Asia Pacific Submarine Cable System Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

6.90 Million

USD

13.55 Million

2024

2032

USD

6.90 Million

USD

13.55 Million

2024

2032

| 2025 –2032 | |

| USD 6.90 Million | |

| USD 13.55 Million | |

|

|

|

|

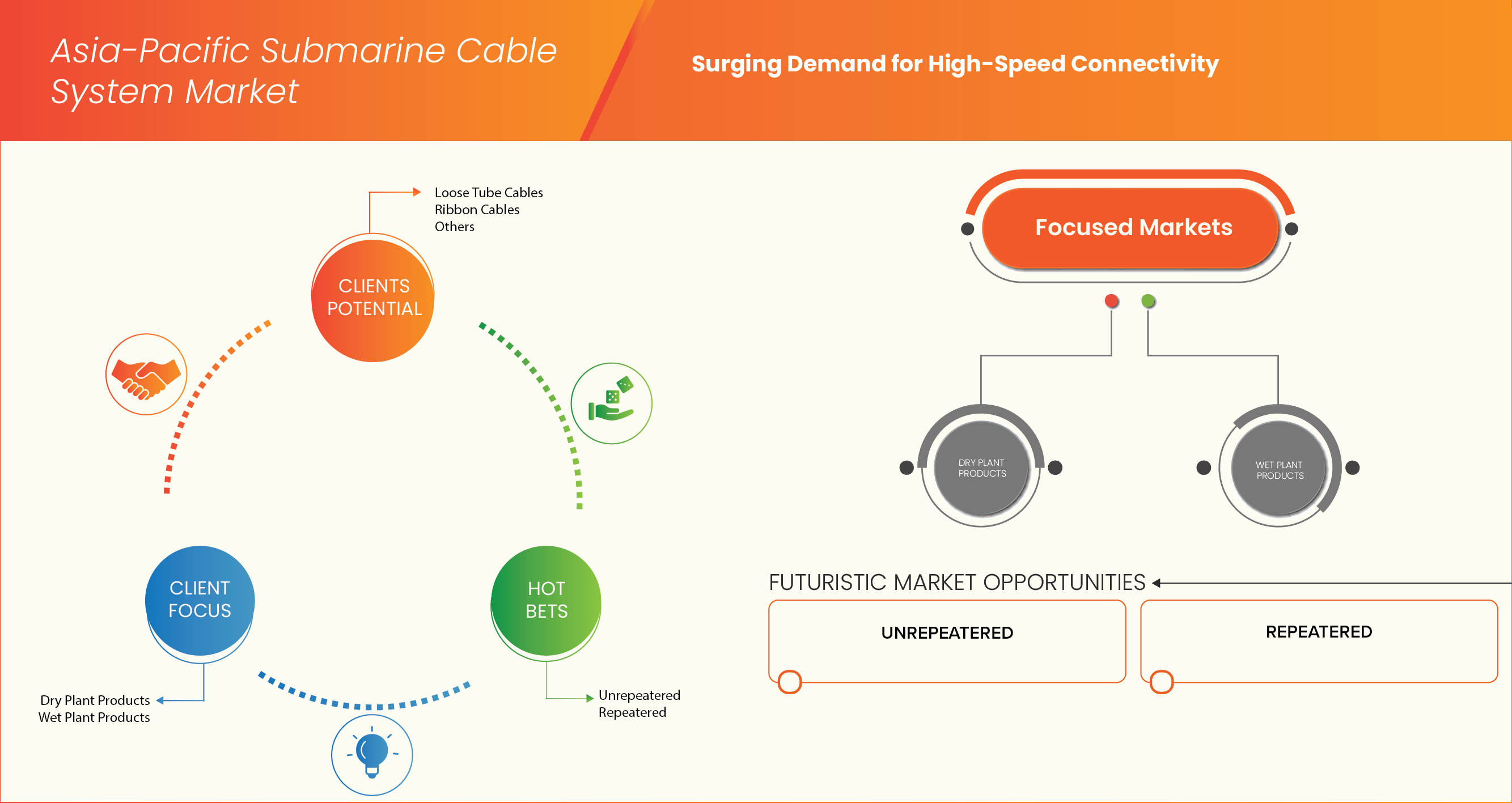

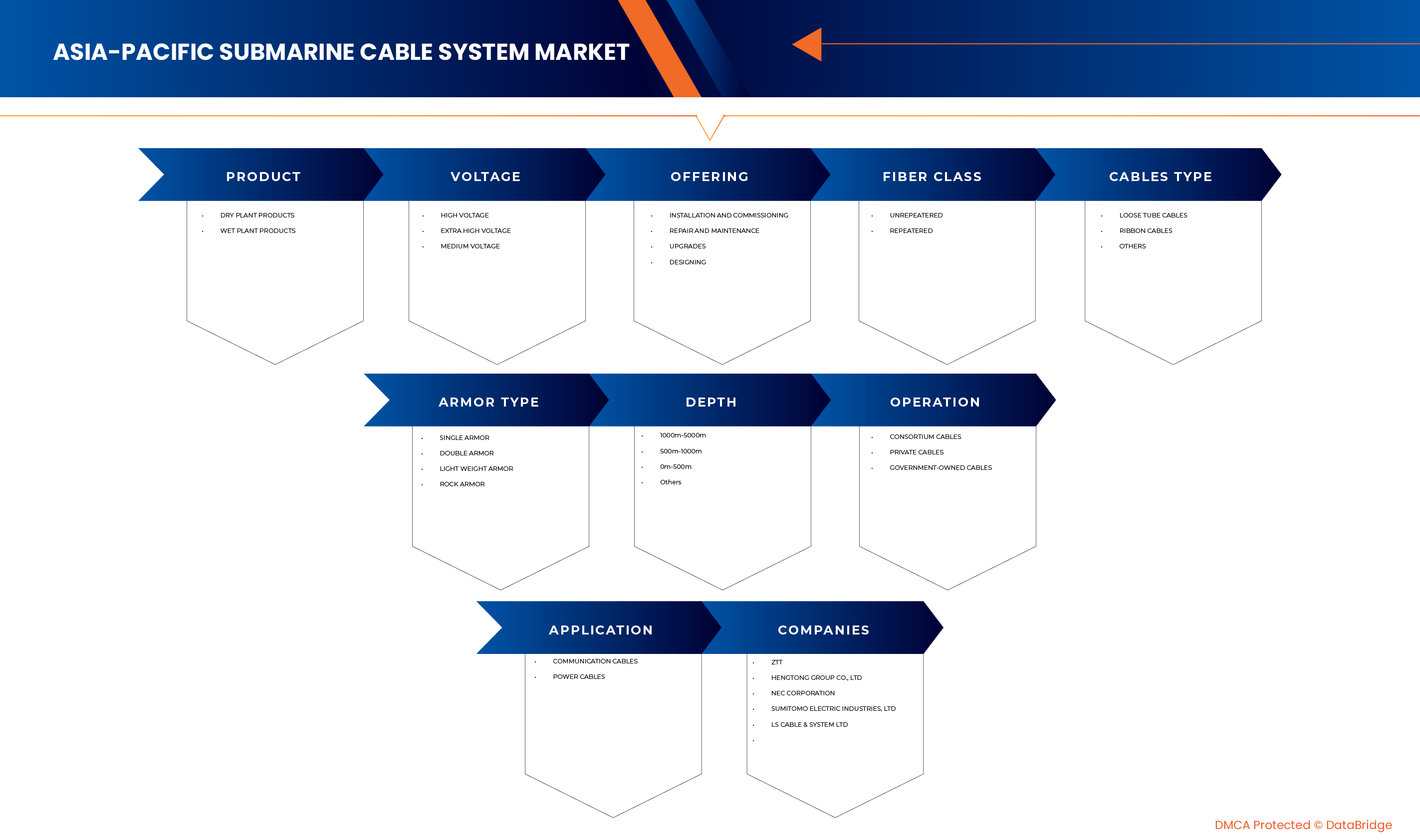

Segmentación del mercado de sistemas de cable submarino en Asia-Pacífico, por producto (productos de planta seca y productos de planta húmeda), voltaje (alto voltaje, extra alto voltaje y medio voltaje), por servicio (instalación y puesta en marcha, reparación y mantenimiento, actualizaciones y diseño), por clase de fibra (sin repetidor y con repetidor), por tipo de cable (cables de tubo holgado, cables planos y otros), tipo de blindaje (blindaje simple, doble, ligero y blindaje de roca), por profundidad (1000 m-5000 m, 500 m-1000 m, 0 m-500 m y otras), por operación (cables de consorcio, cables privados y cables de propiedad gubernamental), por aplicación (cables de comunicación y cables de energía) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de sistemas de cable submarino de Asia-Pacífico

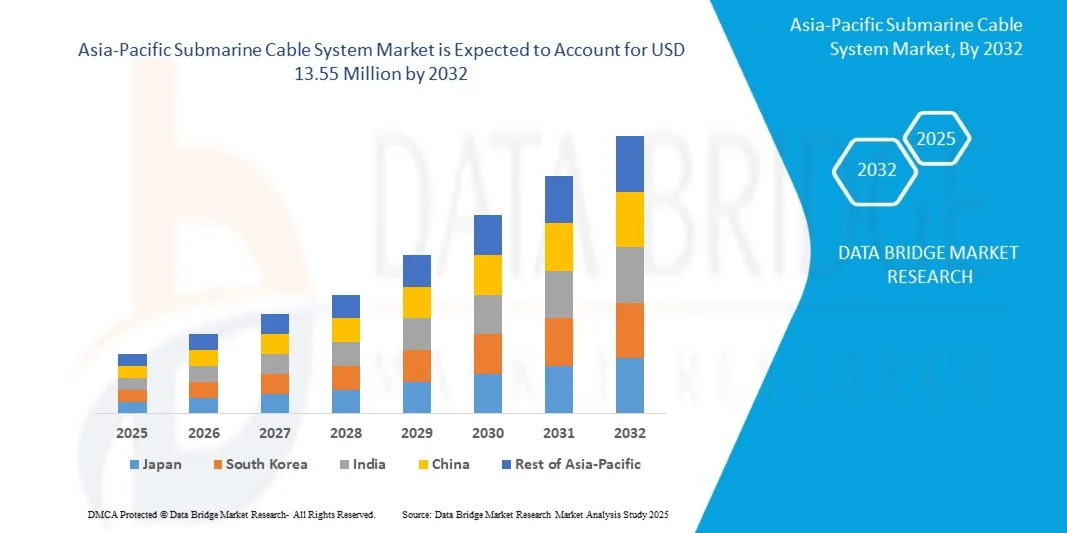

- Se prevé que el mercado de sistemas de cable submarino de Asia-Pacífico alcance los 13,55 millones de dólares en 2032 , frente a los 6,90 millones de dólares en 2024 , con una tasa de crecimiento anual compuesta (TCAC) sustancial del 8,9% en el período de previsión de 2025 a 2032.

- El crecimiento del mercado de sistemas de cables submarinos de Asia-Pacífico está significativamente influenciado por la creciente prevalencia de infecciones bacterianas multirresistentes (MDR), lo que hace necesario el uso de antibióticos carbapenémicos de amplio espectro como el meropenem.

- Esta expansión se ve respaldada además por el aumento de las inversiones en la infraestructura sanitaria de Asia-Pacífico, incluyendo la capacidad hospitalaria y la mejora de los diagnósticos, lo que impulsa la demanda de antibióticos inyectables potentes. Asimismo, la creciente disponibilidad y adopción de formulaciones genéricas del Sistema de Cable Submarino contribuye a la accesibilidad al mercado y al crecimiento sostenido al ofrecer opciones de tratamiento más rentables.

Análisis del mercado de sistemas de cable submarino de Asia-Pacífico

- La creciente demanda de conectividad de alta velocidad y baja latencia, impulsada por la digitalización, la adopción de la nube y las tecnologías emergentes, es una tendencia clave que impulsa la demanda de sistemas de cable submarino en la región de Asia-Pacífico. A medida que el tráfico de datos sigue aumentando, las redes terrestres y satelitales existentes se enfrentan a limitaciones de capacidad y velocidad.

