Asia Pacific Superhydrophobic Coating Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

13.57 Million

USD

29.27 Million

2025

2033

USD

13.57 Million

USD

29.27 Million

2025

2033

| 2026 –2033 | |

| USD 13.57 Million | |

| USD 29.27 Million | |

|

|

|

|

Segmentación del mercado de recubrimientos superhidrofóbicos en Asia-Pacífico, por tipo de producto (anticorrosión, antihielo, autolimpiable y antihumectante), materia prima (nanotubos de carbono, grafeno, poliestireno de óxido de manganeso, carbonato de calcio precipitado, poliestireno de óxido de zinc y nanopartículas de sílice), industria del usuario final (textil y calzado, automoción, construcción y otros): tendencias y pronóstico de la industria hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

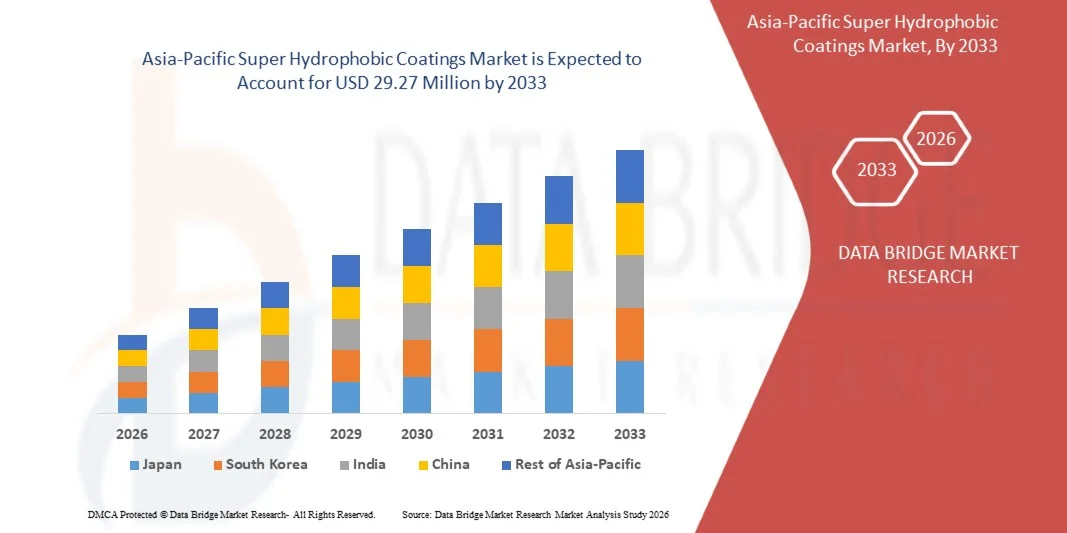

- El tamaño del mercado de recubrimientos superhidrofóbicos de Asia-Pacífico se valoró en USD 13,57 millones en 2025 y se espera que alcance los USD 29,27 millones para 2033 , con una CAGR del 10,08% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de superficies autolimpiables, anticorrosivas y repelentes al agua en las industrias automotriz, electrónica, textil y de la construcción.

- Además, los avances en nanotecnología y las crecientes inversiones en I+D están mejorando el rendimiento, la versatilidad y la viabilidad comercial de los recubrimientos superhidrofóbicos en diversas aplicaciones de uso final.

¿Cuáles son las principales conclusiones del mercado de recubrimientos superhidrofóbicos de Asia y el Pacífico?

- La creciente preferencia de los consumidores por superficies duraderas y de bajo mantenimiento está impulsando la adopción de recubrimientos superhidrofóbicos en aplicaciones como teléfonos inteligentes, parabrisas y paneles solares.

- La innovación en nanotecnología y ciencia de los materiales está mejorando el rendimiento y la rentabilidad de estos recubrimientos.

- China dominó el mercado de recubrimientos superhidrofóbicos de Asia-Pacífico con una participación estimada en los ingresos del 36,1 % en 2025, impulsada por una fuerte demanda en los sectores de la construcción, la fabricación de automóviles, la electrónica, los equipos industriales y las aplicaciones de energía renovable.

- Se proyecta que India registre la CAGR más rápida del 8,36% durante el período de pronóstico, impulsada por la expansión de las actividades de construcción, el aumento de la producción automotriz, el aumento del uso de recubrimientos avanzados en la protección de infraestructura y la creciente adopción en equipos electrónicos y de atención médica.

- El segmento de autolimpieza dominó el mercado con la mayor participación en los ingresos en 2024, impulsado por su amplia adopción en aplicaciones electrónicas, automotrices y de construcción.

Alcance del informe y segmentación del mercado de recubrimientos superhidrofóbicos en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de recubrimientos superhidrofóbicos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

Creciente demanda de superficies autolimpiables y antiincrustantes en todas las industrias

- Existe una creciente necesidad de recubrimientos superhidrofóbicos en aplicaciones autolimpiables en los sectores de la electrónica, la construcción y la automoción.

