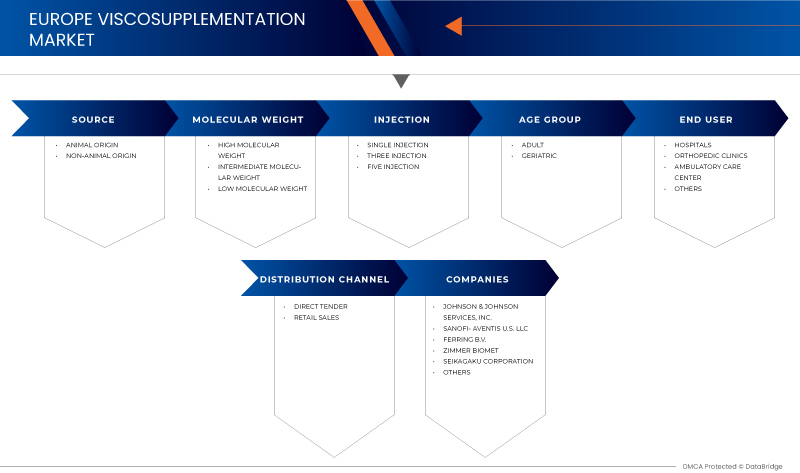

Mercado de viscosuplementación de Asia y el Pacífico, por fuente (origen animal y origen no animal), grupo de edad (geriátrico y adultos), inyección (inyección única, tres inyecciones y cinco inyecciones), peso molecular (peso molecular intermedio, peso molecular bajo y peso molecular alto), usuario final (hospital, clínicas ortopédicas, centros de atención ambulatoria y otros), canal de distribución (licitación directa y ventas minoristas).

