Asia Pacific Pharmaceutical Vials Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

17.23 Billion

USD

28.31 Billion

2025

2033

USD

17.23 Billion

USD

28.31 Billion

2025

2033

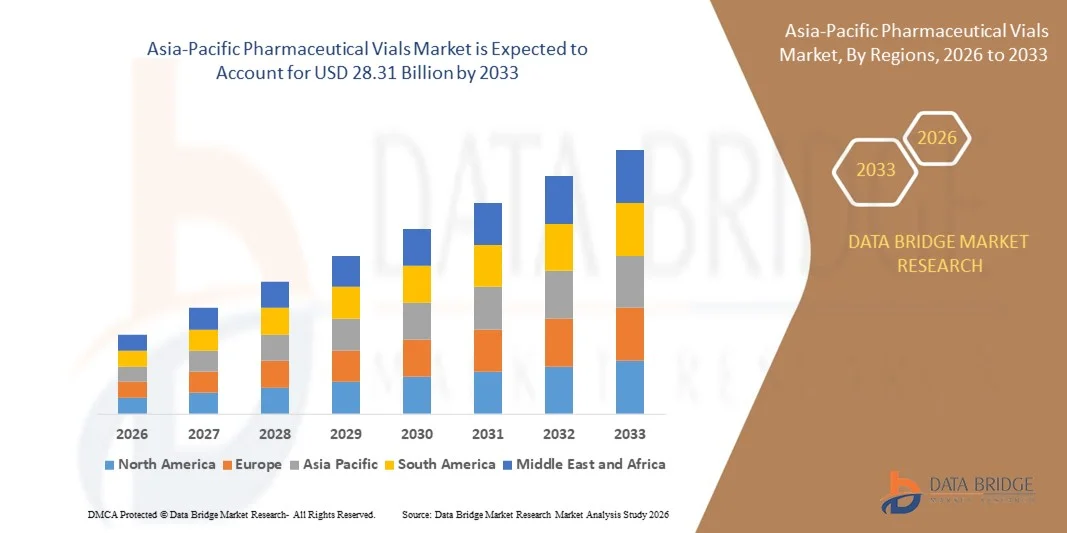

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 28.31 Billion | |

|

|

|

|

Segmentación del mercado de viales farmacéuticos de Asia-Pacífico, por material (vidrio, plástico y otros), tipo de cuello (cuello de rosca, cuello de engarce, doble cámara, tapa abatible y otros), tamaño de la tapa (13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm y otros), canal de distribución (venta directa, tiendas médicas/farmacias, comercio electrónico y otros), capacidad (1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml y otros), tipo de fármaco (inyectable y no inyectable), aplicación (oral, nasal, inyectable y otros), usuario final (empresas farmacéuticas, empresas biofarmacéuticas, empresas de desarrollo y fabricación por contrato, farmacia de compuestos y otros), mercado (parenteral, gastroenterología, otorrinolaringología y Otros) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de viales farmacéuticos en Asia-Pacífico

- El tamaño del mercado de viales farmacéuticos de Asia-Pacífico se valoró en USD 17,23 mil millones en 2025 y se espera que alcance los USD 28,31 mil millones para 2033 , con una CAGR del 6,40% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por el aumento de la producción farmacéutica y la creciente demanda de medicamentos inyectables, vacunas y productos biológicos en toda la región, respaldados por la expansión de la infraestructura de atención médica y las aprobaciones regulatorias.

- Además, los avances en las tecnologías de fabricación de viales, como la esterilización, la mejora de la calidad del vidrio y las soluciones multidosis, están impulsando la eficiencia de la producción y los estándares de seguridad. Estos factores convergentes están acelerando la adopción de viales farmacéuticos, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de viales farmacéuticos en Asia-Pacífico

- Los viales farmacéuticos, utilizados para almacenar y transportar medicamentos inyectables, vacunas y productos biológicos, son componentes cada vez más vitales de las cadenas de suministro farmacéuticas y de atención médica modernas, tanto en entornos hospitalarios como de laboratorio, debido a su mayor esterilidad, durabilidad y compatibilidad con sistemas avanzados de administración de medicamentos.

