Asia Pacific Fibrotic Diseases Treatment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

856.12 Million

USD

1,656.29 Million

2024

2032

USD

856.12 Million

USD

1,656.29 Million

2024

2032

| 2025 –2032 | |

| USD 856.12 Million | |

| USD 1,656.29 Million | |

|

|

|

Mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico, por tratamiento (medicamentos, trasplante de órganos, oxigenoterapia y otros), aplicación (fibrosis pulmonar idiopática, cirrosis hepática, fibrosis renal, fibrosis cutánea y otras), usuario final (hospitales, clínicas especializadas, institutos académicos y de investigación y otros): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

La creciente prevalencia de enfermedades fibróticas , como la fibrosis pulmonar idiopática, la cirrosis hepática y la fibrosis renal, es un factor importante que impulsa el mercado de tratamiento de enfermedades fibróticas. Factores como el envejecimiento de la población, los cambios en el estilo de vida y las crecientes tasas de enfermedades crónicas como la diabetes y la hipertensión están contribuyendo a una mayor incidencia de estas enfermedades. A medida que aumenta el número de personas afectadas, se intensifica la demanda de tratamientos efectivos, lo que impulsa la necesidad de terapias avanzadas, incluidos los fármacos antifibróticos y los productos biológicos. Los sistemas de atención médica se enfrentan a una presión cada vez mayor para gestionar las enfermedades fibróticas crónicas, lo que impulsa la demanda de tratamientos más efectivos e impulsa el crecimiento del mercado.

Tamaño del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

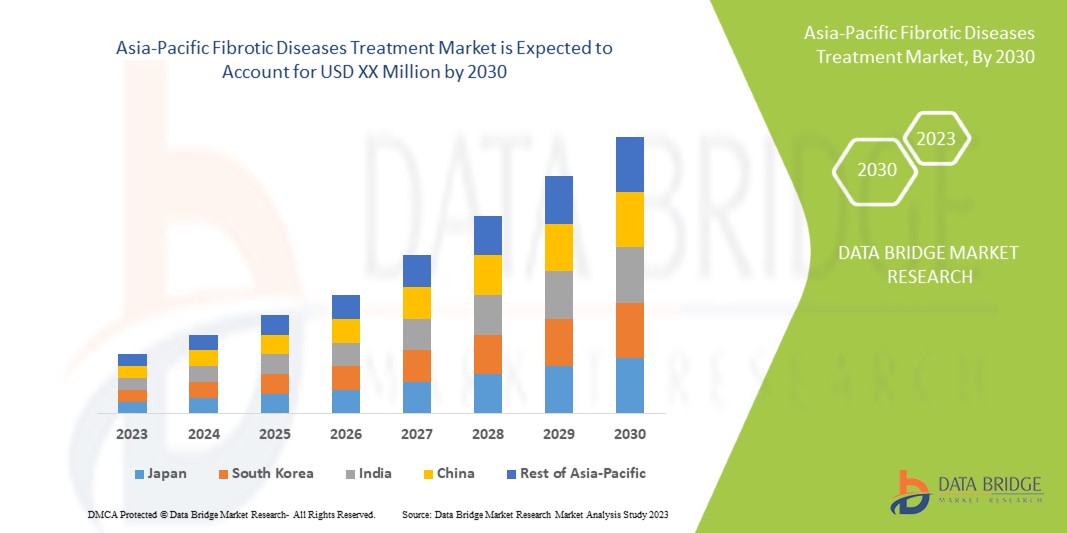

Data Bridge Market Research analiza que se espera que el mercado de tratamiento de enfermedades fibróticas de Asia-Pacífico alcance los USD 1.656,29 millones para 2032 desde USD 856,12 millones en 2024, creciendo con una CAGR del 8,7% durante el período de pronóstico de 2025 a 2032.

