Mercado de condensadores síncronos de Asia y el Pacífico, por tecnología de enfriamiento (condensador síncrono enfriado por hidrógeno, condensador síncrono enfriado por aire y condensador síncrono enfriado por agua), método de arranque (convertidor de frecuencia estático, motor Pony y otros), potencia reactiva nominal (más de 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR y 0-30 MVAR), usuario final (servicios eléctricos y sectores industriales), tipo (condensador síncrono nuevo y condensador síncrono renovado), diseño (diseño de polos salientes y diseño de rotor cilíndrico), número de polos (4 a 8, menos de 4 y más de 8), tipo de sistema de excitación (excitación estática y sistema de excitación sin escobillas) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de condensadores síncronos de Asia y el Pacífico

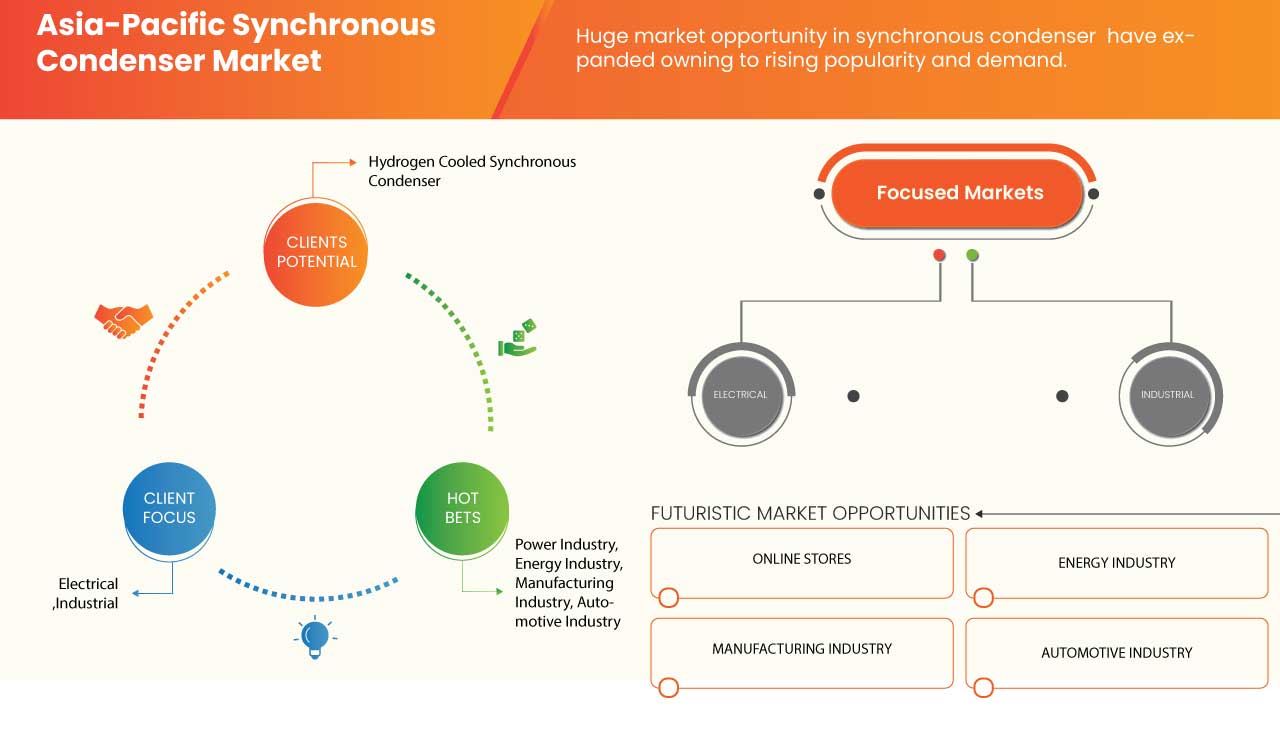

Un condensador o compensador síncrono es un motor que funciona sin una carga fija. Puede generar o consumir voltamperios reactivos (VAr) al variar la excitación de su devanado de campo. Puede configurarse para que admita una corriente máxima con sobreexcitación de su devanado de campo. La creciente demanda de condensadores se debe a la introducción de dispositivos de compensación de estado sólido, como el compensador estático de VAR (SVC) que proporciona potencia reactiva. La creciente demanda de fuentes de energía limpia y la creciente necesidad de sistemas integrados en las centrales eléctricas son los principales factores que impulsan el mercado. Sin embargo, los altos precios asociados con los servicios de instalación y mantenimiento están restringiendo el crecimiento del mercado. Se estima que el aumento en el desmantelamiento de fuentes de generación de energía convencionales antiguas y el aumento de las iniciativas gubernamentales para reducir la contaminación del aire brindarán oportunidades de crecimiento del mercado. Sin embargo, la participación de procesos de instalación sofisticados y que requieren mucho tiempo crea un entorno desafiante para el crecimiento del mercado.

