Mercado de robótica submarina de Asia y el Pacífico, por tipo (vehículos operados de forma remota (ROV) y vehículo submarino autónomo (AUV)), profundidad de trabajo (aguas poco profundas, profundas y ultraprofundas), tipo de tarea (observación, estudio , inspección, construcción , intervención, entierro y zanjas y otros), profundidad (menos de 1000 m, 1000 m a 5000 m y más de 5000 m), componente (luz, cámara , marco, propulsores, amarres, controles piloto y otros), aplicación ( petróleo y gas, exploración comercial, defensa y seguridad , investigación científica y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

Análisis y tamaño del mercado

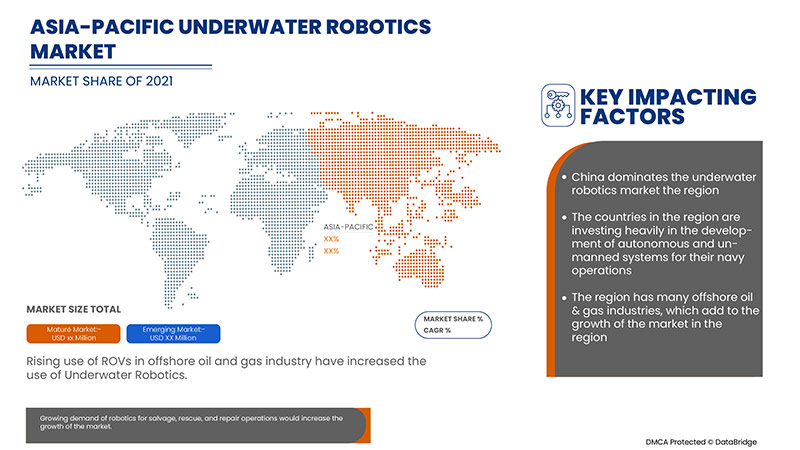

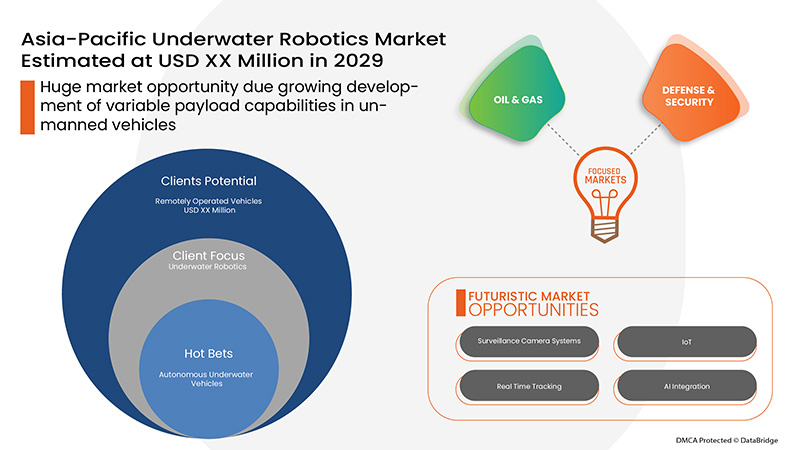

El mercado de robótica submarina de Asia-Pacífico está impulsado principalmente por la creciente demanda de ROV en las industrias de petróleo y gas en alta mar y su necesidad esencial para la exploración marina y la investigación científica. Además, las aplicaciones de la robótica submarina para operaciones de salvamento, rescate y reparación están impulsando el crecimiento del mercado a un ritmo rápido. Sin embargo, el alto costo de los ROV y AUV después de los complementos y las amenazas relacionadas con la seguridad cibernética pueden restringir el crecimiento del mercado de robótica submarina de Asia-Pacífico. Además, la barrera técnica para la navegación y la comunicación de AUV y ROV en fuertes corrientes de agua y debajo de las capas de hielo puede desafiar el crecimiento del mercado. Además, el lento avance en la tecnología de sensores y la alta complejidad técnica en robótica submarina pueden impedir el crecimiento del mercado. Sin embargo, el creciente desarrollo de capacidades de carga útil variable en vehículos submarinos y la integración de tecnologías avanzadas para aumentar la eficiencia y el funcionamiento de la robótica submarina brindan oportunidades lucrativas para el mercado de robótica submarina de Asia-Pacífico.

