Mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia y el Pacífico, por grado (grado de alto valor K, grado de valor K medio, grado de bajo valor K, grado de copolímero de suspensión y grado de mezcla de suspensión), proceso de fabricación (proceso de microsuspensión y proceso de emulsión), aplicación (cuero artificial, papeles pintados, tintas plastisol, guantes de mano, flores artificiales, bolas transparentes y otros), uso final (construcción, automoción, bienes de consumo, electricidad y electrónica, embalaje, atención médica y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de resina de pasta de cloruro de polivinilo (PVC) en Asia y el Pacífico

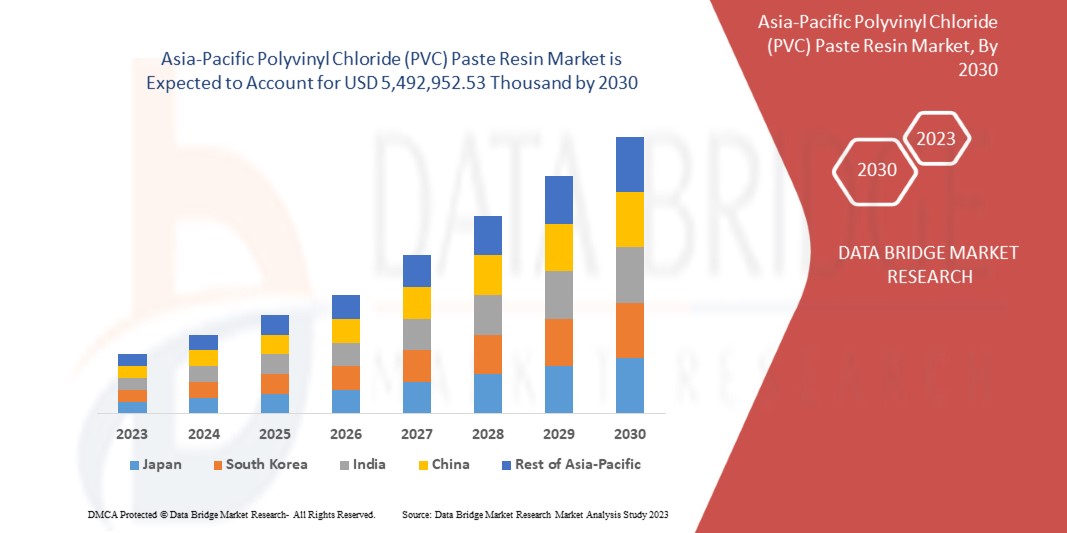

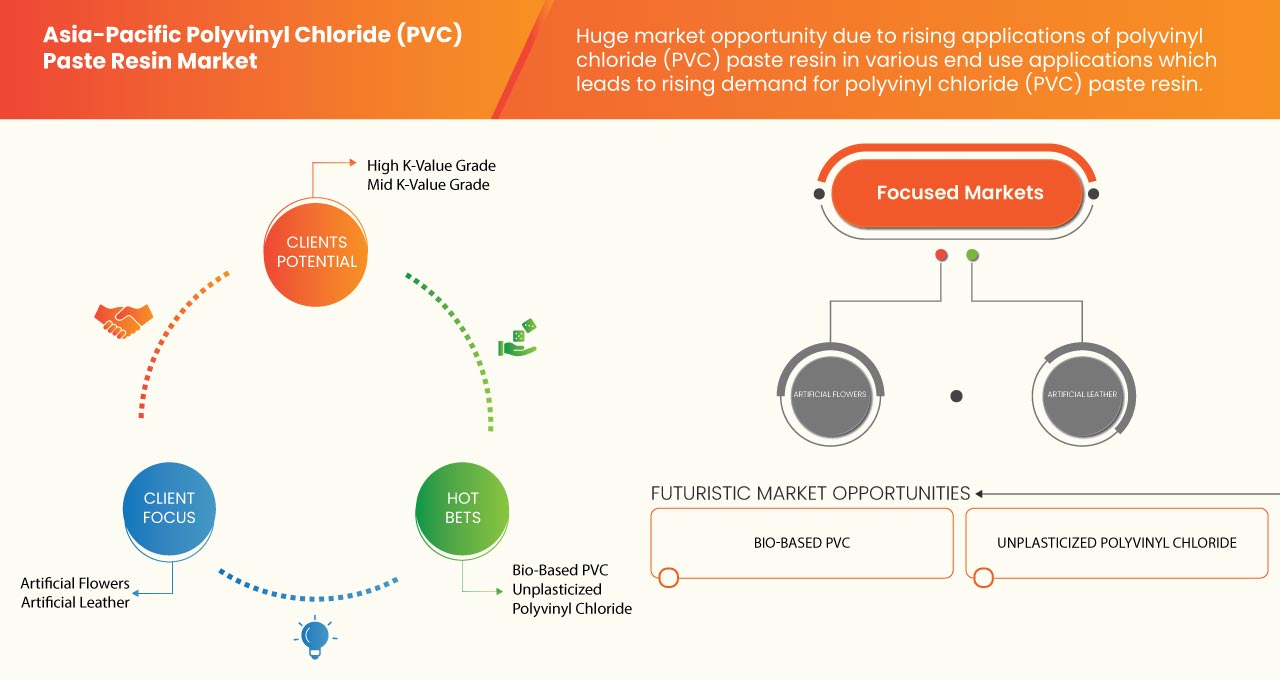

Se espera que el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico crezca significativamente entre 2023 y 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 3,8% entre 2023 y 2030 y se espera que alcance los USD 5.492.952,53 mil para 2030. El aumento de la demanda de materiales de construcción a base de PVC en Asia-Pacífico es el factor clave que impulsa la expansión del mercado de resina en pasta de cloruro de polivinilo (PVC).

El sector de la construcción está siendo testigo de un aumento en la inversión en infraestructura por parte del gobierno, las empresas de construcción y los constructores privados para satisfacer la creciente demanda de propiedades residenciales y comerciales. La demanda de alternativas de bajo costo y bajo peso para reemplazar materiales convencionales como el metal y la madera está aumentando, lo que deja espacio para los materiales a base de PVC, como revestimientos de vinilo, perfiles de ventanas, tarjetas de banda magnética, tuberías y plomería, así como accesorios para conductos. Por lo tanto, los materiales de construcción a base de PVC están ganando importancia en el sector de la construcción. Además, la resina de pasta de PVC puede soportar la humedad y tiene una buena resistencia a la tracción, lo que los convierte en una opción preferida para la fabricación de guantes industriales.

