Asia Pacific Skin Packaging For Fresh Meat Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

390.25 Million

USD

559.25 Million

2025

2033

USD

390.25 Million

USD

559.25 Million

2025

2033

| 2026 –2033 | |

| USD 390.25 Million | |

| USD 559.25 Million | |

|

|

|

|

Segmentación del mercado de envasado skin para carne fresca en Asia-Pacífico, por tipo (envasado skin termoformable con y sin cardado), material (plástico, papel y cartón, entre otros), recubrimiento termosellable (a base de agua, a base de solvente, entre otros), llenado con aire (al vacío y sin vacío), función (preservación y protección, idoneidad para el propósito, etiquetado reglamentario, presentación, entre otros), naturaleza (apto para microondas y no apto para microondas), uso final (carne, aves y mariscos): tendencias y pronóstico del sector hasta 2033.

Tamaño del mercado de envasado skin para carne fresca en Asia-Pacífico

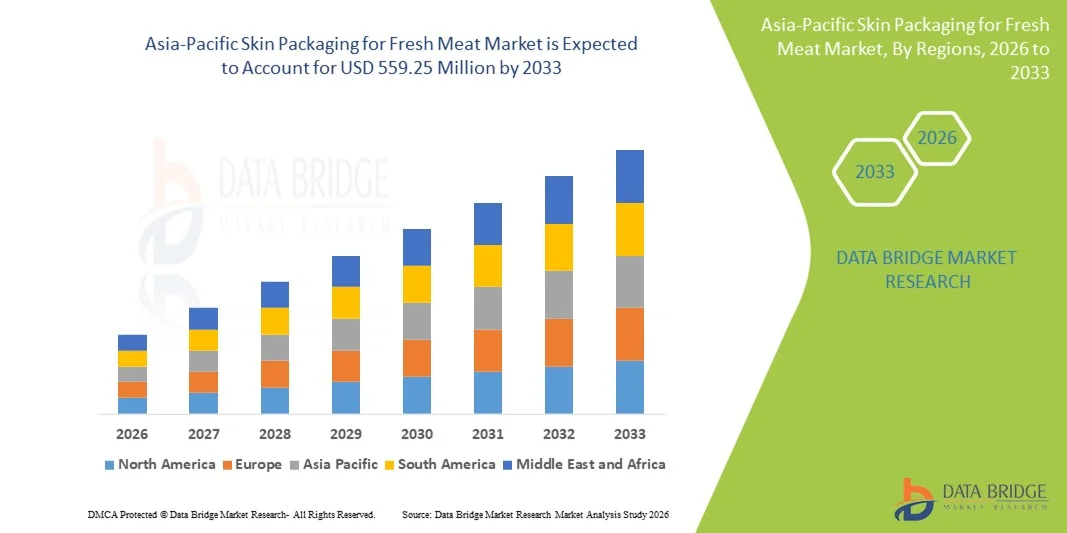

- El tamaño del mercado de envases de piel para carne fresca en Asia-Pacífico se valoró en USD 390,25 millones en 2025 y se espera que alcance los USD 559,25 millones en 2033 , con una CAGR del 4,60 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de una vida útil más prolongada y una mejor visibilidad del producto en los envases de carne fresca, ya que el envasado en piel ayuda a preservar la frescura al tiempo que mejora el atractivo en las estanterías.

- El aumento del consumo de productos cárnicos frescos y de primera calidad, junto con la creciente preferencia por formatos de envasado herméticos y sellados al vacío, está respaldando una expansión constante del mercado.

Análisis del mercado de envases skin para carne fresca en Asia-Pacífico

- El mercado está experimentando un crecimiento constante debido a la capacidad de los envases de piel para adaptarse perfectamente a los productos cárnicos, reduciendo la exposición al oxígeno y manteniendo la calidad del producto durante períodos más prolongados.

