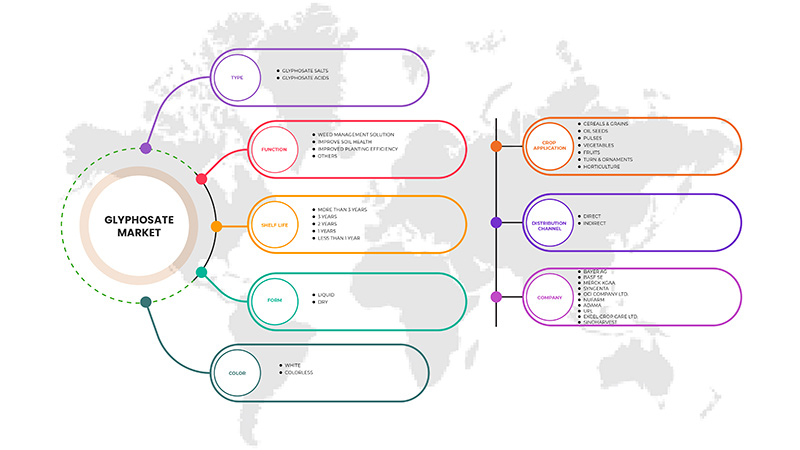

Mercado de glifosato de Asia y el Pacífico, por tipo (sales de glifosato y ácidos de glifosato), forma (seca y líquida), función (solución para el manejo de malezas, mejora de la salud del suelo, mejora de la eficiencia de siembra y otros), color (blanco e incoloro), vida útil (menos de 1 año, 1 año, 2 años, 3 años y más de 3 años), aplicación en cultivos (semillas oleaginosas, legumbres, cereales y granos, frutas, verduras, horticultura y hortalizas y adornos), canal de distribución (directo e indirecto), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de glifosato en Asia y el Pacífico