El informe del mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia y el Pacífico proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Contáctenos para obtener un informe de analista para comprender el análisis y el escenario del mercado. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por grado (grado de alto valor K, grado de valor K medio, grado de bajo valor K, grado de copolímero en suspensión y grado de mezcla en suspensión), proceso de fabricación (proceso de microsuspensión y proceso de emulsión), aplicación (cuero artificial, papeles tapiz, tintas de plastisol, guantes de mano, flores artificiales, pelotas transparentes y otros), uso final (construcción, automoción, bienes de consumo, electricidad y electrónica, embalaje, atención médica y otros) |

|

Países cubiertos |

Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

Formosa Plastics Corporation, EE. UU., KANEKA CORPORATION, Orbia, INEOS, Shin-Etsu Chemical Co., Ltd., PT. Standard Toyo Polymer (una subsidiaria de TOSOH CORPORATION), LG Chem, Solvay, Westlake Vinnolit GmbH & Co. KG, Occidental Petroleum Corporation, Braskem, KEM ONE, SCG Chemicals Public Company Limited, CIRES, Lda, Chemplast Sanmar Ltd, Redox, CHEMDO, Gogara International, THE CHEMICAL COMPANY y SHANGHAI KEAN TECHNOLOGY CO., LTD., entre otras. |

Definición de mercado

La resina de pasta de PVC de cloruro de polivinilo es un tipo de resina que se utiliza para producir caucho y plástico. La resina de pasta de PVC se fabrica mediante emulsión y microsuspensión y se utiliza ampliamente en procesos como inmersión, rotoconformado, revestimiento y espumado. También se utiliza como materia prima principal para cuero artificial, papel tapiz, guantes de examen de látex de PVC desechables y lonas, entre otros.

Dinámica del mercado de resina en pasta de cloruro de polivinilo (PVC) en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductor

- Crecientes aplicaciones de la pasta de PVC en la industria de la construcción y la salud

El sector de la construcción está siendo testigo de un aumento en la inversión en infraestructura por parte del gobierno, las empresas de construcción y los constructores privados para satisfacer la creciente demanda de propiedades residenciales y comerciales. La demanda de alternativas de bajo costo y bajo peso para reemplazar materiales convencionales como el metal y la madera está aumentando, lo que deja espacio para los materiales a base de PVC, como revestimientos de vinilo, perfiles de ventanas, tarjetas de banda magnética, tuberías y plomería, así como accesorios de conductos. Por lo tanto, los materiales de construcción a base de PVC están ganando importancia en el sector de la construcción.

