Asia Pacific Biologics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

73.52 Billion

USD

175.63 Billion

2024

2032

USD

73.52 Billion

USD

175.63 Billion

2024

2032

| 2025 –2032 | |

| USD 73.52 Billion | |

| USD 175.63 Billion | |

|

|

|

|

Segmentación del mercado de productos biológicos de Asia-Pacífico, por clase (inhibidores del factor de necrosis tumoral-Α (TNF), inhibidores de células B, inhibidores de interleucina, moduladores selectivos de coestimulación (Abatacept) y otros), tipo (anticuerpos monoclonales (MAB), proteínas terapéuticas, vacunas, productos biológicos de base celular, productos biológicos de base genética y otros), vía de administración (inyección e infusión), aplicación (oncología, enfermedades autoinmunes, diabetes, enfermedades infecciosas, enfermedades cardiovasculares, afecciones oftálmicas, enfermedades dermatológicas y otras), material de origen (humanos, cultivo de células aviares, levaduras, bacterias, cultivo de células de insectos, transgénicos y otros), usuario final (hospitales, clínicas especializadas, instituciones académicas y de investigación, y otros), canal de distribución (licitación directa, ventas minoristas y distribución de terceros): tendencias de la industria y pronóstico 2032

Tamaño del mercado de productos biológicos de Asia y el Pacífico

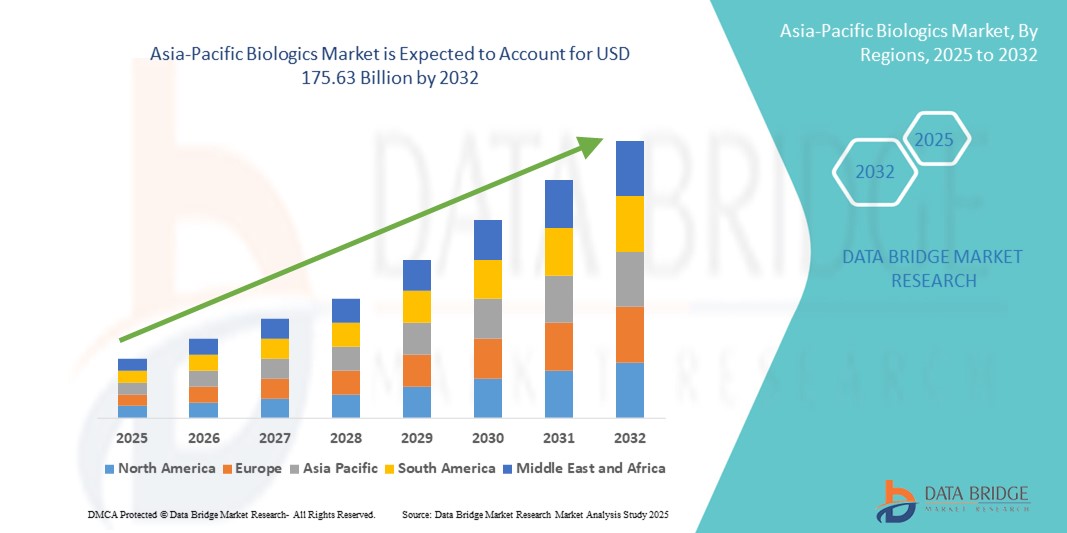

- El tamaño del mercado de productos biológicos de Asia-Pacífico se valoró en USD 73,52 mil millones en 2024 y se espera que alcance los USD 175,63 mil millones para 2032 , con una CAGR del 11,5% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por el aumento de las inversiones en investigación biofarmacéutica , la creciente prevalencia de enfermedades crónicas y la expansión de la infraestructura de atención médica en las economías emergentes de la región.

- Además, el creciente apoyo gubernamental a la biotecnología , la creciente adopción de la medicina personalizada y los avances tecnológicos en el desarrollo de fármacos biológicos contribuyen a la rápida expansión del mercado de productos biológicos en Asia-Pacífico. Estos factores, en conjunto, mejoran la disponibilidad y la aceptación de las terapias biológicas, acelerando así el crecimiento del mercado.

