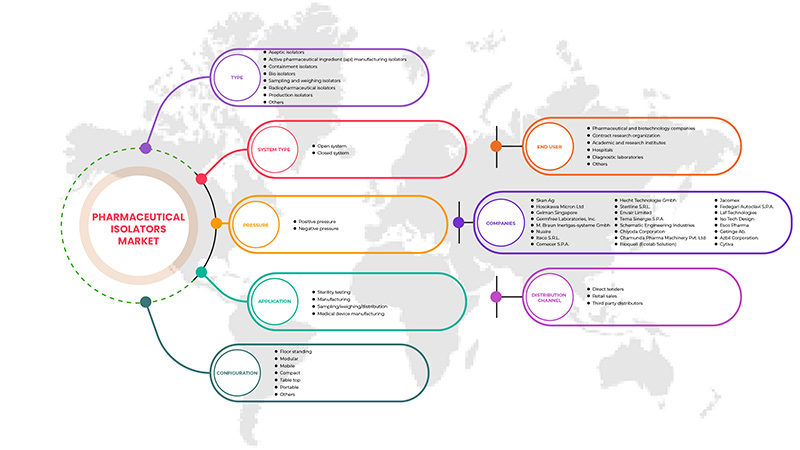

Mercado de aisladores farmacéuticos de Asia y el Pacífico, por tipo (aisladores asépticos, aisladores de contención, aisladores biológicos, aisladores de muestreo y pesaje, aisladores de fabricación de ingredientes farmacéuticos activos (API), aisladores radiofarmacéuticos, aisladores de producción, otros), tipo de sistema (sistema cerrado, sistema abierto), presión (presión positiva, presión negativa), configuración (de suelo, modular, móvil, compacto, de sobremesa, portátil, otros), aplicación ( pruebas de esterilidad , fabricación, muestreo/pesaje/distribución, fabricación de dispositivos médicos), usuario final (hospitales, laboratorios de diagnóstico, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, organizaciones de investigación por contrato, otros), canal de distribución (licitación directa, ventas minoristas, distribuidores externos), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de aisladores farmacéuticos de Asia y el Pacífico

Los aisladores farmacéuticos se utilizan en la industria farmacéutica como un sistema de barrera libre de contaminación. Las pruebas microbiológicas, el procesamiento de terapia celular, la fabricación farmacéutica avanzada (ATMP) y el pesaje, envasado y distribución de productos inyectables estériles son solo algunas de las aplicaciones de los aisladores farmacéuticos. El uso de aisladores farmacéuticos se ve impulsado por el crecimiento continuo del mercado farmacéutico en los países en desarrollo y desarrollados y el aumento de los gastos de I+D para producir tratamientos innovadores. Los aisladores médicos avanzados y los requisitos de la industria farmacéutica han llevado a los principales fabricantes a hacer crecer la industria de aisladores médicos. El uso creciente de compuestos peligrosos, el aumento del costo del incumplimiento y el aumento de los laboratorios de investigación son factores importantes que impulsan el mercado de aisladores farmacéuticos durante el período de pronóstico.

Sin embargo, la mayoría de los expertos no están de acuerdo en que las entidades reguladoras ya no impidan avances como el desarrollo de aislantes farmacéuticos.