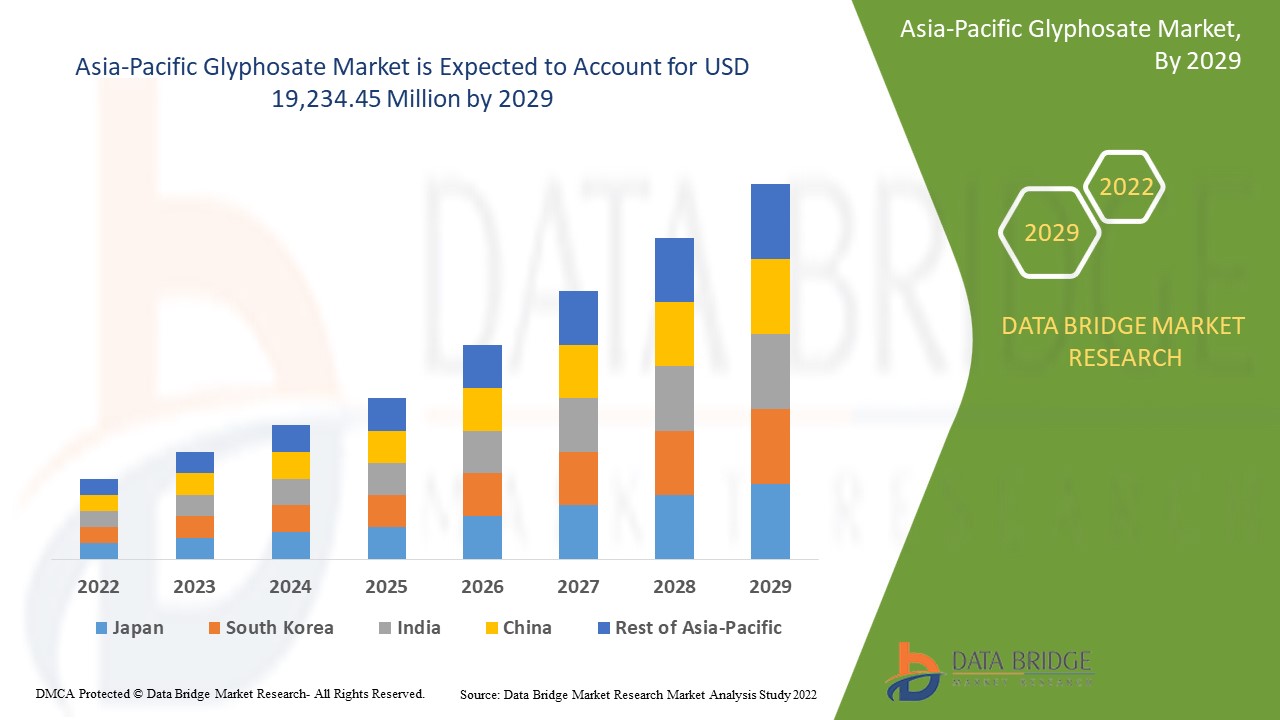

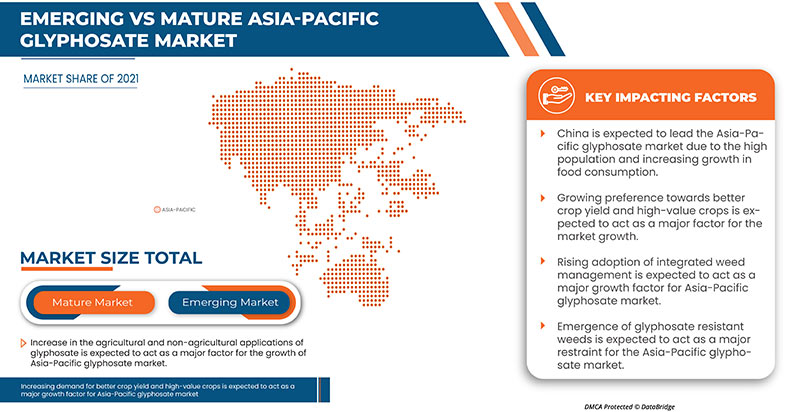

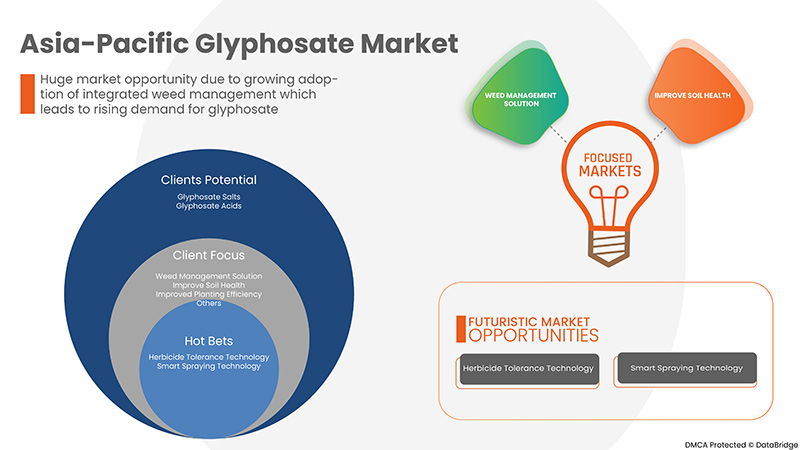

Se espera que el mercado de glifosato de Asia y el Pacífico crezca significativamente en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,1% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 19.234,45 millones para 2029. El principal factor que impulsa el crecimiento del mercado de glifosato es el aumento del sector agrícola, la creciente adopción de la gestión integrada de malezas, la creciente comercialización de cultivos de alto valor y el aumento de las aplicaciones agrícolas y no agrícolas del glifosato.

El aumento de las aplicaciones agrícolas y no agrícolas del glifosato en todo el mundo es uno de los principales factores que impulsan el crecimiento del mercado del glifosato. El uso de glifosato para matar malezas como la pamplina, el pasto de corral, el diente de león y otras malezas y el aumento en la sustitución del control mecánico de malezas en muchos cultivos aceleran el crecimiento del mercado. El aumento en la aprobación de la tecnología de tolerancia a herbicidas para cultivos que crecen inorgánicamente con una rápida adopción por parte de los agricultores y las ventajas del producto sobre los sistemas de labranza mecánica, como el bajo costo, menos suelo y degradación ambiental, influyen en el mercado. Además, un aumento en la demanda de cultivos de mejor calidad y la expansión del sector agrícola afectan positivamente al mercado del glifosato.

El informe del mercado de glifosato en Asia-Pacífico proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico. Nuestro equipo lo ayudará a crear una solución que tenga impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (sales de glifosato y ácidos de glifosato), forma (seca y líquida), función (solución para el manejo de malezas, mejora de la salud del suelo, mejora de la eficiencia de siembra y otros), color (blanco e incoloro), vida útil (menos de 1 año, 1 año, 2 años, 3 años y más de 3 años), aplicación en cultivos ( semillas oleaginosas , legumbres, cereales y granos, frutas, verduras, horticultura y plantas ornamentales), canal de distribución (directo e indirecto), |

|

Países cubiertos |

Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia, Resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

SinoHarvest, Syngenta, AgroStar, Novus Biologicals, Bayer AG, Nufarm, UPL, ADAMA, OCI COMPANY Ltd., Excel Crop Care Ltd., Merck KGaA, BASF SE |

Definición de mercado

El glifosato es uno de los herbicidas más utilizados y está clasificado como un herbicida post-emergente, sistémico, no selectivo, capaz de matar malezas con follaje verde. Estos pesticidas se utilizan para prevenir y controlar el crecimiento de hongos y enfermedades por esporas. Es un herbicida que se aplica a las hojas de las plantas para matar tanto plantas de hoja ancha como pastos. Se utiliza en agricultura y silvicultura, céspedes y jardines, y para malezas en áreas industriales. También se utiliza para controlar el crecimiento de plantas acuáticas. 2 tipos de glifosato son las sales de glifosato y los ácidos de glifosato. Es una solución de manejo de malezas para mejorar la salud del suelo, la eficiencia de la siembra y otros.

