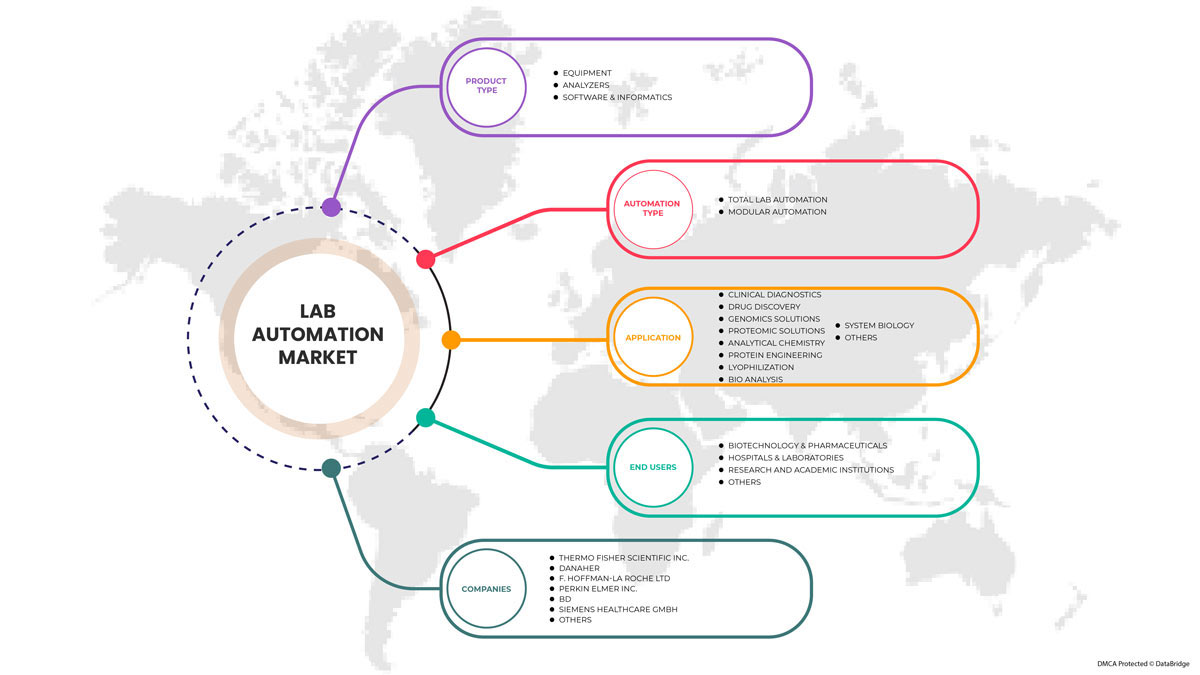

Mercado de automatización de laboratorio de Asia y el Pacífico, por tipo de producto (equipo, software e informática y analizador), tipo de automatización (automatización modular y automatización total de laboratorio), aplicación (descubrimiento de fármacos, diagnóstico clínico, genómica , soluciones de proteómica, bioanálisis, ingeniería de proteínas, liofilización, biología de sistemas, química analítica y otros), usuarios finales (biotecnología y productos farmacéuticos, hospitales y laboratorios, instituciones de investigación y académicas y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de automatización de laboratorios de Asia y el Pacífico

La demanda del mercado de automatización de laboratorios está aumentando debido al avance de la tecnología en todo el mundo. Para el sector de la salud se utilizan equipos y herramientas de automatización de laboratorio. Como el gasto en atención médica ha aumentado debido a varios factores, las principales empresas farmacéuticas y de atención médica tienen que automatizar los laboratorios para brindar servicios de atención médica avanzados en la puerta de su casa en menos tiempo.

La creciente demanda de atención médica en el mercado es la principal causa de la competencia entre las principales empresas de atención médica y farmacéuticas en la mejora de la automatización de laboratorios en todo el mundo. El aumento en el uso de equipos, analizadores y software para el laboratorio se ha aprovechado. El enfoque de los actores del mercado es proporcionar variabilidad de herramientas, equipos, máquinas y técnicas para respaldar el desarrollo y la fabricación de infraestructura de laboratorio automatizada. Los actores del mercado están aportando más inversiones y financiación para construir tecnología y métodos avanzados.

