Asia Pacific Molecular Diagnostics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

9.47 Billion

USD

16.02 Billion

2025

2033

USD

9.47 Billion

USD

16.02 Billion

2025

2033

| 2026 –2033 | |

| USD 9.47 Billion | |

| USD 16.02 Billion | |

|

|

|

|

Mercado de diagnóstico molecular de Asia y el Pacífico, por productos (reactivos y kits, instrumentos y servicios y software), tecnología (espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros), aplicación (oncología, farmacogenómica, microbiología, pruebas prenatales, tipificación de tejidos, detección de sangre, enfermedades cardiovasculares, enfermedades neurológicas, enfermedades infecciosas y otras), usuario final (hospital, laboratorios clínicos y académicos), país (China, India, Japón, Australia, Corea del Sur, Malasia, Singapur, Tailandia, Indonesia, Filipinas, resto de Asia y el Pacífico), tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de diagnóstico molecular de Asia y el Pacífico

Análisis y perspectivas del mercado: mercado de diagnóstico molecular de Asia y el Pacífico

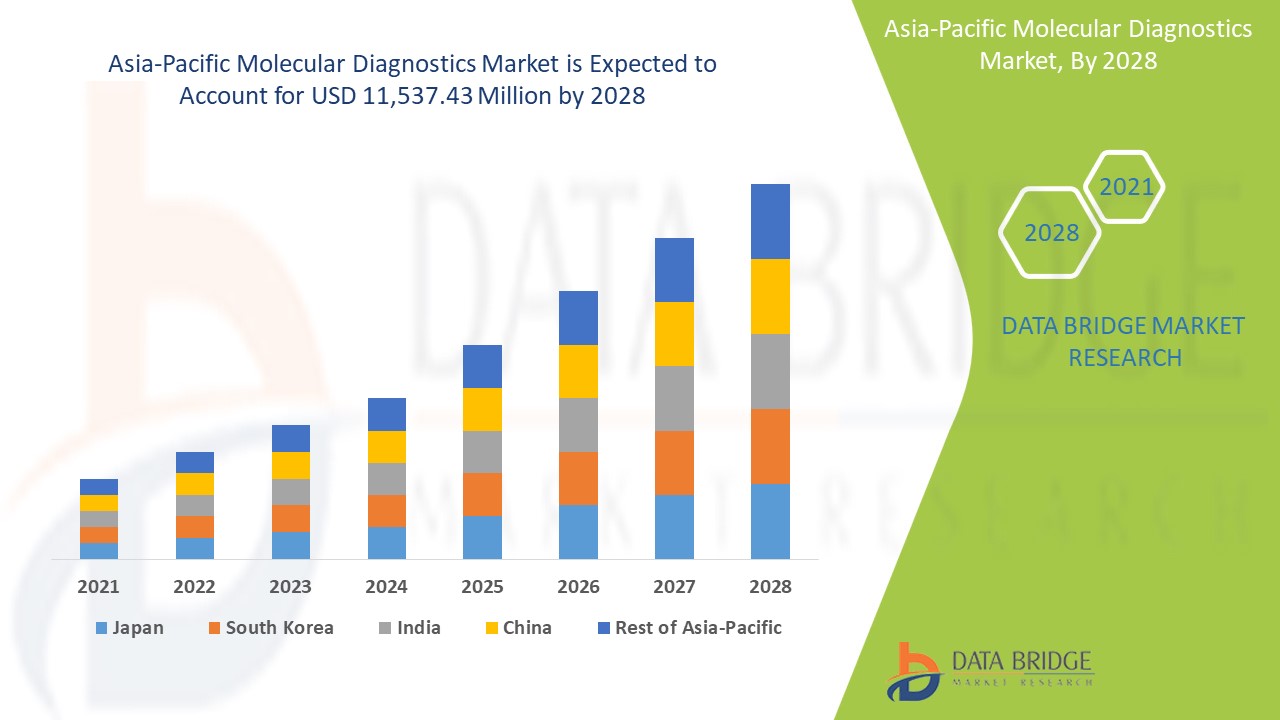

Se espera que el mercado de diagnóstico molecular gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,8% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 11.537,43 millones para 2028. La demanda de herramientas de diagnóstico molecular está aumentando para diagnosticar a los pacientes con COVID-19, junto con un aumento en la prevalencia de enfermedades infecciosas y cáncer como impulsores del crecimiento del mercado de diagnóstico molecular.

