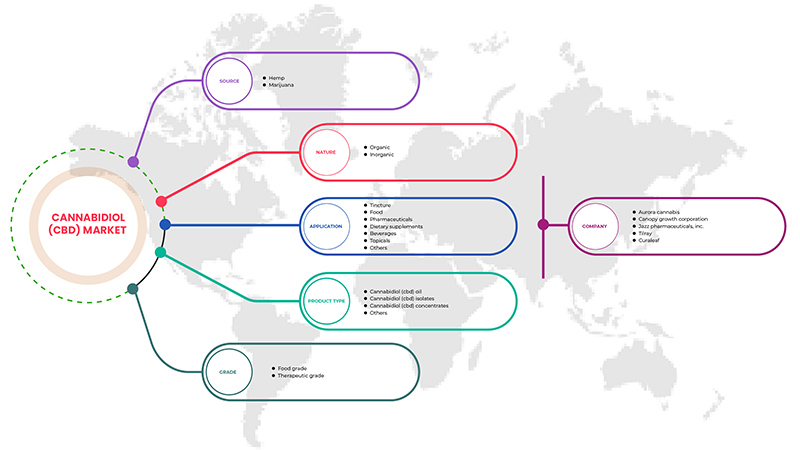

Mercado de cannabidiol (CBD) de Asia y el Pacífico, por fuente (cáñamo y marihuana), grado (grado alimenticio y grado terapéutico), naturaleza (orgánico e inorgánico), aplicación (tintura, alimentos, bebidas, productos farmacéuticos, tópicos, suplementos dietéticos y otros), tipo de producto (aceite de CBD, concentrados de CBD, aislados de CBD y otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de cannabidiol (CBD) en Asia y el Pacífico

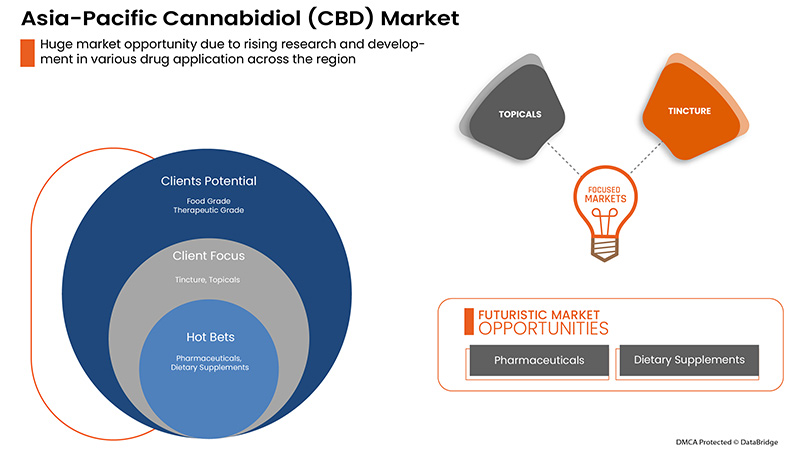

Se espera que el mercado de cannabidiol (CBD) de Asia-Pacífico gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 24,1% en el período de pronóstico de 2022 a 2029. Los avances tecnológicos en los tratamientos farmacológicos con cannabidiol (CBD) y el aumento en el sector de la salud son otros factores que impulsan el crecimiento del mercado de cannabidiol (CBD) de Asia-Pacífico en el período de pronóstico.

Sin embargo, los efectos secundarios asociados con el aceite de CBD y los productos falsificados y sintéticos disponibles en el mercado limitarán el crecimiento del mercado. La adopción de alianzas estratégicas como asociaciones y adquisiciones por parte de actores clave del mercado actúa como una oportunidad para el crecimiento del mercado de cannabidiol (CBD) en Asia-Pacífico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por origen (cáñamo y marihuana), grado (grado alimenticio y grado terapéutico), naturaleza (orgánico e inorgánico), aplicación (tintura, alimentos, bebidas, productos farmacéuticos, tópicos, suplementos dietéticos y otros), tipo de producto (aceite de CBD, concentrados de CBD, aislados de CBD y otros) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Tailandia, Malasia, Australia, Nueva Zelanda y resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