Data Bridge Market Research analiza que se espera que el mercado de condensadores síncronos de Asia-Pacífico alcance los 958.152,78 mil dólares en 2030, con una tasa compuesta anual del 4,2 % durante el período de pronóstico. El informe del mercado de condensadores síncronos de Asia-Pacífico también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable 2015-2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Tecnología de enfriamiento (condensador síncrono enfriado por hidrógeno, condensador síncrono enfriado por aire y condensador síncrono enfriado por agua), método de arranque (convertidor de frecuencia estático, motor Pony y otros), potencia reactiva nominal (más de 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR y 0-30 MVAR), usuario final (servicios eléctricos y sectores industriales), tipo (condensador síncrono nuevo y condensador síncrono renovado), diseño (diseño de polos salientes y diseño de rotor cilíndrico), número de polos (de 4 a 8, menos de 4 y más de 8), tipo de sistema de excitación (excitación estática y sistema de excitación sin escobillas) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Australia, Singapur, Indonesia, Tailandia, Malasia, Taiwán, Filipinas y resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

General Electric, ABB, Siemens, Eaton, WEG, Ansaldo Energia, Shanghai Electric Power Generation Equipment Co., Ltd. (una filial de Shanghai Electric), Ingeteam, Hitachi Energy Ltd, Voith GmbH & Co. KGaA, Mitsubishi Electric Power Products, Inc., Baker Hughes Company, Power Systems & Controls, Inc., IDEAL ELECTRIC POWER CO., Doosan Škoda Power y ANDRITZ, entre otras. |

Definición de mercado

Un condensador síncrono se considera un motor síncrono excitado por corriente continua que ajusta la temperatura y la potencia en función de la transmisión de energía eléctrica y la red inteligente . Los compensadores síncronos, también llamados condensadores síncronos, están diseñados para controlar el nivel de voltaje en un área de la red. Pueden producir o consumir potencia reactiva en función del valor de la corriente de excitación. Los condensadores síncronos son una alternativa a los bancos de condensadores para la corrección del factor de potencia en las redes eléctricas.

Una de las principales ventajas del condensador síncrono es la cantidad de potencia reactiva que se puede ajustar de forma continua. El condensador síncrono se desarrolla con técnicas avanzadas para mejorar el factor de potencia en un banco de condensadores estáticos. Los condensadores síncronos se han utilizado tradicionalmente en niveles de tensión de distribución y transmisión para mejorar la estabilidad y mantener las tensiones dentro de los límites deseados en condiciones de carga cambiantes y situaciones de contingencia. El condensador síncrono consta de un estator y un rotor con puntas de polo sólidas integradas, un sistema de refrigeración (hidrógeno, aire o agua), un sistema de excitación, un suministro de aceite lubricante y un transformador elevador y un transformador auxiliar.

Un condensador síncrono es una tecnología conocida desde hace mucho tiempo que ofrece ventajas. La alta inercia del sistema es una característica inherente de un condensador síncrono, ya que es una máquina rotatoria. El beneficio de la inercia es una rigidez de voltaje mejorada, lo que mejora el comportamiento general del sistema. La mayor capacidad de sobrecarga a corto plazo puede proporcionar más del doble de su capacidad nominal durante unos pocos segundos, lo que mejora el soporte del sistema durante emergencias o contingencias o incluso bajo contingencias de voltaje extremadamente bajo. Permanece conectado y proporciona un funcionamiento suave y confiable y una resistencia real a cortocircuitos a la red, lo que mejora la estabilidad del sistema con interconexiones débiles y mejora la protección del sistema.

Dinámica del mercado de condensadores síncronos en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Demanda creciente de fuentes de energía limpia

La energía limpia es la energía que se obtiene de fuentes que no liberan contaminantes al aire. La energía renovable es la energía generada a partir de fuentes que se renuevan constantemente. A diferencia de los combustibles fósiles y el gas, estas fuentes de energía renovables no se agotan e incluyen la energía eólica y solar. Sin embargo, la mayoría de las fuentes de energía verde son renovables. Por lo tanto, la energía limpia verde perfecta puede denominarse fuentes de energía renovables.

