Mercado de química medicinal para el descubrimiento de fármacos en Asia-Pacífico, por proceso ( selección de objetivos , validación de objetivos, identificación de hit-to-lead, optimización de leads y validación de candidatos), diseño (variación basada en fragmentos, diseño de fármacos basado en la estructura, síntesis orientada a la diversidad, quimiogenómica, productos naturales y otros), tipo de fármaco (moléculas pequeñas y productos biológicos), área terapéutica ( oncología , neurología, enfermedades infecciosas y del sistema inmunológico , enfermedades cardiovasculares, enfermedades del sistema digestivo y otras), usuario final (organización de investigación por contrato, empresas farmacéuticas y biotecnológicas , institutos académicos y de investigación y otros), país (Japón, China, Australia, India, Corea del Sur, Singapur, Indonesia, Tailandia, Malasia, Filipinas, Vietnam, resto de Asia-Pacífico), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado de química medicinal para el descubrimiento de fármacos en Asia y el Pacífico

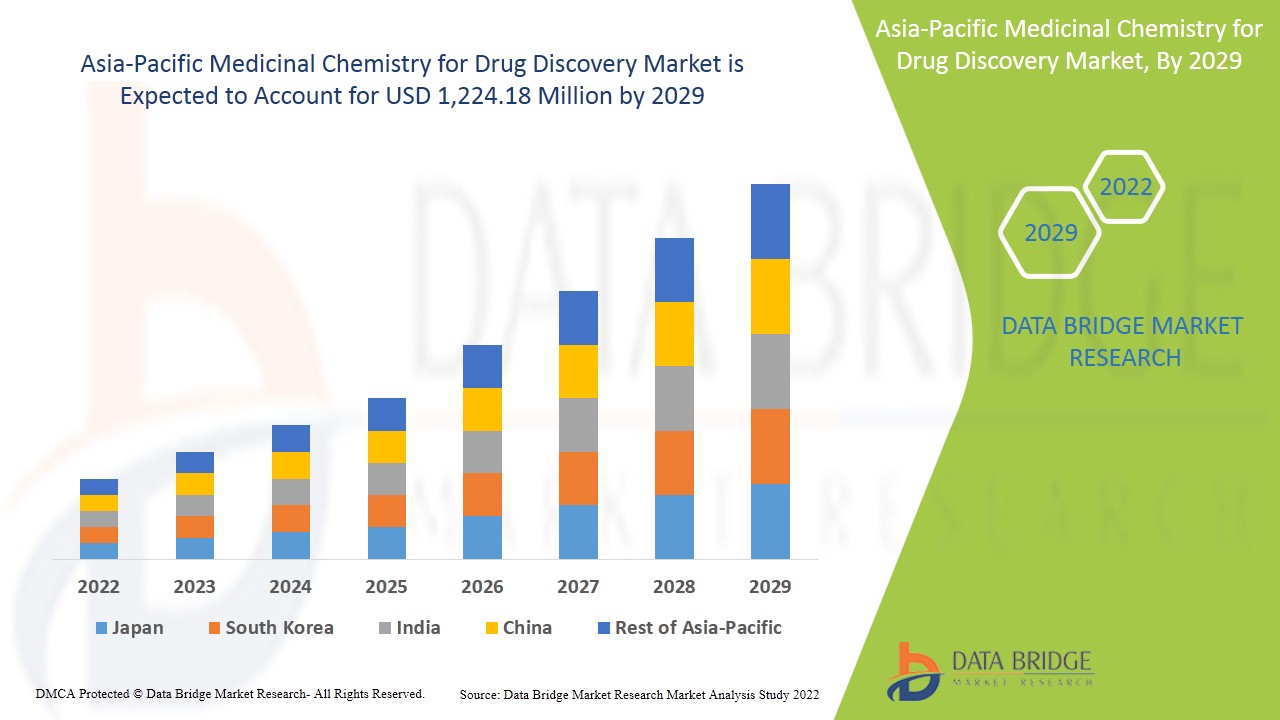

Se espera que el mercado de la química medicinal para el descubrimiento de fármacos gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 11,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1224,18 millones para 2029. La creciente carga de diversas enfermedades crónicas y el crecimiento de los productos biológicos son los principales impulsores que impulsaron la demanda del mercado en el período de pronóstico.