- Los sistemas de cable submarino, al ser la columna vertebral crucial de internet y la transferencia de datos a nivel mundial, siguen siendo una solución de infraestructura esencial para conectar continentes, dar soporte a centros de datos hiperescalables y permitir una comunicación digital fluida a través de la vasta geografía de Asia-Pacífico.

- La creciente complejidad y el volumen del intercambio de datos, incluidos los servicios de streaming, las aplicaciones de IA/ML y el IoT, generan la necesidad de una infraestructura altamente robusta y de gran capacidad, como los sistemas de cable submarino, para respaldar el crecimiento económico y la transformación digital. Esto consolida el papel fundamental del cable en el ecosistema digital de la región.

- El mercado de sistemas de cable submarino en Asia-Pacífico está impulsado principalmente por la necesidad crítica de combatir las bacterias multirresistentes y la alta tasa de utilización de antibióticos inyectables en hospitales y otros entornos clínicos para infecciones graves, a menudo nosocomiales (adquiridas en el hospital). El mercado se ve influenciado por la prevalencia de enfermedades infecciosas y el marco regulatorio para el uso y la dispensación de antibióticos, incluyendo la práctica de vender antimicrobianos con o sin receta, lo cual afecta el consumo general.

- China se consolida como una región clave en el mercado de sistemas de cables submarinos, con un alto potencial de crecimiento debido al aumento del gasto sanitario y la creciente incidencia de enfermedades infecciosas. El mercado de la región se caracteriza principalmente por la urgente demanda de antibióticos eficaces para tratar infecciones graves, una tendencia común en muchas economías emergentes con infraestructuras sanitarias en expansión.

- Se prevé que el mercado de sistemas de cables submarinos de Asia-Pacífico experimente un crecimiento con una tasa de crecimiento anual compuesta (TCAC) del 8,9%, impulsado por las continuas reformas e inversiones en el sector sanitario. El enfoque regional en la mejora de la atención hospitalaria y el control de infecciones graves en entornos densamente poblados impulsa aún más la demanda de antibióticos potentes de amplio espectro, como los que se utilizan en los sistemas de cables submarinos, como parte fundamental de las estrategias de control de infecciones y gestión de pacientes.