- El envasado skin se prefiere cada vez más a los formatos de envasado convencionales, ya que mejora la higiene, minimiza la pérdida por goteo y mejora la confianza del consumidor en la seguridad y frescura del producto.

- China dominó el mercado del envasado al vacío para carne fresca en 2025, impulsada por el alto consumo de carne y la rápida expansión de las modernas redes minoristas y de cadena de frío. La creciente preocupación de los consumidores por la seguridad y la frescura de los alimentos ha acelerado la adopción de soluciones de envasado al vacío y al vacío.

- Se espera que Japón sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de envasado de piel para carne fresca de Asia-Pacífico debido a la fuerte demanda de productos cárnicos premium, frescos y visualmente atractivos, la creciente adopción de formatos de carne listos para cocinar y orientados a la conveniencia, y el uso creciente de tecnologías avanzadas de envasado de piel en los canales minoristas y de servicios de alimentos modernos.

- El segmento de envases skin termoformables sin cardado registró la mayor cuota de mercado en 2025, gracias a su amplio uso en el envasado de carne fresca, su rentabilidad y su excelente compatibilidad con las líneas de envasado automatizadas. Este tipo permite una adhesión firme de la película alrededor de los cortes de carne, lo que mejora la conservación de la frescura y reduce las purgas. Es ampliamente adoptado por grandes procesadores de carne y minoristas gracias a su escalabilidad y rendimiento de sellado uniforme. Además, los formatos sin cardado permiten una producción de alto volumen, manteniendo la visibilidad y la higiene del producto.

Alcance del informe y segmentación del mercado de envasado skin para carne fresca en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de envasado de carne fresca en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de envases skin para carne fresca en Asia-Pacífico

Creciente demanda de una vida útil más larga y una presentación de productos de primera calidad

- La creciente atención a la conservación de la frescura y el atractivo visual de los productos cárnicos frescos está transformando significativamente el mercado del envasado skin para carne fresca, ya que minoristas y consumidores prefieren soluciones que preserven la calidad y mejoren la apariencia del producto. El envasado skin está ganando terreno gracias a su capacidad para sellar herméticamente los productos cárnicos, reducir la exposición al oxígeno y prolongar su vida útil sin el uso de conservantes. Esta tendencia está fortaleciendo su uso en los canales minoristas y de servicios de alimentación, lo que impulsa a los fabricantes de envases a desarrollar películas y tecnologías de sellado avanzadas.

- El creciente consumo de productos cárnicos frescos, refrigerados y de primera calidad está acelerando la demanda de envases skin en supermercados y carnicerías especializadas. Los consumidores se inclinan cada vez más por envases herméticos y sellados al vacío que ofrecen una clara visibilidad de los cortes de carne, garantizando al mismo tiempo la higiene y la seguridad. Esto ha impulsado a los procesadores de carne a adoptar el envasado skin para satisfacer las cambiantes expectativas de los consumidores y reducir las pérdidas por deterioro.

- Las tendencias de premiumización en la industria cárnica influyen en las decisiones de compra, ya que las marcas priorizan la calidad, la frescura y el atractivo estético. El envasado skin contribuye a estos objetivos al mejorar la diferenciación en el lineal y generar oportunidades de marca mediante películas transparentes y bandejas con diseños atractivos. Estos factores ayudan a los fabricantes a fortalecer el posicionamiento de marca, aumentar la confianza del consumidor y mejorar las tasas de repetición de compra en entornos minoristas competitivos.

- Por ejemplo, en 2024, los principales procesadores de carne y cadenas minoristas de los mercados desarrollados ampliaron el uso del envasado skin para productos frescos de carne de res, aves y cerdo con el fin de mejorar la presentación en los estantes y reducir el desperdicio de alimentos. Estas mejoras en el envasado se introdujeron en respuesta a la creciente demanda de carne fresca de primera calidad, cuyos productos se distribuyen a través de grandes superficies y establecimientos especializados. El envasado mejorado también reforzó los mensajes de sostenibilidad al reducir el deterioro y las tasas de devolución de productos.

