Tubos termorretráctiles para el mercado automotriz en Asia-Pacífico, por aplicación (mangueras, conectores, terminales de anillo, empalmes en línea, tuberías de freno , grupos de inyección diésel, protección de cables bajo el capó, tuberías de gas, empalmes en miniatura), material (poliolefina, cloruro de polivinilo, politetrafluoroetileno, etileno propileno fluorado, perfluoroalcoxi alcano, etileno tetrafluoroetileno y otros), color (rojo, amarillo y otros), tipo ( tubos termorretráctiles de pared simple y doble), voltaje (bajo, medio y alto), tipo de combustible (gasolina, diésel/GNC y eléctrico ), canal de venta (OEM y posventa), tipo de vehículo (turismos, vehículos comerciales ligeros, vehículos comerciales pesados y vehículos eléctricos), país (Japón, China, Corea del Sur, India, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas, resto de Asia-Pacífico), tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: Tubos termorretráctiles para el mercado automotriz en Asia-Pacífico

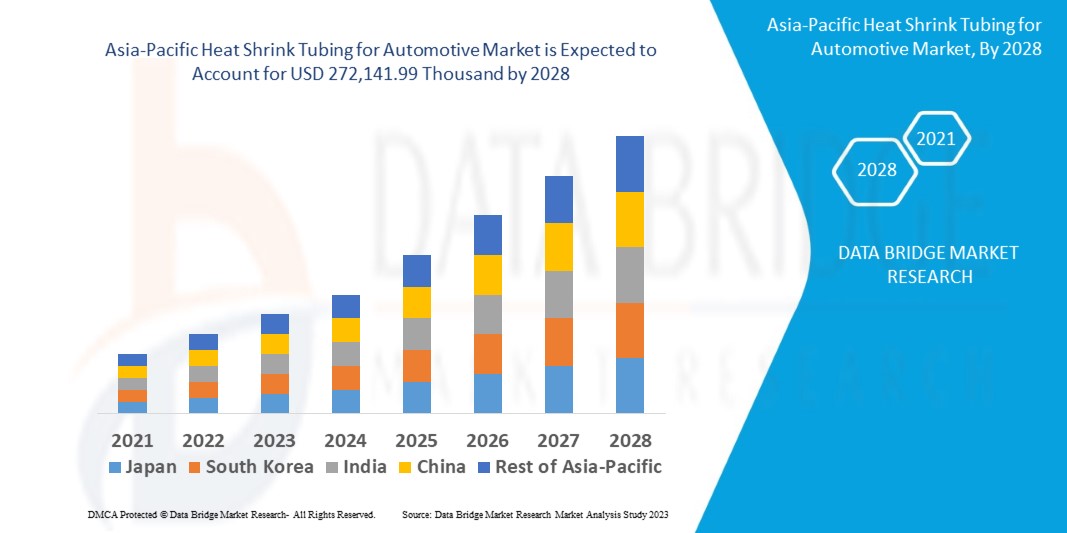

Se prevé que el mercado de tubos termorretráctiles para automoción en Asia-Pacífico experimente un crecimiento durante el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado crecerá con una tasa de crecimiento anual compuesta (TCAC) del 7,1 % durante dicho período y se espera que alcance los 272 141 990 USD para 2028. Se prevé que la creciente demanda de arneses de cableado para sistemas de seguridad automotriz impulse significativamente el crecimiento del mercado.

Los tubos termorretráctiles se utilizan para aislar cables, proporcionando resistencia a la abrasión y protección ambiental a los conductores sólidos trenzados con conexiones, uniones y terminales en instalaciones eléctricas . En general, un tubo con una temperatura de contracción más baja se contrae más rápido. Al envolver conjuntos de cables y componentes eléctricos, los tubos termorretráctiles se contraen radialmente para adaptarse a los contornos del equipo, formando una capa protectora. Ofrecen protección contra la abrasión, los impactos, los cortes, la humedad y el polvo, cubriendo cables individuales o conjuntos completos. Los fabricantes de plásticos empiezan por extruir un tubo termoplástico para crear los tubos termorretráctiles. Los materiales de los tubos termorretráctiles varían según la aplicación prevista.

