Asia Pacific Flow Cytometry Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.29 Billion

USD

3.25 Billion

2024

2032

USD

1.29 Billion

USD

3.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 3.25 Billion | |

|

|

|

|

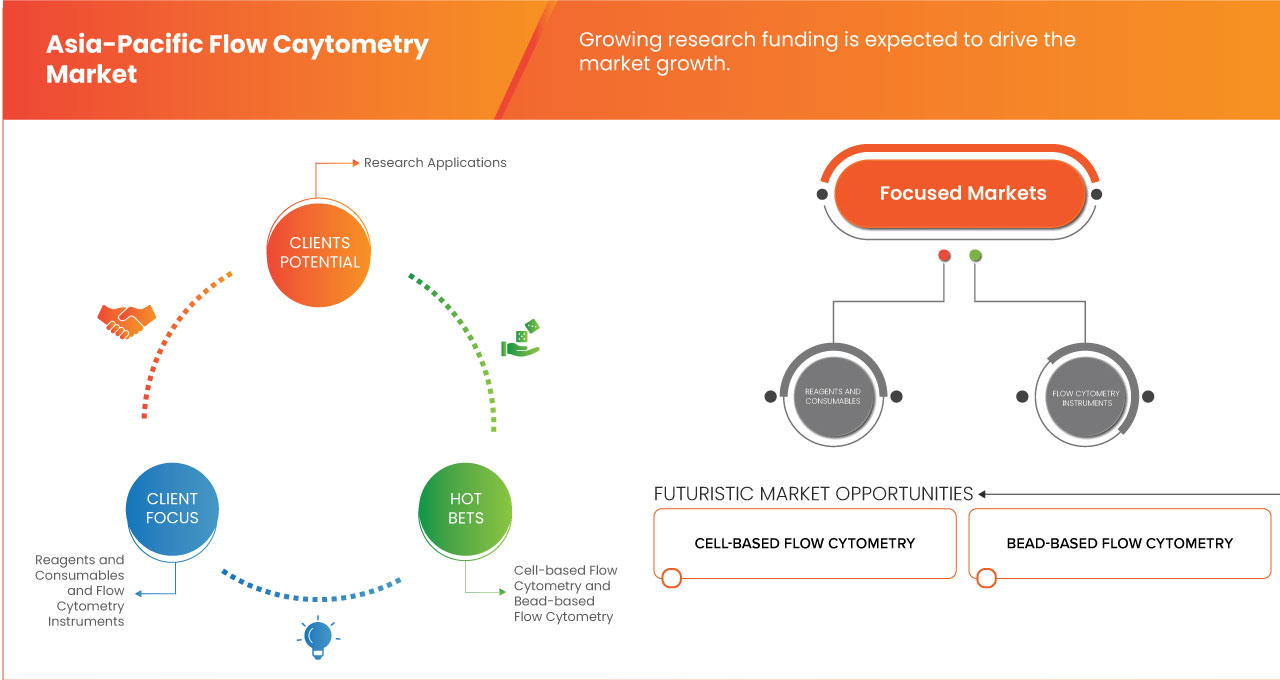

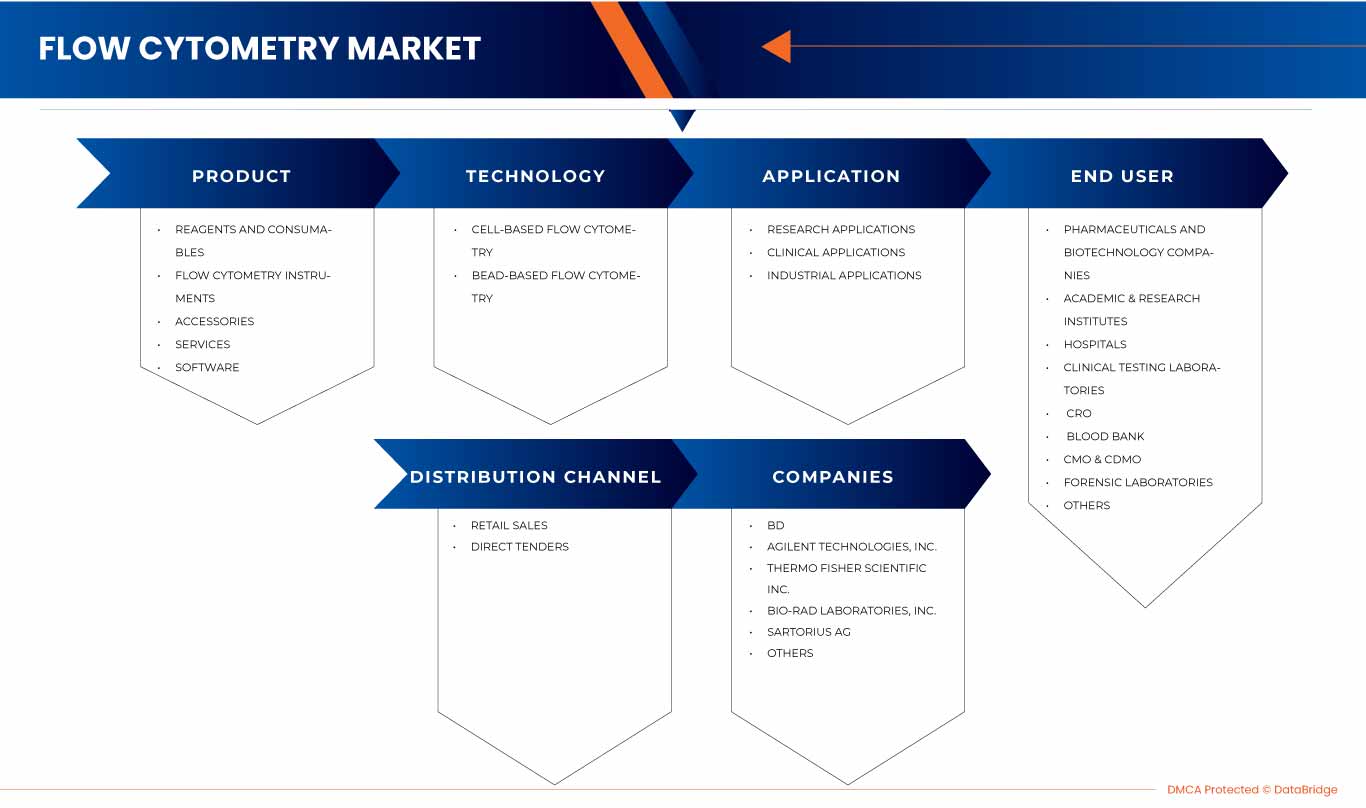

Segmentación del mercado de citometría de flujo en Asia-Pacífico, por producto (reactivos y consumibles, instrumentos de citometría de flujo, accesorios, servicios y software), tecnología (citometría de flujo celular y microesferas), aplicación (aplicaciones de investigación, aplicaciones clínicas y aplicaciones industriales), usuario final (empresas farmacéuticas y biotecnológicas, institutos académicos y de investigación, hospitales, laboratorios de análisis clínicos, organizaciones de investigación por contrato (CRO), bancos de sangre, CMO y CDMO, laboratorios forenses, entre otros), canal de distribución (venta minorista y licitaciones directas): tendencias y pronóstico del sector hasta 2032.

Análisis del mercado de citometría de flujo en Asia-Pacífico

La citometría de flujo es una técnica para detectar y cuantificar las propiedades físicas y químicas de una población de células o partículas. Una muestra que contiene células o partículas se suspende en un fluido y se inyecta en el equipo del citómetro de flujo en este proceso. La citometría de flujo es una tecnología bien establecida para identificar células en una solución que se utiliza más típicamente para evaluar la sangre periférica, la médula ósea y otros fluidos corporales. Las células inmunitarias se identifican y cuantifican mediante citometría de flujo, que también se utiliza para describir neoplasias hematológicas. La evaluación de células mediante esta técnica tiene un papel clave en el diagnóstico de muchas enfermedades crónicas. Analiza las actividades biológicas dentro de las células, la apoptosis, la necrosis, el ciclo celular, la membrana celular, la proliferación celular y la medición del ADN por célula.

