Asia Pacific Graphite Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8,810,314.29 Million

USD

15,913,167.87 Million

2022

2030

USD

8,810,314.29 Million

USD

15,913,167.87 Million

2022

2030

| 2023 –2030 | |

| USD 8,810,314.29 Million | |

| USD 15,913,167.87 Million | |

|

|

|

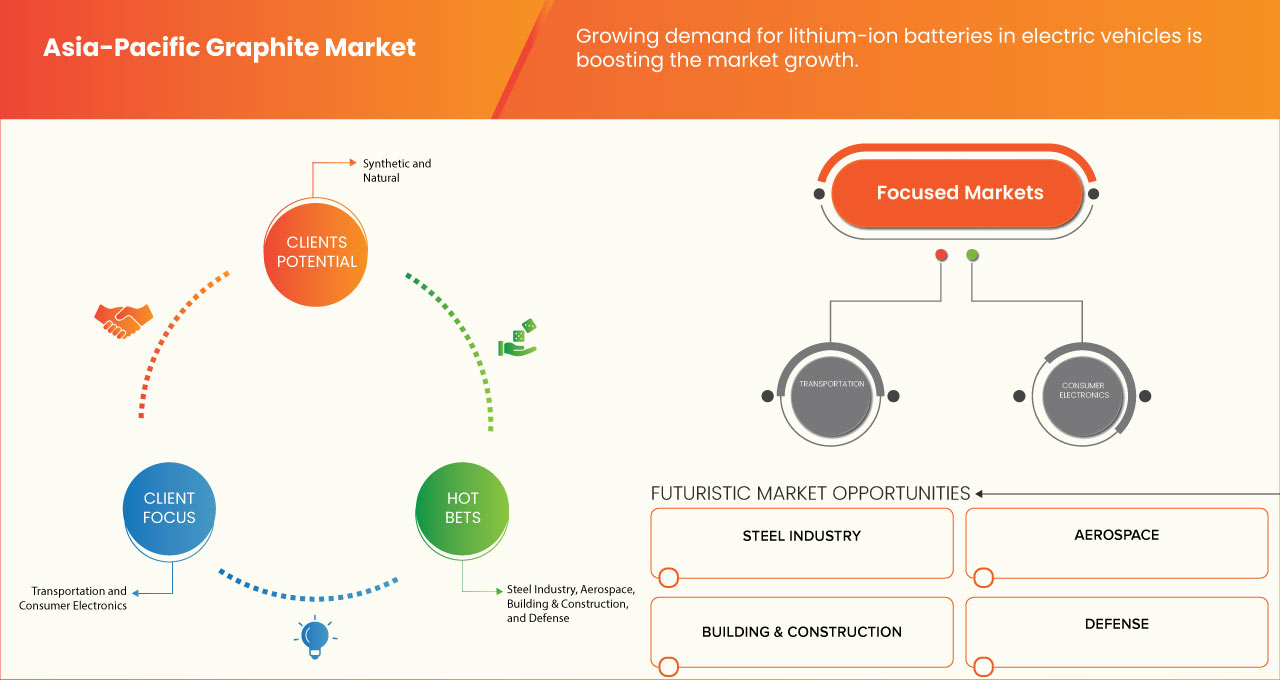

Mercado de grafito de Asia y el Pacífico, por tipo de producto (sintético y natural), forma física (aditivos en escamas, polvo, escamas expandibles, pellets y películas y láminas), aplicación ( electrónica de consumo , transporte, industrial, construcción y edificación, diagnóstico médico y defensa): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de grafito en Asia-Pacífico

El uso indispensable del grafito en la industria del acero y los refractarios y la versatilidad y la excepcional conductividad eléctrica del grafito, que lo convierten en un material fundamental en la industria de la electrónica de consumo, son algunos de los factores que impulsan el crecimiento del mercado. Sin embargo, la principal limitación que afecta negativamente al crecimiento del mercado son los problemas asociados con la disponibilidad y los precios del grafito y sus precursores.

Se espera que las iniciativas estratégicas adoptadas por los actores clave del mercado brinden oportunidades para el crecimiento del mercado. Sin embargo, se prevé que las preocupaciones ambientales causadas por los precursores de grafito y los productos finales supongan un desafío para el crecimiento del mercado.