- El segmento de productos vegetales secos es el usuario final dominante en el mercado de sistemas de cable submarino de Asia-Pacífico, con una cuota de mercado del 63,20%, lo que refleja que una infraestructura de red resiliente requiere el despliegue continuo y estratégico de sistemas de cable submarino para la conectividad internacional e interregional, posicionando a estos sistemas como un componente vital en el futuro digital de Asia-Pacífico.

Alcance del informe y segmentación del mercado de sistemas de cables submarinos de Asia-Pacífico

|

Atributos |

Información clave del mercado de sistemas de cable submarino en la región Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

China, Japón, Corea del Sur, India, Singapur, Australia, Indonesia, Tailandia, Malasia, Filipinas, Taiwán, Vietnam, Nueva Zelanda y el resto de Asia-Pacífico |

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, producción y capacidad de las empresas representadas geográficamente, esquemas de red de distribuidores y socios, análisis detallado y actualizado de la tendencia de los precios y análisis de déficit de la cadena de suministro y la demanda. |

Tendencias del mercado de sistemas de cable submarino en Asia-Pacífico

“Aumento de la demanda de conectividad de alta velocidad y baja latencia”

- La creciente demanda de conectividad de alta velocidad y baja latencia, impulsada por la digitalización, la adopción de la nube y las tecnologías emergentes, es una tendencia clave que impulsa la demanda de sistemas de cable submarino en la región de Asia-Pacífico. A medida que el tráfico de datos sigue aumentando, las redes terrestres y satelitales existentes se enfrentan a limitaciones de capacidad y velocidad.

- Los sistemas de cable submarino, al ser la columna vertebral crucial de internet y la transferencia de datos a nivel mundial, siguen siendo una solución de infraestructura esencial para conectar continentes, dar soporte a centros de datos hiperescalables y permitir una comunicación digital fluida a través de la vasta geografía de Asia-Pacífico.

- La creciente complejidad y el volumen del intercambio de datos, incluidos los servicios de streaming, las aplicaciones de IA/ML y el IoT, generan la necesidad de una infraestructura altamente robusta y de gran capacidad, como los sistemas de cable submarino, para respaldar el crecimiento económico y la transformación digital. Esto consolida el papel fundamental del cable en el ecosistema digital de la región.

- Por ejemplo, un informe reciente destacó que se prevé que el tráfico de datos en la región de Asia-Pacífico crezca más del 30 % anual, alcanzando niveles sin precedentes para 2028, lo que requerirá importantes inversiones en nuevos sistemas de cable y la modernización de los existentes. Esto subraya la urgente necesidad de contar con sistemas de cable submarino avanzados para satisfacer esta creciente demanda.

- La creciente incidencia de actividades con uso intensivo de datos y la necesidad de una infraestructura de red resiliente exigen el despliegue continuo y estratégico de sistemas de cable submarino para la conectividad internacional e interregional, posicionando a estos sistemas como un componente vital en el futuro digital de Asia-Pacífico.

Dinámica del mercado de sistemas de cables submarinos de Asia-Pacífico

Conductor

“Aumento de la demanda de conectividad de alta velocidad”

- La conectividad a internet de alta velocidad se está convirtiendo en un requisito fundamental en toda la región de Asia-Pacífico, impulsada por la rápida adopción de servicios digitales, computación en la nube, trabajo remoto y aplicaciones con uso intensivo de datos.

- A medida que aumentan las expectativas de los consumidores en cuanto a transmisión fluida, comunicación instantánea y acceso en tiempo real, crece la demanda de una transmisión de datos global más rápida y fiable. Los sistemas de cable submarino, responsables de transportar más del 95 % del tráfico internacional de internet, son ahora fundamentales para posibilitar esta transformación digital, sobre todo en las economías emergentes con poblaciones conectadas en aumento.

- Para satisfacer la creciente demanda de ancho de banda, gobiernos, proveedores de telecomunicaciones y empresas tecnológicas están invirtiendo fuertemente en infraestructura de cables submarinos nuevos y modernizados. Estos sistemas no solo mejoran la velocidad de la red y reducen la latencia, sino que también impulsan el crecimiento de las ciudades inteligentes, el comercio digital y el intercambio de datos transfronterizo. A medida que la conectividad digital se convierte en una prioridad económica y estratégica en toda la región, la demanda de internet de alta velocidad consolida a los cables submarinos como un motor fundamental para la expansión del mercado.

Por ejemplo

- En noviembre de 2024, Digital Realty destacó la creciente demanda de conectividad de alta velocidad en los centros de datos hiperescalables de Asia-Pacífico. La empresa enfatizó que el 65 % de las organizaciones de la región están implementando activamente estrategias formales de datos para sus centros de datos. Además, el 72 % de las empresas están integrando estrategias de ubicación de datos en sus planes de IA para mejorar el rendimiento y la escalabilidad. La plataforma PlatformDIGITAL® de Digital Realty está diseñada para satisfacer estas necesidades ofreciendo soluciones de interconexión escalables y seguras en los principales mercados de Asia-Pacífico, incluidos Tokio, Osaka, Singapur, Hong Kong y Sídney.

- En agosto de 2024, la revista Swarajya destacó el plan de la India para cuadruplicar su capacidad de internet para 2025 mediante tres importantes proyectos de cables submarinos: 2Africa Pearls, India-Asia-Express (IAX) e India-Europe-Express (IEX). Estas iniciativas reflejan la creciente demanda de conectividad de alta velocidad en la región de Asia-Pacífico, impulsada por el rápido crecimiento digital y el consumo de datos. Al aumentar significativamente el ancho de banda y mejorar la conectividad con regiones clave, estos cables submarinos desempeñarán un papel fundamental en el soporte de aplicaciones que requieren un gran ancho de banda y en la satisfacción de las crecientes demandas de datos de empresas, proveedores de servicios en la nube y consumidores de toda la región.

- En diciembre de 2024, NEC Corporation anunció la finalización del Asia Direct Cable (ADC), un sistema de cable submarino de alto rendimiento con una extensión aproximada de 10 000 kilómetros. El ADC conecta China (Región Administrativa Especial de Hong Kong y provincia de Guangdong), Japón, Filipinas, Singapur, Tailandia y Vietnam. Diseñado para gestionar más de 160 terabits por segundo (Tbps) de tráfico de datos, el ADC tiene como objetivo satisfacer la creciente demanda de conectividad de alta velocidad en el este y sureste de Asia. El cable es propiedad del Consorcio ADC, que incluye a importantes empresas de telecomunicaciones y tecnología como China Telecom, China Unicom, PLDT Inc., Singtel, SoftBank Corp., Tata Communications y Viettel. NEC, con más de 60 años de experiencia en sistemas de cable submarino, actuó como integrador de sistemas para este proyecto, proporcionando soluciones integrales que incluyeron la fabricación, la instalación y las pruebas del cable.

