Asia Pacific Digital Therapeutics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4.66 Billion

USD

25.08 Billion

2024

2032

USD

4.66 Billion

USD

25.08 Billion

2024

2032

| 2025 –2032 | |

| USD 4.66 Billion | |

| USD 25.08 Billion | |

|

|

|

|

Segmentación del mercado de terapia digital (DTx) en Asia-Pacífico por tipo de producto y servicio (hardware, soluciones/software y servicios), aplicación (tratamiento/cuidado y prevención), modalidad de compra (organización de compra grupal e individual), canal de venta (B2B y B2C): tendencias y pronóstico del sector hasta 2032

Tamaño del mercado de terapia digital (DTx) en Asia-Pacífico

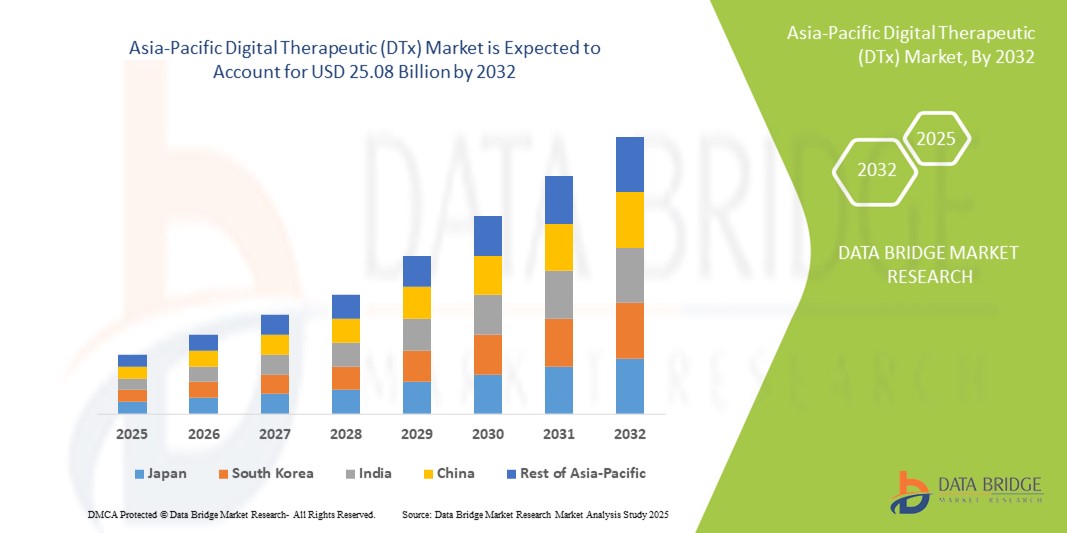

- El tamaño del mercado terapéutico digital (DTx) de Asia-Pacífico se valoró en USD 4.66 mil millones en 2024 y se espera que alcance los USD 25.08 mil millones para 2032 , con una CAGR del 23,40% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente prevalencia de enfermedades crónicas, la creciente digitalización de la atención médica y el enfoque creciente en la prestación de atención rentable y centrada en el paciente en toda la región.

- Además, la creciente penetración de teléfonos inteligentes, una mayor accesibilidad a internet y marcos regulatorios favorables están mejorando la participación de los pacientes y fomentando la adopción generalizada de soluciones de DTx. Estas dinámicas están impulsando el mercado de DTx en Asia-Pacífico, consolidando su papel en el ecosistema de salud digital en evolución de la región.

Análisis del mercado de terapia digital (DTx) en Asia-Pacífico

- Las terapéuticas digitales (DTx), que ofrecen intervenciones terapéuticas basadas en evidencia a través de software para prevenir, gestionar o tratar afecciones médicas, se están convirtiendo en un componente integral del panorama de la atención médica en la región de Asia y el Pacífico debido a su escalabilidad, capacidades de acceso remoto y capacidad para respaldar el manejo de enfermedades crónicas y la atención de la salud mental.