- Creciente necesidad de sistemas integrados en las centrales eléctricas

La integración de sistemas energéticos (ESI) coordina la operación y planificación de los sistemas energéticos para ofrecer servicios energéticos fiables y rentables con un impacto ambiental mínimo. Estos sistemas implican la interacción entre factores energéticos como la electricidad, la energía térmica, los combustibles, el agua y los transmisores. Por lo tanto, la ESI es un área multidisciplinaria que abarca la ciencia, la ingeniería y la tecnología.

Oportunidad

- Aumentan las iniciativas gubernamentales para reducir la contaminación del aire

El consumo de energía ha aumentado en todo el mundo debido al aumento de la demanda de electricidad. La producción de energía a partir de combustibles fósiles es responsable de más de un tercio de las emisiones de gases de efecto invernadero del mundo, que causan contaminación y cambio climático.

Restricciones/Desafíos

- Precios más altos asociados al capital y al mantenimiento

Un condensador síncrono es una solución convencional que se ha utilizado durante décadas para regular la potencia. Este tipo de dispositivo incluye un motor síncrono de CA que puede proporcionar un control continuo de la potencia reactiva cuando se utiliza con un excitador automático adecuado. Esto ha provocado un aumento en el uso de este tipo de dispositivos eléctricos a lo largo de los años.

- Mayor volatilidad de precios de las materias primas

Los condensadores síncronos están asociados a varios componentes y sistemas, como rotores, estatores y sistemas de refrigeración. Estos sistemas están fabricados con aluminio, cobre y acero inoxidable. Además, la construcción o integración de este sistema es sofisticada pero útil para el sistema de distribución de energía y módulos de transistores de alta potencia.

Acontecimientos recientes

- En abril de 2023, Eaton anunció la adquisición de una participación del 9% en Jiangsu Ryan Electrical Co. Ltd., que fabrica transformadores de distribución y subtransmisión de energía en China. Esta adquisición ayudará a la empresa a concentrarse en productos y servicios eléctricos. Además, acelera la distribución global de la empresa, especialmente en Asia-Pacífico.

- En enero de 2022, Siemens anunció la firma de un acuerdo con Elering para construir tres condensadores síncronos en estaciones de unión de 330 kV en Estonia para 2024. Este acuerdo ayudó a la empresa a obtener un negocio de USD 83,5 millones y reconocimiento del mercado para condensadores síncronos y mejora el negocio en Alemania.

Alcance del mercado de condensadores síncronos en Asia y el Pacífico

El mercado de condensadores síncronos de Asia-Pacífico está segmentado en ocho segmentos notables según la tecnología de refrigeración, el método de arranque, la potencia reactiva nominal, el usuario final, el tipo, el diseño, la cantidad de polos y el tipo de sistema de excitación. El crecimiento entre estos segmentos lo ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tecnología de refrigeración

- Condensador síncrono refrigerado por hidrógeno

- Condensador síncrono refrigerado por aire

- Condensador síncrono refrigerado por agua

Sobre la base de la tecnología de enfriamiento, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en condensadores síncronos enfriados por hidrógeno, condensadores síncronos enfriados por aire y condensadores síncronos enfriados por agua.

Método de inicio

- Convertidor de frecuencia estático

- Motor de pony

- Otros

Sobre la base del método de inicio, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en convertidores de frecuencia estáticos, motores pony y otros.

Clasificación de potencia reactiva

- Más de 200 MVAR

- 101-200 MVAR

- 61-100 MVAR

- 31-60 MVAR

- 0-30 MVAR

Sobre la base de la clasificación de potencia reactiva, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en más de 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR y 0-30 MVAR.

Usuario final

- Empresas de servicios eléctricos

- Sectores industriales

Sobre la base del usuario final, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en servicios eléctricos y sector industrial.

Tipo

- Nuevo condensador síncrono

- Condensador síncrono reacondicionado

Según el tipo, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en condensadores síncronos nuevos y condensadores síncronos renovados.

Número de polos

- 4 a 8

- Menos de 4

- Más de 8

Sobre la base del número de polos, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en 4 a 8, menos de 4 y más de 8.

Diseño

- Diseño de polos salientes

- Diseño de rotor cilíndrico

Sobre la base del diseño, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en diseño de polos salientes y diseño de rotor cilíndrico.

Tipo de sistema de excitación

- Excitación estática

- Sistema de excitación sin escobillas

Sobre la base del tipo de sistema de excitación, el mercado de condensadores síncronos de Asia-Pacífico está segmentado en sistema de excitación estática y sistema de excitación sin escobillas.

Análisis y perspectivas regionales del mercado de condensadores síncronos de Asia y el Pacífico

Se analiza el mercado de condensadores síncronos de Asia y el Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado por región, tecnología de enfriamiento, método de arranque, potencia reactiva nominal, usuario final, tipo, diseño, número de polos y tipo de sistema de excitación, como se menciona anteriormente.