- La creciente necesidad de internet de alta velocidad y fiable en la región de Asia-Pacífico es un importante catalizador que impulsa la expansión de los sistemas de cable submarino. Impulsada por el aumento del consumo digital, los servicios en la nube y las tecnologías emergentes, esta demanda motiva a los proveedores de telecomunicaciones y a los gigantes tecnológicos a invertir fuertemente en nueva infraestructura de cable. Estas inversiones no solo mejoran la capacidad de datos y reducen la latencia, sino que también respaldan el crecimiento económico regional y la inclusión digital. A medida que la conectividad se vuelve cada vez más crucial para la vida cotidiana y los negocios, los cables submarinos siguen siendo fundamentales en esta transformación digital, consolidando su papel como un motor de crecimiento clave en el mercado.

Restricción/Desafío

“Altos costos de instalación y mantenimiento”

- Los sistemas de cable submarino se encuentran entre los componentes de infraestructura digital que requieren mayor inversión de capital, con elevados costos iniciales vinculados a la prospección submarina, la fabricación de cables, las operaciones marítimas y el equipo de instalación especializado. Dependiendo de la longitud y la ruta, el despliegue de un solo cable submarino puede costar entre 100 y más de 500 millones de dólares estadounidenses.

- Estos costes se ven incrementados aún más por la necesidad de sortear complejas geografías marítimas, obtener permisos transfronterizos y cumplir con las normativas medioambientales y de seguridad. Para las economías en desarrollo y los operadores más pequeños, estos elevados requisitos de capital pueden constituir una importante barrera de entrada, limitando una mayor participación en el desarrollo de infraestructuras submarinas.

- Además de la instalación, el mantenimiento y la reparación a largo plazo de los cables submarinos incrementan la carga financiera. Los daños causados por desastres naturales, actividades pesqueras y anclas de barcos son relativamente comunes, especialmente en aguas poco profundas, lo que requiere intervenciones costosas y urgentes por parte de buques especializados en reparación de cables. Dado que las operaciones de mantenimiento pueden implicar largos periodos de inactividad y están limitadas geográficamente por la disponibilidad de buques y permisos, los gastos operativos se mantienen elevados durante todo el ciclo de vida del cable. Estos desafíos financieros y logísticos pueden retrasar nuevos despliegues y dificultar la expansión de la conectividad internacional, lo que convierte el costo en una limitación constante para el crecimiento del mercado de sistemas de cables submarinos en la región Asia-Pacífico.

Por ejemplo,

- En un estudio publicado en agosto de 2021 en la revista Journal of Marine Science and Engineering, los investigadores identificaron que la instalación de repetidores en sistemas de cable submarino de fibra óptica para aguas profundas aumenta significativamente el riesgo de fallas en el cable. El estudio sugiere que minimizar el número de repetidores puede reducir tanto el riesgo de fallas como los elevados costos de instalación y mantenimiento asociados. Esto pone de manifiesto cómo las decisiones de diseño técnico, como el número de repetidores, pueden afectar la rentabilidad y la resiliencia generales de los sistemas de cable submarino.

- Los elevados costes de instalación y mantenimiento siguen siendo un obstáculo importante en el mercado de cables submarinos de Asia-Pacífico. La gran inversión de capital que requiere el despliegue y mantenimiento de estos cables supone importantes barreras financieras, sobre todo para las empresas más pequeñas y las economías emergentes. Las frecuentes interrupciones y la complejidad de la logística marítima agravan aún más estos gastos. En consecuencia, estos altos costes pueden retrasar proyectos de infraestructura, limitar la expansión de la conectividad regional y poner en entredicho la viabilidad económica de nuevos despliegues.

Alcance del mercado de sistemas de cable submarino de Asia-Pacífico

El mercado de sistemas de cable submarino de Asia-Pacífico está segmentado por producto, voltaje, oferta, clase de fibra, tipo de cable, tipo de armadura, profundidad, operación y aplicación.

• Por producto

Según el tipo de producto, el mercado de sistemas de cable submarino de Asia-Pacífico se segmenta en productos de planta seca y productos de planta húmeda. Se prevé que el segmento de productos de planta seca domine el mercado debido a su papel fundamental como infraestructura terrestre, que incluye estaciones de amarre de cables, centros de operaciones de red y equipos de alimentación eléctrica, esenciales para la operación y gestión eficaces de los cables submarinos. La consolidación de la infraestructura terrestre y la importante inversión de capital asociada a los componentes terrestres para su perfecta integración con las redes terrestres contribuyen significativamente a su liderazgo en el mercado, garantizando un suministro eléctrico y un procesamiento de datos fiables.

Se prevé que el segmento de productos de planta seca sea el de mayor crecimiento debido a los continuos avances tecnológicos en componentes sumergidos como repetidores, unidades de derivación y amplificadores ópticos submarinos, que mejoran significativamente la capacidad del cable, reducen la pérdida de señal y prolongan su vida útil. Este crecimiento también se ve impulsado por la creciente profundidad y longitud de las nuevas rutas de cable, lo que exige componentes de planta húmeda más sofisticados y resistentes para garantizar un rendimiento a largo plazo. Además, las innovaciones en tecnologías de despliegue y mantenimiento en aguas profundas para productos de planta húmeda podrían acelerar la adopción de este segmento.

• Por voltaje

En función del voltaje, el mercado de sistemas de cable submarino de Asia-Pacífico se segmenta en alto voltaje, extra alto voltaje y medio voltaje. Se prevé que el segmento de alto voltaje domine el mercado debido a los requisitos de potencia estándar para el funcionamiento de repetidores y otros componentes activos en los cables de comunicación de larga distancia, que suelen operar a voltajes más elevados para minimizar la pérdida de potencia en grandes distancias. El despliegue generalizado de cables de comunicación transoceánicos, que constituyen la mayoría de las nuevas instalaciones, también contribuye a la preferencia por los sistemas de alto voltaje. Además, la creciente demanda de capacidad de datos a menudo requiere repetidores más potentes, lo que consolida la posición de liderazgo del segmento de alto voltaje.

Se prevé que el segmento de alta tensión sea el de mayor crecimiento debido a los requisitos de energía específicos para cables de comunicación interinsulares o costeros de corta distancia, así como, cada vez más, para proyectos de transmisión de energía submarina, donde las tensiones más bajas podrían ser más eficientes o adecuadas para la integración a la red. Este crecimiento también se ve impulsado por el uso cada vez mayor de interconexiones especializadas de centros de datos de corto alcance, donde la media tensión puede resultar rentable. La creciente disponibilidad de tecnologías avanzadas de conversión de energía para diversos niveles de tensión, que pueden mejorar la asequibilidad y el acceso a diversas aplicaciones submarinas en la región Asia-Pacífico, está acelerando aún más la expansión de este mercado.

• Al ofrecer

Según la oferta, el mercado de sistemas de cable submarino de Asia-Pacífico se segmenta en instalación y puesta en marcha, reparación y mantenimiento, actualizaciones y diseño. Se prevé que el segmento de instalación y puesta en marcha domine el mercado debido a la elevada inversión de capital y la experiencia especializada que requiere el despliegue de nuevos cables submarinos, que incluye el estudio de la ruta, el tendido del cable y la activación final del sistema. La continua expansión del tráfico de datos y la necesidad de nuevas rutas para conectar economías emergentes y evitar zonas congestionadas se traducen directamente en una mayor cuota de mercado para esta fase inicial crucial.