- La creciente demanda de viales farmacéuticos está impulsada principalmente por la creciente producción de medicamentos inyectables, el aumento de los programas de vacunación y la creciente adopción de productos biológicos y medicamentos especializados.

- China dominó el mercado de viales farmacéuticos de Asia y el Pacífico con la mayor participación en los ingresos del 32,2 % en 2025, caracterizado por una infraestructura de fabricación farmacéutica bien establecida, un alto gasto en atención médica y una fuerte presencia de fabricantes de viales líderes, mientras que Estados Unidos experimentó un crecimiento sustancial en el uso de viales multidosis y prellenados, impulsado por innovaciones en la calidad del vidrio, los procesos de esterilización y el cumplimiento normativo.

- Se espera que India sea la región de más rápido crecimiento en el mercado de viales farmacéuticos de Asia y el Pacífico durante el período de pronóstico debido a la expansión de la fabricación farmacéutica, el aumento de las iniciativas de atención médica del gobierno y la creciente demanda de vacunas y productos biológicos.

- El segmento de vidrio dominó el mercado con la mayor participación en los ingresos del 47,5% en 2025, impulsado por su probada resistencia química, esterilidad y compatibilidad con una amplia gama de formulaciones de medicamentos, incluidos productos biológicos y vacunas.

Alcance del informe y segmentación del mercado de viales farmacéuticos en Asia-Pacífico

|

Atributos |

Viales farmacéuticos: información clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de viales farmacéuticos en Asia-Pacífico

Mayor eficiencia mediante tecnologías de viales avanzadas

- Una tendencia significativa y en auge en el mercado de viales farmacéuticos de Asia-Pacífico es la adopción de tecnologías de fabricación avanzadas y soluciones digitales, como la automatización, los sistemas de llenado de precisión y la monitorización de la calidad en tiempo real. Estas innovaciones están mejorando significativamente la eficiencia de la producción, la seguridad del producto y la consistencia en toda la cadena de suministro farmacéutica.

- Por ejemplo, las líneas de llenado automatizadas con sistemas integrados de esterilización y tapado permiten a los fabricantes mantener un alto rendimiento y minimizar los riesgos de contaminación. De igual manera, las soluciones de viales prellenados y multidosis agilizan la administración de fármacos y reducen los errores de dosificación en entornos clínicos y hospitalarios.

- La integración digital en la fabricación de viales permite funciones como la monitorización en tiempo real de los parámetros de producción, el mantenimiento predictivo y una mejor trazabilidad a lo largo de la cadena de suministro. Por ejemplo, algunas soluciones de Stevanato Group y Schott AG utilizan sensores con IoT para supervisar la integridad de los viales y garantizar el cumplimiento de las normas regulatorias. Además, los sistemas automatizados de seguimiento y etiquetado facilitan la gestión del inventario y la trazabilidad de los lotes.

- La integración fluida de los viales farmacéuticos con plataformas digitales de control de calidad y soluciones de envasado inteligente facilita la supervisión centralizada de la producción, el almacenamiento y la distribución. Mediante un único sistema, los fabricantes pueden supervisar múltiples líneas de producción, garantizar la esterilidad y realizar el seguimiento de los lotes en tiempo real, creando un flujo de trabajo altamente eficiente y fiable.

- Esta tendencia hacia sistemas de fabricación y control de calidad más automatizados, precisos e interconectados está transformando radicalmente las expectativas en la producción de viales farmacéuticos. En consecuencia, empresas como Corning, West Pharmaceutical Services y Stevanato Group están desarrollando viales de alta tecnología con características como la monitorización de calidad asistida por IA, diseños compatibles con la automatización y compatibilidad con sistemas avanzados de administración de fármacos.

