Asia Pacific Closed System Transfer Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

200.07 Million

USD

746.95 Million

2025

2033

USD

200.07 Million

USD

746.95 Million

2025

2033

| 2026 –2033 | |

| USD 200.07 Million | |

| USD 746.95 Million | |

|

|

|

|

Mercado de dispositivos de transferencia de sistema cerrado de Asia-Pacífico, por tipo (sistemas de membrana a membrana y dispositivo de transferencia de sistema cerrado sin aguja), componente (dispositivos y accesorios), mecanismo de cierre (sistemas de presionar para girar, sistemas de alineación de color a color, sistema Luer-Lock y sistemas de clic para bloquear), tecnología (dispositivos basados en diafragma, dispositivos compartimentados y dispositivos de limpieza/filtración de aire), usuario final ( hospitales , centros y clínicas de oncología , centros quirúrgicos ambulatorios, institutos académicos y de investigación), canal de distribución (licitación directa y ventas minoristas), país (China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y resto de Asia-Pacífico) Tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de dispositivos de transferencia de sistemas cerrados de Asia y el Pacífico

Análisis y perspectivas del mercado: mercado de dispositivos de transferencia de sistemas cerrados de Asia y el Pacífico

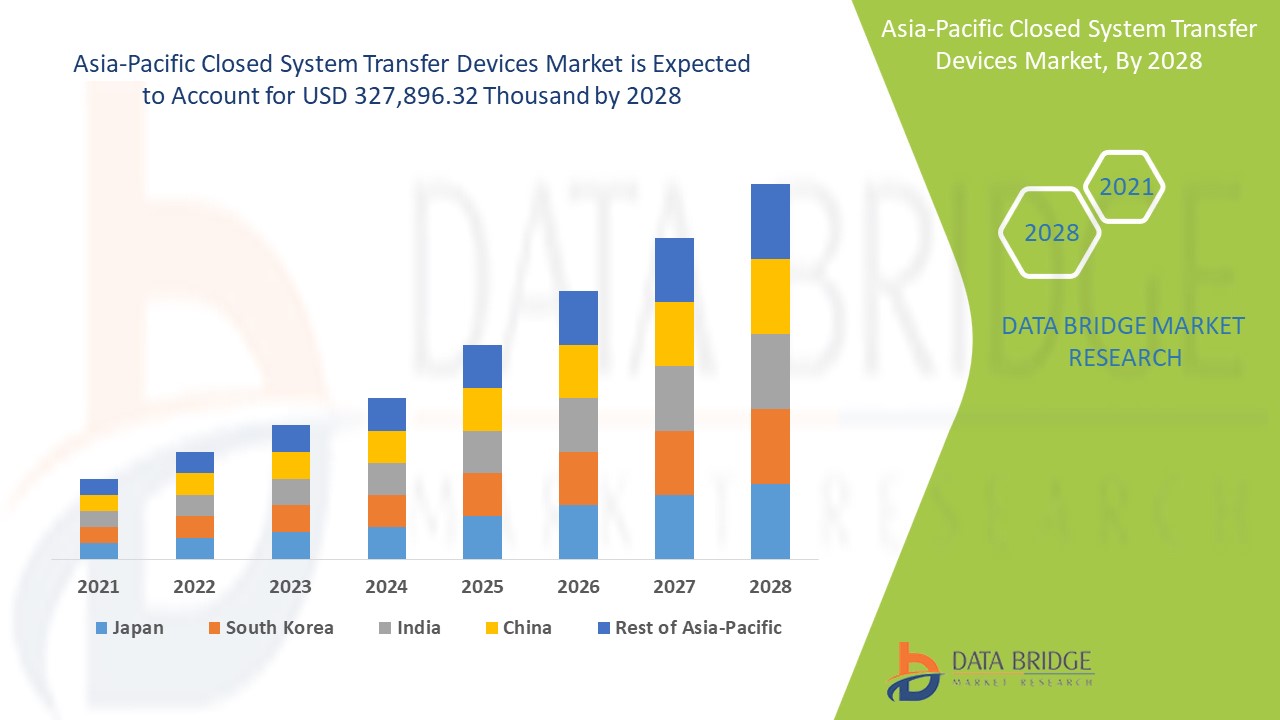

Se espera que el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico gane un crecimiento significativo en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 17,9% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 327.896,32 mil para 2028. Los avances tecnológicos en la prestación de servicios de atención médica efectivos están impulsando el crecimiento del mercado.