Se prevé que el segmento de Instalación y Puesta en Marcha sea el de mayor crecimiento debido a la importancia crítica de garantizar la operación continua y maximizar la vida útil de los sistemas de cable existentes. A medida que los cables envejecen y surgen nuevas tecnologías, aumenta la necesidad de mantenimiento proactivo, detección de fallas y mejoras de capacidad. Una mayor concienciación y el cumplimiento de las mejores prácticas operativas, junto con las mejoras en la robótica submarina y las capacidades de los buques de reparación, están impulsando la utilización de estos servicios para prevenir costosos tiempos de inactividad y prolongar la vida útil del sistema.

• Por clase de fibra

Según el tipo de fibra, el mercado de sistemas de cable submarino de Asia-Pacífico se divide en sistemas sin repetidores y con repetidores. Se prevé que el segmento de cables con repetidores domine el mercado, impulsado por las vastas distancias que cubren la mayoría de los cables submarinos internacionales en Asia-Pacífico, lo que requiere repetidores para amplificar las señales ópticas y mantener la integridad de los datos a lo largo de miles de kilómetros. Los altos requisitos de capacidad de las rutas transpacíficas e intraasiáticas exigen sistemas capaces de transmitir datos a alta velocidad de forma sostenida en largas distancias, lo que convierte a los cables con repetidores en una solución indispensable y consolida su uso principal.

Se prevé que el segmento de sistemas con repetidores sea el de mayor crecimiento debido al despliegue cada vez mayor de cables interinsulares o costeros de corto alcance, especialmente en países archipelágicos de la región Asia-Pacífico. Estos sistemas suelen operar sin repetidores activos en distancias de hasta unos pocos cientos de kilómetros, lo que ofrece una solución de despliegue más sencilla y rentable. Además, los avances en la tecnología de fibra óptica, como la mejora de la atenuación y la transmisión coherente, están ampliando el alcance viable de los sistemas sin repetidores, impulsando aún más la demanda y el ritmo de crecimiento de esta aplicación.

• Por tipo de cable

Según el tipo de cable, el mercado de sistemas de cable submarino de Asia-Pacífico se segmenta en cables de tubo holgado, cables planos y otros. Se prevé que el segmento de cables de tubo holgado domine el mercado, ya que es un diseño robusto y ampliamente adoptado para cables submarinos, conocido por su flexibilidad, facilidad de manejo durante el despliegue y protección eficaz de las fibras ópticas individuales frente a la tensión y los factores ambientales. Su probada fiabilidad en entornos submarinos adversos, junto con su capacidad para adaptarse a diferentes cantidades de fibras, consolida su uso en diversos proyectos de cable submarino.

Se prevé que el segmento de cables de tubo holgado sea el de mayor crecimiento debido a la creciente demanda de cables con mayor número de fibras en nuevos despliegues y actualizaciones, impulsada por la necesidad de mayor capacidad y preparación para el futuro. Los cables planos permiten un empaquetamiento extremadamente denso de fibras en un diámetro de cable menor, lo que ofrece ventajas significativas en términos de eficiencia de fabricación, zanjeo y coste total por fibra. Este cambio busca maximizar el rendimiento de datos en corredores de cable cada vez más congestionados. El creciente establecimiento de nuevas rutas de alta capacidad también contribuye al aumento del despliegue de cables planos, acelerando el crecimiento de este segmento.

• Por tipo de armadura

Según el tipo de blindaje, el mercado de sistemas de cables submarinos de Asia-Pacífico se segmenta en blindaje simple, doble, ligero y de roca. Se prevé que el segmento de blindaje simple domine el mercado debido a su uso frecuente en zonas oceánicas profundas, donde los riesgos de agresiones externas (como la pesca o el fondeo) son significativamente menores. El blindaje simple ofrece protección suficiente contra la tensión durante el despliegue y una abrasión moderada, logrando un equilibrio entre protección y rentabilidad para la gran mayoría de las rutas de cables submarinos.

Se prevé que el segmento de blindaje simple sea el de mayor crecimiento debido al creciente despliegue de cables en zonas costeras de aguas poco profundas y rutas marítimas de alto tráfico, donde las amenazas externas derivadas de la pesca de arrastre, las anclas de los buques y la abrasión del lecho marino son significativamente mayores. El doble blindaje ofrece una mayor protección mecánica, fundamental para prevenir daños y garantizar la resiliencia del sistema en estas zonas vulnerables. Además, el mayor énfasis en la protección y la resiliencia de los cables en proyectos críticos de infraestructura nacional está impulsando mayores tasas de crecimiento para los tipos de cables con blindaje robusto.

• Por profundidad

En función de la profundidad, el mercado de sistemas de cables submarinos de Asia-Pacífico se segmenta en 0-500 m, 500-1000 m, 1000-5000 m y otros. Se prevé que el segmento de 1000-5000 m domine el mercado debido a las vastas extensiones de aguas profundas que atraviesan los principales cables de comunicación internacionales en la región de Asia-Pacífico. Este rango de profundidad abarca la mayor parte del lecho marino donde se instalan los cables, lo que exige técnicas y componentes especializados para su instalación en aguas profundas. El objetivo principal de conectar continentes y grandes masas terrestres implica necesariamente tramos significativos a estas profundidades.

Se prevé que el segmento de 1000 a 5000 metros sea el de mayor crecimiento debido al aumento de sistemas de cable nacionales y regionales, especialmente en países archipelágicos, que operan principalmente en aguas menos profundas cerca de costas, islas y plataformas continentales. Este segmento también incluye infraestructura crítica para parques eólicos marinos y plataformas de petróleo y gas. Si bien su volumen es menor, el rápido desarrollo de las economías costeras y las aplicaciones submarinas especializadas está impulsando tasas de crecimiento significativamente mayores para los sistemas de cable desplegados en estas profundidades.

• Por operación

Según su funcionamiento, el mercado de sistemas de cable submarino de Asia-Pacífico se segmenta en cables de consorcio, cables privados y cables de propiedad estatal. Se prevé que el segmento de cables de consorcio domine el mercado debido a los elevados costes de capital y el riesgo compartido que implica el desarrollo de sistemas de cable transcontinentales e intercontinentales de gran envergadura. Los consorcios, integrados por múltiples operadores de telecomunicaciones y proveedores de contenido, mancomunan recursos para construir y operar estas redes de gran escala y alta capacidad, que constituyen la columna vertebral de la conectividad global a internet y representan la mayoría de los despliegues de cable.

Se prevé que el segmento de cables de consorcio sea el de mayor crecimiento debido a la creciente inversión de los proveedores de contenido hiperescalables (como Google, Meta, Amazon y Microsoft) en su propia infraestructura de cable submarino dedicada para dar soporte a sus extensas redes de centros de datos y servicios en la nube. Estos cables privados ofrecen un mayor control sobre la arquitectura, la capacidad y la seguridad de la red. Este cambio estratégico de los gigantes tecnológicos, que buscan optimizar su flujo global de tráfico de datos, está impulsando mayores tasas de crecimiento para los sistemas de cable de propiedad y operación privadas.

