Asia Pacific Gene Synthesis Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

429.59 Million

USD

2,557.01 Million

2021

2029

USD

429.59 Million

USD

2,557.01 Million

2021

2029

| 2022 –2029 | |

| USD 429.59 Million | |

| USD 2,557.01 Million | |

|

|

|

Mercado de síntesis genética en Asia-Pacífico, por componente (sintetizador, consumibles y software y servicios), tipo de gen (gen estándar, gen exprés, gen complejo y otros), tipo de síntesis genética (síntesis de bibliotecas genéticas y síntesis genética personalizada), aplicación ( biología sintética , ingeniería genética, diseño de vacunas, anticuerpos terapéuticos y otros), método (síntesis en fase sólida, síntesis de ADN basada en chip y síntesis enzimática basada en PCR), usuario final (institutos académicos y de investigación, laboratorios de diagnóstico, empresas biotecnológicas y farmacéuticas y otros), canal de distribución (licitación directa, distribución en línea y distribuidores externos), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado de síntesis genética en Asia y el Pacífico

La síntesis genética es el proceso de creación de genes artificiales en un laboratorio mediante biología sintética. La generación de proteínas recombinantes es una de las numerosas aplicaciones de la tecnología del ADN recombinante, en la que la síntesis genética se perfila como un instrumento clave. Los métodos tradicionales de clonación y mutagénesis están siendo rápidamente reemplazados por la síntesis genética de novo, que también permite la producción de ácidos nucleicos para los que no existe una plantilla.

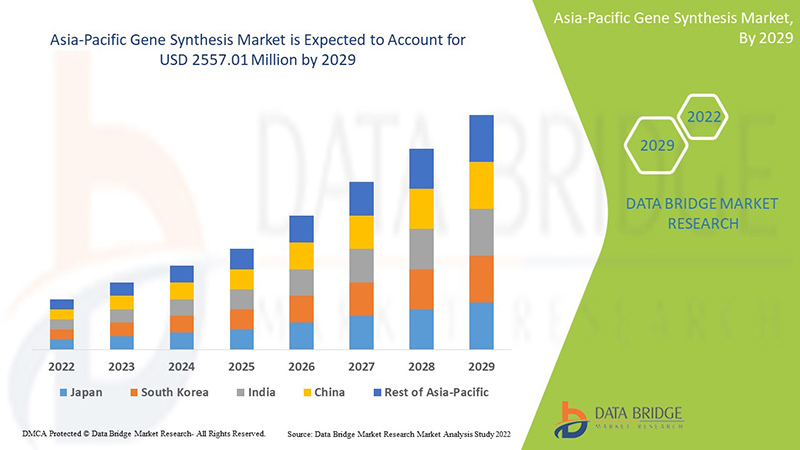

Se espera que el mercado de síntesis genética de Asia-Pacífico crezca en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 24,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2557,01 millones para 2029 desde USD 429,59 millones en 2021.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por componente (sintetizador, consumibles y software y servicios), tipo de gen (gen estándar, gen exprés, gen complejo y otros), tipo de síntesis genética (síntesis de biblioteca de genes y síntesis genética personalizada), aplicación (biología sintética, ingeniería genética, diseño de vacunas, anticuerpos terapéuticos y otros), método (síntesis en fase sólida, síntesis de ADN basada en chip y síntesis de enzimas basada en PCR), usuario final (institutos académicos y de investigación, laboratorios de diagnóstico, empresas biotecnológicas y farmacéuticas y otros), canal de distribución (licitación directa, distribución en línea y distribuidores externos) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

MACROGEN CO., LTD., Bioneer Pacific, Kaneka Eurogentec SA, Bbi-lifesciences y GCC Biotech (INDIA) Pvt. Ltd., entre otros. |

Definición de mercado

La síntesis génica se refiere a la síntesis química de la hebra de ADN base por base. A diferencia de la replicación del ADN que ocurre en las células o mediante la reacción en cadena de la polimerasa (PCR), la síntesis génica no requiere una hebra molde. En cambio, la síntesis génica implica la adición gradual de nucleótidos a una molécula monocatenaria, que luego sirve como plantilla para crear una hebra complementaria. La síntesis génica es la tecnología fundamental sobre la que se ha construido el campo de la biología sintética.