El diagnóstico molecular identifica o diagnostica enfermedades como enfermedades infecciosas , enfermedades genéticas, enfermedades cardiovasculares, enfermedades neurológicas y otras mediante el estudio de moléculas como ADN, ARN, proteínas en un tejido o un fluido. Diferentes tecnologías como PCR, espectrometría de masas, secuenciación de próxima generación, citogenética, hibridación in situ, imágenes moleculares y otras se utilizan para diagnosticar diferentes enfermedades. El diagnóstico molecular utiliza herramientas poderosas como el perfil de expresión genética, el análisis de secuencias de ADN y la detección de biomarcadores para determinar la susceptibilidad de las personas a ciertas afecciones o la etapa existente de la enfermedad. Se ha convertido en una parte importante de los hospitales, laboratorios clínicos y otros, ya que incluye todas las pruebas y métodos para identificar una enfermedad y analizarla. Ayuda a ofrecer el mejor tratamiento a los pacientes y, con las nuevas tecnologías, el proceso de diagnóstico se ha vuelto más rápido y eficiente.

Se desarrollan herramientas, instrumentos y kits de diagnóstico molecular para diagnosticar una o varias enfermedades a partir de fluidos o tejidos corporales. Muchos desarrollos tecnológicos están lanzando nuevos productos con tecnología altamente eficiente para ofrecer el mejor tratamiento posible a tiempo. Además, la demanda de herramientas de diagnóstico molecular está aumentando para diagnosticar a los pacientes con COVID-19, junto con un aumento en la prevalencia de enfermedades infecciosas y cáncer. La creciente demanda de pruebas en el punto de atención es el factor clave que impulsa el mercado de diagnóstico molecular de Asia y el Pacífico. Sin embargo, el alto costo de la instrumentación y las estrictas reglas establecidas por los organismos gubernamentales para la aprobación de productos de diagnóstico molecular pueden obstaculizar el crecimiento de este mercado.

Además, el aumento de la financiación de organismos gubernamentales y autoridades privadas para desarrollar productos de diagnóstico molecular, junto con el aumento del gasto sanitario y la creciente adopción de software de análisis para diagnóstico molecular, crearán enormes oportunidades para el mercado de diagnóstico molecular de Asia y el Pacífico. Sin embargo, se espera que la alta competencia en el mercado y las perturbaciones en la cadena de suministro debido a la pandemia de COVID-19 supongan un desafío para el mercado de diagnóstico molecular de Asia y el Pacífico.

El informe de mercado de diagnóstico molecular proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de diagnóstico molecular, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de diagnóstico molecular

Alcance y tamaño del mercado de diagnóstico molecular

El mercado de diagnóstico molecular está segmentado en función de los productos, la tecnología, la aplicación y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En cuanto a los productos, el mercado de diagnóstico molecular de Asia-Pacífico se segmenta en reactivos y kits, instrumentos y servicios y software. En 2021, se espera que el segmento de instrumentos domine el mercado de diagnóstico molecular debido al aumento de la demanda de tecnología avanzada para diagnosticar enfermedades como enfermedades infecciosas, cáncer y otras.

- En función de la tecnología, el mercado de diagnóstico molecular de Asia-Pacífico se segmenta en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. Los métodos basados en la reacción en cadena de la polimerasa (PCR) se segmentan además en PCR fría, PCR digital, análisis lineal directo, PCR fluorescente cuantitativa, PCR en tiempo real y PCR con transcriptasa inversa. El segmento de imágenes moleculares se subdivide a su vez en imágenes ópticas y FDG-PET. En 2021, se espera que el segmento de métodos basados en la reacción en cadena de la polimerasa (PCR) domine el mercado de diagnóstico molecular debido a la mayor demanda de kits de PCR para diagnosticar COVID-19 y frenar la pandemia.