El aumento de la demanda de una amplia gama de materiales aislantes para el mantenimiento preventivo es el principal factor impulsor del mercado de tubos termorretráctiles para la automoción en Asia-Pacífico. La falta de experiencia de los operadores en la instalación de tubos termorretráctiles puede representar un desafío. Sin embargo, la automatización del proceso de fabricación de tubos termorretráctiles puede representar una oportunidad para el mercado. Las estrictas regulaciones gubernamentales sobre la emisión de gases tóxicos limitan el mercado de tubos termorretráctiles para la automoción en Asia-Pacífico.

El informe del mercado de tubos termorretráctiles para automoción en Asia-Pacífico proporciona detalles sobre la cuota de mercado, nuevos desarrollos y análisis de la cartera de productos, así como el impacto de los actores del mercado nacional y local. Analiza las oportunidades en cuanto a nuevas oportunidades de negocio, cambios en la normativa, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas. Para comprender el análisis y la situación del mercado de tubos termorretráctiles para automoción en Asia-Pacífico, contacte con Data Bridge Market Research para obtener un informe analítico. Nuestro equipo le ayudará a crear una solución que genere impacto en los ingresos para alcanzar su objetivo.

Alcance y tamaño del mercado de tubos termorretráctiles para la industria automotriz en Asia-Pacífico

El mercado de tubos termorretráctiles para automoción en Asia-Pacífico se divide en ocho segmentos principales según la aplicación, el material, el tipo, el canal de venta, el color, el voltaje, el tipo de combustible y el tipo de vehículo. El crecimiento entre segmentos le ayuda a analizar nichos de mercado y estrategias para abordar el mercado, determinar sus principales áreas de aplicación y la diferenciación en sus mercados objetivo.

- En cuanto a su aplicación, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en mangueras, conectores, terminales de anillo, empalmes en línea, tubos de freno, grupos de inyección diésel, protección de cables bajo el capó, tuberías de gas y empalmes miniatura. En 2021, se prevé que el segmento de mangueras domine el mercado debido a la mayor utilidad de los tubos termorretráctiles para cumplir con los requisitos de seguridad de las mangueras.

- En cuanto a los materiales, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en poliolefina, cloruro de polivinilo, politetrafluoroetileno, etileno propileno fluorado, perfluoroalcoxi alcano, etileno tetrafluoroetileno, entre otros. En 2021, se prevé que el segmento de poliolefinas domine el mercado gracias a su flexibilidad y rápida contracción. Además, resiste el contacto con la soldadura.

- En cuanto al color, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en rojo, amarillo y otros. En 2021, se espera que el segmento rojo domine el mercado, ya que se utiliza ampliamente en aplicaciones importantes como conectores de batería, entre otras.

- Según el tipo, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en tubos termorretráctiles de pared simple y de pared doble. En 2021, se prevé que el segmento de tubos termorretráctiles de pared simple domine el mercado, ya que es el más utilizado gracias a su buen rendimiento, eficiencia y bajo costo.

- En función del voltaje, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en bajo, medio y alto voltaje. En 2021, se prevé que el segmento de bajo voltaje domine el mercado debido al mayor número actual de aplicaciones automotrices de bajo voltaje.

- Según el tipo de combustible, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en gasolina/diésel, GNC y electricidad. En 2021, se prevé que el segmento de gasolina domine el mercado, ya que actualmente muchos automóviles utilizan este tipo de combustible debido a su buena capacidad de combustión.

- Según el canal de venta, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en OEM y posventa. En 2021, se prevé que el segmento OEM domine el mercado, ya que ofrece productos y servicios de la mejor calidad.

- Según el tipo de vehículo, el mercado de tubos termorretráctiles para automoción en Asia-Pacífico se segmenta en turismos, vehículos comerciales ligeros (LCV), vehículos industriales pesados (HCV) y vehículos eléctricos. En 2021, se prevé que el segmento de turismos domine el mercado debido a la creciente demanda de transporte de pasajeros para la creciente población.

Análisis por país del mercado de tubos termorretráctiles para la industria automotriz en Asia-Pacífico

Se analiza el mercado de tubos termorretráctiles para automóviles de Asia-Pacífico y se proporciona información sobre el tamaño del mercado por país, aplicación, material, tipo, canal de venta, color, voltaje, tipo de combustible y tipo de vehículo como se menciona anteriormente.

Los países cubiertos en el informe del mercado de tubos termorretráctiles para automoción de Asia-Pacífico son Japón, China, Corea del Sur, India, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico.

China domina la región Asia-Pacífico debido a la mayor presencia de fabricantes de tubos termorretráctiles y una enorme infraestructura industrial.

