Asia Pacific Industrial Ethanol Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

22.31 Billion

USD

47.78 Billion

2025

2033

USD

22.31 Billion

USD

47.78 Billion

2025

2033

| 2026 –2033 | |

| USD 22.31 Billion | |

| USD 47.78 Billion | |

|

|

|

|

Segmentación del mercado de etanol industrial en Asia-Pacífico, por materia prima (de origen biológico y sintético), tipo (etanol absoluto, etanol al 95 %, etanol desnaturalizado y otros), aplicación ( pinturas y recubrimientos , productos farmacéuticos, alimentos y bebidas, tintas de impresión, agricultura, soluciones de limpieza doméstica e industrial, cosméticos y cuidado personal, adhesivos y otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de etanol industrial en Asia-Pacífico

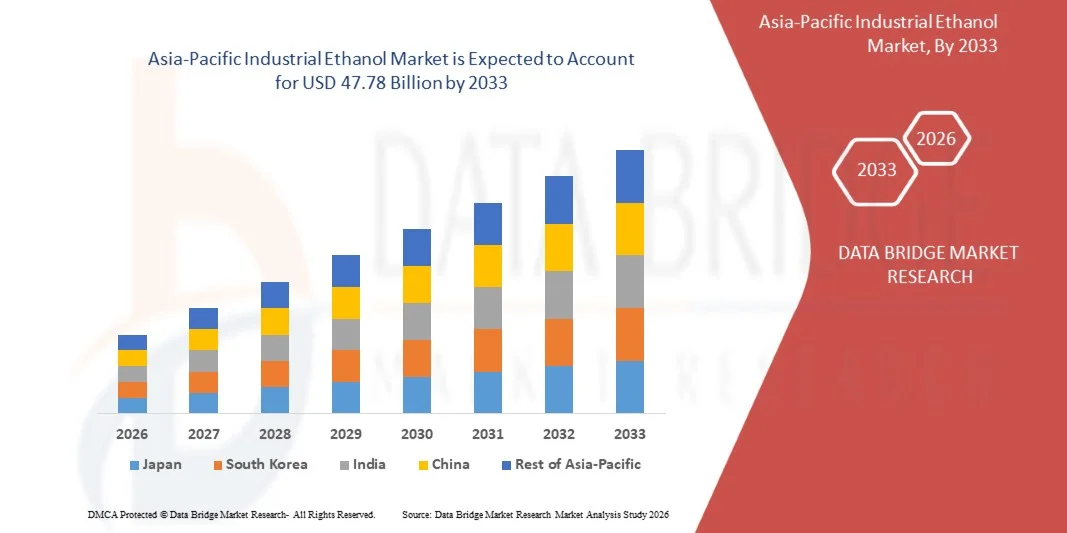

- El tamaño del mercado de etanol industrial de Asia-Pacífico se valoró en USD 22,31 mil millones en 2025 y se espera que alcance los USD 47,78 mil millones para 2033 , con una CAGR del 9,99% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de las industrias de fabricación de productos químicos, productos farmacéuticos, cosméticos, pinturas y revestimientos y cuidado personal.

- Además, la creciente adopción de solventes de origen biológico, el enfoque creciente en materias primas sostenibles y renovables y la expansión del uso de etanol como materia prima industrial están apoyando la expansión del mercado.

Análisis del mercado de etanol industrial en Asia-Pacífico

- El mercado se caracteriza por una fuerte demanda de etanol como disolvente versátil, desinfectante e intermedio en la producción de productos químicos, polímeros y formulaciones farmacéuticas.

- Los fabricantes se centran cada vez más en la producción de etanol de origen biológico y con bajas emisiones de carbono para alinearse con las regulaciones ambientales, los objetivos de sostenibilidad y las estrategias de descarbonización corporativa.

- China dominó el mercado industrial de etanol de Asia-Pacífico con la mayor participación en los ingresos en 2025, atribuido al alto consumo industrial en productos farmacéuticos, químicos, recubrimientos y productos de cuidado personal.