Tendencias del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

“Aumento de la adopción de diagnósticos basados en biomarcadores”

El uso de diagnósticos basados en biomarcadores en los tumores de células germinales testiculares (TGCT, por sus siglas en inglés) es cada vez más frecuente, y los biomarcadores como la alfa-fetoproteína (AFP), la gonadotropina coriónica humana beta (β-hCG) y la lactato deshidrogenasa (LDH) desempeñan un papel crucial en la práctica clínica. Estos biomarcadores permiten a los médicos lograr una detección temprana, monitorear la progresión de la enfermedad y adaptar los tratamientos a las características individuales de cada paciente. Esta tendencia refleja los avances en la medicina de precisión y está dando lugar a una estadificación y una estratificación del riesgo más precisas de los TGCT. A medida que la investigación continúa identificando biomarcadores adicionales, la integración de estas herramientas de diagnóstico se está convirtiendo en un enfoque estándar, mejorando los protocolos de tratamiento y los resultados de los pacientes.

Segmentación del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

|

Atributos |

Perspectivas del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Japón, China, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas, Vietnam, Taiwán, Resto de Asia-Pacífico |

|

Actores clave del mercado |

CH Boehringer Sohn AG & Co. KG. (Alemania), F. Hoffmann-La Roche Ltd (Suiza), Teva Pharmaceutical Industries Ltd. (Israel), Sandoz International GmbH (Alemania), Accord Healthcare (Reino Unido), AbbVie Inc. (EE. UU.), Redx Pharma Pic (Reino Unido), Bristol-Myers Squibb Company (EE. UU.), BioMX (EE. UU.), KITHER BIOTECH SRL (Italia), Verona Pharma pic (Reino Unido), Intercept Pharmaceuticals, Inc. (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

Las enfermedades fibróticas son una afección en la que se forma un exceso de tejido conectivo fibroso (fibrosis), a menudo como resultado de una inflamación crónica o una lesión tisular. Esta acumulación anormal de tejido altera el funcionamiento normal de los órganos y suele afectar a los pulmones (fibrosis pulmonar), el hígado (fibrosis hepática), el corazón, los riñones y la piel.

El tratamiento de la enfermedad fibrótica se centra en ralentizar o detener la progresión de la fibrosis, reducir la inflamación y controlar los síntomas. Los enfoques pueden incluir fármacos antifibróticos, agentes inmunosupresores, modificaciones del estilo de vida y, en casos avanzados, opciones quirúrgicas como el trasplante de órganos. Los tratamientos más nuevos exploran terapias dirigidas que bloquean vías específicas responsables del desarrollo de la fibrosis.

Dinámica del mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

Conductores

- Aumento de la prevalencia de enfermedades fibróticas

La creciente prevalencia de enfermedades fibróticas, como la fibrosis pulmonar idiopática, la cirrosis hepática y la fibrosis renal, es un factor importante que impulsa el mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico. Factores como el envejecimiento de la población, los cambios en el estilo de vida y las crecientes tasas de enfermedades crónicas como la diabetes y la hipertensión están contribuyendo a una mayor incidencia de estas enfermedades. A medida que aumenta el número de personas afectadas, se intensifica la demanda de tratamientos efectivos, lo que impulsa la necesidad de terapias avanzadas, incluidos los fármacos antifibróticos y los productos biológicos. Los sistemas de atención sanitaria se enfrentan a una presión cada vez mayor para gestionar las enfermedades fibróticas crónicas, lo que impulsa la demanda de tratamientos más efectivos e impulsa el crecimiento del mercado.

Por ejemplo,

- En agosto de 2024, según un artículo publicado por ScienceDirect, una revisión de 46 estudios que involucraron a alrededor de 8 millones de participantes de 21 países encontró una prevalencia combinada de fibrosis hepática avanzada del 3,3%, lo que subraya su impacto sustancial y creciente en Asia y el Pacífico, con notables diferencias geográficas.

- Se espera que la creciente prevalencia de enfermedades fibróticas, impulsada por las crecientes tasas de incidencia en Asia y el Pacífico, impulse la demanda de tratamientos efectivos, actuando como un motor para el mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico.