La sección de países del informe también presenta los factores que impactan cada mercado y los cambios en la regulación que impactan las tendencias actuales y futuras. Datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, las leyes regulatorias y los aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado en cada país. Además, se considera la presencia y disponibilidad de marcas de Asia Pacífico y los desafíos que enfrentan debido a la alta o escasa competencia de marcas locales y nacionales, así como el impacto de los canales de venta, al proporcionar un análisis de pronóstico de los datos del país.

El aumento de los avances tecnológicos para aumentar el rendimiento de los vehículos está impulsando el crecimiento del mercado de tubos termorretráctiles para el mercado automotriz en Asia-Pacífico.

El mercado de tubos termorretráctiles para automoción de Asia-Pacífico también ofrece un análisis detallado del crecimiento de cada país en un mercado específico. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y la cuota de mercado de tubos termorretráctiles para la industria automotriz en Asia-Pacífico

El panorama competitivo del mercado de tubos termorretráctiles para automoción en Asia-Pacífico ofrece información detallada por competidor. La información incluye una descripción general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, plantas de producción, fortalezas y debilidades, lanzamiento de productos, líneas de prueba, aprobaciones, patentes, alcance y variedad de productos, dominio de aplicaciones y curva de vida útil tecnológica. Los datos anteriores se refieren únicamente al enfoque de la empresa en el mercado de tubos termorretráctiles para automoción en Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de tubos termorretráctiles para automoción en Asia-Pacífico son Qualtek Electronics Corp., ABB, SHAWCOR, Sumitomo Electric Industries, Ltd., Zeus Industrial Products, Inc., HellermannTyton, Shenzhen Woer Heat - Shrinkable Material Co., Ltd., 3M, Dasengh, Inc., Huizhou Guanghai Electronic Insulation Materials Co., Ltd., Alpha Wire, GREMCO GmbH, Dee Five Shrink Insulations Pvt. Ltd., The Zippertubing Company, Suzhou Feibo Cold and Heat Shrinking Co., Ltd., Paras Enterprises, Molex, TE Connectivity, Panduit, entre otros.

Numerosas empresas de todo el mundo también están firmando numerosos contratos y acuerdos, lo que también está acelerando el mercado de tubos termorretráctiles para automoción en Asia-Pacífico.

Por ejemplo,

- En abril de 2021, Alpha Wire lanzó la última incorporación a su familia de cableado premium Xtra-Guard. Los nuevos cables Xtra-Guard Flex TPE garantizan el rendimiento y la fiabilidad en condiciones industriales adversas. Con esto, la empresa amplió su gama de accesorios para cables.

- En abril de 2019, Suzhou Feibo Cold and Heat Shrinking Co., Ltd. adquirió su equipo de producción de tubos termorretráctiles. Esta adquisición mejoró la producción de tubos termorretráctiles en la empresa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 APPLICATION TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS

5.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

5.1.3 INCREASING VEHICLE SALES AND DEMAND FOR PREMIUM VEHICLES

5.1.4 INCREASING DEMAND FOR WIDE RANGE OF INSULATING MATERIAL FOR PREVENTIVE MAINTENANCE

5.2 RESTARINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

5.2.2 TRADE BARRIERS IN LEAST DEVELOPED COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC ACQUISITIONS & PARTNERSHIPS BETWEEN ORGANIZATIONS

5.3.2 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

5.3.3 INCREASE IN PENETRATION OF ELECTRIC VEHICLE ACROSS THE GLOBE

5.3.4 EASY PRODUCTION OF HEAT SHRINK TUBING PRODUCTS

5.4 CHALLENGES

5.4.1 INCREASE IN PRICES OF RAW MATERIALS FOR TUBING

5.4.2 AVAILABILITY OF DUPLICATE & INEXPENSIVE PRODUCTS IN THE MARKET

5.4.3 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE

6 IMPACT ANALYSIS OF COVID-19 ON ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.1 AFTERMATH OF ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.2 OPPORTUNITIES FOR THE MARKET POST-COVID-19 PANDEMIC

6.3 IMPACT ON SUPPLY, DEMAND, AND PRICES

6.4 CONCLUSION

7 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 FUEL DELIVERY SYSTEM HOSES