- La demanda de viales farmacéuticos que ofrecen mayor eficiencia de fabricación, seguridad e integración digital está creciendo rápidamente en los sectores farmacéuticos comerciales y hospitalarios, a medida que los fabricantes priorizan cada vez más la calidad del producto, el cumplimiento normativo y las operaciones optimizadas.

Dinámica del mercado de viales farmacéuticos en Asia-Pacífico

Impulsor

Creciente necesidad debido a la creciente demanda de medicamentos inyectables y vacunas

- La creciente prevalencia de enfermedades crónicas, junto con la creciente demanda de vacunas y productos biológicos, es un impulsor importante para la mayor adopción de viales farmacéuticos

- Por ejemplo, en 2025, fabricantes clave como Schott AG y Stevanato Group anunciaron expansiones en sus líneas de producción automatizadas de viales para satisfacer la creciente demanda de vacunas multidosis contra la COVID-19 y la gripe. Se espera que estas estrategias de las principales empresas impulsen el crecimiento del mercado de viales farmacéuticos durante el período de pronóstico.

- A medida que los proveedores de atención médica y las compañías farmacéuticas buscan garantizar una administración segura, estéril y eficiente de medicamentos, los viales farmacéuticos ofrecen características avanzadas como capacidad de múltiples dosis, compatibilidad con jeringas precargadas y esterilidad mejorada, lo que proporciona una ventaja convincente sobre los formatos de envasado alternativos.

- Además, el creciente énfasis en los programas de vacunación, los productos biológicos y los medicamentos inyectables especiales está convirtiendo a los viales farmacéuticos en un componente integral de las cadenas de suministro de atención médica modernas, lo que facilita una integración perfecta con los sistemas automatizados de llenado, almacenamiento y distribución.

- La comodidad de los viales prellenados, multidosis y listos para la automatización, junto con el cumplimiento normativo y las características de trazabilidad, son factores clave que impulsan su adopción en hospitales, clínicas y sectores farmacéuticos. La tendencia hacia líneas de producción escalables y diseños de viales intuitivos contribuye aún más al crecimiento del mercado.

Restricción/Desafío

Preocupaciones sobre el cumplimiento normativo y los costos de producción

- La preocupación por los estrictos requisitos regulatorios y los altos costos de producción supone un desafío significativo para una expansión más amplia del mercado. Los viales farmacéuticos deben cumplir con estrictos estándares de esterilidad, calidad del vidrio y biocompatibilidad, lo que incrementa la complejidad y los costos de fabricación.

- Por ejemplo, el cumplimiento de las normas FDA, EMA e ISO requiere pruebas y validaciones rigurosas, lo que puede retrasar el tiempo de comercialización de nuevos diseños de viales.

- Abordar estos desafíos regulatorios mediante un sólido control de calidad, sistemas de producción automatizados y el cumplimiento de las normas globales es crucial para generar confianza entre las compañías farmacéuticas. Fabricantes como West Pharmaceutical Services y Corning priorizan el cumplimiento y la garantía de calidad en sus procesos de producción para garantizar la seguridad de sus clientes. Además, el costo relativamente alto de los viales de vidrio avanzados o multidosis, en comparación con los viales básicos, puede ser un obstáculo para los fabricantes farmacéuticos más pequeños, especialmente en los mercados emergentes.

- Si bien la eficiencia de fabricación y las economías de escala están reduciendo gradualmente los costos, la prima percibida por los viales estériles de alta calidad todavía puede obstaculizar su adopción generalizada, especialmente entre compradores sensibles al precio.

- Superar estos desafíos mediante una mejor automatización, métodos de producción rentables y una adhesión constante a los estándares de calidad globales será vital para el crecimiento sostenido del mercado.

Análisis del mercado de viales farmacéuticos en Asia-Pacífico

El mercado de viales farmacéuticos está segmentado según el material, el tipo de cuello, el tamaño de la tapa, el canal de distribución, la capacidad, el tipo de fármaco, la aplicación, el usuario final y el mercado.