- En enero de 2023, según un artículo publicado por PubMed Central, la incidencia y prevalencia de la fibrosis pulmonar idiopática (FPI) están aumentando en Asia-Pacífico, y ya no se ajusta a su clasificación de enfermedad rara. En América del Norte, las tasas de prevalencia varían de 2,4 a 2,98 por 10 000 personas, y Corea del Sur tiene la prevalencia más alta, 4,51 por 10 000

La creciente prevalencia de enfermedades fibróticas impulsa significativamente la expansión del mercado al resaltar la necesidad de soluciones de tratamiento mejores y más accesibles, al tiempo que fomenta una mayor investigación y desarrollo en el campo.

- Aumento del número de personas que fuman cigarrillos

Fumar cigarrillos es uno de los factores de riesgo más reconocidos para el desarrollo de fibrosis pulmonar idiopática (FPI). Además, trabajos recientes sugieren que fumar puede tener un efecto perjudicial en la supervivencia de los pacientes con FPI. El mecanismo por el cual el tabaquismo puede contribuir a la patogénesis de la FPI es en gran parte desconocido. Sin embargo, la evidencia acumulada sugiere que el aumento del estrés oxidativo podría promover la progresión de la enfermedad en pacientes con FPI que son fumadores actuales y ex fumadores.

Por ejemplo,

- En junio de 2023, según un artículo publicado por NCBI, fumar es un factor de riesgo clave para las enfermedades pulmonares intersticiales (EPI) como la fibrosis pulmonar idiopática (FPI), y los estudios indican que entre el 41% y el 83% de los pacientes con FPI tienen antecedentes de tabaquismo y un riesgo 60% mayor.

- En mayo de 2022, según el artículo publicado en el National Center for Biotechnology Information (NCBI), el tabaquismo se ha considerado un factor de riesgo importante para la incidencia de fibrosis pulmonar idiopática (FPI). Según el estudio realizado en el artículo, el riesgo de FPI fue significativamente mayor en fumadores actuales y exfumadores que en los nunca fumadores, con un HRa de 1,66 (IC del 95%: 1,61 a 1,72) y 1,42 (IC del 95%: 1,37 a 1,48), respectivamente. Los fumadores actuales tenían un mayor riesgo de FPI que los exfumadores (HRa 1,17; IC del 95%: 1,13 a 1,21). El riesgo de desarrollar FPI aumentó a medida que aumentaba la intensidad y la duración del tabaquismo.

Por lo tanto, el humo del cigarrillo contiene partículas, así como numerosos productos químicos, incluidos RONS altamente tóxicos que aumentan la hinchazón dentro del cuerpo y, por lo tanto, conducen a varias enfermedades, incluida la fibrosis pulmonar, el cáncer, etc., lo que se espera que impulse el crecimiento del mercado de tratamiento de enfermedades fibróticas de Asia y el Pacífico.

Oportunidades

- Aumento de las actividades de investigación y desarrollo

La creciente prevalencia de enfermedades fibróticas y la demanda de tratamientos más eficaces están impulsando a las empresas farmacéuticas y biotecnológicas a aumentar sus inversiones en I+D. Estos esfuerzos tienen como objetivo desarrollar terapias innovadoras, incluidos nuevos fármacos antifibróticos, productos biológicos y terapias genéticas dirigidas a las causas subyacentes de la fibrosis. Además, se espera que los avances en medicina personalizada y tecnologías de diagnóstico mejoren los resultados del tratamiento y la atención general al paciente. A medida que avance la I+D, surgirán nuevas opciones terapéuticas, lo que impulsará el crecimiento del mercado y mejorará el tratamiento de las enfermedades fibróticas.