Algunos de los actores clave que operan en el mercado de cannabidiol (CBD) de Asia y el Pacífico son CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., Tilray, Curaleaf, KAZMIRA, Freedom Leaf, Inc., Koi CBD, Groff North America Hemplex, Joy Organics, Elixinol Wellness Limited, Isodiol International Inc., Healthy Food Ingredients, LLC, NuLeaf Naturals, LLC, Diamond CBD, Medterra CBD, ENDOCA, Green Roads, entre otros. |

Definición del mercado de cannabidiol (CBD)

El cannabidiol (CBD) es un compuesto químico que se encuentra en la planta de cannabis sativa y se extrae del cáñamo o cannabis, generalmente del cáñamo debido a su alto contenido natural de cannabidiol (CBD). Tiene varios beneficios en el tratamiento de la ansiedad y las convulsiones y en la reducción del dolor. Debido a sus propiedades curativas, la demanda de CBD para fines de salud y bienestar es alta, que es el principal factor que impulsa el mercado. De todos los cannabinoides, el cannabidiol es el más utilizado por razones terapéuticas debido a la falta de efectos psicoactivos. En muchas aplicaciones médicas, se utiliza aceite de cannabidiol, como el tratamiento de la ansiedad y la depresión, el alivio del estrés, la prevención de la diabetes, el alivio del dolor, el alivio de los síntomas del cáncer y la inflamación. Debido a la creciente adopción de productos basados en CBD para tratar enfermedades, se prevé que el mercado de Asia y el Pacífico crezca a un ritmo lucrativo durante el período de pronóstico. El aceite de cannabidiol se utiliza cada vez más para fabricar productos para el cuidado de la piel para tratar el acné y las arrugas. Sephora, por ejemplo, había introducido recientemente una línea de cuidado de la piel con cannabidiol o CBD en sus tiendas. De manera similar, Ulta Beauty tiene la intención de lanzar una línea de productos a base de cannabidiol. Varias empresas nuevas también están ingresando al mercado de productos cosméticos con infusión de cannabidiol.

Además, los gobiernos de diferentes países, así como los principales actores del mercado de los cannabinoides, están invirtiendo en actividades de investigación y desarrollo. Se dice que el CBD es un tratamiento eficaz para varias enfermedades neurológicas, incluida la epilepsia, en varios ensayos clínicos.

Dinámica del mercado

Conductores

- Demanda creciente de CBD en el ámbito de la salud y el fitness

La creciente concienciación de los consumidores sobre la salud y la forma física ayudará a que el mercado del CBD experimente un rápido crecimiento. Se prevé que el aumento de los ingresos disponibles de los consumidores junto con la legalización del cannabis medicinal tengan un impacto positivo en la demanda de cannabidiol en este sector.

Además, los productos de CBD se utilizan para aliviar diversos problemas como ansiedad/estrés, sueño/insomnio, dolor crónico, migraña, cuidado de la piel, convulsiones, dolor e inflamación de las articulaciones, afecciones neurológicas y muchos otros. El tratamiento del dolor crónico ha ganado mucha popularidad debido a los beneficios adicionales que ofrece el CBD cuando se usa. Ha habido una creciente demanda de productos de cannabidiol (CBD) en los últimos años debido a sus amplias aplicaciones médicas y al tratamiento del alivio del dolor. El CBD ayuda a reducir el dolor crónico al actuar sobre una variedad de procesos biológicos en el cuerpo. Además, el CBD posee propiedades antioxidantes, antiinflamatorias y analgésicas. Por lo tanto, los productos de CBD reducen la ansiedad que experimentan las personas que sufren dolor crónico. Por lo tanto, la creciente demanda de CBD en el tratamiento del dolor crónico está aumentando el mercado para crecer. Esto también ayuda a las personas a mantener sus rutinas de salud y ejercicio, mientras se mantienen alejadas del dolor que puede ocurrir durante las actividades de ejercicio.