Análisis y perspectivas del mercado de viscosuplementación en Asia-Pacífico

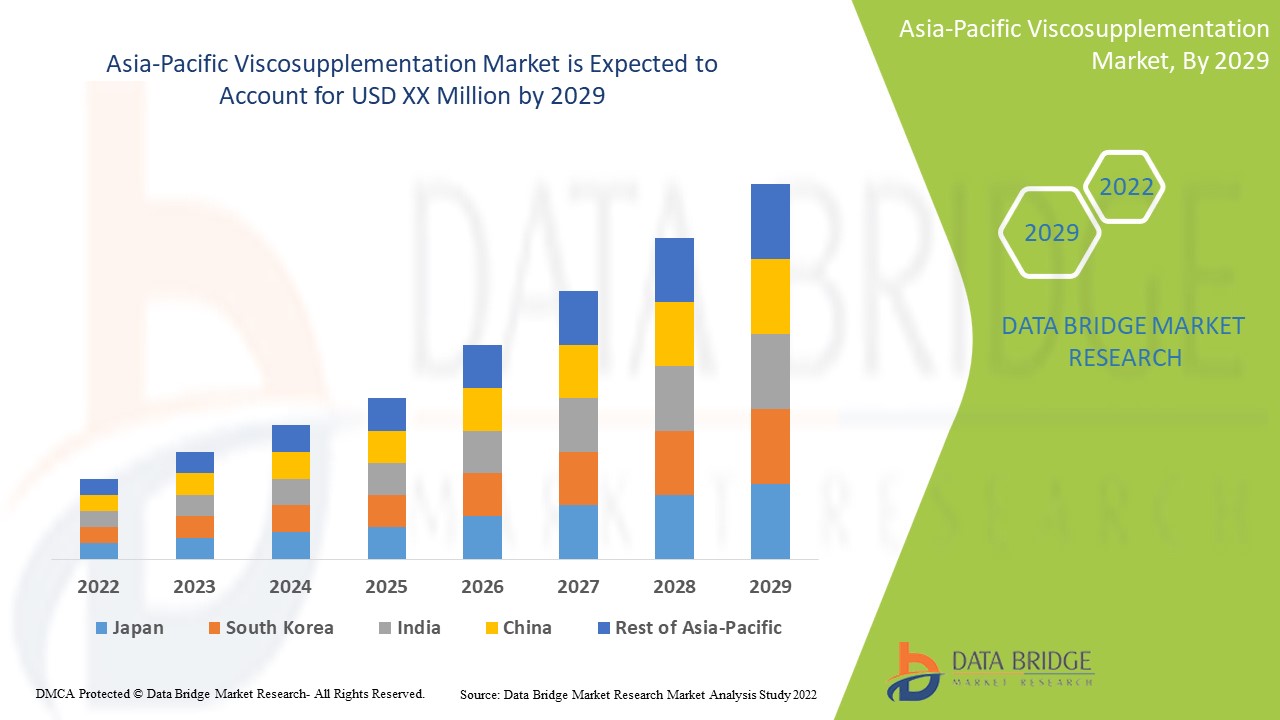

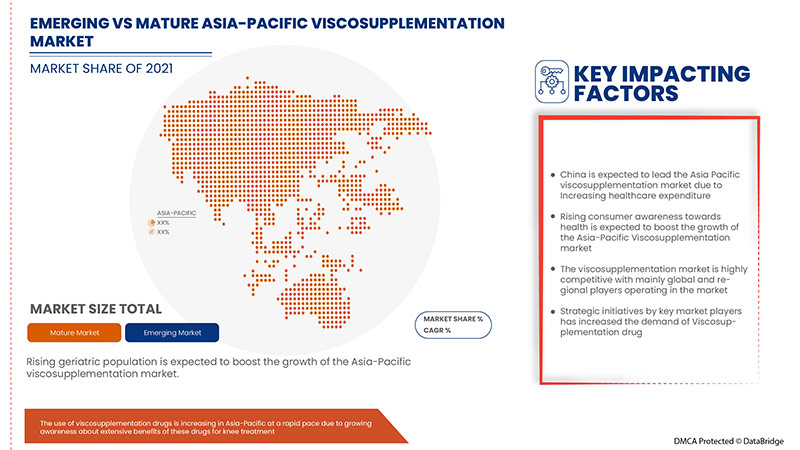

Se espera que el mercado de viscosuplementación de Asia-Pacífico gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 9,6% en el período de pronóstico de 2022 a 2029. Los avances tecnológicos en los tratamientos de viscosuplementación aumentan en el sector de la salud son otro factor que impulsa el crecimiento del mercado de viscosuplementación de Asia-Pacífico en el período de pronóstico.

Sin embargo, el alto costo asociado con los tratamientos y los efectos secundarios, como la inyección temporal, el dolor en el lugar, la hinchazón, el calor y la pérdida de enrojecimiento, limitarán el crecimiento del mercado. La adopción de alianzas estratégicas, como asociaciones y adquisiciones, por parte de actores clave del mercado actúa como una oportunidad para el crecimiento del mercado de viscosuplementación en Asia-Pacífico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD Volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por origen (origen animal y origen no animal), grupo de edad (geriátrico y adultos), inyección (inyección única, tres inyecciones y cinco inyecciones), peso molecular (peso molecular intermedio, peso molecular bajo y peso molecular alto), usuario final (hospital, clínicas ortopédicas, centros de atención ambulatoria y otros), canal de distribución (licitación directa y ventas minoristas) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Australia, Tailandia, Vietnam, Malasia, Taiwán, Indonesia, Filipinas y resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

Algunos de los actores clave que operan en el mercado de viscosuplementación de Asia y el Pacífico son Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici SPA, Ferring BV, sanofi-aventis US LLC, Zimmer Biomet, OrthogenRx, Inc. (una subsidiaria de AVNS ), APTISSEN, Johnson & Johnson Services, Inc., LG Chem., Viatris Inc., Instituto IBSA Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (subsidiaria de Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (subsidiaria de Emcure Pharmaceuticals), entre otras. |

