Mercado de agricultura vertical de Asia y el Pacífico, por mecanismo de crecimiento (hidroponía, aeroponía y acuaponía), estructura (contenedores de envío y edificios), tipo ( biopesticidas , biofertilizantes y bioestimulantes), tipo de cultivo (plantas de hoja verde, plantas polinizadas y plantas nutracéuticas), aplicación (interior y exterior), componente (iluminación, componente hidropónico, control del clima y sensores), tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de agricultura vertical en Asia y el Pacífico

Las granjas verticales son modulares y se pueden adaptar a cualquier estructura. Como producen 75 veces más alimentos por metro cuadrado que una granja convencional, las granjas verticales también pueden alimentar a más personas que la agricultura estándar. Además, no se utilizan pesticidas ni fungicidas en las granjas verticales para mejorar y limpiar los alimentos. Las granjas verticales a menudo minimizan el uso de agua porque las granjas de interior requieren un 90 por ciento menos de agua que las granjas de exterior, por lo que no importa si hay una estación lluviosa o seca. La agricultura de interior también regula la fertilización de nutrientes por parte de las plantas, de modo que los alimentos proporcionados son altamente nutritivos. Cultiva una gran cantidad de alimentos y utiliza menos agua en una habitación comparativamente pequeña. 6.500 metros cuadrados = una cosecha de 900.000 kilos. Las estrategias de agricultura vertical pueden ayudar a conservar las tierras de cultivo y las selvas tropicales y también proporcionar tiempo para regenerar y reponer la capa superficial del suelo para otras tierras y también ayudar a minimizar el consumo de combustible.

Data Bridge Market Research analiza que el mercado de agricultura vertical de Asia-Pacífico crecerá a una CAGR del 27,5 % durante el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por mecanismo de crecimiento (hidroponía, aeroponía y acuaponía), estructura (contenedores de envío y edificios), tipo (biopesticidas, biofertilizantes y bioestimulantes), tipo de cultivo (hojas verdes, plantas polinizadas y plantas nutracéuticas), aplicación (interior y exterior), componente (iluminación, componente hidropónico, control del clima y sensores). |

|

Países cubiertos |

Japón, China, Corea del Sur, India, Australia, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

Entre otras, se encuentran: Signify Holding, CubicFarm Systems Corp., InFarm, Gills N Claws Pte Ltd, Sky Greens, SPREAD Co., Ltd., Triton Foodworks, SANANBIO, EVERLIGHT, OSRAM GmbH, Valoya, Heliospectra AB, Jain Irrigation Systems Ltd, Glenorie Hydroponics y Sino Opto Technology Co., Ltd. |

Definición de mercado

La agricultura vertical es un método de procesamiento de alimentos, como en un rascacielos, una fábrica usada o un contenedor de transporte, que se realiza en capas apiladas verticalmente. Los métodos de cultivo en interiores y las tecnologías de agricultura en ambiente controlado (CEA) se utilizan para los conceptos de agricultura vertical moderna, donde se pueden controlar todas las condiciones ambientales. La regulación artificial de la iluminación, el control ambiental (humedad, temperatura, gases, entre otros) y la fertirrigación se utilizan para estos servicios. Pocas granjas verticales utilizan métodos similares a los invernaderos, donde se puede utilizar iluminación artificial y reflectores metálicos para maximizar la luz solar natural.

Dinámica del mercado de agricultura vertical en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

CRECIENTE DEMANDA DE ALIMENTOS ORGÁNICOS

Como los cultivos se cultivan sin el uso de pesticidas químicos en un ambiente interior bien controlado, la agricultura vertical nos permite cultivar cultivos orgánicos y sin pesticidas. Los alimentos orgánicos se aplican a los bienes producidos a través del sector agrícola que no requieren fertilizantes industriales, productos químicos ni reguladores del desarrollo. Hoy en día, los consumidores de todo el mundo se han vuelto más conscientes del origen de los alimentos que consumen de forma habitual y han pasado de los cultivos procesados con aditivos y pesticidas a los alimentos orgánicos. Además, el aumento del poder adquisitivo de las personas y el cambio de preferencia de los consumidores por los alimentos orgánicos o libres de contaminación están aumentando el crecimiento de la conciencia de la salud.

