Asia Pacific Bioactive Ingredient Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

48.95 Billion

USD

91.95 Billion

2025

2033

USD

48.95 Billion

USD

91.95 Billion

2025

2033

| 2026 –2033 | |

| USD 48.95 Billion | |

| USD 91.95 Billion | |

|

|

|

|

El mercado de ingredientes bioactivos de Asia-Pacífico está segmentado por tipo de ingrediente (prebióticos, probióticos, aminoácidos, péptidos, omega 3 y lípidos estructurados, fitoquímicos y extractos de plantas, minerales, vitaminas, fibras y carbohidratos especiales, carotenoides y antioxidantes y otros), aplicación (alimentos funcionales, suplementos dietéticos, suplementos gomosos, nutrición animal, cuidado personal y otros) y fuente (planta, animal y microbiana), por país Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Nueva Zelanda, Vietnam, resto de Asia-Pacífico), tendencias del mercado y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de ingredientes bioactivos de Asia y el Pacífico

Análisis y perspectivas del mercado: mercado de ingredientes bioactivos de Asia y el Pacífico

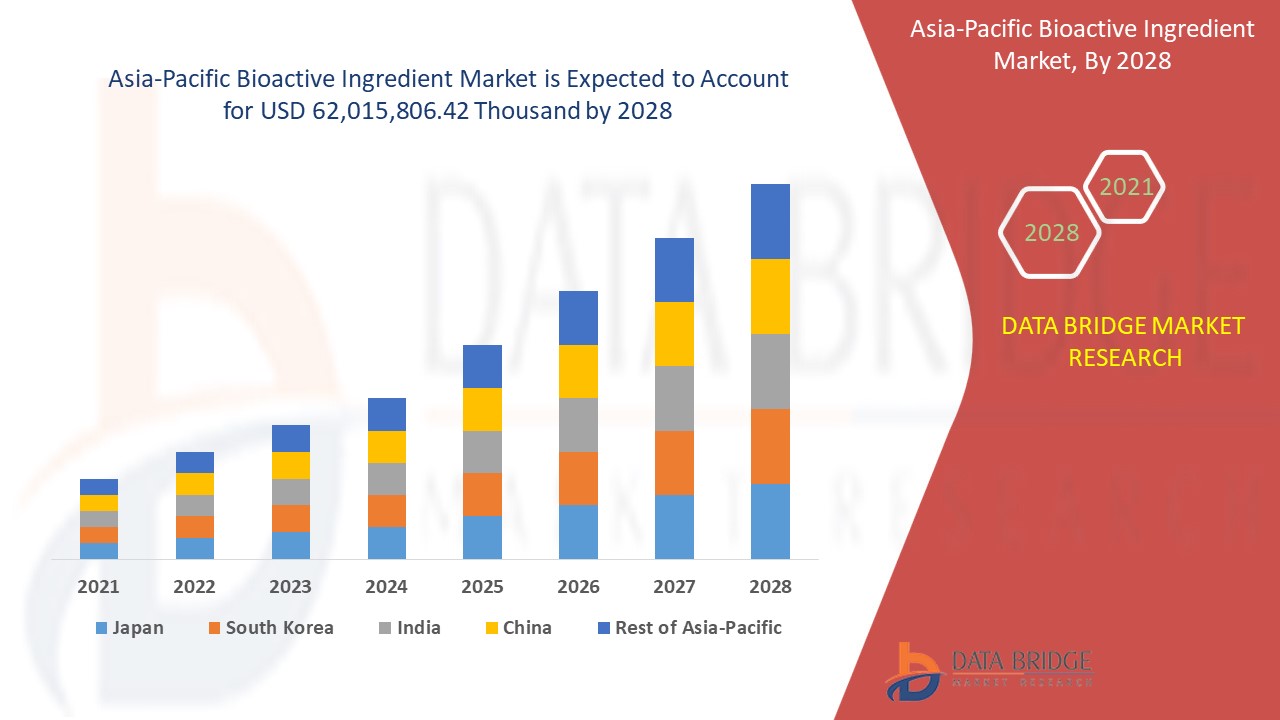

Se espera que el mercado de ingredientes bioactivos alcance los USD 62.015.806,42 mil para 2028 desde USD 23.504.077,80 mil en 2020, creciendo con una CAGR sustancial del 8,2% en el período de pronóstico de 2021 a 2028.