Además, se espera que el rápido cambio hacia la modernización de los hogares mediante el uso de diversas opciones de pisos impulse pronto el crecimiento del mercado. En la industria de la construcción, las resinas de PVC también se utilizan para fabricar bienes de consumo y materiales para el hogar, como tuberías y accesorios, aislamiento de cables, puertas y resortes, muebles de oficina y muchos más. La resina de pasta de PVC se utiliza para recubrimiento, inmersión, espumado, recubrimiento por pulverización y conformado rotacional.

Por lo tanto, con un aumento en la producción de construcción y las actividades de inversión en todo el mundo, la demanda y la producción de resinas de PVC están creciendo, lo que, a su vez, se anticipa que impulsará el alcance de crecimiento del mercado de resina en pasta de cloruro de polivinilo (PVC) en el período de pronóstico.

Oportunidad

- El floreciente crecimiento de la industria eléctrica y electrónica

La resina de cloruro de polivinilo (PVC) se utiliza ampliamente en el sector eléctrico y electrónico para su aplicación en cables , computadoras, iluminación y otros, debido a su excelente aislamiento y durabilidad. Con la constante investigación y desarrollo en el sector, la innovación allana el camino hacia productos mejorados y de mayor calidad. El mercado eléctrico y electrónico se expande constantemente a medida que los productos tradicionales dan paso a productos inteligentes.

Además, varios gobiernos están realizando esfuerzos continuos para impulsar la industria electrónica india y están atrayendo a actores extranjeros y locales para invertir en el sector electrónico del país.

Restricción/Desafío

- Prohibición de ftalatos

Varios países han prohibido los ftalatos debido a su toxicidad, lo que se prevé que obstruya el crecimiento del comercio en el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia y el Pacífico. Los ftalatos se utilizan principalmente como plastificantes, sustancias que se añaden a los plásticos para aumentar su flexibilidad, transparencia, durabilidad y longevidad. Se utilizan principalmente para ablandar el cloruro de polivinilo (PVC).

Los ftalatos se consideraban inicialmente inofensivos porque no tienen efectos tóxicos agudos. Sin embargo, las evaluaciones de riesgo realizadas en la UE han demostrado que algunos ftalatos deben clasificarse como tóxicos para la reproducción. De los ftalatos más utilizados, los cuatro ftalatos DEHP, DBP, DIBP y BBP están clasificados en la UE como tóxicos para la reproducción. El consumo de estos ftalatos ha disminuido desde que se clasificaron.

Por lo tanto, se espera que el aumento de casos de daños causados por ftalatos y su prohibición representen un desafío para el crecimiento del mercado de resina de pasta de cloruro de polivinilo (PVC) en Asia y el Pacífico.

Acontecimientos recientes

- En febrero de 2023, INEOS adquirió una parte de los activos de petróleo y gas de Chesapeake Energy en el yacimiento de esquisto de Eagle Ford, en el sur de Texas (EE. UU.), por 1400 millones de dólares. La incorporación de los activos y operaciones de Chesapeake en el sur de Texas forma parte de la estrategia de INEOS de crear una cartera integrada en Asia-Pacífico adecuada para la transición energética, ofreciendo soluciones energéticas de alta calidad a sus clientes.

- En septiembre de 2022, Orbia fue incluida en el índice DJSI MILA Pacific Alliance, con un aumento interanual de su puntuación del 6 %. Orbia recibió una puntuación de 68, lo que supone un aumento del 6 % con respecto a 2021 y refleja el progreso de la empresa en las dimensiones económica, de gobernanza, medioambiental y social.