Dinámica del mercado de síntesis de genes

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- AUMENTO DE LA PREVALENCIA DE ENFERMEDADES INFECCIOSAS CRÓNICAS

Las enfermedades bacterianas y virales se están expandiendo rápidamente debido a la creciente prevalencia de enfermedades infecciosas en todo el mundo. Como resultado, ha aumentado la demanda de terapias nuevas y efectivas para luchar contra estas enfermedades mortales. Estas enfermedades se pueden curar utilizando medicamentos químicos y terapias biológicas, incluida la terapia génica. Al aplicar la genómica, se ha mejorado el manejo de las enfermedades infecciosas y endémicas. También nos permite comprender la resistencia emergente a los medicamentos e identificar objetivos para nuevas terapias y vacunas. Para el tratamiento de enfermedades infecciosas, la terapia génica ha atraído a muchos investigadores, ya que se puede tratar mediante el uso de tecnología de ADN recombinante, ribozimas de ADN y ARN y anticuerpos de cadena simple.

A medida que aumenta la prevalencia de enfermedades infecciosas crónicas a nivel mundial, también aumenta la demanda de vacunas y terapias génicas efectivas, lo que ha aumentado la demanda de genes nuevos con una aplicación significativa para actividades de investigación y fabricación de medicamentos y vacunas. Por lo tanto, la creciente prevalencia de enfermedades infecciosas actúa como impulsor del crecimiento del mercado de síntesis génica.

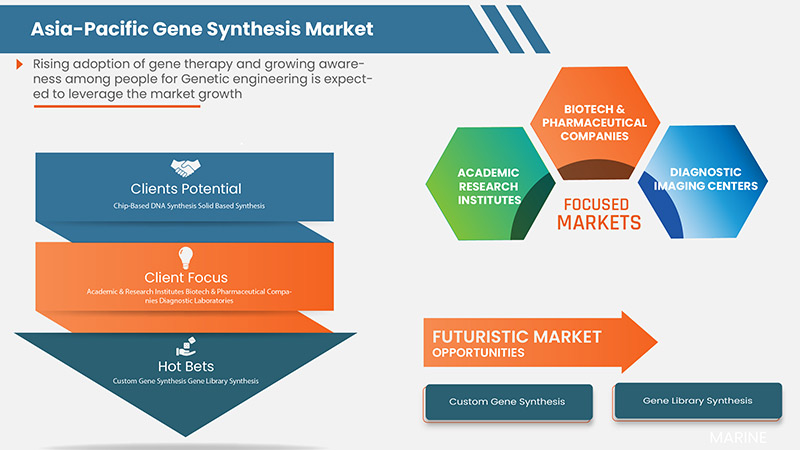

- AUMENTO DE LA ADOPCIÓN DE LA TERAPIA GÉNICA

La terapia génica es una técnica avanzada que incluye el uso de varios genes para la prevención de un tipo particular de enfermedad. La técnica implica la inserción de genes en las células del paciente en lugar de medicamentos y cirugía. Debido a la creciente demanda de resultados terapéuticos novedosos y duraderos, la adopción de la terapia génica está aumentando. Las terapias génicas requieren construcciones de genes sintéticos, entre otros productos genéticos, para acelerar el desarrollo de la terapia génica. Debido al aumento de las enfermedades genéticas, la demanda de una cura adecuada es un factor importante y, con la ayuda de la terapia génica, se puede curar un tipo particular de enfermedad.

Debido a la creciente demanda, los líderes se centran constantemente en producir productos de terapia genética, lograr aprobaciones y autorizaciones de comercialización.