- Estos recubrimientos reducen la adhesión de agua, polvo y contaminantes, lo que prolonga la vida útil del producto y minimiza el mantenimiento.

- En la construcción, se utilizan en paneles solares y superficies de vidrio para mantener la eficiencia energética y la claridad visual.

- Los recubrimientos se adoptan cada vez más en la electrónica para proteger contra daños causados por el agua y el polvo.

- Por ejemplo, Apple integra recubrimientos hidrofóbicos en los iPhones para mejorar la resistencia al agua y reducir los costos de reparación.

¿Cuáles son los impulsores clave del mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

- Los recubrimientos superhidrofóbicos se utilizan ampliamente en teléfonos inteligentes y dispositivos portátiles para mejorar la resistencia a la humedad.

- En el sector automotriz, estos recubrimientos mejoran la visibilidad y reducen la necesidad de limpieza frecuente.

- El auge de los vehículos eléctricos y autónomos incrementa la demanda de recubrimientos que protejan los sensores y las cámaras

- Los beneficios de durabilidad y protección contribuyen a ciclos de vida más largos del producto y a la comodidad del usuario.

- Por ejemplo, Samsung emplea recubrimientos repelentes al agua avanzados en su serie Galaxy para satisfacer la demanda de los consumidores de dispositivos resistentes al agua.

¿Qué factor está obstaculizando el crecimiento del mercado de recubrimientos superhidrofóbicos en Asia-Pacífico?

- La fabricación de recubrimientos superhidrofóbicos implica nanomateriales costosos y técnicas de aplicación complejas.

- La durabilidad limitada en condiciones reales, como la abrasión o la exposición a los rayos UV, reduce la eficacia a largo plazo.

- Las preocupaciones ambientales y los desafíos regulatorios obstaculizan la adopción de ciertos recubrimientos basados en productos químicos

- Los altos costos de producción limitan su uso en industrias sensibles a los precios, como la textil y la de envases de consumo.

- Por ejemplo, muchas marcas textiles dudan en integrar tecnología superhidrofóbica debido a su alto costo y su limitada durabilidad al lavado.

¿Cómo está segmentado el mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

El mercado está segmentado según el tipo de producto, la materia prima y la industria del usuario final .

• Por tipo de producto

Según el tipo de producto, el mercado de recubrimientos superhidrofóbicos se segmenta en anticorrosión, antihielo, autolimpiantes y antihumedad. El segmento autolimpiante dominó el mercado con la mayor participación en ingresos en 2024, impulsado por su amplia adopción en aplicaciones de electrónica, automoción y construcción. Estos recubrimientos reducen significativamente las necesidades de mantenimiento y prolongan la vida útil del producto al evitar la acumulación de suciedad y la penetración de humedad. La creciente demanda de superficies de bajo mantenimiento, especialmente en electrónica y paneles solares, contribuye a la creciente demanda de recubrimientos autolimpiantes.

Se prevé que el segmento anticorrosivo experimente un crecimiento acelerado entre 2025 y 2032, impulsado por su creciente uso en los sectores automotriz e industrial. Estos recubrimientos ofrecen una resistencia superior contra la oxidación y la degradación de las superficies, especialmente en condiciones climáticas extremas o entornos marinos. Su capacidad para prolongar la vida útil de los equipos y reducir los costos de reparación los posiciona como una innovación crucial en la tecnología de protección de superficies.

• Por materia prima

Según la materia prima, el mercado se segmenta en nanotubos de carbono, grafeno, poliestireno de óxido de manganeso, carbonato de calcio precipitado, poliestireno de óxido de zinc y nanopartículas de sílice. El segmento de nanopartículas de sílice registró la mayor participación en los ingresos en 2024 debido a su amplio uso en diversas formulaciones de productos, que ofrecen excelente hidrofobicidad y rentabilidad. Los recubrimientos a base de sílice son preferidos por su versatilidad, transparencia y facilidad de aplicación en superficies como vidrio, metal y tela.

Se prevé que el segmento del grafeno experimente un crecimiento más rápido entre 2025 y 2032, gracias a su superior resistencia mecánica, conductividad y propiedades de barrera. Con el aumento de la inversión en I+D y la demanda de las industrias de alta tecnología, los recubrimientos a base de grafeno están cobrando impulso para aplicaciones premium en electrónica, aeroespacial y defensa.

• Por industria del usuario final

Según la industria del usuario final, el mercado de recubrimientos superhidrofóbicos se segmenta en textiles y calzado, automoción, construcción y otros. El segmento textil y del calzado dominó el mercado en 2024 debido a la alta demanda de prendas y accesorios repelentes al agua y resistentes a las manchas. Estos recubrimientos mejoran la durabilidad y la estética de los productos, lo que los hace muy atractivos en los segmentos de ropa deportiva y estilo de vida.

