Mercado de pantallas industriales robustas de Asia y el Pacífico, por tecnología (LCD, LED, OLED, pantalla de papel electrónico), tamaño de pantalla (8”-11”, 11”-12”, 13”-18”, 19”-25”, 40” y más), resolución (1920x1200, 1920x1080, 1280x1024, 1024x768, 800x600, 1366x768), montaje (montaje en panel, montaje en bastidor, montaje en pared, montaje en brazo, marco abierto, otros), tipo de pantalla táctil (resistiva, PCAP, táctil IR, capacitiva), aplicación (médica, HMI, automatización industrial, quiosco/punto de venta, señalización digital, imágenes, juegos/lotería), vertical (petróleo y gas, fabricación, química, energía y electricidad, minería y metales, transporte, militar y defensa, Otros), País (China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas, Resto de Asia-Pacífico) Tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de pantallas industriales resistentes en Asia y el Pacífico

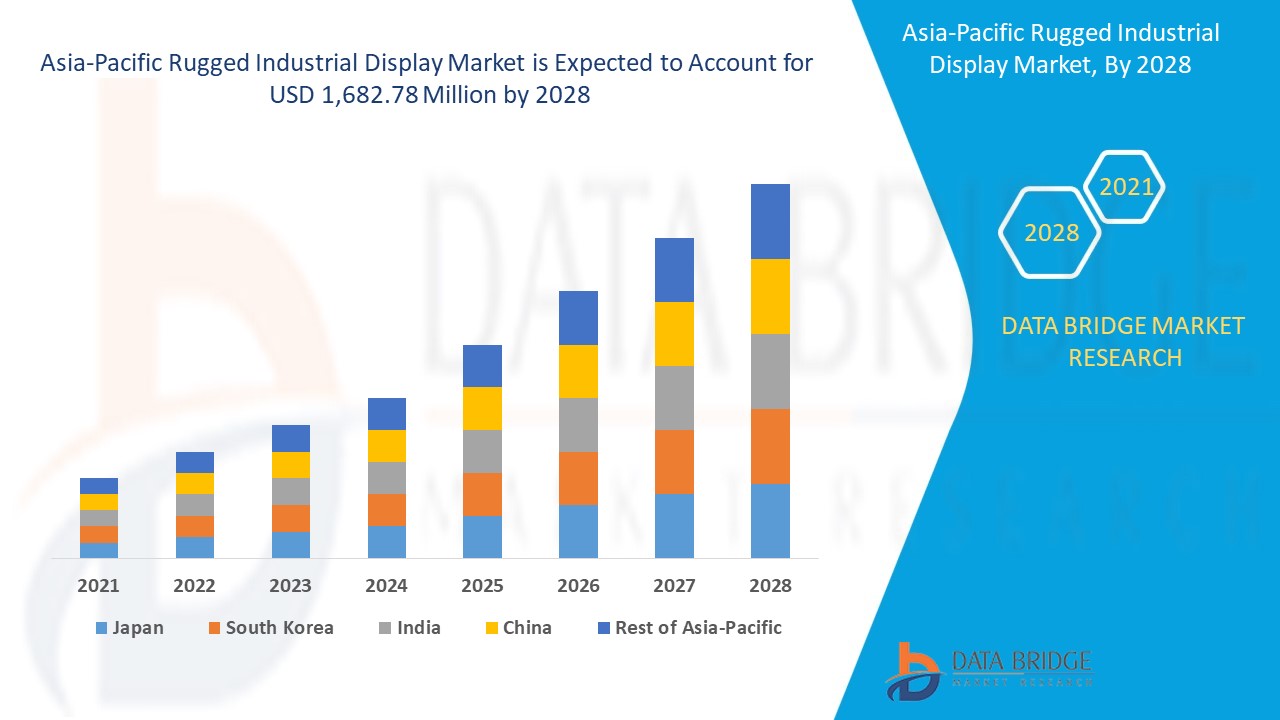

Se espera que el mercado de pantallas industriales robustas gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,9% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 1.682,78 millones para 2028. La creciente automatización y la IoT bajo la Industria 4.0 y el aumento de los datos digitales en los campos de la medicina, la fabricación, el ejército y la defensa requieren pantallas de interacción que se adapten mejor a los entornos hostiles de los respectivos sectores, por lo que actúan como impulsores del crecimiento del mercado de pantallas industriales robustas.