- Mejorar las aprobaciones y regulaciones gubernamentales para los productos de CBD

Existen estrictas regulaciones gubernamentales y los productos a base de CBD requieren aprobaciones estrictas antes de comercializarse y suministrarse en el mercado local e internacional, lo que limitó el crecimiento del mercado. Sin embargo, con el tiempo, estas restricciones se han suavizado y ha habido una creciente aceptación de los productos de CBD refinados junto con la creciente legalización de la marihuana y los productos derivados de la marihuana para diversas aplicaciones. Esto impulsará el crecimiento y la demanda en el mercado.

Además, existe la presencia de importantes fabricantes de productos de CBD en todo el mundo, lo que ha inducido aún más al gobierno y otros organismos reguladores como la Administración de Alimentos y Medicamentos (FDA) en los EE. UU., la Unión Europea en Europa, etc. a aliviar las restricciones para el CBD y los productos basados en CBD.

Restricción

-

Alto costo de los productos de CBD

El CBD es una opción popular y holística para las personas que sufren dolor, inflamación y problemas de sueño. Dado que el CBD es un producto nuevo con menos investigación y desarrollo y que recientemente ha sido regulado y aprobado, el precio del CBD está sujeto a fluctuaciones. La producción de cáñamo se legalizó en 2018, lo que afectó el precio de los productos de CBD. Como resultado, varios productos de CBD experimentaron cierta inflación de precios.

Además, muchos agricultores están haciendo la transición hacia el cultivo y la venta de cáñamo para elaborar productos con CBD, pero a pesar de la creciente popularidad de este producto, presenta sus propios desafíos agrícolas. En primer lugar, cambiar a un nuevo cultivo genera nuevos gastos. La forma más eficiente de cosechar cáñamo es utilizando una cosechadora. Sin embargo, los agricultores que anteriormente han cultivado cultivos que no requieren cosechadoras, como las fresas, no pueden permitirse comprar una cosechadora de inmediato. Por lo tanto, necesitan contratar personas que los ayuden a cosechar el cáñamo, lo que aumenta los precios generales del producto a medida que la materia prima se vuelve costosa.

Además, el cáñamo requiere más tiempo y mano de obra para crecer y los agricultores deben inspeccionar de cerca su cultivo a medida que crece. Además, una vez cosechado, extraer el cannabidiol es un proceso difícil y costoso. Los procesadores y extractores de CBD necesitan utilizar etanol o dióxido de carbono supercrítico (extracción con CO2). El proceso de extracción y refinamiento requiere maquinaria especial y lleva mucho tiempo, lo que aumenta el costo del CBD. Por lo tanto, todos estos factores se suman a los costos de los productos de CBD, haciéndolos mucho más costosos que otros productos, lo que probablemente restringirá la demanda del mercado.

Oportunidad

-

Aumentan las inversiones en el desarrollo de nuevos productos basados en CBD

Con la creciente tendencia de ofrecer productos innovadores y refinados en el mercado, los fabricantes están invirtiendo grandes cantidades en investigación y desarrollo para la producción de nuevos productos basados en CBD. Aceites, tinturas, concentrados, cápsulas, soluciones tópicas como lociones, bálsamos labiales, lociones y comestibles como productos horneados, café, chocolates, chicles y caramelos son algunos de los productos de CBD que tienen una gran demanda.

La creciente demanda ha aumentado el número de ensayos para estudiar el impacto del CBD en ciertas condiciones de salud, lo que se espera que genere nuevos productos que, a su vez, brinden la oportunidad de aumentar la demanda en los próximos años. Además, muchas empresas compran aceites de CBD a granel y fabrican productos con infusión de CBD. Asimismo, numerosos minoristas de salud y bienestar ofrecen productos a base de CBD, como Rite Aid, CVS Health y Walgreens Boots Alliance.

Además, con la flexibilización de las normativas y la aprobación posterior de los productos de cannabis, las empresas están invirtiendo enormes cantidades en el desarrollo de productos y en la mejora de la producción de materias primas, lo que también les ayudará a reducir los costes y, al mismo tiempo, a satisfacer la creciente demanda del mercado. El desarrollo de nuevos productos y el aumento de las actividades de investigación y desarrollo, junto con diversas decisiones estratégicas adoptadas por los principales fabricantes del mercado, ofrecerán una oportunidad lucrativa para el crecimiento del mercado del CBD en Asia y el Pacífico.