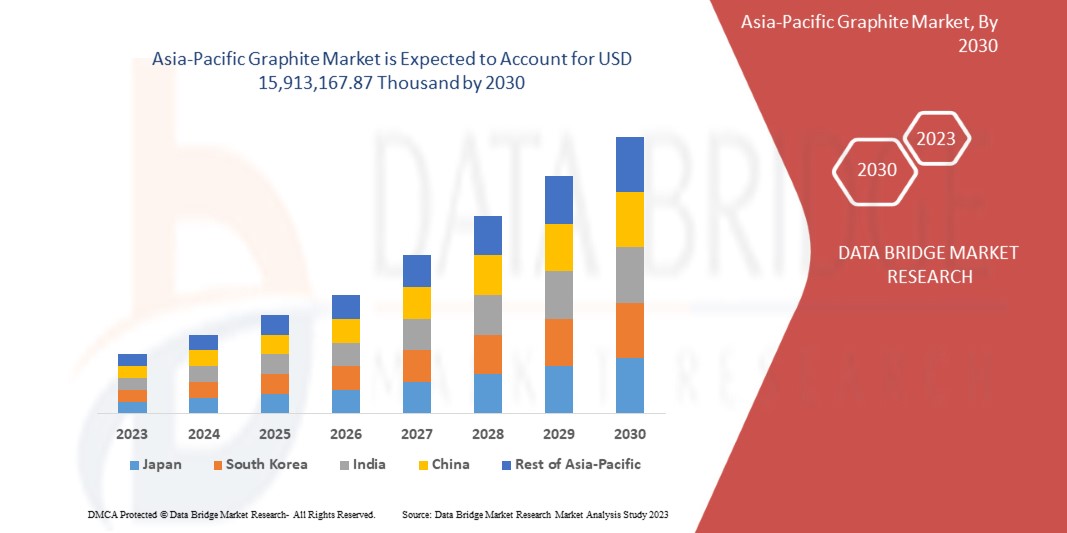

Data Bridge Market Research analiza que se espera que el mercado de grafito de Asia-Pacífico alcance los USD 15.913.167,87 mil para 2030 desde USD 8.810.314,29 mil en 2022, creciendo con una CAGR sustancial del 7,8% en el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable 2015-2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Tipo de producto (sintético y natural), forma física (aditivos en escamas, polvo, escamas expandibles, pellets y películas y láminas), aplicación (electrónica de consumo, transporte, industria, construcción, diagnóstico médico y defensa) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Australia, Tailandia, Singapur, Filipinas, Malasia, Indonesia y el resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

TOKAI CARBON, GrafTech International, SGL Carbon, Mersen, Toyo Tanso Co., Ltd., HEG Limited, Nippon Carbon Co Ltd., Superior Graphite, Qingdao Tennry Carbon Co., Ltd. y Resonac Holdings Corporation, entre otros. |

Definición de mercado

El grafito es una forma natural de carbono que es un material industrial clave que se utiliza para diversos fines. Está compuesto principalmente de átomos de carbono dispuestos en una estructura reticular hexagonal. En el contexto del mercado, el grafito se define típicamente como un mineral que se extrae y procesa por sus propiedades únicas, que incluyen alta conductividad, resistencia a altas temperaturas y cualidades de lubricación. El grafito se usa ampliamente como un componente esencial en varias industrias, como la metalurgia, la electrónica, la automotriz, la aeroespacial y la energía, donde sirve como un material crucial en aplicaciones, como electrodos, lubricantes , refractarios y como material estructural en forma de compuestos.

Dinámica del mercado de grafito en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todos ellos se analizan en detalle a continuación:

Conductores

- Uso indispensable del grafito en la industria siderúrgica y refractaria

La principal aplicación del grafito sintético es la fabricación de electrodos de grafito, que son capaces de soportar corrientes eléctricas extremadamente altas. Estos electrodos se forman moldeando el grafito sintético inmediatamente después de su producción. Los electrodos de grafito son fundamentales en la fabricación de acero en hornos de arco eléctrico (EAF). Sirven como materiales conductores que transfieren energía eléctrica al EAF, donde crean arcos de alta temperatura para fundir chatarra de acero y otras materias primas. Los electrodos de grafito deben soportar calor extremo y estrés mecánico durante este proceso. El grafito se utiliza para revestir cucharas y otros recipientes utilizados en el proceso de fabricación de acero. Proporciona una excelente resistencia térmica, lo que permite el transporte de acero fundido desde el horno hasta el área de fundición.