- La creciente demanda de DTx en Asia-Pacífico se debe principalmente a la creciente incidencia de enfermedades crónicas relacionadas con el estilo de vida, el creciente enfoque en la atención médica preventiva y una mayor conciencia de las soluciones de salud digital entre los pacientes y los proveedores de atención médica.

- Japón dominó el mercado terapéutico digital (DTx) de Asia-Pacífico con la mayor participación en los ingresos del 37,3 % en 2024, respaldado por su infraestructura de atención médica avanzada, el envejecimiento de su población y las vías regulatorias favorables, con un progreso notable en la adopción de plataformas digitales para la salud mental y el manejo de enfermedades crónicas.

- Se espera que India sea el país de más rápido crecimiento en el mercado terapéutico digital (DTx) de Asia-Pacífico durante el período de pronóstico, debido a la creciente penetración de teléfonos inteligentes, la mejor conectividad a Internet, la creciente carga de enfermedades crónicas y el creciente enfoque en soluciones de atención médica digital asequibles.

- El segmento de organización de compras grupales dominó el mercado terapéutico digital (DTx) de Asia-Pacífico con una participación de mercado del 54,6 % en 2024, impulsado por su capacidad para agilizar las adquisiciones, reducir los costos y permitir la adopción a gran escala a través de instituciones de atención médica y redes de empleadores.

Alcance del informe y segmentación del mercado de terapia digital (DTx) en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de terapia digital (DTx) en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de terapia digital (DTx) en Asia-Pacífico

Plataformas terapéuticas personalizadas e impulsadas por IA

- Una tendencia significativa y en auge en el mercado de DTx en Asia-Pacífico es la integración de inteligencia artificial (IA) y algoritmos de atención personalizada para ofrecer terapias digitales a medida que se adaptan al comportamiento, las necesidades clínicas y el nivel de participación del paciente. Esta innovación está mejorando significativamente la adherencia al tratamiento y los resultados de los pacientes con enfermedades crónicas y de salud mental.

- Por ejemplo, CureApp (Japón) ofrece terapia de detoxificación basada en IA para afecciones como la adicción a la nicotina y la hipertensión, proporcionando retroalimentación individualizada y planes terapéuticos. De igual manera, JOGO Health, con sede en India, utiliza biorretroalimentación basada en IA para trastornos neurológicos, lo que permite la rehabilitación a distancia.

- La integración de IA en las plataformas DTx permite la monitorización continua y el análisis de datos en tiempo real para ajustar dinámicamente los protocolos de tratamiento, emitir alertas predictivas y habilitar intervenciones sanitarias proactivas. Este nivel de personalización fomenta una mayor participación y beneficios clínicos mensurables.

- Además, la integración con wearables y aplicaciones móviles facilita un flujo de datos fluido y la conectividad entre paciente y profesional sanitario. Las interfaces multilingües y culturalmente adaptables impulsan aún más la adopción de DTx en diversos segmentos demográficos de la región.

- Esta tendencia hacia intervenciones de salud digitales inteligentes, en tiempo real y específicas para cada paciente está transformando rápidamente el enfoque de la región hacia la atención crónica, con empresas innovando para satisfacer la creciente demanda de terapias digitales holísticas y accesibles.

Dinámica del mercado de terapia digital (DTx) en Asia-Pacífico

Conductor

Aumento de la carga de enfermedades crónicas y expansión del ecosistema de salud digital

- La creciente prevalencia de enfermedades crónicas como diabetes , hipertensión , trastornos cardiovasculares y de salud mental, junto con un ecosistema de salud digital en rápida expansión, es un impulsor clave que acelera la adopción de terapias digitales en Asia-Pacífico.

- Por ejemplo, en agosto de 2024, Wellthy Therapeutics se asoció con una importante red de atención médica de la India para lanzar una plataforma de DTx para el manejo de enfermedades crónicas, ampliando el acceso a la atención a poblaciones remotas y desatendidas. Estas alianzas refuerzan la utilidad de DTx en la prestación de servicios de salud escalables y asequibles.