Desafío

- Efectos secundarios asociados con el aceite de CBD

El cannabidiol es conocido por su capacidad para curar diversas enfermedades, como ansiedad, convulsiones, problemas neurológicos, náuseas relacionadas con el cáncer, dolor crónico y más. Sin embargo, al ser útil para una variedad de enfermedades médicas, varios estudios e investigaciones realizados por numerosas organizaciones han demostrado que los medicamentos a base de CBD también pueden tener efectos negativos.

Algunos de los efectos secundarios que suelen experimentar los consumidores son sequedad de boca, somnolencia, presión arterial baja y mareos. También se sabe que el CBD aumenta el nivel de Coumadin (un anticoagulante) en el cuerpo, lo que puede interactuar con otros medicamentos y causar efectos secundarios negativos. Estos factores podrían impedir la adopción futura del CBD con fines terapéuticos.

Además, otro motivo de preocupación es la falta de fiabilidad de la pureza y la dosis de CBD en productos como el aceite de CBD. Una concentración elevada de aceite de CBD también puede tener efectos nocivos para la salud de los consumidores. En algunos casos, el uso excesivo de aceite de CBD también puede aumentar las enzimas hepáticas, que es un marcador de inflamación del hígado. El citocromo P450 (CYP450) es una enzima que el cuerpo utiliza para descomponer algunos medicamentos. El aceite de CBD puede bloquear el CYP450. Eso significa que tomar aceite de CBD con estos medicamentos podría hacer que tengan un efecto más fuerte del necesario o que no funcionen en absoluto.

Además, los suplementos dietéticos que contienen CBD y una mezcla de ingredientes a base de hierbas pueden no ser seguros para todos, ya que muchas hierbas tienen el potencial de interactuar con medicamentos comúnmente recetados. Todos estos efectos secundarios pueden variar de persona a persona, ya que los efectos secundarios menores para algunos pueden resultar graves para otros. Esto puede representar un desafío para la creciente demanda de productos de CBD en el mercado de CBD de Asia y el Pacífico.

Impacto posterior al COVID-19 en el mercado de cannabidiol (CBD) en Asia y el Pacífico

La COVID-19 ha provocado un aumento sustancial de la demanda de suministros médicos tanto por parte de los profesionales sanitarios como del público en general como medida de precaución. Los fabricantes de estos artículos tienen la oportunidad de aprovechar la mayor demanda de suministros médicos garantizando un suministro constante de equipos de protección personal en el mercado. Se prevé que la COVID-19 tenga un gran impacto en el mercado de cannabidiol (CBD) de Asia y el Pacífico.

Alcance y tamaño del mercado del cannabidiol (CBD) en Asia y el Pacífico

El mercado de cannabidiol (CBD) de Asia-Pacífico está segmentado en función de la fuente, el grado, la aplicación, el tipo de producto y la naturaleza. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

POR FUENTE

- CÁÑAMO

- MARIJUANA

Según la fuente, el mercado de cannabidiol (CBD) de Asia-Pacífico está segmentado en cáñamo y marihuana.

POR TIPO DE PRODUCTO

- ACEITE DE CBD

- AISLADOS DE CBD

- CONCENTRADOS DE CBD

- OTROS

Según el tipo de producto, el mercado de cannabidiol (CBD) de Asia-Pacífico está segmentado en aceite de CBD, concentrados de CBD, aislados de CBD y otros.

POR NATURALEZA

- ORGÁNICO

- INORGÁNICO

Sobre la base de la naturaleza, el mercado de cannabidiol (CBD) de Asia-Pacífico está segmentado en orgánico e inorgánico.

POR GRADO

- GRADO ALIMENTARIO

- GRADO TERAPÉUTICO

Sobre la base del grado, el mercado de cannabidiol (CBD) de Asia-Pacífico está segmentado en grado alimenticio y grado terapéutico.

POR APLICACIÓN

- Tintura

- Alimento

- Bebidas

- Farmacéutico

- Temas tópicos

- Suplementos dietéticos

- Otros

Sobre la base de la aplicación, el mercado de cannabidiol (CBD) de Asia-Pacífico está segmentado en tinturas, alimentos, bebidas, productos farmacéuticos, tópicos, suplementos dietéticos y otros.