Los aditivos de grafito se utilizan para producir materiales refractarios para entornos de alta temperatura, como revestimientos para hornos, estufas, incineradores y reactores. Los refractarios son el segundo mercado más grande para el grafito después de los electrodos. El grafito se utiliza para aumentar la eficacia del producto refractario final al aumentar la conductividad térmica, disminuir el gradiente térmico entre las caras frías y calientes del producto, reduciendo así la expansión, repeliendo la escoria fundida, aumentando la vida útil del producto, aumentando la capacidad del producto para soportar choques térmicos/corrosión, mejorando así el rendimiento a temperaturas más altas y reduciendo la humectabilidad de los metales fundidos para que no afecten al producto final.

Las propiedades únicas del grafito lo hacen indispensable en la industria del acero y los refractarios, donde contribuye a la eficiencia, la seguridad y la calidad general de los procesos de producción de acero y aplicaciones relacionadas, lo que impulsa el crecimiento del mercado.

- Versatilidad y conductividad eléctrica excepcional del grafito

El grafito se presenta como un componente crucial en diversos aspectos del diseño y la funcionalidad de los dispositivos electrónicos. Sus extraordinarias propiedades han permitido la integración perfecta de tecnologías avanzadas en la vida cotidiana de las personas, desde su papel en las baterías que alimentan los teléfonos inteligentes y los ordenadores portátiles hasta su presencia en soluciones de gestión térmica e incluso como componente fundamental en las pantallas táctiles.

Se utiliza como material de ánodo en baterías de iones de litio , que se utilizan ampliamente en teléfonos inteligentes, computadoras portátiles y otros dispositivos electrónicos portátiles. El ánodo de grafito ayuda a almacenar y liberar energía eléctrica de manera eficiente. También se utiliza en soluciones de gestión térmica, como disipadores de calor de grafito y materiales de interfaz térmica (TIM) para disipar el calor de los componentes electrónicos, lo que garantiza que funcionen a temperaturas óptimas. Los dispositivos electrónicos, especialmente aquellos con pantallas táctiles o teclados, utilizan grafito como lubricante o como componente en tintas conductoras para facilitar interacciones táctiles o de pulsación de teclas suaves y confiables.

Oportunidad

- Creciente demanda de baterías de iones de litio para vehículos eléctricos

El cambio hacia soluciones de transporte más limpias y sostenibles ha provocado un aumento sustancial en la adopción de vehículos eléctricos. Esta tendencia está impulsada por preocupaciones ambientales, incentivos gubernamentales y la preferencia de los consumidores por los vehículos eléctricos. La tecnología de baterías de iones de litio ha mejorado significativamente en términos de densidad energética, velocidad de carga y rendimiento general. Estos avances han hecho que las baterías de iones de litio sean la opción preferida por los fabricantes de vehículos eléctricos.

Por lo tanto, se espera que la creciente demanda de vehículos eléctricos y sus baterías de iones de litio asociadas se acelere a medida que estos factores continúen evolucionando, lo que se espera que cree oportunidades para el crecimiento del mercado.

Restricción/Desafío

- Cuestiones relacionadas con la disponibilidad y los precios del grafito

Los problemas asociados con la disponibilidad y los precios del grafito y sus precursores plantean limitaciones significativas que están restringiendo el crecimiento del mercado. El grafito, un material industrial crítico con diversas aplicaciones, enfrenta varios factores que afectan su disponibilidad y precio, lo que impacta la dinámica general del mercado.