- Sobre la base de la aplicación, el mercado de diagnóstico molecular de Asia-Pacífico se segmenta en oncología, farmacogenómica, microbiología, pruebas prenatales, tipificación de tejidos, detección de sangre, enfermedades cardiovasculares, enfermedades neurológicas, enfermedades infecciosas y otras. El segmento de oncología se segmenta a su vez en oncología, por tipo de cáncer y oncología, por tecnología. La oncología, por tipo de cáncer, se subdivide a su vez en cáncer de mama, cáncer colorrectal, cáncer de pulmón, cáncer de próstata y otros. La oncología, por tecnología, se subdivide a su vez en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. La farmacogenómica se segmenta además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. La microbiología se segmenta además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. Las pruebas prenatales se segmentan además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. La tipificación de tejidos se segmenta además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. El cribado de sangre se segmenta además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. Las enfermedades cardiovasculares se segmentan además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. La neurología se segmenta además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética, hibridación in situ (ISH o FISH), imágenes moleculares y otros. Las enfermedades infecciosas se segmentan además en espectrometría de masas (MS), electroforesis capilar, secuenciación de próxima generación (NGS), chips y microarrays, métodos basados en la reacción en cadena de la polimerasa (PCR), citogenética,Hibridación in situ (ISH o FISH), imágenes moleculares y otras. En 2021, se espera que el segmento de enfermedades infecciosas domine el mercado de diagnóstico molecular debido al aumento de enfermedades infecciosas como la gripe, COVID-19, SIDA y otras y la mayor demanda de tecnología de diagnóstico molecular altamente eficiente.

- En función de los usuarios finales, el mercado de diagnóstico molecular de Asia-Pacífico se segmenta en hospitales, laboratorios clínicos y académicos. En 2021, se espera que el segmento de laboratorios clínicos domine el mercado de diagnóstico molecular debido al creciente número de pacientes con diversas enfermedades y la creciente necesidad de instrumentos de diagnóstico.

Análisis a nivel de país del mercado de diagnóstico molecular de Asia y el Pacífico

Se analiza el mercado de diagnóstico molecular de Asia Pacífico y se proporciona información sobre el tamaño del mercado por país, productos, tecnología, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de diagnóstico molecular son China, Tailandia, Australia, Japón, Corea del Sur, Singapur, Malasia, Indonesia, Filipinas, India y el resto de Asia-Pacífico:

Se espera que el segmento de productos en la región de China crezca con la tasa de crecimiento más alta en el período de pronóstico de 2021 a 2028 debido al aumento de la demanda de instrumentos de diagnóstico para diagnosticar a pacientes con COVID-19 y otras enfermedades cardiovasculares, enfermedades infecciosas y otras. El segmento de productos en la India está dominando el mercado de Asia-Pacífico debido al aumento del gasto en atención médica. Filipinas lidera el crecimiento del mercado de Asia-Pacífico porque el segmento de riesgo domina en este país debido a la creciente demanda de pruebas en el punto de atención y medicina de precisión.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre el diagnóstico molecular están impulsando el crecimiento del mercado del diagnóstico molecular

El mercado de diagnóstico molecular también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de los diagnósticos moleculares

El panorama competitivo del mercado de diagnóstico molecular proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de diagnóstico molecular.

Las principales empresas que se dedican al diagnóstico molecular son Abbott, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc., BD, bioMérieux SA, Cepheid, Hologic, Inc., Life Technologies, Myriad Genetics, Inc., QIAGEN, Agilent Technologies, Inc., Quidel Corporation, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., IMMUCOR, Luminex Corporation, Meridian Bioscience, Hoffmann-La Roche Ltd y GenMark Diagnostics, Inc., entre otras empresas nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos, acuerdos y lanzamientos son también iniciados por empresas de todo el mundo que también están acelerando el mercado del diagnóstico molecular.

Por ejemplo,

- En junio de 2021, Thermo Fisher Scientific Inc. lanzó un nuevo producto llamado Attune CytPix, un citómetro de flujo fluorescente que ofrece imágenes mejoradas y enfoque acústico con una cámara de alta velocidad.

- En marzo de 2020, Abbott lanzó un nuevo producto llamado ID NOW para la detección del coronavirus. Es liviano, portátil, ofrece un alto grado de precisión y utiliza tecnología molecular.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias del actor del mercado están mejorando la huella de la empresa en el mercado de diagnóstico molecular, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.