Existe una enorme demanda de medicamentos y terapias que salvan vidas para brindar calidad de vida a diferentes pacientes. Este creciente número de pacientes depende en gran medida de las terapias genéticas disponibles para lograr una cura adecuada. Para fabricar terapias genéticas, se requieren genes sintéticos y novedosos, que se pueden lograr mediante la técnica de síntesis genética. Por lo tanto, se espera que la creciente adopción de la terapia genética actúe como un impulsor del mercado de síntesis genética.

- EXPANSIÓN DE LA BIOLOGÍA SINTÉTICA

La incorporación de principios de ingeniería a la biología se denomina biología sintética. El genoma de ADN se puede volver a ensamblar con la ayuda de la biología sintética, ya que implica la síntesis química del ADN al combinarlo con su genoma. Los oligonucleótidos se pueden construir en un corto período de tiempo incorporando servicios de síntesis genética, software y consumibles. A medida que aumenta la demanda de productos de biología sintética en todo el mundo, también aumentan los productos y servicios de síntesis genética.

Así, debido a sus productos efectivos e innovadores, la demanda de productos de biología sintética está aumentando a nivel mundial, lo que se espera que actúe como un factor impulsor del mercado de síntesis genética.

Oportunidades

-

AUMENTO DEL GASTO SANITARIO

El gasto en atención sanitaria ha aumentado en todo el mundo a medida que aumenta el ingreso disponible de las personas en varios países. Además, para satisfacer las necesidades de la población, los organismos gubernamentales y las organizaciones de atención sanitaria están tomando la iniciativa acelerando el gasto en atención sanitaria.

Además, las iniciativas estratégicas adoptadas por los actores clave del mercado proporcionarán integridad estructural y oportunidades futuras para el mercado de pruebas de dispositivos médicos en el período de pronóstico de 2022 a 2029.

Restricciones/Desafíos

- ALTO COSTO DEL PROCESO DE SÍNTESIS GÉNICA

Sin embargo, las barreras a las técnicas de síntesis genética y el alto costo del proceso de síntesis genética en algunas regiones pueden impedir el crecimiento de los procedimientos de síntesis genética, lo que dificulta el crecimiento del mercado. Además, la alta competencia en las industrias de tecnología médica y el largo tiempo de espera para la calificación en el extranjero pueden ser factores desafiantes para el crecimiento del mercado.

Este informe sobre el mercado de síntesis genética proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de síntesis genética, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Desarrollo reciente

- En diciembre de 2020, Twist Bioscience lanzó fragmentos de genes clonales listos para completar la oferta de genes. Los fragmentos lanzados se pueden usar con adaptadores o sin ellos para construir los clones perfectos. Los fragmentos de genes clonales listos son compatibles con las vías de expresión de proteínas, ingeniería enzimática y expresión génica, entre otras.

- En 2020, según un artículo publicado en una revista de la ACS, se estima que se notificaron en todo el mundo un total de 19,3 millones de nuevos casos de cáncer y casi 10,0 millones de muertes por cáncer. Esto sugiere que la cobertura del cáncer no es óptima y que existe una gran necesidad de implementar una alta cobertura del cáncer en todo el mundo.

Alcance del mercado de síntesis genética en Asia y el Pacífico

El mercado de síntesis genética de Asia-Pacífico está segmentado en componentes, tipos de genes, tipos de síntesis genética, aplicaciones, métodos, usuarios finales y canales de distribución. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Sintetizadores

- Consumibles

- Software y servicios

Sobre la base de los componentes, el mercado de síntesis genética de Asia-Pacífico está segmentado en sintetizadores, consumibles y software y servicios.

Tipo de gen

- Gen estándar

- Gen expreso

- Gen complejo

- Otros

Sobre la base del tipo de gen, el mercado de síntesis genética de Asia y el Pacífico está segmentado en gen estándar, gen expreso, gen complejo y otros.

Tipo de síntesis génica

- Síntesis de bibliotecas de genes

- Síntesis genética personalizada

Sobre la base del tipo de síntesis genética, el mercado de síntesis genética de Asia y el Pacífico está segmentado en síntesis de bibliotecas genéticas y síntesis genética personalizada.