- Por material

En cuanto a los materiales, el mercado de viales farmacéuticos de Asia-Pacífico se segmenta en vidrio, plástico y otros. El segmento de vidrio dominó el mercado con la mayor participación en los ingresos, con un 47,5 % en 2025, gracias a su probada resistencia química, esterilidad y compatibilidad con una amplia gama de formulaciones farmacéuticas, incluyendo productos biológicos y vacunas. Los viales de vidrio son ampliamente preferidos por los fabricantes farmacéuticos para medicamentos inyectables de alto valor debido a su estabilidad y baja reactividad.

Se prevé que el segmento del plástico experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 22,3 %, entre 2026 y 2033, impulsada por su ligereza, resistencia a la rotura y su idoneidad para la distribución de vacunas a gran escala. Los viales de plástico se utilizan cada vez más como soluciones rentables, especialmente en mercados emergentes, y para aplicaciones que requieren un bajo riesgo de rotura durante el transporte. Se espera que la creciente demanda de envases de medicamentos seguros, ligeros y fáciles de transportar impulse el crecimiento general de ambos tipos de materiales.

- Por tipo de cuello

Según el tipo de cuello, el mercado se segmenta en cuello de rosca, cuello de engarce, doble cámara, tapón abatible y otros. El segmento de cuello de rosca dominó con una cuota de mercado del 44,6 % en 2025, debido a su facilidad de sellado, compatibilidad con máquinas de tapado automatizadas y uso generalizado en medicamentos inyectables y productos biológicos. Los viales de cuello de rosca ofrecen cierres fiables a prueba de fugas y son los preferidos tanto para aplicaciones de dosis única como de dosis múltiples

Se proyecta que el segmento de doble cámara experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida, del 20,8 %, entre 2026 y 2033, gracias a su capacidad para almacenar medicamentos liofilizados por separado de los disolventes, lo que facilita la administración avanzada y la estabilidad de los fármacos. Se espera que la creciente adopción de productos biológicos liofilizados y terapias combinadas impulse el crecimiento en este segmento, especialmente entre los fabricantes biofarmacéuticos que buscan diseños de viales innovadores para formulaciones complejas.

- Por tamaño de tapa

En función del tamaño de la tapa, el mercado de viales farmacéuticos de Asia-Pacífico está segmentado en múltiples tamaños que van desde 8-425 mm hasta 24-400 mm. El segmento de 13-425 mm dominó con una cuota de mercado del 41,2 % en 2025, debido a su versatilidad para envasar una amplia variedad de medicamentos inyectables y su facilidad de uso con máquinas de tapado estándar. Este tamaño de tapa es el preferido en hospitales y programas de vacunación a gran escala por su compatibilidad con las jeringas y los equipos de llenado de uso común

Se espera que el segmento de 22-350 mm registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 21,0 %, entre 2026 y 2033, impulsada por la creciente demanda de viales de mayor volumen para vacunas multidosis y productos biológicos. La creciente producción de terapias inyectables de alto volumen y la expansión de los programas de vacunación en la región Asia-Pacífico están impulsando la adopción de estos tamaños de tapa tanto en entornos comerciales como hospitalarios.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en venta directa, farmacias, comercio electrónico y otros. El segmento de venta directa dominó el mercado con una cuota de mercado del 45,7 % en 2025, gracias a las sólidas relaciones entre los fabricantes farmacéuticos y hospitales, clínicas y distribuidores de medicamentos a gran escala. La venta directa facilita la adquisición a granel, el control de calidad y el cumplimiento normativo, lo que la convierte en el canal predilecto de las grandes farmacéuticas.

Se prevé que el segmento del comercio electrónico registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 23,1 %, entre 2026 y 2033, impulsada por el crecimiento de las plataformas minoristas farmacéuticas en línea, la creciente digitalización y la comodidad de la entrega a domicilio para los pequeños proveedores de atención médica y farmacias. La creciente adopción de canales de comercio electrónico es especialmente notable en los mercados emergentes de Asia-Pacífico, donde el acceso a suministros médicos se está expandiendo rápidamente.