- El uso generalizado de teléfonos inteligentes, la expansión de la conectividad a Internet y las iniciativas gubernamentales de apoyo como la visión Sociedad 5.0 de Japón y la Misión Digital Ayushman Bharat de la India están posibilitando aún más la infraestructura para la implementación de DTx.

- A medida que los proveedores de atención médica integran cada vez más herramientas digitales en la atención al paciente, las plataformas DTx se están volviendo vitales para respaldar el manejo de enfermedades a largo plazo, mejorar el acceso y reducir los costos generales de atención.

Restricción/Desafío

Preocupaciones sobre la privacidad de datos e incertidumbre regulatoria

- Las preocupaciones sobre la privacidad y las inconsistencias regulatorias siguen siendo un desafío importante que obstaculiza la adopción más amplia de soluciones DTx en Asia-Pacífico, particularmente en los mercados emergentes donde las leyes de protección de datos aún están evolucionando.

- Por ejemplo, los diferentes niveles de aplicación de la ciberseguridad y las prácticas de gestión de datos en los distintos países plantean inquietudes sobre el acceso no autorizado a los datos, especialmente para las plataformas que recopilan información confidencial sobre la salud de los pacientes. Estas inquietudes pueden reducir la confianza de los usuarios y obstaculizar la adopción de DTx.

- Para abordar esto, las empresas deben garantizar el cumplimiento de las leyes de privacidad específicas de cada país, como la APPI de Japón y la Ley DPDP de la India, implementar un cifrado sólido y mantener prácticas de datos transparentes.

- Además, la ausencia de marcos regulatorios estandarizados para la DTx en muchos países de Asia-Pacífico genera vías poco claras para la validación clínica, la aprobación de productos y el reembolso. Esta incertidumbre regulatoria crea barreras de entrada tanto para las startups locales como para las empresas globales que buscan expandirse.

- La creación de un ecosistema regulatorio coherente, transparente y centrado en el paciente, junto con campañas de concientización pública e iniciativas de alfabetización digital, será esencial para superar estas barreras y liberar todo el potencial de DTx en la región.

Alcance del mercado de terapia digital (DTx) en Asia-Pacífico

El mercado está segmentado según el tipo de producto y servicio, la aplicación, el modo de compra y el canal de ventas.

- Por tipo de producto y servicio

Según el tipo de producto y servicio, el mercado de terapia digital (DTx) de Asia-Pacífico se segmenta en productos de hardware, soluciones/software y servicios. El segmento de soluciones/software dominó el mercado con la mayor participación en ingresos, un 61,3 %, en 2024, gracias a su escalabilidad, rentabilidad y capacidad para ofrecer terapias personalizadas e interactivas para diversas enfermedades crónicas y conductuales. Estas soluciones de software se integran frecuentemente con smartphones, wearables y plataformas en la nube, lo que permite la interacción con el paciente en tiempo real y el seguimiento de su progreso.

Se prevé que el segmento de productos de hardware experimente la tasa de crecimiento más rápida, del 19,4 %, entre 2025 y 2032, impulsada por la creciente integración de biosensores portátiles y dispositivos de monitorización inteligente en los ecosistemas terapéuticos. Estas herramientas permiten la recopilación y retroalimentación continua de datos de los pacientes, mejorando la precisión y la personalización de las terapias digitales en toda la región.

- Por aplicación

En función de su aplicación, el mercado de terapia digital (DTx) de Asia-Pacífico se segmenta en aplicaciones relacionadas con el tratamiento/cuidado y aplicaciones preventivas. El segmento de aplicaciones relacionadas con el tratamiento/cuidado dominó el mercado con una cuota de ingresos del 57,4 % en 2024, debido principalmente a la creciente demanda de herramientas digitales para el manejo de enfermedades crónicas como la diabetes, la hipertensión y los trastornos de salud mental. Estas soluciones ayudan a mejorar la adherencia al tratamiento y facilitan la monitorización remota para obtener mejores resultados clínicos.