Dinámica del mercado de glifosato en Asia y el Pacífico

Conductores

- Aumento del sector agrícola

La agricultura desempeña un papel importante en el crecimiento económico y el desarrollo de los países. Contribuye al desarrollo garantizando la seguridad alimentaria y mejorando la nutrición. La transformación económica implica un cambio en la contribución relativa de la tecnología y los sectores de un país a su producto interno bruto (PIB) general, donde el sector agrícola desempeña un papel crucial. Impulsa la productividad laboral, aumenta el excedente agrícola para acumular capital y aumenta las divisas a través de las exportaciones.

- Creciente adopción de la gestión integrada de malezas

La creciente adopción de sistemas y soluciones eficaces e integrados de control de malezas es el principal factor que se espera que acelere el crecimiento del mercado de glifosato en Asia-Pacífico durante el período de pronóstico. El glifosato está ganando popularidad en el manejo de malezas en diversas masas de tierra y agua para controlar el crecimiento innecesario de malezas no deseadas. El glifosato se usa ampliamente en aguas agrícolas, canales, aguas de riego, granjas, viveros y más.

- Creciente comercialización de cultivos de alto valor

Los cultivos de alto valor son cultivos básicos como hortalizas, frutas, flores, plantas ornamentales, condimentos y especias. Estos proporcionan mayores ganancias netas por hectárea al agricultor que los cultivos básicos u otros cultivos ampliamente cultivados. La introducción de prácticas y soluciones innovadoras en la explotación agrícola contribuye a la comercialización de los cultivos de alto valor. Estos sistemas y tecnologías ayudarán a los agricultores a beneficiarse de la transformación agrícola en curso. La producción agrícola en Asia está cambiando hacia cultivos de alto valor como hortalizas y frutas respaldados por nuevas prácticas y tecnologías. La agricultura por contrato tiene el potencial de beneficiar tanto a los agricultores como a los contratistas al permitir la especialización de los productos, pero requiere la capacidad de los organismos gubernamentales locales para supervisar y hacer cumplir los contratos. De manera similar, las tecnologías digitales pueden promover el desarrollo inclusivo al ayudar a los agricultores de zonas remotas a acceder a información técnica y de mercado, pero esto requerirá un mejor acceso a la tecnología móvil. Para apoyar la transformación agrícola en curso, la política agrícola debe facilitar una mayor orientación al mercado mediante la investigación y el desarrollo.

- Aumento de las aplicaciones agrícolas y no agrícolas del glifosato

El glifosato es un herbicida ampliamente utilizado y aplicado/pulverizado en la agricultura y la silvicultura, en céspedes y jardines, y para las malezas en áreas industriales. Mata las malezas, especialmente las malezas anuales de hoja ancha y las gramíneas que compiten con los cultivos. La forma de sal de sodio del glifosato regula el crecimiento de las plantas y madura cultivos específicos. Impide que las plantas produzcan ciertas proteínas para detener el crecimiento de las plantas. Este herbicida no selectivo se mueve desde el follaje tratado a otras partes de la planta, incluidas las raíces. De esta manera, el glifosato mata las malezas anuales y perennes. Se utiliza en diversas aplicaciones de cultivos como semillas oleaginosas, legumbres, cereales y granos, frutas, verduras y horticultura.

Oportunidad

- Aumento de la aprobación de tecnologías de tolerancia a herbicidas

Los glifosatos son pesticidas que protegen y controlan enfermedades causadas por hongos y esporas. Los glifosatos pueden controlar enfermedades fúngicas específicas, así como aquellas de múltiples fuentes. Los híbridos de cultivos tolerantes a herbicidas se modifican genéticamente para soportar herbicidas no selectivos, como el glifosato. Para desarrollar tolerancia al glifosato, muchos esfuerzos de investigación y desarrollo se centran en evaluar el glifosato, el herbicida más eficaz que puede controlar todas las plantas independientemente de la especie. Varias empresas realizan continuamente investigaciones exhaustivas y lanzan nuevos productos al mercado.

