Asia Pacific Biodegradable Paper Plastic Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.14 Billion

USD

2.66 Billion

2024

2032

USD

1.14 Billion

USD

2.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.66 Billion | |

|

|

|

|

Segmentación del mercado de envases de papel y plástico biodegradables en Asia-Pacífico, por tipo (plástico y papel), material (plástico y papel), usuario final (envases, alimentos y bebidas, artículos de catering, cuidado personal y del hogar, atención médica, etc.): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de envases de papel y plástico biodegradables

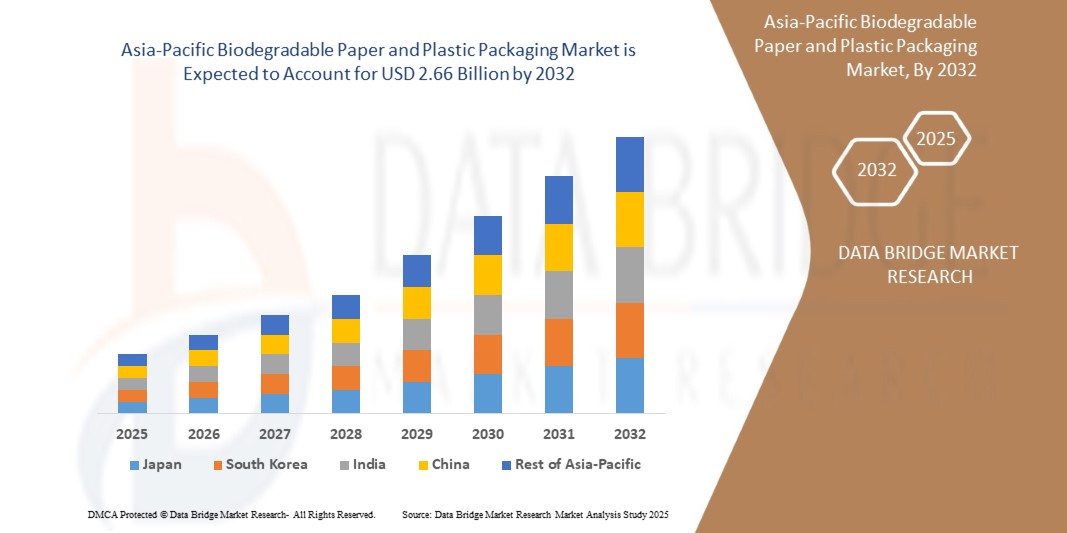

- El tamaño del mercado de envases de plástico y papel biodegradables de Asia-Pacífico se valoró en USD 1.14 mil millones en 2024 y se espera que alcance los USD 2.66 mil millones para 2032 , con una CAGR del 11,2% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida al aumento de la conciencia sobre los materiales que emiten menos carbono.

- Además, se prevé que el aumento de la urbanización en India y China, que aumenta la demanda de envases de papel y plástico biodegradables entre los consumidores, impulse aún más el crecimiento del mercado de envases de papel y plástico biodegradables.

Análisis del mercado de envases de papel y plástico biodegradables

- La creciente demanda en la industria del cuidado personal con la alta disponibilidad de materias primas para la fabricación de envases de papel y plástico biodegradables está impulsando el mercado de envases de papel y plástico biodegradables.

- China domina el mercado de envases de papel y plástico biodegradables con la mayor participación en los ingresos del 42,1 % en 2024, caracterizada por estrictas políticas gubernamentales orientadas a la reducción de residuos plásticos y la promoción de alternativas de base biológica.

- Se espera que India sea la región de más rápido crecimiento en el mercado de envases de papel y plástico biodegradables durante el período de pronóstico debido a la rápida urbanización, un sector de bienes de consumo de alta rotación en auge y un mayor enfoque regulatorio en los plásticos de un solo uso.

- Se espera que el segmento de plástico domine el mercado de envases de papel y plástico biodegradables con una participación de mercado del 54,2 % en 2024, impulsado por su versatilidad, facilidad de procesamiento y aplicación en varios formatos de envases, como bolsas.

Alcance del informe y segmentación del mercado de envases de papel y plástico biodegradables

|

Atributos |

Perspectivas clave del mercado de compuestos plásticos reforzados con fibra de vidrio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de envases de papel y plástico biodegradables

Integración de tecnologías de embalaje inteligente para una mayor sostenibilidad y trazabilidad

- Una tendencia importante en el mercado de envases biodegradables de Asia-Pacífico es la adopción de tecnologías de envases inteligentes, incluidos RFID, códigos QR y sensores IoT, para mejorar la trazabilidad y la sostenibilidad de los productos.