Un problema clave es la concentración geográfica de la producción de grafito. Una parte importante del grafito natural del mundo se obtiene de unos pocos países, principalmente China. Esta concentración crea vulnerabilidades en la cadena de suministro y expone el mercado de Asia-Pacífico a riesgos geopolíticos y relacionados con el comercio. Las interrupciones en el suministro, como las restricciones a las exportaciones o las fluctuaciones en la producción, pueden provocar escasez de suministro y volatilidad de precios, lo que afecta a las industrias que dependen del grafito, incluidos los sectores automotriz, aeroespacial y de fabricación de baterías. Otro factor que afecta la disponibilidad de grafito es la dependencia de materiales precursores, principalmente grafito en escamas y grafito sintético, en varias industrias. El grafito en escamas natural se utiliza ampliamente en la fabricación de baterías para vehículos eléctricos (VE) y aplicaciones de almacenamiento de energía. Mientras tanto, el grafito sintético es crucial en la producción de electrodos para baterías de iones de litio. La demanda de estos precursores está aumentando debido al impulso de Asia-Pacífico a la adopción de energía limpia y VE. Esta mayor demanda puede tensar las cadenas de suministro de precursores, lo que afecta a su disponibilidad y, a su vez, a la producción de productos basados en grafito.

Acontecimientos recientes

- En julio de 2023, Mersen, líder mundial en energía eléctrica y materiales avanzados, inauguró oficialmente su planta de fabricación de Columbia en EE. UU. Este sitio de 240.000 metros cuadrados, adquirido en 2019, ha experimentado una importante inversión total de casi USD 70,00 millones en los últimos cuatro años para expandir sus capacidades de producción, centrándose en el grafito extruido e isostático. La instalación está estratégicamente posicionada para satisfacer la creciente demanda, particularmente en el mercado de semiconductores. El plan de Mersen para 2027 incluye el objetivo de aumentar la capacidad de fabricación de grafito isostático a nivel mundial a 16.000 toneladas para fines de 2024. Esta expansión refuerza el compromiso de Mersen con los mercados de desarrollo sostenible, con un enfoque específico en el mercado de semiconductores de SiC.

- En abril de 2023, GrafTech International Ltd., un destacado productor de productos de electrodos de grafito de primera calidad, cruciales para la producción de acero en hornos de arco eléctrico, inauguró oficialmente una nueva oficina de ventas en Dubái, Emiratos Árabes Unidos. La inauguración de la última oficina de ventas en Dubái subraya su enfoque estratégico para realizar negocios a escala mundial. Equipada con experimentados equipos de ventas y servicio al cliente en todo el mundo, la empresa se centra en brindar una amplia asistencia a la base de clientes global de GrafTech.

- En septiembre de 2022, Showa Denko KK (SDK) y Showa Denko Materials Co., Ltd. (SDMC) se fusionaron para crear "Resonac", y SDK se convirtió en "Resonac Holdings Corporation" y SDMC se transformó en "Resonac Corporation" a partir del 1 de enero de 2023. Este movimiento estratégico tiene como objetivo establecer a Resonac como líder mundial en materiales funcionales avanzados dentro de la industria química. La empresa recién integrada contará con importantes ventas netas, impulsadas en gran medida por semiconductores y materiales electrónicos, particularmente en el "proceso back-end". Resonac busca lograr sinergia, innovación y el desarrollo de nuevos valores de mercado combinando los negocios estables de SDK con el potencial de crecimiento de SDMC. Se hará especial hincapié en el sector de semiconductores y materiales electrónicos, asegurando que la empresa mantenga unas ventas netas superiores a 1 billón y, al mismo tiempo, mantenga un margen de EBITDA de más del 20 %.

- En febrero de 2019, según Axios, la creciente demanda de grafito en baterías de iones de litio, impulsada por la expansión del mercado de vehículos eléctricos, ha suscitado preocupaciones medioambientales en China. Los procesos de extracción y producción de grafito generan partículas contaminantes del aire, lo que supone riesgos para la salud respiratoria. Además, los productos químicos agresivos utilizados en la producción suelen vertidos al medio ambiente, lo que puede alterar los ecosistemas locales. Desde 2010, las inspecciones de control de la contaminación han pasado de las autoridades locales al gobierno central en un esfuerzo por abordar estos problemas medioambientales.

