Asia Pacific Photo Printing And Merchandise Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.13 Billion

USD

8.30 Billion

2025

2033

USD

5.13 Billion

USD

8.30 Billion

2025

2033

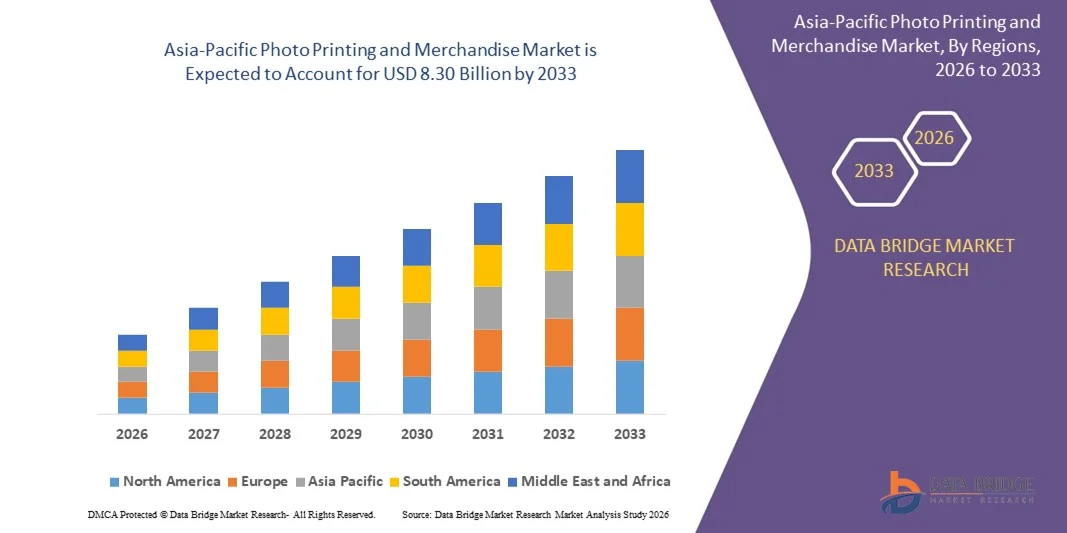

| 2026 –2033 | |

| USD 5.13 Billion | |

| USD 8.30 Billion | |

|

|

|

|

Segmentación del mercado de impresión fotográfica y artículos promocionales en Asia-Pacífico, por producto (calendarios, tarjetas, tazas, álbumes de fotos, regalos fotográficos, impresiones, camisetas, decoración mural, etc.), tipo de impresión (impresión digital, impresión en película y offset), dispositivo (de escritorio y móvil), canal de distribución (quiosco instantáneo, tiendas en línea, tiendas minoristas, etc.): tendencias del sector y pronóstico hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de impresión de fotografías y mercancías en Asia-Pacífico?

- El tamaño del mercado de impresión y mercadería fotográfica de Asia-Pacífico se valoró en USD 5.13 mil millones en 2025 y se espera que alcance los USD 8.30 mil millones para 2033 , con una CAGR del 6,20% durante el período de pronóstico.

- El creciente uso de dispositivos móviles para imágenes de alta resolución y la creciente demanda de impresiones e imágenes 3D son un factor clave para el crecimiento del mercado. Además, el creciente desarrollo de la tecnología de captura de fotografías está impulsando el crecimiento del mercado.

¿Cuáles son las principales conclusiones del mercado de impresión fotográfica y mercancías?

- La integración de la inteligencia artificial con la tecnología de impresión digital está creando una nueva ventana de oportunidad para el mercado. Sin embargo, la sustitución de los calendarios de papel por agendas digitales supone un importante reto para el crecimiento del mercado.

- China dominó el mercado mundial de impresión y comercialización de fotografías con una participación estimada en los ingresos del 44,6 % en 2025, impulsada por la rápida adopción digital, la alta penetración de los teléfonos inteligentes y la fuerte demanda de productos fotográficos personalizados en China, Japón, India, Corea del Sur y el sudeste asiático.

- Se espera que India registre la CAGR más rápida del 9,4% entre 2026 y 2033, impulsada por la rápida adopción de teléfonos inteligentes, la creciente penetración de Internet y la creciente demanda de regalos personalizados asequibles.

- El segmento de álbumes de fotos dominó el mercado con una participación estimada del 34,6 % en 2025, impulsado por una fuerte demanda de recuerdos personalizados de primera calidad utilizados para recuerdos, bodas, álbumes de viajes y portafolios de fotografía profesional.