El gasto en atención médica ha aumentado debido a varios factores, como el envejecimiento de la población, la prevalencia de enfermedades crónicas, el aumento de los precios de los medicamentos, los costos de los servicios de atención médica y los costos administrativos, entre otros. Además, los hospitales, los laboratorios privados, los centros de investigación clínica y de diagnóstico están aumentando, lo que aumenta la demanda del mercado de automatización de laboratorios.

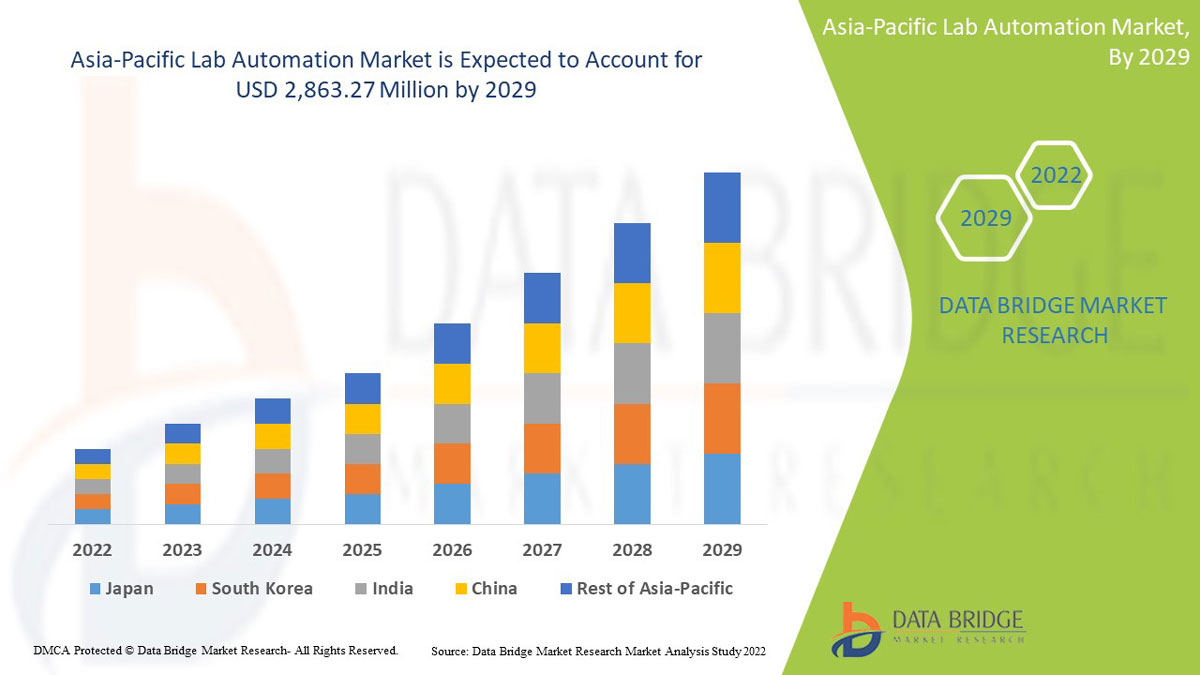

Se espera que el mercado de automatización de laboratorios de Asia-Pacífico gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,6% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2.863,27 millones para 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de producto (equipos, software e informática y analizadores), tipo de automatización (automatización modular y automatización total de laboratorio), aplicación (descubrimiento de fármacos, diagnóstico clínico, soluciones genómicas, soluciones proteómicas, bioanálisis, ingeniería de proteínas, liofilización, biología de sistemas, química analítica y otros), usuarios finales (biotecnología y productos farmacéuticos, hospitales y laboratorios, instituciones académicas y de investigación y otros) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE y Labware, entre otros. |

Definición de mercado

La automatización de laboratorio es la combinación de tecnologías automatizadas en el laboratorio para permitir procesos nuevos y mejorados. Se utiliza como estrategia para investigar, desarrollar, optimizar y aprovechar las tecnologías en el laboratorio. Se utiliza especialmente para automatizar procesos de laboratorio que requieren una intervención humana mínima y eliminan el error humano. La automatización de laboratorio se utiliza con el objetivo de proporcionar pruebas y diagnósticos más eficientes.