Panorama del mercado de grafito en Asia y el Pacífico

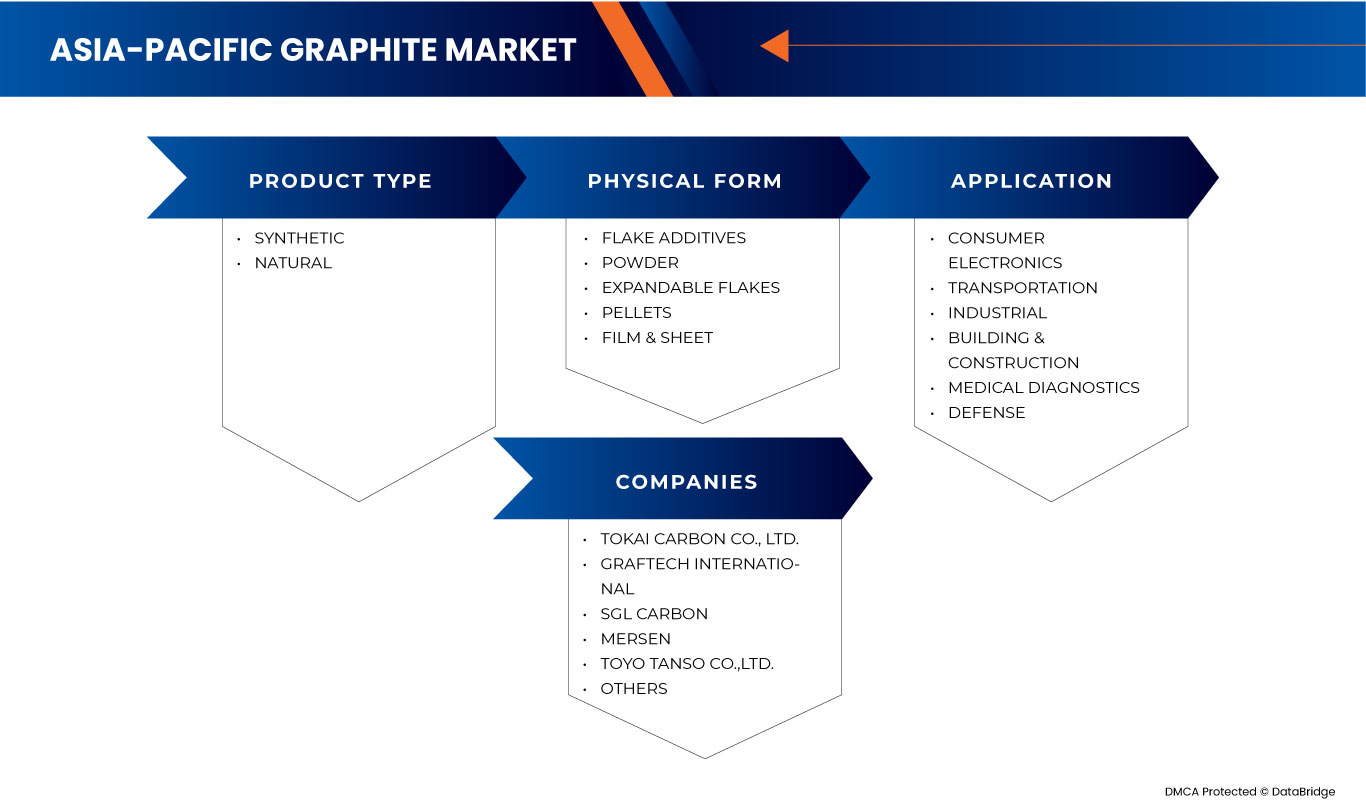

El mercado de grafito de Asia-Pacífico se divide en tres segmentos importantes según el tipo de producto, la forma física y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Sintético

- Natural

Según el tipo de producto, el mercado se segmenta en sintético y natural.

Forma física

- Aditivos para escamas

- Polvo

- Copos expandibles

- Pellets

- Película y partituras

Sobre la base de la forma física, el mercado está segmentado en aditivos en escamas, polvo, escamas expandibles, pellets y películas y láminas.

Solicitud

- Electrónica de consumo

- Transporte

- Industrial

- Construcción y edificación

- Diagnóstico médico

- Defensa

Sobre la base de la aplicación, el mercado está segmentado en electrónica de consumo, transporte, industria, construcción y edificación, diagnóstico médico y defensa.

Análisis y perspectivas regionales del mercado de grafito en Asia y el Pacífico

Se analiza el mercado de grafito de Asia-Pacífico y se proporcionan información y tendencias del tamaño del mercado por tipo de producto, forma física y aplicación como se menciona anteriormente.