El dispositivo de transferencia de sistema cerrado o "CSTD" es un dispositivo de transferencia de medicamentos que impide mecánicamente la transferencia de contaminación ambiental en el sistema médico y el escape de concentraciones peligrosas de medicamentos o vapores fuera del sistema. Los sistemas abiertos y cerrados se aplican comúnmente en dispositivos médicos para mantener la esterilidad de una vía de fluido. Los CSTD funcionan evitando la entrada y salida incontrolada de contaminantes y medicamentos, preservando la calidad de la solución que se va a infundir en un paciente. Estos dispositivos garantizan la seguridad de los trabajadores de la salud durante el uso de medicamentos o productos químicos peligrosos. Los diseños y modelos de dispositivos de transferencia de sistema cerrado han cambiado a un ritmo rápido en los últimos años, lo que resultó en el desarrollo de una serie de metodologías de prueba independientes para evaluar el rendimiento de los dispositivos de transferencia de sistema cerrado. Actualmente, los fabricantes del mercado de dispositivos de transferencia de sistema cerrado se están centrando más en cumplir con los requisitos de rendimiento, que se centran principalmente en la seguridad del paciente y las prácticas estériles .

El aumento de las preocupaciones por la seguridad de los trabajadores sanitarios es el principal factor impulsor del mercado. La escasez de personal cualificado en el sector sanitario puede resultar el principal reto para el crecimiento del mercado. Sin embargo, los amplios proyectos de financiación de la investigación por parte del gobierno en el manejo seguro de los medicamentos resultan ser una oportunidad para el mercado. Por otro lado, se espera que la falta de compatibilidad entre el material biológico y de construcción de los CSTD restrinja el crecimiento del mercado. Además, se espera que los desafíos a los que se enfrenta debido al impacto de la Covid-19 en la cadena de suministro de materias primas limiten aún más el crecimiento del mercado.

El informe de mercado de dispositivos de transferencia de sistema cerrado proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de dispositivos de transferencia de sistema cerrado, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de dispositivos de transferencia de sistemas cerrados de Asia y el Pacífico

Alcance y tamaño del mercado de dispositivos de transferencia de sistemas cerrados de Asia y el Pacífico

El mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico está segmentado en función del tipo, componente, mecanismo de cierre, tecnología, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del tipo, el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico se segmenta en sistemas de membrana a membrana y dispositivos de transferencia de sistemas cerrados sin aguja. En 2021, se espera que el segmento de sistemas de membrana a membrana domine el mercado, ya que brinda una protección comparativamente mayor contra la contaminación externa.

- En función de los componentes, el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico se ha segmentado en dispositivos y accesorios. En 2021, se espera que el segmento de dispositivos domine el mercado debido al mayor uso y precio de los dispositivos en comparación con los accesorios.

- Sobre la base del mecanismo de cierre, el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico se ha segmentado en sistemas de pulsar para girar, sistemas de alineación de color a color, sistema luer-lock y sistemas de clic para bloquear. En 2021, se espera que el segmento de clic para bloquear domine el mercado porque es bastante fácil de usar y tiene el mismo tipo de eficacia que otros, lo que lo hace más adecuado para productores y usuarios finales.

- En función de la tecnología, el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico se ha segmentado en dispositivos basados en diafragma, dispositivos compartimentados y dispositivos de limpieza/filtración de aire. En 2021, se espera que el segmento de dispositivos basados en diafragma domine el mercado porque es más eficaz en lo que respecta a la capacidad de sellado. Ofrece más protección contra la contaminación en comparación con otras tecnologías.