La química medicinal es un campo interdisciplinario de la ciencia en el que participan equipos de científicos (incluidos químicos orgánicos sintéticos, químicos analíticos, biólogos, toxicólogos, farmacólogos, microbiólogos y biofarmacéuticos) que trabajan juntos para el descubrimiento, diseño, desarrollo y síntesis de nuevos fármacos. Además, la contribución de la química medicinal no se limita a la etapa de descubrimiento, sino que lleva su propósito a lo largo de todo el espectro del desarrollo clínico. Todas y cada una de las etapas del desarrollo clínico implican cantidades excedentes de fármacos formulados para estudiar los beneficios potenciales en ensayos con seres humanos. Con el tiempo, los métodos químicos adoptados para el descubrimiento de las moléculas también han sufrido cambios que han llevado al desarrollo de tecnologías como la química combinatoria (combichem), la síntesis orgánica asistida por microondas (MAOS) y el cribado biológico de alto rendimiento (HTS).

La química medicinal para el descubrimiento de fármacos comprende características tales como la creciente necesidad de fármacos seguros y eficaces que repercutirá en el lanzamiento de nuevos productos por parte de los fabricantes al mercado, lo que aumentará su demanda, así como el aumento de la inversión en investigación y desarrollo para el descubrimiento y desarrollo de nuevas moléculas de fármacos que conducen al crecimiento del mercado. Actualmente se están llevando a cabo varios estudios de investigación que se espera que brinden varias otras oportunidades en el mercado de la química medicinal para el descubrimiento de fármacos. Sin embargo, se espera que los riesgos técnicos en el descubrimiento de fármacos y la falta de profesionales capacitados limiten el crecimiento del mercado en el período de pronóstico.

El informe de mercado de química medicinal para el descubrimiento de fármacos proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado , aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de la química medicinal para el descubrimiento de fármacos en Asia y el Pacífico