Los países cubiertos en este informe de mercado son China, Japón, India, Corea del Sur, Australia, Tailandia, Singapur, Filipinas, Malasia, Indonesia y el resto de Asia-Pacífico.

Se espera que China domine el mercado de grafito de Asia-Pacífico debido a sus abundantes recursos de grafito, bajos costos de producción y alta demanda de grafito en aplicaciones industriales como la producción de acero y baterías de iones de litio.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas regionales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del grafito en Asia-Pacífico

El panorama competitivo del mercado de grafito de Asia-Pacífico proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia regional, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado.

Algunos de los principales actores que operan en el mercado de grafito de Asia-Pacífico son TOKAI CARBON, GrafTech International, SGL Carbon, Mersen, Toyo Tanso Co., Ltd., HEG Limited, Nippon Carbon Co Ltd., Superior Graphite, Qingdao Tennry Carbon Co., Ltd. y Resonac Holdings Corporation, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC GRAPHITE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INDISPENSABLE USAGE OF GRAPHITE IN THE STEEL AND REFRACTORIES INDUSTRY

5.1.2 GRAPHITE'S VERSATILITY AND EXCEPTIONAL ELECTRICAL CONDUCTIVITY

5.1.3 GROWTH AND DIVERSIFICATION OF THE AEROSPACE SECTOR

5.1.4 SURGE IN DEMAND FOR GRAPHITE IN THE DEFENSE SECTOR

5.2 RESTRAINT

5.2.1 ISSUES ASSOCIATED WITH THE AVAILABILITY AND PRICES OF GRAPHITE

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES TAKEN BY THE KEY MARKET PLAYERS

