Asia Pacific Transparent Conductive Films Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

7.08 Billion

USD

16.57 Billion

2025

2033

USD

7.08 Billion

USD

16.57 Billion

2025

2033

| 2026 –2033 | |

| USD 7.08 Billion | |

| USD 16.57 Billion | |

|

|

|

|

Segmentación del mercado de películas conductoras transparentes en Asia-Pacífico, por material (óxido de indio y estaño sobre vidrio, óxido de indio y estaño sobre PET, nanocables de plata, malla metálica, grafeno, nanotubos de carbono, polímeros conductores, pedot y otros), aplicación (teléfonos inteligentes, DSSCS, tabletas, portátiles, PC, televisores, iluminación OLED, OPV, dispositivos portátiles y otros): tendencias de la industria y pronóstico hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de películas conductoras transparentes de Asia-Pacífico?

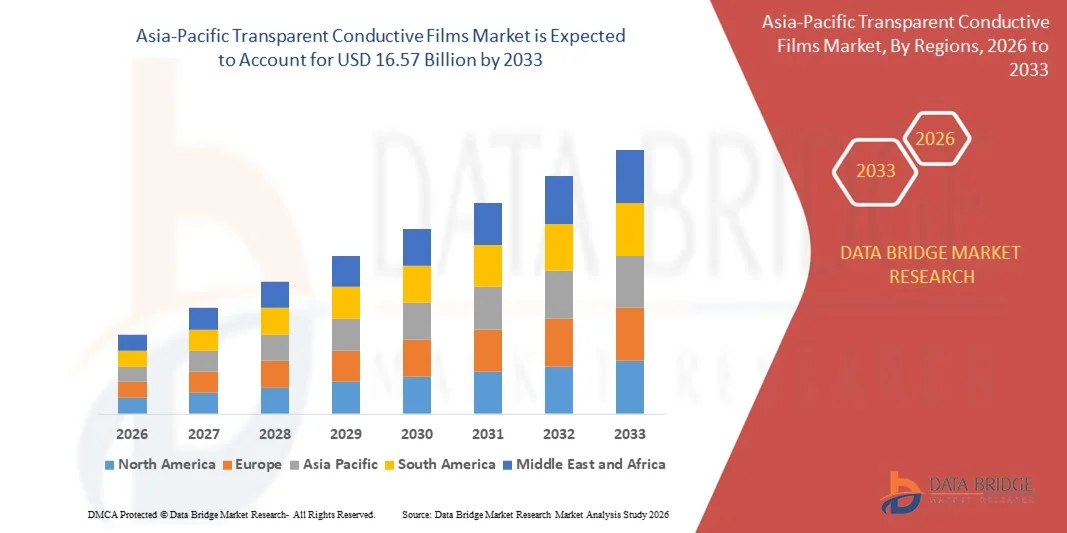

- El tamaño del mercado de películas conductoras transparentes de Asia-Pacífico se valoró en USD 7.08 mil millones en 2025 y se espera que alcance los USD 16.57 mil millones para 2033 , con una CAGR del 11,2% durante el período de pronóstico.

- El crecimiento del mercado de películas conductoras transparentes está impulsado significativamente por la creciente demanda de tecnologías de visualización avanzadas y pantallas táctiles en diversas aplicaciones, incluidos teléfonos inteligentes, tabletas, computadoras portátiles, PC, pantallas de TV, iluminación OLED y pantallas flexibles.

- La creciente demanda de películas de alto rendimiento, baja resistencia y alta transparencia en los sectores en expansión de la electrónica de consumo, la automoción (especialmente en pantallas) y las energías renovables es un factor clave. Su creciente adopción en dispositivos portátiles, pantallas táctiles industriales y aplicaciones de ventanas inteligentes, donde las propiedades únicas de las películas conductoras transparentes son muy valoradas, está impulsando aún más la expansión del mercado.

¿Cuáles son las principales conclusiones del mercado de películas conductoras transparentes?

- Las películas conductoras transparentes son capas delgadas, ópticamente transparentes y con conductividad eléctrica. Compuestas típicamente por materiales como el óxido de indio y estaño (ITO), permiten el paso de la luz a la vez que facilitan la conducción de la corriente eléctrica. Estas películas se utilizan en pantallas táctiles, células solares, electrónica flexible y otras tecnologías que requieren transparencia y conductividad.