Todos los países con un consumo relativamente alto de alimentos orgánicos tienen niveles altos de ingreso per cápita, como China, que ha adoptado los alimentos "verdes" para introducir alimentos orgánicos en el país. Japón, en Asia, representa el mayor mercado de alimentos orgánicos. El gasto per cápita en alimentos orgánicos está correlacionado marginalmente de manera favorable con los niveles de ingreso per cápita, pero Japón es una excepción significativa. En términos generales, los productos orgánicos tienden a ser productos de primera calidad en el sentido de que su consumo es mayor en los países de alto ingreso per cápita. En varios países de ingresos medios, el conocimiento fragmentado sobre los mercados de alimentos orgánicos muestra que los mercados de supermercados aún están en las primeras etapas de crecimiento. Alrededor de 50 artículos orgánicos diferentes se venden en los principales supermercados de los principales países.

Los alimentos y bebidas orgánicos importados, así como las frutas, verduras, arroz y té orgánicos producidos en el país, se venden principalmente en tiendas especializadas en Taiwán. Los alimentos orgánicos están disponibles de forma limitada en Hong Kong. El mercado de alimentos orgánicos recién está comenzando a hacerse evidente en una sola tienda, tiendas que venden alimentos orgánicos producidos localmente, como verduras, huevos y queso . Es probable que algunos países de ingresos medios tengan mayores proporciones de productos orgánicos en el futuro, pero las ventas actuales parecen ser muy modestas en términos absolutos.

Principios de minimización de los insumos químicos en la agricultura y, por lo tanto, respetuosos con el medio ambiente. Por lo tanto, las técnicas de agricultura vertical se pueden utilizar para aumentar la producción y la productividad para satisfacer las crecientes demandas de alimentos. La creciente demanda de alimentos orgánicos está impulsando el crecimiento del mercado de agricultura vertical en Asia y el Pacífico.