Por ejemplo,

- En julio de 2021, según el artículo publicado por Moez Ghumman et.al, las terapias orales existentes, pirfenidona y nintedanib, pueden intentar mejorar la calidad de vida de los pacientes al mitigar los síntomas y ralentizar la progresión de la enfermedad, sin embargo, las dosis crónicas y las administraciones sistémicas de estos medicamentos pueden provocar efectos secundarios graves. La falta de opciones de tratamiento efectivas exige una mayor investigación de terapias restauradoras y paliativas adicionales para la FPI. Se pueden utilizar estrategias de administración sostenida de fármacos basadas en nanopartículas para garantizar la administración dirigida para el tratamiento en un sitio específico, así como una terapia de acción prolongada, lo que mejora el cumplimiento general del paciente.

El aumento de las actividades de I+D presenta una oportunidad importante para acelerar la expansión del mercado fomentando la innovación y mejorando las estrategias de tratamiento.

- Avances en el desarrollo de fármacos en fase de desarrollo

En la actualidad, se encuentran en diversas etapas de desarrollo un número cada vez mayor de terapias prometedoras, entre ellas nuevos fármacos antifibróticos, productos biológicos y terapias genéticas. Estos fármacos apuntan a atacar las causas subyacentes de las enfermedades fibróticas, lo que ofrece la posibilidad de lograr tratamientos más eficaces y mejores resultados para los pacientes, en particular en el caso de enfermedades como la fibrosis pulmonar idiopática, la cirrosis hepática y la fibrosis renal. La aprobación y comercialización exitosa de estos fármacos ampliará la gama de opciones terapéuticas disponibles, satisfará la creciente demanda de mejores tratamientos y fomentará el crecimiento del mercado.

Por ejemplo,

- En septiembre de 2024, según un artículo publicado por la Fundación de Fibrosis Pulmonar, los medicamentos que actualmente se encuentran en la fase 1 de desarrollo para enfermedades fibróticas incluyen células madre esferoides pulmonares autólogas, AZD5055, dasatinib + quercetina, epigalocatequina-3-galato, NIP292, ORIN1001, saracatinib, sirolimus, TRK-250 y valganciclovir.

- En febrero de 2022, según el NCBI, un ensayo clínico de fase I/II, iniciado en febrero de 2021, está probando Imatinib (200 mg/día) para la fibrosis hepática avanzada (grados 3-4) en el Hospital Taleghani de Teherán. El ensayo compara Imatinib con el tratamiento estándar y un placebo durante 24 semanas.

Restricciones/Desafíos

- Alto costo de medicamentos y tratamientos

Los tratamientos de la enfermedad fibrótica se han vuelto cada vez más costosos debido al creciente número de pacientes que padecen fibrosis y al aumento de los precios de los dispositivos médicos y medicamentos. Los dispositivos tecnológicos modernos utilizados en el tratamiento de la fibrosis también juegan un papel importante en los altos precios de los tratamientos y la alta precisión, que proporciona un diagnóstico definitivo de la fibrosis pulmonar idiopática (FPI). Por lo tanto, el alto costo de los medicamentos y los procedimientos de tratamiento para la enfermedad fibrótica está obstaculizando el crecimiento del mercado.

Por ejemplo,

- En octubre de 2022, según un artículo publicado por PubMed Central, las opciones terapéuticas para la FPI son limitadas, y solo hay dos fármacos antifibróticos aprobados (pirfenidona y nintedanib) disponibles para casos leves a moderados. Estos medicamentos son costosos, y varían entre 2.000 y 14.000 dólares por persona al mes, según el país.

- En septiembre de 2022, según el artículo publicado por Alan Katz et.al, el costo por tratamiento de la terapia de oxígeno hiperbárico generalmente oscilará entre USD 250 y USD 600 por tratamiento dependiendo de algunos factores, incluida la cantidad de sesiones y la ubicación de los servicios.

- En enero de 2022, según un artículo publicado en BMC Pulmonary Medicine, el precio de lista anual de la pirfenidona era de aproximadamente 36.070,80 dólares, mientras que el coste anual tanto de la pirfenidona como del nintedanib en Estados Unidos supera los 100.000 dólares y, en Bélgica, el precio de lista anual del nintedanib ronda los 28.910 dólares. Se espera que este elevado coste de los medicamentos y tratamientos actúe como un freno para el mercado de tratamiento de enfermedades fibróticas de Asia y el Pacífico, limitando el acceso a estas terapias y ejerciendo presión financiera sobre los pacientes y los sistemas sanitarios.