5.3.2 GROWING DEMAND FOR LITHIUM-ION BATTERIES IN ELECTRIC VEHICLES

5.4 CHALLENGE

5.4.1 ENVIRONMENTAL CONCERNS CAUSED BY GRAPHITE PRECURSORS AND END PRODUCTS

6 ASIA-PACIFIC GRAPHITE MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SYNTHETIC

6.3 NATURAL

7 ASIA-PACIFIC GRAPHITE MARKET, BY PHYSICAL FORM

7.1 OVERVIEW

7.2 FLAKE ADDITVES

7.3 POWDER

7.4 EXPANDABLE FLAKE

7.5 PELLETS

7.6 FILM & SHEET

8 ASIA-PACIFIC GRAPHITE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CONSUMER ELECTRONICS

8.2.1 CONSUMER ELECTRONICS, B Y APPLICATION

8.2.1.1 LAPTOP/TABLET

8.2.1.2 MOBILE

8.2.1.3 DISPLAY (OLED, LCD, LED)

8.2.1.4 POWER ELECTRONICS

8.2.1.5 LED LIGTHNING

8.2.1.6 SET-TOP BOX ENCLOSURES

8.2.2 CONSUMER ELECTRONICS, BY PHYSICAL FORM

8.2.2.1 FILM & SHEET

8.2.2.2 POWDER

8.2.2.3 FLAKE ADDITIVES

8.2.2.4 EXPANDABLE FLAKE

8.3 TRANSPORTATION

8.3.1 TRANSPORTATION, BY APPLICATION

8.3.1.1 BATTERIES

8.3.1.1.1 EV

8.3.1.1.2 ELECTRIC GROUND TRANSPORTATION

8.3.1.1.3 AERO

8.3.1.1.4 MARINE

8.3.1.1.5 SPORT/SNOWMOBILES

8.3.1.1.6 CHARGERS

8.3.1.2 FUEL CELLS

8.3.1.2.1 AUTO & LIGHT TRUCK

8.3.1.2.2 GROUND TRANSPORTATION

8.3.1.2.3 AERO

8.3.1.2.4 MARINE

8.3.1.2.5 PORTABLE AUXILIARY POWER UNITS

8.3.1.2.6 MATERIAL HANDLING

8.3.1.3 INTERNAL COMBUSTION ENGINES

8.3.1.4 INTERIOR

8.3.1.4.1 CLIMATE CONTROL

8.3.1.4.2 SEATING

8.3.1.5 EXTERIOR

8.3.2 TRANSPORTATION, BY PHYSICAL FORM

8.3.2.1 POWDER

8.3.2.2 FLAKE ADDITIVES

8.3.2.3 EXPANDABLE FLAKE

8.3.2.4 PELLETS

8.3.2.5 FILM & SHEET

8.4 INDUSTRIAL

8.4.1 INDUSTRIAL, B Y APPLICATION

8.4.2 FLUID SEALS

8.4.3 PIPE GASKETS

8.4.4 VALVE PACKING

8.4.5 INDUSTRIAL, BY PHYSICAL FORM

8.4.6 FLAKE ADDITIVES

8.4.7 EXPANDABLE FLAKE

8.4.8 POWDER

8.4.9 FILM & SHEET

8.4.10 PELLETS

8.5 BUILDING & CONSTRUCTION

8.5.1 BUILDING & CONSTRUCTION, BY APPLICATION

8.5.2 INSULATION FOAM

8.5.3 FIRESTOP (INTUMESCENT) COATINGS, PASTES AND PUTTIES

8.5.4 CONCRETE

8.5.5 COATINGS

8.5.6 ROOFING

8.5.7 WALL COVERINGS

8.5.8 ADHESIVES

8.5.9 EXPANSION JOINTS

8.5.10 BUILDING & CONSTRUCTION, BY PHYSICAL FORM

8.5.11 EXPANDABLE FLAKE

8.5.12 FLAKE ADDITIVES

8.5.13 POWDER

8.5.14 FILM & SHEET

8.5.15 PELLETS

8.6 MEDICAL DIAGNOSTICS

8.6.1 MEDICAL DIAGNOSTICS, BY PHYSICAL FORM

8.6.2 FLAKE ADDITIVES

8.6.3 POWDER

8.6.4 FILM & SHEET

8.6.5 EXPANDABLE FLAKE

8.6.6 PELLETS

8.7 DEFENSE

8.7.1 DEFENSE, BY PHYSICAL FORM

8.7.2 FLAKE ADDITIVES

8.7.3 EXPANDABLE FLAKE

8.7.4 POWDER

8.7.5 PELLETS

8.7.6 FILM & SHEET

9 ASIA-PACIFIC GRAPHITE MARKET, BY COUNTRY

9.1 ASIA PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 SOUTH KOREA

9.1.4 JAPAN

9.1.5 THAILAND

9.1.6 INDONESIA

9.1.7 SINGAPORE

9.1.8 MALAYSIA

9.1.9 AUSTRALIA

9.1.10 PHILIPPINES

9.1.11 REST OF ASIA-PACIFIC

10 ASIA-PACIFIC GRAPHITE MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 TOKAI CARBON CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 GRAFTECH INTERNATIONAL

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 SGL CARBON

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 MERSEN

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 TOYO TANSCO CO., LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 HEG LIMITED

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 NIPPON CARBON CO LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.2 RECENT DEVELOPMENT

12.8 QINGDAO TENNRY CARBON CO., LTD

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 RESONAC HOLDINGS CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 SUPERIOR GRAPHITE