La automatización de laboratorios permite a los investigadores y técnicos producir resultados de manera eficiente y eficaz en menos tiempo, lo que se espera que impulse el mercado de la automatización de laboratorios. Además, la rápida propagación de enfermedades, junto con los nuevos descubrimientos en el campo de la atención médica, aumentan la demanda de diagnósticos y tratamientos, lo que se espera que impulse el mercado de la automatización de laboratorios. La alta financiación gubernamental y privada para la investigación y el descubrimiento y la presencia de importantes actores del mercado también contribuyen al crecimiento del mercado.

Dinámica del mercado de automatización de laboratorios

Conductores

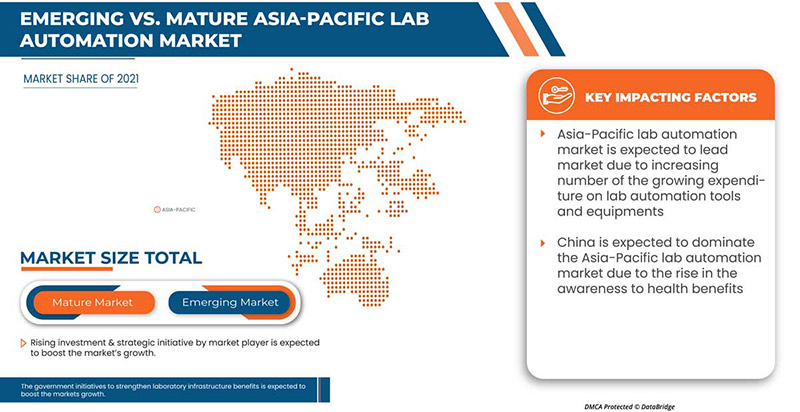

- Aumento de la inversión y de las iniciativas estratégicas de los actores del mercado

El mercado de la automatización de laboratorios está aumentando debido a la gran demanda de servicios automatizados avanzados especializados que eliminen los errores humanos. El objetivo de los actores del mercado y las empresas es proporcionar una variabilidad de herramientas, equipos, máquinas y técnicas para respaldar el desarrollo y la fabricación de infraestructura de laboratorio automatizada. El mercado de la automatización de laboratorios está aumentando debido a la gran demanda de servicios automatizados avanzados especializados que eliminen los errores humanos. Para capturar la participación de mercado global, los actores del mercado están realizando más inversiones y financiación para desarrollar tecnología y métodos avanzados. Estos actores están más centrados en reducir los esfuerzos manuales y el tiempo de trabajo práctico para el proceso tradicionalmente intensivo en mano de obra. Se espera que esto impulse el crecimiento del mercado.