Análisis del mercado de productos biológicos de Asia-Pacífico

- Los productos biológicos, que abarcan medicamentos complejos derivados de células vivas para tratar enfermedades crónicas y raras, se están convirtiendo en componentes esenciales del sector de la salud de Asia y el Pacífico debido a los rápidos avances biotecnológicos y la creciente demanda de terapias dirigidas.

- La creciente prevalencia de enfermedades crónicas, la expansión de la infraestructura de atención médica y el creciente gasto en atención médica en las economías emergentes están impulsando una fuerte demanda de productos biológicos en la región.

- China dominó el mercado de productos biológicos de Asia-Pacífico con una participación en los ingresos del 39,2 % en 2024, respaldada por sólidas iniciativas gubernamentales, la expansión de la base de pacientes y la creciente adopción de productos biológicos innovadores y biosimilares.

- Se anticipa que India será el país de más rápido crecimiento en el mercado de productos biológicos de Asia-Pacífico durante el período de pronóstico, debido a las actividades de investigación clínica mejoradas, los entornos regulatorios mejorados y las crecientes capacidades de fabricación biofarmacéutica.

- El segmento de anticuerpos monoclonales dominó el mercado de productos biológicos de Asia-Pacífico con una participación del 46,1 % en 2024, impulsado por amplias aplicaciones en oncología, enfermedades autoinmunes e innovación continua para mejorar la eficacia y seguridad del tratamiento.

Alcance del informe y segmentación del mercado de productos biológicos de Asia y el Pacífico

|

Atributos |

Perspectivas clave del mercado de productos biológicos de Asia y el Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de productos biológicos en Asia-Pacífico

Expansión rápida impulsada por la innovación biotecnológica y la medicina personalizada

- Una tendencia destacada y en aceleración en el mercado de productos biológicos de Asia y el Pacífico es el aumento de las innovaciones biotecnológicas combinado con la creciente adopción de enfoques de medicina personalizada adaptados a los perfiles genéticos y moleculares de los pacientes.

- Por ejemplo, empresas como Biocon (India) y Shanghai Fosun Pharmaceutical están desarrollando biosimilares y nuevos productos biológicos dirigidos al cáncer, enfermedades autoinmunes y trastornos raros, mejorando la accesibilidad y la eficacia del tratamiento en toda la región.

- Los avances en terapias celulares y genéticas, respaldados por capacidades de fabricación mejoradas y colaboraciones entre empresas biotecnológicas locales y compañías farmacéuticas globales, están impulsando líneas de innovación y expandiendo las carteras de productos biológicos.

- Los organismos reguladores de Asia-Pacífico, incluidos la PMDA de Japón y la NMPA de China, están agilizando los procesos de aprobación de productos biológicos y biosimilares, lo que facilita una entrada y una adopción más rápidas en el mercado.

- Esta tendencia hacia terapias de precisión y productos biológicos avanzados está transformando los modelos de atención al paciente, con una creciente integración en programas nacionales de atención sanitaria y esquemas de reembolso de seguros, particularmente en China, Japón y Corea del Sur.

- La demanda de tratamientos biológicos de vanguardia está creciendo rápidamente debido a sus perfiles superiores de seguridad y eficacia en comparación con los medicamentos tradicionales de moléculas pequeñas, lo que impulsa una sólida expansión del mercado en los países desarrollados y emergentes de Asia y el Pacífico.

Dinámica del mercado de productos biológicos en Asia-Pacífico

Conductor

Aumento de la carga de enfermedades crónicas y expansión de la infraestructura sanitaria

- La creciente prevalencia de enfermedades crónicas como el cáncer, la diabetes y los trastornos autoinmunes en Asia-Pacífico, junto con la expansión de la infraestructura de atención médica y las mejores tasas de diagnóstico de enfermedades, es un impulsor clave para el crecimiento del mercado de productos biológicos.

