Asia Pacific Stem Cell Manufacturing Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.23 Billion

USD

6.97 Billion

2025

2033

USD

3.23 Billion

USD

6.97 Billion

2025

2033

| 2026 –2033 | |

| USD 3.23 Billion | |

| USD 6.97 Billion | |

|

|

|

|

Mercado de fabricación de células madre en Asia-Pacífico, por productos (líneas de células madre, instrumentos, consumibles y kits), aplicación (aplicaciones de investigación, aplicaciones clínicas, bancos de células y tejidos y otros), usuario final (empresas de biotecnología y farmacéuticas, institutos de investigación e institutos académicos, bancos de células y tejidos, hospitales y centros quirúrgicos y otros), canal de distribución (ventas directas y distribuidores externos), país (Japón, China, Australia, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas y resto de Asia-Pacífico). Tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de fabricación de células madre en Asia y el Pacífico

Análisis y perspectivas del mercado: mercado de fabricación de células madre en Asia y el Pacífico

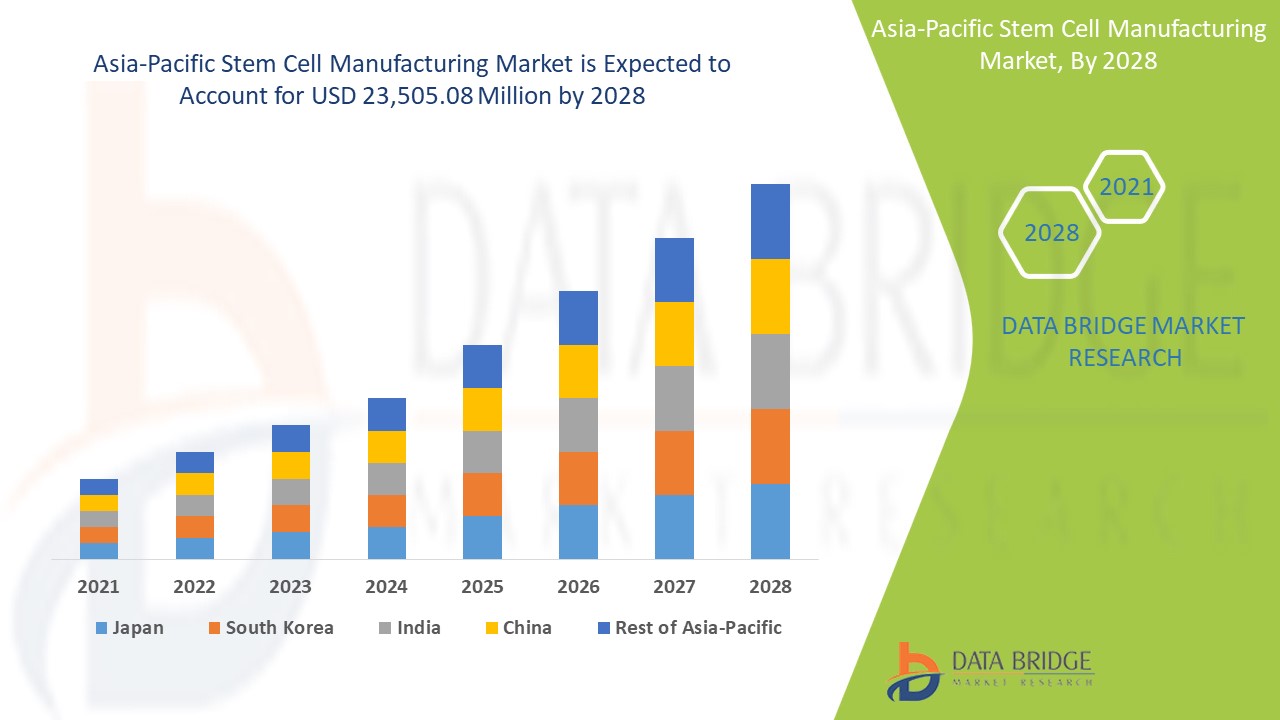

Se espera que el mercado de fabricación de células madre de Asia y el Pacífico gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 10,1% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 23.505,08 millones para 2028 desde USD 11.076,78 millones en 2020. La creciente prevalencia del cáncer y el trasplante de células madre, el crecimiento de nuevos avances tecnológicos para el trasplante de células madre es probable que sean los principales impulsores que impulsan la demanda del mercado en el período de pronóstico.

Las células madre son la materia prima del cuerpo que puede diferenciarse en una variedad de células, es decir, células a partir de las cuales se generan todas las demás células con funciones especializadas. Las terapias con células madre se definen como el tratamiento de una afección médica que implica el uso de cualquier tipo de células madre humanas , incluidas las células madre embrionarias y las células madre adultas para terapias alogénicas y autólogas.

La aparición de la investigación con células madre ha revelado el potencial terapéutico de las células madre y sus derivados . La fabricación exitosa de células madre y sus derivados está teniendo un impacto positivo en el ámbito de la atención sanitaria. Estos productos de células madre se utilizan para restaurar la función de tejidos y órganos dañados y para desarrollar terapias celulares basadas en células madre para el tratamiento del cáncer, trastornos hematológicos, trastornos genéticos , enfermedades autoinmunes e inflamatorias.