- Se espera que Japón sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de etanol industrial de Asia-Pacífico debido a la creciente adopción de etanol de alta pureza y sostenible en productos farmacéuticos, cosméticos y productos químicos especiales, un enfoque cada vez mayor en procesos de producción más limpios e incentivos regulatorios para soluciones de base biológica.

- El segmento de origen biológico obtuvo la mayor cuota de mercado en 2025, impulsado por la creciente demanda de materias primas renovables y sostenibles, los incentivos gubernamentales para productos químicos ecológicos y la creciente adopción en las industrias farmacéutica, de cuidado personal y química. El etanol de origen biológico es el preferido por su menor huella de carbono y su conformidad con las regulaciones ambientales, lo que lo convierte en una opción popular entre los fabricantes industriales.

Alcance del informe y segmentación del mercado de etanol industrial en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado del etanol industrial en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

• Expansión de las aplicaciones industriales de etanol de base biológica y renovable |

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de etanol industrial en Asia-Pacífico

Creciente demanda de insumos industriales sostenibles y de base biológica

- El creciente enfoque en la sostenibilidad y la reducción de las emisiones de carbono está configurando significativamente el mercado de etanol industrial en Asia-Pacífico, a medida que las industrias buscan alternativas renovables y de origen biológico a los productos químicos de origen fósil. El etanol industrial está ganando terreno gracias a su versatilidad como disolvente, intermediario y desinfectante, a la vez que promueve procesos de producción más limpios. Esta tendencia está fortaleciendo su adopción en los sectores de productos químicos, farmacéuticos, cuidado personal, pinturas y recubrimientos, y fabricación industrial, lo que anima a los productores a mejorar su capacidad y eficiencia.

- La creciente concienciación sobre la responsabilidad ambiental y el cumplimiento normativo ha acelerado el uso de etanol industrial en aplicaciones de química verde. Los fabricantes incorporan cada vez más etanol derivado de materias primas renovables para cumplir los objetivos de sostenibilidad y mejorar el perfil ambiental de los productos finales. Este cambio también impulsa la inversión en tecnologías avanzadas de fermentación y la optimización de las materias primas para mejorar el rendimiento y reducir los costes de producción.

- Las decisiones de compra basadas en la sostenibilidad influyen en los compradores industriales, con un mayor énfasis en la trazabilidad del abastecimiento, la reducción de las emisiones durante el ciclo de vida y el cumplimiento de las normas ambientales. Estos factores permiten a los proveedores de etanol industrial de origen biológico diferenciar sus ofertas, fortalecer los contratos a largo plazo y generar confianza con las industrias transformadoras centradas en los objetivos ESG.

- Por ejemplo, en 2024, BASF en Alemania incrementó el uso de etanol de origen biológico como intermediario en la fabricación de productos químicos y especializados. Estas iniciativas se implementaron para apoyar los compromisos de sostenibilidad y reducir la dependencia de insumos petroquímicos, contribuyendo así a una menor huella de carbono y a una mayor eficiencia de los procesos.

- Si bien la demanda de etanol industrial sigue en aumento, el crecimiento sostenido del mercado depende de la disponibilidad estable de materia prima, tecnologías de producción eficientes y el mantenimiento de la competitividad de costos frente a las alternativas petroquímicas convencionales. Los productores se centran en la escalabilidad, la integración de la cadena de suministro y la innovación de procesos para impulsar la expansión del mercado a largo plazo.

Dinámica del mercado de etanol industrial en Asia-Pacífico

Conductor

Creciente adopción de productos químicos industriales de origen biológico y renovables

- La creciente demanda de insumos industriales renovables y respetuosos con el medio ambiente es un factor clave para el mercado de etanol industrial en Asia-Pacífico. Fabricantes de las industrias química, farmacéutica y de cuidado personal utilizan cada vez más el etanol como disolvente e intermediario de origen biológico para cumplir con las normativas de sostenibilidad y los objetivos corporativos de descarbonización.

- La expansión de las aplicaciones en productos farmacéuticos, desinfectantes, recubrimientos, tintas y productos químicos industriales impulsa el crecimiento del mercado. El etanol industrial ofrece alta pureza, solvencia eficaz y compatibilidad con diversas formulaciones, lo que lo convierte en la opción preferida para múltiples procesos industriales. El mayor énfasis en la higiene y el saneamiento refuerza aún más la demanda.