Definición de mercado

El desarrollo del paradigma terapéutico de la viscosuplementación para el alivio duradero del dolor en articulaciones humanas y animales con osteoartritis o artritis traumática se basó en el hallazgo de que en condiciones artríticas, el peso molecular promedio y la concentración de ácido hialurónico disminuyen. En consecuencia, las propiedades elastoviscosas del líquido sinovial se reducen sustancialmente. La viscosuplementación es un proceso terapéutico en el que el líquido o derrame sinovial patológico se extrae de la articulación mediante artrocentesis y se reemplaza con una solución de ácido hialurónico altamente purificada que tiene una concentración de 16 a 30 veces mayor que el líquido articular patológico, y una concentración de 2 a 5 veces mayor que la del ácido hialurónico en el líquido sinovial sano. En algunas preparaciones de ácido hialurónico utilizadas actualmente con fines terapéuticos, las propiedades reológicas (viscosidad y elasticidad) son bajas. Por lo tanto, la elastoviscosidad del líquido es similar a la del líquido extraído de una articulación artrítica. Otra preparación disponible para pacientes en todo el mundo está compuesta por derivados de hialuronano (hilanos) con una elastoviscosidad sustancialmente mayor que las soluciones de hialuronano. Tiene propiedades reológicas comparables a las del líquido que se encuentra en individuos jóvenes y sanos. El beneficio clínico de la viscosuplementación es el alivio duradero del dolor en las articulaciones artríticas.

Además, la creciente demanda de tratamientos no quirúrgicos para la osteoartritis, la prevalencia de trastornos inducidos por el estilo de vida y los avances en el desarrollo de terapias basadas en ácido hialurónico son algunos de los factores que se espera que impulsen el mercado.

Dinámica del mercado

Conductores

- Aumento de la población geriátrica

Con el aumento de la edad se produce un aumento recíproco de pacientes de edad avanzada ingresados en los hospitales debido a lesiones traumáticas fatales. La creciente prevalencia de enfermedades de osteoartritis de rodilla aumenta la demanda de diagnóstico y tratamiento. Con el crecimiento de la población, aumenta la presión sobre el sistema de atención sanitaria. La creciente necesidad de un tratamiento adecuado aumenta proporcionalmente la demanda de atención, servicios y tecnologías para la prevención y el tratamiento de las afecciones de osteoartritis de rodilla, como la sarcopenia, la osteoporosis , la osteopenia y otras complicaciones. La población de edad avanzada es más propensa a estas afecciones, lo que conduce a huesos y articulaciones frágiles. En estos pacientes, se utiliza la viscosuplementación en el procedimiento para proporcionarles beneficios inmediatos y eficientes asociados con sus cuerpos.

Con el aumento de la edad y la prevalencia de la osteoartritis, también aumenta la demanda de diagnóstico temprano de las enfermedades. Por lo tanto, aumenta la necesidad de viscosuplementación para el tratamiento en el sistema de salud en todo el mundo.

- Aumento del riesgo de osteoporosis y osteoartritis

La osteoporosis es una enfermedad de los huesos que progresa debido a una menor densidad mineral ósea y masa ósea o debido a alguna variación en la calidad o estructura del hueso. La osteoporosis puede aumentar el riesgo de fracturas que conducen a la rotura de huesos debido a la disminución de la resistencia ósea. Se observa más en mujeres en comparación con hombres. Las mujeres posmenstruales a menudo sufren fracturas óseas debido a la osteoporosis, ya que la enfermedad es silenciosa y generalmente no muestra síntomas. La mayoría de las personas mayores son más propensas a la osteoporosis. La osteoartritis es una enfermedad de las articulaciones o una inflamación de las articulaciones y los tejidos circundantes. La movilidad de una persona se ve afectada cuando ocurren estas afecciones.

Las enfermedades silenciosas como la osteoporosis y la osteoartritis no presentan síntomas y debilitan los huesos de la persona, lo que lleva a muertes importantes como malformaciones de la columna, fracturas, caídas repentinas o roturas de huesos, entre otras. Por lo tanto, el aumento de los riesgos de estas afecciones aumenta directamente la demanda de viscosuplementación necesaria para tratar las malformaciones debidas a dichas afecciones. Por lo tanto, se prevé que el aumento del riesgo de osteoporosis y osteoartritis impulse el crecimiento del mercado de viscosuplementación en Asia y el Pacífico.