7.2.3 BRAKING SYSTEM HOSES

7.2.4 TURBOCHARGER HOSES

7.2.5 POWER STEERING SYSTEM HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 wire to wire

7.3.1.2 wire to board

7.3.1.3 board to board

7.3.2 BY SYSTEM TYPE

7.3.2.1 Unsealed

7.3.2.2 sealed

7.3.3 BY APPLICATION

7.3.3.1 htat

7.3.3.2 atum

7.3.3.3 cgpt

7.3.3.4 LSTT<150 C

7.3.3.5 others

7.4 RING TERMINAL

7.4.1 12-10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 BRAKE PIPES

7.7 DIESEL INJECTION CLUSTERS

7.8 UNDER BONNET CABLE PROTECTION

7.9 GAS PIPES

7.1 MINIATURE SPLICES

8 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYVINYL CHLORIDE

8.4 POLYTETRAFLUOROETHYLENE

8.5 FLOURINATED ETHYLENE PROPYLENE

8.6 PERFLUOROALKOXY ALKANES

8.7 ETHYLENE TETRAFLUORO ETHYLENE

8.8 OTHERS

9 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE

10.1 OVERVIEW

10.2 SINGLE WALL SHRINK TUBING

10.3 DUAL WALL SHRINK TUBING

11 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE

11.1 OVERVIEW

11.2 LOW VOLTAGE

11.3 MEDIUM VOLTAGE

11.4 HIGH VOLTAGE

12 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE

12.1 OVERVIEW

12.2 PETROL

12.3 DIESEL/CNG

12.4 ELECTRIC

13 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 PASSENGER CARS

14.2.1 BY TYPE

14.2.1.1 SUV

14.2.1.2 SEDAN

14.2.1.3 CROSSOVER

14.2.1.4 COUPE

14.2.1.5 HATCHBACK

14.2.1.6 MPV

14.2.1.7 CONVERTIBLE

14.2.1.8 OTHERS

14.2.2 BY APPLICATION

14.2.2.1 HOSES

14.2.2.2 CONNECTORS

14.2.2.3 RING TERMINALS

14.2.2.4 IN-LINE SPLICES

14.2.2.5 BRAKING PIPES

14.2.2.6 DIESEL INJECTION CLUSTERS

14.2.2.7 UNDER BONNET CABLE PROTECTION

14.2.2.8 GAS PIPES

14.2.2.9 MINIATURE SPLICES

14.3 LCV

14.3.1 BY TYPE

14.3.1.1 PICKUP TRUCKS

14.3.1.2 VANS

14.3.1.2.1 CARGO VANS

14.3.1.2.2 PASSENGER VANS

14.3.1.3 MINI BUS

14.3.1.4 COACHES

14.3.1.5 OTHERS

14.3.2 BY APPLICATION

14.3.2.1 HOSES

14.3.2.2 CONNECTORS

14.3.2.3 RING TERMINALS

14.3.2.4 IN-LINE SPLICES

14.3.2.5 BRake PIPES

14.3.2.6 DIESEL INJECTION CLUSTERS

14.3.2.7 UNDER BONNET CABLE PROTECTION

14.3.2.8 GAS PIPES

14.3.2.9 MINIATURE SPLICES

14.4 ELECTRIC VEHICLE

14.4.1 BY TYPE

14.4.1.1 BATTERY OPERATED VEHICLES

14.4.1.2 PLUGIN VEHICLES

14.4.1.3 HYBRID VEHICLES

14.4.1.4 FUEL CELL ELECTRIC VEHICLES

14.4.2 BY APPLICATION

14.4.2.1 HOSES

14.4.2.2 CONNECTORS

14.4.2.3 RING TERMINALS

14.4.2.4 IN-LINE SPLICES

14.4.2.5 BRAKING PIPES

14.4.2.6 DIESEL INJECTION CLUSTERS

14.4.2.7 UNDER BONNET CABLE PROTECTION

14.4.2.8 GAS PIPES

14.4.2.9 MINIATURE SPLICES

14.5 HCV

14.5.1 BY TYPE

14.5.1.1 TRUCKS

14.5.1.1.1 DUMP TRUCKS

14.5.1.1.2 TOW TRUCKS

14.5.1.1.3 CEMENT TRUCKS

14.5.1.2 BUSES

14.5.2 BY APPLICATION

14.5.2.1 HOSES

14.5.2.2 CONNECTORS

14.5.2.3 RING TERMINALS

14.5.2.4 IN-LINE SPLICES

14.5.2.5 BRAKING PIPES

14.5.2.6 DIESEL INJECTION CLUSTERS

14.5.2.7 UNDER BONNET CABLE PROTECTION

14.5.2.8 GAS PIPES

14.5.2.9 MINIATURE SPLICES

15 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 INDIA

15.1.4 SOUTH KOREA

15.1.5 AUSTRALIA

15.1.6 INDONESIA

15.1.7 THAILAND

15.1.8 MALAYSIA

15.1.9 SINGAPORE

15.1.10 PHILIPPINES

15.1.11 REST OF ASIA-PACIFIC

16 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TE CONNECTIVITY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 SHAWCOR

