Asia Pacific Weight Loss And Obesity Management Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5,983.74 Million

USD

12,632.55 Million

2021

2029

USD

5,983.74 Million

USD

12,632.55 Million

2021

2029

| 2022 –2029 | |

| USD 5,983.74 Million | |

| USD 12,632.55 Million | |

|

|

|

Mercado de pérdida de peso y control de la obesidad en Asia-Pacífico, por tipo de producto (suplementos dietéticos y sustitutos de comidas), forma del producto (geles blandos, tabletas, cápsulas, polvos, gomitas y jaleas, premezclas, líquidos y otros), naturaleza (convencional y con etiqueta limpia), categoría (con receta y sin receta (OTC)), demografía del usuario final (menores de 18 años, de 18 a 35 años, de 35 a 50 años y más de 50 años), canal de distribución (en tiendas y no en tiendas), país (Japón, China, Corea del Sur, India, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas y resto de Asia-Pacífico), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado de pérdida de peso y control de la obesidad en Asia-Pacífico

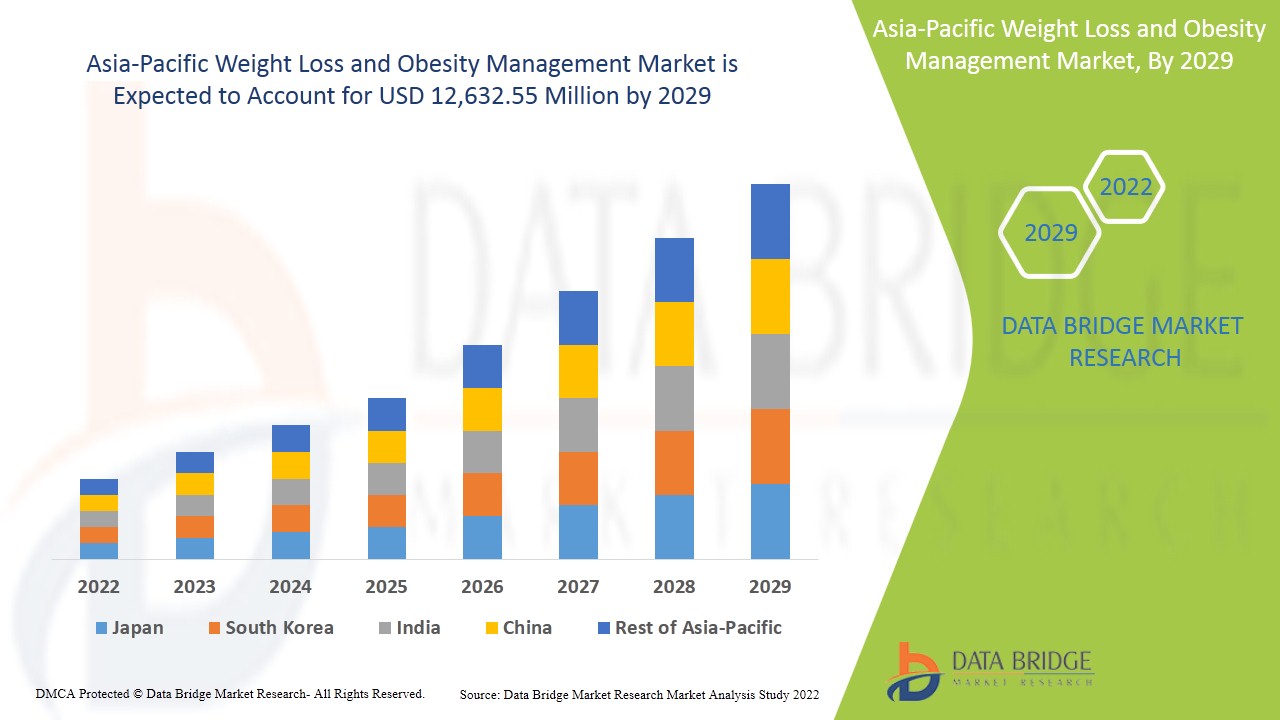

Se espera que el mercado de Asia-Pacífico crezca en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 9,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 12.632,55 millones para 2029 desde USD 5.983,74 millones en 2021. La creciente demanda de bebidas no alcohólicas, incluidos los jugos de frutas y las bebidas energéticas, impulsa el crecimiento del mercado de pérdida de peso y control de la obesidad en Asia-Pacífico.