Se espera que el segmento de aplicaciones preventivas crezca a la CAGR más rápida del 20,8 % entre 2025 y 2032, impulsado por la creciente conciencia sobre la atención médica preventiva, el aumento del uso de programas de modificación del estilo de vida y el papel cada vez mayor de las plataformas digitales en el fomento de estrategias de intervención temprana para poblaciones en riesgo.

- Desbloqueando el mecanismo

Según el modelo de compra, el mercado de terapia digital (DTx) de Asia-Pacífico se segmenta en organizaciones de compra grupal (GPO) e individuales. El segmento de organizaciones de compra grupal dominó el mercado con la mayor participación, un 54,6 %, en 2024, gracias a la adquisición masiva de soluciones DTx por parte de instituciones sanitarias y empleadores para reducir costos y ampliar el acceso entre pacientes y personal. Estos modelos garantizan una implementación más amplia y reducen los costos de adquisición de pacientes para los desarrolladores de DTx.

Se proyecta que el segmento individual crecerá a la CAGR más rápida del 21,2% entre 2025 y 2032, impulsado por la creciente conciencia de los consumidores, la autogestión de enfermedades crónicas y la creciente adopción de aplicaciones de salud basadas en dispositivos móviles compradas directamente a través de tiendas de aplicaciones o sitios web de empresas.

- Por canal de venta

Según el canal de venta, el mercado de terapia digital (DTx) de Asia-Pacífico se segmenta en B2B y B2C. El segmento B2B lideró el mercado con una cuota de ingresos del 63,6 % en 2024, gracias a las colaboraciones estratégicas entre proveedores de terapia digital y hospitales, aseguradoras y empresas. Estas colaboraciones suelen incluir la integración con plataformas de atención y modelos de seguros existentes, lo que permite una implementación estructurada y a gran escala.

Se prevé que el segmento B2C sea testigo de la tasa de crecimiento más rápida del 22,5% durante 2025-2032, impulsado por la creciente alfabetización en salud digital, la creciente penetración de Internet y los teléfonos inteligentes, y la creciente preferencia por herramientas de salud digitales autoguiadas entre los consumidores más jóvenes y expertos en tecnología en las regiones urbanas y semiurbanas.

Análisis regional del mercado de terapia digital (DTx) en Asia-Pacífico

- Japón dominó el mercado terapéutico digital (DTx) de Asia-Pacífico con la mayor participación en los ingresos del 37,3 % en 2024, respaldado por su infraestructura de atención médica avanzada, el envejecimiento de su población y las vías regulatorias favorables, con un progreso notable en la adopción de plataformas digitales para la salud mental y el manejo de enfermedades crónicas.

- Los consumidores y proveedores de atención médica en Japón valoran mucho las funciones de validación clínica, personalización y atención remota que ofrecen las plataformas DTx, lo que lleva a una integración generalizada en el sistema de atención médica del país.

- Esta sólida posición en el mercado está respaldada además por marcos regulatorios favorables, alta alfabetización digital y colaboraciones activas entre los desarrolladores de DTx y las instituciones de salud pública, posicionando a Japón como líder en el impulso de la transformación digital dentro del panorama terapéutico de la región.

Perspectivas del mercado de terapia digital (DTx) en Asia-Pacífico

Se proyecta que el mercado de terapia digital (TD) en Asia-Pacífico crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta, del 23,2 %, durante el período de pronóstico de 2025 a 2032, impulsado por la creciente prevalencia de enfermedades crónicas, el aumento del uso de teléfonos inteligentes y la expansión de la infraestructura de salud digital. Las iniciativas gubernamentales de digitalización de la atención médica y el aumento de la demanda de soluciones de atención remota están acelerando la adopción de TD en países como India, Japón, China y Corea del Sur. Además, el creciente interés en la atención preventiva y las soluciones digitales personalizadas está mejorando la participación de los pacientes y los resultados de los tratamientos en toda la región.

