Mercado de servicios gestionados de telecomunicaciones de Asia y el Pacífico, por tipo (servicios de centro de datos gestionados, servicios de red gestionados, servicios de colaboración y comunicación gestionados, servicios de seguridad gestionados, servicios de movilidad gestionados y otros), servicio de información gestionado (MIS) ( gestión de procesos de negocio , sistemas de soporte operativo gestionados/sistemas de soporte empresarial, gestión de proyectos y carteras, y otros), modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas y pequeñas y medianas empresas (PYME)): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado

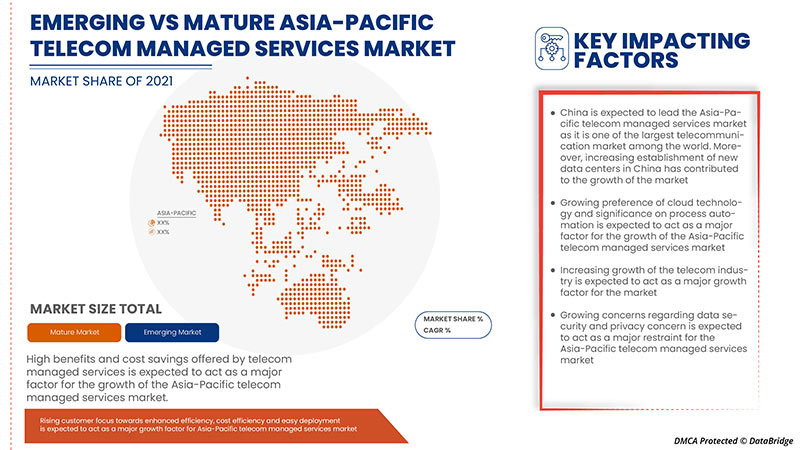

El papel de los servicios gestionados de telecomunicaciones es ayudar a la organización a centrarse en la eficiencia operativa mediante la gestión de las actividades y estrategias comerciales. Los servicios gestionados de telecomunicaciones ayudan a las organizaciones a mantener la infraestructura de TI y a proporcionar funciones de servicio críticas para el negocio. La creciente adopción de tecnologías de computación en la nube por parte de las pequeñas y medianas empresas y el creciente avance en tecnología como los servicios de movilidad y los servicios de big data para mejorar la eficiencia operativa son los principales factores responsables del crecimiento del mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico. Sin embargo, la escasez de profesionales capacitados o de personal capacitado puede frenar el crecimiento del mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico.

Data Bridge Market Research analiza que se espera que el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico alcance un valor de 14.365,10 millones de dólares en 2029, con una tasa de crecimiento anual compuesta (CAGR) del 14,8 % durante el período de pronóstico. Los "servicios de centros de datos gestionados" representan el segmento de sistemas más grande en el mercado de servicios gestionados de telecomunicaciones. El informe del mercado de servicios gestionados de telecomunicaciones también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (servicios de centro de datos administrados, servicios de red administrados, servicios de colaboración y comunicación administrados, servicios de seguridad administrados , servicios de movilidad administrados y otros), servicio de información administrado (MIS) (gestión de procesos de negocio, sistemas de soporte operativo administrados/sistemas de soporte de negocio, gestión de proyectos y carteras y otros), modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas y pequeñas y medianas empresas (PYME)) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

FUJITSU, DXC Technology Company, IBM Corporation, Cognizant, Wipro Limited, Capgemini, Accenture, Tata Consultancy Services Limited, HCL Technologies Limited, NTT DATA Corporation, Verizon, Cisco Systems, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, AT&T Intellectual Property, Nokia Corporation, Lumen Technologies, RACKSPACE TECHNOLOGY, INC., Comarch SA, Tech Mahindra Limited, Infosys Limited, GTT Communications, Inc., BT, Unisys, entre otras. |

Definición de mercado

Un servicio gestionado es una tarea que lleva a cabo un tercero, con frecuencia en el contexto de la empresa a la que presta servicios. Los servicios gestionados se utilizan para reducir gastos, mejorar la calidad del servicio o liberar a los equipos internos para que trabajen en tareas que son exclusivas de la empresa específica, y es un medio para delegar tareas generales a un especialista. Un proveedor de servicios gestionados es una empresa que ofrece estos servicios. Un proveedor de servicios gestionados suele ser un proveedor de servicios de TI que gestiona y asume la responsabilidad de proporcionar un conjunto definido de servicios a sus clientes.