- Por ejemplo, las empresas en China están implementando cada vez más soluciones de embalaje inteligente habilitadas con RFID en la logística, mejorando la eficiencia de la cadena de suministro y la participación del consumidor.

- En Corea del Sur, la integración de las tecnologías NFC e IoT en soluciones de embalaje está ganando impulso, impulsada por la infraestructura tecnológica avanzada del país y el panorama industrial centrado en la innovación.

- La adopción de envases inteligentes se alinea con la creciente demanda de transparencia y eficiencia en las cadenas de suministro, particularmente en sectores como el comercio electrónico, la alimentación y la atención médica.

Dinámica del mercado de envases de papel y plástico biodegradables

Conductor

Creciente demanda de las industrias del comercio electrónico y del envasado de alimentos

- El crecimiento exponencial del comercio electrónico y de la industria del envasado de alimentos en la región Asia-Pacífico es un impulsor importante del mercado de envases de papel y plástico biodegradables.

- Los minoristas en línea y los proveedores de servicios de alimentos están invirtiendo en soluciones de envasado sostenibles y rentables para satisfacer las preferencias de los consumidores y los requisitos reglamentarios.

- La necesidad de embalajes eficientes, protectores y ecológicos en el comercio electrónico y los servicios de entrega de alimentos ha provocado una mayor demanda de materiales biodegradables.

- Esta tendencia se ve respaldada además por el creciente énfasis en la sostenibilidad ambiental, que genera una mayor demanda de opciones de embalaje reciclables y compostables.

Restricción/Desafío

Disponibilidad limitada de materias primas e infraestructura para envases biodegradables

- La disponibilidad limitada de materias primas, como los insumos agrícolas como el maíz y la caña de azúcar, plantea un desafío importante para el mercado.

- Estos materiales pueden verse limitados por las demandas competitivas de producción de alimentos o biocombustibles, lo que afecta el suministro constante para la producción de envases.

- Además, la falta de infraestructura adecuada, como instalaciones de compostaje industrial, en muchas regiones dificulta la degradación efectiva de materiales biodegradables.

- Esta brecha infraestructural, sumada a la posible contaminación de los flujos de reciclaje cuando los plásticos biodegradables se mezclan con plásticos convencionales, crea incertidumbre para los fabricantes y los consumidores.

Alcance del mercado de envases de papel y plástico biodegradables

El mercado está segmentado según tipo, material y usuario final.

- Por tipo

Según el tipo, el mercado de envases de papel y plástico biodegradables de Asia-Pacífico se segmenta en plástico y papel. El segmento de plástico domina la mayor cuota de mercado, con un 54,2 % en 2025, gracias a su versatilidad, facilidad de procesamiento y aplicación en diversos formatos de envase, como bolsas, películas y contenedores. Los plásticos biodegradables como el PLA, el PHA y el PBS están ganando terreno gracias a su compostabilidad, su rendimiento y su creciente adopción en los sectores de bienes de consumo de alta rotación y de reparto de alimentos. La prohibición gubernamental de los plásticos de un solo uso impulsa aún más la demanda.

Se prevé que el segmento de papel experimente la tasa de crecimiento más rápida, del 8,7 %, entre 2025 y 2032, impulsada por la creciente conciencia ambiental y la preferencia de los consumidores por materiales renovables y reciclables. Los envases biodegradables de papel son populares por su baja huella de carbono y su reciclabilidad, especialmente en alimentos secos, cuidado personal y aplicaciones minoristas. La expansión del comercio electrónico y la venta minorista ecológica también impulsa la demanda.

- Por material

Según el material, el mercado se segmenta en plástico y papel. El segmento de plásticos obtuvo la mayor cuota de mercado en 2025, gracias al uso generalizado de polímeros de origen biológico como el PLA y las mezclas de almidón. Estos materiales ofrecen un rendimiento comparable al de los plásticos convencionales, a la vez que contribuyen a los objetivos medioambientales. Su uso en soluciones de embalaje flexibles y rígidos los hace adecuados para diversas aplicaciones en los sectores minorista, de cuidado personal y industrial.