- La creciente adopción de películas conductoras transparentes se debe principalmente a la creciente demanda de estas películas en varios dispositivos optoelectrónicos, la creciente producción de dispositivos táctiles que requieren electrodos transparentes y los continuos avances en las tecnologías de visualización que exigen materiales con alta transparencia y conductividad para un mejor rendimiento y eficiencia energética en diversas aplicaciones industriales y de consumo.

- China dominó el mercado de películas conductoras transparentes de Asia-Pacífico con la mayor participación en los ingresos del 36,8 % en 2024, impulsada por la producción masiva de productos electrónicos de consumo, la fabricación de paneles de visualización a gran escala y la rápida expansión de las industrias de vehículos eléctricos y energías renovables.

- El mercado japonés de películas conductoras transparentes está experimentando un crecimiento constante a una CAGR del 8,1 %, respaldado por una fuerte demanda de productos electrónicos avanzados, pantallas automotrices y aplicaciones industriales de alta precisión.

- El segmento de óxido de indio y estaño domina el mercado con una cuota de mercado del 42,81 % en 2024 gracias a su consolidada presencia y probada fiabilidad en una amplia gama de aplicaciones. Su madurez en los procesos de fabricación, su excelente conductividad eléctrica y su alta transparencia óptica lo han convertido en el material predilecto para numerosos dispositivos, a pesar de las limitaciones de disponibilidad y coste del indio.

Alcance del informe y segmentación del mercado de películas conductoras transparentes

|

Atributos |

Perspectivas clave del mercado de películas conductoras transparentes |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de películas conductoras transparentes?

Aumento de la demanda de productos electrónicos de consumo

- Una tendencia significativa y en auge en el mercado de películas conductoras transparentes es su creciente integración en la electrónica de consumo. Esta creciente adopción se ve impulsada por la necesidad de pantallas de alto rendimiento e interfaces táctiles que puedan mejorar la experiencia del usuario, mejorar la estética del dispositivo y habilitar funcionalidades innovadoras en smartphones, tablets, portátiles, wearables y otros dispositivos electrónicos.

- Por ejemplo, importantes empresas líderes en electrónica de consumo, como Apple, Samsung y LG, incorporan ampliamente películas conductoras transparentes en las pantallas táctiles de sus teléfonos inteligentes, tabletas y portátiles para una respuesta táctil ágil y una imagen nítida. Fabricantes líderes de materiales como Nitto Denko, Oike & Co., Ltd. y Teijin Limited ofrecen una amplia gama de películas conductoras transparentes diseñadas específicamente para los exigentes requisitos estéticos y de rendimiento de la electrónica de consumo.

- Esta mayor integración de películas conductoras transparentes en la electrónica de consumo permite una interacción más intuitiva con los dispositivos, mejora la claridad y el brillo de las pantallas y contribuye a diseños elegantes y modernos al permitir dispositivos más delgados y ligeros. En comparación con los métodos de interfaz tradicionales, las pantallas táctiles basadas en películas conductoras transparentes ofrecen la ventaja de la manipulación directa, la capacidad multitáctil y una integración perfecta con la pantalla, lo que se traduce en una mayor usabilidad y una experiencia de usuario más atractiva.

- El creciente énfasis en funciones avanzadas, pantallas de alta resolución, dispositivos plegables y la búsqueda continua de interfaces de usuario innovadoras en electrónica de consumo refuerzan la importancia de las películas conductoras transparentes como componentes esenciales en los dispositivos electrónicos modernos. La tendencia hacia pantallas más grandes en los teléfonos inteligentes y la creciente adopción de tabletas y dispositivos portátiles también impulsan la demanda de películas conductoras transparentes de alta calidad.

- Las organizaciones reconocen cada vez más los beneficios del uso de películas conductoras transparentes por su excelente claridad óptica, buena conductividad eléctrica y versatilidad de aplicación, lo que las hace ideales para integrarse en los complejos y sofisticados diseños de la electrónica de consumo moderna, donde la calidad de la pantalla y la respuesta táctil son primordiales. Esta tendencia hacia dispositivos electrónicos avanzados y con numerosas funciones está impulsando avances e inversiones sustanciales en el mercado de películas conductoras transparentes.