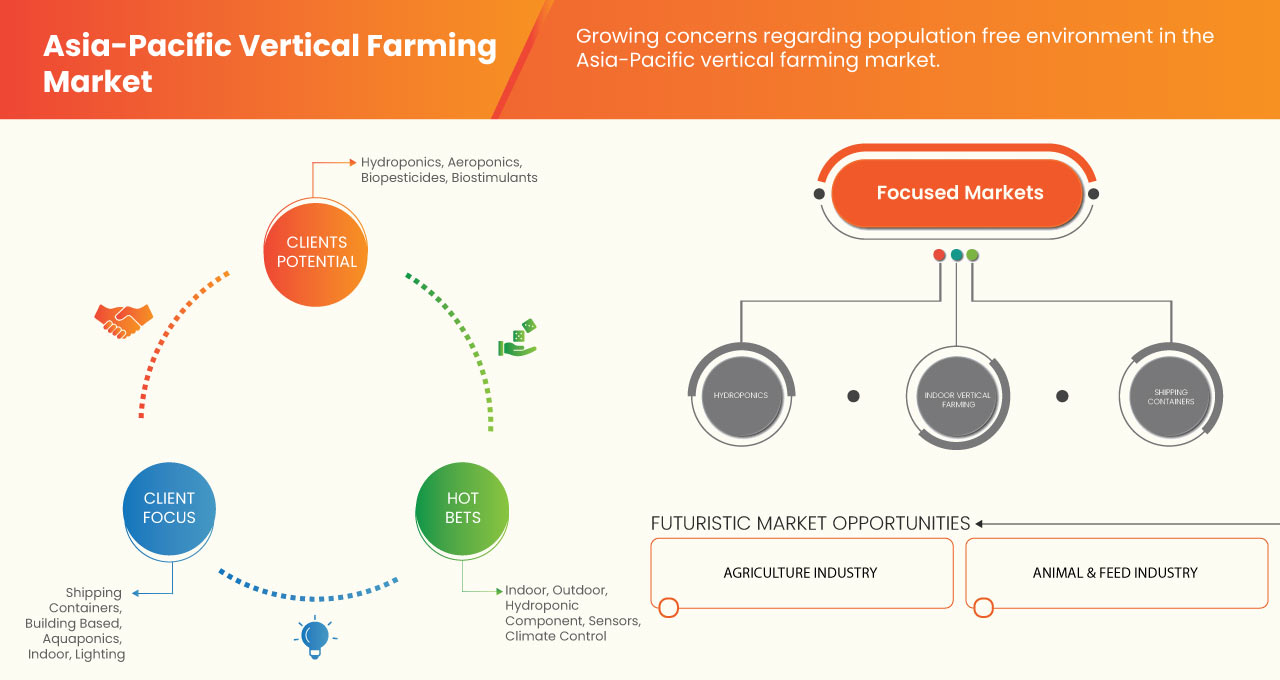

PREOCUPACIONES CRECIENTES POR UN MEDIO AMBIENTE LIBRE DE CONTAMINACIÓN

La contaminación del aire es el mayor riesgo ambiental para la salud en el mundo. Alrededor de 6,5 millones de personas en todo el mundo mueren prematuramente cada año por exposición a la contaminación del aire exterior e interior. La contaminación no es un fenómeno moderno; se puede regular en gran medida y, a veces, evitar, pero se ignora en gran medida. La contaminación de la tierra y el suelo es en gran medida el producto de malas prácticas agrícolas, riego ineficiente, gestión inadecuada de los residuos sólidos (incluido el almacenamiento inseguro de existencias obsoletas de productos químicos peligrosos y desechos nucleares) y una variedad de actividades industriales, militares y extractivas. Una mayor conciencia, nuevas formas de consumo y desarrollo, así como métodos técnicos creativos, significan que muchas naciones, ciudades e industrias están resolviendo hoy de manera efectiva importantes problemas de emisiones. La agricultura vertical en interiores puede reducir significativamente los riesgos laborales asociados con la agricultura tradicional. Los agricultores no están expuestos a peligros relacionados con el equipo agrícola pesado, enfermedades como la malaria, productos químicos venenosos, etc. Como no perturba a los animales ni a los árboles de las zonas interiores, también es bueno para la biodiversidad. Los riesgos laborales asociados con la agricultura convencional se pueden minimizar en gran medida con la agricultura vertical en interiores. Los agricultores no están expuestos a riesgos asociados con maquinaria agrícola pesada, patógenos como la malaria, sustancias peligrosas, etc. Como las zonas del interior no perturban a los animales ni a la vegetación, también son ideales para la biodiversidad. En 2019, los seres humanos emitieron 54 mil millones de toneladas de dióxido de carbono equivalente (CO2eq), de las cuales 17 mil millones de toneladas (31%) procedieron de los sistemas agroalimentarios.

La contaminación puede tener efectos negativos y cargas desproporcionadas sobre las mujeres y los hombres, y en particular sobre los pobres y los vulnerables, como los ancianos, los niños y los discapacitados, afectando sus derechos a la salud, el agua, la alimentación, la vida, la vivienda y el desarrollo. Muchos vertederos tóxicos están situados en zonas pobres, lo que da lugar a injusticias ambientales. La contaminación tiene importantes costes económicos desde el punto de vista de la salud, pérdidas de productividad, costes sanitarios y daños a los ecosistemas. La agricultura vertical puede ahorrar una gran cantidad de agua y minimizar el efecto del efecto invernadero.

Por lo tanto, la creciente preocupación por un medio ambiente libre de contaminación está impulsando el crecimiento del mercado de la agricultura vertical.

Oportunidades

AUMENTO DEL USO DE SENSORES DE IoT EN LA PRODUCCIÓN DE CULTIVOS

La agricultura inteligente ofrece conciencia a los agricultores que quieren mantenerse alejados de los problemas e intervenir antes de que las ganancias se vean afectadas por problemas pequeños o grandes a través de dispositivos conectados, el Internet de las cosas. Entra en juego para decirles a los agricultores lo que necesitan saber sobre el suelo, la humedad, los niveles de agua y otras métricas importantes. Al practicar la agricultura vertical, a la mayoría de los agricultores les gustaría monitorear las condiciones agrícolas, pero el conocimiento limitado sobre la gestión de datos los ha obligado a investigar las condiciones de las plantas a simple vista. Por lo tanto, el sistema de monitoreo de agricultura vertical con Internet de las cosas (IoT) se presenta como una plataforma para recopilar datos y visualizarlos a través de aplicaciones basadas en la web. Es una forma más conveniente de realizar un seguimiento del rendimiento de la agricultura vertical y contribuir a la investigación y el desarrollo en el campo agrícola con análisis de datos de casos reales. Con la ayuda del sistema, se podría formar un entorno confiable para las actividades agrícolas. En consecuencia, los cultivos se cultivan en un entorno controlado y se eliminan los peligros causados por el clima extremo, como las sequías y las inundaciones.