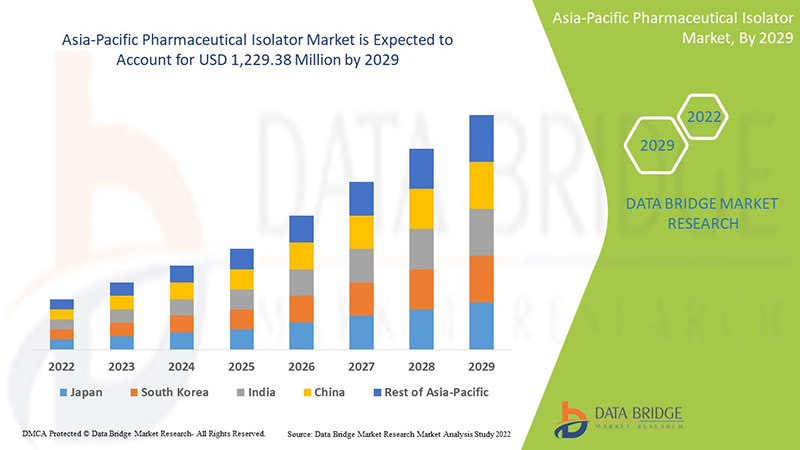

Data Bridge Market Research analiza que se espera que el mercado de aisladores farmacéuticos de Asia-Pacífico alcance un valor de USD 1229,38 millones para 2029, con una CAGR del 15,7 % durante el período de pronóstico. El tipo representa el segmento de tipo más grande en el mercado debido a la rápida demanda de aisladores farmacéuticos a nivel mundial. Este informe de mercado también cubre análisis de precios, análisis de patentes y avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo (aisladores asépticos, aisladores de contención, aisladores biológicos, aisladores de muestreo y pesaje, aisladores de fabricación de ingredientes farmacéuticos activos (API), aisladores radiofarmacéuticos, aisladores de producción, otros), tipo de sistema (sistema cerrado, sistema abierto), presión (presión positiva, presión negativa), configuración (de suelo, modular, móvil, compacto, de sobremesa, portátil, otros), aplicación (pruebas de esterilidad, fabricación, muestreo/pesaje/distribución, fabricación de dispositivos médicos), usuario final (hospitales, laboratorios de diagnóstico, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, organizaciones de investigación por contrato, otros), canal de distribución (licitación directa, ventas minoristas, distribuidores externos). |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Tailandia, Malasia, Australia, Filipinas, Indonesia y resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

Entre las empresas que participan se encuentran: Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma, entre otras. |

Definición del mercado de aisladores farmacéuticos de Asia y el Pacífico

El concepto de aislamiento protege el proceso del operador y/o al operador del proceso, al mismo tiempo que protege el medio ambiente. La clave para la contención es una exposición mínima. Al controlar el rango de exposición por debajo del nivel de riesgo establecido para el compuesto, el operador y el medio ambiente están adecuadamente protegidos. Por lo tanto, el producto está protegido y, por lo tanto, se aborda una cuestión regulatoria clave. Un aislador farmacéutico es un recinto bacteriano sellado que se utiliza en el entorno farmacéutico para el llenado aséptico y el proceso tóxico. Está hecho de un aislador principal perfectamente estéril donde los productos se manipulan, almacenan o envasan utilizando guantes a la altura de los hombros colocados en una de las paredes. El aislador farmacéutico permite el control y la contención de los procesos farmacéuticos. Las condiciones requeridas para el funcionamiento de un aislador farmacéutico son un entorno estéril y libre de microorganismos viables. Un aislador farmacéutico garantiza que el área de producción y el entorno aséptico se coloquen en posiciones separadas. Un aislador de la industria farmacéutica es rentable y eficiente, en comparación con las salas blancas para la industria farmacéutica en un entorno aséptico. Crea una atmósfera controlada durante el proceso de producción microbiana y de fármacos ajustándose a los diferentes estándares de certificación exigidos para aisladores y barreras de acceso restringido, garantizando al mismo tiempo la protección del producto, de los operarios y del medio ambiente.

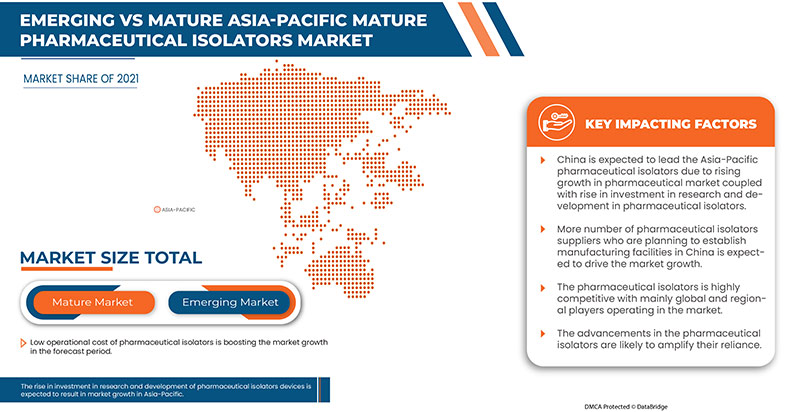

Las abundantes aplicaciones de los aisladores farmacéuticos varían según los propósitos de producción y control. Se utilizan durante la manipulación, transferencia o envasado de medicamentos farmacéuticos sólidos, semisólidos o en polvo, la manipulación y el llenado de soluciones e infusiones. Los aisladores farmacéuticos se aplican en pruebas de esterilidad, manipulación aséptica de tejidos o sistemas de producción biológica o muestras patógenas, etc. Se pueden utilizar para la producción y el control de medicamentos y productos farmacéuticos. El aumento de la demanda de aisladores en la industria farmacéutica y biotecnológica, junto con el bajo coste operativo, el alto mantenimiento de las condiciones asépticas en la producción de productos farmacéuticos y la creciente demanda de la industria biofarmacéutica son los factores que se espera que impulsen el crecimiento del mercado en el período de pronóstico.