- Por ejemplo, en marzo de 2024, Samsung Biologics anunció una importante expansión de capacidad en Corea del Sur, con el objetivo de satisfacer la creciente demanda de servicios de fabricación biofarmacéutica, lo que subraya el compromiso de la industria con las necesidades del mercado.

- La creciente concienciación de los pacientes y el mejor acceso a la atención médica han acelerado la adopción de productos biológicos, respaldados por iniciativas gubernamentales y mejoras en la cobertura de seguros en países como China e India.

- Además, las inversiones en I+D y fabricación por parte de empresas locales y multinacionales están mejorando la disponibilidad y asequibilidad de las terapias biológicas, fomentando la penetración en el mercado.

- Las crecientes colaboraciones y asociaciones entre empresas de biotecnología de Asia y el Pacífico y compañías farmacéuticas globales están acelerando la innovación, la transferencia de tecnología y la comercialización de productos biológicos en la región.

- La expansión de los mercados de biosimilares está creando alternativas rentables a los productos biológicos de marca, lo que aumenta la accesibilidad al tratamiento e impulsa el crecimiento general del mercado.

Restricción/Desafío

Altos costos de tratamiento y entorno regulatorio complejo

- El costo relativamente alto de las terapias biológicas sigue siendo una barrera importante para su adopción generalizada en los mercados de Asia y el Pacífico sensibles a los precios, lo que limita la accesibilidad entre los segmentos de pacientes con ingresos más bajos.

- Por ejemplo, a pesar de que los biosimilares ofrecen ahorros de costos, los requisitos regulatorios estrictos y variados en los diferentes países crean demoras y aumentan los costos de cumplimiento para el ingreso al mercado.

- La variabilidad en las protecciones de la propiedad intelectual y la falta de regulaciones armonizadas plantean desafíos adicionales para los fabricantes y obstaculizan una disponibilidad más rápida de biosimilares.

- Además, las complejidades logísticas en el almacenamiento y distribución de productos biológicos, especialmente en zonas rurales o subdesarrolladas, afectan la continuidad y la escalabilidad del tratamiento.

- La limitada fuerza laboral calificada y la infraestructura inadecuada en algunos países emergentes de Asia y el Pacífico ralentizan los ensayos clínicos y la ampliación de la fabricación de productos biológicos.

- Las preocupaciones sobre la inmunogenicidad y los perfiles de seguridad a largo plazo de los productos biológicos más nuevos también contribuyen a una adopción cautelosa entre los proveedores de atención médica y los pacientes.

Alcance del mercado de productos biológicos de Asia y el Pacífico

El mercado está segmentado según clase, tipo, vía de administración, aplicación, material de origen, usuario final y canal de distribución.

- Por clase

En cuanto a la clase, el mercado de productos biológicos de Asia-Pacífico se segmenta en inhibidores del factor de necrosis tumoral α (TNF), inhibidores de células B, inhibidores de interleucina, moduladores selectivos de coestimulación (abatacept) y otros. El segmento de inhibidores del factor de necrosis tumoral α (TNF) dominó el mercado con la mayor participación en los ingresos, con un 37,5 % en 2024, debido principalmente a su consolidada función en el tratamiento de enfermedades autoinmunes como la artritis reumatoide y la enfermedad inflamatoria intestinal. Este segmento se beneficia de una sólida adopción clínica y de una amplia familiaridad con los médicos.

Por el contrario, se espera que el segmento de inhibidores de interleucina experimente la CAGR más rápida del 22,3 % entre 2025 y 2032, impulsada por la expansión de las indicaciones terapéuticas en afecciones dermatológicas como la psoriasis y otros trastornos autoinmunes, respaldadas por la innovación continua y las aprobaciones regulatorias.

- Por tipo

Según el tipo, el mercado de productos biológicos de Asia-Pacífico se segmenta en anticuerpos monoclonales (mAb), proteínas terapéuticas, vacunas, productos biológicos celulares, productos biológicos genéticos, entre otros. El segmento de anticuerpos monoclonales dominó el mercado con una participación del 46,1 % en 2024, gracias a su amplia aplicación en oncología y enfermedades autoinmunes, así como a las continuas mejoras tecnológicas que optimizan la especificidad y la seguridad.