Solicitud

- Biología sintética,

- Ingeniería genética,

- Diseño de vacunas,

- Anticuerpos terapéuticos

- Otros

Sobre la base de la aplicación, el mercado de síntesis genética de Asia y el Pacífico está segmentado en biología sintética, ingeniería genética, diseño de vacunas, anticuerpos terapéuticos y otros.

Método

- Síntesis de base sólida,

- Síntesis de ADN basada en chips

- Síntesis enzimática basada en PCR

Sobre la base de este método, el mercado de síntesis genética de Asia y el Pacífico se segmenta en síntesis basada en sólidos, síntesis de ADN basada en chip y síntesis enzimática basada en PCR.

Usuario final

- Institutos académicos y de investigación,

- Laboratorios de diagnóstico,

- Empresas biotecnológicas y farmacéuticas

- Otros

Sobre la base del usuario final, el mercado de síntesis genética de Asia-Pacífico está segmentado en institutos académicos y de investigación, laboratorios de diagnóstico, empresas biotecnológicas y farmacéuticas, y otros.

Canal de distribución

- Licitación directa

- Distribución en línea

- Distribuidores de terceros

Sobre la base del canal de distribución, el mercado de síntesis genética de Asia-Pacífico está segmentado en licitación directa, distribución en línea y distribuidores externos.

Análisis y perspectivas regionales del mercado de síntesis de genes

The gene synthesis market is analyzed, and market size insights and trends are provided by the country, component, gene type, gene synthesis type, application, method, end user, and distribution channel, as referenced above.

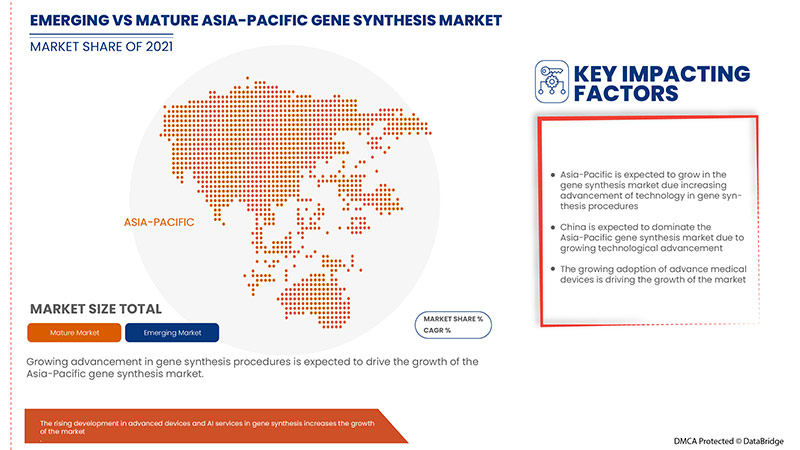

China dominates the Asia-Pacific gene synthesis market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the rising need for the verification and validation of gene synthesis processes in the region, and rapid research development is boosting the market.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Gene Synthesis Market Share Analysis

The gene synthesis market competitive landscape provides details by the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the gene synthesis market.

Some of the major players operating in the gene synthesis market are ATDBio Ltd (Subsidiary of Biotage), General Biosystems, Inc., MACROGEN CO., LTD., Boster Biological Technology, Creative Biogene, Bioneer Pacific, exonbio, trenzyme GmbH, Twist Bioscience, BioCat GmbH (Subsidiary of AddLife AB), OriGene Technologies, Inc., Integrated DNA Technologies, Inc. 9Subsidiary of Danaher Corporation), Eurofins Scientific, NZYTech, Lda. - Genes and Enzymes, Ansa Biotechnologies, Inc., Thermo Fisher Scientific, Genescript, Synbio Technologies, Proteogenix, Bio Basic Inc., ATG:biosynthetics GmbH, Merck KGaA, Kaneka Eurogentec S.A, Ginkgo Bioworks, Bbi-lifesciences, Evonetix, ProMab Biotechnologies, Inc., GCC Biotech (INDIA) Pvt. Ltd., CSBio, Azenta US, Inc., and among others.

