Asia Pacific Extruded Nets Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

425.35 Billion

USD

657.74 Billion

2025

2033

USD

425.35 Billion

USD

657.74 Billion

2025

2033

| 2026 –2033 | |

| USD 425.35 Billion | |

| USD 657.74 Billion | |

|

|

|

|

Mercado de redes extruidas de Asia y el Pacífico, por material (polipropileno (PP), polietileno lineal de baja densidad (LLDPE), acetato de etilvinilo (EVA), nailon, elastómero termoplástico (TPE), poliuretano termoplástico (TPU), polietileno de alta densidad (HDPE), polietileno de baja densidad (LDPE), otros), configuración (cuadrado, diamante, plano), tipo (cilíndrico, plano), malla (mejorada, simple), aplicación (alimentos y bebidas, embalaje, energía, industrial, médico, agricultura, infraestructura, bienes de consumo, control de erosión, automotriz, otros), país (China, Corea del Sur, Japón, India, Australia y Nueva Zelanda, Singapur, Malasia, Indonesia, Tailandia, Filipinas, Taiwán, Hong Kong, resto de Asia y el Pacífico), tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de mallas extruidas en Asia y el Pacífico

Análisis y perspectivas del mercado: mercado de mallas extruidas en Asia y el Pacífico

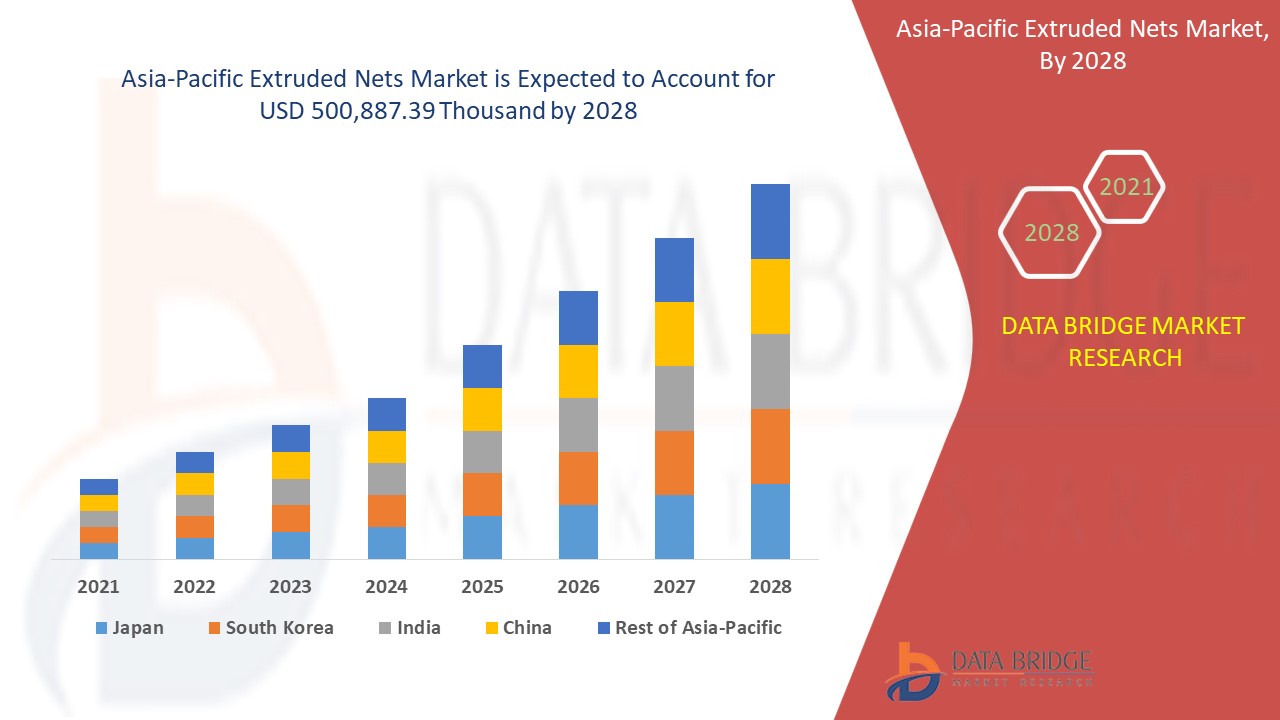

Se espera que el mercado de redes extruidas de Asia-Pacífico gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,6% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 500.887,39 mil para 2028. Se espera que la creciente demanda de redes extruidas en las economías emergentes impulse el crecimiento del mercado de redes extruidas en la región de Asia-Pacífico.

Las redes extruidas son redes de plástico fabricadas mediante un proceso llamado extrusión en el que se introducen materiales plásticos fundidos a través de un troquel con la forma deseada. A continuación, la red moldeada se enfría y se conserva para su estabilización antes de envasarse y venderse. Los materiales más comunes que se utilizan para preparar redes extruidas son polímeros plásticos como el polipropileno, el polietileno de alta densidad y el polietileno de baja densidad. La estabilidad del producto obtenido mediante el proceso de extrusión es la principal ventaja de las redes extruidas frente a las redes tejidas tradicionalmente o las redes formadas mediante el proceso de moldeo por inyección.