Restricción

- Falta de experiencia técnica

Encontrar, atraer y contratar talentos es también el primer paso para crear una plantilla profesional de ingenieros y técnicos. Incluso en las mejores circunstancias, este procedimiento puede resultar complicado. La fuerza laboral existente en el sector manufacturero está envejeciendo y jubilándose rápidamente. En la industria médica, hay escasez de habilidades STEM (ciencia, tecnología, ingeniería y matemáticas). Aunque la demanda de trabajadores cualificados (técnicos) y de habilidades de pregrado y posgrado (ingenieros) sigue siendo fuerte en el sector manufacturero, la cantidad de personas con las habilidades necesarias se está acercando a un goteo. Solo los profesionales capacitados deberían realizar la viscosuplementación, pero esta cantidad es mucho menor en todo el mundo, ya que estos procedimientos son complejos.

Sin embargo, formar una buena fuerza laboral de fabricación aditiva (FA) implica algo más que simplemente encontrar y contratar candidatos calificados. Los empleados deben estar calificados para mantenerse actualizados y mantener las habilidades requeridas a medida que la tecnología cambia y crece. Incluso con su educación centrada en STEM, los ingenieros recién graduados seguramente necesitarán capacitación en el trabajo en técnicas de FA, que es uno de los principales desafíos de reclutarlos y contratarlos. De hecho, muchos programas de ingeniería de pregrado brindan poca educación específica en FA y, como resultado, muchos graduados pueden carecer de las habilidades de FA que buscan los empleadores.

Por lo tanto, la falta de experiencia técnica puede actuar como un freno al crecimiento del mercado.

Oportunidad

-

Seguridad y eficacia del ácido hialurónico intraarticular (IAHA)

Existen varios tipos de inyecciones de ácido hialurónico, también llamadas viscosuplementación, que se utilizan para la osteoartritis de rodilla. Se elaboran a partir de crestas de gallo o de pollo o se derivan de bacterias y se inyectan directamente en la articulación. El ácido hialurónico intraarticular es un tratamiento aprobado por la Administración de Alimentos y Medicamentos de los EE. UU. para la osteoartritis de rodilla (OA). La inyección de ácido hialurónico intraarticular (IAHA) presenta una opción de tratamiento local alternativa que proporciona un beneficio sintomático sin los efectos adversos sistémicos asociados con los corticosteroides IA. Numerosos ECA y metanálisis han buscado evaluar la eficacia y la seguridad de IAHA, con resultados y conclusiones mixtos. Se ha demostrado que IAHA tiene un efecto positivo sobre el dolor y la función articular. También hay datos cada vez mayores que muestran que múltiples cursos de IAHA pueden afectar los resultados a largo plazo, incluida una reducción en el uso concomitante de analgésicos y un retraso en la necesidad de una cirugía de reemplazo total de rodilla.

Desafío

- Políticas gubernamentales estrictas para EL USO de viscosuplementación

La comercialización de viscosuplementación en todo el mundo por parte de diversos actores clave del mercado se ve facilitada por el cumplimiento de los marcos regulatorios establecidos por muchos países en todo el mundo. La aprobación previa a la comercialización de varios dispositivos médicos varía de un país a otro. La Ley de Alimentos, Medicamentos y Cosméticos de los EE. UU. ("FD&C Act") clasifica los dispositivos médicos en los EE. UU. La Unión Europea (UE) regula los dispositivos médicos en Europa. Sin embargo, el rápido desarrollo de políticas y regulaciones de privacidad se está realizando en Asia-Pacífico y EMEA, incluidos India, Rusia, China, Corea del Sur, Singapur, Hong Kong y Australia.

La viscosuplementación está regulada por una estructura de leyes, normas y reglamentos que son extensos y complejos para salvaguardarlos de su uso en cualquier tratamiento potencialmente dañino.