- Los fabricantes químicos e industriales promueven activamente las formulaciones basadas en etanol mediante la innovación de productos, la optimización de procesos y la elaboración de informes de sostenibilidad. Estos esfuerzos se ven respaldados por regulaciones ambientales más estrictas y la creciente preferencia de los clientes por materiales bajos en carbono y renovables, lo que fomenta las colaboraciones entre los productores de etanol y las industrias de consumo final.

- Por ejemplo, en 2023, Bayer en Alemania reportó un aumento en el consumo de etanol industrial en los procesos de fabricación y formulación farmacéutica. Este cambio fue impulsado por la demanda de solventes de alta pureza que cumplan con las normas y la alineación con las iniciativas de sostenibilidad, lo que mejoró la eficiencia operativa y el cumplimiento normativo.

- A pesar de los fuertes impulsores de la demanda, el crecimiento a largo plazo depende de la gestión de los costos de las materias primas, la eficiencia de la producción y la fiabilidad de las cadenas de suministro. La inversión en tecnologías avanzadas de fermentación, materias primas basadas en residuos y la optimización logística serán cruciales para mantener la competitividad.

Restricción/Desafío

Volatilidad de los precios de las materias primas y restricciones regulatorias

- La fluctuación de los precios y la disponibilidad de materias primas agrícolas como el maíz, la caña de azúcar y los cereales siguen siendo un desafío clave para el mercado de etanol industrial de Asia-Pacífico. La variabilidad en el rendimiento de los cultivos, las condiciones climáticas y la demanda competitiva de etanol combustible pueden afectar los costos de producción y la estabilidad de los precios del etanol industrial.

- Las complejidades regulatorias relacionadas con la manipulación, la tributación y el cumplimiento normativo del alcohol generan desafíos operativos, en particular para el comercio transfronterizo y la distribución industrial. Los estrictos requisitos de licencia y la diversidad de regulaciones entre mercados pueden limitar la flexibilidad y aumentar la carga administrativa para fabricantes y distribuidores.

- Los desafíos de la cadena de suministro y el almacenamiento también afectan el crecimiento del mercado, ya que el etanol industrial requiere una manipulación controlada, una infraestructura de almacenamiento especializada y el cumplimiento de las normas de seguridad. Estos requisitos incrementan los costos operativos y pueden limitar su adopción entre los pequeños usuarios industriales.

- Por ejemplo, en 2024, los distribuidores de productos químicos de Asia-Pacífico que abastecen a fabricantes de recubrimientos y productos farmacéuticos informaron de una presión sobre sus márgenes debido al aumento de los costos de las materias primas agrícolas, el aumento de los precios de la energía y los estrictos requisitos de cumplimiento normativo. Estos factores influyeron en las estrategias de precios, incrementaron los gastos operativos y provocaron retrasos en las decisiones de compra entre los usuarios finales industriales.

- Para abordar estos desafíos será necesario diversificar las fuentes de materia prima, mejorar la eficiencia de la cadena de suministro y armonizar las regulaciones. La inversión en la producción de etanol de segunda generación y a partir de residuos, junto con una mayor colaboración entre productores, organismos reguladores y usuarios finales, será esencial para aprovechar el potencial de crecimiento a largo plazo del mercado global de etanol industrial en Asia-Pacífico.

Análisis del mercado de etanol industrial en Asia-Pacífico

El mercado está segmentado según la materia prima, el tipo y la aplicación.

• Por materia prima

En cuanto a la materia prima, el mercado de etanol industrial de Asia-Pacífico se segmenta en bioetanol y sintético. El segmento de bioetanol registró la mayor participación en los ingresos del mercado en 2025, impulsado por la creciente demanda de materias primas renovables y sostenibles, los incentivos gubernamentales para productos químicos ecológicos y la creciente adopción en las industrias farmacéutica, de cuidado personal y química. El etanol de bioetanol es preferido por su menor huella de carbono y su cumplimiento con las regulaciones ambientales, lo que lo convierte en una opción popular entre los fabricantes industriales.