Análisis a nivel de país del mercado de cannabidiol (CBD) en Asia y el Pacífico

Se analiza el mercado de cannabidiol (CBD) y se proporciona información sobre el tamaño del mercado por fuente, grado, aplicación, tipo de producto y naturaleza.

Los países cubiertos en el informe del mercado de cannabidiol (CBD) son China, Japón, India, Corea del Sur, Tailandia, Malasia, Australia, Nueva Zelanda y el resto de Asia-Pacífico.

En 2022, China dominará gracias a la presencia de actores clave en el mercado de consumo más grande con un PIB elevado. Se espera que China crezca debido al aumento de los avances tecnológicos en tratamientos farmacológicos.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El mercado del cannabidiol (CBD) también le ofrece un análisis detallado del mercado para el crecimiento de la industria de la salud en cada país. Además, proporciona información detallada sobre los servicios y tratamientos de atención médica, el impacto de los escenarios regulatorios y los parámetros de tendencia con respecto al mercado del cannabidiol (CBD).

Análisis del panorama competitivo y de la cuota de mercado del cannabidiol (CBD) en Asia y el Pacífico

El panorama competitivo del mercado de cannabidiol (CBD) en Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con los productos de cannabidiol (CBD).

Las principales empresas que operan en el mercado del cannabidiol (CBD) son CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., Tilray, Curaleaf, KAZMIRA, Freedom Leaf, Inc., Koi CBD, Groff North America Hemplex, Joy Organics, Elixinol Wellness Limited, Isodiol International Inc., Healthy Food Ingredients, LLC, NuLeaf Naturals, LLC, Diamond CBD, Medterra CBD, ENDOCA, Green Roads, entre otras.

Se espera que las alianzas estratégicas como fusiones, adquisiciones y acuerdos entre los actores clave del mercado aceleren aún más el crecimiento de los productos de cannabidiol (CBD).

Por ejemplo,

- En mayo de 2022, Canopy Growth Corporation y Lemurian, Inc., un productor con sede en California de extractos de cannabis de alta calidad y pionero de la tecnología de vapeo limpio, anunciaron que han firmado acuerdos definitivos que otorgan a Canopy Growth, a través de una subsidiaria de propiedad absoluta, el derecho a adquirir, previa permisibilidad federal de THC en los EE. UU. o antes a elección de Canopy Growth, hasta el 100% del capital social en circulación de Jetty. Esto ha ayudado a la empresa a expandir su negocio en el mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CANNABIDIOL (CBD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 BENCHMARKING ANALYSIS

4.2 CBD PRODUCTS, INCLUDING CANNABINOIDS (IN %)

4.3 CBD RAW MATERIAL DEVELOPMENT TREND

4.3.1 MORE CONTROLLED CBD LEVELS:

4.3.2 CBD AND GENETICS:

4.3.3 ADVANCEMENTS MADE IN EXTRACTION:

4.3.4 NANOTECHNOLOGY

4.3.5 CONCLUSION

4.4 COMPANY POSITIONING GRID

4.4.1 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

4.4.1.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

4.4.1.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

4.4.1.3 COMPANY SHARE ANALYSIS: EUROPE

4.4.1.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

4.4.2 COMPANY’S CURRENT VENDORS

4.5 OVERALL VOLUME (KILO TONS) & QUANTITY OF COMPLETED TRANSACTIONS: ASIA PACIFIC CANNABIDIOL (CBD) MARKET

4.6 LIST OF COUNTRIES THAT LEGALIZED CANNABIDIOL (CBD)

4.7 REGULATION COVERAGE

4.8 IMPORT & EXPORT REGULATION

4.8.1 IMPORT REGULATIONS

4.8.2 EXPORT REGULATIONS

4.9 IMPORT STANDARDS

4.1 GOVERNMENT POLICIES

4.11 QUALIFICATION/CERTIFICATION REQUIRED

4.12 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: PRICING ANALYSIS & DEAL PRICING