Mientras tanto, se espera que el segmento de productos biológicos basados en células registre el crecimiento más rápido con una CAGR del 23,1%, seguido de cerca por los productos biológicos basados en genes que crecen a un 24,5%, ambos impulsados por avances en terapia génica y medicina personalizada, junto con mayores aprobaciones de ensayos clínicos en la región de Asia y el Pacífico.

- Por vía de administración

Según la vía de administración, el mercado de productos biológicos de Asia-Pacífico se segmenta en inyección e infusión. El segmento de inyección dominó con una participación en los ingresos del 62,8 % en 2024, favorecido por su comodidad e idoneidad para el tratamiento ambulatorio y la autoadministración, especialmente en enfermedades crónicas.

Se proyecta que el segmento de infusión, aunque más pequeño, crecerá de manera constante durante el período de pronóstico, ya que sigue siendo fundamental para la administración hospitalaria de productos biológicos complejos, como quimioterapia e inmunoterapias que requieren administración controlada, en particular en indicaciones oncológicas y autoinmunes.

- Por aplicación

Según su aplicación, el mercado de productos biológicos de Asia-Pacífico se segmenta en oncología, enfermedades autoinmunes, diabetes, enfermedades infecciosas, enfermedades cardiovasculares, afecciones oftálmicas, enfermedades dermatológicas, entre otras. La oncología dominó el mercado con una participación en los ingresos del 39,7 % en 2024, impulsada por el aumento de la prevalencia del cáncer y la disponibilidad de productos biológicos específicos para diversos tipos de tumores.

Se anticipa que el segmento de enfermedades autoinmunes experimentará la tasa de crecimiento más rápida, con una CAGR del 21,4 %, durante el período de pronóstico, debido al aumento de las tasas de diagnóstico de enfermedades y la creciente preferencia por los productos biológicos sobre los tratamientos convencionales debido a mejores perfiles de eficacia y seguridad.

- Por material de origen

Según el material de origen, el mercado de productos biológicos de Asia-Pacífico se segmenta en humanos, cultivos celulares aviares, levaduras, bacterias, cultivos celulares de insectos, transgénicos y otros. Los productos biológicos de origen humano dominaron el mercado con una participación del 41,3 % en los ingresos en 2024, siendo preferidos por su probada seguridad y compatibilidad con la fisiología humana.

Se espera que los sistemas de expresión de levaduras y bacterias registren las tasas de crecimiento más rápidas con CAGR del 19,8% y 18,5% respectivamente durante el período de pronóstico, impulsados por su rentabilidad y escalabilidad en la fabricación de biosimilares y nuevos productos biológicos en los mercados emergentes de Asia y el Pacífico.

- Usuario final

En función del usuario final, el mercado de productos biológicos de Asia-Pacífico se segmenta en hospitales, clínicas especializadas, institutos académicos y de investigación, entre otros. Los hospitales dominaron el mercado con una participación del 52,1 % en los ingresos en 2024, gracias a su función como centros primarios para la administración de terapias biológicas complejas y la realización de ensayos clínicos.

Se proyecta que las clínicas especializadas serán testigos del crecimiento más rápido con una CAGR del 20,3 % durante el período de pronóstico, impulsado por una mayor accesibilidad a los productos biológicos en entornos ambulatorios y una creciente preferencia de los pacientes por opciones de tratamiento convenientes.

- Por canal de distribución

Según el canal de distribución, el mercado de productos biológicos de Asia-Pacífico se segmenta en licitación directa, venta minorista y distribución a terceros. La licitación directa dominó el mercado con una participación del 48,6 % en 2024, impulsada por la adquisición a gran escala por parte de hospitales públicos y privados, lo que garantizó un suministro constante de productos biológicos.