Las principales aplicaciones diagnósticas incluyen procesos hematológicos benignos, cáncer, SIDA, inmunodeficiencias, enfermedades hematológicas benignas y la detección de estas enfermedades mediante fluorescencia. En este proceso, las células se tiñen con fluoróforos para detectar la luz emitida y producir la intensidad mediante el marcaje de proteínas específicas (inmunofenotipado) para el diagnóstico de leucemias y linfomas.

Tamaño del mercado de citometría de flujo en Asia-Pacífico

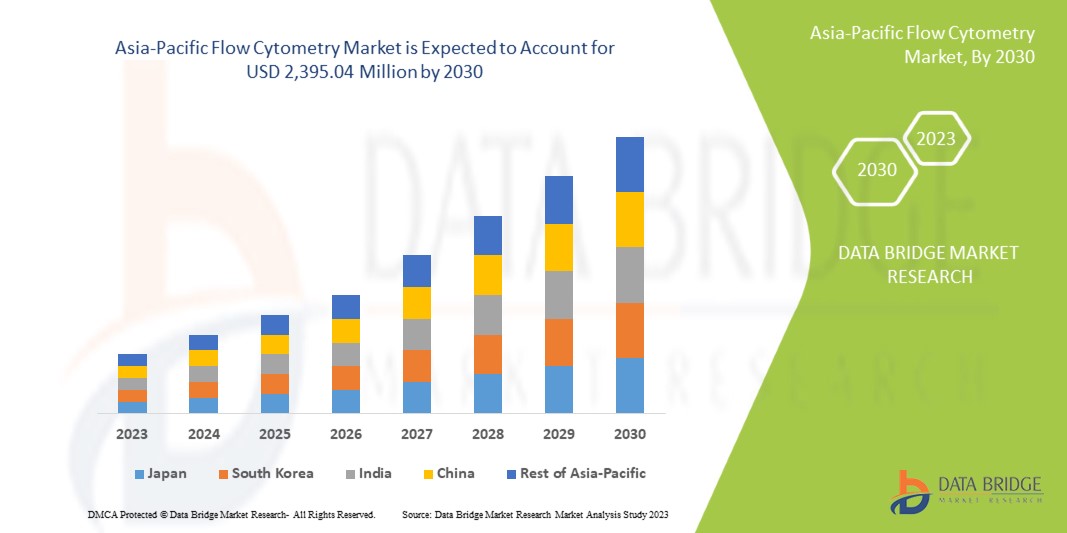

El tamaño del mercado de citometría de flujo de Asia-Pacífico se valoró en USD 1.290 millones en 2024 y se proyecta que alcance los USD 3.250 millones para 2032, con una CAGR del 12,2% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado de citometría de flujo en Asia-Pacífico

“Aumento de la adopción de capacidades de análisis multiparamétrico”

Una tendencia significativa en el mercado de citometría de flujo de Asia-Pacífico es la creciente adopción de capacidades de análisis multiparamétrico, impulsada por los avances tecnológicos que permiten la medición simultánea de numerosos marcadores celulares. Esta tendencia se debe en gran medida a la creciente demanda de caracterización celular detallada en áreas como la investigación del cáncer, la inmunología y la medicina personalizada, donde es necesario comprender las interacciones celulares complejas. Las innovaciones en sistemas láser, detectores y software permiten analizar más parámetros con mayor sensibilidad y resolución, lo que permite a investigadores y médicos comprender mejor los procesos biológicos y mejorar la precisión diagnóstica. Esta transición hacia sistemas de citometría de flujo más sofisticados está transformando las metodologías de investigación y ampliando la aplicabilidad de la citometría de flujo en diversos campos.