- La demanda de películas conductoras transparentes confiables y de alta calidad está creciendo rápidamente a medida que la creciente implementación de interfaces táctiles y tecnologías de visualización avanzadas alienta a las empresas a adoptar soluciones materiales como películas conductoras transparentes que pueden garantizar un funcionamiento perfecto y confiable, lo que en última instancia aumenta la funcionalidad y la satisfacción del usuario de los productos electrónicos de consumo.

¿Cuáles son los impulsores clave del mercado de películas conductoras transparentes?

- Un factor clave y en crecimiento para el mercado de películas conductoras transparentes es la creciente preferencia de los consumidores por pantallas antirreflejos de alta calidad, lo que ha impulsado una rápida expansión de la demanda de recubrimientos antirreflejos. Esta tendencia exige el uso de películas conductoras transparentes como componente crucial en estas pantallas avanzadas para permitir la funcionalidad táctil y mantener la claridad visual, minimizando al mismo tiempo los reflejos.

- Por ejemplo, importantes empresas del sector de la electrónica de consumo, como Apple y Samsung, incorporan recubrimientos antirreflectantes en las pantallas de sus teléfonos inteligentes, tabletas y portátiles, que utilizan películas conductoras transparentes para la entrada táctil. Fabricantes líderes de materiales para pantallas, como Corning y AGC Inc., ofrecen sustratos de vidrio especializados con recubrimientos antirreflectantes integrados, compatibles con las películas conductoras transparentes de empresas como Nitto Denko y Gunze.

- A medida que los consumidores exigen cada vez más experiencias visuales óptimas con reducción del deslumbramiento en diversas condiciones de iluminación, aumenta la demanda de películas conductoras transparentes que se puedan combinar eficazmente con recubrimientos antirreflejos. Las películas conductoras transparentes son esenciales para la funcionalidad de las pantallas táctiles y las pantallas avanzadas, donde las propiedades antirreflejos mejoran la visibilidad y la comodidad del usuario, lo que las convierte en la opción preferida para satisfacer las expectativas del consumidor de un rendimiento visual de alta calidad.

- Las empresas de los sectores de fabricación de pantallas y electrónica de consumo reconocen cada vez más las ventajas de combinar recubrimientos antirreflectantes con películas conductoras transparentes para ofrecer una calidad de pantalla superior y mayor satisfacción del usuario. Esta tendencia hacia pantallas de alto rendimiento con reducción del deslumbramiento en diversos dispositivos está generando importantes oportunidades y crecimiento en el mercado de películas conductoras transparentes.

- La demanda de tecnologías de pantalla avanzadas con excelente visibilidad y mínimos reflejos está creciendo rápidamente en el mercado de la electrónica de consumo, lo que anima a los fabricantes a integrar películas conductoras transparentes con recubrimientos antirreflectantes en sus productos para mejorar la experiencia del usuario y la claridad visual. Esta integración, en última instancia, aumenta el valor y el atractivo de los dispositivos que utilizan estas tecnologías combinadas.

¿Qué factor está desafiando el crecimiento del mercado de películas conductoras transparentes?

- Un desafío importante para el mercado de películas conductoras transparentes surge de los altos costos de producción inherentes a la fabricación de estos materiales especializados. El uso de materias primas escasas y a menudo costosas, como el óxido de indio y estaño (ITO), junto con procesos de fabricación complejos y de alto consumo energético, contribuye significativamente al costo total de producción, lo que podría dificultar la adopción generalizada y la asequibilidad de ciertas aplicaciones.

- Por ejemplo, mientras fabricantes líderes como Nitto Denko y Teijin Limited se esfuerzan por optimizar sus procesos de producción, el coste fundamental del indio, un componente clave en las películas de ITO de amplio uso, sigue siendo un factor importante. Este elevado coste puede ser una preocupación especial para las empresas de los segmentos de la electrónica de consumo, sensibles a los precios, ya que podría limitar la integración de películas conductoras transparentes en dispositivos de gama baja o impulsar la búsqueda de alternativas rentables.

- Abordar este desafío requiere esfuerzos continuos de investigación y desarrollo centrados en la exploración de materiales alternativos como nanocables de plata, nanotubos de carbono y polímeros conductores, que ofrecen el potencial de reducir los costos de producción. Si bien empresas como Cambrios Technologies y C3Nano están logrando avances en estos materiales alternativos, el ITO sigue siendo un material dominante, y su costo inherente aún puede representar una barrera de entrada o expansión en ciertos segmentos del mercado.