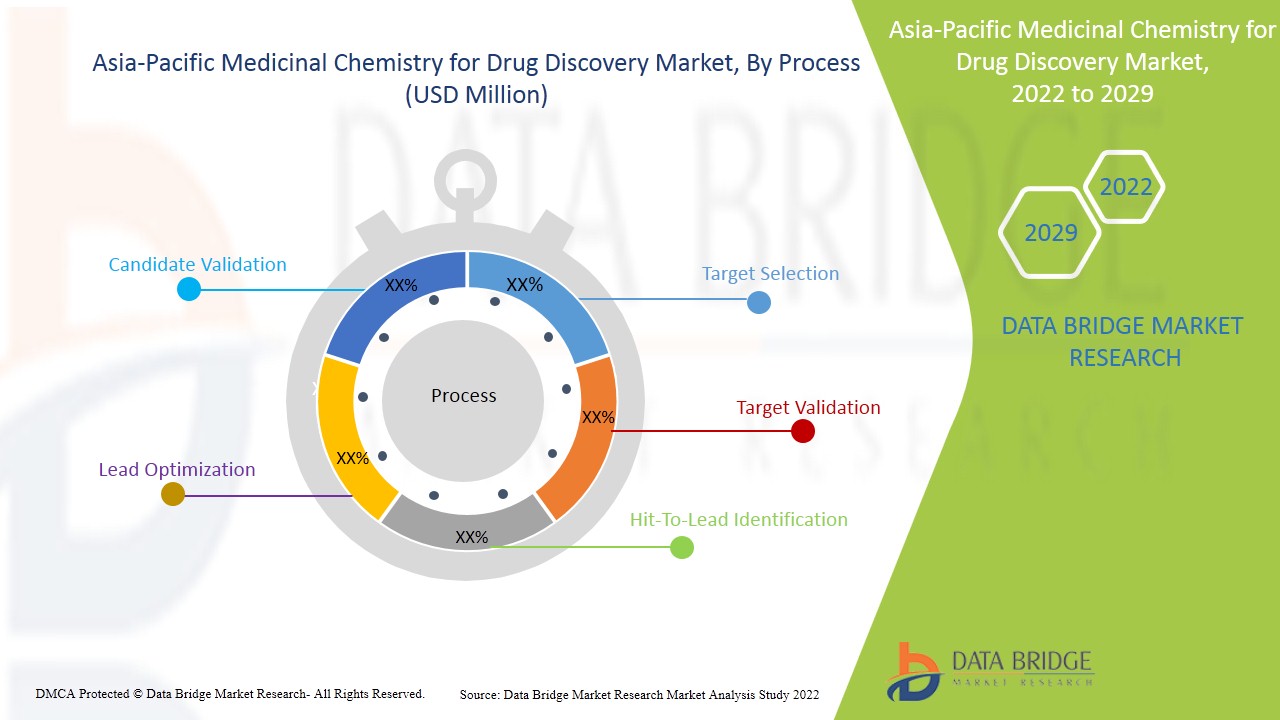

El mercado de química medicinal para el descubrimiento de fármacos está segmentado en función del proceso, el diseño, el tipo de fármaco, el área terapéutica y el usuario final. El crecimiento entre segmentos lo ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Sobre la base del proceso, el mercado de la química medicinal para el descubrimiento de fármacos se segmenta en selección de objetivos, validación de objetivos, identificación de hit-to-lead, optimización de leads y validación de candidatos. En 2022, se espera que el segmento de selección de objetivos domine el mercado global de la química medicinal para el descubrimiento de fármacos, ya que es el primer proceso desde donde comienza el descubrimiento de fármacos y donde se seleccionan los objetivos biológicos en un área de necesidades médicas no satisfechas. Antes de la validación de objetivos, se investigan la eficacia, la seguridad y la variación genética potencial de los objetivos en el proceso de selección de objetivos.

- Sobre la base del diseño, el mercado de la química medicinal para el descubrimiento de fármacos se segmenta en variación basada en fragmentos, diseño de fármacos basado en la estructura, síntesis orientada a la diversidad, quimiogenómica, productos naturales y otros. En 2022, se espera que el segmento de variación basada en fragmentos domine el mercado mundial de la química medicinal para el descubrimiento de fármacos debido al hecho de que se han desarrollado muchos compuestos/inhibidores potentes de diversos objetivos utilizando este método. Además, es un método poderoso para desarrollar compuestos de moléculas pequeñas a partir de fragmentos que se unen débilmente a los objetivos. Otra ventaja de los métodos de química medicinal basados en fragmentos es que ofrecen ahorros en costos experimentales, ofrecen diversos resultados y desempeñan un papel importante en el descubrimiento de fármacos basado en objetivos.

- En función del tipo de fármaco, el mercado de la química medicinal para el descubrimiento de fármacos se segmenta en moléculas pequeñas y productos biológicos. En 2022, se espera que el segmento de moléculas pequeñas domine el mercado debido a que, según el estudio de mercado, la mayoría de las organizaciones de descubrimiento de fármacos están muy centradas en el descubrimiento de moléculas pequeñas y menos centradas en productos biológicos, como proteínas y péptidos, entre otros.

- En función del área terapéutica, el mercado de la química medicinal para el descubrimiento de fármacos se segmenta en oncología, enfermedades infecciosas y del sistema inmunológico, neurología, enfermedades cardiovasculares, enfermedades del sistema digestivo y otras. En 2022, se espera que el segmento de oncología domine el mercado debido a la creciente prevalencia del cáncer y al creciente número de ensayos clínicos y actividades de investigación y desarrollo para el desarrollo de nuevas terapias.

- En función del usuario final, el mercado de la química medicinal para el descubrimiento de fármacos se segmenta en organizaciones de investigación por contrato, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, entre otros. En 2022, se espera que las organizaciones de investigación por contrato dominen el mercado mundial de la química medicinal para el descubrimiento de fármacos, ya que la mayor parte del mercado está ocupado por organizaciones de investigación por contrato, por lo que se espera que dominen el mercado. Además, los principales actores del mercado firman acuerdos de colaboración con organizaciones de investigación por contrato para ensayos clínicos en curso con el fin de lograr el desarrollo y la aprobación temprana de medicamentos.

Análisis a nivel de país del mercado de química medicinal para el descubrimiento de fármacos

Se analiza el mercado de química medicinal para el descubrimiento de fármacos y se proporciona información sobre el tamaño del mercado en función del proceso, el diseño, el tipo de fármaco, el área terapéutica y el usuario final.