Los servicios gestionados de telecomunicaciones permiten a las organizaciones reducir sus costos en las operaciones comerciales, lo que les permite concentrarse más en ejercicios comerciales esenciales y técnicas fundamentales, reducir los riesgos relacionados con las operaciones comerciales y mejorar la eficacia y precisión operativa.

Dinámica del mercado de servicios gestionados de telecomunicaciones en Asia-Pacífico

- Creciente necesidad de agilidad empresarial

La agilidad empresarial tiene la capacidad de mantener su máximo potencial, tanto en términos de ganancias como de empleados, en un entorno externo e interno dinámico. Permite a las organizaciones innovar y ofrecer resultados de manera más eficaz, convirtiendo así la disrupción del mercado en una ventaja competitiva y prosperando en entornos complejos.

- Mayor enfoque en el cliente hacia una mayor eficiencia, rentabilidad y una fácil implementación

Los servicios gestionados son una práctica muy rentable que se utiliza ampliamente en el mundo digitalizado actual. Además, permiten a los propietarios de empresas reducir la carga de trabajo y concentrarse en otros aspectos fundamentales de su operación. Los países desarrollados como Japón, China e India siempre prefieren externalizar sus procesos comerciales.

- Creciente preferencia por la tecnología en la nube y su importancia en la automatización de procesos

Las tecnologías digitales han creado nuevas oportunidades para los líderes empresariales. Los modelos tradicionales de gestión de operaciones y procesos empresariales se están reinventando para convertirse en flujos de trabajo más inteligentes mediante la automatización, la inteligencia artificial, el Internet de las cosas (IdC), la nube y otras nuevas tecnologías. Las empresas deben evolucionar constantemente hacia procesos más inteligentes y completamente orquestados que tengan en cuenta a los clientes, empleados, proveedores y socios comerciales por igual para seguir siendo relevantes y continuar su crecimiento.

- Creciente demanda de centros de datos

La COVID-19 ha provocado una gran generación de datos, ya que las personas han comenzado a trabajar desde casa, las organizaciones se están transformando digitalmente y están adoptando diversas tecnologías digitales. El creciente flujo de datos necesita ser operado y almacenado, con la ayuda de los centros de datos. Por lo tanto, varios centros de datos están aumentando la demanda de sus servicios de gestión, lo que es uno de los principales factores para el crecimiento del mercado en el período de pronóstico.

Oportunidad

-

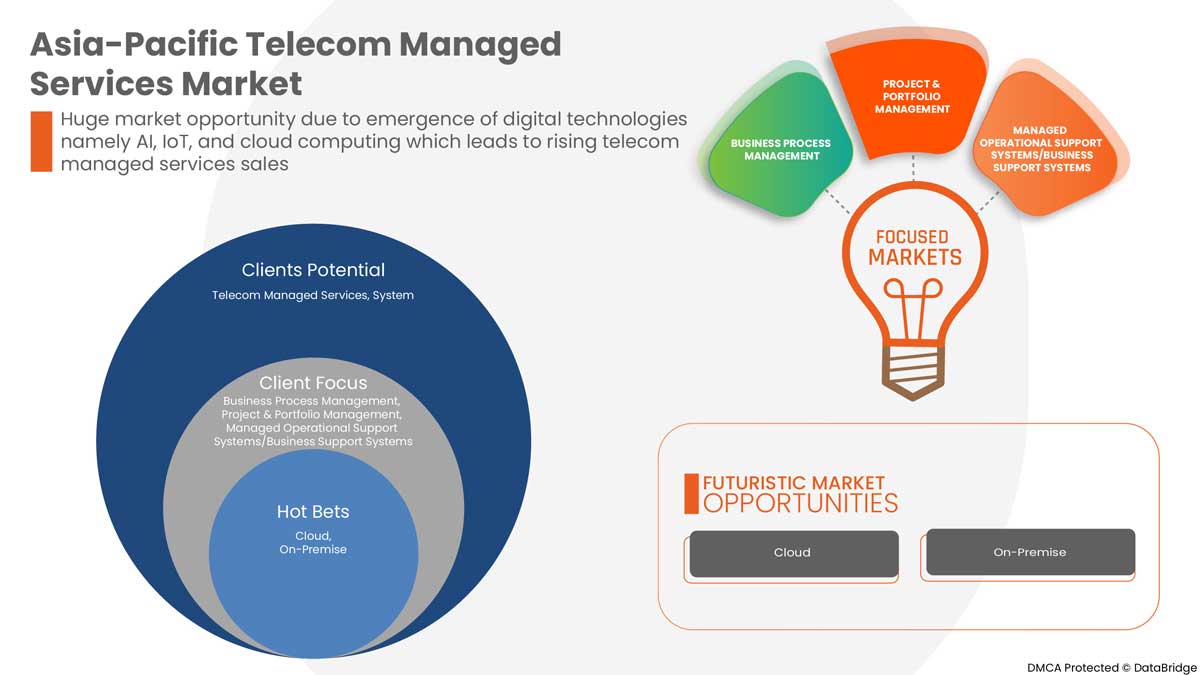

Surgimiento de tecnologías digitales, a saber, IA, IoT y computación en la nube.