La obesidad afecta la salud de una persona de varias maneras, como por ejemplo, puede aumentar los riesgos de enfermedades crónicas y reducir la esperanza de vida de las personas. Se utilizan diversas dietas, dispositivos y medicamentos con el fin de controlar o reducir el peso en personas obesas en estos programas de manejo. Se mide por el índice de masa corporal (IMC). Varios métodos utilizados para el control de la pérdida de peso y la obesidad son los medicamentos, los suplementos dietéticos, la cirugía para bajar de peso y el ejercicio. Según la información de la Organización Mundial de la Salud (OMS), cuando el índice de masa corporal es mayor o igual a 25, la persona se clasifica como con sobrepeso y el índice de masa corporal (IMC) superior a 30 se clasifica como obesa.

Se espera que el aumento de la cantidad de casos de obesidad entre la población de Asia y el Pacífico impulse el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Se espera que el aumento de la prevalencia de enfermedades crónicas, como la hipertensión y la diabetes, causado por el aumento en la adopción de patrones de vida poco saludables y sedentarios y el aumento en la cantidad de cirugías bariátricas aceleren el crecimiento del mercado de la pérdida de peso y el control de la obesidad.

- Además, el aumento de la preferencia por la comida chatarra, la inactividad física, la rutina agitada y el creciente estrés están provocando que las personas consuman comida rápida, lo que influirá aún más en el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Además, la creciente adopción de programas de pérdida de peso y control del peso en línea, las iniciativas gubernamentales para crear conciencia y el aumento de los ingresos disponibles en las economías en desarrollo afectarán positivamente el crecimiento del mercado de la pérdida de peso y el control de la obesidad. Además, el aumento de la tasa de obesidad infantil y las naciones emergentes amplían las oportunidades rentables para el mercado de la pérdida de peso y el control de la obesidad.

El informe de mercado de pérdida de peso y control de la obesidad en Asia-Pacífico proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de pérdida de peso y control de la obesidad en Asia-Pacífico, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de pérdida de peso y control de la obesidad en Asia-Pacífico

El mercado de pérdida de peso y control de la obesidad de Asia-Pacífico está segmentado en seis segmentos notables según el tipo de producto, la forma del producto, la naturaleza, la categoría, la demografía del usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo de producto, el mercado de pérdida de peso y control de la obesidad de Asia-Pacífico se segmenta en suplementos dietéticos y sustitutos de comidas. En 2022, se espera que el segmento de suplementos dietéticos domine el mercado debido al aumento de la población obesa y la creciente conciencia de los consumidores sobre los alimentos y bebidas bajos en calorías en las economías en desarrollo.

- En función de la forma del producto, el mercado de pérdida de peso y control de la obesidad de Asia-Pacífico se segmenta en geles blandos, tabletas, cápsulas, polvos, gomitas y gelatinas, premezclas, líquidos y otros. En 2022, se espera que el segmento de polvos domine el mercado debido a la facilidad de uso de la forma en polvo en comparación con otras formas de pérdida de peso y control de la obesidad.

- En función de la naturaleza, el mercado de pérdida de peso y control de la obesidad de Asia-Pacífico se segmenta en productos convencionales y de etiqueta limpia. En 2022, se espera que el segmento convencional domine el mercado debido a la creciente demanda de productos orgánicos y de cultivo natural.

- Según la categoría, el mercado de pérdida de peso y control de la obesidad de Asia-Pacífico se segmenta en medicamentos recetados y de venta libre (OTC). En 2022, se espera que el segmento de venta libre (OTC) domine el mercado debido a la creciente popularidad de los medicamentos de venta libre para la pérdida de peso y el control de la obesidad.

- En función del usuario final, el mercado de pérdida de peso y control de la obesidad de Asia-Pacífico se segmenta en menores de 18 años, de 18 a 35 años, de 35 a 50 años y mayores de 50 años. En 2022, se espera que el segmento de 18 a 35 años domine el mercado debido al aumento de la tasa de obesidad infantil.

- En función del canal de distribución, el mercado de pérdida de peso y control de la obesidad de Asia-Pacífico se segmenta en el segmento basado en tiendas y el segmento no basado en tiendas. En 2022, se espera que el segmento no basado en tiendas domine el mercado debido a la pandemia emergente de COVID-19.

- Según la geografía, el mercado de la pérdida de peso y el control de la obesidad se segmenta en cinco regiones geográficas: América del Norte, Europa, Asia-Pacífico, América del Sur y Oriente Medio y África. Las regiones se segmentan además en países importantes como India, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico. En 2022, se espera que Japón domine el mercado debido al aumento de los ingresos disponibles junto con los cambios en los estilos de vida debido a la rápida urbanización.

Análisis a nivel de país del mercado de pérdida de peso y control de la obesidad en Asia-Pacífico

El mercado de pérdida de peso y control de la obesidad de Asia-Pacífico está segmentado en seis segmentos notables según el tipo de producto, la forma del producto, la naturaleza, la categoría, la demografía del usuario final y el canal de distribución.