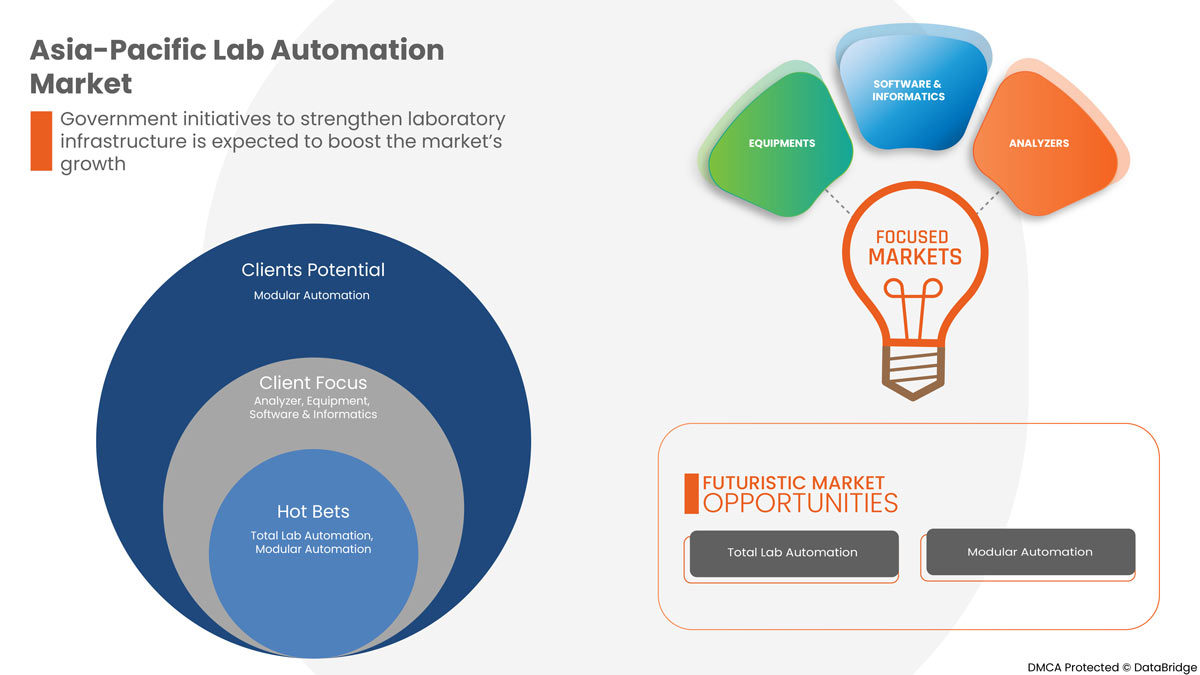

- Iniciativas gubernamentales para fortalecer las infraestructuras de laboratorio

Para fortalecer aún más el sector de la atención médica y la infraestructura de laboratorio, las organizaciones gubernamentales desempeñan un papel importante. La financiación y la iniciativa del gobierno para expandir la automatización de laboratorios ayudarán al crecimiento del mercado y aumentarán el número de actores del mercado. Las colaboraciones y los acuerdos del gobierno con los actores clave del mercado fortalecerán aún más la infraestructura de laboratorio.

- Creciente gasto en herramientas y equipos de automatización de laboratorio

El gasto en herramientas y equipos de automatización de laboratorio va en aumento. Esto se debe principalmente a que la demanda de análisis de laboratorio aumenta rápidamente por diversas razones, como el envejecimiento de la población, el aumento de enfermedades crónicas, el descubrimiento de biomarcadores nuevos y más eficaces y un aumento de las demandas generales de salud o de diagnóstico.

- Reducir los esfuerzos humanos y eliminar el error humano

Existen varias formas tradicionales de reducir los errores humanos, pero desarrollar un sistema para minimizar el riesgo de errores humanos ayudará a garantizar que no se repitan los mismos errores nuevamente. Las instalaciones de fabricación se centran en la creación de sistemas avanzados para utilizar tecnología de inteligencia artificial para reconocer y corregir problemas antes de que ocurran.

Oportunidades

-

Aumento del gasto sanitario

El gasto en atención médica ha aumentado debido a varios factores, como el envejecimiento de la población, la prevalencia de enfermedades crónicas, el aumento de los precios de los medicamentos, los costos de los servicios de atención médica y los costos administrativos, entre otros. Sin embargo, 2020 fue el punto de inflexión en el que los gastos ocuparon el primer lugar debido a la pandemia de COVID-19. Se ha descubierto que en 2020, el gasto en atención médica creció al ritmo de crecimiento más rápido experimentado desde 2002 debido a la pandemia .

-

Iniciativas estratégicas de actores clave

Las principales empresas farmacéuticas y de atención médica han tomado varias iniciativas para automatizar los laboratorios y ofrecer servicios de atención médica avanzados en menos tiempo. La creciente demanda de atención médica en el mercado es la principal causa de competencia entre las principales empresas farmacéuticas y de atención médica en la mejora de la automatización de laboratorios en todo el mundo. Por lo tanto, se espera que las iniciativas estratégicas de los actores del mercado actúen como una oportunidad para el crecimiento del mercado de automatización de laboratorios.