La computación en la nube ha resultado ser una fuerza impulsora importante de la transformación digital en todas las industrias. No solo proporciona una agilidad incomparable, sino que también reduce los costos operativos y de gestión. Varios gobiernos y empresas están comenzando a aprovechar esta tecnología y poco a poco está ganando popularidad en varios sectores verticales. El potencial se ha vuelto tan abierto que la noción de que la nube se limita solo a las funciones de TI ha cambiado por completo. Esto se integra aún más con otras tecnologías como la inteligencia artificial (IA), la Internet de las cosas (IoT) y la computación de borde, entre otras.

Restricciones/Desafíos

- Crecientes preocupaciones en torno a la seguridad de los datos y la privacidad

La seguridad de los datos se ha vuelto más importante que nunca, lo que ha provocado que muchas personas sientan curiosidad por cómo las empresas gestionan la seguridad de los datos. Si bien la subcontratación de procesos empresariales está ganando popularidad, muchas organizaciones temen que trabajar con una empresa externa pueda poner en riesgo sus datos. En esencia, las crecientes preocupaciones sobre la seguridad de los datos debido a los ataques externos y las fallas de seguridad internas son un factor importante que puede obstaculizar el crecimiento del mercado de servicios gestionados de telecomunicaciones.

Impacto de la COVID-19 en el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico

La COVID-19 afectó significativamente al mercado de servicios gestionados, ya que casi todos los países optaron por cerrar las instalaciones corporativas. Por lo tanto, las empresas enfrentaron problemas al operar de forma remota en la fase inicial.

Sin embargo, el crecimiento del mercado de servicios gestionados en el período posterior a la pandemia se atribuye a la creciente demanda de habilidades digitales en las economías subdesarrolladas.

Los proveedores de servicios están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología de estos servicios. Con ello, las empresas llevarán tecnologías avanzadas al mercado.

Acontecimientos recientes

- En septiembre de 2021, Huawei Technologies Co., Ltd. anunció que había firmado un acuerdo de servicios gestionados y de TIC con Ooredoo Oman. En virtud de este acuerdo, la empresa proporcionará a Ooredoo servicios de gestión del rendimiento de la red y operaciones y mantenimiento. De este modo, la empresa está ampliando su base de clientes en el mercado.

- En noviembre de 2020, Telefonaktiebolaget LM Ericsson anunció la apertura de un nuevo centro de servicios gestionados en Turquía. La empresa promoverá soluciones de ingeniería y diseño de alto valor basadas en tecnologías de última generación, incluidas la inteligencia artificial (IA) y el aprendizaje automático. De esta forma, la empresa ampliará su negocio en la región.

Alcance del mercado de servicios gestionados de telecomunicaciones en Asia-Pacífico

El mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico está segmentado en función del tipo, el servicio de información gestionada (MIS), el modelo de implementación y el tamaño de la organización. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Servicios de centro de datos gestionados

- Servicios de red gestionados

- Servicios de comunicación y colaboración gestionados

- Servicios de seguridad gestionados

- Servicios de movilidad gestionada

- Otros

Según el tipo, el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico se segmenta en servicios de centros de datos gestionados, servicios de red gestionados, servicios de comunicación y colaboración gestionados, servicios de seguridad gestionados, servicios de movilidad gestionados y otros.

Servicio de información gestionada (MIS)

- Gestión de procesos de negocio

- Sistemas de soporte operativo gestionados/Sistemas de soporte empresarial

- Gestión de proyectos y carteras

- Otros

Sobre la base del servicio de información gestionado (MIS), el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico está segmentado en gestión de procesos de negocio, sistemas de soporte operativo gestionados/sistemas de soporte de negocio, gestión de proyectos y carteras, y otros.

Modelo de implementación

- Nube

- En las instalaciones

Sobre la base del modelo de implementación, el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico se ha segmentado en local y en la nube.