- A pesar de sus ventajas en términos de rendimiento y claridad óptica para numerosas aplicaciones, los altos costos de producción de las películas conductoras transparentes pueden ser un problema para las industrias que buscan una implementación a gran escala en diversas líneas de productos. Este factor de costo podría llevar a algunos fabricantes a explorar materiales conductores alternativos, potencialmente menos eficientes o versátiles, o a limitar la implementación de tecnologías avanzadas de visualización o táctiles en sus ofertas más económicas.

- Superar estas limitaciones implica la innovación continua en la ciencia de los materiales y las técnicas de fabricación para reducir el coste de los materiales existentes, como el ITO, o para desarrollar y ampliar la producción de materiales conductores transparentes alternativos, asequibles y de alto rendimiento. Comprender las ventajas y desventajas de la relación coste-beneficio y los requisitos específicos de las diferentes aplicaciones es fundamental para utilizar eficazmente las películas conductoras transparentes dentro de sus parámetros económicos óptimos y fomentar una mayor penetración en el mercado.

¿Cómo está segmentado el mercado de películas conductoras transparentes?

El mercado está segmentado según el material y la aplicación .

- Por material

Según el material, el mercado se segmenta en óxido de indio y estaño sobre vidrio, óxido de indio y estaño sobre PET, nanocables de plata, malla metálica, grafeno, nanotubos de carbono, polímeros conductores, pedot y otros. El segmento de óxido de indio y estaño sobre vidrio domina la mayor cuota de mercado, con un 42,81 % en 2024, gracias a su consolidada presencia y su probada fiabilidad en una amplia gama de aplicaciones. Su madurez en los procesos de fabricación, su excelente conductividad eléctrica y su alta transparencia óptica lo han convertido en el material predilecto para numerosos dispositivos, a pesar de las limitaciones de disponibilidad y coste del indio.

Se prevé que el segmento de nanotubos de carbono experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente demanda de electrónica flexible y transparente. Los avances en la síntesis y el procesamiento de nanotubos de carbono (CNT) están dando lugar a películas conductoras más eficientes y rentables. Su mayor flexibilidad, alta conductividad y potencial de menores costos de producción en comparación con el ITO los convierten en una alternativa atractiva para las pantallas y dispositivos de próxima generación.

- Por aplicación

Según su aplicación, el mercado se segmenta en smartphones, DSSCS, tablets, portátiles, PC, pantallas de TV, iluminación OLED, OPV, wearables y otros. El segmento de pantallas de TV domina la mayor cuota de mercado en ingresos en 2024, impulsado por la creciente demanda de pantallas de mayor tamaño y alta resolución en los hogares de todo el mundo. La consolidada infraestructura de fabricación para pantallas de ITO de gran tamaño y la preferencia del consumidor por experiencias visuales de alta calidad en televisores contribuyen a este predominio.

Se espera que el segmento de smartphones experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la continua proliferación de smartphones y la creciente demanda de conectividad constante y funciones avanzadas. La rápida adopción de las redes 5G y los avances en las tecnologías de visualización, incluidas las pantallas flexibles y plegables, están impulsando la necesidad de películas conductoras transparentes innovadoras y eficientes en la fabricación de smartphones.

¿Qué región posee la mayor participación en el mercado de películas conductoras transparentes?

- China dominó el mercado de películas conductoras transparentes de Asia-Pacífico con la mayor participación en los ingresos del 36,8 % en 2024, impulsada por la producción masiva de productos electrónicos de consumo, la fabricación de paneles de visualización a gran escala y la rápida expansión de las industrias de vehículos eléctricos y energías renovables.

- El liderazgo del país en la fabricación de paneles OLED y LCD, la producción de módulos fotovoltaicos y la integración de baterías para vehículos eléctricos está acelerando la adopción de películas conductoras transparentes en paneles táctiles, pantallas flexibles, sensores y células solares.

- El fuerte apoyo gubernamental, las cadenas de suministro integradas verticalmente y las importantes inversiones en ITO, nanocables de plata y películas conductoras basadas en grafeno posicionan a China como el principal centro de fabricación e innovación para el mercado de películas conductoras transparentes de Asia-Pacífico.