Incluso el gobierno está empezando a adoptar nuevas oportunidades de agricultura inteligente. En su Centro de Investigación del Área de Beltsville, el Departamento de Agricultura de los Estados Unidos (USDA) convirtió recientemente una granja de 7.000 acres en un banco de pruebas para la tecnología de IoT y avances relacionados, como la inteligencia artificial (IA). Según se informa, esta iniciativa ayudará a miles de científicos de datos a recopilar información más rápidamente.

Los sensores IoT pueden proporcionar información sobre la salud de los cultivos en tiempo real y mostrar claramente la presencia de plagas. Para evaluar cultivos en una zona amplia, son adecuados los sensores de imágenes de baja resolución. Estos instrumentos toman fotografías de plagas que no se pueden observar con el ojo humano.

El Internet de las cosas (IoT) es una tecnología de éxito que ofrece soluciones eficientes y fiables para la modernización de múltiples dominios. Se están creando soluciones basadas en IoT para realizar el mantenimiento y la supervisión de explotaciones agrícolas de forma automática con una mínima intervención humana.

Por lo tanto, la creciente utilización de sensores de IoT en la producción de cultivos ha brindado amplias oportunidades para el crecimiento del mercado de agricultura vertical de Asia y el Pacífico.

Restricciones/Desafíos

ALTAS INVERSIONES INICIALES EN AGRICULTURA VERTICAL

El mayor obstáculo para la introducción de la agricultura vertical son los altos costos iniciales. Los altos costos de capital son el producto tanto de los precios más altos del terreno por metro cuadrado en los centros urbanos como de las instalaciones necesarias para gestionar el desarrollo de las plantas. El cultivo vertical se realiza sin la participación de insectos en un clima controlado. Por lo tanto, el método de polinización debe realizarse manualmente, lo que requeriría mucha mano de obra y sería costoso. A pesar de lo altos que son los precios de la energía en la agricultura vertical, debido a su concentración en los centros urbanos donde los ingresos son más altos, así como a la necesidad de trabajadores más calificados, los costos laborales pueden ser mucho más altos. Sin embargo, la automatización en las granjas verticales puede contribuir a la necesidad de menos empleados. En las granjas verticales, la polinización manual puede convertirse en una de las funciones que requieren más mano de obra. Aunque los costos iniciales de la agricultura vertical son altos, las ventajas a largo plazo están siendo gradualmente comprendidas y aceptadas por todos, incluso los minoristas, que participan en la cadena de suministro de alimentos. La realidad de que el capital inicial necesario para construir y desarrollar una granja vertical es significativo no es una escapatoria. Sin embargo, el potencial de crecimiento a largo plazo y los beneficios que ofrece estar a la vanguardia de esta industria emergente la convierten en una propuesta de inversión atractiva para quienes cuentan con fondos. En lugar de la automatización, una granja vertical depende más del trabajo manual para regar y cosechar. El costo de alimentar las luces LED para cultivo es uno de los mayores obstáculos que debe superar una granja vertical para que sus productos sean competitivos con las frutas y verduras de una granja tradicional. Mientras las empresas se enfrentan a los costos de energía que implica mantener una atmósfera regulada las 24 horas del día, los 7 días de la semana, y al desafío de coordinar el método de operación de una granja vertical, que requiere mucha mano de obra, la industria está plagada de quiebras.

Por lo tanto, las elevadas inversiones iniciales en agricultura vertical están retrasando el crecimiento del mercado de agricultura vertical en Asia y el Pacífico.