Alcance del mercado de resina en pasta de cloruro de polivinilo (PVC) en Asia y el Pacífico

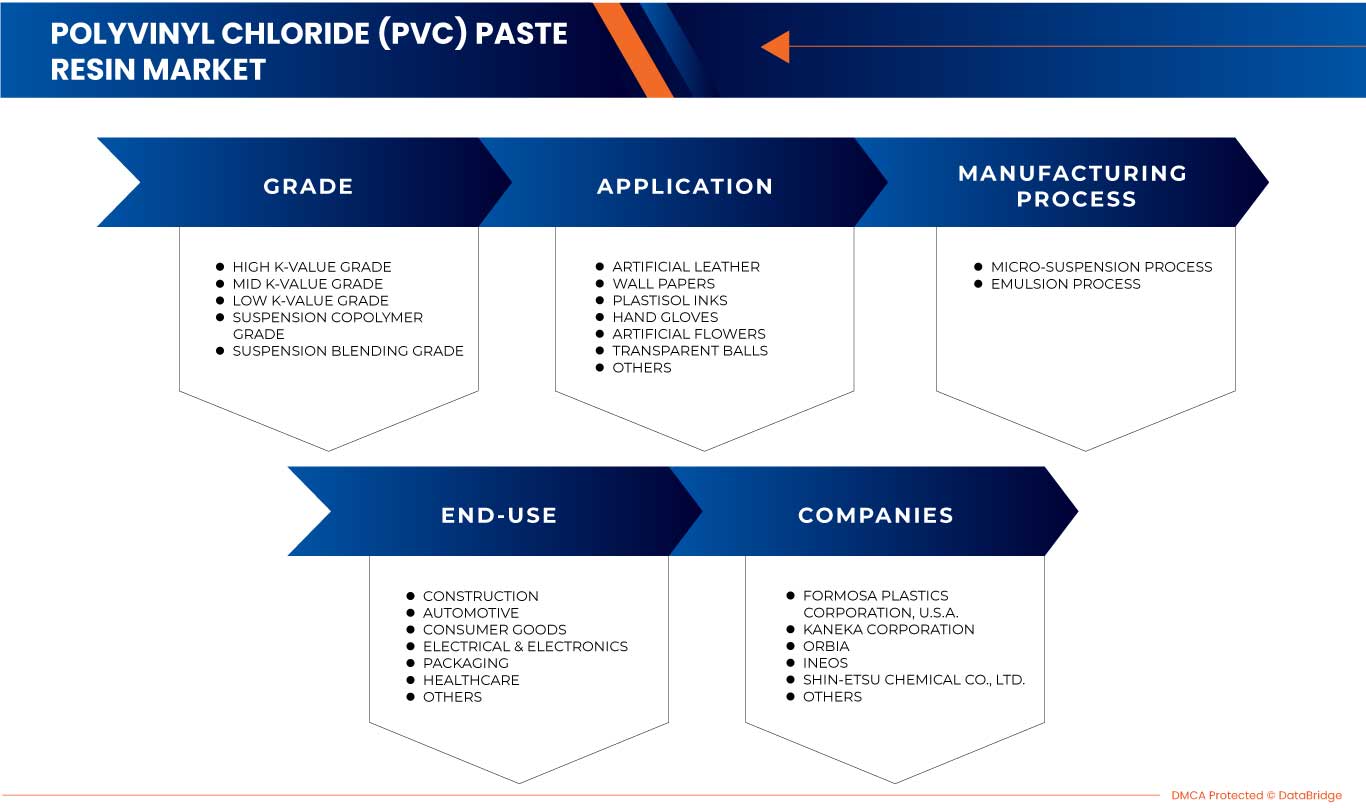

El mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico se divide en cuatro segmentos importantes: grado, proceso de fabricación, aplicación y uso final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento de la industria y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por grado

- Calificación de alto valor K

- Calificación de valor K medio

- Calificación de valor K bajo

- Copolímero de suspensión de grado

- Grado de mezcla de suspensión

Sobre la base del grado, el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico se clasifica en cinco segmentos, a saber, grado de valor k alto, grado de valor k medio, grado de valor k bajo, grado de copolímero de suspensión y grado de mezcla de suspensión.

Por proceso de fabricación

- Proceso de microsuspensión

- Proceso de emulsión

Sobre la base del proceso de fabricación, el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico se clasifica en dos segmentos, a saber, el proceso de microsuspensión y el proceso de emulsión.

Por aplicación

- Cuero artificial

- Papeles pintados

- Tintas plastisol

- Guantes de mano

- Flores artificiales

- Bolas transparentes

- Otros

Sobre la base de la aplicación, el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico se clasifica en siete segmentos: cuero artificial, papeles pintados, tintas plastisol, guantes de mano, flores artificiales, bolas transparentes y otros.