La viscosuplementación actúa como reemplazo de las partes del cuerpo dañadas, lesionadas o infectadas en casos de osteoartritis o accidentes deportivos entre los pacientes, además de mantener la demanda del paciente de un buen movimiento corporal. Sin embargo, cualquier descuido afectará la seguridad y la estructura corporal del paciente.

Por lo tanto, las estrictas normas y regulaciones para el uso de viscosuplementación pueden actuar como un desafío para el crecimiento del mercado.

Impacto posterior al COVID-19 en el mercado de viscosuplementación de Asia-Pacífico

La COVID-19 ha provocado un aumento sustancial de la demanda de suministros médicos por parte de los profesionales sanitarios y del público en general como medida de precaución. Los fabricantes de estos artículos tienen la oportunidad de aprovechar la mayor demanda de suministros médicos garantizando un suministro constante de equipos de protección personal en el mercado. Se prevé que la COVID-19 tenga un gran impacto en el mercado de viscosuplementación de Asia y el Pacífico.

Alcance y tamaño del mercado de viscosuplementación en Asia-Pacífico

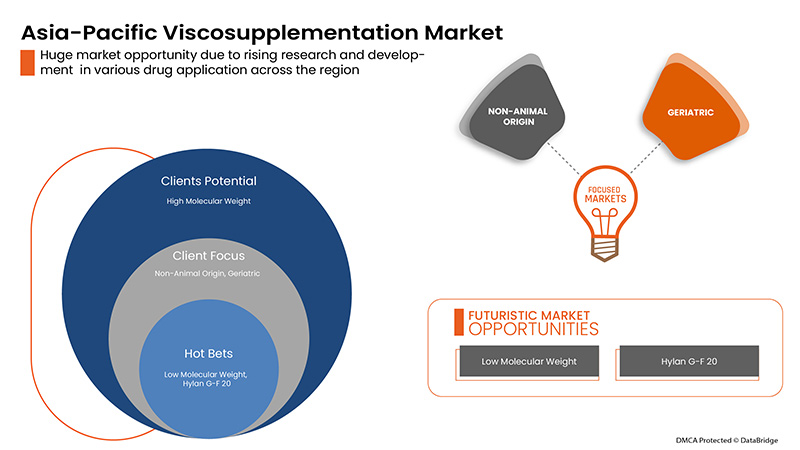

El mercado de viscosuplementación de Asia-Pacífico está segmentado en función de la fuente, el grupo de edad, el peso molecular, la inyección, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

POR FUENTE

- ORIGEN ANIMAL

- ORIGEN NO ANIMAL

Sobre la base de la fuente, el mercado de viscosuplementación se segmenta en origen animal y origen no animal.

POR PESO MOLECULAR

- ALTO PESO MOLECULAR

- BAJO PESO MOLECULAR

- PESO MOLECULAR INTERMEDIO

Sobre la base del peso molecular, el mercado de viscosuplementación se segmenta en peso molecular intermedio, bajo peso molecular y alto peso molecular.

POR INYECCIÓN

- INYECCIÓN ÚNICA

- TRES INYECCIONES

- CINCO INYECCIONES

Sobre la base de la inyección, el mercado de viscosuplementación se segmenta en inyección única, tres inyecciones y cinco inyecciones.

POR GRUPO DE EDAD

- ADULTOS

- GERIATRÍA

Según el grupo de edad, el mercado de viscosuplementación se segmenta en geriátrico y adultos.

USUARIO FINAL

- HOSPITALES

- CLÍNICA ORTOPÉDICA

- ATENCIÓN MÉDICA DOMICILIARIA

- OTROS

Sobre la base del usuario final, el mercado de viscosuplementación se segmenta en hospitales, clínicas ortopédicas, centros de atención ambulatoria y otros.

POR CANAL DE DISTRIBUCIÓN

- LICITACIÓN DIRECTA

- VENTAS AL POR MENOR

Sobre la base del canal de distribución, el mercado de viscosuplementación se segmenta en licitación directa y ventas minoristas.

Análisis del mercado de viscosuplementación a nivel de país

Se analiza el mercado de viscosuplementación y se proporciona información sobre el tamaño del mercado por fuente, grupo de edad, peso molecular, inyección, usuario final y canal de distribución.