4.13 RAW MATERIAL EXTRACTOR POSITIONING GRID

4.13.1 KEY EXTRACTION

4.13.2 LINE CAPABILITY

4.14 TECHNOLOGICAL ADVANCEMENTS:

4.15 VENDOR/ DISTRIBUTOR SHARE ANALYSIS

4.16 VENDOR/DISTRIBUTOR KEY BUYERS

5 CLIMATE CHANGE SCENARIO: ASIA PACIFIC CANNABIDIOL (CBD) MARKET

5.1 ENVIRONMENT CONCERNS-

5.2 INDUSTRY RESPONSE-

5.3 GOVERNMENT INITIATIVES

5.4 ANALYST RECOMMENDATIONS

6 SUPPLY CHAIN OF THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET

6.1 LOGISTIC COST SCENARIO

6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN DEMAND FOR CBD IN HEALTH & FITNESS

7.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

7.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

7.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AS WELL AS RECREATIONAL USE

7.2 RESTRAINTS

7.2.1 HIGH COST OF CBD PRODUCTS

7.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

7.3 OPPORTUNITIES

7.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

7.3.2 GROWING MEDICAL APPLICATIONS OF CBD

7.4 CHALLENGES

7.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

7.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

8 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 CANNABIDIOL (CBD) OIL

9.2.1 CARBON DIOXIDE EXTRACTION

9.2.2 STEAM DISTILLATION

9.2.3 SOLVENT EXTRACTION

9.2.4 OTHERS

9.3 CANNABIDIOL (CBD) ISOLATES

9.4 CANNABIDIOL (CBD) CONCENTRATES

9.5 OTHERS

10 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY NATURE

10.1 OVERVIEW

10.2 ORGANIC

10.3 INORGANIC

11 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY GRADE

11.1 OVERVIEW

11.2 FOOD GRADE

11.3 THERAPEUTIC GRADE

12 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 TINCTURE

12.3 FOOD

12.3.1 CHOCOLATE & CONFECTIONERY

12.3.1.1 CANDY

12.3.1.2 CHOCOLATE

12.3.1.3 CHEWS

12.3.1.4 GUMMIES

12.3.1.5 OTHERS

12.3.2 HONEY

12.3.3 DAIRY BASED EDIBLE

12.3.3.1 MILK

12.3.3.2 ICE CREAM

12.3.3.3 OTHERS

12.3.4 SAUCES AND SEASONINGS

12.3.5 BAKERY EDIBLE

12.3.5.1 COOKIES AND BISCUITS

12.3.5.2 BROWNIES

12.3.5.3 OTHERS

12.3.6 OTHERS

12.3.7 PHARMACEUTICALS

12.3.7.1 DRAVET SYNDROME

12.3.7.2 MULTIPLE SCLEROSIS DRUG APPLICATIONS

12.3.7.3 NEUROLOGICAL DRUG APPLICATIONS

12.3.7.4 CANCER DRUG APPLICATIONS

12.3.7.5 OTHERS

12.3.8 DIETARY SUPPLEMENTS

12.3.8.1 CAPSULES

12.3.8.2 GUMMIES

12.3.8.3 OTHERS

12.3.9 BEVERAGES

12.3.9.1 NON-ALCOHOLIC BEVERAGES

12.3.9.1.1 ENERGY DRINKS

12.3.9.1.2 SOFT DRINKS

12.3.9.1.3 RTD COFFEE

12.3.9.1.4 TEA

12.3.9.1.5 SPARKLING WATER

12.3.9.1.6 OTHERS

12.3.9.2 FLAVORED DRINKS

12.3.9.2.1 ORANGE

12.3.9.2.2 LEMON

12.3.9.2.3 BERRIES

12.3.9.2.4 COCONUT

12.3.9.2.5 OTHERS

12.3.9.3 ALCOHOLIC BEVERAGES

12.3.9.3.1 BEER

12.3.9.3.2 WINE

12.3.9.3.3 OTHERS

12.3.9.4 OTHERS

12.3.10 TOPICAL

12.3.10.1 LOTION

12.3.10.2 SALVE

12.3.10.3 LIP BALM

12.3.10.4 OTHERS

12.3.11 OTHERS

12.3.11.1 VAPES

12.3.11.2 CIGARETTES

12.3.11.3 SPA AND RECREATION

13 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 AUSTRALIA

13.1.4 INDIA

13.1.5 THAILAND

13.1.6 MALAYSIA

13.1.7 SOUTH KOREA

13.1.8 NEW ZEALAND

13.1.9 REST OF ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CURALEAF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TILRAY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JAZZ PHARMACEUTICALS, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CANOPY GROWTH CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AURORA CANNABIS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CHARLOTTE’S WEB.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CV SCIENCES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DIAMOND CBD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ELIXINOL WELLNESS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ENDOCA.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 FREEDOM LEAF, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GAIA HERBS HEMP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GREEN ROADS.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GROFF NORTH AMERICA HEMPLEX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HEXO CORP.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 HEALTHY FOOD INGREDIENTS, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ISODIOL INTERNATIONAL INC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 JOY ORGANICS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KAZMIRA

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KOI CBD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MEDICAL MARIJUANA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 EVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 MEDTERRA CBD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NULEAF NATURALS, LLC

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 PHOENA HOLDINGS INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 THE CRONOS GROUP

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 VIVO CANNABIS INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 BENCHMARK ANALYSIS

TABLE 2 AVERAGE VOLUME TREND FOR ASIA PACIFIC CANNABIDIOL (CBD) MARKET (KILO TONS)

TABLE 3 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 4 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC HEMP IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MARIJUANA IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC CANNABIDIOL (CBD) ISOLATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CANNABIDIOL (CBD) CONCETRATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC INORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC FOOD GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC THERAPEUTIC GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC TINCTURE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FOOD IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC FOOD IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTICALS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC TOPICAL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 CHINA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 61 CHINA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 CHINA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 63 CHINA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CHINA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 CHINA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CHINA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 