Alcance del informe y segmentación del mercado de citometría de flujo en Asia-Pacífico

|

Atributos |

Perspectivas del mercado de citometría de flujo en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Región cubierta |

EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, España, Rusia, Países Bajos, Suiza, Turquía, Bélgica, Austria, Irlanda, Noruega, Polonia, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Vietnam, Filipinas, Resto de Asia-Pacífico, Brasil, Argentina, Perú, Resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Kuwait, Israel y Resto de Oriente Medio y África. |

|

Actores clave del mercado |

BD (EE. UU.), Agilent Technologies, Inc. (EE. UU.), Thermo Fisher Scientific Inc. (EE. UU.), Bio-Rad Laboratories, Inc. (EE. UU.), Sartorius AG (Alemania), Bennubio Inc. (EE. UU.), Enzo Biochem Inc. (EE. UU.), Apogee Flow Systems Ltd. (Reino Unido), Beckman Coulter, Inc. (EE. UU.), Coherent Corp. (EE. UU.), Cell Signaling Technology, Inc. (EE. UU.), Cytek Biosciences (EE. UU.), Biomérieux (Francia) y Cytonome/ST LLC (EE. UU.). |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de citometría de flujo de Asia-Pacífico

El mercado de citometría de flujo en Asia-Pacífico abarca el desarrollo, la producción y la distribución de equipos, reactivos, software y servicios de citometría de flujo utilizados para el análisis y la clasificación de células y otras partículas suspendidas en un fluido. La citometría de flujo es una técnica potente que permite la medición simultánea de múltiples características físicas y químicas de células individuales, como el tamaño, la complejidad y la expresión proteica. Esta tecnología se emplea ampliamente en diversas aplicaciones, como la inmunología, la oncología, la microbiología y el desarrollo de fármacos, lo que la convierte en una herramienta esencial tanto en el diagnóstico clínico como en la investigación.

Dinámica del mercado de citometría de flujo en Asia-Pacífico

Conductores

- Aumento de la prevalencia de enfermedades crónicas

La citometría de flujo es una técnica para detectar y cuantificar las propiedades físicas y químicas de una población de células o partículas. Una muestra que contiene células o partículas se suspende en un fluido y se inyecta en el citómetro de flujo. La citometría de flujo es una tecnología consolidada para la identificación de células en una solución, que se utiliza habitualmente para evaluar sangre periférica, médula ósea y otros fluidos corporales. Las células inmunitarias se identifican y cuantifican mediante citometría de flujo, que también se utiliza para describir neoplasias hematológicas. La evaluación de células mediante esta técnica desempeña un papel fundamental en el diagnóstico de numerosas enfermedades crónicas. Analiza las actividades biológicas intracelulares, la apoptosis, la necrosis, el ciclo celular, la membrana celular, la proliferación celular y la medición del ADN por célula.

Las principales aplicaciones diagnósticas incluyen procesos hematológicos benignos, cáncer, SIDA, inmunodeficiencias, enfermedades hematológicas benignas y la detección de estas enfermedades mediante fluorescencia. En este proceso, las células se tiñen con fluoróforos para detectar la luz emitida y producir la intensidad mediante el marcaje de proteínas específicas (inmunofenotipado) para el diagnóstico de leucemias y linfomas.

La creciente prevalencia de enfermedades crónicas ha creado una creciente demanda de técnicas de citometría de flujo que puedan ayudar a los investigadores y médicos a comprender mejor los mecanismos subyacentes de estas enfermedades y desarrollar tratamientos más efectivos.

- Aumento de la aplicación de instrumentos de citometría

La citometría de flujo es una potente herramienta analítica que permite analizar y cuantificar células o partículas individuales en una mezcla heterogénea. Utiliza láseres y óptica para detectar y medir características como el tamaño, la forma y la intensidad de la fluorescencia de células o partículas. Esta técnica implica el marcaje de células o partículas con colorantes fluorescentes o anticuerpos que se unen a marcadores específicos de la superficie celular o moléculas intracelulares. Las células o partículas marcadas se pasan a través de un citómetro de flujo, que detecta y mide la fluorescencia emitida por cada célula o partícula. La citometría de flujo se utiliza ampliamente en numerosos campos de investigación, como la inmunología, la microbiología, la investigación con células madre, la investigación oncológica, el descubrimiento y desarrollo de fármacos y el diagnóstico clínico. Esta técnica evoluciona constantemente con nuevas aplicaciones y mejoras de hardware y software, lo que la convierte en una herramienta fundamental en el estudio de sistemas biológicos.

Por ejemplo,

- En julio de 2023, según un artículo publicado por el NCBI, la creciente aplicación de la citometría de flujo en diversos campos, como la inmunofenotipificación, los ensayos de viabilidad, el análisis del ciclo celular y la identificación de células raras, impulsa el mercado de la citometría de flujo en Asia-Pacífico. Su capacidad para analizar células individuales a nivel unicelular y clasificar poblaciones específicas para la investigación avanzada impulsa la demanda. Esta versatilidad acelera el crecimiento de la investigación académica y clínica, impulsando la expansión del mercado.