Por uso final

- Construcción

- Automotor

- Bienes de consumo

- Electricidad y electrónica

- Embalaje

- Cuidado de la salud

- Otros

Sobre la base del uso final, el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico se clasifica en siete segmentos: construcción, automotriz, bienes de consumo, electricidad y electrónica, embalaje, atención médica y otros.

Análisis y perspectivas regionales del mercado de resina de pasta de cloruro de polivinilo (PVC) en Asia y el Pacífico

El mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico está segmentado en cuatro segmentos notables que son grado, proceso de fabricación, aplicación y uso final.

Los países cubiertos en este informe son Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, y el resto de Asia-Pacífico.

Se espera que China domine el mercado de resina en pasta de cloruro de polivinilo (PVC) en Asia-Pacífico. China domina en la región de Asia-Pacífico debido al creciente uso de resina en pasta de cloruro de polivinilo (PVC), y las crecientes aplicaciones de la pasta de PVC en la industria de la construcción y la atención médica están impulsando la demanda de productos de resina en pasta de cloruro de polivinilo (PVC).

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de Asia-Pacífico y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de resina en pasta de cloruro de polivinilo (PVC) en Asia y el Pacífico

El panorama competitivo del mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con las empresas que se centran en el mercado de resina en pasta de cloruro de polivinilo (PVC) de Asia-Pacífico.

Algunos de los participantes destacados que operan en el mercado de resina de pasta de cloruro de polivinilo (PVC) de Asia-Pacífico son Formosa Plastics Corporation, EE. UU., KANEKA CORPORATION, Orbia, INEOS, Shin-Etsu Chemical Co., Ltd., PT. Standard Toyo Polymer (una subsidiaria de TOSOH CORPORATION), LG Chem, Solvay, Westlake Vinnolit GmbH & Co. KG, Occidental Petroleum Corporation, Braskem, KEM ONE, SCG Chemicals Public Company Limited, CIRES, Lda, Chemplast Sanmar Ltd, Redox, CHEMDO, Gogara International, THE CHEMICAL COMPANY y SHANGHAI KEAN TECHNOLOGY CO., LTD., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATIONS OF PVC PASTE IN THE CONSTRUCTION AND HEALTHCARE INDUSTRY