Alcance del informe y segmentación del mercado de impresión de fotografías y mercancías

|

Atributos |

Perspectivas clave del mercado de impresión fotográfica y mercancía |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de impresión fotográfica y mercancías?

Aumento de la demanda de productos e impresiones fotográficas personalizadas, de primera calidad y a pedido

- El mercado de impresión fotográfica y de productos está siendo testigo de una fuerte adopción de productos de alta resolución, personalizados e impresos digitalmente, incluidos álbumes de fotos, decoración de paredes, calendarios, prendas de vestir y regalos personalizados.

- Los fabricantes están ampliando sus carteras con productos específicos para cada aplicación, como impresiones fotográficas duraderas, acabados de papel de primera calidad, envoltorios de lona y productos funcionales de estilo de vida diseñados para regalar y decorar.

- La creciente demanda de personalización, valor emocional y narración visual está impulsando su adopción entre consumidores individuales, fotógrafos profesionales y segmentos de obsequios corporativos.

- Por ejemplo, empresas como WhiteWall, Kodak Alaris, Cimpress, District Photo y Walmart están invirtiendo en tecnologías avanzadas de impresión digital, automatización y plataformas de personalización masiva.

- El creciente enfoque en tiempos de respuesta rápidos, servicios de impresión bajo demanda y experiencias de pedidos omnicanal está acelerando la demanda de productos fotográficos de primera calidad.

- A medida que los consumidores valoran cada vez más las experiencias personalizadas y los productos visuales de alta calidad, la impresión de fotografías y la comercialización seguirán siendo esenciales en los casos de uso personal, profesional y comercial.

¿Cuáles son los impulsores clave del mercado de impresión fotográfica y mercancías?

- Creciente demanda de regalos personalizados, decoración del hogar y productos de estilo de vida personalizados en los mercados de consumo globales.

- Por ejemplo, durante 2024-2025, actores líderes como Cimpress, WhiteWall, Kodak Alaris y Hallmark ampliaron las capacidades de impresión digital e introdujeron nuevas ofertas de productos personalizados.

- El rápido crecimiento de las plataformas de comercio electrónico, el uso de fotografías desde dispositivos móviles y la creación de contenido en redes sociales en Estados Unidos, Europa y Asia-Pacífico está impulsando la demanda de servicios de impresión de fotografías.

- Los avances en la impresión de inyección de tinta, la gestión del color, la mejora de imágenes basada en IA y el cumplimiento automatizado han mejorado la calidad de impresión, la velocidad y la rentabilidad.

- La creciente adopción de productos fotográficos en marcas corporativas, campañas promocionales y obsequios para eventos respalda aún más la expansión del mercado.

- Con el respaldo del aumento de los ingresos disponibles, la adopción de la fotografía digital y la preferencia de los consumidores por productos personalizados, se espera que el mercado de impresión y comercialización de fotografías sea testigo de un crecimiento constante a largo plazo.

¿Qué factor está obstaculizando el crecimiento del mercado de impresión fotográfica y mercancías?

- Los altos costos operativos asociados con equipos de impresión premium, tintas especiales, sustratos y logística pueden afectar la rentabilidad.

- Por ejemplo, durante 2024-2025, las fluctuaciones en los precios del papel, los costos de la energía y las interrupciones en la cadena de suministro afectaron los plazos de producción de varios proveedores de servicios globales.

- La intensa competencia de las plataformas de impresión en línea de bajo costo y las imprentas locales crea presión sobre los precios y restricciones de márgenes.

- La limitada conciencia de los consumidores en ciertas regiones con respecto a la calidad de impresión premium, los materiales de archivo y la durabilidad a largo plazo frena la adopción basada en el valor.

- La creciente tendencia hacia el almacenamiento y uso compartido de fotografías exclusivamente digitales reduce los volúmenes de impresión en algunos segmentos de consumidores

- Para abordar estos desafíos, las empresas se están centrando en la automatización, los materiales sostenibles, los servicios de valor agregado, los modelos de entrega más rápidos y las experiencias de usuario digitales mejoradas para fortalecer la adopción global de la impresión de fotografías y mercancías.

¿Cómo está segmentado el mercado de impresión fotográfica y mercancías?

El mercado está segmentado según el producto, el modelo de tipo de impresión, el dispositivo y el canal de distribución .