- Por capacidad

En función de la capacidad, el mercado está segmentado en varios volúmenes de viales. El segmento de 10 ml dominó con una cuota de mercado del 42,8 % en 2025, debido a su uso generalizado para medicamentos inyectables, vacunas y formulaciones multidosis. Proporciona un equilibrio óptimo entre la flexibilidad de dosificación y la eficiencia de almacenamiento

Se espera que el segmento de 2 ml experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 22,6 %, entre 2026 y 2033, impulsada por el aumento de la producción de productos biológicos y vacunas de alto valor que requieren dosis de bajo volumen. Los viales de pequeña capacidad son los preferidos para medicamentos liofilizados, jeringas precargadas y formulaciones pediátricas, lo que genera una fuerte demanda en hospitales, clínicas y fabricantes farmacéuticos.

- Por tipo de fármaco

Según el tipo de fármaco, el mercado se segmenta en medicamentos inyectables y no inyectables. El segmento inyectable dominó con una cuota de mercado del 56,3 % en 2025, impulsado por la creciente adopción de vacunas, productos biológicos y medicamentos inyectables especializados tanto en entornos hospitalarios como clínicos. Los viales inyectables son fundamentales para garantizar la esterilidad, la precisión de la dosis y el almacenamiento seguro

Se espera que el segmento de medicamentos no inyectables registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 20,5 %, entre 2026 y 2033, impulsada por la creciente demanda de formulaciones líquidas orales, aerosoles nasales y medicamentos tópicos en viales pequeños. Se espera que la expansión de la cartera de productos farmacéuticos y el aumento de las formulaciones centradas en el paciente aceleren el crecimiento de este segmento.

- Por aplicación

Según la aplicación, el mercado se segmenta en oral, nasal, inyectable y otros. El segmento inyectable dominó con una cuota de mercado del 57.1 % en 2025, debido a la alta demanda de vacunas, productos biológicos y medicamentos parenterales. Los viales inyectables garantizan la esterilidad, la precisión de la dosis y la estabilidad a largo plazo, lo que los hace indispensables en hospitales, clínicas y la fabricación farmacéutica

Se espera que el segmento nasal experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 21,9 %, entre 2026 y 2033, impulsada por la creciente popularidad de las vacunas nasales, los sistemas de administración de fármacos para enfermedades crónicas y las terapias no invasivas preferidas por los pacientes. La creciente innovación en formulaciones de fármacos nasales y la compatibilidad de dispositivos está impulsando su adopción en la región.

- Por usuario final

En función del usuario final, el mercado se segmenta en compañías farmacéuticas, compañías biofarmacéuticas, compañías de desarrollo y fabricación por contrato (CDMO), farmacias de compuestos y otras. El segmento de compañías farmacéuticas dominó con una participación de mercado del 48.5% en 2025, impulsado por la producción a gran escala de vacunas, productos biológicos y medicamentos inyectables. Las empresas farmacéuticas establecidas prefieren proveedores confiables para una calidad constante de los viales y el cumplimiento normativo

Se espera que el segmento de empresas biofarmacéuticas sea testigo de la CAGR más rápida del 22,7 % entre 2026 y 2033, impulsada por el creciente sector de productos biológicos y biosimilares, el aumento de las líneas de investigación y desarrollo y la necesidad de formatos de viales especializados para compuestos sensibles.

- Por mercado: Parenteral, Gastro, Otorrinolaringología y otros

En cuanto al mercado, el mercado de viales farmacéuticos de Asia-Pacífico se segmenta en parenterales, gastroenterológicos, otorrinolaringológicos y otros. El segmento parenteral dominó el mercado con una cuota de mercado del 54,2 % en 2025, impulsado por la amplia demanda de medicamentos inyectables, vacunas y productos biológicos que requieren un almacenamiento estéril y fiable de los viales. Los viales parenterales son fundamentales en hospitales y entornos clínicos para garantizar la seguridad del paciente y mantener la eficacia de los medicamentos.

