Asia Pacific Aseptic Sampling Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

143.60 Million

USD

343.05 Million

2024

2032

USD

143.60 Million

USD

343.05 Million

2024

2032

| 2025 –2032 | |

| USD 143.60 Million | |

| USD 343.05 Million | |

|

|

|

|

Segmentación del mercado de muestreo aséptico en Asia-Pacífico, por tipo (muestreo aséptico manual y automatizado), técnica (muestreo fuera de línea, en línea y en línea), aplicación (procesos previos y posteriores), usuario final (fabricantes de biotecnología y productos farmacéuticos, empresas de fabricación por contrato, empresas de investigación por contrato, departamentos académicos y de I+D, entre otros), canal de distribución (licitación directa, distribuidor externo, entre otros): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de muestreo aséptico en Asia-Pacífico

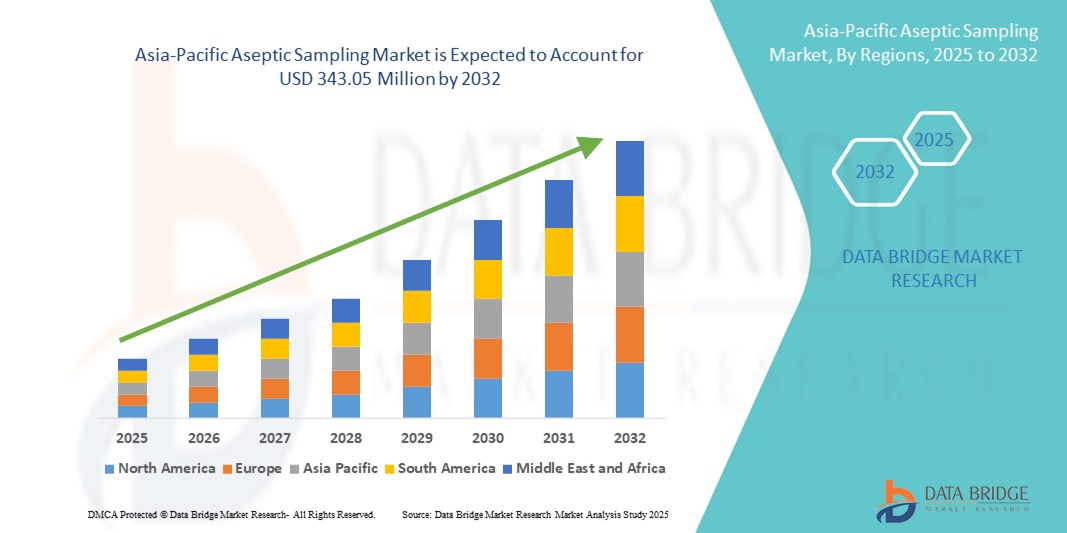

- El tamaño del mercado de muestreo aséptico de Asia-Pacífico se valoró en USD 143,60 millones en 2024 y se espera que alcance los USD 343,05 millones para 2032 , con una CAGR del 11,50 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la mayor concienciación sobre el control de la contaminación, el aumento de las actividades de fabricación biofarmacéutica y los avances en las tecnologías de procesamiento aséptico en Asia-Pacífico, lo que permite un muestreo eficiente y estéril en entornos de producción. La región está experimentando un auge en la fabricación de productos biológicos, vacunas y terapias avanzadas, especialmente en países en rápida industrialización como India, China y Corea del Sur, lo que contribuye a la creciente adopción de soluciones de muestreo aséptico.

- Además, la creciente inversión en infraestructura farmacéutica y biotecnológica, la expansión de las plantas de fabricación en zonas rurales y semiurbanas, y el aumento de las colaboraciones público-privadas impulsan la innovación y la disponibilidad de sistemas avanzados de muestreo aséptico. Las iniciativas gubernamentales que promueven el cumplimiento de la calidad, junto con la creciente presencia de empresas internacionales de ciencias de la vida y la capacidad de fabricación local, están impulsando significativamente el crecimiento del mercado de muestreo aséptico en Asia-Pacífico.

Análisis del mercado de muestreo aséptico en Asia-Pacífico

- Las soluciones de muestreo aséptico, que garantizan la recolección de muestras sin contaminación en la industria farmacéutica, biotecnológica y de alimentos y bebidas, están experimentando una creciente adopción en la región Asia-Pacífico, impulsada por la expansión de la producción de productos biológicos, requisitos regulatorios más estrictos y el aumento de las inversiones en infraestructura para salas blancas. Países como China, India, Japón y Corea del Sur están fortaleciendo significativamente sus capacidades de procesamiento aséptico para satisfacer la demanda tanto del mercado nacional como de exportación.