Perspectivas del mercado japonés de terapia digital (DTx)

El mercado japonés de terapia digital (DTx) capturó la mayor participación en ingresos en Asia-Pacífico en 2024, gracias a la avanzada infraestructura sanitaria del país, el envejecimiento de la población y un entorno regulatorio favorable. Japón se ha consolidado como líder en la adopción de soluciones de DTx clínicamente validadas para el manejo de la hipertensión, la diabetes y la salud mental. La integración de las plataformas de DTx con los historiales clínicos electrónicos y los sistemas nacionales de seguro médico está impulsando aún más su uso. Además, las alianzas entre hospitales, aseguradoras y desarrolladores de DTx están ampliando la accesibilidad y escalando su adopción tanto en zonas urbanas como rurales.

Perspectivas del mercado de terapia digital (DTx) en India

Se espera que el mercado indio de terapias digitales (TD) crezca a su CAGR más alta durante el período de pronóstico, impulsado por la rápida urbanización, el aumento de la alfabetización digital y la creciente carga de enfermedades no transmisibles. La gran población de la India, la creciente penetración de teléfonos inteligentes y el impulso gubernamental a la salud digital a través de programas como la Misión Digital Ayushman Bharat son factores clave para el crecimiento de las TD. Las startups locales están desarrollando activamente plataformas multilingües y rentables para la gestión de la diabetes, la salud cardiovascular y la salud conductual, lo que aumenta la adopción de las TD tanto en las ciudades metropolitanas como en las regiones de nivel 2 y 3.

Análisis del mercado de terapia digital (DTx) en China

El mercado chino de terapia digital (DTx) está experimentando un fuerte crecimiento, impulsado por políticas gubernamentales que fomentan la innovación en salud digital y una población con amplios conocimientos tecnológicos. Las plataformas de DTx se integran cada vez más en programas de telemedicina y gestión de enfermedades crónicas. Con una proporción significativa de pacientes con enfermedades crónicas, China está adoptando la DTx basada en IA para el tratamiento personalizado y la monitorización en tiempo real. La colaboración entre empresas tecnológicas y profesionales sanitarios está impulsando la escalabilidad de las plataformas, especialmente en los tratamientos para la diabetes y la salud mental.

Análisis del mercado de terapia digital (DTx) en Corea del Sur

El mercado surcoreano de terapias digitales (DTx) está en rápido crecimiento, impulsado por su sólida infraestructura de TIC, su alto nivel de alfabetización digital y los esfuerzos regulatorios para acelerar su comercialización. El Ministerio de Seguridad Alimentaria y Farmacéutica (MFDS) ha tomado medidas proactivas para desarrollar un marco regulatorio para terapias basadas en software, lo que permite una aprobación más rápida de productos. La sólida interacción de los consumidores surcoreanos con las tecnologías de la salud y las aplicaciones móviles de bienestar está impulsando la demanda de DTx, especialmente en áreas como los trastornos del sueño, la salud mental y las enfermedades metabólicas.

Cuota de mercado de la terapia digital (DTx) en Asia-Pacífico

La industria terapéutica digital (DTx) de Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- CureApp, Inc. (Japón)

- Wellthy Therapeutics Pvt. Ltd. (India)

- JOGOHEALTH (India)

- Samsung Electronics Co., Ltd. (Corea del Sur)

- Tunstall Australasia Pty Ltd (Australia)

- Biofourmis, Inc. (Singapur)

- Health2Sync Inc. (Taiwán)

- M3, Inc. (Japón)

- Smartfuture Pte. Ltd. (Singapur)

- AinOne Inc. (Corea del Sur)

- Neurowyzr Pte. Ltd. Ltd. (Singapur)

- Bioritmo Pte. Limitado. Ltd. (Singapur)

- Ubie, Inc. (Japón)

- RoundGlass LLC (India)

- Olive Union Inc. (Japón)

- Onsurity Technologies Pvt. Ltd. (India)

- Zoi Health Co., Ltd. (Corea del Sur)

- MediHub Co., Ltd. (Corea del Sur)

- CareVoice Digital Health Co. Ltd. (China)

¿Cuáles son los desarrollos recientes en el mercado terapéutico digital (DTx) de Asia-Pacífico?