Los países cubiertos en el informe del mercado de química medicinal para el descubrimiento de fármacos son Japón, China, Australia, India, Corea del Sur, Singapur, Indonesia, Tailandia, Malasia, Filipinas, Vietnam y el resto de Asia-Pacífico.

Se espera que China domine el mercado debido al creciente esfuerzo por promover el descubrimiento de fármacos locales y la creciente demanda de servicios especializados que impulsan la innovación farmacéutica.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El aumento del gasto sanitario y el aumento de las enfermedades crónicas están impulsando el crecimiento del mercado de la química medicinal para el descubrimiento de fármacos

El mercado de química medicinal para el descubrimiento de fármacos también le proporciona un análisis de mercado detallado para cada país, el crecimiento de la industria de química medicinal para el descubrimiento de fármacos con las ventas de química medicinal para el descubrimiento de fármacos, el impacto del avance en la tecnología de química medicinal para el descubrimiento de fármacos y los cambios en los escenarios regulatorios con su apoyo al mercado de química medicinal para el descubrimiento de fármacos. Los datos están disponibles para el período histórico de 2011 a 2019.

Análisis de la cuota de mercado de la química medicinal para el descubrimiento de fármacos y panorama competitivo

El panorama competitivo del mercado de química medicinal para el descubrimiento de fármacos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de química medicinal para el descubrimiento de fármacos.

Algunos de los principales actores que operan en el mercado de la química medicinal para el descubrimiento de fármacos son Eurofins Scientific, Covance Inc. (ahora parte del Grupo LabCorp), WuXi Apptec, Charles River, Thermo Fisher Scientific, Inc., Evotec SE, Piramal Pharma Solutions, Pfizer, Inc., Certara, USA, Sygnature Discovery Limited, Malvern Panalytical Ltd (empresa matriz Spectris PLC), Jubilant Biosys Ltd. (una empresa limitada de Jubilant Pharmova), Taros Chemicals GmbH & Co. KG, Genscript Biotech Corporation, Nereid Therapeutics Inc., BioBlocks, Inc., Charnwood Molecular LTD, Domainex, Aurigene Pharmaceutical Services Ltd. (una subsidiaria de Dr. Reddy's Laboratories Ltd.), Selvita, Nanosyn y Drug Discovery Alliances Inc., entre otros.

Varios actores del mercado proporcionan las últimas tecnologías de química medicinal para el descubrimiento de fármacos, lo que también está acelerando el mercado de la química medicinal para el descubrimiento de fármacos.

Por ejemplo,

- En noviembre de 2021, Jubilant Biosys Limited amplió sus instalaciones para respaldar los servicios de química de descubrimiento de fármacos y los servicios ADME in vitro. Además, la empresa brinda servicios a Turning Point Therapeutics Inc. para programas de investigación oncológica de moléculas pequeñas. A través de esta expansión, la empresa ha aprovechado su oferta, lo que le ha permitido penetrar en su raíz en el mercado global de química medicinal para el descubrimiento de fármacos.

- En febrero de 2021, Eurofins adquirió Beacon Discovery por sus años de experiencia en el descubrimiento y desarrollo de fármacos y su enfoque innovador. Beacon Discovery también es conocida por su profunda experiencia en la investigación de GPCR (receptor acoplado a proteína G). A través de esta adquisición, la empresa ha fortalecido su presencia en el mercado mundial de la química médica para el descubrimiento de fármacos.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando el mercado de la empresa en la química medicinal para el descubrimiento de fármacos, lo que también proporciona el beneficio para que la organización mejore su oferta para la bronquiectasia.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PROCESS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 POTERS FIVE FORCES

5 ASIA PACIFIC MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN R&D FOR DISCOVERY AND DEVELOPMENT OF NOVEL DRUG MOLECULES

6.1.2 RISE IN CHRONIC DISEASES

6.1.3 INITIATIVES FOR RESEARCH ON RARE DISEASES AND ORPHAN DRUGS

6.1.4 GROWTH IN BIOLOGICS

6.1.5 COLLABORATIONS AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRIES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF FORMULATED DRUG

6.2.2 TECHNICAL RISKS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.2.3 BIOETHICAL ISSUES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIOCHEMICAL, TRANSLATIONAL, AND MOLECULAR STUDIES

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 USE OF ARTIFICIAL INTELLIGENCE IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.4 CHALLENGES