Restricciones/Desafíos

- Aparición de malezas resistentes al glifosato

La resistencia al glifosato apareció por primera vez en Lolium rigidum en un huerto de manzanas en Australia en 1996, y el mismo año, se introdujo el primer cultivo resistente al glifosato (soja) en los EE. UU. Actualmente, hay más de treinta especies de malezas que han desarrollado resistencia al glifosato, que se distribuyen en 37 países y en 34 cultivos diferentes y seis situaciones no agrícolas. Además, se han identificado malezas resistentes al glifosato en huertos, viñedos, plantaciones, cereales y situaciones de barbecho y no agrícolas. Las malezas resistentes al glifosato presentan la mayor amenaza para el control sostenido de malezas en los principales cultivos agronómicos porque este herbicida se usa para controlar malezas con resistencia a herbicidas con otros sitios de acción, y no se han introducido nuevos sitios de acción de herbicidas durante mucho tiempo. Sin embargo, la industria está respondiendo desarrollando rasgos de resistencia a herbicidas en los principales cultivos que permiten que los herbicidas existentes se usen de una manera nueva. Pero la dependencia excesiva de estas características da lugar a una resistencia múltiple en las malezas.

- Regulación gubernamental estricta respecto al glifosato

Se espera que la promulgación de normas estrictas, especialmente en la región de Asia y el Pacífico, limite la expansión del mercado del glifosato en esa región. Los organismos reguladores de los países de Asia y el Pacífico aplican normas estrictas sobre el cultivo de cultivos modificados genéticamente. Su adopción entusiasta ha dado lugar a un uso extensivo de herbicidas, lo que ha provocado la aparición de malezas resistentes al glifosato. Por lo tanto, un factor que limita la industria son las rigurosas leyes que regulan el uso del glifosato debido a varias preocupaciones ambientales y de salud. La sobreexposición al glifosato puede provocar cáncer y problemas de salud relacionados.

- Impacto nocivo de los glifosatos sobre el medio ambiente y la población humana

Se prevé que las preocupaciones sobre los efectos nocivos del glifosato en la población humana y el medio ambiente supongan un desafío para el mercado del glifosato. Se han documentado y registrado varios efectos ambientales del glifosato en entornos terrestres y acuáticos y contra la salud humana. La fuga del herbicida glifosato en los cuerpos de agua afecta negativamente a los organismos acuáticos, como los renacuajos y los peces, que mueren. Además de matar plantas en las zonas donde se distribuye el glifosato, también mata plantas en sus alrededores. Ya sea en la tierra o en el agua, la muerte de estos organismos vivos puede tener efectos adversos. Este tipo de impacto ambiental amenaza el mercado y desafía su crecimiento.

Desarrollo reciente

En septiembre de 2022, Merck KGaA inauguró un laboratorio de depuración viral (VC) como parte de la primera fase de construcción de su nuevo Centro de Pruebas Biológicas en China, valorado en 29 millones de euros. Este nuevo centro de 5.000 metros cuadrados es el primero de este tipo para Merck KGaA en China. El laboratorio de VC permite a los clientes realizar estudios de depuración viral a nivel local, desde el desarrollo preclínico hasta la comercialización, y satisfará la demanda de dos dígitos de servicios de pruebas de VC en China. Esto ayudará a la empresa a mejorar sus operaciones en la región de Asia y el Pacífico.

Panorama del mercado de glifosato en Asia y el Pacífico

El mercado de glifosato de Asia-Pacífico se clasifica en función del tipo, la forma, la función, el color, la vida útil, la aplicación y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Sales de glifosato

- Acidos de glifosato

Según el tipo, el mercado de glifosato de Asia y el Pacífico se clasifica en dos segmentos: sales de glifosato y ácidos de glifosato.

Forma

- Líquido

- Seco

Según un formulario, el mercado de glifosato de Asia y el Pacífico se clasifica en dos segmentos: seco y líquido.

Función

- Solución para el manejo de malezas

- Mejorar la salud del suelo

- Mayor eficiencia en la plantación

- Otros

Según su función, el mercado de glifosato de Asia y el Pacífico se clasifica en cuatro segmentos: soluciones de manejo de malezas, mejora de la salud del suelo, mejora de la eficiencia de siembra y otros.

Color

- Blanco

- Incoloro

Según el color, el mercado de glifosato de Asia y el Pacífico se clasifica en tres segmentos: blanco e incoloro.

Duración

- Más de 3 años

- 3 años

- 2 años

- 1 año

- Menos de 1 año

Según la vida útil, el mercado de glifosato de Asia y el Pacífico se clasifica en cinco segmentos: menos de 1 año, 1 año, 2 años, 3 años y más de 3 años.

Aplicación en cultivos

- Cereales y granos

- Semillas oleaginosas

- Legumbres

- Verduras

- Frutas

- Giros y adornos

- Horticultura

Según la aplicación del cultivo, el mercado de glifosato de Asia y el Pacífico se clasifica en siete segmentos: semillas oleaginosas, legumbres, cereales y granos, frutas, verduras, horticultura y plantas ornamentales.