CHINA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 77 JAPAN CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 JAPAN CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 79 JAPAN CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 JAPAN CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 JAPAN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 JAPAN FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 JAPAN CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 JAPAN BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 JAPAN DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 JAPAN BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 JAPAN ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 JAPAN NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 JAPAN FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 JAPAN TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 JAPAN DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 JAPAN OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDIA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 113 INDIA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDIA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 115 INDIA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 116 INDIA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 117 INDIA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 INDIA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDIA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDIA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDIA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDIA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDIA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 INDIA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 INDIA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 INDIA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 THAILAND CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 THAILAND CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 133 THAILAND CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 THAILAND FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 THAILAND ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 THAILAND NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 THAILAND FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 THAILAND PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 THAILAND TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 THAILAND DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 THAILAND OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 MALAYSIA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 MALAYSIA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 MALAYSIA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 MALAYSIA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 167 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 SOUTH KOREA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 169 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 170 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 171 SOUTH KOREA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 SOUTH KOREA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 SOUTH KOREA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 SOUTH KOREA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 SOUTH KOREA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SOUTH KOREA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SOUTH KOREA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 SOUTH KOREA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SOUTH KOREA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 SOUTH KOREA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SOUTH KOREA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 SOUTH KOREA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 185 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 NEW ZEALAND CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 187 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 188 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 189 NEW ZEALAND CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 NEW ZEALAND FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 NEW ZEALAND CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 NEW ZEALAND BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 NEW ZEALAND DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 NEW ZEALAND BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 NEW ZEALAND ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 NEW ZEALAND FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 NEW ZEALAND PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 NEW ZEALAND TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 NEW ZEALAND DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 NEW ZEALAND OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 REST OF ASIA-PACIFIC CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE INCREASING DEMAND FOR CANNABIDIOL (CBD) DUE TO ITS HEALING PROPERTIES AND HEALTH AND WELLNESS PURPOSES IS HIGH, WHICH IS THE MAJOR FACTOR DRIVING THE MARKET IS EXPECTED TO DRIVE THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEMP IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 13 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 14 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 15 EUROPE CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 16 SOUTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 17 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: VENDOR/ DISTRIBUTOR SHARE ANALYSIS (%)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC CANNABIDIOL (CBD) MARKET

FIGURE 19 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, 2021

FIGURE 20 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 24 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 28 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY NATURE, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 32 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY GRADE, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 36 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC CANNABIDIOL (CBD) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC CANNABIDIOL (CBD) MARKET: BY SOURCE (2022-2029)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.