6.4.1 BIOLOGICS NEED SPECIALIST TESTING SERVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 ON ASIA PACIFIC MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS

8.1 OVERVIEW

8.2 TARGET SELECTION

8.3 TARGET VALIDATION

8.4 HIT-TO-LEAD IDENTIFICATION

8.5 LEAD OPTIMIZATION

8.6 CANDIDATE VALIDATION

9 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN

9.1 OVERVIEW

9.2 FRAGMENT-BASED VARIATION

9.3 STRUCTURE BASED DRUG DESIGN

9.4 DIVERSITY ORIENTED SYNTHESIS

9.5 CHEMOGENOMICS

9.6 NATURAL PRODUCTS

9.7 OTHERS

10 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULES

10.3 BIOLOGICS

11 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA

11.1 OVERVIEW

11.2 ONCOLOGY

11.3 NEUROLOGY

11.4 INFECTIOUS AND IMMUNE SYSTEM DISEASES

11.5 CARDIOVASCULAR DISEASES

11.6 DIGESTIVE SYSTEM DISEASES

11.7 OTHERS

12 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER

12.1 OVERVIEW

12.2 CONTRACT RESEARCH ORGANIZATION

12.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.4 ACADEMIC AND RESEARCH INSTITUTES

12.5 OTHERS

13 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 PHILIPPINES

13.1.9 MALAYSIA

13.1.10 INDONESIA

13.1.11 VIETNAM

13.1.12 REST OF ASIA-PACIFIC

14 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EUROFINS SCIENTIFIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LABCORP DRUG DEVELOPMENT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CHARLES RIVER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 EVOTEC SE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 PIRAMAL PHARMA SOLUTIONS

16.6.1 COMPANY SNAPSHOT

16.6.2 SERVICE PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 THERMO FISHER SCIENTIFIC INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.7.4.1 ACQUISITION

16.8 AURIGENE PHARMACEUTICAL SERVICES (A SUBSIDIARY OF DR. REDDY'S LABORATORIES)

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 AURELIA BIOSCIENCES

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIOBLOCKS INC

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CERTARA INC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICE PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 DOMAINEX

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DRUG DISCOVERY ALLIANCES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GENSCRIPT BIOTECH

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 JUBILANT BIOSYS

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NANOSYN

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NEREID THERAPEUTICS

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 PFIZER INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SERVICE PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SELVITA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SERVICE PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.19.4.1 ACQUISITION

16.2 SPECTRIS PLC

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 SYGNATURE DISCOVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TAROS CHEMICAL GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC TARGET SELECTION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC TARGET VALIDATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC HIT-TO-LEAD IDENTIFICATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC LEAD OPTIMIZATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CANDIDATE VALIDATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC FRAGMENT-BASED VARIATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC STRUCTURE BASED DRUG DESIGN IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DIVERSITY ORIENTED SYNTHESIS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CHEMOGENOMICS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC NATURAL PRODUCTS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OTHERS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC SMALL MOLECULES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC BIOLOGICS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ONCOLOGY IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC NEUROLOGY IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC INFECTIOUS AND IMMUNE SYSTEM DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC CARDIOVASCULAR DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC DIGESTIVE SYSTEM DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTIAL AND BIOTECHNOLOGY COMPANIES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ACADEMIC AND RESEARCH INSTITUTES DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 35 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 36 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 37 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 39 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 41 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 42 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 44 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 46 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 47 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 48 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 49 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 56 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 57 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 58 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 59 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 61 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 62 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 63 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 64 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 66 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 67 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 68 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 69 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 71 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 72 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 73 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 74 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 76 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 77 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 78 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 79 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 81 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 82 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 84 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 86 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 87 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 88 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 89 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 REST OF ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: END USER COVERAGE GRID

FIGURE 8 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWTH IN BIOLOGICS DISCOVERY AND COLLABORATION AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 PROCESS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

FIGURE 15 ESTIMATED NEW CANCER CASES IN 2021, IN THE U.S.

FIGURE 16 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2021

FIGURE 17 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2020-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2021

FIGURE 21 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2021

FIGURE 25 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2020-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2021

FIGURE 29 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2021

FIGURE 33 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS (2022-2029)

FIGURE 41 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.