Se proyecta que el segmento de papel experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente demanda de alternativas basadas en fibra y la implementación de medidas de sustitución del plástico en los países de Asia-Pacífico. Los materiales de papel ofrecen alta imprimibilidad y biodegradabilidad, lo que los hace ideales para iniciativas de desarrollo de marca sostenible y ecoetiquetado.

- Por el usuario final

En función del usuario final, el mercado de envases de papel y plástico biodegradables de Asia-Pacífico se segmenta en envases, alimentos y bebidas, artículos de catering, cuidado personal y del hogar, atención médica y otros. El segmento de alimentos y bebidas domina la mayor cuota de mercado, con un 42,1 % en 2025, impulsado por la demanda de envases sostenibles en aplicaciones de comida rápida, comidas preparadas y bebidas. Las marcas están adoptando formatos biodegradables para alinearse con el consumo ecológico y reducir la dependencia del plástico.

Se prevé que el segmento de la salud experimente la tasa de crecimiento más rápida, del 9,8 %, entre 2025 y 2032, impulsada por el creciente escrutinio regulatorio sobre la eliminación de residuos y la necesidad de materiales biodegradables seguros y de un solo uso. Las aplicaciones en blísteres farmacéuticos, bandejas médicas y kits de diagnóstico impulsan su rápida adopción en los sectores de la salud regionales.

Análisis regional del mercado de envases de papel y plástico biodegradables

- China domina el mercado de envases de papel y plástico biodegradables con la mayor participación en los ingresos del 42,1 % en 2024, impulsada por estrictas políticas gubernamentales orientadas a la reducción de residuos plásticos y la promoción de alternativas de base biológica.

- La ampliación de la capacidad de fabricación y la creciente conciencia de los consumidores sobre los envases sostenibles son factores clave para el crecimiento.

Análisis del mercado de envases de papel y plástico biodegradables en India

El mercado indio de envases de papel y plástico biodegradables está creciendo rápidamente, con una tasa de crecimiento anual compuesta (TCAC) del 6,7 %, impulsada por la rápida urbanización, el auge del sector de bienes de consumo de alta rotación (FMCG) y una mayor atención regulatoria a los plásticos de un solo uso. Las Normas de Gestión de Residuos Plásticos de 2023 del gobierno están acelerando la adopción de envases biodegradables.

Análisis del mercado japonés de envases de papel y plástico biodegradables

Se proyecta que el mercado japonés de envases de papel y plástico biodegradables se expanda a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por la preferencia de los consumidores por envases ecológicos y los firmes compromisos corporativos con la sostenibilidad. Los avances tecnológicos en formulaciones de materiales biodegradables y los incentivos gubernamentales están facilitando una mayor adopción de soluciones de envasado sostenibles.

Cuota de mercado de envases de papel y plástico biodegradables

La industria de compuestos plásticos reforzados con fibra de vidrio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Industrias SmartSolve (India)

- STOROPACK HANS REICHENECKER GMBH (Alemania)

- Shanghai Disoxidation Enterprise Development Co. Ltd. (China)

- Stora Enso (Finlandia)

- Soluciones Tekpak (India)

- International Paper (EE. UU.)

- Sede de Be Green Packaging (India)

- Hsing Chung Paper Ltd. (Taiwán)

- Ecoware (India)

Últimos avances en el mercado de envases de papel y plástico biodegradables en Asia-Pacífico

- En octubre de 2024, la startup australiana Earthodic recaudó 6 millones de dólares en financiación inicial para impulsar su innovador recubrimiento protector reciclable para envases de papel y cartón. Este recubrimiento, elaborado a partir de lignina (un subproducto de la industria de la pulpa y el papel), refuerza las cajas y las impermeabiliza, ofreciendo una alternativa ecológica a los recubrimientos no reciclables. La financiación financiará el establecimiento de una sede en EE. UU. y la continuación de la investigación y el desarrollo, incluyendo la certificación de la FDA para vasos de café termosellables.

- En 2024, Nestlé inició un programa piloto en Australia, introduciendo envases de papel reciclable para sus paquetes de cuatro dedos de 45 g de KitKat. Realizado exclusivamente con supermercados Coles en Australia Occidental, Australia Meridional y el Territorio del Norte, este ensayo busca la opinión pública para perfeccionar el envase. A pesar de incorporar una fina película metálica de barrera para mantener la frescura del chocolate, la iniciativa supone un paso significativo en el compromiso de Nestlé de reducir el uso de plástico virgen en un tercio para 2025.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.