Se prevé que el sector automotriz experimente un crecimiento más rápido entre 2025 y 2032, impulsado por la creciente adopción de estos recubrimientos en parabrisas, sensores y exteriores de vehículos. Su función para mantener la visibilidad, prevenir la acumulación de suciedad y prolongar la vida útil de los componentes los hace valiosos en el mantenimiento y el diseño de vehículos modernos.

¿Qué región posee la mayor participación en el mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

- China dominó el mercado de recubrimientos superhidrofóbicos en Asia-Pacífico, con una cuota de ingresos estimada del 36,1 % en 2025, impulsada por la fuerte demanda en los sectores de la construcción, la fabricación de automóviles, la electrónica, los equipos industriales y las energías renovables. La creciente necesidad de protección de superficies contra la humedad, la corrosión, la acumulación de polvo y las duras condiciones ambientales está impulsando significativamente el crecimiento del mercado.

- La amplia presencia de centros de fabricación a gran escala, el rápido desarrollo de infraestructura urbana y las fuertes inversiones en materiales avanzados y tecnologías de ingeniería de superficies están acelerando la adopción de recubrimientos superhidrofóbicos en los sectores industriales y comerciales.

- El creciente énfasis en extender la vida útil de los activos, reducir los costos de mantenimiento y mejorar la eficiencia energética continúa impulsando la demanda de recubrimientos superhidrofóbicos en toda la región de Asia y el Pacífico.

Análisis del mercado de recubrimientos superhidrofóbicos en India y Asia-Pacífico

Se proyecta que India registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 8,36 %, durante el período de pronóstico, impulsada por la expansión de las actividades de construcción, el aumento de la producción automotriz, el mayor uso de recubrimientos avanzados para la protección de infraestructuras y la creciente adopción en equipos electrónicos y sanitarios. Las iniciativas gubernamentales centradas en las ciudades inteligentes, la expansión de la manufactura y la modernización de las infraestructuras impulsan aún más el crecimiento del mercado.

Análisis del mercado de recubrimientos superhidrofóbicos en Japón y Asia-Pacífico

Japón está experimentando un crecimiento constante en el mercado de recubrimientos superhidrofóbicos de Asia-Pacífico, impulsado por la demanda de las industrias electrónica, automotriz, aeroespacial y de ingeniería de precisión. El fuerte enfoque en materiales de alto rendimiento, la innovación tecnológica y la fabricación de alta calidad impulsa la adopción de soluciones avanzadas de protección de superficies en todo el país.

¿Cuáles son las principales empresas del mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

La industria de recubrimientos superhidrofóbicos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- P2i Ltd. (Reino Unido)

- Corporación NEI (EE. UU.)

- UltraTech International Inc. (EE. UU.)

- Aculon Inc. (EE. UU.)

- Lotus Leaf Coatings, Inc. (EE. UU.)

- Rust-Oleum (EE. UU.)

- Cytonix (EE. UU.)

- RECUBRIMIENTOS NASIOL NANO (Turquía)

- El presidente y los miembros del Harvard College (EE. UU.)

- LiquiGlide Inc. (EE. UU.)

- Surfactis Technologies (Francia)

- PearlNano (EE. UU.)

- Henkel AG & Co. KGaA (Alemania)

- Keronite (Reino Unido)

- Nanoshel LLC (EE. UU.)

- Nanorh (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de recubrimientos superhidrofóbicos de Asia-Pacífico?

- En agosto de 2023, Aculon anunció una alianza estratégica con Ellsworth Adhesives para distribuir su serie NanoProof 3. Este desarrollo constituye una alternativa directa a los recubrimientos Novec de 3M, con el objetivo de ofrecer una resistencia avanzada a la humedad y la corrosión. Esta alianza fortalece el alcance global de Aculon y amplía las opciones de productos en el mercado de recubrimientos superhidrofóbicos.

- En junio de 2023, NEI Corporation amplió sus instalaciones de fabricación e introdujo láminas de electrodos LMFP para baterías de iones de litio. Este aumento de capacidad se inició para satisfacer la creciente demanda del mercado e incluye avances en recubrimientos protectores. Esta medida fortalece la presencia de NEI en el sector de los recubrimientos superhidrofóbicos al aumentar la producción y diversificar su oferta de productos.

- En noviembre de 2021, Henkel AG & Co. integró Extra Horizon en su red de socios para impulsar la innovación en la digitalización de la atención médica. Esta colaboración combina la ciencia de materiales de Henkel con la tecnología de salud digital de Extra Horizon. La iniciativa busca introducir soluciones de recubrimiento inteligentes, lo que influirá positivamente en el desarrollo de aplicaciones superhidrofóbicas de próxima generación en el sector salud.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.