Los países cubiertos en el informe del mercado de viscosuplementación son China, Japón, India, Corea del Sur, Singapur, Australia, Tailandia, Vietnam, Malasia, Taiwán, Indonesia, Filipinas y el resto de Asia-Pacífico.

En 2022, China dominará debido a la creciente demanda de tratamientos no quirúrgicos para la osteoartritis con un PIB elevado. Se espera que China crezca debido al aumento de los avances tecnológicos en los tratamientos farmacológicos.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de Asia-Pacífico y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales que impactan en los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

El mercado de viscosuplementación también le ofrece un análisis detallado del mercado de cada país en cuanto al crecimiento de la industria de la salud. Además, proporciona información detallada sobre los servicios y tratamientos de atención médica, el impacto de los escenarios regulatorios y los parámetros de tendencia con respecto al mercado de viscosuplementación.

Análisis del panorama competitivo y de la cuota de mercado de viscosuplementación en Asia-Pacífico

El panorama competitivo del mercado de la viscosuplementación proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de la aplicación y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con los tratamientos de viscosuplementación.

Las principales empresas que operan en el mercado de la viscosuplementación son Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici SPA, Ferring BV, sanofi-aventis US LLC, Zimmer Biomet, OrthogenRx, Inc. (una subsidiaria de AVNS), APTISSEN. , Johnson & Johnson Services, Inc., LG Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (subsidiaria de Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (subsidiaria de Emcure Pharmaceuticals), entre otras

Se espera que las alianzas estratégicas como fusiones, adquisiciones y acuerdos entre los actores clave del mercado aceleren aún más el crecimiento de los tratamientos de viscosuplementación.

Por ejemplo,

- En mayo de 2022, Fidia Farmaceutici SpA aprovecha el poder regenerativo del ácido hialurónico con su innovador portfolio lanzado en España

Fidia Farmaceutici SpA presentó su cartera de productos para el cuidado estético con un simposio científico sobre su innovadora tecnología ACP (polímero auto-reticulado) en el 20º Congreso Mundial de Medicina Estética y Antienvejecimiento 2022 (AMWC) en Montecarlo. La empresa ha lanzado su cartera completa Hyal System y Hy-Tissue en España. Esto ha ayudado a la empresa a mostrar su investigación sobre el ácido hialurónico.

- En junio de 2022, Johnson & Johnson anunció nuevos datos de estudios de fase 3 que demuestran que los pacientes tratados con el medicamento lograron una eficacia constante a largo plazo durante dos años en todos los dominios de la artritis psoriásica (APs) activa, incluidos los criterios de valoración de articulaciones, piel, entesitis, a dactilitis,b dolor espinal y gravedad de la enfermedadc, independientemente de las características iniciales. Esto ha ayudado a la empresa a mostrar su progreso

- En noviembre de 2021, LG Chem inició el desarrollo clínico para el desarrollo de un nuevo tratamiento de próxima generación para la osteoartritis. LG Chem anunció que la empresa había recibido la aprobación del Ministerio de Seguridad Alimentaria y Farmacéutica de Corea para los ensayos clínicos de fase 1b/2 basados en los resultados preclínicos positivos de LG00034053, un nuevo fármaco candidato para el tratamiento de la osteoartritis. LG Chem planea acelerar el desarrollo de nuevos fármacos mediante el diseño de ensayos clínicos que vinculen las fases 1 y 2.

Esto ha ayudado a la empresa a buscar nuevos medicamentos para tratar la osteoartritis.