Una de las principales limitaciones que afecta a la demanda del mercado de mallas extruidas de Asia-Pacífico es la disponibilidad de productos de embalaje de reemplazo. Una de las principales oportunidades para el mercado de mallas extruidas de Asia-Pacífico es el crecimiento experimentado en el mercado de la agricultura y la acuicultura. Algunos de los impulsores significativos relacionados con el mercado respectivo son el aumento de la demanda del producto de mallas extruidas para filtraciones farmacéuticas e industriales. Sin embargo, la tendencia a generar desechos en vertederos a gran escala plantea un desafío para el mercado de mallas extruidas de Asia-Pacífico.

El informe de mercado de redes extruidas proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de redes extruidas, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de las redes extruidas

Alcance y tamaño del mercado de las redes extruidas

El mercado de redes extruidas de Asia-Pacífico está segmentado en función de los materiales, la configuración, el tipo, la malla y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Sobre la base del material, el mercado de redes extruidas de Asia-Pacífico está segmentado en polipropileno (PP), polietileno lineal de baja densidad (LLDPE), acetato de etilvinilo (EVA), nailon, elastómero termoplástico (TPE), poliuretano termoplástico (TPU), polietileno de alta densidad (HDPE), polietileno de baja densidad (LDPE) y otros. En 2021, el segmento de polietileno de alta densidad (HDPE) está dominando el mercado de redes extruidas de Asia-Pacífico debido a la fabricación de polietileno de alta densidad (HDPE), ya que es rentable y está ampliamente disponible en el mercado.

- Según la configuración, el mercado de redes extruidas de Asia-Pacífico se segmenta en cuadradas, romboidales y planas. En 2021, el segmento cuadrado domina el mercado de redes extruidas de Asia-Pacífico debido a sus aplicaciones en la fabricación de jaulas y alojamientos para aves de corral, lo que supone una economía importante en el mercado respectivo.

- Según el tipo, el mercado de mallas extruidas de Asia-Pacífico se segmenta en cilíndricas y planas. En 2021, el segmento plano domina el mercado de mallas extruidas de Asia-Pacífico porque las mallas extruidas de tipo plano tienen una aplicación generalizada en los envases agrícolas, que es una economía importante de la región.

- En cuanto a la malla, el mercado de redes extruidas de Asia-Pacífico se segmenta en mejoradas y simples. En 2021, el segmento simple domina el mercado de redes extruidas de Asia-Pacífico porque la malla simple es reutilizable y económica, por lo que es ideal para las economías en crecimiento de la región.

- En función de la aplicación, el mercado de mallas extruidas de Asia-Pacífico se segmenta en alimentos y bebidas, embalaje, energía, industria, medicina, filtración, agricultura, bienes de consumo, control de erosión, automoción y otros. En 2021, el segmento de alimentos y bebidas domina el mercado de mallas extruidas de Asia-Pacífico debido a los requisitos de protección de alimentos y alimentos de la región debido a la alta saturación de la población.

Análisis a nivel de país del mercado de redes extruidas

Se analiza el mercado de redes extruidas y se proporciona información sobre el tamaño del mercado por país, material, configuración, malla, tipo y aplicación mencionados anteriormente.

Los países cubiertos en el informe del mercado de redes extruidas son Japón, China, Corea del Sur, India, Australia y Nueva Zelanda, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Taiwán, Hong Kong y el resto de Asia-Pacífico.

- En Asia-Pacífico, China domina el mercado de redes extruidas debido a su aplicación en la protección de alimentos para la creciente población.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento de las redes extruidas están impulsando el crecimiento del mercado de redes extruidas.

El mercado de redes extruidas también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de las mallas extruidas

El panorama competitivo del mercado de redes extruidas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de redes extruidas.

Las principales empresas que se dedican a las mallas extruidas son Schweitzer-Mauduit International, Inc., GSH Group., EXPO-NET Danmark A/S, ROM PLASTICA srl, Min Shen Enterprise Co., Ltd., LC Packaging y otros actores nacionales e internacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos son iniciados también por empresas de todo el mundo que también están acelerando el mercado de redes extruidas.

Por ejemplo,

- En abril de 2021, LC Packaging anunció que participará en el seminario web sobre la responsabilidad corporativa en materia de respeto de los derechos humanos, organizado por la Red del Pacto Mundial de los Países Bajos y KPMG. La empresa espera generar vínculos corporativos y buena voluntad con su participación en esta conferencia.

- En abril de 2021, GSH Group anunció la instalación de 837 paneles solares, capaces de producir 238 KWP en la planta de producción de la empresa en Peterborough Road. La empresa espera reducir su dependencia de la red eléctrica nacional y volverse más autosuficiente con esta ampliación de las instalaciones.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de redes extruidas, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.