Se prevé que el segmento sintético experimente el mayor crecimiento entre 2026 y 2033, gracias a un suministro constante, menores costos de producción y su idoneidad para procesos químicos e industriales a gran escala. El etanol sintético se favorece especialmente cuando las aplicaciones de alto volumen y la rentabilidad son cruciales.

• Por tipo

Según el tipo, el mercado de etanol industrial de Asia-Pacífico se segmenta en etanol absoluto, etanol al 95%, etanol desnaturalizado y otros. El segmento de etanol absoluto dominó en 2025 debido a su alta pureza y amplio uso en aplicaciones farmacéuticas, de laboratorio y químicas especializadas. El etanol absoluto ofrece una calidad y un rendimiento consistentes, lo que lo hace crucial para los procesos industriales regulados.

Se espera que el segmento de etanol desnaturalizado experimente la tasa de crecimiento más rápida entre 2026 y 2033, impulsado por su amplia aplicación en pinturas, revestimientos, soluciones de limpieza y productos para el hogar donde se requiere etanol rentable sin necesidad de alta pureza.

• Por aplicación

Según su aplicación, el mercado de etanol industrial de Asia-Pacífico se segmenta en pinturas y recubrimientos, productos farmacéuticos, alimentos y bebidas, tintas de impresión, soluciones de limpieza agrícolas, domésticas e industriales, cosméticos y cuidado personal, adhesivos, entre otros. El segmento farmacéutico registró la mayor participación en los ingresos en 2025, debido a la creciente demanda de etanol como disolvente, desinfectante e intermediario en formulaciones farmacéuticas.

Se espera que el segmento de pinturas y recubrimientos experimente el crecimiento más rápido entre 2026 y 2033, impulsado por la creciente industrialización, el crecimiento de las actividades de construcción y la creciente demanda de formulaciones de recubrimientos ecológicos y de base biológica en Asia-Pacífico.

Análisis regional del mercado de etanol industrial en Asia-Pacífico

- China dominó el mercado industrial de etanol de Asia-Pacífico con la mayor participación en los ingresos en 2025, atribuido al alto consumo industrial en productos farmacéuticos, químicos, recubrimientos y productos de cuidado personal.

- Los consumidores industriales en China priorizan el etanol por su pureza, rentabilidad y versatilidad para múltiples aplicaciones, lo que permite una adopción generalizada en los procesos de fabricación química e industrial.

- Las fuertes capacidades de fabricación, las políticas gubernamentales de apoyo a los productos químicos de origen biológico y la creciente demanda de etanol como materia prima renovable impulsan aún más el dominio del mercado.

Análisis del mercado de etanol industrial en Japón y Asia-Pacífico

Se prevé que el mercado japonés de etanol industrial en Asia-Pacífico experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de etanol de origen biológico y sostenible en los sectores farmacéutico, cosmético y químico especializado. El creciente enfoque en procesos de producción más limpios, el cumplimiento normativo y los avances tecnológicos en la fabricación de etanol impulsan la expansión del mercado. Los usuarios industriales utilizan cada vez más el etanol para aplicaciones de alta pureza y formulaciones ecológicas, lo que impulsa el crecimiento a largo plazo del país.

Cuota de mercado del etanol industrial en Asia-Pacífico

La industria del etanol industrial en Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Corporación Nacional de Cereales, Aceites y Alimentos de China (COFCO, China)

- Anhui BBCA Bioquímica (China)

- Grupo Shandong Xiwang (China)

- Grupo Unión Tailandesa (Tailandia)

- Biorrefinerías de Godavari (India)

- Jubilant Life Sciences (India)

- Mitsui Chemicals (Japón)

- Kuraray Co., Ltd. (Japón)

- Showa Denko (Japón)

- Lotte Chemical (Corea del Sur)

- Wilmar International (Singapur)

- Biocombustibles BPCL (India)

- Bioenergía Devco (China)

- Grupo de destilerías de vino Shanxi Xinghuacun Fen (China)

- Productos biológicos verdes (Japón)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.