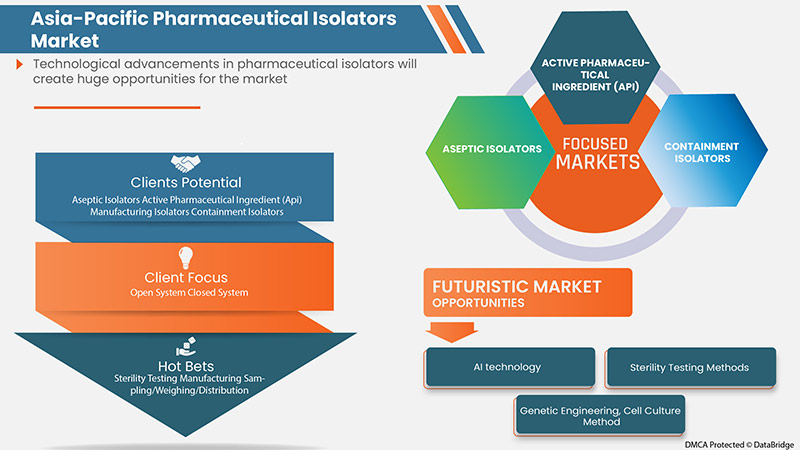

Además, las iniciativas estratégicas de los actores del mercado, los avances tecnológicos en aisladores farmacéuticos, la alta garantía de esterilidad y la creciente inversión en infraestructura de atención médica aumentan el crecimiento del mercado de aisladores farmacéuticos.

Dinámica del mercado de aisladores farmacéuticos en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

Creciente demanda de aisladores farmacéuticos en las industrias farmacéuticas en auge

El aislador farmacéutico es un dispositivo separador que separa un procedimiento o actividad farmacéutica del operador y el entorno adyacente. Se utiliza para diversos fines, como:

- Proporcionar un ambiente aséptico categorizado para una actividad o procedimiento y protegerlo de la contaminación microbiana y no microbiana que surge del operador y el entorno adyacente, lo que se conoce como protección del producto.

- Producto protector contra la contaminación producida por otros productos y procedimientos, incluso al mismo tiempo o durante operaciones anteriores. Esto se denomina protección contra la contaminación generada por el método o contaminación cruzada.

Los crecientes problemas de contaminación en la unidad de fabricación en la que viene el aislador crean una demanda de aisladores farmacéuticos que ayuden en la contaminación y descontaminación.

- Bajo costo operativo de los aisladores farmacéuticos

Los recintos sellados con un cierto estándar de hermeticidad que comprende un ambiente controlado calificado, que se modifica con las condiciones ambientales, la aplicación del aislador abarca desde la investigación y el desarrollo hasta la producción de productos farmacéuticos y el uso en laboratorio, especialmente para el control de calidad microbiológico. Mientras que la producción farmacéutica aséptica tiene estándares extremadamente altos de limpieza, casi completamente libres de partículas y gérmenes, para la producción aséptica.

Debido al crecimiento de la industria farmacéutica y la ampliación de la gama de productos, cada vez más fabricantes y proveedores necesitan pensar en inversiones en las últimas tecnologías agregadas a la tecnología de salas limpias.

El procesamiento aséptico de los medicamentos farmacéuticos es el factor principal que debe incluirse en las buenas prácticas de fabricación que cumplen con las regulaciones gubernamentales. El alto costo del mantenimiento de la condición aséptica mediante la tecnología de sala limpia, que es aproximadamente un 62% más alto que el de los aisladores farmacéuticos, obliga a los fabricantes a adquirir tecnología de aisladores y limita el costo general de fabricación de los productos farmacéuticos.

Restricción

Regulaciones gubernamentales estrictas

Los ingredientes farmacéuticos activos (API) y los intermedios para uso farmacéutico (por ejemplo, biológicos, radiofarmacéuticos y farmacéuticos) y aquellos utilizados para la producción de medicamentos para ensayos clínicos están regulados por las Divisiones 1A y 2, Parte C del Reglamento de Alimentos y Medicamentos.