- Por producto

Según el producto, el mercado de impresión fotográfica y artículos promocionales se segmenta en calendarios, tarjetas, tazas, álbumes de fotos, regalos con foto, impresiones, camisetas, decoración mural y otros. El segmento de álbumes de fotos dominó el mercado con una participación estimada del 34,6 % en 2025, impulsado por la fuerte demanda de recuerdos personalizados de alta calidad para bodas, álbumes de viajes y portafolios de fotografía profesional. El alto valor emocional, las opciones de personalización y la mejor calidad de impresión han incrementado la preferencia de los consumidores por los álbumes de fotos tanto en plataformas online como físicas.

Se prevé que el segmento de regalos fotográficos experimente su mayor crecimiento anual compuesto (CAGR) entre 2026 y 2033, impulsado por la creciente demanda de soluciones de regalo personalizadas en festivales, eventos corporativos y ocasiones especiales. La creciente disponibilidad de tazas, cojines, marcos y accesorios de estilo de vida personalizados, junto con la rápida respuesta y la accesibilidad al comercio electrónico, está acelerando su adopción a nivel mundial.

- Por modelo de tipo de impresión

Según el modelo de tipo de impresión, el mercado se segmenta en Impresión Digital e Impresión Offset y en Película. El segmento de Impresión Digital dominó el mercado con una participación del 58,2% en 2025, gracias a su flexibilidad, capacidad para tiradas cortas, plazos de entrega más rápidos y rentabilidad para la impresión personalizada y bajo demanda. La impresión digital permite la impresión de datos variables, resultados de alta resolución y una integración fluida con plataformas de pedidos en línea, lo que la convierte en la opción preferida para productos fotográficos personalizados.

Se proyecta que el segmento de Impresión Offset y Película crecerá a su CAGR más rápida entre 2026 y 2033, impulsado por la demanda de producción a gran escala, calidad de color consistente y rentabilidad en aplicaciones de impresión a gran escala. La impresión offset sigue siendo ampliamente utilizada para calendarios, tarjetas de felicitación y productos fotográficos estandarizados en entornos comerciales e institucionales.

- Por dispositivo

Según el dispositivo, el mercado de impresión fotográfica y productos se segmenta en plataformas de escritorio y móviles. El segmento móvil dominó el mercado con una participación del 61,4 % en 2025, gracias a la amplia adopción de teléfonos inteligentes, cámaras móviles de alta calidad y aplicaciones de impresión fotográfica intuitivas. Los consumidores prefieren cada vez más los dispositivos móviles para capturar, editar y solicitar productos fotográficos debido a su comodidad, accesibilidad y flujos de trabajo fluidos basados en aplicaciones.

Se prevé que el segmento de escritorio crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por el uso continuo entre fotógrafos profesionales, diseñadores y usuarios corporativos que requieren herramientas de edición avanzadas, pantallas más grandes y gestión de archivos de alta resolución. El crecimiento de la impresión fotográfica profesional y las aplicaciones empresariales impulsa aún más la adopción de plataformas de escritorio.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en tiendas en línea, tiendas minoristas, quioscos instantáneos y otros. El segmento de tiendas en línea dominó el mercado con una participación del 46,9 % en 2025, impulsado por la conveniencia, las amplias opciones de personalización de productos, los precios competitivos y la entrega a domicilio. Las plataformas en línea permiten a los consumidores subir imágenes, personalizar diseños y realizar pedidos con un mínimo esfuerzo, lo que impulsa una alta adopción en los mercados globales.

Se proyecta que el segmento de quioscos instantáneos crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la demanda de servicios de impresión fotográfica rápidos e inmediatos en centros comerciales, aeropuertos, destinos turísticos y recintos para eventos. Los avances en quioscos de autoservicio y la tecnología de impresión instantánea están acelerando aún más el crecimiento del segmento.

¿Qué región posee la mayor participación en el mercado de impresión fotográfica y mercancías?

- China dominó el mercado mundial de impresión y comercialización de fotografías con una participación estimada en los ingresos del 44,6 % en 2025, impulsada por la rápida adopción digital, la alta penetración de los teléfonos inteligentes y la fuerte demanda de productos fotográficos personalizados en China, Japón, India, Corea del Sur y el sudeste asiático.

- El creciente uso de las redes sociales, la fotografía digital y las plataformas de pedidos móviles ha incrementado significativamente la demanda de álbumes de fotos, arte mural, regalos personalizados y productos impresos en toda la región.