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE AANLYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HELLERMANNTYTON

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOILIO

18.5.4 RECENT DEVELOPMENT

18.6 AUTOSPARKS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ALPHA WIRE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE SHRINK INSULATION PVT. LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 DASENGH, INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 FLEX WIRES INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GREMCO GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO.,LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVLOPMENT

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 3M

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MOLEX

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 RADPOL S.A.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SUZHOU FEIBO COLD AND HEAT SHRINKING CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TECHFLEX, INC.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 THE ZIPPERTUBING COMPANY

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 TEXCAN

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 2 ASIA PACIFIC HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 ASIA PACIFIC HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 4 ASIA PACIFIC CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 5 ASIA PACIFIC CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 6 ASIA PACIFIC CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 7 ASIA PACIFIC CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 8 ASIA PACIFIC RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 9 ASIA PACIFIC RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 10 ASIA PACIFIC IN-LINE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 11 ASIA PACIFIC BRAKE PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 ASIA PACIFIC DIESEL INJECTION CLUSTERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 ASIA PACIFIC UNDER BONNET CABLE PROTECTION IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 ASIA PACIFIC GAS PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 15 ASIA PACIFIC MINIATURE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 17 ASIA PACIFIC POLYOLEFIN IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 ASIA PACIFIC POLYVINYL CHLORIDE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 19 ASIA PACIFIC POLYTETRAFLUOROETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 ASIA PACIFIC FLUORINATED ETHYLENE PROPYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 ASIA PACIFIC PERFLUOROALKOXY ALKANES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 22 ASIA PACIFIC ETHYLENE TETRAFLUORO ETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 ASIA PACIFIC OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 25 ASIA PACIFIC RED IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 26 ASIA PACIFIC YELLOW IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 ASIA PACIFIC OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 29 ASIA PACIFIC SINGLE WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 ASIA PACIFIC DUAL WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 32 ASIA PACIFIC LOW VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 ASIA PACIFIC MEDIUM VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 ASIA PACIFIC HIGH VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 36 ASIA PACIFIC PETROL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 ASIA PACIFIC DIESEL/CNG IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 ASIA PACIFIC ELECTRIC IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 40 ASIA PACIFIC OEM IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 ASIA PACIFIC AFTERMARKET IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 42 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 ASIA PACIFIC PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 44 ASIA PACIFIC PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 ASIA PACIFIC PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 46 ASIA PACIFIC LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 47 ASIA PACIFIC LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 ASIA PACIFIC VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 49 ASIA PACIFIC LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 50 ASIA PACIFIC ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 51 ASIA PACIFIC ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 52 ASIA PACIFIC ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 53 ASIA PACIFIC HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 54 ASIA PACIFIC HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 ASIA PACIFIC TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 ASIA PACIFIC HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 81 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 82 CHINA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 CHINA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 84 CHINA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 CHINA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 86 CHINA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 88 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 89 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 90 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 91 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 92 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 93 CHINA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 94 CHINA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 CHINA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 96 CHINA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 CHINA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 CHINA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 99 CHINA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 100 CHINA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 101 CHINA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 102 CHINA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 103 CHINA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 104 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 105 JAPAN HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 106 JAPAN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 107 JAPAN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 108 JAPAN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 109 JAPAN RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 110 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 111 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 112 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 113 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 114 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 115 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 116 JAPAN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 117 JAPAN PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 118 JAPAN PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 119 JAPAN LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 120 JAPAN VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 121 JAPAN LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 122 JAPAN HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 123 JAPAN TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 124 JAPAN HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 125 JAPAN ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 126 JAPAN ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 127 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 128 INDIA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 129 INDIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 130 INDIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 131 INDIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 132 INDIA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 133 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 134 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 135 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 136 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 137 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 138 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 139 INDIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 140 INDIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 141 INDIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 142 INDIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 143 INDIA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 144 INDIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 145 INDIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 146 INDIA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 147 INDIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 148 INDIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 149 INDIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 150 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 151 SOUTH KOREA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 152 SOUTH KOREA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 153 SOUTH KOREA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 154 SOUTH KOREA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 155 SOUTH KOREA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 156 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 157 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 158 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 159 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 160 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 161 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 162 SOUTH KOREA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 163 SOUTH KOREA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 164 SOUTH KOREA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 165 SOUTH KOREA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 166 SOUTH KOREA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 167 SOUTH KOREA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 168 SOUTH KOREA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 169 SOUTH KOREA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 170 SOUTH KOREA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 171 