The Complex and Multifactorial Nature of Fibrotic Diseases

Fibrosis is driven by a variety of factors, including genetic predispositions, environmental exposures, and underlying chronic conditions, making it difficult to pinpoint a single cause or develop a one-size-fits-all treatment. This complexity complicates the development of effective therapies that can address the diverse mechanisms involved in fibrosis. Additionally, the progressive and often asymptomatic nature of these diseases until advanced stages further complicates early diagnosis and treatment, leading to delayed interventions.

For instance,

- In January 2023, according to an article published by PubMed Central, in IPF, normal lung tissue is replaced by abnormal matrix buildup, impairing alveolar function and leading to respiratory failure. Repeated micro-injuries and disrupted cell repair drive irreversible lung damage

This complex and multifactorial nature of fibrotic diseases poses a significant challenge to developing effective treatments, affecting the Asia-Pacific fibrotic diseases treatment market

The multifaceted nature of fibrotic diseases requires a highly tailored approach to treatment, posing a challenge for pharmaceutical companies to develop universally effective therapies and strategies to manage these conditions.

Asia-Pacific Fibrotic Disease Treatment Market Scope

The market is segmented on the basis of treatment, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

This research report categorizes the Asia-Pacific Fibrotic Disease Treatment market into the following segments:

By Treatment

- Medication

- Nintedanib (OFEV)

- Pirfenidone (ESBRIET)

- Organ Transplantation

- Oxygen Therapy

- Others

By Application

- Idiopathic Pulmonary Fibrosis

- Hepatic Cirrhosis

- Renal Fibrosis

- Cutaneous Fibrosis

- Others

By End User

- Hospitals

- Specialty Clinics

- Academic and Research Institutes

- Others

Asia-Pacific Fibrotic Disease Treatment Market Regional Analysis

The market is segmented on the basis of treatment, application, and end user.

The countries covered in the market are Japan, China, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, Taiwan, and rest of Asia-Pacific.

Japan is expected to be the fastest growing country in the market due to increasing healthcare investments, rising awareness about fibrotic diseases, and improving access to advanced medical therapies. The region's large and aging population, combined with a growing burden of chronic conditions linked to fibrosis, such as diabetes and liver diseases, further drives demand for effective treatments.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado del tratamiento de enfermedades fibróticas en Asia y el Pacífico

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de tratamiento de enfermedades fibróticas de Asia y el Pacífico que operan en el mercado son:

- CH Boehringer Sohn AG & Co. KG. (Alemania)

- F. Hoffmann-La Roche Ltd (Suiza)

- Industrias farmacéuticas Teva Ltd. (Israel)

- Sandoz International GmbH (Alemania)

- Accord Healthcare (Reino Unido)

Últimos avances en el mercado de tratamiento de enfermedades fibróticas en Asia y el Pacífico

- En septiembre de 2024, Boehringer Ingelheim International GmbH anunció que el ensayo FIBRONEER-IPF alcanzó su criterio de valoración principal de mejora de la CVF en la semana 52, y planea presentar una nueva solicitud de medicamento para nerandomilast para el tratamiento de la FPI a la FDA y otras autoridades de Asia y el Pacífico. Este ensayo exitoso y la próxima presentación fortalecerán la posición de Boehringer Ingelheim en el competitivo mercado de la FPI, lo que podría ampliar su cartera de medicamentos respiratorios.

- En noviembre de 2022, Teva Pharmaceuticals, una filial estadounidense de Teva Pharmaceutical Industries Ltd., anunció una nueva colaboración con Rimidi, una plataforma de gestión clínica líder diseñada para optimizar los flujos de trabajo clínicos, mejorar las experiencias de los pacientes y lograr objetivos de calidad. Esto ha ayudado a la empresa a expandirse en Asia-Pacífico.