- La División 1A, Parte C del Reglamento de Alimentos y Medicamentos describe las actividades para las cuales se requiere el cumplimiento de las Buenas Prácticas de Manufactura (BPM) y debe demostrarse antes de la emisión de una licencia de establecimiento de API (EL).

- La División 2, Parte C del Reglamento sobre Alimentos y Medicamentos define los requisitos para las BPM de los API y sus intermedios, que se interpretan en el presente documento de orientación.

Debido a esta estricta regulación por parte del gobierno que se debe seguir para la producción, las Directrices de Buenas Prácticas de Manufactura (BPM) para Ingredientes Farmacéuticos Activos (API) - (GUI-0104) limitan la tasa de crecimiento del mercado.

Oportunidad

-

Iniciativas estratégicas de los actores del mercado

El auge del mercado de aisladores farmacéuticos aumenta la necesidad de ideas comerciales estratégicas, que incluyen asociaciones, expansión comercial y otros desarrollos. La creciente demanda de productos farmacéuticos está aumentando significativamente la demanda de excipientes y, para hacer frente a esta demanda, las empresas están construyendo nuevas plantas de fabricación, entre otras iniciativas estratégicas.

Estas iniciativas estratégicas, como lanzamientos de productos, acuerdos y expansión comercial por parte del principal actor del mercado, impulsarán el crecimiento del mercado de aisladores farmacéuticos y se espera que actúen como una oportunidad para el mercado de exhibiciones médicas de Asia y el Pacífico.

Desafío

Falta de experiencia especializada

La falta de personal especializado podría dificultar el ritmo de la recuperación y el crecimiento en un lugar determinado. A menudo, las personas que están desempleadas en un lugar tienen habilidades que escasean en otros lugares. Además, el rápido avance tecnológico en este campo también conduce a una falta de personal especializado.

La falta de profesionales capacitados para manipular aisladores farmacéuticos plantea un gran desafío a la hora de seleccionar y desarrollar los aisladores farmacéuticos. Los datos de Phys.org de 2003 mencionan que las industrias de pantallas médicas enfrentan una escasez de trabajadores debido al aumento de la demanda de aisladores farmacéuticos en la región de Asia y el Pacífico y a la grave escasez de microchips utilizados en pantallas LED y LCD, lo que aumenta los plazos de producción de LCD.

Como las demandas de habilidades son demasiado altas, se ha manifestado como un desafío retener y gestionar a los profesionales con habilidades específicas. Además, el avance tecnológico es otro aspecto que conduce a la mayor demanda de profesionales capacitados. Los neurólogos informan de importantes necesidades de atención de apoyo no satisfechas y barreras en sus centros, y solo una pequeña minoría se considera competente en la prestación de cuidados de apoyo. Existe una necesidad urgente de formar a los neurólogos y a los profesionales para el tratamiento de la demencia y la obtención de los recursos de atención de apoyo disponibles. La falta de profesionales capacitados y experimentados y las brechas persistentes de habilidades limitan las perspectivas de empleabilidad y el acceso a empleos de calidad. Por lo tanto, es evidente que se espera que la disponibilidad de profesionales equipados con las habilidades adecuadas suponga un desafío para el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado de aisladores farmacéuticos de Asia y el Pacífico

La pandemia de COVID-19 se ha convertido en la amenaza más grave del mundo. Ha causado estragos en muchas tiendas y negocios de todo el mundo. La pandemia, por otro lado, ha brindado muchas oportunidades para que las empresas farmacéuticas y biofarmacéuticas amplíen sus actividades de investigación y desarrollo para desarrollar nuevas vacunas contra el nuevo coronavirus. Las empresas están realizando ensayos clínicos para tratar de detener la propagación del virus COVID-19. Los proveedores de aisladores farmacéuticos para organizaciones biofarmacéuticas tienen más oportunidades a medida que aumenta el número de ensayos clínicos.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D y lanzamiento de productos y asociaciones estratégicas para mejorar la tecnología y los resultados de las pruebas involucradas en el mercado de pantallas médicas farmacéuticas.

Acontecimientos recientes

- En junio de 2022, la empresa anunció una asociación con Medical Supply Company (MSC) para comercializar y dar servicio a los equipos de Jacomex para las industrias farmacéutica y farmacéutica en Irlanda. MSC cuenta con muchos años de experiencia reconocida en el mercado con equipos de campo más cercanos a los clientes y el equipo comercial de la empresa que actualmente trabaja en el extranjero tuvo el placer de recibir a Cian Murphy y finalizar el acuerdo entre Jacomex y MSC. El comienzo de una larga y fructífera colaboración. Esto ha ayudado a la empresa a expandir su negocio.