Research Methodology

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, Asia-Pacífico frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC GENE SYNTHESIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 COMPONENT SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC GENE SYNTHESIS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC INFECTIOUS DISEASES

6.1.2 RISING ADOPTION OF GENE THERAPY

6.1.3 EXPANSION OF SYNTHETIC BIOLOGY

6.1.4 RISING INTEREST OF GENE SYNTHESIS IN THE FIELD OF MOLECULAR BIOLOGY

6.2 RESTRAINTS

6.2.1 LACK OF TRAINED PROFESSIONALS

6.2.2 ETHICAL ISSUES

6.2.3 LONG APPROVAL PROCESS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISING DEMAND FOR CUSTOMIZED MEDICATIONS

6.4 CHALLENGES

6.4.1 TECHNICAL LIMITATIONS ACROSS PRODUCTION PROCESS

6.4.2 LACK OF WELL DEFINED PATENT SYSTEM

7 ASIA PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE & SERVICES

7.3 CONSUMABLES

7.3.1 REAGENTS

7.3.2 ASSAYS

7.3.3 PROBES & DYES

7.3.4 OTHERS

7.4 SYNTHESIZER

7.4.1 COLUMN-BASED SYNTHESIZERS

7.4.2 MICROARRAY-BASED SYNTHESIZERS

8 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE

8.1 OVERVIEW

8.2 STANDARD GENE

8.3 COMPLEX GENE

8.4 EXPRESS GENE

8.5 OTHERS

9 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE

9.1 OVERVIEW

9.2 CUSTOM GENE SYNTHESIS

9.2.1 STANDARD GENE

9.2.2 COMPLEX GENE

9.2.3 EXPRESS GENE

9.2.4 OTHERS

9.3 GENE LIBRARY SYNTHESIS

9.3.1 STANDARD GENE

9.3.2 COMPLEX GENE

9.3.3 EXPRESS GENE

9.3.4 OTHERS

10 ASIA PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SYNTHETIC BIOLOGY

10.2.1 CUSTOM GENE SYNTHESIS

10.2.2 GENE LIBRARY SYNTHESIS

10.3 GENETIC ENGINEERING

10.3.1 CUSTOM GENE SYNTHESIS

10.3.2 GENE LIBRARY SYNTHESIS

10.4 THERAPEUTIC ANTIBODIES

10.4.1 CUSTOM GENE SYNTHESIS

10.4.2 GENE LIBRARY SYNTHESIS

10.5 VACCINE DESIGN

10.5.1 CUSTOM GENE SYNTHESIS

10.5.2 GENE LIBRARY SYNTHESIS

10.6 OTHERS

11 ASIA PACIFIC GENE SYNTHESIS MARKET, BY METHOD

11.1 OVERVIEW

11.2 PCR-BASED ENZYME SYNTHESIS

11.3 CHIP-BASED DNA SYNTHESIS

11.4 SOLID BASED SYNTHESIS

12 ASIA PACIFIC GENE SYNTHESIS MARKET, BY END USER

12.1 OVERVIEW

12.2 ACADEMIC & RESEARCH INSTITUTE

12.3 BIOTECH & PHARMACEUTICAL COMPANIES

12.4 DIAGNOSTIC LABORATORIES

12.5 OTHERS

13 ASIA PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 ONLINE DISTRIBUTION

13.4 THIRD PARTY DISTRIBUTORS

14 ASIA PACIFIC GENE SYNTHESIS MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 SOUTH KOREA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC GENE SYNTHESIS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 EUROFINS SCIENTIFIC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 SERVICE PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 MERCK KGAA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KANEKA EUROGENTEC S.A.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ANSA BIOTECHNOLOGIES, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ATD BIO LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ATG:BIOSYNTHETICS GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 AZENTUS US, INC (2021)