5.1.2 SHIFTING FOCUS ON THE PRODUCTION OF SYNTHETIC LEATHER AND INDUSTRIAL GLOVES

5.1.3 EXTENSIVE PROPERTIES OFFERED BY POLYVINYL CHLORIDE (PVC) PASTE RESIN

5.2 RESTRAINTS

5.2.1 LESS CONSUMER KNOWLEDGE RELATED TO PVC PASTE RESIN

5.2.2 AVAILABILITY OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 RAPID GROWTH OF THE AUTOMOTIVE INDUSTRY

5.3.2 FLOURISHING GROWTH OF THE ELECTRICAL & ELECTRONICS INDUSTRY

5.4 CHALLENGES

5.4.1 BAN ON PHTHALATES

5.4.2 HARMFUL IMPACTS OF POLYVINYL CHLORIDE (PVC) RESIN ON THE ENVIRONMENT

6 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE

6.1 OVERVIEW

6.2 HIGH K-VALUE GRADE

6.3 MID K-VALUE GRADE

6.4 LOW K-VALUE GRADE

6.5 SUSPENSION COPOLYMER GRADE

6.6 SUSPENSION BLENDING GRADE

7 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 MICRO-SUSPENSION PROCESS

7.3 EMULSION PROCESS

8 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ARTIFICIAL LEATHER

8.3 WALL PAPERS

8.4 PLASTISOL INKS

8.5 HAND GLOVES

8.6 ARTIFICIAL FLOWERS

8.7 TRANSPARENT BALLS

8.8 OTHERS

9 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE

9.1 OVERVIEW

9.2 CONSTRUCTION

9.2.1 CONSTRUCTION, BY GRADE

9.2.1.1 HIGH K-VALUE GRADE

9.2.1.2 MID K-VALUE GRADE

9.2.1.3 LOW K-VALUE GRADE

9.2.1.4 SUSPENSION COPOLYMER GRADE

9.2.1.5 SUSPENSION BLENDING GRADE

9.3 AUTOMOTIVE

9.3.1 AUTOMOTIVE, BY GRADE

9.3.1.1 HIGH K-VALUE GRADE

9.3.1.2 MID K-VALUE GRADE

9.3.1.3 LOW K-VALUE GRADE

9.3.1.4 SUSPENSION COPOLYMER GRADE

9.3.1.5 SUSPENSION BLENDING GRADE

9.4 CONSUMER GOODS

9.4.1 CONSUMER GOODS, BY GRADE

9.4.1.1 HIGH K-VALUE GRADE

9.4.1.2 MID K-VALUE GRADE

9.4.1.3 LOW K-VALUE GRADE

9.4.1.4 SUSPENSION COPOLYMER GRADE

9.4.1.5 SUSPENSION BLENDING GRADE

9.5 ELECTRICAL & ELECTRONICS

9.5.1 ELECTRICAL & ELECTRONICS, BY GRADE

9.5.1.1 HIGH K-VALUE GRADE

9.5.1.2 MID K-VALUE GRADE

9.5.1.3 LOW K-VALUE GRADE

9.5.1.4 SUSPENSION COPOLYMER GRADE

9.5.1.5 SUSPENSION BLENDING GRADE

9.6 PACKAGING

9.6.1 PACKAGING, BY GRADE

9.6.1.1 HIGH K-VALUE GRADE

9.6.1.2 MID K-VALUE GRADE

9.6.1.3 LOW K-VALUE GRADE

9.6.1.4 SUSPENSION COPOLYMER GRADE

9.6.1.5 SUSPENSION BLENDING GRADE

9.7 HEALTHCARE

9.7.1 HEALTHCARE, BY GRADE

9.7.1.1 HIGH K-VALUE GRADE

9.7.1.2 MID K-VALUE GRADE

9.7.1.3 LOW K-VALUE GRADE

9.7.1.4 SUSPENSION COPOLYMER GRADE

9.7.1.5 SUSPENSION BLENDING GRADE

9.8 OTHERS

9.8.1 OTHERS, BY GRADE

9.8.1.1 HIGH K-VALUE GRADE

9.8.1.2 MID K-VALUE GRADE

9.8.1.3 LOW K-VALUE GRADE

9.8.1.4 SUSPENSION COPOLYMER GRADE

9.8.1.5 SUSPENSION BLENDING GRADE

10 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA & NEW ZEALAND

10.1.6 SINGAPORE

10.1.7 INDONESIA

10.1.8 THAILAND

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA PACIFIC

11 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 BUSINESS ACQUISITION & EXPANSION

11.3 RECOGNITION & PRODUCT LAUNCH

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 FORMOSA PLASTICS CORPORATION, U.S.A.

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 KANEKA CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 ORBIA

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 INEOS

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 SHIN-ETSU CHEMICALS., LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BRASKEM

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CHEMDO

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CHEMPLAST SANMAR LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 CIRES, LDA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GOGARA INTERNATIONAL

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KEM ONE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 LG CHEM

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 OCCIDENTAL PETROLEUM CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PT. STANDARD TOYO POLYMER

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 REDOX

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SCG CHEMICALS PUBLIC COMPANY LIMITED

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SHANGHAI KEAN TECHNOLOGY CO., LTD

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SOLVAY

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 THE CHEMICAL COMPANY

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 WESTLAKE VINNOLIT GMBH & CO. KG