- En junio de 2020, según un artículo publicado por la biblioteca en línea de Wiley, la citometría de flujo puede utilizarse para identificar y caracterizar diferentes subconjuntos de células inmunitarias en pacientes con enfermedades autoinmunes como el lupus eritematoso sistémico (LES). El estudio concluyó que la citometría de flujo podría proporcionar información valiosa sobre la patogénesis de estas enfermedades y ayudar a desarrollar terapias más específicas. Esto acelera el crecimiento de la investigación académica y clínica, impulsando la expansión del mercado.

Uso creciente de la citometría de flujo en el descubrimiento de fármacos

- Se prevé que la creciente actividad de investigación impulse el crecimiento de la citometría de flujo. Esta se ha consolidado como la clave principal para explorar los procesos de descubrimiento y desarrollo de fármacos. Gracias a su excepcional capacidad para analizar poblaciones celulares heterogéneas, la citometría de flujo representa una atractiva promesa para el descubrimiento y desarrollo de fármacos. Proporciona información de mayor resolución sobre la información funcional y biológica multiparamétrica de una sola célula. Además, el continuo progreso en los enfoques de la citometría de flujo, como el análisis multifactorial de alto rendimiento, las mejoras en la clasificación celular y la rápida detección y resolución de eventos, garantiza una mayor eficiencia en el descubrimiento y la caracterización de nuevos medicamentos bioactivos.

- Por ejemplo;-

- En marzo de 2024, según el artículo publicado por el NCBI, el creciente uso de la citometría de flujo en el descubrimiento de fármacos, en particular para la modulación de biomarcadores en ensayos clínicos iniciales, impulsa el mercado de la citometría de flujo en Asia-Pacífico. Su capacidad para proporcionar información valiosa sobre la progresión molecular y la traducción inversa de datos de pacientes acelera los descubrimientos en el desarrollo terapéutico. Esta creciente aplicación en el descubrimiento de fármacos impulsa la demanda de tecnologías avanzadas de citometría de flujo en los sectores sanitario y farmacéutico.

- En noviembre de 2021, según un artículo publicado por News Medical Life Sciences, el creciente uso de la citometría de flujo en el descubrimiento de fármacos, desde la identificación de dianas hasta el desarrollo de fármacos líderes, está impulsando el mercado de Asia-Pacífico. Permite el análisis de diversas estructuras biomoleculares, como membranas celulares, proteínas, ADN y ARNm, lo que permite una selección precisa de dianas en el desarrollo de fármacos. Esta amplia aplicabilidad para comprender procesos biológicos complejos impulsa la demanda de tecnologías de citometría de flujo en la investigación farmacéutica.

Oportunidades

- Aumento de la adopción de técnicas de citometría de flujo en la investigación y el ámbito académico

La citometría de flujo es una técnica sofisticada para medir células individuales y otras partículas en suspensión a una velocidad de miles de células por segundo. Se ha extendido a investigaciones ambientales, análisis de vesículas extracelulares y la capacidad de utilizar más de 30 parámetros diferentes para análisis más exhaustivos. Se utiliza principalmente en el ámbito de la inmunología. Los citómetros de flujo ofrecen capacidades excepcionales, datos de alta calidad y una plataforma fácil de usar que ahorra tiempo a los investigadores en la recopilación y evaluación de datos.

El aumento de la prevalencia e incidencia de enfermedades crónicas e infecciosas ha abierto amplias oportunidades para una enorme investigación y desarrollo de nuevas aplicaciones diagnósticas y terapéuticas.

Por ejemplo,

En febrero de 2021, según un estudio publicado en PLOS ONE, investigadores utilizaron la citometría de flujo para analizar la respuesta inmunitaria de pacientes con COVID-19. El estudio concluyó que la citometría de flujo era una herramienta fiable y eficaz para caracterizar la respuesta inmunitaria al virus, lo que podría ayudar a orientar las estrategias de tratamiento.

En abril de 2021, según un estudio publicado en Frontiers in Immunology, investigadores utilizaron la citometría de flujo para estudiar la respuesta inmunitaria a la infección por VIH. El estudio reveló que la citometría de flujo era una herramienta eficaz para caracterizar la respuesta inmunitaria al virus, lo que podría impulsar el desarrollo de nuevos tratamientos y vacunas.

- Creciente desarrollo de las industrias farmacéutica y biotecnológica

Los instrumentos de citometría de flujo se han convertido en parte integral del descubrimiento y desarrollo de fármacos en las industrias farmacéutica y biotecnológica. El desarrollo de nuevos equipos de citometría de flujo ha ayudado a los investigadores a analizar y clasificar células con mayor rapidez, precisión y eficiencia, lo que ha contribuido a acelerar el desarrollo de fármacos. Por ejemplo, Beckman Coulter, fabricante líder de equipos de citometría de flujo, ha desarrollado el citómetro de flujo CytoFLEX LX, con detección rápida, sensibilidad mejorada y un tamaño compacto. CytoFLEX LX está diseñado para ayudar a los investigadores a analizar poblaciones de células raras con mayor rapidez y eficiencia.

En general, el desarrollo de nuevos dispositivos de citometría de flujo está ayudando a las empresas farmacéuticas y biotecnológicas a acelerar los plazos de desarrollo de fármacos al permitir un análisis más rápido y preciso de poblaciones celulares complejas. Con el aumento de la población geriátrica y de los casos de enfermedades crónicas, el crecimiento de las empresas biotecnológicas y farmacéuticas también se está expandiendo. A nivel mundial, las actividades de investigación y desarrollo están en aumento debido al gasto público en salud y al rendimiento económico.

Por ejemplo,

- En octubre de 2024, Ardena anunció una importante expansión de su área de bioanálisis en los Países Bajos. Además, se centró en ampliar sus capacidades en inmunoquímica, citometría de flujo y plataformas de qPCR, aumentar su capacidad de LC-MS/MS e incorporar nuevos sistemas automatizados Hamilton para mejorar la eficiencia y abordar los desafíos bioanalíticos en constante evolución.