Acontecimientos recientes

- En mayo de 2022, Signify, el líder mundial en iluminación, completó la adquisición de Fluence de ams OSRAM. La transacción fortalece nuestra plataforma de crecimiento de iluminación agrícola en Asia-Pacífico y amplía nuestra posición en el atractivo mercado de iluminación hortícola de América del Norte.

- En junio de 2022, Jain Irrigation Systems Limited., India (Jain Irrigation) y Rivulis Pte Ltd., propiedad de Temasek, Singapur (Rivulis) se complacen en anunciar que Jain International Trading BV (una subsidiaria de propiedad absoluta de Jain Irrigation) y Rivulis han celebrado acuerdos de transacción definitivos.

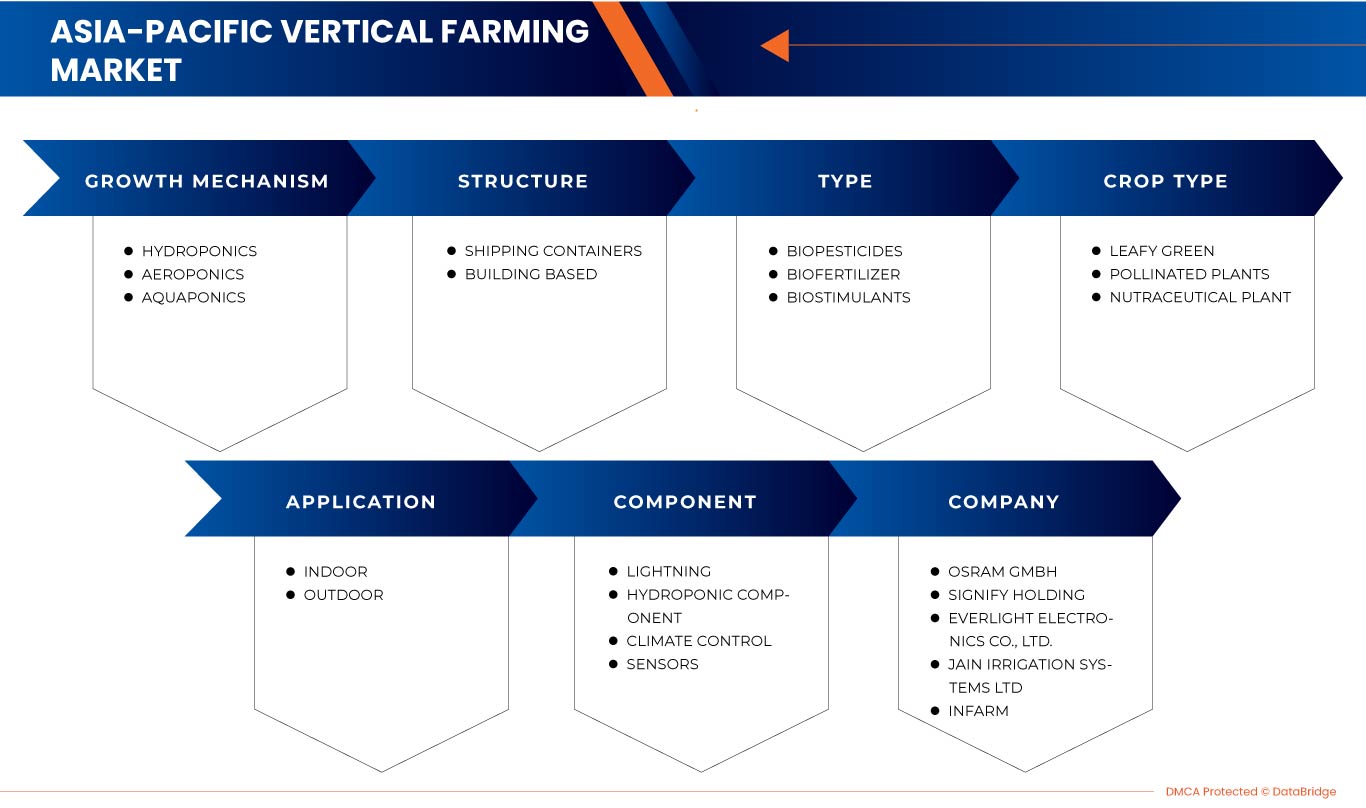

Alcance del mercado de agricultura vertical en Asia y el Pacífico

El mercado de agricultura vertical de Asia y el Pacífico está segmentado según el mecanismo de crecimiento, la estructura, el tipo, el tipo de cultivo, la aplicación y el componente. El crecimiento entre estos segmentos lo ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Mecanismo de crecimiento

- Hidroponia

- Aeroponía

- Acuaponía

Sobre la base del mecanismo de crecimiento, el mercado de agricultura vertical de Asia-Pacífico está segmentado en hidroponía, aeroponía y acuaponía.