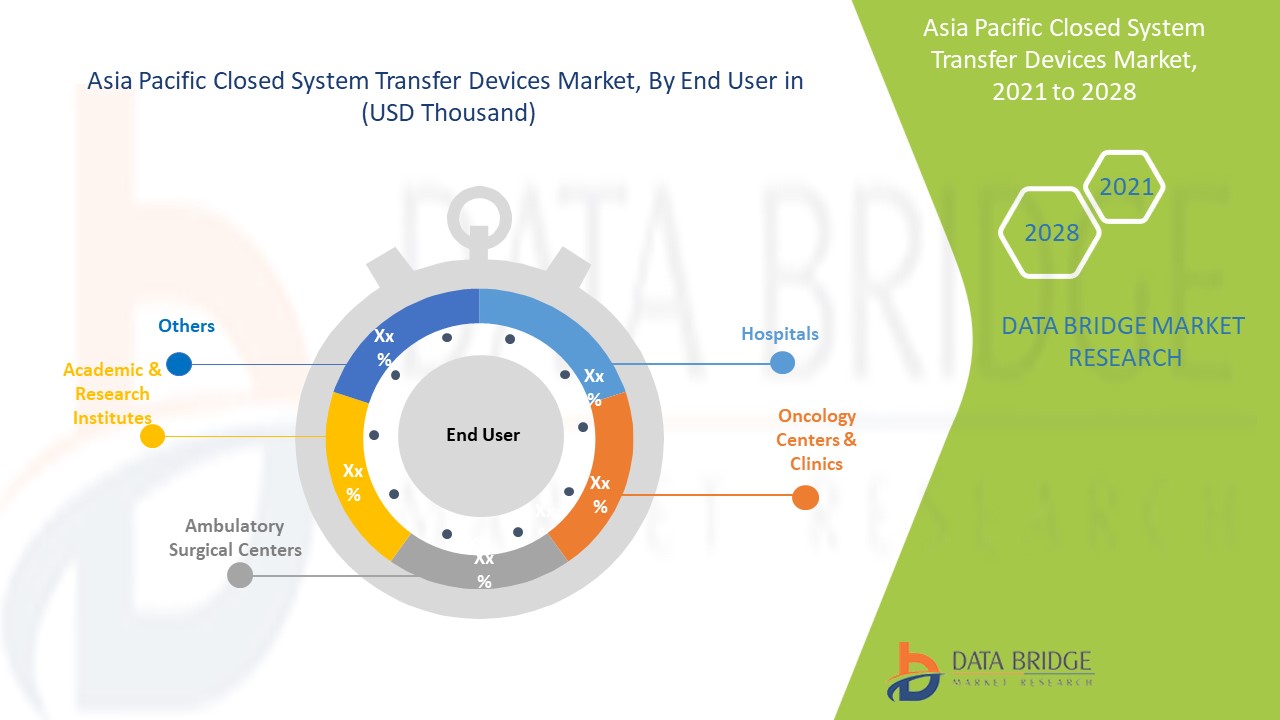

- En función del usuario final, el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico se clasifica en hospitales, centros y clínicas de oncología, centros de cirugía ambulatoria, institutos académicos y de investigación. En 2021, se espera que el subsegmento Hospitalario domine el mercado, ya que los organismos reguladores médicos están fomentando el uso de productos CSTD en los hospitales para la seguridad del personal. En comparación con otros usuarios finales, los hospitales están adoptando en gran medida el uso de CSTD al tratar con medicamentos peligrosos.

- Sobre la base del canal de distribución, el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico se segmenta en licitación directa y ventas minoristas. En 2021, se espera que el segmento minorista domine el mercado porque la región de Asia-Pacífico depende en gran medida del suministro de los principales proveedores extranjeros de CSTD. Las empresas extranjeras prefieren el canal de ventas minoristas de terceros para expandirse globalmente.

Análisis a nivel de país del mercado de dispositivos de transferencia de sistemas cerrados de Asia y el Pacífico

Se analiza el mercado de dispositivos de transferencia de sistema cerrado y se proporciona información sobre el tamaño del mercado según el país, el tipo, el componente, el mecanismo de cierre, la tecnología, el usuario final y el canal de distribución como se mencionó anteriormente.

Los países incluidos en el informe sobre el mercado de dispositivos de transferencia de sistemas cerrados son China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico. China domina el mercado debido a sus avances en investigación y tecnología médica.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El creciente número de aprobaciones de medicamentos oncológicos está impulsando el crecimiento del mercado de dispositivos de transferencia de sistemas cerrados.

El mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de los dispositivos de transferencia de sistemas cerrados

El panorama competitivo del mercado de dispositivos de transferencia de sistemas cerrados proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de dispositivos de transferencia de sistemas cerrados de Asia y el Pacífico.

Las principales empresas que operan en el mercado de dispositivos de transferencia de sistemas cerrados de Asia-Pacífico son ICU Medical, Inc., BD, B. Braun Medical Inc., EQUASHIELD, YUKON MEDICAL, Vygon, Epic Medical y otras. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Las empresas de todo el mundo también inician numerosos contratos y acuerdos que están acelerando aún más el crecimiento del mercado de dispositivos de transferencia de sistemas cerrados en Asia y el Pacífico.

Por ejemplo,

- En septiembre de 2019, EQUASHIELD anunció la disponibilidad de CSTD en la región de Japón a través del distribuidor japonés Tosho Inc. En virtud de esta adquisición, Tosho proporcionará a PAL Medical los conectores intravenosos cerrados de Equashield con el fin de desarrollar equipos intravenosos más seguros para enfermeras oncológicas que administren medicamentos de quimioterapia peligrosos. Esto también ayudará a la empresa a convertirse en un líder reconocido en la región de Asia y el Pacífico en cuanto a manipulación segura en entornos sanitarios.

- En abril de 2019, ICU Medical, Inc. y Scripps Health firmaron un acuerdo que establece el contrato de compra a largo plazo, que cubre la línea completa de productos de soluciones intravenosas y consumibles de ICU Medical, junto con otro software de medicación. Con esto, hay un mayor nivel de diligencia clínica y de TI que Scripps Health realizó para evaluar la tecnología y las capacidades como parte de su sólido proceso de análisis de valor. Esto también ayudará a la empresa a brindar el más alto nivel de atención al paciente con tecnología y soluciones avanzadas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.