- En abril de 2021, según datos de la Oficina de Presupuesto del Congreso (CBO), el sector farmacéutico gastó 83 000 millones de dólares en investigación y desarrollo. Estos costos se destinaron a diversas operaciones, como el descubrimiento y la prueba de nuevos medicamentos, el desarrollo de avances progresivos, como la expansión de productos, y las pruebas clínicas para la monitorización de la seguridad y la comercialización.

Restricciones/Desafíos

- Alto costo de los instrumentos de citometría de flujo

La sustancial inversión inicial que requieren los instrumentos de citometría de flujo, sumada a los costos continuos de reactivos, colorantes y mantenimiento, crea barreras financieras, especialmente para laboratorios pequeños o aquellos en entornos con recursos limitados. Además, la complejidad técnica de la citometría de flujo exige personal capacitado para su operación, con capacitación especializada para utilizar correctamente la tecnología. Esto limita su accesibilidad en regiones con escasez de experiencia, lo que reduce su tasa de adopción. Además, los sistemas de citometría de flujo requieren mantenimiento, calibración y resolución de problemas regulares, lo que aumenta los costos operativos y puede resultar en tiempo de inactividad, lo que afecta aún más la eficiencia del laboratorio. Los estrictos requisitos regulatorios para la aprobación de estos dispositivos médicos también generan retrasos en la entrada al mercado y costos adicionales de cumplimiento. Estos factores, en conjunto, dificultan la adopción generalizada de la citometría de flujo, especialmente en mercados emergentes donde las limitaciones financieras, la falta de profesionales capacitados y la lentitud de los procesos regulatorios actúan como barreras significativas para el crecimiento, lo que en última instancia limita el potencial de expansión del mercado.

Por ejemplo -

- En enero de 2024, según el artículo publicado por Excedr, el alto costo de los instrumentos de citometría de flujo, que oscila entre USD 100 000 y USD 1,5 millones, representa una importante limitación para el mercado de Asia-Pacífico. Estos gastos limitan el acceso a laboratorios e instituciones más pequeños, lo que dificulta su adopción de tecnología avanzada. Como resultado, los altos costos iniciales de inversión y mantenimiento dificultan su uso generalizado y ralentizan el crecimiento del mercado, especialmente en entornos con recursos limitados.

- En noviembre de 2023, según el artículo publicado por el NCBI, el alto costo de los instrumentos de citometría de flujo, que oscila entre USD 50 000 y USD 750 000 o más, representa una importante limitación para el mercado de Asia-Pacífico. Esta sustancial inversión financiera, necesaria para funciones y especificaciones avanzadas, limita la accesibilidad, especialmente para laboratorios de investigación más pequeños e instituciones con presupuestos limitados. En consecuencia, el alto costo ralentiza la adopción y obstaculiza el crecimiento del mercado, especialmente en entornos con recursos limitados.

La inversión inicial en instrumentos y los gastos continuos en reactivos y mantenimiento plantean desafíos financieros para los laboratorios más pequeños y aquellos ubicados en zonas con recursos limitados. La complejidad de la tecnología también requiere personal capacitado, lo que limita su uso en regiones con poca experiencia. Además, la necesidad de mantenimiento y calibración regulares incrementa los costos operativos y provoca posibles tiempos de inactividad. Los estrictos requisitos regulatorios retrasan aún más la aprobación de productos y su entrada al mercado. Estos factores limitan la adopción de la citometría de flujo, especialmente en mercados emergentes, lo que frena el crecimiento general del mercado.

- Limitaciones de la citometría de flujo

La citometría de flujo presenta limitaciones inherentes, como su incapacidad para analizar tejidos fijados con formalina, lo que restringe su uso en ciertas aplicaciones clínicas y de investigación. El método está diseñado para muestras frescas o congeladas, y la fijación con formalina puede alterar la estructura celular y la expresión de marcadores, haciéndolas inadecuadas para el análisis. Además, la citometría de flujo tiene dificultades para capturar completamente las interacciones celulares complejas o las vías de señalización multicapa. Estas restricciones limitan su alcance en diversos campos y actúan como una restricción en el mercado de la citometría de flujo en Asia-Pacífico, al limitar su aplicabilidad, especialmente en entornos clínicos y patológicos.

Por ejemplo

- En junio de 2021, según un artículo publicado por LearnHaem, la citometría de flujo requiere el procesamiento de muestras frescas inmediatamente después de su recolección, ya que el almacenamiento inadecuado o prolongado provoca apoptosis natural, lo que disminuye la precisión de los resultados. Además, la citometría de flujo no puede utilizarse en tejidos fijados con formalina, lo que limita su aplicación en ciertos entornos clínicos y de investigación. Estas limitaciones limitan el mercado de la citometría de flujo en Asia-Pacífico, reduciendo su versatilidad y aplicabilidad en algunas áreas.

- En marzo de 2020, según un artículo publicado por el NCBI, la citometría de flujo se enfrentaba a limitaciones debido a la borrosidad óptica causada por el alto movimiento celular, lo que afecta la claridad de la imagen. Además, la detección de objetos raros y atípicos, como las células tumorales circulantes (CTC), supone un reto a pesar de su importancia pronóstica. Estos problemas limitan la capacidad de capturar y analizar con precisión biomarcadores críticos, lo que frena el desarrollo y la aplicación de la citometría de flujo en ciertas áreas de diagnóstico e investigación.