SOUTH KOREA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 172 SOUTH KOREA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 173 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 174 AUSTRALIA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 175 AUSTRALIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 176 AUSTRALIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 177 AUSTRALIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 178 AUSTRALIA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 179 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 180 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 181 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 182 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 183 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 184 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 185 AUSTRALIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 186 AUSTRALIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 187 AUSTRALIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 188 AUSTRALIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 189 AUSTRALIA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 190 AUSTRALIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 191 AUSTRALIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 192 AUSTRALIA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 193 AUSTRALIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 194 AUSTRALIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 195 AUSTRALIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 196 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 197 INDONESIA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 198 INDONESIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 199 INDONESIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 200 INDONESIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 201 INDONESIA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 202 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 203 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 204 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 205 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 206 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 207 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 208 INDONESIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 209 INDONESIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 210 INDONESIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 211 INDONESIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 212 INDONESIA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 213 INDONESIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 214 INDONESIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 215 INDONESIA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 216 INDONESIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 217 INDONESIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 218 INDONESIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 219 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 220 THAILAND HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 221 THAILAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 222 THAILAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 223 THAILAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 224 THAILAND RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 225 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 226 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 227 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 228 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 229 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 230 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 231 THAILAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 232 THAILAND PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 233 THAILAND PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 234 THAILAND LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 235 THAILAND VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 236 THAILAND LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 237 THAILAND HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 238 THAILAND TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 239 THAILAND HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 240 THAILAND ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 241 THAILAND ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 242 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 243 MALAYSIA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 244 MALAYSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 245 MALAYSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 246 MALAYSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 247 MALAYSIA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 248 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 249 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 250 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 251 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 252 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 253 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 254 MALAYSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 255 MALAYSIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 256 MALAYSIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 257 MALAYSIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 258 MALAYSIA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 259 MALAYSIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 260 MALAYSIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 261 MALAYSIA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 262 MALAYSIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 263 MALAYSIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 264 MALAYSIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 265 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 266 SINGAPORE HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 267 SINGAPORE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 268 SINGAPORE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 269 SINGAPORE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 270 SINGAPORE RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 271 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 272 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 273 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 274 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 275 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 276 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 277 SINGAPORE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 278 SINGAPORE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 279 SINGAPORE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 280 SINGAPORE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 281 SINGAPORE VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 282 SINGAPORE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 283 SINGAPORE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 284 SINGAPORE TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 285 SINGAPORE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 286 SINGAPORE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 287 SINGAPORE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 288 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 289 PHILIPPINES HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 290 PHILIPPINES CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 291 PHILIPPINES CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 292 PHILIPPINES CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 293 PHILIPPINES RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 294 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 295 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 296 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 297 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 298 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 299 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 300 PHILIPPINES HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 301 PHILIPPINES PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 302 PHILIPPINES PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 303 PHILIPPINES LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 304 PHILIPPINES VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 305 PHILIPPINES LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 306 PHILIPPINES HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 307 PHILIPPINES TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 308 PHILIPPINES HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 309 PHILIPPINES ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 310 PHILIPPINES ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 311 REST OF ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

Lista de figuras

FIGURE 1 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS & RISE IN TECHNOLOGICAL ADVANCEMENTS TO IMPROVE VEHICLE PERFORMANCE IS EXPECTED TO DRIVE ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN 2021 & 2028

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

FIGURE 14 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION, 2020

FIGURE 15 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY MATERIAL, 2020

FIGURE 16 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COLOUR, 2020

FIGURE 17 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY TYPE, 2020

FIGURE 18 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VOLTAGE, 2020

FIGURE 19 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY FUEL TYPE, 2020

FIGURE 20 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY SALES CHANNEL, 2020

FIGURE 21 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2020

FIGURE 22 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SNAPSHOT (2020)

FIGURE 23 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020)

FIGURE 24 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 25 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 26 ASIA-PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION (2021-2028)

FIGURE 27 ASIA PACIFIC HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.