Las pantallas industriales resistentes son un tipo especial de pantallas diseñadas para los entornos hostiles que se presentan en las aplicaciones marinas, militares e industriales, donde el alto rendimiento y la robustez son cruciales. Ofrecen características como una carcasa resistente a los golpes, pantallas resistentes a los arañazos, resistencia a la corrosión y revestimientos especiales según el caso de uso.

Los avances tecnológicos emergentes y los procesos automatizados en las industrias están demostrando ser el principal impulsor del mercado de pantallas industriales resistentes de Asia-Pacífico. El aumento de la interacción hombre-máquina en los últimos años ha visto el auge del mercado de pantallas HMI en los últimos años y la creciente adopción de la automatización en el sector manufacturero está impulsando el mercado. El mayor costo de adopción de pantallas resistentes y el alto costo de desarrollo para condiciones desafiantes pueden resultar una restricción, sin embargo, muchas industrias que se están moviendo hacia la industria 4.0 y la rápida digitalización y automatización son la mayor oportunidad para el mercado. El desarrollo de pantallas para todo clima puede ser un desafío y los desafíos a los que se enfrenta debido al impacto de COVID-19 en la cadena de suministro de las materias primas, especialmente las importaciones de China, que es un importante proveedor de productos electrónicos a nivel internacional.

El informe de mercado de pantallas industriales resistentes proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de pantallas industriales resistentes, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de pantallas industriales resistentes

El mercado de pantallas industriales resistentes está segmentado en función de la tecnología, el tamaño de la pantalla, la resolución, el montaje, el tipo de pantalla táctil, la aplicación y la vertical. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de la tecnología, el mercado de pantallas industriales resistentes se segmenta en pantallas LCD, LED, OLED y de papel electrónico. En 2021, el segmento LCD domina el mercado de pantallas industriales resistentes, ya que es el más económico de adoptar entre todos.

- En función del tamaño de la pantalla, el mercado de pantallas industriales resistentes se segmenta en 8”-11”, 11”-12”, 13”-18”, 19”-25”, 40” y más. En 2021, el segmento de 13”-18” domina el mercado, ya que es el tamaño de pantalla óptimo para todo tipo de aplicaciones y tipos de montaje.

- En función de la resolución, el mercado de pantallas industriales resistentes se segmenta en 1920x1200, 1920x1080, 1280x1024, 1024x768, 800x600 y 1366x768. En 2021, el segmento 1024x768 domina el mercado, ya que su relación de aspecto de 4:3 es común en las pantallas HMI y también es compatible con software heredado.

- En función del tipo de montaje, el mercado de pantallas industriales resistentes se segmenta en montaje en panel, montaje en bastidor, montaje en pared, montaje en brazo, marco abierto y otros. En 2021, el segmento de montaje en panel domina el mercado debido a su naturaleza versátil de adopción de diferentes adaptadores y la amplia adopción en el sector manufacturero.

- Según el tipo de pantalla táctil, el mercado de pantallas industriales resistentes se segmenta en resistivas, PCAP, táctiles IR y capacitivas. En 2021, el segmento resistivo domina el mercado debido a su menor costo de adopción y su facilidad de uso con guantes y lápiz óptico pasivo.

- En función de la aplicación, el mercado de pantallas industriales robustas se segmenta en medicina, HMI, automatización industrial , quioscos/puntos de venta, señalización digital, imágenes y juegos/lotería. En 2021, el segmento HMI domina el mercado debido a la rápida industrialización y el uso en la automatización.

- En función de la vertical, el mercado de pantallas industriales robustas se segmenta en petróleo y gas, fabricación, química , energía y electricidad, minería y metales, transporte, militar y defensa, entre otros. En 2021, el segmento de fabricación domina el mercado debido a la mayor demanda debido a la creciente automatización y al crecimiento de las instalaciones de fabricación en Asia-Pacífico.