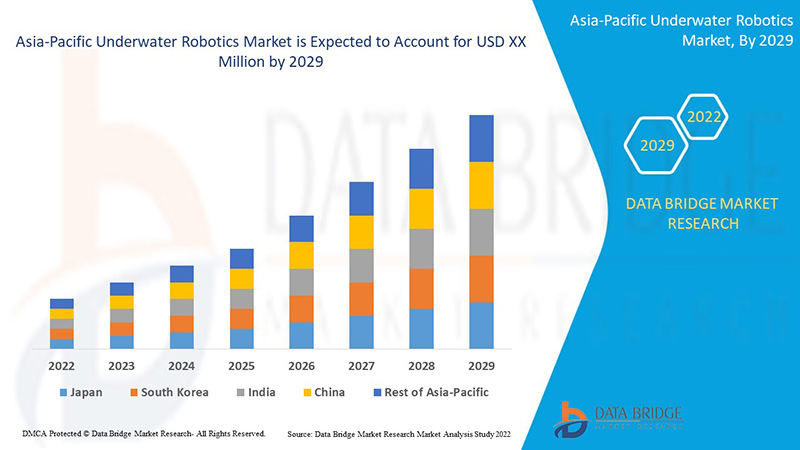

Data Bridge Market Research analiza que se espera que el mercado de robótica submarina de Asia-Pacífico alcance los XX millones de dólares para el año 2029, con una tasa compuesta anual del 14,1 % durante el período de pronóstico. Los "vehículos operados a distancia (ROV)" representan el segmento de tipo más destacado en el mercado respectivo. El informe de mercado elaborado por el equipo de Data Bridge Market Research incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por Tipo (Vehículos Operados Remotamente (ROV) y Vehículos Submarinos Autónomos (AUV)), Profundidad de Trabajo (Aguas Someras, Aguas Profundas y Aguas Ultra Profundas), Tipo de Tarea (Observación, Levantamiento, Inspección, Construcción, Intervención, Enterramiento y Zanjas y Otros), Profundidad (Menos de 1000 Mts, 1000 Mts a 5000 Mts y Más de 5000 Mts), Componente (Luz, Cámara, Marco, Propulsores, Amarres, Controles de Piloto y Otros), Aplicación (Petróleo y Gas, Exploración Comercial, Defensa y Seguridad, Investigación Científica y Otros) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Malasia, Australia y Nueva Zelanda, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico (APAC) |

|

Actores del mercado cubiertos |

Español Grupo ATLAS ELEKTRONIK, General Dynamics Mission Systems, Inc., ECA GROUP, Eddyfi, Boeing, Soil Machine Dynamics Ltd., MacArtney A/S, Oceaneering International, Inc., Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, Total Marine Technology Pty Ltd, Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd. |

Definición de mercado

La robótica submarina es una rama de la robótica que abarca la investigación y el desarrollo, el diseño, la fabricación y la aplicación de robots que operan en entornos submarinos. El término puede referirse a cualquier robot que funcione a nivel del agua o por debajo de él (sistemas robóticos marinos). Aun así, normalmente se refiere específicamente a vehículos autónomos diseñados para su uso bajo el agua. Un robot submarino, también llamado vehículo submarino autónomo, es una máquina que se puede operar de forma remota. Está diseñado para trabajar bajo el agua para la vigilancia oceánica continua. La robótica se ha utilizado en la fabricación en los últimos años. La maravillosa expansión los ha hecho más cultos y fiables para aplicaciones de implementación militar y legal. Los robots submarinos desempeñan un papel importante en la expansión de la industria offshore. Además, tiene numerosas implementaciones en biología marina, arqueología submarina y seguridad marítima.

La dinámica del mercado de robótica submarina de Asia-Pacífico incluye:

- Aumento del uso de la robótica submarina con fines militares y de seguridad

La región de Asia y el Pacífico ha experimentado un rápido aumento en el uso de la robótica submarina debido a su uso en diversas misiones y operaciones militares y con fines de seguridad en puertos y mares. La vigilancia y la recopilación de información son dos factores que han impulsado el uso de la robótica submarina con fines militares y de seguridad.

- Aumento del uso de ROV en las industrias del petróleo y el gas

Los descubrimientos de nuevas industrias de petróleo y gas en alta mar en el océano Índico y el mar de China Meridional han aumentado la demanda de vehículos de control remoto en las industrias de petróleo y gas. Es seguro y la operación se puede realizar con mayor eficiencia y a gran escala.

- Creciente demanda de vehículos submarinos autónomos (AUV) para exploración submarina e investigación científica

La creciente funcionalidad de los AUV y la capacidad de operarlos de forma remota han aumentado su demanda para la exploración submarina y la investigación científica en la región de Asia y el Pacífico. El descubrimiento de minerales y cables subyacentes para un sistema de comunicación es un impulso adicional para el mercado de robótica submarina de Asia y el Pacífico.