Estructura

- Contenedores de envío

- Basado en la construcción

Sobre la base de la estructura, el mercado de agricultura vertical de Asia-Pacífico está segmentado en contenedores de envío y edificios.

Tipo

- Biopesticidas

- Biofertilizante

- Bioestimulantes

Según el tipo, el mercado de agricultura vertical de Asia-Pacífico está segmentado en biopesticidas, biofertilizantes y bioestimulantes.

Tipo de cultivo

- Hoja verde

- Plantas polinizadas

- Planta nutraceutica

Según el tipo de cultivo, el mercado de agricultura vertical de Asia y el Pacífico se segmenta en plantas de hoja verde, plantas polinizadas y plantas nutracéuticas.

Solicitud

- Interior

- Exterior

En función de la aplicación, el mercado de agricultura vertical de Asia-Pacífico se segmenta en interior y exterior .

- Iluminación

- Componente hidropónico

- Control del clima

- Sensores

Sobre la base de los componentes, el mercado de agricultura vertical de Asia-Pacífico está segmentado en iluminación, componentes hidropónicos, control climático y sensores.

Análisis y perspectivas regionales del mercado de agricultura vertical en Asia y el Pacífico

Se analiza el mercado de agricultura vertical de Asia y el Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado según lo mencionado anteriormente.

Los países cubiertos en el informe del mercado de agricultura vertical de Asia-Pacífico son Japón, China, Corea del Sur, India, Australia, Singapur, Tailandia, Indonesia, Malasia, Filipinas y el resto de Asia-Pacífico.

Se espera que China domine el mercado de agricultura vertical de Asia-Pacífico en términos de participación de mercado e ingresos. Se estima que mantendrá su dominio durante el período de pronóstico debido a los fuertes actores del mercado y la alta demanda de agricultura vertical en la región de China.

La sección de regiones del informe también proporciona factores de impacto individuales en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas de Asia-Pacífico y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de la agricultura vertical en Asia-Pacífico

El mercado de la agricultura vertical proporciona información detallada sobre los competidores. Los detalles incluyen una descripción general de la empresa, sus finanzas, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de la agricultura vertical.

Algunos de los principales actores que operan en el mercado de agricultura vertical de Asia-Pacífico son Signify Holding, CubicFarm Systems Corp., InFarm, Gills N Claws Pte Ltd, Sky Greens, SPREAD Co., Ltd., Triton Foodworks, SANANBIO, EVERLIGHT, OSRAM GmbH, Valoya, Heliospectra AB, Jain Irrigation Systems Ltd, Glenorie Hydroponics, Sino Opto Technology Co., Ltd, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC VERTICAL FARMING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 GROWTH MECHANISM LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ORGANIC FOOD