• Mediante solicitud

Según su aplicación, el mercado de sistemas de cable submarino de Asia-Pacífico se divide en cables de comunicación y cables de energía. Se prevé que el segmento de cables de comunicación domine el mercado debido a la enorme dependencia global de los cables submarinos para la transmisión de datos de internet, voz y vídeo entre continentes. El continuo auge del contenido digital, la computación en la nube y las operaciones comerciales internacionales impulsa una demanda insaciable de enlaces de comunicación de alta velocidad y baja latencia, lo que convierte a esta aplicación en la principal y más importante para los sistemas de cable submarino.

Se prevé que el segmento de cables de comunicación sea el de mayor crecimiento debido al creciente énfasis mundial en las fuentes de energía renovables, en particular los parques eólicos marinos. Los cables de energía submarinos son esenciales para transmitir la electricidad generada por estas instalaciones marinas a las redes terrestres. Además, existe una tendencia creciente a interconectar las redes eléctricas nacionales a través de masas de agua para mejorar la seguridad energética y optimizar la distribución de energía. Si bien su cuota de mercado es menor en comparación con los cables de comunicación, el rápido desarrollo de la infraestructura de energía verde está impulsando tasas de crecimiento significativamente mayores para la transmisión de energía submarina.

Análisis regional del mercado de sistemas de cables submarinos de Asia-Pacífico

- La región de Asia-Pacífico está reconocida como un mercado importante para los sistemas de cable submarino, impulsado por la alta y creciente prevalencia de la transformación digital, el crecimiento masivo del tráfico de datos y la expansión de los servicios en la nube, lo que convierte a la infraestructura en un componente esencial de las estrategias de conectividad global y economía digital de la región.

- El ritmo creciente de consumo de datos y penetración de internet, junto con la necesidad de una mayor resiliencia de la red y una mejor infraestructura digital en las diversas economías de Asia-Pacífico, es un importante catalizador para la adopción esencial y creciente de sistemas de cable submarino en la región.

- La constante expansión y modernización de la infraestructura de telecomunicaciones, especialmente en los principales centros económicos y mercados emergentes, y la gran exigencia de garantizar una comunicación internacional fluida y la interconexión de centros de datos, están acelerando aún más la demanda de sistemas de cable submarino potentes y de alta capacidad en la región Asia-Pacífico.

Perspectivas del mercado de sistemas de cable submarino en China y la región Asia-Pacífico

El mercado de sistemas de cable submarino en la región Asia-Pacífico, China, está impulsado principalmente por la necesidad crítica de soportar el elevado y creciente volumen de tráfico de datos digitales, derivado en particular de su vasta base de usuarios de internet, la floreciente industria de la computación en la nube y su extensa economía digital. Esto exige el despliegue y la actualización continuos de sistemas de cable submarino para la conectividad internacional y la interconexión de centros de datos. Asimismo, el mercado destaca el papel cada vez más importante de la fabricación e innovación nacionales para reducir la dependencia de la tecnología extranjera y la urgente expansión de la capacidad de la red para satisfacer una demanda insaciable.

Perspectivas del mercado de sistemas de cable submarino en la región Asia-Pacífico (India)

El mercado de sistemas de cable submarino entre India y Asia-Pacífico está impulsado principalmente por la necesidad crítica de soportar el elevado y creciente volumen de tráfico de datos digitales, derivado en particular de la rápida expansión de la penetración de internet, el auge del sector de servicios digitales y las ambiciosas iniciativas de la «India Digital». Esto exige el despliegue y la actualización continuos de sistemas de cable submarino para la conectividad internacional y los centros de datos regionales. Asimismo, el mercado destaca el papel cada vez más importante de la inversión extranjera y las alianzas para mejorar la infraestructura de red y la urgente expansión del acceso a banda ancha para conectar a su enorme población.

Cuota de mercado de sistemas de cable submarino en Asia-Pacífico

La industria de los sistemas de cable submarino está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ZTT (China)

- GRUPO HENGTONG CO. LTD. (China)

- Corporación NEC (Japón)

- Sumitomo Electric Industries, Ltd. (Japón)

- LS Cable & System Ltd. (Corea del Sur)

- SSGCABLE (China)

- APAR Industries Ltd (India)

- Furukawa Electric Co., Ltd (Japón)

- Nusantara Marina (Indonesia)

- PT Ketrosden Triasmitra Tbk (Indonesia)

- PT INFRASTRUKTUR TELEKOMUNIKASI I (Indonesia)

- Taihan Cable & Solution Co., Ltd. (Corea del Sur)

- Ningbo Orient Wires & Cables Co., Ltd. (China)

- SubCom, LLC (EE. UU.)

- Pure Pro Technology Co., Ltd (China)

- PT NICA Globalmarin Indonesia (Indonesia)

- Prima Navalink (Indonesia)

- PT TWINK INDONESIA (Indonesia)

- GRUPO MARINO ÓPTICO (Singapur)

- Xtera Inc. (EE. UU.)

- PT. Salvamento Marítimo Náutico (Indonesia)

- Compañía de Cables Qingdao Hanhe (China)

- Corporación OCC (Japón)

- PT Communication Cable Systems Indo (Indonesia)

- Grupo Prysmian (Italia)

- PT Voksel Electric Tbk (Indonesia)

Últimos avances en el mercado de sistemas de cables submarinos de Asia-Pacífico

- En diciembre de 2024, NEC Corporation finalizó la construcción del Asia Direct Cable (ADC), un cable submarino de alto rendimiento que conecta China (Región Administrativa Especial de Hong Kong y provincia de Guangdong), Japón, Filipinas, Singapur, Tailandia y Vietnam. El cable submarino ADC pertenece al Consorcio ADC y cuenta con múltiples pares de fibras ópticas de alta capacidad. Está diseñado para transportar más de 160 Tbps de tráfico, lo que permite la transmisión de datos de alta velocidad en las regiones del este y sureste de Asia.

- En junio de 2024, Sumitomo Electric adquirió una participación mayoritaria en Südkabel, fabricante alemán líder de cables de alta tensión. Esta adquisición fortalece la capacidad de Sumitomo Electric para ejecutar dos importantes proyectos de cables HVDC (corriente continua de alta tensión) para Amprion, operador del sistema de transmisión alemán. Los proyectos, el Korridor B V49 y parte del enlace Rin-Meno, son fundamentales para la transición energética de Alemania y tienen un valor combinado superior a los 3000 millones de euros. La adquisición también respalda la expansión de las capacidades de producción de Sumitomo Electric en Alemania, en consonancia con los objetivos de cero emisiones netas del país.