Restricciones y desafíos que enfrenta el mercado de robótica submarina en Asia y el Pacífico

- Alto coste de los robots/vehículos submarinos

El uso y la necesidad de vehículos submarinos están aumentando rápidamente en diversas industrias. Sin embargo, muchas empresas no pueden adquirir el vehículo submarino para las operaciones y tareas requeridas debido al alto costo asociado con él. El alto costo de compra y los altos costos de mantenimiento del vehículo submarino pueden actuar como una restricción para el mercado de robótica submarina de Asia-Pacífico.

- Amenazas y preocupaciones sobre la ciberseguridad y la seguridad operacional

El sistema de comunicación utilizado para operar estos vehículos submarinos autónomos y recopilar datos en el centro de operaciones puede ser pirateado, lo que supone un riesgo de seguridad y una preocupación para los operadores de los vehículos submarinos autónomos y afecta a sectores como el militar, el de la biología marina, el del petróleo y el gas y el de la energía marina. Estas amenazas y preocupaciones en materia de ciberseguridad y seguridad operativa de los vehículos submarinos pueden frenar el crecimiento del mercado de robótica submarina de Asia y el Pacífico.

Acontecimientos recientes

- En febrero de 2021, Eddyfi probó dos productos, MaggHD y OnSpec Robot, para comprobar su idoneidad para aplicaciones industriales. Ambos productos se probaron con éxito para aplicaciones multiindustriales, como soluciones de deshielo y otras operaciones remotas. La empresa se centra en comercializar estos productos a operadores de vigilancia marina e investigación científica en todo el mundo.

- En septiembre de 2018, International Submarine Engineering Limited y la Asociación China de Investigación y Desarrollo de Recursos Minerales Oceánicos (COMRA) firmaron un acuerdo en virtud del cual la empresa vendería sus AUV Explorer a la institución. El AUV tiene una profundidad de trabajo de 6000 metros y fue entregado a finales de año. Esto ha permitido a la empresa expandir su mercado en la región de Asia y el Pacífico en robótica submarina.

Alcance del mercado de robótica submarina en Asia y el Pacífico

El mercado de robótica submarina de Asia-Pacífico está segmentado en función del tipo, la profundidad de trabajo, el tipo de tarea, la profundidad, los componentes y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Vehículos operados remotamente (ROV)

- Vehículo submarino autónomo (AUV)

Según el tipo, el mercado de robótica submarina de Asia-Pacífico está segmentado en vehículos operados a distancia (ROV) y vehículos submarinos autónomos (AUV).

Profundidad de trabajo

- Poco profundo

- Aguas profundas

- Aguas ultra profundas

Sobre la base de la profundidad de trabajo, el mercado de robótica submarina de Asia-Pacífico está segmentado en aguas poco profundas, aguas profundas y aguas ultraprofundas.

Tipo de tarea

- Observación

- Encuesta

- Inspección

- Construcción

- Intervención

- Entierro y excavación de zanjas

- Otros

Según el tipo de tarea, el mercado de robótica submarina de Asia y el Pacífico se segmenta en observación, estudio, inspección, construcción, intervención, entierro y excavación de zanjas, entre otros.

Profundidad

- Menos de 1000 Mts

- 1000 Mts a 5000 Mts

- Más de 5000 Mts

En función de la profundidad, el mercado de robótica submarina de Asia-Pacífico está segmentado en menos de 1000 m, de 1000 m a 5000 m y más de 5000 m.

Componente

- Luz

- Cámara

- Marco

- Propulsores

- Correas de sujeción

- Controles piloto

- Otros

Sobre la base de los componentes, el mercado de robótica submarina de Asia-Pacífico está segmentado en luz, cámara, marco, propulsores, correas, controles del piloto y otros.

Solicitud

- Petróleo y gas

- Exploración comercial

- Defensa y seguridad

- Investigación científica

- Otros

Sobre la base de la aplicación, el mercado de robótica submarina de Asia-Pacífico está segmentado en petróleo y gas, exploración comercial, defensa y seguridad, investigación científica y otros.

Análisis y perspectivas regionales del mercado de robótica submarina

Se analiza el mercado de robótica submarina de Asia-Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado por tipo, profundidad de trabajo, tipo de tarea, profundidad, componentes y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de robótica submarina de Asia-Pacífico son China, Japón, India, Corea del Sur, Singapur, Malasia, Australia y Nueva Zelanda, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico (APAC).