- La fuerte presencia de instalaciones de impresión a gran escala, la fabricación rentable y los ecosistemas de comercio electrónico en expansión fortalecen aún más el liderazgo de Asia-Pacífico en el mercado mundial de impresión fotográfica y mercancías.

Perspectiva del mercado de impresión fotográfica y mercancías en Japón

En Japón, el mercado experimenta un crecimiento constante, impulsado por una fuerte demanda de productos fotográficos de alta calidad, minimalistas y de alta calidad. Los consumidores valoran la calidad de impresión, la durabilidad y la artesanía, lo que impulsa la adopción de fotolibros, calendarios y arte mural. Las tecnologías de impresión avanzadas, los sistemas de gestión eficientes y la sólida integración con el comercio minorista impulsan la expansión a largo plazo del mercado.

Perspectiva del mercado de impresión fotográfica y mercancías en India

Se espera que India registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,4 %, entre 2026 y 2033, impulsada por la rápida adopción de teléfonos inteligentes, la creciente penetración de internet y la creciente demanda de regalos personalizados asequibles. La expansión de las plataformas de impresión fotográfica en línea, el creciente uso de las redes sociales y la mejora de la infraestructura logística siguen acelerando la adopción del mercado en las regiones urbanas y semiurbanas.

Perspectiva del mercado de impresión fotográfica y productos de Corea del Sur

En Corea del Sur, el mercado crece de forma constante gracias a la sólida cultura digital, la alta interacción de los consumidores con el contenido visual y la adopción avanzada del comercio móvil. La demanda de impresiones fotográficas personalizadas, productos temáticos y regalos premium se ve impulsada por la innovación en las tecnologías de impresión digital y la rapidez de entrega.

¿Cuáles son las principales empresas en el mercado de impresión fotográfica y mercancías?

La industria de la impresión fotográfica y de mercancías está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Walmart (EE. UU.)

- Kodak Alaris Inc. (Reino Unido)

- Cimpress (Irlanda)

- HALLMARK LICENSING, LLC (EE. UU.)

- WhiteWall (Alemania)

- District Photo, Inc. (EE. UU.)

- JONDO, Ltd. (Japón)

¿Cuáles son los desarrollos recientes en el mercado global de impresión de fotografías y mercancías?

- En mayo de 2025, Xiaomi, una empresa china líder en electrónica de consumo, anunció el lanzamiento global de su impresora fotográfica portátil Xiaomi 1S, con tecnología de impresión sin tinta (ZINK), una resolución de 313 x 512 ppp y un tamaño de impresión compacto de 2 x 3 pulgadas, fortaleciendo su presencia en el segmento de impresión fotográfica portátil y acelerando la adopción por parte de los consumidores de soluciones de impresión fotográfica instantánea.

- En noviembre de 2024, Sticker Mule, un destacado proveedor de impresión personalizada, lanzó Stores, una solución de servicio completo que permite a los influencers, creadores y marcas vender productos personalizados directamente a través del sitio web de la empresa, mientras que Sticker Mule gestiona el cumplimiento y el servicio al cliente, mejorando las oportunidades de monetización y simplificando la distribución de productos.

- En octubre de 2024, FastEditor, un proveedor líder de software de edición, presentó Logo Editor, una nueva herramienta alojada en los sitios web de los socios de impresión que permite a los clientes diseñar y visualizar logotipos en una gama completa de productos antes de imprimir, lo que mejora las capacidades de personalización y agiliza el proceso de pedido de impresión.

- En diciembre de 2022, American Greetings, en colaboración con Alicia Keys, lanzó las felicitaciones navideñas digitales personalizadas Creatacard™, diseñadas por la artista ganadora de 15 premios GRAMMY®, ampliando las ofertas de personalización digital premium y elevando la participación del consumidor en el segmento de las felicitaciones digitales.

- En abril de 2021, Eastman Kodak Company adquirió los activos del negocio de dispositivos de computadora a placa (CTP) de ECRM Incorporated, que atiende a las industrias de las artes gráficas y los periódicos, fortaleciendo la cartera de tecnología de impresión de Kodak y reforzando su posición en soluciones de imágenes profesionales.

- En 2021, Card Factory anunció la apertura de una nueva tienda en Flintshire Retail Park en el norte de Gales para expandir su cartera de productos y fortalecer su presencia minorista, respaldando la visibilidad de la marca e impulsando el crecimiento en los canales de venta minorista físicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.