-

Aumento del número de empresas farmacéuticas

La industria farmacéutica ha experimentado un crecimiento significativo durante las últimas dos décadas. El aumento de los ingresos disponibles, el mayor acceso a los servicios de salud, la creciente concienciación sobre la atención sanitaria entre las personas y la mayor penetración de los servicios médicos están haciendo que las empresas farmacéuticas aumenten en número para satisfacer la demanda.

La pandemia de COVID-19 tuvo un gran impacto en la industria farmacéutica debido al aumento de la demanda de servicios médicos y suministros de medicamentos. Las industrias farmacéuticas han estado creciendo rápidamente en todo el mundo para satisfacer la alta demanda de la humanidad y, por lo tanto, el servicio debe brindarse lo antes posible. Por lo tanto, para lograr instalaciones de atención médica avanzadas que brinden un servicio rápido y sin errores en menos tiempo, se necesita la automatización de laboratorios. Por lo tanto, se espera que el aumento en el número de empresas farmacéuticas actúe como una oportunidad para el crecimiento del mercado de automatización de laboratorios.

Restricciones/Desafíos

- Limitación del análisis de nuevos productos complejos

Existen diversos factores que contribuyen a la complejidad de los nuevos productos que se utilizan en los laboratorios automatizados. La interacción constante entre el personal y los fabricantes de dispositivos en las primeras fases del proceso de desarrollo es muy necesaria y se vuelve obligatoria para comprender el funcionamiento de la pieza o la configuración general. Las limitaciones en la detección y el análisis de nuevos productos complejos, como máquinas, herramientas y equipos, están obstaculizando la instalación y el funcionamiento de los laboratorios automatizados en el mercado.

- Alto costo de instalación y configuración

La instalación y configuración de sistemas automatizados de laboratorio son procedimientos mucho más complejos y que requieren mucho trabajo. La instalación de laboratorios automatizados requiere mucho tiempo, esfuerzo, planificación, implementación y aprobaciones de varios departamentos gubernamentales. Además, lo esencial para la instalación de un nuevo laboratorio requiere una inversión crítica en infraestructura debido al alto costo de las máquinas, herramientas y equipos avanzados.

- Actualización, mantenimiento y revisiones periódicas

La operación eficiente de los laboratorios es la principal preocupación después de la instalación. El mantenimiento, la actualización y las revisiones periódicas de los equipos son necesarios para la operación. El gasto que se requiere para esto es uno de los principales factores restrictivos para los actores del mercado. Los propietarios de los laboratorios están obligados por la regulación o el control de calidad a probar sus productos independientemente de las empresas fabricantes para operar sin problemas y evitar circunstancias que puedan frenar el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado de automatización de laboratorios

El COVID-19 ha afectado positivamente al mercado de la automatización. Debido a la pandemia, la salud de las personas se ha visto afectada, por lo que se han realizado muchas pruebas de diagnóstico y ha aumentado la demanda. Los laboratorios privados, los hospitales y la investigación clínica aumentaron debido a la pandemia. Por lo tanto, el COVID-19 aumentó positivamente el mercado de la automatización de laboratorios.

Acontecimientos recientes

- En junio de 2022, BD anunció que había completado la adquisición de Straub Medical AG, una empresa privada. Con esta adquisición, la empresa ha incorporado la valiosa experiencia y conocimientos de Straub Medical AG y ha ampliado su cartera de productos.

- En enero de 2022, QIAGEN anunció que había iniciado nuevas colaboraciones con Atlia Biosystems para proporcionar soluciones de pruebas prenatales no invasivas.

Alcance del mercado de automatización de laboratorios en Asia y el Pacífico

El mercado de automatización de laboratorios de Asia-Pacífico está segmentado por tipo de producto, sistemas automatizados, aplicación y usuario final. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Equipo

- Analizador

- Software e informática

Según el tipo de producto, el mercado de automatización de laboratorio de Asia-Pacífico está segmentado en equipos, analizadores, software e informática.