5.1.2 LIMITED LAND AVAILABILITY FOR TRADITIONAL AGRICULTURE

5.1.3 GROWING CONCERNS REGARDING POLLUTION FREE ENVIRONMENT

5.1.4 RISING ADOPTION OF ADVANCED TECHNOLOGIES FOR FOOD PRODUCTION

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS IN VERTICAL FARMING

5.2.2 LIMITED VARIETY OF CROPS RESULTS IN ECONOMICAL FEASIBILITY

5.2.3 HIGHER ENERGY CONSUMPTION OF LIGHT AND AIR CONDITIONING

5.3 OPPORTUNITIES

5.3.1 INCREASING UTILIZATION OF IOT SENSORS IN CROP PRODUCTION

5.3.2 GROWING PRODUCTION OF BIOPHARMACEUTICAL PRODUCTS

5.3.3 GROWING ADOPTION OF LED LIGHTING

5.4 CHALLENGES

5.4.1 COMPLEXITY OF HORTICULTURE LIGHTING

5.4.2 MAINTENANCE OF AIR CIRCULATION IN VERTICAL FARMING

5.4.3 VERTICAL FARMING DONE ON LARGE SCALE

6 IMPACT ANALYSIS OF COVID-19

7 APAC VERTICAL FARMING MARKET, BY GROWTH MECHANISM

7.1 OVERVIEW

7.2 HYDROPONICS

7.3 AEROPONICS

7.4 AQUAPONICS

8 APAC VERTICAL FARMING MARKET, BY STRUCTURE

8.1 OVERVIEW

8.2 SHIPPING CONTAINERS

8.3 BUILDING BASED

9 APAC VERTICAL FARMING MARKET, BY TYPE

9.1 OVERVIEW

9.2 BIOPESTICIDES

9.2.1 MICROBIALS

9.2.2 PHEROMONES

9.2.3 PLANT EXTRACTS

9.3 BIOFERTILIZER

9.3.1 NITROGEN FIXING

9.3.2 PHOSPHATE-SOLUBILIZING

9.3.3 POTASH-MOBILIZING

9.4 BIOSTIMULANTS

9.4.1 LIQUID

9.4.2 DRY

10 APAC VERTICAL FARMING MARKET, BY CROP TYPE

10.1 OVERVIEW

10.2 LEAFY GREEN

10.3 POLLINATED PLANTS

10.4 NUTRACEUTICAL PLANT

11 APAC VERTICAL FARMING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 INDOOR

11.3 OUTDOOR

12 APAC VERTICAL FARMING MARKET, BY COMPONENT

12.1 OVERVIEW

12.2 LIGHTING

12.2.1 GROW LIGHT

12.2.2 GROW BALLAST

12.2.3 GROW REFLECTORS

12.3 HYDROPONIC COMPONENT

12.3.1 PUMP & IRRIGATION

12.3.2 WATER FILTRATION

12.3.3 METERS & SOLUTIONS

12.3.4 OTHERS

12.4 CLIMATE CONTROL

12.4.1 VENTILATION FANS

12.4.2 AIR PURIFICATION/CONTROL

12.5 SENSORS

12.5.1 CO2 SENSORS

12.5.2 TEMPERATURE SENSORS

12.5.3 NUTRIENT SENSORS

12.5.4 CROP SENSORS

12.5.5 PH SENSORS

12.5.6 OTHERS

13 APAC VERTICAL FARMING MARKET, BY COUNTRY

13.1 CHINA

13.2 JAPAN

13.3 SOUTH KOREA

13.4 SINGAPORE

13.5 AUSTRALIA

13.6 INDIA

13.7 THAILAND

13.8 INDONESIA

13.9 MALAYSIA

13.1 PHILIPPINES

13.11 REST OF APAC

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OSRAM GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 SIGNIFY HOLDING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 BRAND PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 EVERLIGHT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 JAIN IRRIGATION SYSTEMS LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 INFARM

16.5.1 COMPANY SNAPSHOT

16.5.2 TECHNOLOGY PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 CUBICFARM SYSTEMS CORP.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILLS N CLAWS PTE LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 GLENORIE HYDROPONICS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.9 HELIOSPECTRA AB