Análisis a nivel de país del mercado de pantallas industriales resistentes

Se analiza el mercado de pantallas industriales robustas y se proporciona información sobre el tamaño del mercado por país, tecnología, tamaño de pantalla, resolución, montaje, tipo de pantalla táctil, aplicación y vertical como se menciona anteriormente.

Los países cubiertos en el informe del mercado de pantallas industriales robustas son China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico.

China domina la región Asia Pacífico debido al rápido crecimiento de las industrias y al uso de la HMI en la fabricación.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre las pantallas industriales resistentes están impulsando el crecimiento del mercado de pantallas industriales resistentes.

El mercado de pantallas industriales resistentes también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de las pantallas industriales resistentes

El panorama competitivo del mercado de pantallas industriales resistentes proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de pantallas industriales resistentes.

Las principales empresas que se dedican a la pantalla industrial resistente son SAMSUNG ELECTRONICS AMERICA, Advantech Co., Ltd., AU Optronics Corp., BOE Technology UK Limited, Curtiss-Wright Corporation, GETAC, Kyocera, Pepperl+Fuchs SE, Rockwell Automation, Inc., Siemens y TCI GmbH, entre otras empresas nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosas empresas de todo el mundo también han iniciado numerosos contratos y acuerdos que también están acelerando el mercado de pantallas industriales robustas.

Por ejemplo,

- En abril de 2021, la división de soluciones de defensa de Curtiss-Wright fue seleccionada por Scientific Research Corporation (SRC) para proporcionar una versión de su sistema de grabadora de vuelo Fortress, líder en la industria, para actualizar el avión de entrenamiento T-6 Texan II utilizado por los EE. UU. La empresa ha proporcionado a SRC una nueva variante de la Fortress CVR25, desarrollada para su uso en plataformas aéreas militares de ala fija y helicópteros. Esto ayudará a la empresa a explorar más a fondo otras aplicaciones de grabadora de vuelo dentro del Departamento de Defensa en su división de defensa.

- En marzo de 2021, Advantech Co. Ltd, líder en tecnología IoT en Asia-Pacífico, anunció el lanzamiento de la serie de conferencias de socios en línea más grande del mundo, cuyo tema es "Edge+ hacia el futuro de AIoT". La serie reunió a más de 60 expertos industriales y colaboradores del ecosistema para compartir nuevas soluciones y tecnologías Edge+. La empresa también planea trabajar con estos colaboradores a largo plazo para cocrear un entorno sostenible y mejorar las oportunidades comerciales de IoT.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de pantallas industriales robustas, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRIAL DISPLAY TYPES

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAYS

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRIC MANUFACTURERS ASSOCIATION (NEMA) RATINGS

4.3 KEY CUSTOMERS BY INDUSTRY

4.3.1 MILITARY & DEFENSE INDUSTRY

4.3.2 INDUSTRIAL AUTOMATION & MANUFACTURING

4.3.3 OIL & GAS INDUSTRY

4.3.4 CHEMICAL INDUSTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES RISK OF EYE DAMAGE

5.1.3 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES

5.1.4 INCREASE IN MANUFACTURING FACILITIES WORLDWIDE ENHANCES ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.1.6 RISE IN DEMAND FOR COST-EFFECTIVE KIOSKS FOR INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS/PANELS

5.2.2 DEVELOPING & DESIGNING OF DISPLAY EQUIPMENT FOR ALL WEATHER CONDITIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASE IN DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISE IN ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 TRANSFORMATION OF MANUAL PROCESS INTO DIGITAL PROCESS BY COMPANIES

5.3.5 INCREASE IN PARTNERSHIPS AND ACQUISITIONS AMONGST DIFFERENT MARKET PLAYERS

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCY OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LCD

7.3 LED

7.3.1 FULL ARRAY

7.3.2 EDGE LIT

7.3.3 DIRECT LIT

7.4 OLED

7.4.1 AMOLED DISPLAY

7.4.2 PMOLED DISPLAY

7.5 E-PAPER DISPLAY

8 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE

8.1 OVERVIEW

8.2” – 18”