Sistemas automatizados

- Automatización total del laboratorio

- Automatización de laboratorio modular

Basado en sistemas automatizados, el mercado de automatización de laboratorio de Asia-Pacífico está segmentado en automatización total de laboratorio y automatización de laboratorio modular.

Solicitud

- Diagnóstico clínico

- Descubrimiento de fármacos

- Soluciones genómicas

- Soluciones proteómicas

- Química Analítica

- Ingeniería de proteínas

- Liofilización

- Análisis biológico

- Biología de sistemas

- Otros

Según la aplicación, el mercado de automatización de laboratorio de Asia-Pacífico está segmentado en descubrimiento de fármacos, diagnóstico clínico, soluciones genómicas, soluciones proteómicas, bioanálisis, ingeniería de proteínas, liofilización, biología de sistemas, química analítica y otros.

Usuario final

- Biotecnología y productos farmacéuticos

- Hospitales y laboratorios

- Institutos de investigación y académicos

- Otros

Según el usuario final, el mercado de automatización de laboratorio de Asia-Pacífico está segmentado en biotecnología y productos farmacéuticos, hospitales y laboratorios, instituciones de investigación y académicas, y otros.

Análisis y perspectivas regionales del mercado de automatización de laboratorios de Asia y el Pacífico

Se analiza el mercado de automatización de laboratorio de Asia-Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo de producto, sistemas automatizados, aplicación y usuario final.

Los países cubiertos en el mercado son China, Japón, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico.

Se espera que China domine el mercado de automatización de laboratorios de Asia-Pacífico debido a un número creciente de actividades de investigación junto con la prevalencia de varias empresas farmacéuticas. Se espera que un aumento en la demanda de equipos, analizadores y software impulse el mercado regional en el período previsto.

La sección de regiones del informe también proporciona factores de impacto individuales en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de las marcas de América Central y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de automatización de laboratorios en Asia-Pacífico

El panorama competitivo del mercado de automatización de laboratorios proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de automatización de laboratorios de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de automatización de laboratorio de Asia-Pacífico son QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE y Labware, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen una cuadrícula de posicionamiento de proveedores, un análisis de la línea de tiempo del mercado, una descripción general y una guía del mercado, una cuadrícula de posicionamiento de la empresa, un análisis de la participación de mercado de la empresa, estándares de medición, análisis de Asia-Pacífico frente a la región y de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC LAB AUTOMATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INVESTMENT & STRATEGIC INITIATIVES BY MARKET PLAYERS

6.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN LABORATORY INFRASTRUCTURES

6.1.3 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT

6.1.4 REDUCING HUMAN EFFORTS AND ELIMINATING HUMAN ERROR

6.2 RESTRAINTS

6.2.1 LIMITATION ANALYZING NOVEL COMPLEX PRODUCT

6.2.2 HIGH COST FOR INSTALLATION AND SETUP

6.2.3 UPGRADATION, MAINTENANCE, AND PERIODICAL CHECKUPS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISE IN THE NUMBER OF PHARMA COMPANIES