Los países cubiertos en el informe del mercado de condensadores síncronos de Asia-Pacífico son China, Japón, India, Corea del Sur, Australia, Singapur, Indonesia, Tailandia, Malasia, Taiwán, Filipinas y el resto de Asia-Pacífico.

Se espera que China domine la región Asia-Pacífico a medida que el sector renovable y la infraestructura de la red eléctrica avanzada se están expandiendo significativamente.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas regionales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos de la región.

Análisis del panorama competitivo y de la cuota de mercado de los condensadores síncronos en Asia-Pacífico

El panorama competitivo del mercado de condensadores síncronos de Asia-Pacífico proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia regional, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores que operan en el mercado de condensadores síncronos de Asia-Pacífico son General Electric, ABB, Siemens, Eaton, WEG, Ansaldo Energia, Shanghai Electric Power Generation Equipment Co., Ltd. (una subsidiaria de Shanghai Electric), Ingeteam, Hitachi Energy Ltd, Voith GmbH & Co. KGaA, Mitsubishi Electric Power Products, Inc., Baker Hughes Company, Power Systems & Controls, Inc., IDEAL ELECTRIC POWER CO., Doosan Škoda Power y ANDRITZ, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COOLING TECHNOLOGY CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FLYWHEEL ROLE IN SYNCHRONOUS CONDENSER SYSTEMS

5 REGIONAL REASONING

5.1 ASIA-PACIFIC

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CLEAN ENERGY SOURCES

6.1.2 GROWING NEED FOR INTEGRATED SYSTEMS IN POWER PLANTS

6.1.3 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL GRID SYSTEMS

6.1.4 EXPANSION OF HVDC NETWORK ACROSS THE WORLD

6.2 RESTRAINTS

6.2.1 HIGHER PRICES ASSOCIATED WITH CAPITAL AND MAINTENANCE

6.2.2 STRINGENT STANDARDS RELATED TO SYNCHRONOUS CONDENSER

6.2.3 HIGHER PRICE VOLATILITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT INITIATIVES TO REDUCE AIR POLLUTION

6.3.2 UPSURGE IN DECOMMISSIONING OF AGING AND CONVENTIONAL POWER GENERATION SOURCES

6.3.3 INCREASE IN INVESTMENTS IN R&D TO DEVELOP EFFICIENT SYNCHRONOUS CONDENSER

6.4 CHALLENGES

6.4.1 AVAILABILITY OF LOW-COST SUBSTITUTES

6.4.2 INVOLVEMENT IN SOPHISTICATED AND TIME-CONSUMING INSTALLATION PROCESS

7 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROGEN COOLED SYNCHRONOUS CONDENSER

7.3 AIR-COOLED SYNCHRONOUS CONDENSER

7.4 WATER COOLED SYNCHRONOUS CONDENSER

8 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD

8.1 OVERVIEW

8.2 STATIC FREQUENCY CONVERTOR

8.3 PONY MOTOR

8.4 OTHERS

9 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING

9.1 OVERVIEW

9.2 ABOVE 200 MVAR

9.3 101-200 MVAR

9.4 61-100 MVAR

9.5 31-60 MVAR

9.6 0-30 MVAR

10 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY END USER

10.1 OVERVIEW

10.2 ELECTRICAL UTILITIES

10.3 INDUSTRIAL SECTORS

11 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY TYPE

11.1 OVERVIEW

11.2 NEW SYNCHRONOUS CONDENSER

11.3 REFURBISHED SYNCHRONOUS CONDENSER

12 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY DESIGN

12.1 OVERVIEW

12.2 SALIENT POLE DESIGN

12.3 CYLINDRICAL ROTOR DESIGN

13 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES

13.1 OVERVIEW

13.2 4 TO 8

13.3 LESS THAN 4

13.4 MORE THAN 8

14 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE

14.1 OVERVIEW

14.2 STATIC EXCITATION

14.3 BRUSHLESS EXCITATION SYSTEM

15 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 INDIA

15.1.4 SOUTH KOREA

15.1.5 AUSTRALIA

15.1.6 SINGAPORE

15.1.7 INDONESIA

15.1.8 THAILAND

15.1.9 MALAYSIA

15.1.10 TAIWAN

15.1.11 PHILIPPINES

15.1.12 REST OF ASIA-PACIFIC

16 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GENERAL ELECTRIC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ABB

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 EATON

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SERVICE PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 VOITH GMBH & CO. KGAA

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 BAKER HUGHES COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT & SERVICES PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ANDRITZ