- En enero de 2022, Clario se asoció con XingImaging, una empresa de producción de radiofármacos y adquisición de tomografías por emisión de positrones (PET), para realizar ensayos clínicos de imágenes PET para probar nuevas terapias en China. La asociación ofrece compartir los recursos conjuntos y los expertos en neurociencia de Clario y XingImaging para acelerar el inicio de los ensayos clínicos y el descubrimiento de fármacos en China.

Alcance del mercado de aisladores farmacéuticos en Asia y el Pacífico

El mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado por tipo, presión, aplicación, configuración, tipo de sistema, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR TIPO

- AISLADORES ASÉPTICOS

- AISLADORES DE CONTENCIÓN

- BIO AISLADORES

- AISLADORES DE MUESTREO Y PESAJE

- AISLADORES PARA FABRICACIÓN DE INGREDIENTE FARMACÉUTICO ACTIVO (API)

- AISLADORES RADIOFARMACÉUTICOS

- AISLADORES DE PRODUCCIÓN

- OTROS

Según el tipo, el mercado de aisladores farmacéuticos de Asia y el Pacífico está segmentado en aisladores asépticos, aisladores de contención, aisladores biológicos, aisladores de muestreo y pesaje, aisladores de fabricación de ingredientes farmacéuticos activos (API), aisladores radiofarmacéuticos, aisladores de producción y otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR TIPO DE SISTEMA

- Sistema cerrado

- SISTEMA ABIERTO

Sobre la base del tipo de sistema, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en sistema cerrado y sistema abierto.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA-PACÍFICO, POR PRESIÓN

- PRESIÓN POSITIVA

- PRESIÓN NEGATIVA

Sobre la base de la presión, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en presión positiva y presión negativa.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR CONFIGURACIÓN

- DE PIE

- MODULAR

- MÓVIL

- COMPACTO

- TABLERO DE MESA

- PORTÁTIL

- OTROS

Sobre la base de la configuración, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en aisladores de suelo, modulares, móviles, compactos, de sobremesa, portátiles y otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR APLICACIÓN

- PRUEBA DE ESTERILIDAD

- FABRICACIÓN

- MUESTREO/ PESAJE/ DISTRIBUCIÓN

- FABRICACIÓN DE DISPOSITIVOS MÉDICOS

- OTROS

Sobre la base de la aplicación, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en pruebas de esterilidad, fabricación, muestreo/pesaje/distribución, fabricación de dispositivos médicos y otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR USUARIO FINAL

- HOSPITALES

- LABORATORIOS DE DIAGNÓSTICO

- INSTITUTOS ACADÉMICOS Y DE INVESTIGACIÓN

- EMPRESAS FARMACÉUTICAS Y BIOTECNOLÓGICAS

- ORGANIZACIONES DE INVESTIGACIÓN POR CONTRATO

- OTROS

Sobre la base del usuario final, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en hospitales, laboratorios de diagnóstico, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, organizaciones de investigación por contrato, otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR CANAL DE DISTRIBUCIÓN

- LICITACIÓN DIRECTA

- VENTAS AL POR MENOR

- DISTRIBUIDORES DE TERCEROS

Sobre la base del canal de distribución, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en licitación directa, ventas minoristas y distribuidores externos.

Análisis y perspectivas regionales del mercado de aisladores farmacéuticos de Asia y el Pacífico

Se analiza el mercado de aisladores farmacéuticos de Asia-Pacífico y se proporciona información sobre el tamaño del mercado: tipo, presión, aplicación, configuración, tipo de sistema, usuario final y canal de distribución.

The countries covered in this market report are China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia and rest of Asia-Pacific. In 2022, China is dominating due to increasing investments in R&D.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Pharmaceutical Isolator Market Share Analysis

Asia-Pacific pharmaceutical isolator market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Asia-Pacific pharmaceutical isolator market.

Some of the major players operating in the Asia-Pacific pharmaceutical isolator market are Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma.

Research Methodology: Asia-Pacific Pharmaceutical Isolator Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 CHINA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CHINA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 CHINA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CHINA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 JAPAN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 JAPAN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 JAPAN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 JAPAN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 96 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 99 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 100 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 101 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 INDIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 INDIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 INDIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 INDIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 THAILAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 THAILAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 THAILAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 153 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 INDONESIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 INDONESIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 PHILIPPINES DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 REST OF ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.