6.4 CHALLENGES

6.4.1 SLOW ADOPTION OF AUTOMATION AMONG SMALL AND MEDIUM SIZED LABORATORIES

6.4.2 LIMITED FEASIBILITY WITH TECHNOLOGY INTEGRATION IN ANALYTICAL LABS

7 ASIA PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENT

7.2.1 AUTOMATED WORKSTATIONS

7.2.1.1 AUTOMATED LIQUID HANDLING SYSTEMS

7.2.1.2 AUTOMATED INTEGRATED WORKSTATIONS

7.2.1.3 PIPETTING SYSTEMS

7.2.1.4 MICROPLATE WASHERS

7.2.1.5 REAGENT DISPENSERS

7.2.2 MICROPLATE READERS

7.2.2.1 MULTI-MODE MICROPLATE READERS

7.2.2.2 SINGLE-MODE MICROPLATE READERS

7.2.2.3 AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS

7.2.2.4 AUTOMATED ELISA SYSTEMS

7.2.3 OFF-THE-SHELF AUTOMATED WORKCELLS

7.2.4 ROBOTIC SYSTEMS

7.2.4.1 ROBOTIC ARMS

7.2.4.2 TRACK ROBOTS

7.2.5 AUTOMATE STORAGE & RETRIEVALS (ASRS)

7.2.6 OTHERS

7.3 ANALYZER

7.3.1 BIO CHEMISTRY ANALYZERS

7.3.2 HAEMATOLOGY ANALYZERS

7.3.3 IMMUNO-BASED ANALYZERS

7.4 SOFTWARE & INFORMATICS

7.4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS)

7.4.2 ELECTRONIC LABORATORY NOTEBOOK (ELN)

7.4.3 LABORATORY EXECUTION SYSTEMS (LES)

7.4.4 SCIENTIFIC DATA MANAGEMENT SYSTEMS (SDMS)

8 ASIA PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE

8.1 OVERVIEW

8.2 TOTAL LAB AUTOMATION

8.3 MODULAR AUTOMATION

9 ASIA PACIFIC LAB AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL DIAGNOSTICS

9.3 DRUG DISCOVERY

9.4 GENOMICS SOLUTIONS

9.5 PROTEOMIC SOLUTIONS

9.6 ANALYTICAL CHEMISTRY

9.7 PROTEIN ENGINEERING

9.8 BIO ANALYSIS

9.9 SYSTEM BIOLOGY

9.1 OTHERS

10 ASIA PACIFIC LAB AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECHNOLOGY & PHARMACEUTICALS

10.3 HOSPITALS & LABORATORIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 OTHERS

11 ASIA PACIFIC LAB AUTOMATION MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 SOUTH KOREA

11.1.4 INDIA

11.1.5 AUSTRALIA

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 MALAYSIA

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC LAB AUTOMATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 DANAHER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 F. HOFFMANN- LA ROCHE LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 PERKINELMER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AURORA BIOMED INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AZENTA US INC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BIOMERIEUX

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EPPENDORF SE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAMILTON COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 HUDSON ROBOTICS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABLYNX LIMS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LABWARE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SIEMENS HEALTHCARE GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TECAN TRADING AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC EQUIPMENT IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC TOTAL LAB AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MODULAR AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CLINICAL DIAGNOSTICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DRUG DISCOVERY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC GENOMICS SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC PROTEOMIC SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ANALYTICAL CHEMISTRY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PROTEIN ENGINEERING IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BIO ANALYSIS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC SYSTEM BIOLOGY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC BIOTECHNOLOGY & PHARMACEUTICALS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC HOSPITALS & LABORATORIES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC RESEARCH & ACADEMIC INSTITUTES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 CHINA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 CHINA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 45 CHINA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 CHINA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 JAPAN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 55 JAPAN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 JAPAN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 SOUTH KOREA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH KOREA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH KOREA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH KOREA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 INDIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 INDIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 75 INDIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 INDIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 SINGAPORE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SINGAPORE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 SINGAPORE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 THAILAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 THAILAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 THAILAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 THAILAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 THAILAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 THAILAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 105 THAILAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 THAILAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 107 THAILAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 THAILAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 MALAYSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 MALAYSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 MALAYSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 MALAYSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 MALAYSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 115 MALAYSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 INDONESIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDONESIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDONESIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDONESIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 125 INDONESIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 PHILIPPINES LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 PHILIPPINES EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 PHILIPPINES AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 PHILIPPINES MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 PHILIPPINES ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 PHILIPPINES ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 135 PHILIPPINES SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 PHILIPPINES LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 137 PHILIPPINES LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 REST OF ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC LAB AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC LAB AUTOMATION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC LAB AUTOMATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT IS EXPECTED TO DRIVE THE ASIA PACIFIC LAB AUTOMATION MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC LAB AUTOMATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC LAB AUTOMATION MARKET

FIGURE 14 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 19 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, 2021

FIGURE 23 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 31 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 32 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 ASIA-PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 35 ASIA PACIFIC LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.