- En mayo de 2024, CureApp, Inc. (Japón), pionera en terapias digitales, lanzó CureApp SC, una innovadora plataforma de terapia de desintoxicación (DTx) para dejar de fumar, en colaboración con el Ministerio de Salud de Japón. Esta terapia basada en una aplicación, clínicamente aprobada, integra guía conductual con información basada en IA, lo que mejora los resultados de los pacientes mediante retroalimentación en tiempo real y apoyo personalizado. Este lanzamiento refuerza el liderazgo de Japón en la aceptación regulatoria y la implementación clínica de soluciones de DTx.

- En marzo de 2024, Wellthy Therapeutics (India) se asoció con un importante proveedor de atención médica para implementar su plataforma de gestión de enfermedades crónicas en varias ciudades de la India. La plataforma DTx multilingüe, impulsada por IA, se centra en la diabetes y las enfermedades cardiovasculares, permitiendo planes de atención personalizados y monitoreo remoto. Esta estrategia amplía el acceso a la salud digital a las regiones de nivel 2 y 3, demostrando la escalabilidad de las soluciones DTx localizadas.

- En febrero de 2024, JOGO Health (India) presentó en Corea del Sur su terapia digital basada en neuroplasticidad, destinada al tratamiento del ictus y la incontinencia mediante dispositivos portátiles de biorretroalimentación. La expansión a un nuevo mercado pone de manifiesto el creciente interés transfronterizo en terapias no invasivas basadas en software y demuestra la presencia de innovación de la India en el panorama global de la terapia digital.

- En enero de 2024, el Centro Médico Samsung (Corea del Sur) lanzó un proyecto piloto que integra terapias digitales para trastornos del sueño y terapia cognitivo-conductual (TCC) mediante una plataforma de aplicaciones vinculada al hospital. El proyecto forma parte de una iniciativa más amplia para integrar la terapia digital en la atención médica tradicional, con monitoreo en tiempo real y supervisión clínica, impulsando así los modelos híbridos de salud digital en el país.

- En diciembre de 2023, Tunstall Healthcare (Australia) colaboró con las autoridades sanitarias locales para implementar un programa de intervención de salud digital para pacientes mayores con enfermedades crónicas. El programa combina dispositivos portátiles y software DTx para monitorizar a distancia la evolución del paciente, prevenir reingresos hospitalarios y promover la vida independiente. Esta iniciativa refleja el creciente compromiso de Australia con las soluciones digitales para el envejecimiento y los modelos de atención basados en el valor.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT AND SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 ASIA-PACIFIC DIGITAL THERAPEUTICS (DTX) MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES

5.1.2 INCREASE IN AWARENESS BY GOVERNMENT AGENCIES

5.1.3 TECHNOLOGICAL ADVANCEMENT IN HEALTHCARE

5.1.4 INCREASED NUMBER OF PEOPLE USING SMARTPHONES

5.1.5 IMPROVED QUALITY OF LIFE

5.2 RESTRAINTS

5.2.1 PATIENT INFORMATION PRIVACY POLICIES

5.2.2 DIGITAL PAYMENT ASSOCIATED WITH DIGITAL THERAPEUTICS

5.2.3 UNDER DEVELOPING COUNTIRES LACKING SMARTPHONES AND INTERNET FACILITIES

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND OF DIGITAL THERAPEUTICS

5.3.2 COLLABORATION BETWEEN COMPANIES TO PROVIDE BETTER PRODUCTS/SERVICES

5.3.3 PARTNERSHIP BETWEEN COMPANIES

5.3.4 EXPANSION AND LAUNCH OF PRODUCTS

5.3.5 EVENTS AND EXHIBITION

5.3.6 PHYSICIAN ADOPTION

5.4 CHALLENGES

5.4.1 CLINICAL VALIDATION

5.4.2 REGULATORY APPROVAL

5.4.3 PAYER REIMBURSEMENT

6 IMPACT OF COVID-19 ON ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET

6.1 IMPACT ON DEMAND

6.2 IMPACT ON SUPPLY

6.3 KEY INITIATIVES TAKEN BY PLAYERS DURING COVID-19

6.4 CONCLUSION

7 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE

7.1 OVERVIEW

7.2 SOLUTION/SOFTWARE

7.3 HARDWARE PRODUCTS

7.4 SERVICE

8 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 TREATMENT/CARE-RELATED APPLIACTIONS

8.2.1 DIABETES

8.2.2 CENTRAL NERVOUS SYSTEM DISORDERS

8.2.3 SMOKING CESSATION

8.2.4 CHRONIC RESPIRATORY DISEASES

8.2.5 MUSCULOSKELETAL DISORDER

8.2.6 CARDIOVASCULAR DISEASES

8.2.7 MEDICATION ADHERENCE

8.2.8 GASTROINTESTINAL DISORDERS

8.2.9 REHABILITATION AND PATIENT CARE

8.2.10 SUBSTANCE USE DISORDER AND ADDICTION MANAGEMENT

8.2.11 OTHER TREATMENT/ CARE RELATED APPLICATIONS

8.3 PREVENTIVE APPLICATIONS

8.3.1 PREDIABETES

8.3.2 OBESITY

8.3.3 NUTRITION

8.3.4 LIFESTYLE MANAGEMENT

8.3.5 OTHER PREVENTIVE APPLICATIONS

9 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE

9.1 OVERVIEW

9.2 GROUP PURCHASE ORGANIZATION

9.2.1 SOLUTIONS/ SOFTWARE

9.2.2 HARDWARE PRODUCT

9.2.3 SERVICE

9.3 INDIVIDUAL

9.3.1 SOLUTIONS/ SOFTWARE

9.3.2 HARDWARE PRODUCT

9.3.3 SERVICE

10 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 B2B

10.2.1 PAYERS

10.2.2 EMPLOYERS

10.2.3 PHARMA COMPANIES

10.2.4 PROVIDERS

10.2.5 OTHER BUYERS

10.3 B2C

10.3.1 CAREGIVERS

10.3.2 PATIENTS

11 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY COUNTRY

11.1.1 JAPAN

11.1.2 CHINA

11.1.3 AUSTRALIA

11.1.4 SOUTH KOREA

11.1.5 INDIA

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 MALAYSIA

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT

14 COMPANY PROFILE

14.1 FITBIT,INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 LIVONGO

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 RESMED

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 OMADA HEALTH, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 GINGER

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 SAMSUNG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 MINDSTRONG HEALTH

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 2MORROW INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AKILI INTERACTIVE LABS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ATENTIV

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 AYOGO HEALTH INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 BETTER THERAPEUTICS, INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 CANARY HEALTH

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 CLICK THERAPEUTICS, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 COGNIFIT

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 COGNOA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 GAIA AG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 HAPPIFY, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 KAIA HEALTH

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 MANGO HEALTH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 NATURAL CYCLES USA CORP

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 NOOM, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 PEAR THERAPEUTICS, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 SMARTPATIENT GMBH

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

14.25 VOLUNTIS

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 WELLDOC, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 WELLTHY THERAPEUTICS PVT LTD

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2020-2028 (USD MILLION)

TABLE 3 ASIA-PACIFIC SOLUTIONS/SOFTWARE IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION))