- En marzo de 2022, Genentech, miembro del Grupo Roche, anunció que el estudio de fase III SKYSCRAPER-02, que evaluaba la inmunoterapia en investigación anti-TIGIT tiragolumab más Tecentriq (atezolizumab) y quimioterapia (carboplatino y etopósido) como tratamiento inicial (de primera línea) para personas con cáncer de pulmón de células pequeñas en estadio extenso (ES-SCLC), no cumplió con su criterio de valoración coprincipal de supervivencia libre de progresión. Esto ha ayudado a la empresa a expandirse en Asia-Pacífico.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 ASIA-PACIFIC FIBROTIC DISEASES TREATMENT MARKET, REGULATIONS

5.1 NORTH AMERICA

5.1.1 U.S.

5.1.2 CANADA

5.2 EUROPE

5.2.1 EUROPEAN UNION (EMA - EUROPEAN MEDICINES AGENCY)

5.2.2 GERMANY (FEDERAL INSTITUTE FOR DRUGS AND MEDICAL DEVICES - BFARM)

5.2.3 UNITED KINGDOM (MEDICINES AND HEALTHCARE PRODUCTS REGULATORY AGENCY - MHRA)

5.3 ASIA-PACIFIC

5.3.1 JAPAN (PMDA - PHARMACEUTICALS AND MEDICAL DEVICES AGENCY)

5.3.2 CHINA (NMPA - NATIONAL MEDICAL PRODUCTS ADMINISTRATION)

5.3.3 AUSTRALIA (TGA - THERAPEUTIC GOODS ADMINISTRATION)

5.4 LATIN AMERICA

5.4.1 BRAZIL (ANVISA - BRAZILIAN HEALTH REGULATORY AGENCY)

5.4.2 ARGENTINA (ADMINISTRACIÓN NACIONAL DE MEDICAMENTOS, ALIMENTOS Y TECNOLOGÍA MÉDICA - ANMAT)

5.5 MIDDLE EAST AND AFRICA (MEA)

5.5.1 UNITED ARAB EMIRATES (UAE - MINISTRY OF HEALTH AND PREVENTION)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF FIBROTIC DISEASES

6.1.2 INCREASE IN THE NUMBER OF PEOPLE SMOKING CIGARETTES

6.1.3 TECHNOLOGICAL ADVANCEMENT IN THE TREATMENT OF FIBROSIS DISEASES

6.1.4 AWARENESS AND EARLY DIAGNOSIS INITIATIVES

6.2 RESTRAINTS

6.2.1 HIGH COST OF MEDICATION AND TREATMENTS

6.2.2 LACK OF EFFECTIVE BIOMARKERS AND DIAGNOSTIC TOOLS FOR EARLY DETECTION AND MONITORING OF FIBROTIC DISEASES

6.3 OPPORTUNITIES

6.3.1 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

6.3.2 ADVANCEMENTS IN PIPELINE DRUG DEVELOPMENTS

6.3.3 INCREASING STRATEGIC COLLABORATIONS AND PARTNERSHIPS

6.4 CHALLENGES

6.4.1 THE COMPLEX AND MULTIFACTORIAL NATURE OF FIBROTIC DISEASES.

6.4.2 HIGH RATE OF FAILURE IN CLINICAL TRIALS FOR FIBROTIC DISEASES,

7 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 MEDICATION, BY TREATMENT

7.2.2 MEDICATION, BY DISTRIBUTION CHANNEL

7.3 ORGAN TRANSPLANT

7.4 OXYGEN THERAPY

7.5 OTHERS

8 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 IDIOPATHIC PULMONARY FIBROSIS

8.3 HEPATIC CIRRHOSIS

8.4 RENAL FIBROSIS

8.5 CUTANEOUS FIBROSIS

8.6 OTHERS

9 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 SPECIALTY CLINICS

9.4 ACADEMIC AND RESEARCH INSTITUTES

9.5 OTHERS

10 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY REGION

10.1 ASIA PACIFIC

11 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 GENENTECH, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 TEVA PHARMACEUTICAL INDUSTRIES LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 SANDOZ INTERNATIONAL GMBH