- En mayo de 2024, SSEN Transmission seleccionó a Sumitomo Electric como el proveedor preferido para la instalación de cables eléctricos submarinos, conocidos como el enlace de corriente continua de alta tensión Shetland 2, entre las islas Shetland y la Escocia continental. Este proyecto permitirá conectar tres parques eólicos marinos cercanos a Shetland a la red eléctrica nacional, añadiendo 1,8 GW de energía eólica, lo que equivale al 13 % de la capacidad eólica marina instalada en el Reino Unido. Como parte de esta iniciativa, Sumitomo Electric está construyendo una planta de fabricación de cables en Nigg, Escocia, con una inversión de 350 millones de libras esterlinas, que se espera genere cientos de puestos de trabajo y contribuya al objetivo del Reino Unido de alcanzar la neutralidad de carbono para 2050.

- En abril de 2025, APAR Industries Limited amplió la capacidad de fabricación de cables en su planta de Khatalwada, Gujarat, una de sus principales unidades de producción. Esta planta ya produce una amplia gama de cables, incluyendo cables submarinos, cables marinos especializados y cables elastoméricos. El proyecto de expansión busca mejorar la capacidad de APAR para satisfacer la creciente demanda nacional e internacional de sistemas de cables de alto rendimiento en sectores como energía, energías renovables, defensa e infraestructura marítima. Cabe destacar que esta ampliación de capacidad es una iniciativa interna y no el resultado de ninguna alianza, empresa conjunta ni adquisición.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY COMPETITIVE ANALYSIS

4.1.1 STRATEGIC DEVELOPMENT

4.1.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.1.2.1 CHALLENGES

4.1.2.2 IN-HOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.1.2.3 TECHNOLOGY SPEND OF THE COMPANY

4.1.2.4 CUSTOMER BASE

4.1.2.5 SERVICE POSITIONING

4.1.2.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

4.1.2.7 APPLICATION REACH

4.1.2.8 SERVICE PLATFORM MATRIX

4.2 TECHNOLOGY ANALYSIS

4.2.1 KEY TECHNOLOGIES

4.2.1.1 OPTICAL FIBER TECHNOLOGY

4.2.1.2 REPEATERS/OPTICAL AMPLIFIERS

4.2.1.3 POWER FEED EQUIPMENT (PFE)

4.2.1.4 SPATIAL DIVISION MULTIPLEXING (SDM)

4.2.2 COMPLEMENTARY TECHNOLOGIES

4.2.2.1 INSTALLATION AND COMMISSIONING

4.2.3 ADJACENT TECHNOLOGIES

4.3 USED CASES & ITS ANALYSIS

4.4 OVERVIEW

4.4.1 PRIMARY PRICING MODELS

4.4.2 PRICING INFLUENCERS

4.4.3 COMPETITOR PRICING TACTICS

4.4.4 MARKET CHALLENGES INFLUENCING PRICE STRATEGY

4.4.5 STRATEGIC PRICING APPROACHES ADOPTED BY LEADING PLAYERS

4.4.6 CONCLUSION

4.5 FUNDING DETAILS – INVESTOR OVERVIEW: ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.5.1 TECHNOLOGY GIANTS

4.5.2 TELECOM AND INFRASTRUCTURE COMPANIES

4.5.3 GOVERNMENT AND PUBLIC SECTOR INVOLVEMENT

4.5.4 PRIVATE EQUITY AND INVESTMENT FUNDS

4.5.5 COLLABORATIVE AND CROSS-BORDER FUNDING

4.5.6 STRATEGIC FOCUS OF FUNDING

4.5.7 TRENDS IN INVESTOR PARTICIPATION

4.5.8 CONCLUSION

4.6 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO: ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.6.1 CURRENT INDUSTRY LANDSCAPE

4.6.2 TECHNOLOGICAL ADVANCEMENTS TRANSFORMING THE INDUSTRY

4.6.3 REGIONAL AND GEOPOLITICAL DIMENSIONS

4.6.4 INDUSTRY CHALLENGES

4.6.5 MARKET DRIVERS AND STRATEGIC SHIFTS

4.6.6 INTEGRATION WITH RENEWABLE ENERGY AND SUSTAINABILITY GOALS

4.6.7 FUTURE OUTLOOK AND EMERGING OPPORTUNITIES

4.6.8 CONCLUSION: THE ROAD AHEAD

4.7 PENETRATION AND GROWTH PROSPECT MAPPING: ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.7.1 MARKET PENETRATION OVERVIEW

4.7.1.1 MATURE ECONOMIES WITH HIGH INFRASTRUCTURE DENSITY

4.7.1.2 EMERGING ECONOMIES WITH RAPID ADOPTION

4.7.1.3 ISLAND AND DEVELOPING NATIONS WITH LOW PENETRATION

4.7.2 KEY DRIVERS OF MARKET PENETRATION

4.7.2.1 EXPLOSIVE GROWTH IN DATA DEMAND

4.7.2.2 DIGITAL TRANSFORMATION AND CLOUD INFRASTRUCTURE

4.7.2.3 REGIONAL CONNECTIVITY AND TRADE INTEGRATION

4.7.2.4 PUBLIC-PRIVATE PARTNERSHIPS

4.7.3 GROWTH PROSPECT MAPPING

4.7.3.1 TECHNOLOGICAL ADVANCEMENTS

4.7.3.2 GEOGRAPHIC EXPANSION

4.7.3.3 SERVICE LAYER DIVERSIFICATION

4.7.4 GROWTH HOTSPOTS AND STRATEGIC MARKETS

4.7.4.1 SOUTHEAST ASIA

4.7.4.2 SOUTH ASIA

4.7.4.3 OCEANIA AND PACIFIC ISLANDS

4.7.5 FUTURE GROWTH PROSPECTS

4.7.5.1 INTEGRATION WITH EMERGING TECHNOLOGIES

4.7.5.2 SUSTAINABILITY AND GREEN INFRASTRUCTURE

4.7.5.3 STRATEGIC RESILIENCE AND SECURITY

4.7.5.4 INCREASING ROLE OF HYPERSCALERS

4.7.5.5 GOVERNMENT-LED REGIONAL INITIATIVES

4.7.6 LONG-TERM OUTLOOK

4.7.7 CONCLUSION

4.8 REASONS FOR INVESTMENT FROM INVESTORS IN THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.8.1 RISING DEMAND FOR DATA CONNECTIVITY