Se prevé que el segmento de otorrinolaringología experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 21,3 %, entre 2026 y 2033, impulsada por el creciente uso de sistemas especializados de administración de fármacos para terapias de oído, nariz y garganta, especialmente en atención ambulatoria y clínicas especializadas. El creciente conocimiento de los tratamientos específicos para cada enfermedad y el aumento de la innovación farmacéutica impulsan el crecimiento de este segmento.

Análisis regional del mercado de viales farmacéuticos en Asia-Pacífico

- China dominó el mercado de viales farmacéuticos de Asia-Pacífico con la mayor participación en los ingresos del 32,2 % en 2025, impulsada por una creciente base de fabricación farmacéutica, una alta demanda de vacunas y productos biológicos y una infraestructura de atención médica bien establecida.

- Los proveedores de atención médica y las compañías farmacéuticas de la región priorizan los viales de alta calidad debido a su confiabilidad, esterilidad y compatibilidad con una amplia gama de medicamentos inyectables y biológicos.

- Esta adopción generalizada está respaldada además por estrictos estándares regulatorios, tecnologías de fabricación avanzadas y fuertes relaciones entre los proveedores de viales y las principales compañías farmacéuticas, lo que establece los viales de vidrio y especiales de alta calidad como la opción preferida tanto para la producción comercial como para el uso hospitalario.

Análisis del mercado de viales farmacéuticos en China y Asia-Pacífico

El mercado chino de viales farmacéuticos representó la mayor participación en los ingresos de la región Asia-Pacífico en 2025, impulsado por la sólida base de fabricación farmacéutica del país, la expansión de la producción de vacunas y la creciente demanda de productos biológicos y medicamentos inyectables. La rápida urbanización, el aumento del gasto sanitario y las iniciativas gubernamentales que promueven el acceso a la atención médica impulsan aún más el crecimiento del mercado. China también se está consolidando como un centro clave de fabricación de viales farmacéuticos, lo que permite la producción de viales de vidrio y plástico rentables y de alta calidad para las cadenas de suministro nacionales e internacionales.

Análisis del mercado de viales farmacéuticos de Asia-Pacífico en Japón

El mercado japonés de viales farmacéuticos experimenta un crecimiento constante, impulsado por la alta demanda nacional de productos biológicos avanzados, vacunas y medicamentos inyectables. La apuesta de Japón por la innovación tecnológica, los estrictos estándares de calidad y el envejecimiento de la población impulsan la adopción de viales prellenados y multidosis que ofrecen comodidad, esterilidad y seguridad. La integración de sistemas automatizados de llenado y envasado en la industria farmacéutica japonesa impulsa aún más la expansión del mercado.

Análisis del mercado de viales farmacéuticos en India, Asia y el Pacífico

Se espera que el mercado indio de viales farmacéuticos crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida de la región Asia-Pacífico durante el período de pronóstico, impulsado por el aumento de la fabricación farmacéutica, el incremento de la producción de vacunas y la expansión de las instalaciones biofarmacéuticas. Las iniciativas gubernamentales que promueven las campañas de vacunación, la mayor concienciación sobre la salud y la creciente exportación de medicamentos inyectables contribuyen a la rápida adopción de viales de vidrio y plástico. El competitivo ecosistema de fabricación de la India también atrae a empresas farmacéuticas globales que buscan suministros confiables de viales.

Análisis del mercado de viales farmacéuticos de Corea del Sur en Asia-Pacífico

El mercado de viales farmacéuticos de Corea del Sur está en constante crecimiento gracias a la creciente inversión en productos biológicos, vacunas y la producción de fármacos inyectables estériles. La creciente adopción de viales de vidrio de alta calidad, el estricto cumplimiento normativo y los avances tecnológicos en sistemas de esterilización y llenado de viales impulsan el crecimiento del mercado. Además, la sólida infraestructura farmacéutica del país y su fabricación orientada a la exportación impulsan la demanda, tanto para uso nacional como para el suministro internacional.