Los ingredientes bioactivos son sustancias que tienen un efecto biológico en los organismos vivos. Los componentes provienen de diversas fuentes, incluidas plantas, alimentos, animales, el mar y microorganismos. Las sustancias bioactivas se agregan a los alimentos y piensos para mejorar la salud física y fisiológica de los clientes. Los alimentos y bebidas funcionales , los suplementos nutricionales y la nutrición para recién nacidos hacen un uso extensivo de sustancias bioactivas. Estos productos químicos pueden ayudar a prevenir el cáncer, las enfermedades cardíacas y otras enfermedades.

Las sustancias bioactivas se utilizan ampliamente en diversos sectores, incluidos los alimentos y bebidas, los medicamentos y nutracéuticos, los artículos de cuidado personal y los alimentos para animales. Los carotenoides, los aceites esenciales y los antioxidantes son ejemplos de sustancias bioactivas que se utilizan en los alimentos funcionales para mejorar sus cualidades sensoriales y nutricionales. Son un tipo de biomoléculas que ayudan en el proceso metabólico de las moléculas saludables que se añaden a los alimentos y a diferentes tipos de productos.

Este informe de mercado de ingredientes bioactivos proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de ingredientes bioactivos en Asia y el Pacífico

Alcance y tamaño del mercado de ingredientes bioactivos en Asia y el Pacífico

El mercado de ingredientes bioactivos de Asia y el Pacífico se divide en tres segmentos importantes, que se basan en el tipo de ingrediente, la aplicación y la fuente. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo de ingrediente, el mercado global de ingredientes bioactivos se segmenta en prebióticos, probióticos, aminoácidos, péptidos , omega 3 y lípidos estructurados, fitoquímicos y extractos de plantas, minerales, vitaminas, fibras y carbohidratos especiales, carotenoides y antioxidantes, entre otros. Los prebióticos se segmentan además en fructanos, galactooligosacáridos, almidón y oligosacáridos derivados de la glucosa, oligosacáridos no carbohidratos y otros. Los probióticos se segmentan además en lactobacilos, bifidobacterias y levaduras. Los aminoácidos se segmentan además en isoleucina, histidina, leucina, lisina, metionina, fenilalanina, treonina, triptófano, valina y otros. Los péptidos se segmentan además en dipéptidos, tripéptidos, oligopéptidos y polipéptidos. Los minerales se dividen en calcio, fósforo, magnesio, sodio, potasio, manganeso, hierro, cobre, yodo, zinc y otros. Las vitaminas se dividen en vitamina A, vitamina C, vitamina D, vitamina E, vitamina K, vitamina B1, vitamina B2, vitamina B3, vitamina B6, vitamina B12 y otras.

