros

Sobre la base del hardware, el mercado está segmentado en dispositivos de rastreo GPS, cámaras DASH, etiquetas de rastreo bluetooth, registradores de datos y otros.

Tamaño de la flota

- Flotas pequeñas (1-5 vehículos)

- Flotas medianas (5-20 vehículos)

- Flotas grandes y empresariales (entre 20 y 50 vehículos)

En función del tamaño de la flota, el mercado se segmenta en flotas pequeñas (1 a 5 vehículos), flotas medianas (5 a 20 vehículos) y flotas grandes y empresariales (20 a 50+ vehículos).

Alcance de la comunicación

- Comunicación de corto alcance

- Comunicación de largo alcance

Sobre la base del alcance de comunicación, el mercado se segmenta en comunicación de corto alcance y comunicación de largo alcance.

Modelo de implementación

- En las instalaciones

- Nube

- Híbrido

Sobre la base del modelo de implementación, el mercado está segmentado en local, en la nube e híbrido.

Tecnología

- Sistema global de navegación por satélite (GNSS)

- Sistemas celulares

- Intercambio electrónico de datos (EDI)

- Detección remota

- Métodos computacionales y toma de decisiones

- RFID

- Otros

Sobre la base de la tecnología, el mercado está segmentado en GNSS, sistemas celulares, intercambio electrónico de datos (EDI), teledetección, métodos computacionales y toma de decisiones, RFID y otros.

Funciones

- Gestión de activos

- Gestión de rutas

- Consumo de combustible

- Ubicación del vehículo en tiempo real

- Horario de entrega

- Prevención de accidentes

- Aplicaciones móviles

- Monitoreo del comportamiento del conductor

- Actualizaciones de mantenimiento de vehículos

- Cumplimiento de ELD

- Otros

Sobre la base de las funciones, el mercado está segmentado en gestión de activos, gestión de rutas, consumo de combustible, ubicación del vehículo en tiempo real, cronograma de entrega, prevención de accidentes, aplicaciones móviles, monitoreo del comportamiento del conductor, actualizaciones de mantenimiento del vehículo, cumplimiento de ELD y otros.

Operaciones

- Privado

- Comercial

En función de las operaciones, el mercado está segmentado en privado y comercial.

Tipo de negocio

- Pequeña empresa

- Gran empresa

Según el tipo de negocio, el mercado se segmenta en pequeñas empresas y grandes empresas.

Usuario final

- Automotor

- Transporte y Logística

- Minorista

- Fabricación

- Alimentos y bebidas

- Energía y servicios públicos

- Minería

- Gobierno

- Cuidado de la salud

- Agricultura

- Construcción

- Otros

Sobre la base del usuario final, el mercado está segmentado en automotriz, transporte y logística, comercio minorista, manufactura, alimentos y bebidas, energía y servicios públicos, minería, gobierno, atención médica, agricultura, construcción y otros.

Análisis del panorama competitivo y de la cuota de mercado de la gestión de flotas en Canadá

El panorama competitivo del mercado de gestión de flotas de Canadá ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en el país, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de gestión de flotas.

Algunos de los principales actores que operan en el mercado son Element Fleet Management Corp. (EE. UU.), Verizon. (EE. UU.), Geotab Inc. (Canadá), Motive Technologies, Inc. (EE. UU.), Jim Pattison Lease (Canadá), Holman, Inc. (EE. UU.), Cisco Systems, Inc. (EE. UU.), Donlen (EE. UU.), Omnitracs (una parte de Solera) (EE. UU.), Wheels Inc. (EE. UU.), DENSO CORPORATION (Japón), AT&T (EE. UU.), Continental AG (Alemania), ORBCOMM (EE. UU.), Summit Fleet Leasing and Management (Canadá), Siemens (Alemania), ADDISON LEASING OF CANADA LTD (Canadá), Robert Bosch GmbH (Alemania), RAM Tracking (Reino Unido), TRANSFLO (EE. UU.), Foss National Leasing Ltd. (Canadá), Samsara Inc. (EE. UU.), Sierra Wireless. (EE. UU.), Mendix Technology BV (Países Bajos), ALD Automotive (Francia), IBM (EE. UU.), ADDISON LEASING OF CANADA LTD (Canadá), Robert Bosch GmbH (Alemania), RAM Tracking (Reino Unido) y TRANSFLO (EE. UU.), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CANADA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF GLOBALIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS

6.1 OVERVIEW

6.2 ASSET MANAGEMENT

6.3 ROUTE MANAGEMENT

6.4 FUEL CONSUMPTION

6.5 REAL TIME VEHICLE LOCATION

6.6 DELIVERY SCHEDULE

6.7 ACCIDENT PREVENTION

6.8 MOBILE APPS

6.9 MONITORING DRIVER BEHAVIOR

6.1 VEHICLE MAINTENANCE UPDATES

6.11 ELD COMPLIANCE

6.12 OTHERS

7 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS

7.1 OVERVIEW

7.2 COMMERCIAL

7.3 PRIVATE

8 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

8.1 OVERVIEW

8.2 LARGE BUSINESS

8.2.1 FLORIST & GIFT DELIVERY BUSINESS

8.2.2 CATERING & FOOD DELIVERING COMPANY

8.2.3 CLEANING SERVICE COMPANY

8.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

8.2.5 LANDSCAPING BUSINESS

8.3 SMALL BUSINESS

8.3.1 RENTAL CAR/TRUCK COMPANY

8.3.2 MOVING COMPANY

8.3.3 TAXI COMPANY

8.3.4 DELIVERY COMPANY

8.3.5 LONG HAUL SEMI-TRUCK COMPANY

9 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE

9.1 OVERVIEW

9.2 ON-LEASE

9.3 WITHOUT LEASE

9.3.1 OPEN ENDED

9.3.2 CLOSE ENDED

10 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

10.1 OVERVIEW

10.1.1 AUTOMOTIVE

10.1.2 LIGHT COMMERCIAL VEHICLE

10.1.2.1 PICK UP TRUCKS

10.1.2.2 VANS

10.1.2.2.1 PASSENGER VAN

10.1.2.2.2 CARGO VAN

10.1.2.3 MINI BUS

10.1.2.4 OTHERS

10.1.3 PASSENGER CARS

10.1.3.1 SUV

10.1.3.2 HATCHBACK

10.1.3.3 SEDAN

10.1.3.4 COUPE

10.1.3.5 CROSSOVER

10.1.3.6 CONVERTIBLE

10.1.3.7 OTHERS

10.1.4 HEAVY COMMERCIAL VEHICLE

10.1.4.1 TRUCKS

10.1.4.2 TRAILERS

10.1.4.3 FORKLIFTS

10.1.4.4 SPECIALIST VEHICLES (SUCH AS MOBILE CONSTRUCTION MACHINERY)

10.1.5 MARINE

10.1.6 ROLLING STOCK

10.1.7 AIRCRAFT

11 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 INTERNAL COMBUSTION ENGINE

11.2.1 PETROL

11.2.2 DIESEL

11.2.3 CNG

11.2.4 OTHERS

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 PLUG-IN ELECTRIC VEHICLE (PEV)