8.3 8” – 11”

8.4” – 12”

8.5” – 25”

8.6 ABOVE 40"

9 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION

9.1 OVERVIEW

9.24X768

9.36X768

9.40X1080

9.5X600

9.60X1024

9.70X1200

10 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING

10.1 OVERVIEW

10.2 PANEL MOUNTING

10.3 OPEN-FRAME

10.4 RACK MOUNTING

10.5 WALL MOUNTING

10.6 ARM-MOUNTED

10.7 OTHERS

11 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE

11.1 OVERVIEW

11.2 RESISTIVE

11.3 P CAP

11.4 CAPACITIVE

11.5 IR TOUCH

12 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HMI

12.2.1” – 18”

12.2.2 8” – 11”

12.2.3” – 25”

12.2.4” – 12”

12.2.5 ABOVE 40"

12.3 MEDICAL

12.3.1” – 18”

12.3.2” – 25”

12.3.3” – 12”

12.3.4 8” – 11”

12.3.5 ABOVE 40"

12.4 INDUSTRIAL AUTOMATION

12.4.1 ABOVE 40"

12.4.2” – 25”

12.4.3” – 18”

12.4.4” – 12”

12.4.5 8” – 11”

12.5 DIGITAL SIGNAGE

12.5.1 ABOVE 40"

12.5.2” – 25”

12.5.3” – 18”

12.5.4” – 12”

12.5.5 8” – 11”

12.6 KIOSK/ POS

12.6.1 8” – 11”

12.6.2” – 12”

12.6.3” – 18”

12.6.4” – 25”

12.6.5 ABOVE 40"

12.7 GAMING/ LOTTERY

12.7.1” – 18”

12.7.2” – 25”

12.7.3” – 12”

12.7.4 8” – 11”

12.7.5 ABOVE 40"

12.8 IMAGING

12.8.1” – 18”

12.8.2” – 25”

12.8.3 ABOVE 40"

12.8.4” – 12”

12.8.5 ABOVE 40"

13 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 MANUFACTURING

13.2.1 LCD

13.2.2 LED

13.2.3 OLED

13.3 MILITARY & DEFENCE

13.3.1 LCD

13.3.2 LED

13.3.3 OLED

13.4 ENERGY & POWER

13.4.1 LCD

13.4.2 LED

13.4.3 OLED

13.5 OIL & GAS

13.5.1 LCD

13.5.2 LED

13.5.3 OLED

13.6 CHEMICAL

13.6.1 LCD

13.6.2 LED

13.6.3 OLED

13.7 TRANSPORTATION

13.7.1 LCD

13.7.2 LED

13.7.3 OLED

13.8 METAL & MINING

13.8.1 LCD

13.8.2 LED

13.8.3 OLED

13.9 OTHERS

14 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY GEOGRAPHY

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 SINGAPORE

14.1.6 AUSTRALIA

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILLIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SAMSUNG ELECTRONICS AMERICA

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 AU OPTRONICS CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALSYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 KYOCERA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CURTISS-WRIGHT CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 ROCKWELL AUTOMATION INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 GETAC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ADVANCED EMBEDDED SOLUTIONS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ADVANTECH CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 BIT TRADITION GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BLUESTONE TECHNOLOGY LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BOE TECHNOLOGY UK LIMITED

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BRESSNER TECHNOLOGY GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 CRYSTAL GROUP INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 GENERAL DIGITAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 HEMATEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HOPE INDUSTRIAL SYSTEMS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NOAX TECHNOLOGIES AG

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PEPPERL+FUCHS SE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SIEMENS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 TCI GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 DESCRIPTION OF VARIOUS IP RATING NUMBERS