La citometría de flujo presenta limitaciones, como su incapacidad para analizar tejidos fijados con formalina, comúnmente utilizados en patología y diagnóstico clínico. El proceso requiere muestras frescas o congeladas, y la fijación química altera los marcadores celulares, haciéndolos incompatibles con el análisis citométrico de flujo. Además, la técnica tiene dificultades para capturar completamente las complejas interacciones celulares o las vías de señalización. Estas limitaciones restringen la aplicación más amplia de la tecnología, lo que limita el mercado de la citometría de flujo en Asia-Pacífico al reducir su versatilidad en entornos clínicos y de investigación.

Alcance del mercado de citometría de flujo en Asia-Pacífico

El mercado está segmentado por producto, aplicación, tecnología, canal de distribución y usuario final. El crecimiento de estos segmentos le permitirá analizar segmentos de crecimiento reducido en las industrias y brindar a los usuarios una valiosa visión general del mercado y perspectivas que les ayudarán a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Reactivos y consumibles

- Teñir

- Anticuerpos

- Rosario

- Otros

- Instrumentos de citometría de flujo

- Analizadores de células

- Por tipo

- Citómetros de flujo de imágenes

- Citómetros de flujo sin imágenes

- Por rango

- Analizadores de células de alto rango

- Analizadores de células de rango medio

- Analizadores de células de bajo rango

- Por modalidad

- Banco de trabajo

- Autónomo

- Por tipo

- Clasificadores de células

- Por modalidad

- Banco de trabajo

- Autónomo

- Por rango

- Analizadores de células de alto rango

- Analizadores de células de rango medio

- Analizadores de células de bajo rango

- Por modalidad

- Analizadores de células

- Accesorios

- Filtros

- Detectores

- Otros

- Servicios

- Software

Tecnología

- Citometría de flujo basada en células

- Instrumentos de citometría de flujo

- Reactivos y consumibles

- Accesorios

- Citometría de flujo basada en microesferas

- Instrumentos de citometría de flujo

- Reactivos y consumibles

- Accesorios

Solicitud

- Aplicaciones de investigación

- Análisis del ciclo celular

- Clasificación/cribado de células

- Transfección/Viabilidad Celular

- Farmacéutica y biotecnología

- Descubrimiento de fármacos

- Investigación con células madre

- Pruebas de toxicidad in vitro

- Inmunología

- Apoptosis

- Conteo de células

- Otros

- Aplicaciones clínicas

- Hematología

- Cáncer

- Enfermedades de inmunodeficiencia

- Trasplante de órganos

- Otras aplicaciones clínicas

- Aplicaciones industriales

Usuario final

- Empresas farmacéuticas y biotecnológicas

- Institutos académicos y de investigación

- Hospitales

- Laboratorios de pruebas clínicas

- Cro

- Banco de sangre

- Cmo y Cdmo

- Laboratorios forenses

- Otros

Canal de distribución

- Ventas minoristas

- Desconectado

- En línea

- Licitaciones directas

Análisis regional del mercado de citometría de flujo en Asia-Pacífico

Se analiza el mercado y se proporcionan información sobre el tamaño del mercado y las tendencias por país, producto, aplicación, tecnología, canal de distribución y usuario final como se menciona anteriormente.

Los países cubiertos en el mercado son China, Japón, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico.

Japón posee la mayor cuota de mercado gracias a su avanzada infraestructura sanitaria, sus sólidas industrias biotecnológica y farmacéutica, la adopción de alta tecnología, la importante inversión en I+D y el apoyo gubernamental. El envejecimiento de su población y la presencia de actores consolidados en el mercado impulsan aún más la demanda de citometría de flujo.

La sección de países del informe también presenta los factores que impactan el mercado individual y los cambios en la regulación del mercado nacional, los cuales impactan las tendencias actuales y futuras. Datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de caso son algunos de los indicadores utilizados para pronosticar el escenario del mercado en cada país. Además, se considera la presencia y disponibilidad de marcas de Asia-Pacífico y los desafíos que enfrentan debido a la alta o escasa competencia de marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales, al proporcionar un análisis de pronóstico de los datos nacionales.

Cuota de mercado de citometría de flujo en Asia-Pacífico

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Asia-Pacífico, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los líderes del mercado de citometría de flujo de Asia-Pacífico que operan en el mercado son:

- BD(EE.UU.)

- Agilent Technologies, Inc. (EE. UU.)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Bio-Rad Laboratories, Inc. (EE. UU.)

- Sartorius AG (Alemania)

- Bennubio Inc. (EE. UU.)

- Enzo Biochem Inc. (EE. UU.)

- Apogee Flow Systems Ltd. (Reino Unido)

- Beckman Coulter, Inc. (EE. UU.)

- Coherent Corp. (EE. UU.)

- Cell Signaling Technology, Inc. (EE. UU.)

- Cytek Biosciences (EE. UU.)

- Biomérieux. (Francia)

- Cytonome/ST LLC (EE. UU.)

Últimos avances en el mercado de citometría de flujo de Asia-Pacífico

- En julio de 2024, Agilent Technologies anunció la adquisición de la empresa canadiense de servicios farmacéuticos BioVectra por 925 millones de dólares. Esta operación amplía las capacidades de Agilent en edición genética, específicamente en la fabricación de oligonucleótidos y péptidos, y potencia su papel en terapias basadas en ARN y tecnologías de edición genética como CRISPR-Cas.

- En junio de 2024, Thermo Fisher celebró la inauguración de una ampliación de 72,500 pies cuadrados en su campus de Middleton, que servirá como laboratorio para pruebas farmacéuticas. El proyecto creará 350 empleos en los próximos dos años, con créditos fiscales estatales para apoyar la iniciativa.