Análisis del mercado de películas conductoras transparentes en Japón

El mercado japonés de películas conductoras transparentes experimenta un crecimiento constante con una tasa de crecimiento anual compuesta (TCAC) del 8,1%, impulsado por la fuerte demanda de electrónica avanzada, pantallas automotrices y aplicaciones industriales de alta precisión. Los fabricantes japoneses se centran en alternativas de ITO de alto rendimiento, recubrimientos conductores ultrafinos y electrodos transparentes flexibles para satisfacer las cambiantes necesidades tecnológicas. La continua inversión en I+D, las sólidas carteras de propiedad intelectual y la colaboración entre fabricantes de equipos originales (OEM) de electrónica y proveedores de materiales refuerzan el papel de Japón como un actor clave en el mercado de películas conductoras transparentes de Asia-Pacífico.

Perspectiva del mercado de películas conductoras transparentes de Corea del Sur

El mercado surcoreano de películas conductoras transparentes está en constante expansión, impulsado por el liderazgo mundial en pantallas OLED, smartphones y electrónica de consumo de última generación. La creciente adopción de películas conductoras transparentes en pantallas plegables, dispositivos wearables y sistemas de infoentretenimiento para automóviles impulsa el crecimiento del mercado. El sólido respaldo de los principales fabricantes de pantallas, la innovación continua en nanocables de plata y películas de polímeros conductores, y el apoyo gubernamental a la I+D de materiales avanzados posicionan a Corea del Sur como un centro clave de innovación y producción en el mercado de películas conductoras transparentes de Asia-Pacífico.

¿Cuáles son las principales empresas en el mercado de películas conductoras transparentes?

La industria de películas conductoras transparentes está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Dow, Inc. (EE. UU.)

- Windmöller & Hölscher (Alemania)

- Sealed Air Corporation (EE. UU.)

- Klöckner Pentaplast (Luxemburgo)

- Berry Global Inc. (EE. UU.)

- Amcor plc (Suiza)

- Graphic Packaging International, LLC (EE. UU.)

- FLEXOPACK SA (Grecia)

- WINPAK LTD. (Canadá)

- Schur Flexibles Holding GesmbH (Austria)

- Paquete Mannok (Reino Unido)

- Spa G. Mondini (Italia)

- GRUPO CLONDALKIN (Países Bajos)

- PLASTOPIL (Israel)

- MULTIVAC (Alemania)

- ULMA Packaging (España)

- JASA Packaging Solutions (Países Bajos)

- Sealpac International bv (Países Bajos)

- KM Packaging Services Ltd (Reino Unido)

- Bliston Packaging BV (Países Bajos)

¿Cuáles son los desarrollos recientes en el mercado global de pantallas de pila central?

- En julio de 2021, TEIJIN LIMITED inició sus operaciones comerciales para la fabricación de productos de fibra de carbono, incluyendo preimpregnados, en Vietnam. Esta expansión ha incrementado significativamente la capacidad de producción de la empresa para materiales intermedios compuestos. Esta estrategia refuerza la trayectoria de crecimiento de TEIJIN LIMITED, permitiendo una mayor producción y satisfaciendo la creciente demanda de compuestos avanzados de fibra de carbono en diversas industrias.

- En mayo de 2021, Toyobo Co., Ltd. se convirtió en el primer inversor en cerrar una operación en JMTC Chemical and Materials Investment Limited Partnership, un fondo de inversión que apoya a startups que desarrollan nuevos materiales. Esta alianza estratégica contribuyó a aumentar la producción de la empresa y, posteriormente, a impulsar sus beneficios. La colaboración de Toyobo Co., Ltd. con el fondo de inversión se alinea con su compromiso de impulsar la innovación en el desarrollo de materiales.

- En marzo de 2021, NITTO DENKO CORPORATION reforzó su negocio de fabricación de oligonucleótidos terapéuticos en Japón mediante importantes inversiones. Esta estrategia resultó en una notable expansión de la capacidad de fabricación de oligonucleótidos terapéuticos, posicionando a NITTO DENKO CORPORATION para satisfacer la creciente demanda de soluciones terapéuticas avanzadas y consolidando su presencia en la industria biofarmacéutica.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.