Canal de distribución

- Directo

- Indirecto

Según el canal de distribución, el mercado de glifosato de Asia-Pacífico se clasifica en dos segmentos: directo e indirecto.

Análisis y perspectivas regionales del mercado de glifosato en Asia y el Pacífico

El mercado de glifosato de Asia y el Pacífico está segmentado según el tipo, la forma, la función, el color, la vida útil, la aplicación y el canal de distribución.

Los países que componen el mercado de glifosato en Asia-Pacífico son Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y el resto de Asia-Pacífico. China domina el mercado de glifosato en Asia-Pacífico en términos de participación de mercado e ingresos de mercado debido a la fuerte presencia de actores del mercado en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del glifosato en Asia-Pacífico

El panorama competitivo del mercado de glifosato en Asia-Pacífico ofrece detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de glifosato en Asia-Pacífico.

Algunos de los participantes destacados que operan en el mercado de glifosato de Asia y el Pacífico son SinoHarvest, Syngenta, AgroStar, Novus Biologicals, Bayer AG, Nufarm, UPL, ADAMA, OCI COMPANY Ltd., Excel Crop Care Ltd., Merck KGaA y BASF SE.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, Europa frente a análisis regional y de participación de proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC GLYPHOSATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 CONSUMER-LEVEL TRENDS

4.3 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 IMPORT EXPORT SCENERIO

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.7 MEETING CONSUMER REQUIREMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RE-LAUNCHED

4.8.1.4 NEW FORMULATION

4.9 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.1 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.10.1 OVERVIEW

4.10.2 SOCIAL FACTORS

4.10.3 CULTURAL FACTORS

4.10.4 PSYCHOLOGICAL FACTORS

4.10.5 PERSONAL FACTORS

4.10.6 ECONOMIC FACTORS

4.10.7 PRODUCT TRAITS

4.10.8 MARKET ATTRIBUTES

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN

4.12 PORTER’S FIVE FORCES:

4.12.1 THREAT OF NEW ENTRANTS:

4.12.2 THREAT OF SUBSTITUTES:

4.12.3 CUSTOMER BARGAINING POWER:

4.12.4 SUPPLIER BARGAINING POWER:

4.12.5 INTERNAL COMPETITION (RIVALRY):

4.13 PRICING INDEX

4.14 PROMOTIONAL ACTIVITIES

4.15 RAW MATERIAL SOURCING ANALYSIS

4.16 SHOPPING BEHAVIOUR AND DYNAMICS

4.17 SUPPLY CHAIN ANALYSIS

4.17.1 OVERVIEW

4.17.2 LOGISTIC COST SCENARIO

4.17.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.18 VALUE CHAIN ANALYSIS

5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE AGRICULTURAL SECTOR

7.1.2 RISING ADOPTION OF INTEGRATED WEED MANAGEMENT

7.1.3 GROWING COMMERCIALIZATION OF HIGH-VALUE CROPS

7.1.4 INCREASE IN THE AGRICULTURAL AND NON-AGRICULTURAL APPLICATIONS OF GLYPHOSATE

7.2 RESTRAINTS

7.2.1 EMERGENCE OF GLYPHOSATE-RESISTANT WEEDS

7.2.2 STRINGENT GOVERNMENT REGULATION REGARDING GLYPHOSATE

7.3 OPPORTUNITIES

7.3.1 RISE IN THE APPROVAL OF HERBICIDE-TOLERANCE TECHNOLOGY

7.4 CHALLENGES

7.4.1 HARMFUL IMPACT OF GLYPHOSATES ON THE ENVIRONMENT AND HUMAN POPULATION

8 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE

8.1 OVERVIEW

8.2 GLYPHOSATE SALTS

8.2.1 ISOPROPYLAMINE SALT

8.2.2 MONOAMMONIUM SALT

8.2.3 POTASSIUM SALT

8.2.4 DIAMMONIUM SALT

8.2.5 OTHERS

8.3 GLYPHOSATE ACIDS

9 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

9.3.1 GRANULAR

9.3.2 POWDER

9.3.3 OTHERS

10 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 WEED MANAGEMENT SOLUTION