- Si bien la adopción del envasado skin para carne fresca continúa en aumento, el crecimiento sostenido del mercado depende de la optimización de costos, la innovación en materiales y la compatibilidad con las líneas de procesamiento existentes. Los fabricantes de envases se están centrando en desarrollar películas reciclables y más delgadas, mejorar la eficiencia del sellado y garantizar la consistencia del rendimiento para impulsar una mayor adopción en procesadores de carne, tanto pequeños como grandes.

Dinámica del mercado de envasado skin para carne fresca en Asia-Pacífico

Conductor

Creciente demanda de conservación de la frescura y envases a prueba de fugas

- La creciente demanda de soluciones de envasado que prolonguen la vida útil y mantengan la calidad de la carne es un factor clave para el envasado skin en el mercado de la carne fresca. El envasado skin minimiza el contacto con el aire y mantiene los productos en su lugar de forma segura, reduciendo el crecimiento microbiano y las pérdidas por goteo. Esto ayuda a los procesadores y minoristas de carne a cumplir con las normas de seguridad alimentaria, a la vez que mejora la durabilidad del producto durante el almacenamiento y el transporte.

- La expansión de la distribución minorista de carne fresca a través de supermercados e hipermercados está impulsando el crecimiento del mercado, ya que estos canales requieren formatos de envasado que mejoren la visibilidad del producto y reduzcan las pérdidas por manipulación. El envasado skin permite a los minoristas exhibir la carne fresca durante más tiempo sin comprometer la apariencia, lo que facilita una gestión eficiente del inventario y reduce el desperdicio.

- Los procesadores de carne y las empresas de envasado promueven activamente la carne fresca envasada en envases skin mediante la innovación de productos, la mejora del diseño de las bandejas y la compatibilidad con las líneas de envasado automatizadas. Estos esfuerzos se ven respaldados por la demanda de los minoristas de envases de alto rendimiento y la creciente preferencia de los consumidores por formatos higiénicos y resistentes a la manipulación, lo que fomenta la colaboración entre los proveedores de envases y los procesadores de carne.

- Por ejemplo, en 2023, los principales proveedores de soluciones de envasado se asociaron con procesadores de carne fresca para introducir películas de envasado skin de alta barrera para productos de carne de res y aves de corral. Estas soluciones ayudaron a mejorar la vida útil y el atractivo visual, lo que resultó en una mayor conversión de ventas y una reducción de las devoluciones de productos para los minoristas. También se destacaron los beneficios de sostenibilidad, como la reducción del desperdicio de alimentos, para impulsar su adopción.

- Si bien la fuerte demanda de envases que conservan la frescura impulsa el crecimiento del mercado, la expansión continua depende de equilibrar el rendimiento con la rentabilidad. Las inversiones en materiales avanzados, producción escalable e integración con equipos de envasado de alta velocidad serán esenciales para mantener la competitividad y satisfacer la creciente demanda global.

Restricción/Desafío

Mayores costos de embalaje y preocupaciones sobre la sostenibilidad de los materiales

- El costo relativamente más alto de los sistemas de envasado skin y películas especializadas, en comparación con los envases convencionales de bandeja y sobreenvoltura, sigue siendo un desafío clave para el crecimiento del mercado. Los materiales avanzados, los equipos de vacío y las tecnologías de sellado contribuyen al aumento de los costos iniciales y operativos, lo que puede limitar su adopción entre los procesadores de carne pequeños y medianos.

- Las preocupaciones sobre la sostenibilidad relacionadas con el uso del plástico y su reciclabilidad también plantean desafíos, ya que los envases skin suelen basarse en películas multicapa difíciles de reciclar. El creciente escrutinio regulatorio y la presión de los consumidores por soluciones de envasado ecológicas están obligando a los fabricantes a replantearse la elección de materiales, lo que añade complejidad al desarrollo de productos.