11.3.3 HYBRID ELECTRIC VEHICLES (HEVS)

12 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE

12.1 OVERVIEW

12.2 GPS TRACKING DEVICES

12.3 DASH CAMERAS

12.4 BLUETOOTH TRACKING TAGS

12.5 DATA LOGGERS

12.6 OTHERS

13 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE

13.1 OVERVIEW

13.2 SMALL FLEETS (1-5 VEHICLES)

13.3 MEDIUM FLEETS (5-20 VEHICLES)

13.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

14 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

14.1 OVERVIEW

14.2 SHORT RANGE COMMUNICATION

14.3 LONG RANGE COMMUNICATION

15 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

15.1 OVERVIEW

15.2 ON-PREMISE

15.3 CLOUD

15.4 HYBRID

16 CANADA FLEET MANAGEMENT MARKET, BY OFFERING

16.1 OVERVIEW

16.2 SOLUTIONS

16.2.1 ETA PREDICTIONS

16.2.1.1 STREAMLINED ROUTES

16.2.1.2 DETAILED LOCATION DATA

16.2.1.3 BREAKDOWN NOTIFICATION

16.2.2 OPERATIONS MANAGEMENT

16.2.2.1 FLEET TRACKING & GEO-FENCING

16.2.2.2 ROUTING & SCHEDULING

16.2.2.3 REAL & IDLE TIME MONITORING

16.2.3 PERFORMANCE MANAGEMENT

16.2.3.1 DRIVER MANAGEMENT

16.2.3.1.1 TRACKING

16.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

16.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

16.2.3.2 FLEET MANAGEMENT & TRACKING

16.2.3.2.1 REAL TIME ROUTING

16.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

16.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

16.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

16.2.5 SAFETY & COMPLIANCE MANAGEMENT

16.2.6 FLEET ANALYTICS AND REPORTING

16.2.7 CONTRACT MANAGEMENT

16.2.7.1 BY STRUCTURE

16.2.7.1.1 LEASING

16.2.7.1.2 FUEL MANAGEMENT AND EV CHARGING

16.2.7.1.3 MAINTENANCE SPEND PLANNING

16.2.7.1.4 ACCIDENT MANAGEMENT

16.2.7.1.5 VEHICLE REGISTRATION

16.2.7.1.6 ADMINISTRATIVE COST

16.2.7.1.7 OTHERS

16.2.7.2 BY MODEL

16.2.7.2.1 LONG TERM CONTRACT

16.2.7.2.2 SHORT TERM CONTRACT

16.2.8 RISK MANAGEMENT

16.2.9 ELECTRIFICATION

16.2.10 REMARKETING

16.2.11 OTHERS

16.3 SERVICES

16.3.1 PROFESSIONAL SERVICES

16.3.1.1 SUPPORT & MAINTENANCE

16.3.1.2 IMPLEMENTATION

16.3.1.3 CONSULTING

16.3.2 MANAGED SERVICES

17 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 GNSS

17.3 CELLULAR SYSTEMS

17.4 ELECTRONIC DATA INTERCHANGE (EDI)

17.5 REMOTE SENSING

17.6 COMPUTATIONAL METHOD & DECISION MAKING

17.7 RFID

17.8 OTHERS

18 CANADA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.1.8 RISK MANAGEMENT

18.2.1.9 ELECTRIFICATION

18.2.1.10 REMARKETING

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.1.8 RISK MANAGEMENT

18.3.1.9 ELECTRIFICATION

18.3.1.10 REMARKETING

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.1.8 RISK MANAGEMENT

18.4.1.9 ELECTRIFICATION

18.4.1.10 REMARKETING

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.1.8 RISK MANAGEMENT

18.5.1.9 ELECTRIFICATION

18.5.1.10 REMARKETING

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.1.8 RISK MANAGEMENT

18.6.1.9 ELECTRIFICATION

18.6.1.10 REMARKETING

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.1.8 RISK MANAGEMENT

18.7.1.9 ELECTRIFICATION

18.7.1.10 REMARKETING

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 FLEET ANALYTICS AND REPORTING

18.8.1.7 CONTRACT MANAGEMENT

18.8.1.8 RISK MANAGEMENT

18.8.1.9 ELECTRIFICATION

18.8.1.10 REMARKETING

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 FLEET ANALYTICS AND REPORTING

18.9.1.7 CONTRACT MANAGEMENT

18.9.1.8 RISK MANAGEMENT

18.9.1.9 ELECTRIFICATION

18.9.1.10 REMARKETING

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 FLEET ANALYTICS AND REPORTING

18.10.1.7 CONTRACT MANAGEMENT

18.10.1.8 RISK MANAGEMENT

18.10.1.9 ELECTRIFICATION

18.10.1.10 REMARKETING

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 FLEET ANALYTICS AND REPORTING

18.11.1.7 CONTRACT MANAGEMENT

18.11.1.8 RISK MANAGEMENT

18.11.1.9 ELECTRIFICATION

18.11.1.10 REMARKETING

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 FLEET ANALYTICS AND REPORTING

18.12.1.7 CONTRACT MANAGEMENT

18.12.1.8 RISK MANAGEMENT

18.12.1.9 ELECTRIFICATION

18.12.1.10 REMARKETING

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 CANADA FLEET MANAGEMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: CANADA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 ELEMENT FLEET MANAGEMENT CORP.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 SOLUTION PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 VERIZON

21.2.1 COMPANY SNAPSHOT

21.2.3 SOLUTION PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 GEOTAB INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 SOLUTION PORTFOLIO

21.3.3 RECENT DEVELOPMENTS

21.4 MOTIVE TECHNOLOGIES, INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 JIM PATTISON LEASE (A SUBSIDIARY OF THE JIM PATTISON GROUP)

21.5.1 COMPANY SNAPSHOT

21.5.2 SOLUTION PORTFOLIO

21.5.3 RECENT DEVELOPMENT

21.6 ADDISON LEASING OF CANADA LTD

21.6.1 COMPANY SNAPSHOT

21.6.2 SOLUTION PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 ALD AUTOMOTIVE

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 SOLUTION PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 AT&T INTELLECTUAL PROPERTY

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 SOLUTION PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 CISCO SYSTEMS, INC.