Se espera que las ventas minoristas registren la tasa de crecimiento anual compuesta (TCAC) más rápida, del 18,7 %, durante el período de pronóstico, impulsada por la expansión de las redes de farmacias, el aumento de la autoadministración de medicamentos por parte de los pacientes y una mayor concienciación. La distribución a través de terceros sigue siendo crucial para llegar a regiones remotas y desatendidas, facilitando así una mayor cobertura del mercado.

Análisis regional del mercado de productos biológicos de Asia y el Pacífico

- China dominó el mercado de productos biológicos de Asia-Pacífico con una participación en los ingresos del 39,2 % en 2024, respaldada por sólidas iniciativas gubernamentales, la expansión de la base de pacientes y la creciente adopción de productos biológicos innovadores y biosimilares.

- El país se beneficia de políticas de apoyo que promueven la fabricación biofarmacéutica, aprobaciones regulatorias más rápidas y una creciente adopción de productos biológicos y biosimilares innovadores.

- La creciente prevalencia de enfermedades crónicas, el mayor gasto en atención médica y la expansión de las actividades de investigación clínica en China están acelerando aún más el crecimiento del mercado, convirtiéndolo en el líder regional en el desarrollo y consumo de productos biológicos.

Perspectiva del mercado de productos biológicos de China

El mercado chino de productos biológicos dominó el mercado de Asia-Pacífico con una participación del 42,5% en los ingresos en 2024, impulsado por sólidas iniciativas gubernamentales que promueven la innovación biotecnológica, la agilización de las aprobaciones regulatorias y el aumento del gasto sanitario. La creciente base de pacientes del país y la creciente demanda de biosimilares rentables contribuyen significativamente al crecimiento del mercado. China también se está consolidando como un centro de fabricación de productos biológicos, atrayendo tanto a empresas locales como multinacionales para ampliar sus capacidades de I+D y producción.

Perspectiva del mercado de productos biológicos de Japón

El mercado japonés de productos biológicos está en constante crecimiento gracias a su avanzado sistema de salud, la alta inversión en I+D y el envejecimiento de la población, con una mayor demanda de terapias biológicas dirigidas a enfermedades crónicas y relacionadas con la edad. El país se beneficia de un sólido apoyo regulatorio y de la adopción temprana de productos biológicos innovadores, como las terapias celulares y génicas. La integración de los productos biológicos en los sistemas nacionales de seguro médico facilita el acceso de los pacientes, lo que impulsa una expansión sostenida del mercado.

Perspectiva del mercado de productos biológicos de Corea del Sur

El mercado surcoreano de productos biológicos se está consolidando rápidamente como un actor clave en el mercado de productos biológicos de Asia-Pacífico, gracias a un sólido respaldo gubernamental, una sustancial inversión en I+D y un creciente sector de fabricación biofarmacéutica. El país se centra en gran medida en el desarrollo de productos biológicos innovadores y biosimilares, con un número creciente de ensayos clínicos y aprobaciones. La avanzada infraestructura y la mano de obra cualificada de Corea del Sur refuerzan su posición competitiva, impulsando el crecimiento del mercado tanto en el mercado nacional como en el de exportación.

Perspectivas del mercado de productos biológicos de la India

El mercado indio de productos biológicos representa una participación significativa en el mercado de productos biológicos de Asia-Pacífico, impulsado por una gran población, el crecimiento de la clase media y el aumento del gasto en salud. El mercado se beneficia del aumento de la producción de biosimilares por parte de empresas nacionales, lo que mejora el acceso a terapias biológicas a precios más asequibles. Las iniciativas gubernamentales que promueven las empresas emergentes de biotecnología y el desarrollo de infraestructura están impulsando la innovación y la comercialización de nuevos productos biológicos, acelerando aún más el crecimiento del mercado.

Perspectivas del mercado australiano de productos biológicos

El mercado australiano de productos biológicos se expande de forma constante, gracias a una infraestructura sanitaria consolidada y a una creciente inversión en investigación biofarmacéutica. La creciente incidencia de enfermedades crónicas y la creciente concienciación de los pacientes sobre las terapias avanzadas fomentan su adopción. El marco regulatorio del país está evolucionando para facilitar la aprobación más rápida de biosimilares y nuevos productos biológicos, lo que contribuye al crecimiento del mercado en los sectores sanitarios público y privado.