- La creciente tendencia hacia sistemas de muestreo aséptico de un solo uso en lugar de los métodos reutilizables tradicionales se sustenta en su menor riesgo de contaminación, eficiencia operativa y rentabilidad en entornos de alto cumplimiento normativo. Además, la creciente base de fabricación biofarmacéutica de la región, en particular en la producción de vacunas y anticuerpos monoclonales, está acelerando la demanda de soluciones de muestreo aséptico innovadoras y prevalidadas.

- China dominó el mercado de muestreo aséptico en Asia-Pacífico, representando la mayor participación en los ingresos, con un 38,5 % en 2024. Esto se debió a la capacidad de fabricación farmacéutica a gran escala, la rápida expansión de las instalaciones de productos biológicos y vacunas, y las iniciativas gubernamentales para mejorar el cumplimiento de las BPM. La fuerte presencia de fabricantes nacionales de equipos y las colaboraciones tecnológicas con empresas occidentales impulsan aún más la adopción.

- Se proyecta que India registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,85 %, entre 2025 y 2032, en el mercado de muestreo aséptico de Asia-Pacífico, impulsada por el rápido crecimiento de las exportaciones biofarmacéuticas , los incentivos gubernamentales del programa de Incentivos Vinculados a la Producción (PLI) y el aumento de las inversiones en infraestructura para salas blancas y procesamiento estéril. El creciente sector de fabricación por contrato y servicios de investigación del país también está generando nuevas oportunidades para sistemas avanzados de muestreo aséptico.

- El segmento de procesos upstream dominó el mercado de muestreo aséptico de Asia-Pacífico con una participación del 62,5 % en 2024, dado que el muestreo aséptico es crucial durante las etapas de cultivo celular y fermentación para garantizar la detección temprana de la contaminación y mantener la calidad del producto. Este segmento se beneficia de las crecientes inversiones en I+D biofarmacéutico y del aumento de la producción de productos biológicos en China, India y Corea del Sur.

Alcance del informe y segmentación del mercado de muestreo aséptico en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de muestreo aséptico en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de muestreo aséptico en Asia-Pacífico

Crecientes avances tecnológicos y expansión de la investigación biofarmacéutica

- Una tendencia importante y en auge en el mercado de muestreo aséptico de Asia-Pacífico es la rápida adopción de tecnologías avanzadas de muestreo estéril para apoyar la creciente producción biofarmacéutica y la investigación clínica en la región. La transición hacia productos biológicos, vacunas y terapias celulares y génicas de alto valor impulsa la demanda de métodos de muestreo precisos y sin contaminación que cumplan con los estrictos requisitos regulatorios.

- Por ejemplo, los principales fabricantes farmacéuticos e institutos de investigación de toda la región están invirtiendo en soluciones de muestreo aséptico de sistemas cerrados, incluidos conjuntos de un solo uso, dispositivos de muestreo automatizados y sistemas de monitoreo integrados, para mejorar la confiabilidad del proceso y reducir el riesgo de ingreso de microbios.

- La creciente adopción de marcos de tecnología analítica de procesos (PAT) en las plantas de fabricación permite la monitorización de la calidad en tiempo real, mejora la eficiencia de la producción y garantiza el cumplimiento de las Buenas Prácticas de Fabricación (BPF). Estos avances son especialmente cruciales para entornos de alta contención, como laboratorios con niveles de bioseguridad (BSL) y unidades de producción de vacunas.

- Las colaboraciones entre fabricantes de equipos, empresas de biotecnología y centros de investigación académica están acelerando el despliegue de soluciones de muestreo innovadoras. Las iniciativas respaldadas por los gobiernos y las reformas regulatorias favorables en países como China, India, Japón y Corea del Sur también están mejorando el acceso al mercado y apoyando la transferencia de tecnología para procesos asépticos avanzados.

- A medida que Asia-Pacífico continúa emergiendo como un centro global para la producción biofarmacéutica, se espera que el mercado de muestreo aséptico experimente un crecimiento sostenido, impulsado por la innovación tecnológica, las capacidades de fabricación mejoradas y el papel cada vez mayor de la región en la actividad global de ensayos clínicos.

Dinámica del mercado de muestreo aséptico en Asia-Pacífico

Conductor

Necesidad creciente debido al aumento de la producción biofarmacéutica y los avances en la monitorización de bioprocesos

- La creciente adopción de la fabricación de productos biológicos y biosimilares en Asia-Pacífico, respaldada por las crecientes inversiones en infraestructura farmacéutica y la mejora de las medidas de control de calidad, está impulsando significativamente el crecimiento del mercado. Países como China, India, Corea del Sur y Singapur están mejorando sus capacidades de bioprocesamiento y sus marcos regulatorios, lo que permite estándares de esterilidad más altos y una calidad de producto fiable para la producción a gran escala.