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 SOLUTION PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 CONTINENTAL AG

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 SOLUTION PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 DENSO CORPORATION

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 SOLUTION PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 DONLEN

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 SOLUTION PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 FOSS NATIONAL LEASING LTD.

21.13.1 COMPANY SNAPSHOT

21.13.2 SOLUTION PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 HOLMAN, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 SOLUTION PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 IBM CORPORATION

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 SOLUTION PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 MENDIX TECHNOLOGY BV

21.16.1 COMPANY SNAPSHOT

21.16.2 SOLUTION PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 OMNITRACS

21.17.1 COMPANY SNAPSHOT

21.17.2 SOLUTION PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 ORBCOMM

21.18.1 COMPANY SNAPSHOT

21.18.2 SOLUTION PORTFOLIO

21.18.3 RECENT DEVELOPMENT

21.19 RAM TRACKING

21.19.1 COMPANY SNAPSHOT

21.19.2 SOLUTION PORTFOLIO

21.19.3 RECENT DEVELOPMENTS

21.2 ROBERT BOSCH GMBH

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 SOLUTION PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

21.21 SAMSARA INC.

21.21.1 COMPANY SNAPSHOT

21.21.2 SOLUTION PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SIEMENS

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 SOLUTION PORTFOLIO

21.22.4 RECENT DEVELOPMENTS

21.23 SIERRA WIRELESS

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 SOLUTION PORTFOLIO

21.23.4 RECENT DEVELOPMENT

21.24 SUMMIT FLEET LEASING AND MANAGEMENT LEASING AND MANAGEMENT

21.24.1 COMPANY SNAPSHOT

21.24.2 SOLUTION PORTFOLIO

21.24.3 RECENT DEVELOPMENTS

21.25 TRANSFLO

21.25.1 COMPANY SNAPSHOT

21.25.2 SOLUTION PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 WHEELS INC.

21.26.1 COMPANY SNAPSHOT

21.26.2 SOLUTION PORTFOLIO

21.26.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

Lista de Tablas

TABLE 1 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 2 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 3 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 CANADA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 CANADA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 CANADA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 9 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 CANADA LIGHT COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 CANADA VANS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 CANADA PASSENGER CARS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 CANADA HEAVY COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 CANADA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 CANADA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 18 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 20 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 21 CANADA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 CANADA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 36 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 39 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 54 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 57 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 60 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 63 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 66 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 CANADA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 CANADA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 CANADA FLEET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 CANADA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CANADA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 CANADA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 CANADA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 9 CANADA FLEET MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 10 CANADA FLEET MANAGEMENT MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND OF FULL SERVICE LEASING IS EXPECTED TO DRIVE THE CANADA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA FLEET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF CANADA FLEET MANAGEMENT MARKET

FIGURE 15 CANADA FLEET MANAGEMENT MARKET: BY FUNCTIONS, 2022

FIGURE 16 CANADA FLEET MANAGEMENT MARKET: BY OPERATIONS, 2022

FIGURE 17 CANADA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2022

FIGURE 18 CANADA FLEET MANAGEMENT MARKET: BY LEASE TYPE, 2022

FIGURE 19 CANADA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2022

FIGURE 20 CANADA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2022

FIGURE 21 CANADA FLEET MANAGEMENT MARKET: BY HARDWARE, 2022

FIGURE 22 CANADA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2022

FIGURE 23 CANADA FLEET MANAGEMENT MARKET: BY COMMUNIATION RANGE, 2022

FIGURE 24 CANADA FLEET MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 CANADA FLEET MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 26 CANADA FLEET MANAGEMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 27 CANADA FLEET MANAGEMENT MARKET: END USER, 2022

FIGURE 28 CANADA FLEET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.