- En noviembre de 2024, Sartorius Stedim Biotech inauguró un nuevo Centro de Innovación en Bioprocesos en Marlborough, Massachusetts, cuyo objetivo es impulsar el desarrollo de terapias de nueva generación. Las instalaciones de 63.000 pies cuadrados ofrecerán optimización de procesos, capacitación y suites GMP para la producción clínica a partir de 2025.

- En marzo de 2024, Beckman Coulter Life Sciences lanzó el citómetro de flujo CytoFLEX nano, un avance en el análisis de nanopartículas que permite la detección de partículas de hasta 40 nm. Este sistema mejora la sensibilidad y ofrece hasta un 50 % más de datos para la investigación de vesículas extracelulares y dianas de menor abundancia.

- En marzo de 2024, Beckman Coulter Life Sciences recibió la autorización 510(k) de la FDA para distribuir su citómetro de flujo clínico DxFLEX en EE. UU. Esto simplifica las pruebas de alta complejidad con una sensibilidad mejorada y compensación automatizada, lo que hace que la citometría de flujo multicolor sea más accesible y eficiente para los laboratorios.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 ASIA-PACIFIC FLOW CYTOMETRY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

6.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

6.1.4 GROWING RESEARCH FUNDING

6.2 RESTRAINTS

6.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

6.2.2 LIMITATIONS OF FLOW CYTOMETRY

6.3 OPPORTUNITIES

6.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

6.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

6.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

6.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

7 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REAGENTS AND CONSUMABLES

7.2.1 DYE

7.2.2 ANTIBODIES

7.2.3 BEADS

7.2.4 OTHERS

7.3 FLOW CYTOMETRY INSTRUMENTS

7.3.1 CELL ANALYZERS

7.3.1.1 CELL ANALYZERS, BY TYPE

7.3.1.1.1 IMAGING FLOW CYTOMETERS

7.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

7.3.1.2 CELL ANALYZERS, BY RANGE

7.3.1.2.1 HIGH-RANGE CELL ANALYZERS

7.3.1.2.2 MID-RANGE CELL ANALYZERS

7.3.1.2.3 LOW-RANGE CELL ANALYZERS

7.3.1.3 CELL ANALYZERS, BY MODALITY

7.3.1.3.1 BENCHTOP

7.3.1.3.2 STANDALONE

7.3.2 CELL SORTERS

7.3.2.1 BENCHTOP

7.3.2.2 STANDALONE

7.3.3 CELL SORTERS

7.3.3.1 HIGH-RANGE CELL ANALYZERS

7.3.3.2 MID-RANGE CELL ANALYZERS

7.3.3.3 LOW-RANGE CELL ANALYZERS

7.4 ACCESSORIES

7.4.1 FILTERS

7.4.2 DETECTORS

7.4.3 OTHERS

7.5 SERVICES

7.6 SOFTWARE

8 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CELL-BASED FLOW CYTOMETRY

8.2.1 FLOW CYTOMETRY INSTRUMENTS

8.2.2 REAGENTS & CONSUMABLES

8.2.3 ACCESSORIES

8.3 BEAD-BASED FLOW CYTOMETRY

8.3.1 FLOW CYTOMETRY INSTRUMENTS

8.3.2 REAGENTS & CONSUMABLES

8.3.3 ACCESSORIES

9 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESEARCH APPLICATIONS

9.2.1 CELL CYCLE ANALYSIS

9.2.2 CELL SORTING/SCREENING

9.2.3 CELL TRANSFECTION/VIABILITY

9.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

9.2.4.1 DRUG DISCOVERY

9.2.4.2 STEM CELL RESEARCH

9.2.4.3 IN VITRO TOXICITY TESTING

9.2.5 IMMUNOLOGY

9.2.6 APOPTOSIS

9.2.7 CELL COUNTING

9.2.8 OTHERS

9.3 CLINICAL APPLICATIONS

9.3.1 HAEMATOLOGY

9.3.2 CANCER

9.3.3 IMMUNODEFICIENCY DISEASES

9.3.4 ORGAN TRANSPLANTATION

9.3.5 OTHER CLINICAL APPLICATION

9.4 INDUSTRIAL APPLICATIONS

10 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 DIRECT TENDERS

11 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

11.3 ACADEMIC & RESEARCH INSTITUTES

11.4 HOSPITALS

11.5 CLINICAL TESTING LABORATORIES

11.6 CRO

11.7 BLOOD BANK

11.8 CMO & CDMO

11.9 FORENSIC LABORATORIES

11.1 OTHERS

12 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AGILENT TECHNOLOGIES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 THERMO FISHER SCIENTIFIC INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BIO-RAD LABORATORIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SARTORIUS AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 APOGEE FLOW SYSTEMS LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOMÉRIEUX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIOLEGEND, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BENNUBIO INC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COHERENT CORP.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 CYTONOME/ST, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 CYTOBUOY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CELL SIGNALING TECHNOLOGY, INC

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CYTEK BIOSCIENCES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DIASORIN S.P.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 ELABSCIENCE BIONOVATION INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ENZO BIOCHEM, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MILTENYI BIOTEC AND/OR ITS AFFILIATES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MERCK KGAA