- Los desafíos operativos y técnicos impactan aún más la adopción, ya que el envasado skin requiere un control preciso de la temperatura, compatibilidad con la película y un manejo experto para garantizar un sellado uniforme y la calidad del producto. Cualquier desviación puede provocar fallos en el sellado, una reducción de la vida útil o el rechazo del producto, lo que aumenta el riesgo operativo para los procesadores.

- Por ejemplo, en 2024, varios procesadores de carne a pequeña escala informaron una adopción más lenta del envasado skin debido a los altos costos de los equipos y al acceso limitado a opciones de películas reciclables. La preocupación por el cumplimiento de las nuevas regulaciones de sostenibilidad y la necesidad de experiencia técnica también afectaron las decisiones de inversión, especialmente entre los operadores sensibles a los costos.

- Para abordar estos desafíos se requerirá innovación en películas reciclables y monomateriales, maquinaria rentable y soporte técnico para los procesadores. La colaboración entre fabricantes de envases, procesadores de carne y proveedores de materiales será crucial para reducir costos, mejorar la sostenibilidad y aprovechar el potencial de crecimiento a largo plazo del mercado de envases skin para carne fresca.

Mercado de envasado skin para carne fresca en Asia-Pacífico

El mercado está segmentado según el tipo, material, revestimiento de sellado térmico, relleno de aire, función, naturaleza y uso final.

- Por tipo

En función del tipo, el mercado de envasado skin para carne fresca en Asia-Pacífico se segmenta en envases skin termoformables con cartón y envases skin termoformables sin cartón. El segmento de envases skin termoformables sin cartón registró la mayor cuota de mercado en 2025, gracias a su amplio uso en el envasado de carne fresca, su rentabilidad y su excelente compatibilidad con las líneas de envasado automatizadas. Este tipo permite una adhesión firme de la película alrededor de los cortes de carne, lo que mejora la conservación de la frescura y reduce las pérdidas. Es ampliamente adoptado por grandes procesadores y minoristas de carne gracias a su escalabilidad y a su rendimiento de sellado uniforme. Además, los formatos sin cartón permiten una producción de alto volumen, manteniendo la visibilidad y la higiene del producto.

Se prevé que el segmento de envases skin termoformables en cartón experimente un crecimiento sostenido entre 2026 y 2033, impulsado por la creciente demanda de productos cárnicos frescos premium y de marca. Este formato ofrece una presentación mejorada y espacio adicional para la marca y la información regulatoria. Se utiliza cada vez más en la venta minorista especializada y en ofertas de carne de valor añadido, donde la diferenciación visual es importante. El creciente enfoque en la premiumización y la narrativa del producto impulsa aún más la adopción de formatos en cartón.

- Por material

En cuanto al material, el mercado de envasado skin para carne fresca en Asia-Pacífico se segmenta en plástico, papel y cartón, y otros. El segmento de plástico representó la mayor participación en 2025 gracias a sus excelentes propiedades de barrera, flexibilidad y durabilidad. Los materiales plásticos proporcionan fuertes barreras contra el oxígeno y la humedad, fundamentales para prolongar la vida útil de los productos cárnicos frescos. Su transparencia también mejora la visibilidad del producto, lo que facilita la decisión de compra del consumidor. Además, los materiales plásticos son compatibles con sistemas de envasado skin al vacío y líneas de procesamiento de alta velocidad.

Se prevé que el segmento del papel y el cartón experimente el mayor crecimiento entre 2026 y 2033, impulsado por el creciente énfasis en soluciones de embalaje sostenibles y reciclables. Los fabricantes están desarrollando bandejas de papel con recubrimientos de barrera para reducir el uso de plástico y mantener su funcionalidad. La creciente presión regulatoria y la preferencia de los consumidores por los embalajes ecológicos impulsan aún más la innovación en este segmento. Estos materiales están ganando terreno, especialmente en los canales minoristas premium y centrados en la sostenibilidad.