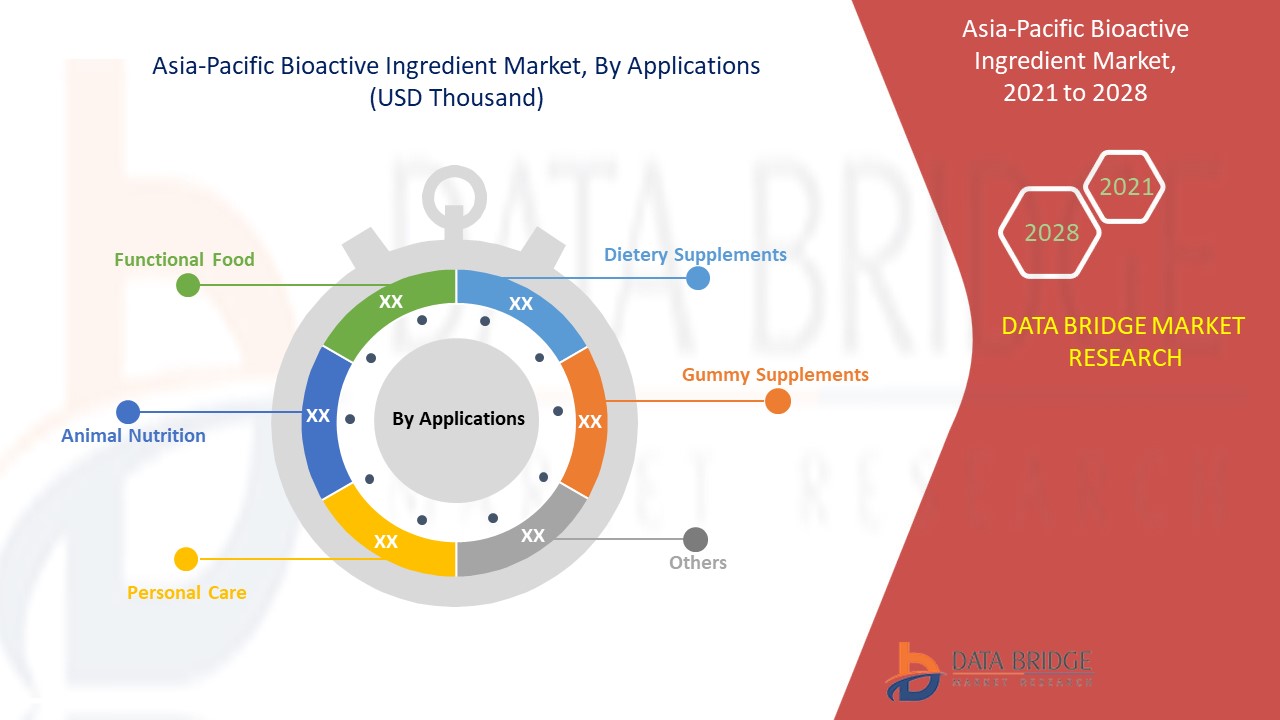

- En función de la aplicación, el mercado global de ingredientes bioactivos se segmenta en alimentos funcionales, suplementos dietéticos, suplementos gomosos, nutrición animal, cuidado personal y otros. Los alimentos funcionales se segmentan además en lácteos, alternativas lácteas, pan, pasta, cereales, productos de huevo, barras de bocadillos, barras y bebidas. Los lácteos se subdividen en leche, yogur, queso, mantequilla y otros. Las alternativas lácteas se subdividen en leche de origen vegetal, yogur de origen vegetal, ingredientes bioactivos y otros. Las barras se subdividen en barras de proteínas, barras de nutrición deportiva, barras de yoga, barras pre-entrenamiento, barras post-entrenamiento y otras. Las bebidas se subdividen en jugos y batidos. La nutrición animal se segmenta además por categoría animal en carne de res, aves, mariscos y cerdo. El cuidado personal se segmenta además en cuidado del cabello y cuidado de la piel.

- Según la fuente, el mercado mundial de ingredientes bioactivos se segmenta en vegetal, animal y microbiano.

Análisis a nivel de país del mercado de ingredientes bioactivos

Se analiza el mercado de Asia-Pacífico y se proporciona información sobre el tamaño del mercado por ingrediente, aplicación y fuente.

Los países cubiertos en el informe del mercado de recubrimientos hidrofóbicos de Asia-Pacífico son Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Nueva Zelanda, Vietnam y el resto de Asia-Pacífico.

Región de Asia y el Pacífico debido al crecimiento de la población y al aumento de enfermedades en un sector importante de la sociedad.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Crecimientos en la industria de ingredientes bioactivos

El mercado de ingredientes bioactivos de Asia y el Pacífico también le proporciona un análisis detallado del mercado para cada país, el crecimiento de la base instalada de diferentes tipos de productos para el mercado de ingredientes bioactivos, el impacto de la tecnología mediante curvas de línea de vida y los cambios en los escenarios regulatorios de las fórmulas infantiles y su impacto en el mercado de recubrimientos hidrofóbicos. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de los ingredientes bioactivos

El panorama competitivo del mercado de ingredientes bioactivos de Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de ensayos clínicos, el análisis de marca, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de recubrimientos hidrofóbicos de Asia-Pacífico.

Los principales actores del mercado involucrados en el mercado global de ingredientes bioactivos son DSM, BASF SE, Kerry, DuPont, ADM, Global Bio-chem Technology Group Company Limited, Evonik Industries AG, Cargill, Incorporated, Arla Food Ingredients Group P/S (una subsidiaria de Arla Foods amba), FMC Corporation, Sunrise Nutrachem Group, Adisseo (una subsidiaria de Bluestar Adisseo Co., Ltd.), Chr.Hansen Holding A/S, Sabinsa, Ajinomoto Co., Inc, NOVUS INTERNATIONAL (una subsidiaria de Mitsui & Co. (USA), Inc.), Ingredion, Roquette Frères, Probi y Advanced Animal Nutrition Pty Ltd. entre otros.

Por ejemplo,

- En mayo de 2021, Chr. Hansen Holding A/S presentó una nueva solución para mejorar la salud y el rendimiento del ganado lechero y de carne. Esta solución se desarrolló para ofrecer un probiótico flexible que se pueda utilizar en una variedad de aplicaciones alimenticias.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.