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 NANOCELLECT BIOMEDICAL

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 NEOGENOMICS LABORATORIES

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 ORLFO TECHNOLOGIES

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 STRATEDIGM, INC

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 SONY BIOTECHNOLOGY INC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 TAKARA BIO INC.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 UNION BIOMETRICA, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 3 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 5 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 7 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 9 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 10 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 13 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 15 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 16 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 18 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 19 ASIA-PACIFIC SERVICES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 ASIA-PACIFIC SOFTWARE IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 ASIA-PACIFIC CELL-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 ASIA-PACIFIC CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 24 ASIA-PACIFIC BEAD-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 ASIA-PACIFIC BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 26 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 27 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 34 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 36 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 38 ASIA-PACIFIC PHARMACEUTICALS & BIOTECHNOLOGY COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 39 ASIA-PACIFIC ACADEMIC & RESEARCH INSTITUTES COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 ASIA-PACIFIC HOSPITALS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 ASIA-PACIFIC CLINICAL TESTING LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 ASIA-PACIFIC CRO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 ASIA-PACIFIC BLOOD BANK IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 ASIA-PACIFIC CMO&CDMO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 ASIA-PACIFIC FORENSIC LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 ASIA-PACIFIC OTHERS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 48 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 50 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 51 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 52 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 53 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 55 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 56 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 57 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 58 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 59 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 60 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 61 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 62 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 63 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 64 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 65 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 66 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 67 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 68 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 69 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 70 ASIA-PACIFIC CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 71 ASIA-PACIFIC BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 72 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 73 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 74 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 76 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 77 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 78 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 79 JAPAN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 80 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 81 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 82 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 83 JAPAN FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 84 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 86 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 87 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 88 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 89 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 90 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 91 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 92 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 93 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 94 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 95 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 96 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 97 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 98 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 99 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 100 JAPAN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 101 JAPAN CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 102 JAPAN BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 103 JAPAN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 104 JAPAN RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 105 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 106 JAPAN CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 107 JAPAN FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 108 JAPAN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 109 JAPAN RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 110 CHINA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 111 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 112 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 113 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 114 CHINA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 115 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 117 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 118 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 119 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 120 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 121 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 122 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 123 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 124 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 125 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 126 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 127 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 128 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 129 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 130 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 131 CHINA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 132 CHINA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 133 CHINA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 134 CHINA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 CHINA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 136 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 137 CHINA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 138 CHINA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 139 CHINA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 140 CHINA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 141 INDIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 142 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 143 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 144 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 145 INDIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 146 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 147 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 148 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 149 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 150 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 151 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 152 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 153 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 154 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 155 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 156 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 157 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 158 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 159 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 160 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 161 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 162 INDIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 163 INDIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 164 INDIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 165 INDIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 166 INDIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 167 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 168 INDIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 169 INDIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 170 INDIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 171 INDIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 172 SOUTH KOREA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 173 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 174 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 175 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 176 SOUTH KOREA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 179 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 180 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 181 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 182 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 183 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 184 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 185 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 186 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 187 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 188 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 189 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 190 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 191 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 192 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 193 SOUTH KOREA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 194 SOUTH KOREA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 195 SOUTH KOREA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 196 SOUTH KOREA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 SOUTH KOREA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 SOUTH KOREA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 SOUTH KOREA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 201 SOUTH KOREA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 202 SOUTH KOREA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 203 AUSTRALIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 204 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 205 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 206 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 207 AUSTRALIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 208 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 209 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 210 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 211 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 212 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 213 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 214 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 215 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 216 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 217 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 218 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 219 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 220 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 221 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 222 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 223 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 224 AUSTRALIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 225 AUSTRALIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 226 AUSTRALIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 227 AUSTRALIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 AUSTRALIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 229 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 230 AUSTRALIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 AUSTRALIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 232 AUSTRALIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 233 AUSTRALIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 234 SINGAPORE FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 235 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 236 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 237 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 238 SINGAPORE FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 239 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 241 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 242 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 243 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 244 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 245 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 246 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 247 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 248 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 249 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 250 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 251 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 252 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 253 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 254 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 255 SINGAPORE FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 256 SINGAPORE CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 257 SINGAPORE BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 258 SINGAPORE FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 259 SINGAPORE RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 260 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 261 SINGAPORE CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 SINGAPORE FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 263 SINGAPORE FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 264 SINGAPORE RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 265 THAILAND FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 266 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 267 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 268 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 269 THAILAND FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 270 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 272 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 273 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 274 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 275 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 276 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 277 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 278 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 279 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 280 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 281 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 282 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 283 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 284 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 285 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 286 THAILAND FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 287 THAILAND CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 288 THAILAND BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 289 THAILAND FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 290 THAILAND RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 THAILAND CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 THAILAND FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 294 THAILAND FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 295 THAILAND RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 296 MALAYSIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 297 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 298 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 299 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 300 MALAYSIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 301 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 302 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 303 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 304 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 305 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 306 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 307 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 308 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 309 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 310 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 311 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 312 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 313 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 314 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 315 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 316 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 317 MALAYSIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 318 MALAYSIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 319 MALAYSIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 320 MALAYSIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 MALAYSIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 322 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 MALAYSIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 324 MALAYSIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 325 MALAYSIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 326 MALAYSIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 327 INDONESIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 328 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 329 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 330 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 331 INDONESIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 332 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 334 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 335 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 336 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 337 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 338 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 339 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 340 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 341 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 342 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 343 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 344 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 345 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 346 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 347 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 348 INDONESIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 349 INDONESIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 350 INDONESIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 351 INDONESIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 352 INDONESIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 353 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 354 INDONESIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 355 INDONESIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 356 INDONESIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 357 INDONESIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 358 PHILIPPINES FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 359 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 360 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 361 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 362 PHILIPPINES FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 363 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 365 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 366 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 367 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 368 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 369 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 370 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 371 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 372 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 373 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 374 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 375 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 376 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 377 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 378 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 379 PHILIPPINES FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 380 PHILIPPINES CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 381 PHILIPPINES BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 382 PHILIPPINES FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 383 PHILIPPINES RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 384 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 385 PHILIPPINES CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 386 PHILIPPINES FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 387 PHILIPPINES FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 388 PHILIPPINES RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 389 REST OF ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA-PACIFIC FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC FLOW CYTOMETRY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC FLOW CYTOMETRY MARKET: DROC ANALYSIS