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA-PACIFIC GRAPHITE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC GRAPHITE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 18 CHINA GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 19 CHINA GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 20 CHINA GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 21 CHINA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 22 CHINA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 23 CHINA TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 CHINA BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 CHINA FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 26 CHINA INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 CHINA TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 31 CHINA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 34 INDIA GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 35 INDIA GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 INDIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 38 INDIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 39 INDIA TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 INDIA BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 INDIA FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 INDIA INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 INDIA TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 44 INDIA INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 45 INDIA INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 46 INDIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 47 INDIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 48 INDIA MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 49 INDIA DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 50 SOUTH KOREA GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 51 SOUTH KOREA GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 52 SOUTH KOREA GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 SOUTH KOREA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 SOUTH KOREA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 55 SOUTH KOREA TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 56 SOUTH KOREA BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 66 JAPAN GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 67 JAPAN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 68 JAPAN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 JAPAN CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 70 JAPAN CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 71 JAPAN TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 72 JAPAN BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 73 JAPAN FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 JAPAN INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 75 JAPAN TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 76 JAPAN INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 JAPAN INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 78 JAPAN BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 JAPAN BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 80 JAPAN MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 81 JAPAN DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 84 THAILAND GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 85 THAILAND CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 86 THAILAND CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 87 THAILAND TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 88 THAILAND BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 89 THAILAND FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 90 THAILAND INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 91 THAILAND TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 92 THAILAND INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 93 THAILAND INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 94 THAILAND BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 95 THAILAND BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 96 THAILAND MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 97 THAILAND DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 98 INDONESIA GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 99 INDONESIA GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 100 INDONESIA GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 101 INDONESIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 102 INDONESIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 103 INDONESIA TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 104 INDONESIA BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 105 INDONESIA FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 106 INDONESIA INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 107 INDONESIA TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 108 INDONESIA INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 109 INDONESIA INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 110 INDONESIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 111 INDONESIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 112 INDONESIA MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 113 INDONESIA DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 114 SINGAPORE GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 115 SINGAPORE GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 116 SINGAPORE GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 117 SINGAPORE CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 SINGAPORE CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 119 SINGAPORE TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 SINGAPORE BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 121 SINGAPORE FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 122 SINGAPORE INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 123 SINGAPORE TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 124 SINGAPORE INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 125 SINGAPORE INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 126 SINGAPORE BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 127 SINGAPORE BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 128 SINGAPORE MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 129 SINGAPORE DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 130 MALAYSIA GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 131 MALAYSIA GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 132 MALAYSIA GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 133 MALAYSIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 134 MALAYSIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 135 MALAYSIA TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 136 MALAYSIA BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 137 MALAYSIA FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 138 MALAYSIA INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 139 MALAYSIA TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 140 MALAYSIA INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 141 MALAYSIA INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 142 MALAYSIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 143 MALAYSIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 144 MALAYSIA MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 145 MALAYSIA DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 146 AUSTRALIA GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 147 AUSTRALIA GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 148 AUSTRALIA GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 149 AUSTRALIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 150 AUSTRALIA CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 151 AUSTRALIA TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 152 AUSTRALIA BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 153 AUSTRALIA FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 154 AUSTRALIA INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 155 AUSTRALIA TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 156 AUSTRALIA INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 157 AUSTRALIA INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 158 AUSTRALIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 159 AUSTRALIA BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 160 AUSTRALIA MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 161 AUSTRALIA DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 162 PHILIPPINES GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

TABLE 163 PHILIPPINES GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 164 PHILIPPINES GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 165 PHILIPPINES CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 166 PHILIPPINES CONSUMER ELECTRONICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 167 PHILIPPINES TRANSPORTATION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 168 PHILIPPINES BATTERIES IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 169 PHILIPPINES FUEL CELLS IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 170 PHILIPPINES INTERIOR IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 171 PHILIPPINES TRANSPORTATION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 172 PHILIPPINES INDUSTRIAL IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 173 PHILIPPINES INDUSTRIAL IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 174 PHILIPPINES BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 175 PHILIPPINES BUILDING & CONSTRUCTION IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 176 PHILIPPINES MEDICAL DIAGNOSTICS IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 177 PHILIPPINES DEFENSE IN GRAPHITE MARKET, BY PHYSICAL FORM, 2021-2030 (USD THOUSAND)

TABLE 178 REST OF ASIA-PACIFIC GRAPHITE MARKET, BY PRODUCT TYPE 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 ASIA-PACIFIC GRAPHITE MARKET

FIGURE 2 ASIA-PACIFIC GRAPHITE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC GRAPHITE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC GRAPHITE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC GRAPHITE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC GRAPHITE MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC GRAPHITE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC GRAPHITE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC GRAPHITE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC GRAPHITE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC GRAPHITE MARKET: SEGMENTATION

FIGURE 12 GRAPHITE’S VERSATILITY AND EXCEPTIONAL ELECTRICAL CONDUCTIVITY IS DRIVING THE GROWTH OF THE ASIA-PACIFIC GRAPHITE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 THE SYNTHETIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC GRAPHITE MARKET IN 2023 AND 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC GRAPHITE MARKET

FIGURE 15 ASIA-PACIFIC GRAPHITE MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 ASIA-PACIFIC GRAPHITE MARKET: BY PHYSICAL FORM, 2022

FIGURE 17 ASIA-PACIFIC GRAPHITE MARKET: BY APPLICATION, 2022

FIGURE 18 ASIA-PACIFIC GRAPHITE MARKET: SNAPSHOT (2022)

FIGURE 19 ASIA-PACIFIC GRAPHITE MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.