Cuota de mercado de productos biológicos en Asia-Pacífico

La industria de productos biológicos de Asia y el Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Biocon Limited (India)

- Samsung Biologics (Corea del Sur)

- Celltrion, Inc. (Corea del Sur)

- Takeda Pharmaceutical Company Limited (Japón)

- AstraZeneca (Reino Unido)

- Fujifilm Diosynth Biotechnologies (Japón)

- Productos biológicos de Wuxi (China)

- Corporación Biotecnológica GenScript (China)

- Zhejiang Hisun Pharmaceutical Co., Ltd. (China)

- Suzhou Hengrui Pharmaceuticals Co., Ltd. (China)

- Laboratorios del Dr. Reddy (India)

- LG Chem Life Sciences (Corea del Sur)

- Lilly (Estados Unidos)

- Chugai Pharmaceutical Co., Ltd. (Japón)

- Jubilant Life Sciences Limited (India)

- Grupo farmacéutico Harbin Co., Ltd. (China)

- Mabpharm Inc. (Corea del Sur)

- Ingeniería Biológica Hualan Inc. (China)

- Grupo farmacéutico Shanghai Fosun (China)

- Sino Biopharmaceutical Limited (China)

¿Cuáles son los desarrollos recientes en el mercado de productos biológicos de Asia y el Pacífico?

- En agosto de 2025, India aprobó la versión subcutánea de Roche del medicamento contra el cáncer, Atezolizumab, comercializado como Tecentriq. Este nuevo método permite una administración más rápida, de tan solo siete minutos, lo que ofrece una alternativa más cómoda a las infusiones intravenosas tradicionales. La aprobación fue otorgada por un comité técnico que supervisa los ensayos clínicos de nuevas entidades químicas. Sin embargo, está sujeta a la finalización de un ensayo de fase IV en India, que normalmente evalúa la eficacia y seguridad del medicamento tras su comercialización.

- En agosto de 2025, Biocon Biologics anunció sus planes de centrarse en la terapia de pérdida de peso con GLP-1 como área clave para su crecimiento futuro. La compañía ve un potencial significativo en el creciente mercado de las terapias con GLP-1, que están ganando reconocimiento a nivel mundial por su eficacia en el control del peso. Este giro estratégico sugiere que Biocon se está alineando con las tendencias emergentes en el ámbito de la salud y el tratamiento de la obesidad para diversificar y ampliar su cartera de productos.

- En agosto de 2025, Agilent Technologies inauguró un nuevo centro de experiencia biofarmacéutica en Hyderabad, India. Las instalaciones están diseñadas para acelerar el desarrollo de medicamentos vitales mediante tecnologías de vanguardia en cromatografía, espectrometría de masas, análisis celular e informática de laboratorio. Su objetivo es fomentar la colaboración entre la industria y el mundo académico, simular entornos de laboratorio reales y acelerar la investigación y el desarrollo, cumpliendo con las normas regulatorias internacionales.

- En julio de 2025, Corea del Sur anunció planes para invertir 100 000 millones de wones durante los próximos 3 a 5 años para impulsar el desarrollo de fármacos basados en IA. Esta iniciativa busca acelerar el descubrimiento y el desarrollo de nuevas terapias biológicas, posicionando a Corea del Sur como líder en investigación biofarmacéutica innovadora.

- En julio de 2025, Aragen anunció sus planes de iniciar la producción según las Buenas Prácticas de Fabricación (BPF) en su planta de productos biológicos de Bangalore. La planta utilizará una plataforma de lotes alimentados intensificada con una productividad superior a 25 g/L. Esta medida busca impulsar la producción flexible con biorreactores 2-KL de un solo uso y capacidades integradas de producción para proyectos de escalamiento rápido o multicliente, satisfaciendo así la creciente demanda mundial de productos biológicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.