10.3 IMPROVE SOIL HEALTH

10.4 IMPROVED PLANTING EFFICIENCY

10.5 OTHERS

11 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR

11.1 OVERVIEW

11.2 WHITE

11.3 COLORLESS

12 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE

12.1 OVERVIEW

12.2 MORE THAN 3 YEARS

12.3 3 YEARS

12.4 2 YEARS

12.5 1 YEAR

12.6 LESS THAN 1 YEAR

13 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION

13.1 OVERVIEW

13.2 CEREALS AND GRAINS

13.2.1 CEREALS AND GRAINS, BY TYPE

13.2.1.1 WHEAT

13.2.1.2 RICE

13.2.1.3 BARLEY

13.2.1.4 MILLET

13.2.1.5 OAT

13.2.1.6 SORGHUM

13.2.1.7 RYE

13.2.1.8 OTHERS

13.2.2 CEREALS AND GRAINS, BY GLYPHOSATE TYPE

13.2.2.1 GLYPHOSATE SALTS

13.2.2.2 GLYPHOSATE ACIDS

13.3 OIL SEEDS

13.3.1 OIL SEEDS, BY TYPE

13.3.1.1 SOYBEAN

13.3.1.2 COTTONSEED

13.3.1.3 SUNFLOWER

13.3.1.4 CORN

13.3.1.5 PEANUT

13.3.1.6 FLAXSEEDS

13.3.1.7 OTHERS

13.3.2 OIL SEEDS, BY GLYPHOSATE TYPE

13.3.2.1 GLYPHOSATE SALTS

13.3.2.2 GLYPHOSATE ACIDS

13.4 PULSES

13.4.1 PULSES, BY TYPE

13.4.1.1 CHICKPEAS

13.4.1.2 BLACK BEANS

13.4.1.3 PEAS

13.4.1.4 OTHERS

13.4.2 PULSES, BY GLYPHOSATE TYPE

13.4.2.1 GLYPHOSATE SALTS

13.4.2.2 GLYPHOSATE ACIDS

13.5 VEGETABLES

13.5.1 VEGETABLES, BY TYPE

13.5.1.1 LEAFY GREENS

13.5.1.2 CRUCIFEROUS VEGETABLES

13.5.1.3 MARROW VEGETABLES

13.5.1.4 ROOT VEGETABLES

13.5.1.5 ONION

13.5.1.6 GARLIC

13.5.1.7 OTHERS

13.5.2 VEGETABLES, BY GLYPHOSATE TYPE

13.5.2.1 GLYPHOSATE SALTS

13.5.2.2 GLYPHOSATE ACIDS

13.6 FRUITS

13.6.1 FRUITS, BY TYPE

13.6.1.1 APPLE & PEARS

13.6.1.2 CITRUS FRUITS

13.6.1.3 TROPICAL FRUITS

13.6.1.4 BERRIES

13.6.1.5 MELONS

13.6.1.6 OTHERS

13.6.2 FRUITS, BY GLYPHOSATE TYPE

13.6.2.1 GLYPHOSATE SALTS

13.6.2.2 GLYPHOSATE ACIDS

13.7 TURN AND ORNAMENTS

13.7.1 TURN AND ORNAMENTS, BY GLYPHOSATE TYPE

13.7.1.1 GLYPHOSATE SALTS

13.7.1.2 GLYPHOSATE ACIDS

13.8 HORTICULTURE

13.8.1 HORTICULTURE, BY GLYPHOSATE TYPE

13.8.1.1 GLYPHOSATE SALTS

13.8.1.2 GLYPHOSATE ACIDS

14 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT

14.3 INDIRECT

15 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY

15.1 CHINA

15.2 INDIA

15.3 AUSTRALIA

15.4 JAPAN

15.5 SOUTH KOREA

15.6 INDONESIA

15.7 THAILAND

15.8 SINGAPORE

15.9 MALAYSIA

15.1 PHILIPPINES

15.11 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC GLYPHOSATE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.1.1 COLLABORATION

16.1.2 FACILITY EXPANSIONS

16.1.3 EVENT

16.1.4 ACQUISITION

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 BAYER AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 BASF SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 MERCK KGAA

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 SYNGENTA

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 OCI COMPANY LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 AGROSTAR

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 EXCEL CROP CARE LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 NOVUS BIOLOGICALS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 NUFARM

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 SINOHARVEST

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATES

18.12 UPL

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF HERBICIDES, ANTI-SPROUTING PRODUCTS, AND PLANT-GROWTH REGULATORS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES (EXCL. GOODS OF SUBHEADING 3808.59); HS CODE - 380893 (USD THOUSAND)