Los países cubiertos en el informe del mercado de pérdida de peso y control de la obesidad de Asia-Pacífico son Japón, China, Corea del Sur, India, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico.

Se espera que el segmento de tipo en la región de Asia-Pacífico crezca a la tasa de crecimiento más alta en el período de pronóstico de 2022 a 2029 debido al crecimiento de las inversiones y colaboraciones en el negocio de pérdida de peso y control de la obesidad. El segmento de tipo de producto en Japón domina el mercado de Asia-Pacífico debido al aumento de los ingresos disponibles junto con los estilos de vida cambiantes debido a la rápida urbanización.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar la conciencia sobre la pérdida de peso y el control de la obesidad están impulsando el crecimiento del mercado de pérdida de peso y control de la obesidad en Asia-Pacífico

El mercado de pérdida de peso y control de la obesidad de Asia-Pacífico también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y la cuota de mercado de la pérdida de peso y el control de la obesidad en Asia-Pacífico

El panorama competitivo del mercado de pérdida de peso y control de la obesidad en Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de pérdida de peso y control de la obesidad en Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de pérdida de peso y control de la obesidad en Asia-Pacífico son Herbalife International of America, Inc., ABH Pharma Inc., Vitaco, Amway Corp., Stepan Company, GNC Holdings, LLC, GlaxoSmithKline plc., Glanbia PLC, Abbott, Shaklee Corporation, Nu Skin Enterprises, Atlantic Multipower UK Ltd., Nature's Sunshine Products, Inc., Ajinomoto Co., Inc., Bionova, DSM, American Health, Omega Protein Corporation, Integrated BioPharma, Inc., Bio-Tech Pharmacal, The Himalaya Drug Company, Pharmavite, Ricola, BLACKMORES, entre otros.

Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Muchos lanzamientos de productos también son iniciados por empresas de todo el mundo, lo que también acelera el mercado de pérdida de peso y control de la obesidad en Asia-Pacífico.

Por ejemplo,

- En julio de 2021, según Cision US Inc., Body Complete Rx (BCRX) lanzó su línea TRIM, sus exclusivos suplementos veganos y de origen vegetal para el control del peso en The Vitamin Shoppe. El suplemento ofrece beneficios como mejorar la energía, la nutrición y ayudar a controlar el peso.

- En octubre de 2020, según GlobeNewswire, Inc., Meticore lanzó un nuevo suplemento para bajar de peso para hombres y mujeres. El suplemento ayuda a estimular el metabolismo, ya que ayuda a aumentar la temperatura de las células internas, lo que da como resultado la regeneración del metabolismo. La fórmula está hecha con la ayuda de seis nutrientes vegetales de calidad superior y extractos de hierbas combinados con píldoras Meticore.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias del actor del mercado mejoran la presencia de la empresa en el mercado de pérdida de peso y gestión de la obesidad de Asia-Pacífico, lo que también beneficia el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS (HERBAL SUPPLEMENTS VS SYNTHETIC SUPPLEMENTS)

4.2 PRICING ANALYSIS FOR WEIGHT LOSS & OBESITY MANAGEMENT SUPPLEMENTS-

4.3 VALUE CHAIN FOR ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

4.4 SUPPLY CHAIN OF ASIA-PACIFIC WEIGHT LOSS & OBESITY MANAGEMENT MARKET

4.5 BRAND COMPARATIVE ANALYSIS

4.6 CLEAN LABELED PRODUCT LAUNCHES

4.7 CONSUMER TRENDS

4.8 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

4.9 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING RATES IN CHRONIC DISEASES