- Por recubrimiento de sellado térmico

En cuanto al recubrimiento termosellable, el mercado de envases skin para carne fresca en Asia-Pacífico se segmenta en base agua, base solvente y otros. El segmento de recubrimiento termosellable a base de agua dominó el mercado en 2025 debido a su bajo impacto ambiental y su idoneidad para aplicaciones en contacto con alimentos. Estos recubrimientos ofrecen un sellado eficaz, a la vez que contribuyen a los objetivos de sostenibilidad y al cumplimiento normativo. Son ampliamente preferidos por los fabricantes de envases que buscan reducir las emisiones de COV. Además, los recubrimientos a base de agua proporcionan una buena adhesión en diversos sustratos de envasado.

Se prevé que el segmento de recubrimientos a base de solventes experimente el mayor crecimiento entre 2026 y 2033, gracias a su gran resistencia de adhesión y rendimiento en aplicaciones de alta barrera. Sin embargo, su adopción se ve cada vez más influenciada por las normativas ambientales y las preocupaciones de sostenibilidad. Los fabricantes utilizan selectivamente recubrimientos a base de solventes en aplicaciones que requieren una mayor resistencia de sellado. La innovación continua se centra en reducir el impacto ambiental manteniendo el rendimiento.

- Por llenado de aire

En cuanto al llenado con aire, el mercado de envasado skin para carne fresca en Asia-Pacífico se segmenta en llenado al vacío y sin llenado al vacío. El segmento de llenado al vacío tuvo la mayor cuota de mercado en 2025, gracias a su eficacia para eliminar el oxígeno y prolongar la vida útil de los productos cárnicos frescos. El envasado skin al vacío ayuda a inhibir el crecimiento microbiano y a reducir las pérdidas por goteo, mejorando así la calidad general del producto. Este formato se utiliza ampliamente en los canales minoristas y de restauración para garantizar la frescura durante la distribución y el almacenamiento. Además, contribuye a la reducción del desperdicio de alimentos y a una mejor gestión del inventario.

Se prevé que el segmento de llenado sin vacío experimente el mayor crecimiento entre 2026 y 2033, especialmente en aplicaciones con menor vida útil. Este segmento se beneficia de menores costos de envasado y equipos, lo que lo hace ideal para procesadores más pequeños. Se utiliza comúnmente en canales de distribución locales y regionales donde se espera una rápida rotación de productos. La facilidad de procesamiento y la rentabilidad siguen impulsando su adopción.

- Por función

En función de su función, el mercado de envasado skin para carne fresca en Asia-Pacífico se segmenta en Conservar y Proteger, Apto para su Uso, Etiquetado Regulatorio, Presentación y Otros. El segmento de conservación y protección representó la mayor participación en 2025, ya que mantener la frescura y la seguridad es el objetivo principal del envasado de carne fresca. El envasado skin proporciona una sólida protección contra la contaminación, los daños físicos y la pérdida de humedad. Esta función es fundamental para cumplir con las normas de seguridad alimentaria y prolongar la vida útil del producto. También facilita una gestión eficiente de la cadena de frío.

Se prevé que el segmento de presentación experimente el mayor crecimiento entre 2026 y 2033, impulsado por el creciente énfasis en el atractivo visual y el posicionamiento premium. El empaque skin mejora la estética del producto al mostrar claramente los cortes de carne y reducir el desorden en el empaque. Esta función favorece la diferenciación de marca y mejora la visibilidad en los estantes en entornos minoristas competitivos. La creciente preferencia de los consumidores por productos cárnicos frescos visualmente atractivos impulsa aún más este segmento.

- Por naturaleza

Por su naturaleza, el mercado de envasado skin para carne fresca en Asia-Pacífico se segmenta en apto para microondas y no apto para microondas. El segmento no apto para microondas dominó el mercado en 2025, ya que la mayoría de los productos cárnicos frescos se cocinan una vez desempacados. Este segmento se beneficia de estructuras de materiales más simples y menores costos de producción. Su adopción es generalizada en los formatos tradicionales de venta al por menor de carne fresca. La fuerte demanda de productos cárnicos crudos y mínimamente procesados continúa impulsando este segmento.