- En noviembre de 2020, Viatris Inc. lanzó una exitosa combinación de Mylan NV y el negocio Upjohn de Pfizer. Al combinar estas dos empresas heredadas complementarias, Viatris cuenta con la experiencia científica, de fabricación y distribución con capacidades comerciales, médicas y regulatorias comprobadas en Asia-Pacífico para entregar medicamentos de alta calidad a pacientes en más de 165 países y territorios. Esto ha ayudado a la empresa a expandir su negocio.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias del actor del mercado mejoran la presencia de la empresa en el mercado de viscosuplementación de Asia y el Pacífico, lo que también beneficia el crecimiento de las ganancias de la organización.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, Asia-Pacífico frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

7 PIPELINE ANALYSIS FOR ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

8 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: REGULATIONS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISING GERIATRIC POPULATION

9.1.2 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS

9.1.3 TECHNOLOGICAL ADVANCEMENT IN VISCOSUPPLEMENTATION

9.1.4 LOW PRODUCTION COST OF VISCOSUPPLEMENTATION PRODUCTS

9.2 RESTRAINTS

9.2.1 LACK OF TECHNICAL EXPERTISE

9.2.2 PRODUCT RECALL PROCEDURES

9.2.3 LIMITED APPLICATIONS OF VISCOSUPPLEMENTATION

9.3 OPPORTUNITIES

9.3.1 SAFETY AND EFFECTIVENESS OF INTRA-ARTICULAR HYALURONIC ACID (IAHA)

9.3.2 RISING HEALTHCARE INFRASTRUCTURE

9.3.3 INCREASE IN DEMAND FOR MINIMALLY INVASIVE PROCEDURES

9.3.4 INCREASING NUMBER OF JOINT REPLACEMENTS AND SPORTS ACCIDENT

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT POLICIES FOR THE USE OF VISCOSUPPLEMENTATION

9.4.2 SIDE-EFFECTS OF VISCOSUPPLEMENTATION

10 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE

10.1 OVERVIEW

10.2 NON-ANIMAL ORIGIN

10.2.1 ORTHOVISC

10.2.2 EUFLEXXA

10.2.3 MONOVISC

10.2.4 DUROLANE

10.2.5 GEL-ONE

10.2.6 SUPARTZ

10.2.7 GELSYN-3

10.2.8 CINGAL

10.2.9 SULPLASYN

10.2.10 VISCOSEAL

10.2.11 OSTEONIL

10.2.12 OTHERS

10.3 ANIMAL ORIGIN

10.3.1 HYLAN G-F 20

10.3.2 SYNVIC ONE

10.3.3 SYNVIC

10.3.4 OTHERS

10.3.5 HYALURONANS

10.3.6 HYALGAN

10.3.7 OTHERS

11 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT

11.1 OVERVIEW

11.2 INTERMEDIATE MOLECULAR WEIGHT

11.2.1 ORTHOVISC

11.2.2 EUFLEXXA

11.2.3 MONOVISC

11.2.4 DUROLANE

11.2.5 VISCOSEAL

11.2.6 OSTEONIL

11.2.7 OTHERS

11.3 LOW MOLECULAR WEIGHT

11.3.1 HYLAGAN

11.3.2 SUPARTZ

11.3.3 GELSYN-3

11.3.4 CINGAL

11.3.5 SULPLASYN

11.3.6 OTHERS

11.4 HIGH MOLECULAR WEIGHT

11.4.1 SYNVIC ONE

11.4.2 SYNVIC

11.4.3 OTHERS

12 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION

12.1 OVERVIEW

12.2 SINGLE INJECTION

12.3 THREE INJECTION

12.4 FIVE INJECTION

13 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

14 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 ORTHOPEDIC CLINICS

14.4 AMBULATORY CARE CENTERS

14.5 OTHERS

15 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.3 DIRECT TENDER

16 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 INDIA

16.1.3 JAPAN

16.1.4 AUSTRALIA

16.1.5 MALAYSIA

16.1.6 THAILAND

16.1.7 SINGAPORE

16.1.8 SOUTH KOREA

16.1.9 INDONESIA

16.1.10 PHILIPPINES

16.1.11 TAIWAN

16.1.12 VIETNAM

16.1.13 REST OF ASIA-PACIFIC

17 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 JOHNSON & JOHNSON SERVICES, INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 BIOVENTUS

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 FERRING B.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 SANOFI-AVENTIS U.S. LLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ZIMMER BIOMET