6.1.2 INCREASING PREVALENCE OF OBESITY

6.1.3 INCREASE IN GERIATRIC POPULATION

6.1.4 INCREASING BARIATRIC SURGERIES

6.2 RESTRAINTS

6.2.1 STRINGENT RULES & REGULATIONS

6.2.2 HIGH COST ASSOCIATED WITH THE LOW-CALORIE DIETS

6.3 OPPORTUNITIES

6.3.1 RISING DISPOSABLE INCOME ENHANCING THE PURCHASING POWER OF RELATED WEIGHT LOSS PRODUCTS

6.3.2 GROWING CONSUMPTION OF PROCESSED FOOD

6.3.3 RISE IN STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS IN LOWER INCOME COUNTRIES

6.4.2 INCREASE IN PRODUCT RECALL

7 IMPACT OF COVID-19 ON THE ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

7.1 AFTERMATH OF COVID-19

7.2 IMPACT ON DEMAND AND SUPPLY CHAIN

7.3 IMPACT ON PRICE

7.4 CONCLUSION

8 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIETARY SUPPLEMENTS

8.2.1 SUPPLEMENT TYPE

8.2.1.1 Herbal/Natural

8.2.1.2 Synthetic

8.2.2 ACTIVE INGREDIENT TYPE

8.2.2.1 Green Tea Extract

8.2.2.2 Chitosan

8.2.2.3 Pyruvate

8.2.2.4 Probiotics

8.2.2.5 Conjugated Linoleic Acid

8.2.2.6 Green Coffee Bean Extract

8.2.2.7 Caffeine

8.2.2.8 Chromium

8.2.2.9 Bitter Orange (Citrus Aurantium L.)

8.2.2.10 Carnitine

8.2.2.11 African Mango (Irvingia Gabonensis)

8.2.2.12 White Kidney Bean (Phaseolus Vulgaris)

8.2.2.13 Others

8.3 MEAL REPLACEMENTS

8.3.1 POWDERED MIXES

8.3.2 READY TO DRINK BEVERAGES/SHAKES

8.3.3 PROTEIN BARS

8.3.4 OTHERS

9 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 POWDERS

9.3 CAPSULE

9.4 LIQUIDS

9.5 TABLETS

9.6 PREMIXES

9.7 SOFT GELS

9.8 GUMMIES & JELLIES

9.9 OTHERS

10 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED

10.2.1 PHARMACIES

10.2.2 SPECIALTY STORES

10.2.3 HEALTH AND BEAUTY STORES

10.2.4 CONVENIENCE STORE

10.2.5 SUPERMARKET/HYPERMARKET

10.2.6 OTHERS

10.3 NON STORED BASED

10.3.1 ONLINE (THIRD PARTY ONLINE RETAILERS)

10.3.2 COMPANY OWNED WEBSITE

11 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY

11.1 OVERVIEW

11.2 TO 35 YEARS

11.3 TO 50 YEARS

11.4 ABOVE 50 YEARS

11.5 UNDER 18 YEARS

12 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 INDIA

12.1.4 AUSTRALIA

12.1.5 SOUTH KOREA

12.1.6 MALAYSIA

12.1.7 THAILAND

12.1.8 SINGAPORE

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 MOST OBESE COUNTRIES OF ASIA-PACIFIC 2020

TABLE 2 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA-PACIFIC DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC POWDERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC CAPSULE IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC LIQUIDS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC TABLETS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC PREMIXES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC SOFT GELS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC GUMMIES & JELLIES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC OTHERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION))

TABLE 18 ASIA-PACIFIC STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 ASIA-PACIFIC NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC 18 TO 35 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC 35 TO 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC ABOVE 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC UNDER 18 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 37 JAPAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 JAPAN DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 JAPAN DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 40 JAPAN MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 JAPAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 42 JAPAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 43 JAPAN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 JAPAN STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 45 JAPAN NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 46 CHINA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CHINA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CHINA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 51 CHINA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 52 CHINA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 CHINA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 54 CHINA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 55 INDIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 INDIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 57 INDIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 58 INDIA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 INDIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 60 INDIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 61 INDIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 INDIA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 63 INDIA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 64 AUSTRALIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 69 AUSTRALIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 72 AUSTRALIA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 73 SOUTH KOREA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 81 SOUTH KOREA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 82 MALAYSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 85 MALAYSIA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 MALAYSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 87 MALAYSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 88 MALAYSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 MALAYSIA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 90 MALAYSIA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 91 THAILAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 THAILAND DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 93 THAILAND DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 94 THAILAND MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 THAILAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 96 THAILAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 97 THAILAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 THAILAND STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 99 THAILAND NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 100 SINGAPORE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 108 SINGAPORE NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 109 INDONESIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 114 INDONESIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 INDONESIA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 117 INDONESIA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 118 PHILIPPINES WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 PHILIPPINES DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 120 PHILIPPINES DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 121 PHILIPPINES MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 PHILIPPINES WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 123 PHILIPPINES WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 124 PHILIPPINES WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 PHILIPPINES STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 126 PHILIPPINES NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 127 REST OF ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET : DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: ASIA-PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DBMR POSITION GRID

FIGURE 8 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN OBESE POPULATION IS DRIVING THE GROWTH OF ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 DIETARY SUPPLEMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN 2022 & 2029

FIGURE 12 SUPPLY CHAIN OF WEIGHT LOSS & OBESITY MANAGEMENT MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

FIGURE 14 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT FORM, 2021

FIGURE 16 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 17 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2021

FIGURE 18 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 23 ASIA-PACIFIC WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.