China domina el mercado de la robótica submarina, ya que la región ha sido testigo de una gran presencia de fabricantes líderes. Además, la región ha visto grandes inversiones en equipos para búsqueda y rescate, militares, recreación y descubrimiento, acuicultura, biología marina, petróleo, gas, energía marina, transporte marítimo, infraestructura sumergida y más. Se espera que China sea testigo de un crecimiento significativo durante el período de pronóstico de 2022 a 2029 debido al aumento de las inversiones en equipos de robótica marina.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la robótica submarina en Asia-Pacífico

El panorama competitivo del mercado de robótica submarina de Asia-Pacífico proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de robótica submarina de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de robótica submarina de Asia-Pacífico son ATLAS ELEKTRONIK GmbH, General Dynamics Mission Systems, Inc., ECA GROUP, Eddyfi, Boeing, Soil Machine Dynamics Ltd., MacArtney A/S, Oceaneering International, Inc., Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, Total Marine Technology Pty Ltd, Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd., entre otros.

Metodología de investigación: mercado de robótica submarina en Asia y el Pacífico

La recopilación de datos y el análisis del año base se realizan mediante módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman mediante modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíenos su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (por parte de expertos de la industria). Además de esto, los modelos de datos incluyen una cuadrícula de posicionamiento de proveedores, un análisis de la línea de tiempo del mercado, una descripción general y una guía del mercado, un análisis de expertos, un análisis de importación y exportación, un análisis de precios, un análisis de producción y consumo, un escenario de la cadena climática, una cuadrícula de posicionamiento de la empresa, un análisis de la participación de mercado de la empresa, estándares de medición, análisis global versus regional y de la participación de los proveedores. Para saber más sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 GENERAL DYNAMICS AND MIT PARTNERED DURING THE U.S. NAVY'S BIENNIAL ICE EXERCISE (ICEX 2020) TO TEST THE BLUEFIN-21 UNMANNED UNDERWATER VEHICLE (UUV) UNDER THE ICE AT THE ARCTIC CIRCLE

4.3.2 OCEANEERING INTERNATIONAL, INC. DEVELOPED ISURUS ROV, WHICH REDUCES COST AND CARBON FOOTPRINT WHILE SHORTENING THE PROJECT SCHEDULE

4.3.3 RESULTS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES

6.1.2 RISING USE OF ROVS IN THE OIL AND GAS INDUSTRY

6.1.3 INCREASING DEMAND FOR AUVS FOR UNDERWATER EXPLORATION AND SCIENTIFIC RESEARCH

6.1.4 GROWING DEMAND FOR UNDERWATER ROBOTICS FOR SEARCH, RESCUE, AND REPAIR OPERATIONS

6.2 RESTRAINTS

6.2.1 HIGH COST OF UNDERWATER ROBOTS/VEHICLES

6.2.2 THREATS AND CONCERNS FOR CYBER SECURITY AND OPERATIONAL SECURITY

6.3 OPPORTUNITIES

6.3.1 GROWING DEVELOPMENT OF VARIABLE PAYLOAD CAPABILITIES IN UNDERWATER VEHICLE

6.3.2 INCREASING DEVELOPMENTS IN UNDERWATER ROBOTICS SYSTEMS

6.3.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN UNDERWATER VEHICLES

6.3.4 INCREASING WORKING DEPTH OF UNDERWATER ROBOTS

6.4 CHALLENGES

6.4.1 THE TECHNICAL BARRIER IN NAVIGATION AND COMMUNICATION OF AUV

6.4.2 SLOW TECHNICAL PROGRESS IN UNDERWATER ROBOT SENSING TECHNOLOGIES

6.4.3 HIGH TECHNICAL COMPLEXITY IN UNDERWATER ROBOTICS

7 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 REMOTELY OPERATED VEHICLES (ROV)