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 ACCORD HEALTHCARE

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ABBVIE INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 BRISTOL-MYERS SQUIBB COMPANY.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 BIOMX.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 INTERCEPT PHARMACEUTICALS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 KITHER BIOTECH S.R.L.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 REDX PHARMA PLC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 VERONA PHARMA PLC

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET: BY TREATMENT, 2018-2032 (VOLUME)

TABLE 5 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET: BY TREATMENT, 2018-2032 (ASP)

TABLE 6 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC ORGAN TRANSPLANT IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC OXYGEN THERAPY IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC OTHERS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC IDIOPATHIC PULMONARY FIBROSIS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC HEPATIC CIRRHOSIS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC RENAL FIBROSIS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC CUTANEOUS FIBROSIS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC OTHERS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC HOSPITALS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC SPECIALTY CLINICS IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ACADEMIC AND RESEARCH INSTITUTES IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC OTHER END-USE IN FIBROTIC DISEASE TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 25 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 26 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 32 JAPAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 33 JAPAN FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 36 CHINA FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 37 CHINA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 38 CHINA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 39 CHINA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 40 CHINA FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 CHINA FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 CHINA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 INDIA FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 44 INDIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 45 INDIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 46 INDIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 47 INDIA FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 INDIA FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 49 INDIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 50 SOUTH KOREA FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 51 SOUTH KOREA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 52 SOUTH KOREA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 53 SOUTH KOREA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 54 SOUTH KOREA FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH KOREA FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH KOREA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 AUSTRALIA FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 58 AUSTRALIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 59 AUSTRALIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 60 AUSTRALIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 61 AUSTRALIA FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 AUSTRALIA FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 63 AUSTRALIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 64 SINGAPORE FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 65 SINGAPORE MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 66 SINGAPORE MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 67 SINGAPORE MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 68 SINGAPORE FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 69 SINGAPORE FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 SINGAPORE MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 THAILAND FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 72 THAILAND MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 73 THAILAND MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 74 THAILAND MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 75 THAILAND FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 THAILAND FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 77 THAILAND MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 MALAYSIA FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 79 MALAYSIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 80 MALAYSIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 81 MALAYSIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 82 MALAYSIA FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 MALAYSIA FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 84 MALAYSIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 85 INDONESIA FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 86 INDONESIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 87 INDONESIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 88 INDONESIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 89 INDONESIA FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 INDONESIA FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 91 INDONESIA MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 PHILIPPINES FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 93 PHILIPPINES MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 94 PHILIPPINES MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 95 PHILIPPINES MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 96 PHILIPPINES FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 PHILIPPINES FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 98 PHILIPPINES MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 99 VIETNAM FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 100 VIETNAM MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 101 VIETNAM MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 102 VIETNAM MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 103 VIETNAM FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 104 VIETNAM FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 105 VIETNAM MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 106 TAIWAN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 107 TAIWAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 108 TAIWAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (VOLUME)

TABLE 109 TAIWAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (ASP)

TABLE 110 TAIWAN FIBROTIC DISEASE TREATMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 TAIWAN FIBROTIC DISEASE TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 112 TAIWAN MEDICATION IN FIBROTIC DISEASE TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 113 REST OF ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET FROM 2025 TO 2032

FIGURE 14 THE MEDICATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET IN 2025 AND 2032

FIGURE 15 MARKET OVERVIEW

FIGURE 16 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY TREATMENT, 2024

FIGURE 17 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY TREATMENT, 2025-2032 (USD THOUSAND)

FIGURE 18 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY TREATMENT, CAGR (2025-2032)

FIGURE 19 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY APPLICATION, 2024

FIGURE 21 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 22 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 23 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY END USER, 2024

FIGURE 25 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 26 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 27 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 29 ASIA-PACIFIC FIBROTIC DISEASE TREATMENT MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.