TABLE 4 ASIA-PACIFIC HARDWARE PRODUCTS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 ASIA-PACIFIC SERVICE IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 ASIA-PACIFIC TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 ASIA-PACIFIC PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2020-2028 (USD MILLION)

TABLE 12 ASIA-PACIFIC GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 ASIA-PACIFIC GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 14 ASIA-PACIFIC INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 ASIA-PACIFIC INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 16 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2020-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 ASIA-PACIFIC B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 19 ASIA-PACIFIC B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 ASIA-PACIFIC B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 21 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 22 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 23 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 25 ASIA-PACIFIC PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 26 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 27 ASIA-PACIFIC GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 28 ASIA-PACIFIC INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 29 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 30 ASIA-PACIFIC B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 32 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 33 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 34 JAPAN TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 35 JAPAN PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 37 JAPAN GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 38 JAPAN INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 39 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 40 JAPAN B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 41 JAPAN B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 42 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 43 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 44 CHINA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 45 CHINA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 46 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 47 CHINA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 48 CHINA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 49 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 50 CHINA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 51 CHINA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 52 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 53 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 AUSTRALIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 AUSTRALIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 57 AUSTRALIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 58 AUSTRALIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 59 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 60 AUSTRALIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 61 AUSTRALIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 62 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 63 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 64 SOUTH KOREA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 SOUTH KOREA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 67 SOUTH KOREA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 68 SOUTH KOREA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 69 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 70 SOUTH KOREA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 71 SOUTH KOREA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 72 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 73 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 INDIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 INDIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 77 INDIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 78 INDIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 79 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 80 INDIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 81 INDIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 82 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 83 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 84 SINGAPORE TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 SINGAPORE PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 87 SINGAPORE GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 88 SINGAPORE INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 89 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 90 SINGAPORE B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 91 SINGAPORE B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 92 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 93 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 94 THAILAND TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 95 THAILAND PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 96 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 97 THAILAND GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 98 THAILAND INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 99 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 100 THAILAND B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 101 THAILAND B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 102 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 103 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 104 MALAYSIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 105 MALAYSIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 106 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 107 MALAYSIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 108 MALAYSIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 109 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 110 MALAYSIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 111 MALAYSIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 112 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 113 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 114 INDONESIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 INDONESIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 116 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 117 INDONESIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 118 INDONESIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 119 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 120 INDONESIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 121 INDONESIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 122 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 123 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 124 PHILIPPINES TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 PHILIPPINES PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 126 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 127 PHILIPPINES GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 128 PHILIPPINES INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 129 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 130 PHILIPPINES B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 131 PHILIPPINES B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 132 REST OF ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET : DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBA DIGITAL THERAPEUTIC (DTX) MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 INCREASING DEMAND OF DIGITAL THERAPEUTICS WORLDWIDE DUE TO PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE MARKET GROWTH IN THE FORECAST PERIOD OF 2021 TO 2028.

FIGURE 13 SOLUTIONS/SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET IN 2021 & 2028

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR DIGITAL THERAPEUTICS (DTX) MANUFACTURERS IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET

FIGURE 16 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, 2020

FIGURE 17 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, 2020-2028 (USD MILLION)

FIGURE 18 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, CAGR (2021-2028)

FIGURE 19 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, 2020

FIGURE 21 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, 2020-2028 (USD MILLION)

FIGURE 22 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 23 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, 2020

FIGURE 25 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, 2020-2028 (USD MILLION)

FIGURE 26 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, CAGR (2021-2028)

FIGURE 27 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, 2020

FIGURE 29 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, 2020-2028 (USD MILLION)

FIGURE 30 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, CAGR (2021-2028)

FIGURE 31 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: SNAPSHOT (2020)

FIGURE 33 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY COUNTRY (2020)

FIGURE 34 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 35 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY COUNTRY (2020 & 2028)

FIGURE 36 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE (2021-2028)

FIGURE 37 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.