TABLE 2 EXPORT DATA OF HERBICIDES, ANTI-SPROUTING PRODUCTS, AND PLANT-GROWTH REGULATORS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES (EXCL. GOODS OF SUBHEADING 3808.59); HS CODE - 380893 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 ASIA-PACIFIC GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 8 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 10 ASIA-PACIFIC DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 12 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 14 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 16 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 18 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 20 ASIA-PACIFIC CEREAL AND GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 22 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 24 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 26 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 28 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 30 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 32 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 34 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC VEGETABLE GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 36 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 38 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 40 ASIA-PACIFIC TURN AND ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC TURN AND ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 42 ASIA-PACIFIC HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 44 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 46 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 48 CHINA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 CHINA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 52 CHINA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 53 CHINA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 54 CHINA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 CHINA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 57 CHINA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 58 CHINA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 59 CHINA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 60 CHINA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 61 CHINA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 62 CHINA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 64 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 66 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 68 CHINA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 70 CHINA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 72 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 74 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 75 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 76 CHINA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CHINA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 78 CHINA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 79 CHINA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 80 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 82 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 84 CHINA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 85 CHINA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 86 CHINA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 87 CHINA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 88 CHINA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 CHINA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 90 INDIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 92 INDIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 INDIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 INDIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 96 INDIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 98 INDIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 99 INDIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 100 INDIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 101 INDIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 102 INDIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 103 INDIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 104 INDIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 INDIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 106 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 108 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 109 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 110 INDIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 112 INDIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 114 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 118 INDIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 120 INDIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 122 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 124 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 126 INDIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 128 INDIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 130 INDIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 INDIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 132 AUSTRALIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 AUSTRALIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 134 AUSTRALIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 AUSTRALIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 136 AUSTRALIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 137 AUSTRALIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 138 AUSTRALIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 AUSTRALIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 140 AUSTRALIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 AUSTRALIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 142 AUSTRALIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 144 AUSTRALIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 146 AUSTRALIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 AUSTRALIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 148 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 150 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 151 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 152 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 154 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 155 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 156 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 159 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 160 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 162 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 163 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 164 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 166 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 167 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 168 AUSTRALIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 169 AUSTRALIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 170 AUSTRALIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 171 AUSTRALIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 172 AUSTRALIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 AUSTRALIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 174 JAPAN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 JAPAN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 176 JAPAN GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 JAPAN GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 178 JAPAN GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 179 JAPAN GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 180 JAPAN DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 JAPAN DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 182 JAPAN GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 183 JAPAN GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 184 JAPAN GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 185 JAPAN GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 186 JAPAN GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 187 JAPAN GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 188 APAN GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 JAPAN GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 190 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 193 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 194 JAPAN PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 JAPAN PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 196 JAPAN PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 197 JAPAN PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 198 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 200 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 201 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 202 JAPAN FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 JAPAN FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 204 JAPAN FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 206 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 208 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 209 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 210 JAPAN HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 211 JAPAN HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 212 JAPAN TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 213 JAPAN TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 214 JAPAN GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 215 JAPAN GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 216 SOUTH KOREA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 218 SOUTH KOREA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 220 SOUTH KOREA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 222 SOUTH KOREA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SOUTH KOREA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 224 SOUTH KOREA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 225 SOUTH KOREA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 226 SOUTH KOREA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 227 SOUTH KOREA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 228 SOUTH KOREA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 229 SOUTH KOREA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 230 SOUTH KOREA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 231 SOUTH KOREA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 232 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 234 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 235 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 236 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 238 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 239 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 240 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 242 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 243 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 244 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 246 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 248 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 250 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 251 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 252 SOUTH KOREA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 253 SOUTH KOREA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 254 SOUTH KOREA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 255 SOUTH KOREA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 256 SOUTH KOREA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 257 SOUTH KOREA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 258 INDONESIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 INDONESIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 260 INDONESIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 INDONESIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 262 INDONESIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 263 INDONESIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 264 INDONESIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 INDONESIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 266 INDONESIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 267 INDONESIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 268 INDONESIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 269 INDONESIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 270 INDONESIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 271 INDONESIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 272 INDONESIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 INDONESIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 274 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 276 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 277 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 278 INDONESIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 INDONESIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 280 INDONESIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDONESIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 282 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 284 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 285 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 286 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 288 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 289 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 290 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 292 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 293 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 294 INDONESIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 295 INDONESIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 296 INDONESIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 297 INDONESIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 298 INDONESIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 299 INDONESIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 300 THAILAND GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 THAILAND GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 302 THAILAND GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 THAILAND GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 304 THAILAND GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 305 THAILAND GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 306 THAILAND DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 THAILAND DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 308 THAILAND GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 309 THAILAND GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 310 THAILAND GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 311 THAILAND GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 312 THAILAND GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 313 THAILAND GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 314 THAILAND GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 315 THAILAND GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 316 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 317 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 318 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 319 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 320 THAILAND PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 321 THAILAND PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 322 THAILAND PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 323 THAILAND PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 324 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 325 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 326 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 327 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 328 THAILAND FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 329 THAILAND FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 330 THAILAND FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 331 THAILAND FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 332 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 333 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 334 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 335 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 336 THAILAND HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 337 THAILAND HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 338 THAILAND TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 339 THAILAND TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 340 THAILAND GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 341 THAILAND GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 342 SINGAPORE GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 343 SINGAPORE GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 344 SINGAPORE GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 345 SINGAPORE GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 346 SINGAPORE GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 347 SINGAPORE GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 348 SINGAPORE DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 349 SINGAPORE DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 350 SINGAPORE GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 351 SINGAPORE GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 352 SINGAPORE GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 353 SINGAPORE GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 354 SINGAPORE GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 355 SINGAPORE GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 356 SINGAPORE GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 357 SINGAPORE GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 358 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 359 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 360 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 361 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 362 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 363 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 364 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 365 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 366 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 367 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 368 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 369 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 370 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 371 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 372 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 373 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 374 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 375 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 376 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 377 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 378 SINGAPORE HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 379 SINGAPORE HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 380 SINGAPORE TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 381 SINGAPORE TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 382 SINGAPORE GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 383 SINGAPORE GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 384 MALAYSIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 385 MALAYSIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 386 MALAYSIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 387 MALAYSIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 388 MALAYSIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 389 MALAYSIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 390 MALAYSIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 391 MALAYSIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 392 MALAYSIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 393 MALAYSIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 394 MALAYSIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 395 MALAYSIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 396 MALAYSIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 397 MALAYSIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 398 MALAYSIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 399 MALAYSIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 400 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 401 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 402 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 403 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 404 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 405 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 406 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 407 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 408 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 409 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 410 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 411 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 412 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 413 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 414 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 415 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 416 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 417 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 418 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 419 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 420 MALAYSIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 421 MALAYSIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 422 MALAYSIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 423 MALAYSIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 424 MALAYSIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 425 MALAYSIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 426 PHILIPPINES GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 427 PHILIPPINES GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 428 PHILIPPINES GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 429 PHILIPPINES GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 430 PHILIPPINES GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 431 PHILIPPINES GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 432 PHILIPPINES DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 433 PHILIPPINES DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 434 PHILIPPINES GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 435 PHILIPPINES GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 436 PHILIPPINES GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 437 PHILIPPINES GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 438 PHILIPPINES GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 439 PHILIPPINES GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 440 PHILIPPINES GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 441 PHILIPPINES GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 442 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 443 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 444 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 445 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 446 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 448 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 449 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 450 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 452 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 453 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 454 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 455 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 456 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 457 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 458 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 459 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 460 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 461 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 462 PHILIPPINES HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 463 PHILIPPINES HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 464 PHILIPPINES TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 465 PHILIPPINES TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 466 PHILIPPINES GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 467 PHILIPPINES GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 468 REST OF ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 469 REST OF ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 ASIA-PACIFIC GLYPHOSATE MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC GLYPHOSATE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC GLYPHOSATE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC GLYPHOSATE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC GLYPHOSATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC GLYPHOSATE MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC GLYPHOSATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC GLYPHOSATE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC GLYPHOSATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC GLYPHOSATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA-PACIFIC GLYPHOSATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA-PACIFIC GLYPHOSATE MARKET: SEGMENTATION