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 BBI LIFESCIENCES CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BIO BASIC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BIOCAT GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 BIONEER PACIFIC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BOSTER BIOLOGICAL TECHNOLOGY

17.14.1 COMPANY SNAPSHOT

17.14.2 SERVICE PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CSBIO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 CREATIVE BIOGENE

17.16.1 COMPANY SNAPSHOT

17.16.2 RODUCTPORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 EVONETIX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 EXONBIO

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 GCC BIOTECH (INDIA) PVT. LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 GINKGO BIOWORKS (2021)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 GENERAL BIOSYSTEMS INC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 GENSCRIPT

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MACROGEN CO., LTD. (A SUBSIDIARY OF MACROGEN, INC)

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 NZYTECH, LDA. - GENES AND ENZYMES.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 ORIGENE TECHNOLOGIES, INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 PROMAB BIOTECHNOLOGIES

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PROTEOGENIX

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SYNBIO TECHNOLOGIES

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 TRENZYME GMBH

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 TWIST BIOSCIENCE

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE & SERVICES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC STANDARD GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC COMPLEX GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC EXPRESS GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC PCR-BASED ENZYME SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC CHIP-BASED DNA SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC SOLID BASED SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC ACADEMIC & RESEARCH INSTITUTES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BIOTECH & PHARMACEUTICAL COMPANIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC DIRECT TENDER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ONLINE DISTRIBUTION IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 CHINA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 57 CHINA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHINA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 63 CHINA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 69 CHINA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CHINA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 JAPAN GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 72 JAPAN CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 77 JAPAN GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 78 JAPAN GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 JAPAN SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 80 JAPAN GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 81 JAPAN THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 82 JAPAN VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 83 JAPAN GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 84 JAPAN GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 JAPAN GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 INDIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 INDIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 NDIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 90 INDIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 92 INDIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 INDIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 96 INDIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 99 INDIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 SOUTH KOREA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 132 SINGAPORE CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 161 THAILAND GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 162 THAILAND CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 THAILAND SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 THAILAND GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 165 THAILAND GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 166 THAILAND CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 167 THAILAND GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 168 THAILAND GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 170 THAILAND GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 171 THAILAND THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 173 THAILAND GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 174 THAILAND GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 THAILAND GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 200 PHILIPPINES GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 201 PHILIPPINES THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 202 PHILIPPINES VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 203 PHILIPPINES GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 REST OF ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC GENE SYNTHESIS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC GENE SYNTHESIS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 ASIA PACIFIC GENE SYNTHESIS MARKET: DATA TRIANGULATION

FIGURE 4 ASIA PACIFIC GENE SYNTHESIS MARKET: SNAPSHOT

FIGURE 5 ASIA PACIFIC GENE SYNTHESIS MARKET: BOTTOM UP APPROACH

FIGURE 6 ASIA PACIFIC GENE SYNTHESIS MARKET: TOP DOWN APPROACH

FIGURE 7 ASIA PACIFIC GENE SYNTHESIS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 ASIA PACIFIC GENE SYNTHESIS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC GENE SYNTHESIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC GENE SYNTHESIS MARKET: END USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC GENE SYNTHESIS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 ASIA PACIFIC GENE SYNTHESIS MARKET SEGMENTATION

FIGURE 13 GROWING PREVALENCE OF CHRONIC INFECTIOUS DISEASES , EXPANSION OF SYNTHETIC BIOLOGY AND RISING ADOPTION OF GENE THERAPY ARE EXPECTED TO DRIVE THE MARKET FOR ASIA PACIFIC GENE SYNTHESIS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 SYNTHESIZER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GENE SYNTHESIS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC GENE SYNTHESIS MARKET

FIGURE 16 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, 2021

FIGURE 17 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, 2021

FIGURE 21 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2021

FIGURE 25 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, 2021

FIGURE 29 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, 2021

FIGURE 33 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, 2021

FIGURE 37 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC GENE SYNTHESIS MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT (2022-2029)

FIGURE 49 ASIA PACIFIC GENE SYNTHESIS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.