TABLE 2 SIGNIFICANCE OF NEMA RATING

TABLE 3 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 4 ASIA-PACIFIC LCD IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 5 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 6 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 8 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC E-PAPER DISPLAY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 10 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC 13” – 18” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 12 ASIA-PACIFIC 8” – 11” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 13 ASIA-PACIFIC 11” – 12” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 14 ASIA-PACIFIC 19” – 25” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 15 ASIA-PACIFIC ABOVE 40" IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 16 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC 1024X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 18 ASIA-PACIFIC 1366X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 19 ASIA-PACIFIC 1920X1080 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 20 ASIA-PACIFIC 800X600 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 21 ASIA-PACIFIC 1280X1024 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 22 ASIA-PACIFIC 1920X1200 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 23 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC PANEL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 25 ASIA-PACIFIC OPEN-FRAME IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 26 ASIA-PACIFIC RACK MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 27 ASIA-PACIFIC WALL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 28 ASIA-PACIFIC ARM-MOUNTED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 29 ASIA-PACIFIC OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 30 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC RESISTIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 32 ASIA-PACIFIC P CAP IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 33 ASIA-PACIFIC CAPACITIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 34 ASIA-PACIFIC IR TOUCH IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 35 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 ASIA-PACIFIC HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 37 ASIA-PACIFIC HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 38 ASIA-PACIFIC MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 39 ASIA-PACIFIC MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 40 ASIA-PACIFIC INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 41 ASIA-PACIFIC INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 43 ASIA-PACIFIC DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 44 ASIA-PACIFIC KIOSK/POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 45 ASIA-PACIFIC KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 46 ASIA-PACIFIC GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 47 ASIA-PACIFIC GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 49 ASIA-PACIFIC IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 50 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 51 ASIA-PACIFIC MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 52 ASIA-PACIFIC MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 ASIA-PACIFIC MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 54 ASIA-PACIFIC MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 55 ASIA-PACIFIC ENERGY AND POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 56 ASIA-PACIFIC ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 ASIA-PACIFIC OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 58 ASIA-PACIFIC OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 59 ASIA-PACIFIC CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 60 ASIA-PACIFIC CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 ASIA-PACIFIC TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 62 ASIA-PACIFIC TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 63 ASIA-PACIFIC METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 64 ASIA-PACIFIC METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 ASIA-PACIFIC OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 66 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 67 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 68 ASIA-PACIFIC LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 ASIA-PACIFIC OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 71 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 72 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 73 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 74 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (THOUSAND UNITS)