7.2.1 BY CONFIGURATION

7.2.1.1 OPEN OR BOX FRAME ROVS

7.2.1.2 TORPEDO SHAPED TOVS

7.2.2 BY CLASS TYPE

7.2.2.1 CLASS III (WORK CLASS VEHICLES)

7.2.2.2 CLASS II (OBSERVATION WITH PAYLOAD OPTIONS)

7.2.2.3 CLASS IV (SEABED-WORKING VEHICLES)

7.2.2.4 CLASS I (PURE OBSERVATION)

7.2.2.5 CLASS V (PROTOTYPE OR DEVELOPMENT VEHICLES)

7.3 AUTONOMOUS UNDERWATER VEHICLES

7.3.1 BY SHAPE

7.3.1.1 TORPEDO

7.3.1.2 STREAMLINED RECTANGULAR STYLE

7.3.1.3 LAMINAR FLOW BODY

7.3.1.4 MULTI-HULL VEHICLE

8 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH

8.1 OVERVIEW

8.2 DEEP WATER

8.3 SHALLOW

8.4 ULTRA-DEEP WATER

9 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TASK TYPE

9.1 OVERVIEW

9.2 INSPECTION

9.3 SURVEY

9.4 INTERVENTION

9.5 OBSERVATION

9.6 BURIAL AND TRENCHING

9.7 CONSTRUCTION

9.8 OTHERS

10 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY DEPTH

10.1 OVERVIEW

10.2 1,000 MTS TO 5,000 MTS

10.3 LESS THAN 1,000 MTS

10.4 MORE THAN 5,000 MTS

11 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 THRUSTERS

11.3 TETHERS

11.4 CAMERA

11.4.1 HIGH-RESOLUTION DIGITAL STILL CAMERA

11.4.2 DUAL-EYE CAMERAS

11.5 LIGHTS

11.6 FRAME

11.7 PILOT CONTROLS

11.8 OTHERS

12 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL & GAS

12.3 DEFENCE & SECURITY

12.4 SCIENTIFIC RESEARCH

12.5 COMMERCIAL EXPLORATION

12.6 OTHERS

13 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY GEOGRAPHY

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 SOUTH KOREA

13.1.4 INDIA

13.1.5 AUSTRALIA AND NEW ZEALAND

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OCEANEERING INTERNATIONAL, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAAB AB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL DYNAMICS MISSION SYSTEMS, INC. (A SUBSIDIARY OF GENERAL DYNAMICS CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCTS PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SUBSEA 7

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TELEDYNE TECHNOLOGIES INCORPORATED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ATLAS ELEKTRONIK GMBH

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOEING

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DEEP TREKKER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCTS PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ECA GROUP (A SUBSIDIARY OF GROUPE GORGÉ COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCTS PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 EDDYFI

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FORUM ENERGY TECHNOLOGY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCTS PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FUGRO

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE AND PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HUNTINGTON INGALLS INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 KONGSBERG MARITIME

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 MACARTNEY AS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MITSUI E&S HOLDINGS CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 ROVCO LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SEAROBOTICS CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SOIL MACHINE DYNAMICS LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCTS PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TECHNIPFMC PLC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCTS PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TOTAL MARINE TECHNOLOGY PTY LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 PHOENIX INTERNATIONAL HOLDINGS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCTS PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VIDEORAY LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCTS PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPARATIVE CHARACTERISTICS OF AUV

TABLE 2 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC SHALLOW IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ULTRA-DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC INSPECTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC SURVEY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC INTERVENTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OBSERVATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC BURIAL AND TRENCHING IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC CONSTRUCTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC 1,000 MTS TO 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC LESS THAN 1,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC MORE THAN 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC THRUSTERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC TETHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC CAMERA IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC LIGHTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC FRAME IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PILOT CONTROLS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OIL & GAS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC DEFENSE & SECURITY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC SCIENTIFIC RESEARCH IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC COMMERCIAL EXPLORATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 CHINA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 CHINA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 53 CHINA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 55 CHINA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 56 CHINA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 57 CHINA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 58 CHINA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHINA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 JAPAN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 62 JAPAN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 65 JAPAN UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 67 JAPAN UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 INDIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 82 INDIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 85 INDIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 86 INDIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 87 INDIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 88 INDIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA AND NEW ZEALAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA AND NEW ZEALAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA AND NEW ZEALAND AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA AND NEW ZEALAND CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 THAILAND UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 112 THAILAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 113 THAILAND AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 115 THAILAND UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 116 THAILAND UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 117 THAILAND UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 118 THAILAND CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 THAILAND UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 INDONESIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 REST OF ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: END-USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES IS EXPECTED TO BE A KEY DRIVER FOR THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 REMOTELY OPERATED VEHICLES (ROVS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET

FIGURE 16 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY WORKING DEPTH, 2021

FIGURE 18 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY TASK TYPE, 2021

FIGURE 19 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY DEPTH, 2021

FIGURE 20 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY COMPONENT, 2021

FIGURE 21 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY APPLICATION, 2021

FIGURE 22 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY TYPE (2022-2029)

FIGURE 27 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.