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 SEIKAGAKU CORPORATION

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ANIKA THERAPEUTICS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 FIDIA FARMACEUTICI S.P.A

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 APTISSEN

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 IBSA INSTITUT BIOCHIMIQUE SA

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 LG CHEM.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 LIFECORE (A SUBSIDIARY OF LANDEC CORPORATION)

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 ORTHOGENRX, INC. (A SUBSIDIARY OF AVNS)

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 ORTOBRAND INTERNATIONAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 TRB CHEMEDICA SA

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS

19.17 VIATRIS INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 VIRCHOW BIOTECH

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 ZUVENTUS HEALTHCARE LTD. (A SUBSIDIARY OF EMCURE PHARMACEUTICALS)

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC NON-ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 5 ASIA PACIFIC ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 9 ASIA PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 11 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SINGLE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC THREE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FIVE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ADULT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC GERIATRIC IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC HOSPITALS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ORTHOPEADIC CLINICS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC AMBULATORY CARE CENTERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC RETAIL SALES IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 37 ASIA-PACIFIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 40 ASIA-PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 42 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 CHINA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 51 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 53 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 54 CHINA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 57 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 58 CHINA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 59 CHINA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 60 CHINA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 CHINA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 62 CHINA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 63 CHINA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 64 CHINA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 CHINA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 INDIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 69 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 70 INDIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 72 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 73 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 74 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 75 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 76 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 77 INDIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 78 INDIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 79 INDIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 80 INDIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 81 INDIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 82 INDIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 83 INDIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 INDIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 JAPAN VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 86 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 87 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 88 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 89 JAPAN ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 91 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 92 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 93 JAPAN VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 94 JAPAN INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 95 JAPAN HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 96 JAPAN VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 97 JAPAN VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 98 JAPAN VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 JAPAN VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 103 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 104 AUSTRALIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 107 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 108 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 119 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 120 MALAYSIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 123 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 124 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 126 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 127 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 THAILAND VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 137 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 138 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 139 THAILAND ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 141 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 142 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 143 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 144 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 145 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 146 THAILAND VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 147 THAILAND INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 148 THAILAND LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 149 THAILAND HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 150 THAILAND VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 151 THAILAND VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 152 THAILAND VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 THAILAND VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 155 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 156 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 157 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 158 SINGAPORE ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 160 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 161 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 162 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 163 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 164 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 165 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 174 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 175 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 176 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 177 SOUTH KOREA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 179 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 180 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 181 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 182 SOUTH KOREA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 183 SOUTH KOREA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 184 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 185 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 186 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 187 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 191 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 192 INDONESIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 195 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 196 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 198 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 199 INDONESIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 205 INDONESIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 206 INDONESIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 210 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 211 PHILIPPINES ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 214 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 215 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 217 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 218 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 223 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 224 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 225 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 226 TAIWAN VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 227 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 228 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 229 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 230 TAIWAN ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 232 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 233 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 234 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 235 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 236 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 237 TAIWAN VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 238 TAIWAN INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 239 TAIWAN LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 240 TAIWAN HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 241 TAIWAN VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 242 TAIWAN VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 243 TAIWAN VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 244 TAIWAN VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 VIETNAM VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 246 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 247 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 248 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 249 VIETNAM ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 251 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 252 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 253 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 254 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 255 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 256 VIETNAM VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 257 VIETNAM INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 258 VIETNAM LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 259 VIETNAM HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 260 VIETNAM VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 261 VIETNAM VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 262 VIETNAM VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 263 VIETNAM VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 264 REST OF ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE INCREASING DEMAND FOR NON-SURGICAL TREATMENTS FOR OSTEOARTHRITIS AND ADVANCEMENTS IN THE DEVELOPMENT OF HYALURONIC ACID-BASED THERAPIES IS EXPECTED TO DRIVE THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 NON-ANIMAL ORIGIN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

FIGURE 15 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2021

FIGURE 16 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2021

FIGURE 20 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2021

FIGURE 24 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2021

FIGURE 28 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE (2022-2029)

FIGURE 44 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.