4.8.2 STRATEGIC CONTROL OVER DIGITAL INFRASTRUCTURE

4.8.3 REGIONAL ECONOMIC INTEGRATION AND DIGITAL TRANSFORMATION

4.8.4 LONG-TERM INFRASTRUCTURE INVESTMENT APPEAL

4.8.5 SUPPORT FOR CLOUD EXPANSION AND DATA CENTER ECOSYSTEMS

4.8.6 GEOPOLITICAL AND SECURITY CONSIDERATIONS

4.8.7 EMERGENCE OF RENEWABLE ENERGY AND POWER TRANSMISSION PROJECTS

4.8.8 TECHNOLOGICAL ADVANCEMENT AND INNOVATION OPPORTUNITIES

4.8.9 COLLABORATIVE INVESTMENT ECOSYSTEM

4.8.10 SUSTAINABILITY AND ENVIRONMENTAL GOALS

4.8.11 CONCLUSION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING DEMAND FOR HIGH-SPEED CONNECTIVITY.

5.1.2 RAPID GROWTH OF DATA CENTER ECOSYSTEMS

5.1.3 GOVERNMENT SUPPORT FOR DIGITAL INFRASTRUCTURE

5.1.4 RISING INVESTMENTS FROM HYPERSCALE CLOUD PROVIDERS

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION AND MAINTENANCE COSTS

5.2.2 GEOPOLITICAL TENSIONS IMPACTING CABLE ROUTES

5.3 OPPORTUNITY

5.3.1 EMERGENCE OF AI AND 6G TECHNOLOGIES

5.3.2 LACK OF RELIABLE CONNECTIVITY IN ISOLATED ISLANDS

5.3.3 INCREASE IN FUNDING BY PRIVATE CONSORTIUMS

5.4 CHALLENGES

5.4.1 DELAYS DUE TO COMPLEX REGULATORY APPROVALS

5.4.2 REGULAR SERVICE DISRUPTIONS DUE TO NATURAL HAZARDS

6 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DRY PLANT PRODUCTS

6.3 WET PLANT PRODUCTS

7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE

7.1 OVERVIEW

7.2 HIGH VOLTAGE

7.3 EXTRA HIGH VOLTAGE

7.4 MEDIUM VOLTAGE

8 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 INSTALLATION AND COMMISSIONING

8.3 REPAIR AND MAINTENANCE

8.4 UPGRADES

8.5 DESIGNING

9 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS

9.1 OVERVIEW

9.2 UNREPEATED

9.3 REPEATED

10 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY CABLE TYPE

10.1 OVERVIEW

10.2 LOOSE TUBE CABLES

10.3 RIBBON CABLES

10.4 OTHERS

11 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE

11.1 OVERVIEW

11.2 SINGLE ARMOR

11.3 DOUBLE ARMOR

11.4 LIGHTWEIGHT ARMOR

11.5 ROCK ARMOR

12 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY DEPTH

12.1 OVERVIEW

12.2 1000M-5000M

12.3 500M-1000M

12.4 0M-500M

12.5 OTHERS

13 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OPERATION

13.1 OVERVIEW

13.2 CONSORTIUM CABLES

13.3 PRIVATE CABLES

13.4 GOVERNMENT-OWNED CABLES

14 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COMMUNICATION CABLES

14.3 POWER CABLES

15 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY

15.1 ASIA- PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 SOUTH KOREA

15.1.4 INDIA

15.1.5 SINGAPORE

15.1.6 AUSTRALIA

15.1.7 INDONESIA

15.1.8 THAILAND

15.1.9 MALAYSIA

15.1.10 PHILIPPINES

15.1.11 TAIWAN

15.1.12 VIETNAM

15.1.13 NEW ZEALAND

15.1.14 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ZTT

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 HENGTONG GROUP CO., LTD

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 NEC CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 LS CABLE & SYSTEM LTD

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 APAR INDUSTRIES LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 FURUKAWA ELECTRIC CO., LTD.

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 NINGBO ORIENT WIRES &CABLES CO., LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 NUSANTARA MARINE

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 OCC CORPORATION

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 OMS GROUP SDN BHD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 PT COMMUNICATION CABLE SYSTEMS INDONESIA TBK.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 PT KETROSDEN TRIASMITRA TBK

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 PT. NAUTIC MARITIME SALVAGE

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 PT NICA EUMARIN INDONESIA

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 PT TWINK INDONESIA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 PT VOKSEL ELECTRIC TBK

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 PRIMA NAVALINK

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PRYSMIAN

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 PURE PRO TECHNOBLOGY CO., LTD

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SSGCABLE

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SUBCOM, LLC

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TAIHAN CABLE & SOLUTION CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 TELKOM INFRA

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 QINGDAO HANHE CABLE CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENT

18.26 XTERA

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 USED CASE ANALYSIS

TABLE 4 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 9 TABLE 7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 TABLE 16 ASIA-PACIFIC POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 23 CHINA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 CHINA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 CHINA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 27 CHINA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 28 CHINA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 29 CHINA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 CHINA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 CHINA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 32 CHINA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 33 CHINA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 CHINA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 CHINA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 CHINA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 CHINA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 CHINA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 CHINA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 41 JAPAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 JAPAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 44 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 45 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 46 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 49 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 50 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 JAPAN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 JAPAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 JAPAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 JAPAN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 JAPAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 JAPAN WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH KOREA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH KOREA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH KOREA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH KOREA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 INDIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 INDIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 INDIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 INDIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 SINGAPORE DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SINGAPORE WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 95 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 96 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 97 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 100 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 101 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 SINGAPORE COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SINGAPORE DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SINGAPORE WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SINGAPORE POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 AUSTRALIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 AUSTRALIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 112 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 113 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 114 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 117 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 118 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 AUSTRALIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 AUSTRALIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 AUSTRALIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 AUSTRALIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRALIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRALIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 126 INDONESIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 INDONESIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 129 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 130 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 131 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 134 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 135 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 INDONESIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 INDONESIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 INDONESIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 143 THAILAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 THAILAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 146 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 147 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 148 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 151 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 152 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 THAILAND COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 THAILAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 THAILAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 THAILAND POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 THAILAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 THAILAND WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MALAYSIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 163 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 164 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 165 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 168 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 169 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MALAYSIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MALAYSIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 MALAYSIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MALAYSIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MALAYSIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MALAYSIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 177 PHILIPPINES DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 PHILIPPINES WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 180 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 181 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 182 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 185 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 186 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 PHILIPPINES COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 PHILIPPINES DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 PHILIPPINES WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 PHILIPPINES POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 PHILIPPINES DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 PHILIPPINES WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 TAIWAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 TAIWAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 197 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 198 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 199 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 202 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 203 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 TAIWAN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 TAIWAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 TAIWAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 TAIWAN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 TAIWAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 TAIWAN WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 211 VIETNAM DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 VIETNAM WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 214 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 215 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 216 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 219 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 220 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 VIETNAM COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 VIETNAM DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 VIETNAM WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 VIETNAM POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 VIETNAM DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 VIETNAM WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 228 NEW ZEALAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NEW ZEALAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 231 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 232 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 233 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 236 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 237 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 238 NEW ZEALAND COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NEW ZEALAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NEW ZEALAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NEW ZEALAND POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NEW ZEALAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NEW ZEALAND WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 REST OF ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

FIGURE 2 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY ULTRASOUND SENSOR TYPE (2024)

FIGURE 14 RISING CHRONIC DISEASE BURDEN & AGING POPULATION DRIVING NEED FOR DIAGNOSTIC IMAGING IS EXPECTED TO DRIVE THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY PRODUCT, 2024

FIGURE 18 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY VOLTAGE, 2024

FIGURE 19 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY OFFERINGS, 2024

FIGURE 20 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY FIBRE CLASS, 2024

FIGURE 21 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY CABLES TYPE, 2024

FIGURE 22 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY CABLES TYPE, 2024

FIGURE 23 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY CABLES TYPE, 2024

FIGURE 24 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY OPERATION, 2024

FIGURE 25 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY APPLICATION, 2024

FIGURE 26 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: SNAPSHOT (2024)

FIGURE 27 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.