Cuota de mercado de viales farmacéuticos en Asia-Pacífico

La industria de viales farmacéuticos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Schott AG (Alemania)

• Stevanato Group (Italia)

• Corning Inc. (EE. UU.)

• West Pharmaceutical Services, Inc. (EE. UU.)

• BD (Becton, Dickinson and Company) (EE. UU. ) •

Suzhou Hengrui Medicine (China)

• Vials India Limited (India)

• Sun Pharmaceutical Industries Ltd. (India)

• Flexion Therapeutics (EE. UU.)

• SG Pharma (India)

• Huhtamaki PPL (Finlandia)

• Daikyo Seiko Ltd. (Japón)

• Agilent Technologies (EE. UU.)

• Camber Pharma (Reino Unido)

• Kangtai Biological Products (China)

• Hikma Pharmaceuticals (Reino Unido)

• Ricerca Biosciences (EE. UU.)

• Stein Pharma (China)

• Corning Life Sciences (EE. UU.)

• Daikyo Pharmaceutical Packaging (Japón)

¿Cuáles son los desarrollos recientes en el mercado de viales farmacéuticos de Asia-Pacífico?

- En abril de 2024, Schott AG, líder mundial en soluciones de vidrio especial, lanzó una iniciativa estratégica en India destinada a mejorar la producción y el suministro de viales farmacéuticos de alta calidad para vacunas y productos biológicos. Esta iniciativa subraya el compromiso de la compañía con el suministro de viales fiables, estériles y que cumplen con las normativas, adaptados a las crecientes necesidades sanitarias de la región. Al aprovechar su experiencia global y sus tecnologías de fabricación avanzadas, Schott AG no solo aborda los desafíos farmacéuticos regionales, sino que también refuerza su posición en el mercado de viales farmacéuticos de Asia-Pacífico, en rápida expansión.

- En marzo de 2024, Stevanato Group, fabricante italiano de viales y jeringas precargadas, presentó una nueva línea de viales multidosis diseñados específicamente para programas de vacunación a gran escala en el Sudeste Asiático. El innovador diseño del vial garantiza una mayor esterilidad, un menor riesgo de contaminación y compatibilidad con líneas de llenado automatizadas. Este desarrollo pone de manifiesto el compromiso de Stevanato Group con el apoyo a las iniciativas de inmunización masiva y la mejora de la eficiencia operativa de los profesionales sanitarios.

- En marzo de 2024, Corning Inc. amplió con éxito su capacidad de producción de viales inyectables en China, con el objetivo de satisfacer la creciente demanda de vacunas, productos biológicos y medicamentos especializados. Esta iniciativa aprovecha tecnologías de producción de vanguardia para garantizar un suministro de viales de alta calidad, consistente y estéril, lo que pone de relieve la dedicación de Corning a apoyar la industria farmacéutica en rápido crecimiento de la región.

- En febrero de 2024, West Pharmaceutical Services, Inc., proveedor líder de soluciones para la administración de fármacos inyectables, anunció una alianza estratégica con varios fabricantes biofarmacéuticos regionales de Japón para suministrar viales prellenados y multidosis. La colaboración busca optimizar la eficiencia de la producción, la fiabilidad de la cadena de suministro y la distribución para hospitales y clínicas. Esta iniciativa subraya el compromiso de West con la innovación y la excelencia operativa en el sector farmacéutico.

- En enero de 2024, BD (Becton, Dickinson and Company) presentó su avanzada línea de viales prellenados y de vidrio en la Expo Farmacéutica Asia-Pacífico 2024. Equipados con mayor esterilidad y compatibilidad con sistemas de llenado automatizados, estos viales permiten a las compañías farmacéuticas gestionar la producción y la distribución de forma más eficiente. Los viales BD demuestran el compromiso de la compañía con la integración de tecnología de vanguardia en las soluciones de envasado farmacéutico, ofreciendo a los fabricantes mayor calidad, seguridad y comodidad operativa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.