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 SANANBIO

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 SINO OPTO TECHNOLOGY CO., LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 SKY GREENS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 SPREAD CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 TRITON FOODWORKS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 VALOYA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 APAC VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 2 APAC VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 3 APAC VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 APAC BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 APAC BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 APAC BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 APAC VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 8 APAC VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 APAC VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 10 APAC LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 11 APAC HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 12 APAC CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 13 APAC SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 14 APAC VERTICAL FARMING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 15 CHINA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 16 CHINA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 17 CHINA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 CHINA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 CHINA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 CHINA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 CHINA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 22 CHINA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 CHINA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 24 CHINA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 25 CHINA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 26 CHINA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 27 CHINA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 28 JAPAN VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 29 JAPAN VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 30 JAPAN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 JAPAN BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 JAPAN BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 JAPAN BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 JAPAN VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 35 JAPAN VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 JAPAN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 37 JAPAN LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 38 JAPAN HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 39 JAPAN CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 40 JAPAN SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 41 SOUTH KOREA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 42 SOUTH KOREA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 43 SOUTH KOREA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 SOUTH KOREA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 SOUTH KOREA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SOUTH KOREA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SOUTH KOREA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 48 SOUTH KOREA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 SOUTH KOREA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 50 SOUTH KOREA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 51 SOUTH KOREA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 52 SOUTH KOREA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 53 SOUTH KOREA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 54 SINGAPORE VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 55 SINGAPORE VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 56 SINGAPORE VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 SINGAPORE BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SINGAPORE BIO FERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 SINGAPORE BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 SINGAPORE VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 61 SINGAPORE VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 SINGAPORE VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 63 SINGAPORE LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 64 SINGAPORE HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 65 SINGAPORE CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 66 SINGAPORE SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 67 AUSTRALIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 68 AUSTRALIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 69 AUSTRALIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 AUSTRALIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 80 INDIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 81 INDIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 82 INDIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 INDIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 INDIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 INDIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 INDIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 87 INDIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 INDIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 89 INDIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 90 INDIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 91 INDIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 92 INDIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 93 THAILAND VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 94 THAILAND VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 95 THAILAND VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 THAILAND BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 THAILAND BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 THAILAND BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 THAILAND VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 100 THAILAND VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 THAILAND VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 102 THAILAND LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 103 THAILAND HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 104 THAILAND CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 105 THAILAND SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 106 INDONESIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 107 INDONESIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 108 INDONESIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 INDONESIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 INDONESIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 INDONESIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 INDONESIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 113 INDONESIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 INDONESIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 115 INDONESIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 116 INDONESIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 117 INDONESIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 118 INDONESIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 119 MALAYSIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 120 MALAYSIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 121 MALAYSIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 MALAYSIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 MALAYSIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 MALAYSIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 MALAYSIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 126 MALAYSIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 127 MALAYSIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 128 MALAYSIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 129 MALAYSIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 130 MALAYSIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 132 PHILIPPINES VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 133 PHILIPPINES VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 134 PHILIPPINES VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 PHILIPPINES BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 PHILIPPINES BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 PHILIPPINES BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 PHILIPPINES VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 139 PHILIPPINES VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 PHILIPPINES VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 141 PHILIPPINES LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 142 PHILIPPINES HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 143 PHILIPPINES CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 144 PHILIPPINES SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 145 REST OF APAC VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA-PACIFIC VERTICAL FARMING MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC VERTICAL FARMING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC VERTICAL FARMING MARKET : DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC VERTICAL FARMING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC VERTICAL FARMING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC VERTICAL FARMING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC VERTICAL FARMING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC VERTICAL FARMING MARKET: SEGMENTATION

FIGURE 9 THE GROWING PRODUCTION OF BIOPHARMACEUTICAL PRODUCTS IS DRIVING THE GROWTH OF ASIA-PACIFIC VERTICAL FARMING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 10 HYDROPONICS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC VERTICAL FARMING MARKET IN 2023 & 2030

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC VERTICAL FARMING MARKET

FIGURE 12 APAC VERTICAL FARMING MARKET: BY GROWTH MECHANISM, 2022

FIGURE 13 APAC VERTICAL FARMING MARKET: BY STRUCTURE, 2022

FIGURE 14 APAC VERTICAL FARMING MARKET: BY TYPE, 2022

FIGURE 15 APAC VERTICAL FARMING MARKET: BY CROP TYPE, 2022

FIGURE 16 APAC VERTICAL FARMING MARKET: BY APPLICATION, 2022

FIGURE 17 APAC VERTICAL FARMING MARKET: BY COMPONENT, 2022

FIGURE 18 APAC VERTICAL FARMING MARKET: SNAPSHOT (2022)

FIGURE 19 APAC VERTICAL FARMING MARKET: BY COUNTRY (2022)

FIGURE 20 APAC VERTICAL FARMING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 APAC VERTICAL FARMING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 APAC VERTICAL FARMING MARKET: BY GROWTH MECHANISM (2023 - 2030)

FIGURE 23 ASIA-PACIFIC VERTICAL FARMING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.