TABLE 76 ASIA-PACIFIC HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 77 ASIA-PACIFIC MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 78 ASIA-PACIFIC INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 79 ASIA-PACIFIC MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 80 ASIA-PACIFIC KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 81 ASIA-PACIFIC GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 82 ASIA-PACIFIC IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 83 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 ASIA-PACIFIC MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 ASIA-PACIFIC MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 86 ASIA-PACIFIC ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 87 ASIA-PACIFIC OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 ASIA-PACIFIC CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 ASIA-PACIFIC TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 ASIA-PACIFIC METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 92 CHINA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 CHINA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 95 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 96 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 97 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 98 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 CHINA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 100 CHINA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 101 CHINA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 102 CHINA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 103 CHINA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 104 CHINA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 105 CHINA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 106 CHINA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 107 CHINA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 CHINA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 109 CHINA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 CHINA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 CHINA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 112 CHINA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 113 CHINA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 114 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 115 JAPAN LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 JAPAN OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 118 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 119 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 120 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 121 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 JAPAN HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 123 JAPAN MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 124 JAPAN INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 125 JAPAN MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 126 JAPAN KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 127 JAPAN GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 128 JAPAN IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 129 JAPAN RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 130 JAPAN MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 131 JAPAN MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 JAPAN ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 133 JAPAN OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 134 JAPAN CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 JAPAN TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 136 JAPAN METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 138 SOUTH KOREA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 SOUTH KOREA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 141 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 142 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 143 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 144 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 SOUTH KOREA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 146 SOUTH KOREA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 147 SOUTH KOREA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 148 SOUTH KOREA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 149 SOUTH KOREA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 150 SOUTH KOREA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 151 SOUTH KOREA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 152 SOUTH KOREA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 153 SOUTH KOREA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 154 SOUTH KOREA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 SOUTH KOREA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 156 SOUTH KOREA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 157 SOUTH KOREA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 SOUTH KOREA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 159 SOUTH KOREA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 160 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 INDIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 INDIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 164 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 165 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 166 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 167 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 168 INDIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 169 INDIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 170 INDIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 171 INDIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 172 INDIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 173 INDIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 174 INDIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 175 INDIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 176 INDIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 177 INDIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 178 INDIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 179 INDIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 180 INDIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 181 INDIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 182 INDIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 183 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 184 SINGAPORE LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 SINGAPORE OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 187 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 188 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 189 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 190 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 191 SINGAPORE HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 192 SINGAPORE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 193 SINGAPORE INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 194 SINGAPORE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 195 SINGAPORE KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 196 SINGAPORE GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 197 SINGAPORE IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 198 SINGAPORE RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 199 SINGAPORE MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 200 SINGAPORE MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 201 SINGAPORE ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 202 SINGAPORE OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 203 SINGAPORE CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 204 SINGAPORE TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 205 SINGAPORE METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 206 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 207 AUSTRALIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 208 AUSTRALIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 209 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 210 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 211 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 212 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 213 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 214 AUSTRALIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 215 AUSTRALIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 216 AUSTRALIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 217 AUSTRALIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 218 AUSTRALIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 219 AUSTRALIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 220 AUSTRALIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 221 AUSTRALIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 222 AUSTRALIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 223 AUSTRALIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 224 AUSTRALIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 225 AUSTRALIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 226 AUSTRALIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 227 AUSTRALIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 228 AUSTRALIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 229 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 230 MALAYSIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 231 MALAYSIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 232 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 233 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 234 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 235 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 236 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 237 MALAYSIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 238 MALAYSIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 239 MALAYSIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 240 MALAYSIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 241 MALAYSIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 242 MALAYSIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 243 MALAYSIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 244 MALAYSIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 245 MALAYSIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 246 MALAYSIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 247 MALAYSIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 248 MALAYSIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 249 MALAYSIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 250 MALAYSIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 251 MALAYSIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 252 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 253 THAILAND LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 254 THAILAND OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 255 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 256 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 257 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 258 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 259 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 260 THAILAND HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 261 THAILAND MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 262 THAILAND INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 263 THAILAND MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 264 THAILAND KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 265 THAILAND GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 266 THAILAND IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 267 THAILAND RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 268 THAILAND MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 269 THAILAND MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 270 THAILAND ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 271 THAILAND OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 272 THAILAND CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 273 THAILAND TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 274 THAILAND METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 275 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 276 INDONESIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 277 INDONESIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 278 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 279 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 280 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 281 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 282 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 283 INDONESIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 284 INDONESIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 285 INDONESIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 286 INDONESIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 287 INDONESIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 288 INDONESIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 289 INDONESIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 290 INDONESIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 291 INDONESIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 292 INDONESIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 293 INDONESIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 294 INDONESIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 295 INDONESIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 296 INDONESIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 297 INDONESIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 298 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 299 PHILLIPPINES LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 300 PHILLIPPINES OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 301 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 302 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 303 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 304 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 305 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 306 PHILLIPPINES HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 307 PHILLIPPINES MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 308 PHILLIPPINES INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 309 PHILLIPPINES MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 310 PHILLIPPINES KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 311 PHILLIPPINES GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 312 PHILLIPPINES IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 313 PHILLIPPINES RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 314 PHILLIPPINES MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 315 PHILLIPPINES MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 316 PHILLIPPINES ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 317 PHILLIPPINES OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 318 PHILLIPPINES CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 319 PHILLIPPINES TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 320 PHILLIPPINES METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 321 REST OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 10 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE TH ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 LCD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET

FIGURE 13 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 14 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY DISPLAY SIZE, 2020

FIGURE 15 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY RESOLUTION, 2020

FIGURE 16 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY MOUNTING, 2020

FIGURE 17 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TOUCH SCREEN TYPE, 2020

FIGURE 18 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 19 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 20 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 21 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 22 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 23 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 24 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY (2019-2028)

FIGURE 25 ASIA-PACIFIC RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.