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 COMPANY SHARE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 ANSALDO ENERGIA

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 DOOSAN ŠKODA POWER

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 HITACHI ENERGY LTD

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 IDEAL ELECTRIC POWER CO.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 INGETEAM

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 SOLUTION PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 POWER SYSTEMS & CONTROLS, INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 SHANGHAI ELECTRIC POWER GENERATION EQUIPMENT CO.,LTD. (A SUBSIDIARY OF SHANGHAI ELECTRIC)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 SIEMENS

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 WEG

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 UNINTERRUPTED OPERATION REQUIREMENTS FOR VOLTAGE DISTURBANCES

TABLE 2 COMPARISON BETWEEN SYNCHRONOUS CONDENSER, SVC, AND SATCOM

TABLE 3 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC HYDROGEN COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA PACIFIC AIR-COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC WATER COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC STATIC FREQUENCY CONVERTOR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA PACIFIC PONY MOTOR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC OTHERS IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC ABOVE 200 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC 101-200 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC 61-100 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC 31-60 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC 0-30 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC ELECTRICAL UTILITIES IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC INDUSTRIAL SECTORS IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA PACIFIC NEW SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC REFURBISHED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SALIENT POLE DESIGN IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 ASIA PACIFIC CYLINDRICAL ROTOR DESIGN IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA PACIFIC 4 TO 8 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA PACIFIC LESS THAN 4 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 ASIA PACIFIC MORE THAN 8 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 ASIA PACIFIC STATIC EXCITATION IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 BRUSHLESS EXCITATION SYSTEM IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (UNITS)

TABLE 38 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CHINA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 44 CHINA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 45 CHINA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 46 CHINA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 47 CHINA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CHINA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 49 CHINA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 50 CHINA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 JAPAN SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 52 JAPAN SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 53 JAPAN SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 54 JAPAN SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 55 JAPAN SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 JAPAN SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 57 JAPAN SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 58 JAPAN SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 INDIA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 60 INDIA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 61 INDIA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 62 INDIA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 63 INDIA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 INDIA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 65 INDIA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 66 INDIA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 68 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 69 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH KOREA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 76 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 77 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 78 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 79 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 81 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 82 AUSTRALIA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 84 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 85 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 86 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 87 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 89 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 90 SINGAPORE SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 92 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 93 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 94 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 95 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 97 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 98 INDONESIA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 THAILAND SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 100 THAILAND SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 101 THAILAND SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 102 THAILAND SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 103 THAILAND SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 THAILAND SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 105 THAILAND SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 106 THAILAND SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 108 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 109 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 110 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 111 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 113 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 114 MALAYSIA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 116 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 117 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 118 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 119 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 121 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 122 TAIWAN SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 124 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 125 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 126 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 127 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 129 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 130 PHILIPPINES SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 REST OF ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: MULTIVARIATE MODELLING

FIGURE 10 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: COOLING TECHNOLOGY CURVE

FIGURE 11 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CLEAN ENERGY SOURCES IS EXPECTED TO BE A KEY DRIVER FOR ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 HYDROGEN COOLED SYNCHRONOUS CONDENSER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET IN 2023 TO 2030

FIGURE 15 SYNCHRONOUS CONDENSER WITH FLYWHEEL

FIGURE 16 SYNCHRONOUS CONDENSER WITH FLYWHEEL

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET

FIGURE 18 SHARE OF DIFFERENT POWER GENERATING SOURCES

FIGURE 19 GENERATION OF WIND ENERGY

FIGURE 20 OPPORTUNITIES IN THE INTEGRATION OF SYSTEMS IN POWER PLANTS

FIGURE 21 AVERAGE ANNUAL INVESTMENT SPENDING ON ELECTRICITY GRIDS

FIGURE 22 PRICING LIST OF COPPER MATERIAL

FIGURE 23 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY COOLING TECHNOLOGY, 2022

FIGURE 24 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY STARTING METHOD, 2022

FIGURE 25 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY REACTIVE POWER RATING, 2022

FIGURE 26 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY END USER, 2022

FIGURE 27 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY TYPE, 2022

FIGURE 28 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY DESIGN, 2022

FIGURE 29 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY NO. OF POLES, 2022

FIGURE 30 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: BY EXCITATION SYSTEM TYPE, 2022

FIGURE 31 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET: SNAPSHOT (2022)

FIGURE 32 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2022)

FIGURE 33 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 ASIA-PACIFIC SYNCHRONOUS CONDENSER MARKET: BY COLLING TECHNOLOGY (2023-2030)

FIGURE 36 ASIA PACIFIC SYNCHRONOUS CONDENSER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.