Tamaño de la organización

- Grandes empresas

- Pequeñas y medianas empresas (PYMES)

Sobre la base del tamaño de la organización, el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico está segmentado en grandes empresas y pequeñas y medianas empresas (PYMES).

Mercado de servicios gestionados de telecomunicaciones de Asia y el Pacífico

Se analiza el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo, servicio de información gestionada (MIS), modelo de implementación y tamaño de la organización como se menciona anteriormente.

El mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico cubre países como China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico.

Se espera que China domine el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico, ya que es uno de los mercados de telecomunicaciones más grandes del mundo. Además, el aumento de los servicios de Internet y de telefonía móvil y el establecimiento de nuevos centros de datos en China, India, Singapur y Australia han propiciado un enorme crecimiento del mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico.

La sección de países del informe sobre el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico también proporciona factores de impacto individuales en el mercado y cambios en la regulación nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación son algunos de los indicadores importantes que se utilizan para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de las marcas de Asia-Pacífico y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los servicios gestionados de telecomunicaciones en Asia-Pacífico

El panorama competitivo del mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, sus finanzas, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia regional, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de soluciones, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de servicios gestionados de telecomunicaciones de Asia-Pacífico son FUJITSU, DXC Technology Company, IBM Corporation, Cognizant, Wipro Limited, Capgemini, Accenture, Tata Consultancy Services Limited, HCL Technologies Limited, NTT DATA Corporation, Verizon, Cisco Systems, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, AT&T Intellectual Property, Nokia Corporation, Lumen Technologies, RACKSPACE TECHNOLOGY, INC., Comarch SA, Tech Mahindra Limited, Infosys Limited, GTT Communications, Inc., BT, Unisys, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TELECOM MANAGED SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.1.1 REGULATIONS FOR U.S.

4.1.2 REGULATIONS FOR U.K.

4.1.3 REGULATIONS FOR SPAIN

4.1.4 REGULATIONS FOR NETHERLANDS

4.1.5 REGULATIONS FOR JAPAN

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS:

4.2.2 ECONOMIC FACTORS:

4.2.3 SOCIAL FACTORS:

4.2.4 TECHNOLOGICAL FACTORS:

4.2.5 ENVIRONMENTAL FACTORS:

4.2.6 LEGAL FACTORS:

4.3 PORTERS MODEL

4.4 TECHNOLOGICAL ANALYSIS

4.4.1 BIG DATA AND ANALYTICS

4.4.2 CLOUD COMPUTING

4.4.3 ARTIFICIAL INTELLIGENCE

4.4.4 MACHINE LEARNING

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR BUSINESS AGILITY

5.1.2 RISING CUSTOMER FOCUS TOWARDS ENHANCED COST, EFFICIENCY, AND EASY DEPLOYMENT

5.1.3 GROWING PREFERENCE FOR CLOUD TECHNOLOGY AND ITS SIGNIFICANCE IN PROCESS AUTOMATION

5.1.4 SURGING DEMAND FOR DATA CENTERS

5.1.5 HEIGHTENED DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.6 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINT

5.2.1 GROWING DATA SECURITY AND PRIVACY CONCERNS

5.3 OPPORTUNITIES

5.3.1 FOCUS ON MULTI-WORKFLOW SCHEDULING OF BUSINESS

5.3.2 EMERGENCE OF DIGITAL TECHNOLOGIES, NAMELY AI, IOT, AND CLOUD COMPUTING

5.3.3 GROWING DEMAND FOR DIGITAL SKILLS IN UNDERDEVELOPED ECONOMIES

5.3.4 INCREASING GROWTH IN THE TELECOM INDUSTRY

5.4 CHALLENGE

5.4.1 LACK OF SKILLED WORKFORCE AND HIGH ATTRITION RATE

6 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE

6.1 OVERVIEW

6.2 MANAGED DATA CENTER SERVICES

6.2.1 STORAGE MANAGEMENT

6.2.2 SERVER MANAGEMENT

6.2.3 MANAGED PRINT SERVICES

6.2.4 OTHERS

6.3 MANAGED NETWORK SERVICES

6.3.1 MANAGED WIDE AREA NETWORK

6.3.2 NETWORK MONITORING

6.3.3 MANAGED NETWORK SECURITY

6.3.4 MANAGED LOCAL AREA NETWORK

6.3.5 MANAGED WIRELESS FIDELITY

6.3.6 MANAGED VIRTUAL PRIVATE NETWORK

6.4 MANAGED COMMUNICATION AND COLLABORATION SERVICES

6.4.1 MANAGED VOICE OVER INTERNET PROTOCOL (VOIP)

6.4.2 MANAGED UNIFIED COMMUNICATION AS A SERVICE (UCAAS)

6.4.3 OTHERS

6.5 MANAGED SECURITY SERVICES

6.5.1 MANAGED IDENTITY AND ACCESS MANAGEMENT

6.5.2 MANAGED FIREWALL

6.5.3 MANAGED ANTIVIRUS/ANTIMALWARE

6.5.4 MANAGED INTRUSION DETECTION SYSTEMS/INTRUSION PREVENTION SYSTEMS

6.5.5 MANAGED VULNERABILITY MANAGEMENT

6.5.6 MANAGED UNIFIED THREAT MANAGEMENT

6.5.7 MANAGED RISK AND COMPLIANCE MANAGEMENT

6.5.8 MANAGED ENCRYPTION

6.5.9 MANAGED SECURITY INFORMATION AND EVENT MANAGEMENT

6.5.10 OTHERS

6.6 MANAGED MOBILITY SERVICES

6.6.1 APPLICATION MANAGEMENT

6.6.2 DEVICE LIFE CYCLE MANAGEMENT

6.7 OTHERS

7 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS)

7.1 OVERVIEW

7.2 BUSINESS PROCESS MANAGEMENT

7.3 MANAGED OPERATIONAL SUPPORT SYSTEMS/BUSINESS SUPPORT SYSTEMS

7.4 PROJECT & PORTFOLIO MANAGEMENT

7.5 OTHERS

8 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.2.1 CLOUD

9.2.2 ON-PREMISE

9.3 SMALL AND MEDIUM ENTERPRISES (SMES)

9.3.1 CLOUD

9.3.2 ON-PREMISE

10 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 AUSTRALIA

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 IBM CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SERVICE PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 ACCENTURE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 HUAWEI TECHNOLOGIES CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 AT&T INTELLECTUAL PROPERTY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 VERIZON

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TELEFONAKTIEBOLAGET LM ERICSSON

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 BT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 CAPGEMINI

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 SERVICE PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 CISCO SYSTEMS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 COGNIZANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 SERVICE PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 COMARCH SA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 DXC TECHNOLOGY COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 SERVICE PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 FUJITSU

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 GTT COMMUNICATIONS, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 HCL TECHNOLOGIES LIMITED

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 INFOSYS LIMITED

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 LUMEN TECHNOLOGIES

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 NOKIA CORPORATION

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 NTT DATA CORPORATION

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SERVICES PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 RACKSPACE TECHNOLOGY, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 TATA CONSULTANCY SERVICES LIMITED

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 SERVICE PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

13.22 TECH MAHINDRA LIMITED

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENTS

13.23 UNISYS

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 PRODUCT PORTFOLIO

13.23.4 RECENT DEVELOPMENT

13.24 WIPRO LIMITED

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENTS

13.25 ZTE CORPORATION

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC BUSINESS PROCESS MANAGEMENT IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MANAGED OPERATIONAL SUPPORT SYSTEMS/BUSINESS SUPPORT SYSTEMS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PROJECT & PORTFOLIO MANAGEMENT IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CLOUD IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC ON-PREMISE IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 38 CHINA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 CHINA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 CHINA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 45 CHINA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 46 CHINA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 48 CHINA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 49 JAPAN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 56 JAPAN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 57 JAPAN TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 59 JAPAN SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH KOREA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH KOREA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH KOREA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 71 INDIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 78 INDIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 79 INDIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 INDIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 81 INDIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SINGAPORE MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 104 THAILAND TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 THAILAND MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 THAILAND MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 THAILAND MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 THAILAND MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 THAILAND TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 111 THAILAND TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 112 THAILAND TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 113 THAILAND LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 114 THAILAND SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDONESIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDONESIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 INDONESIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDONESIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDONESIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDONESIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 122 INDONESIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 135 MALAYSIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 136 MALAYSIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 137 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 148 REST OF ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: SEGMENTATION

FIGURE 10 RISING CUSTOMER FOCUS TOWARD ENHANCED COST EFFICIENCY AND EASY DEPLOYMENT IS EXPECTED TO DRIVE THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 11 MANAGED DATA CENTER SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET

FIGURE 14 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY TYPE, 2021

FIGURE 15 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY MANAGED INFORMATION SERVICE (MIS), 2021

FIGURE 16 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 17 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY TYPE (2022-2029)

FIGURE 23 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.