FIGURE 13 RISE IN THE AGRICULTURAL SECTOR EXPECTED TO DRIVE THE ASIA-PACIFIC GLYPHOSATE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE GLYPHOSATE SALTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC GLYPHOSATE MARKET IN 2022 & 2029

FIGURE 15 ASIA-PACIFIC GLYPHOSATE MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 16 PRICE ANALYSIS FOR THE ASIA-PACIFIC GLYPHOSATE MARKET (USD/KG)

FIGURE 17 VALUE CHAIN OF THE ASIA-PACIFIC GLYPHOSATE MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC GLYPHOSATE MARKET

FIGURE 19 ASIA-PACIFIC GLYPHOSATE MARKET: BY TYPE, 2021

FIGURE 20 ASIA-PACIFIC GLYPHOSATE MARKET: BY FORM, 2021

FIGURE 21 ASIA-PACIFIC GLYPHOSATE MARKET: BY FUNCTION, 2021

FIGURE 22 ASIA-PACIFIC GLYPHOSATE MARKET: BY COLOR, 2021

FIGURE 23 ASIA-PACIFIC GLYPHOSATE MARKET: BY SHELF LIFE 2021

FIGURE 24 ASIA-PACIFIC GLYPHOSATE MARKET: BY CROP APPLICATION, 2021

FIGURE 25 ASIA-PACIFIC GLYPHOSATE MARKET: BY DISTRIBUTION CHANNEL 2021

FIGURE 26 ASIA-PACIFIC GLYPHOSATE MARKET: SNAPSHOT (2021)

FIGURE 27 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2021)

FIGURE 28 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 ASIA-PACIFIC GLYPHOSATE MARKET: BY TYPE (2022 - 2029)

FIGURE 31 ASIA-PACIFIC GLYPHOSATE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.