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXY ACIDS, AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS, AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 3 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 5 ASIA PACIFIC HIGH K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC HIGH K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 ASIA PACIFIC MID K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC MID K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 ASIA PACIFIC LOW K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC LOW K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 ASIA PACIFIC SUSPENSION COPOLYMER GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC SUSPENSION COPOLYMER GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 ASIA PACIFIC SUSPENSION BLENDING GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC SUSPENSION BLENDING GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 15 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC MICRO-SUSPENSION PROCESS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC EMULSION PROCESS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC ARTIFICIAL LEATHER IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC WALL PAPERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA PACIFIC PLASTISOL INKS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC HAND GLOVES IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA PACIFIC ARTIFICIAL FLOWERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA PACIFIC TRANSPARENT BALLS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 ASIA PACIFIC OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA PACIFIC CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA PACIFIC CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 29 ASIA PACIFIC AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 ASIA PACIFIC AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 31 ASIA PACIFIC CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 ASIA PACIFIC CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 33 ASIA PACIFIC ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 ASIA PACIFIC ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 35 ASIA PACIFIC PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 ASIA PACIFIC PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 37 ASIA PACIFIC HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 ASIA PACIFIC HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 39 ASIA PACIFIC OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 ASIA PACIFIC OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 43 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 45 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 55 CHINA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 56 CHINA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 57 CHINA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 58 CHINA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 CHINA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 60 CHINA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 61 CHINA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 62 CHINA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 63 CHINA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 64 CHINA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 65 CHINA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 66 CHINA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 67 INDIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 68 INDIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 69 INDIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 70 INDIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 71 INDIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 72 INDIA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 73 INDIA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 74 INDIA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 75 INDIA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 76 INDIA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 77 INDIA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 78 INDIA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 79 JAPAN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 80 JAPAN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 81 JAPAN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 82 JAPAN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 83 JAPAN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 84 JAPAN CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 85 JAPAN AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 86 JAPAN CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 87 JAPAN ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 88 JAPAN PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 89 JAPAN HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 90 JAPAN OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH KOREA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 92 SOUTH KOREA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 93 SOUTH KOREA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 94 SOUTH KOREA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 95 SOUTH KOREA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 96 SOUTH KOREA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 97 SOUTH KOREA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 98 SOUTH KOREA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 99 SOUTH KOREA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 100 SOUTH KOREA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 101 SOUTH KOREA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 102 SOUTH KOREA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 103 AUSTRALIA & NEW ZEALAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 104 AUSTRALIA & NEW ZEALAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 105 AUSTRALIA & NEW ZEALAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 106 AUSTRALIA & NEW ZEALAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 107 AUSTRALIA & NEW ZEALAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 108 AUSTRALIA & NEW ZEALAND CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 110 AUSTRALIA & NEW ZEALAND CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 112 AUSTRALIA & NEW ZEALAND PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 113 AUSTRALIA & NEW ZEALAND HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 114 AUSTRALIA & NEW ZEALAND OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 115 SINGAPORE POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 116 SINGAPORE POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 117 SINGAPORE POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 118 SINGAPORE POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 119 SINGAPORE POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 120 SINGAPORE CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 121 SINGAPORE AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 122 SINGAPORE CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 123 SINGAPORE ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 124 SINGAPORE PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 125 SINGAPORE HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 126 SINGAPORE OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 127 INDONESIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 128 INDONESIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 129 INDONESIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 130 INDONESIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 131 INDONESIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 132 INDONESIA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 133 INDONESIA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 134 INDONESIA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 135 INDONESIA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 136 INDONESIA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 137 INDONESIA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 138 INDONESIA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 139 THAILAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 140 THAILAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 141 THAILAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 142 THAILAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 143 THAILAND POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 144 THAILAND CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 145 THAILAND AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 146 THAILAND CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 147 THAILAND ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 148 THAILAND PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 149 THAILAND HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 150 THAILAND OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 151 MALAYSIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 152 MALAYSIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 153 MALAYSIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 154 MALAYSIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 155 MALAYSIA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 156 MALAYSIA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 157 MALAYSIA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 158 MALAYSIA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 159 MALAYSIA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 160 MALAYSIA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 161 MALAYSIA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 162 MALAYSIA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 163 PHILIPPINES POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 164 PHILIPPINES POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 165 PHILIPPINES POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 166 PHILIPPINES POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 167 PHILIPPINES POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 168 PHILIPPINES CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 169 PHILIPPINES AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 170 PHILIPPINES CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 171 PHILIPPINES ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 172 PHILIPPINES PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 173 PHILIPPINES HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 174 PHILIPPINES OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 175 REST OF ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 176 REST OF ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

Lista de figuras

FIGURE 1 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET

FIGURE 2 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC HANGERS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: SEGMENTATION

FIGURE 14 GROWING APPLICATIONS OF PVC PASTE IN THE CONSTRUCTION AND HEALTHCARE INDUSTRY ARE EXPECTED TO DRIVE THE ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET IN THE FORECAST PERIOD

FIGURE 15 THE HIGH K-VALUE GRADE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET

FIGURE 17 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2022

FIGURE 18 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2022

FIGURE 19 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2022

FIGURE 20 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2022

FIGURE 21 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: SNAPSHOT (2022)

FIGURE 22 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY COUNTRY (2022)

FIGURE 23 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 ASIA-PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY GRADE (2023-2030)

FIGURE 26 ASIA PACIFIC POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.