El aumento de la investigación y el desarrollo por parte de los actores clave de la industria para el desarrollo de productos innovadores, el apoyo del gobierno y la creciente adopción de células madre están impulsando el crecimiento del mercado. Las metodologías avanzadas presentes en el campo también están impulsando el crecimiento del mercado mundial de fabricación de células madre. Sin embargo, el alto costo de las terapias y la disponibilidad de alternativas para el tratamiento de tumores pueden restringir el mercado. La presencia de una gran cantidad de productos en desarrollo junto con las iniciativas estratégicas adoptadas por los actores del mercado están actuando como una oportunidad para el mercado. La falta de profesionales capacitados puede actuar como un desafío para el mercado.

El informe del mercado mundial de fabricación de células madre proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevos segmentos de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de fabricación de células madre a nivel mundial

Alcance y tamaño del mercado de fabricación de células madre a nivel mundial

El mercado de fabricación de células madre de Asia y el Pacífico se clasifica en cuatro segmentos importantes que se basan en productos, aplicaciones, usuarios finales y canales de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de los productos, el mercado de fabricación de células madre se segmenta en líneas de células madre, instrumentos, consumibles y kits. En 2021, se espera que el segmento de consumibles y kits domine el mercado debido a la compra frecuente de consumibles, el aumento de la investigación con células madre y la creciente demanda de terapias con células madre.

- En función de la aplicación, el mercado de fabricación de células madre se segmenta en aplicaciones de investigación, aplicaciones clínicas, bancos de células y tejidos, entre otros. En 2021, se espera que el segmento de aplicaciones de investigación domine el mercado debido al creciente enfoque en la investigación de citología y fisiopatología de células madre y al creciente financiamiento público-privado para respaldar el desarrollo y la comercialización de productos de células madre.

- En función del usuario final, el mercado de fabricación de células madre se segmenta en empresas biotecnológicas y farmacéuticas, institutos de investigación e institutos académicos, bancos de células y de tejidos, hospitales y centros quirúrgicos, entre otros. En 2021, se espera que el segmento de empresas farmacéuticas y biotecnológicas domine el mercado debido al creciente énfasis en las iniciativas estratégicas (como adquisiciones, asociaciones y colaboraciones) de las empresas farmacéuticas y biotecnológicas para expandir sus capacidades en la investigación con células madre.

- Según el canal de distribución, el mercado de fabricación de células madre se segmenta en ventas directas y distribuidores externos. En 2021, se espera que el segmento de ventas directas domine el mercado debido a la gran cantidad de actores en el mercado.

Análisis a nivel de país del mercado de fabricación de células madre en Asia y el Pacífico

Se analiza el mercado de fabricación de células madre y se proporciona información sobre el tamaño del mercado por productos, aplicación, usuario final y canal de distribución.

Los países cubiertos en el informe del mercado de fabricación de células madre son China, Japón, India, Australia, Corea del Sur, Singapur, Tailandia, Malasia, Indonesia, Filipinas, Vietnam y el resto de Asia-Pacífico (APAC).

China está dominando el mercado mundial de fabricación de células madre en la región Asia Pacífico debido a la mayor conciencia sobre el tratamiento basado en células madre y la adopción de tecnología avanzada.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

La creciente adopción de la terapia con células madre junto con la financiación pública y privada están creando oportunidades en el mercado mundial de fabricación de células madre

El mercado de fabricación de células madre también le proporciona un análisis detallado del mercado para el crecimiento de cada país en una industria en particular con ventas de dispositivos de desbridamiento de heridas, impacto del avance en el ensayo ELISpot y FluorSpot y cambios en los escenarios regulatorios con su apoyo al mercado de ensayos ELISpot y FluorSpot. Los datos están disponibles para el período histórico de 2019 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de fabricación de células madre

El panorama competitivo del mercado de fabricación de células madre proporciona detalles por competidor. Los detalles incluidos son la descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de fabricación de células madre.

Las principales empresas que proporcionan la fabricación de células madre son Thermo Fisher Scientific Inc., Merck KGaA, BD, Organogenesis Inc., Vericel Corporation, ANTEROGEN. CO., LTD., VistaGen Therapeutics, Inc., FUJIFILM Cellular Dynamics, Inc., American CryoSystem Corporation, PromoCell GmbH, Sartorius AG, ViaCyte, Inc., STEM CELL Technologies, Inc., Takeda Pharmaceutical Company Limited, DAIICHI SANKYO COMPANY, LIMITED, Bio-Techne, REPROCELL Inc., Catalent, Inc, Mesoblast Ltd, Astellas Pharma Inc. entre otras.

Las iniciativas estratégicas de los actores del mercado junto con los nuevos avances tecnológicos para la fabricación de células madre están cerrando la brecha para diversos tratamientos.

Por ejemplo,

- En junio de 2021, REPROCELL Inc. anunció que había abierto una nueva planta de fabricación de células madre iPSC para satisfacer la creciente demanda de bancos de células madre derivadas de iPSC. Esto ayudará a la empresa a abordar la creciente demanda y crecer en los próximos años.

- En junio de 2021, Catalent Inc. anunció que había adquirido RheinCell Therapeuics, un fabricante de células madre pluripotentes inducidas humanas. Esto ayudará a la empresa a desarrollar su proceso de terapia celular personalizada.

- En junio de 2021, Bio-Techne anunció que había mejorado su capacidad de fabricación de ingeniería genética y terapia celular y génica. Esto ayudará a la empresa a expandir aún más su negocio.

La colaboración, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando el mercado de la empresa en el mercado de fabricación de células madre, lo que también proporciona el beneficio para que la organización mejore su oferta para el mercado de fabricación de células madre.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.