Se prevé que el segmento de productos para microondas experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de productos cárnicos prácticos y listos para cocinar. La urbanización y los cambios en los estilos de vida están fomentando la adopción de envases que facilitan la preparación rápida de comidas. Los fabricantes de envases están desarrollando materiales resistentes al calor compatibles con el calentamiento por microondas. Este segmento está cobrando impulso, especialmente entre los consumidores más jóvenes y los hogares con trabajadores.

- Por uso final

En función del uso final, el mercado de envasado skin para carne fresca en Asia-Pacífico se segmenta en Carne, Aves y Mariscos. El segmento de carnes registró la mayor participación en los ingresos en 2025, impulsado por el alto consumo mundial de carne de res, cerdo y cordero. El envasado skin se utiliza ampliamente para mejorar la frescura, reducir el deterioro y mejorar la presentación de los productos cárnicos. Este segmento se beneficia de la fuerte demanda minorista y de una infraestructura consolidada para la cadena de frío. La oferta de carne premium impulsa aún más la adopción de soluciones avanzadas de envasado skin.

Se prevé que el segmento avícola experimente el mayor crecimiento entre 2026 y 2033, impulsado por el aumento del consumo de pollo y pavo. Los productos avícolas tienen una vida útil más corta, lo que aumenta la necesidad de soluciones de envasado eficaces, como el envasado al vacío skin. La creciente demanda de envases higiénicos y herméticos está impulsando su adopción en este segmento. La expansión de los canales organizados de venta minorista y restauración impulsa aún más el crecimiento del mercado.

Análisis regional del mercado de envasado skin para carne fresca en Asia-Pacífico

- China dominó el mercado del envasado al vacío para carne fresca en 2025, impulsada por el alto consumo de carne y la rápida expansión de las modernas redes minoristas y de cadena de frío. La creciente preocupación de los consumidores por la seguridad y la frescura de los alimentos ha acelerado la adopción de soluciones de envasado al vacío y al vacío.

- Las operaciones de procesamiento de carne a gran escala y las fuertes inversiones en tecnología de envasado respaldan aún más el liderazgo del mercado.

- El enfoque en reducir el desperdicio de alimentos y mejorar la eficiencia de la cadena de suministro también contribuye a un dominio sostenido.

Perspectiva del mercado japonés de envases skin para carne fresca

Se prevé que Japón experimente el mayor crecimiento entre 2026 y 2033, impulsado por una fuerte demanda de productos cárnicos frescos, de alta calidad y visualmente atractivos. Los consumidores valoran enormemente la higiene, el control de las porciones y la presentación premium, lo que impulsa la adopción del envasado skin. Las tecnologías avanzadas de envasado y los formatos minoristas orientados a la conveniencia impulsan aún más el crecimiento. Además, la creciente demanda de productos cárnicos premium y listos para cocinar está acelerando la expansión del mercado.

Cuota de mercado de envasado skin para carne fresca en Asia-Pacífico

La industria de envasado de piel para carne fresca en Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Toyo Seikan Group Holdings (Japón)

- Rengo Co., Ltd. (Japón)

- Dai Nippon Printing Co., Ltd. (Japón)

- Toppan Holdings Inc. (Japón)

- Grupo químico Mitsubishi (Japón)

- SCG Packaging (Tailandia)

- Indorama Ventures (Tailandia)

- Grupo de embalajes de plástico tailandés (Tailandia)

- Amcor Asia (Australia)

- Industrias Visy (Australia)

- Uflex Ltd. (India)

- Ester Industries Ltd. (India)

- Películas de polietileno Jindal (India)

- Papel Shandong Huatai (China)

- Corporación del Gran Sudeste de Zhejiang (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.