- Por ejemplo, en marzo de 2024, Sartorius AG (Alemania) anunció la expansión de su cartera de soluciones de bioprocesamiento en Asia-Pacífico, incluyendo sistemas avanzados de muestreo aséptico para satisfacer la creciente demanda en la fabricación de biotecnología. Se espera que estas innovaciones impulsen la adopción de métodos de muestreo de alto rendimiento, impulsando así el mercado de muestreo aséptico en Asia-Pacífico durante el período previsto.

- El creciente interés en el bioprocesamiento continuo y la disponibilidad de tecnologías de muestreo aséptico de última generación (como sistemas automatizados de un solo uso) están impulsando un cambio del muestreo manual convencional a soluciones de monitoreo más precisas, libres de contaminación y en tiempo real.

- Los organismos reguladores de Asia-Pacífico, como la Administración de Productos Terapéuticos (TGA) en Australia y la Administración Nacional de Productos Médicos (NMPA) en China, apoyan cada vez más la innovación en la fabricación aséptica mediante aprobaciones optimizadas, incentivos de cumplimiento de las Buenas Prácticas de Fabricación (GMP) y programas de capacitación para operadores de procesos.

- Las colaboraciones entre empresas biotecnológicas regionales, organizaciones de fabricación por contrato (OFC) y centros de investigación académica están fortaleciendo el ecosistema de innovación en Asia-Pacífico. Estas alianzas son fundamentales para ampliar el acceso a sistemas de muestreo avanzados, ampliar las iniciativas de optimización de procesos y fomentar el conocimiento de las prácticas de fabricación estéril en diversas instalaciones de producción.

Restricción/Desafío

Infraestructura limitada y variabilidad en la adopción de tecnología

- El alto costo asociado con los sistemas avanzados de muestreo aséptico (incluidas las unidades automatizadas, los consumibles de un solo uso y los dispositivos integrados de monitoreo de procesos) plantea una barrera sustancial para su adopción generalizada, especialmente en el Sudeste Asiático y las zonas de fabricación rurales con presupuestos de capital limitados.

- Incluso cuando los marcos regulatorios promueven el cumplimiento de las BPM, la implementación de sistemas asépticos de vanguardia generalmente requiere actualizaciones sofisticadas de las instalaciones, capacitación de los operadores y procesos de validación, lo que los hace menos factibles para los fabricantes a pequeña escala.

- Además, los ingenieros de procesos especializados y los expertos en validación suelen concentrarse en centros industriales urbanos. Esta disparidad geográfica obliga a las unidades de producción más pequeñas a externalizar el muestreo aséptico o a operar con métodos manuales deficientes.

- Otro desafío es la falta de protocolos estandarizados para el muestreo aséptico en la producción de productos biológicos y terapia celular/génica. Debido a la escasez de datos de campo y a la familiaridad de los operadores, especialmente en instalaciones nuevas en la tecnología de un solo uso, la adopción de sistemas de muestreo innovadores sigue siendo inconsistente.

- Para superar estos desafíos, las reformas políticas, el aumento de los subsidios gubernamentales, los programas de capacitación para toda la industria y el establecimiento de centros regionales de excelencia en bioprocesamiento serán esenciales para ampliar el acceso y lograr un crecimiento sostenible en el mercado de muestreo aséptico de Asia y el Pacífico.

Alcance del mercado de muestreo aséptico en Asia-Pacífico

El mercado está segmentado según tipo, técnica, aplicación, usuario final y canal de distribución.

- Por tipo

Según el tipo, el mercado se segmenta en muestreo aséptico manual y muestreo aséptico automatizado/instrumentos. El muestreo aséptico manual representó la mayor cuota de mercado, con un 57,8 %, en 2024, gracias a su amplia aplicación en las líneas de producción farmacéutica y biotecnológica tradicionales. Su atractivo reside en la baja inversión inicial, la flexibilidad operativa y la facilidad de implementación, lo que lo convierte en la opción preferida de pequeñas empresas biofarmacéuticas, laboratorios académicos e instituciones de investigación de la región Asia-Pacífico. Este segmento sigue siendo una solución rentable, especialmente en países donde las industrias biofarmacéuticas se encuentran en fase de crecimiento y la infraestructura para la automatización avanzada sigue siendo limitada.

Se prevé que el muestreo aséptico automatizado/instrumentos alcance la mayor tasa de crecimiento anual compuesta (TCAC) del 10,3 % entre 2025 y 2032, a medida que los fabricantes avanzan hacia la automatización y la biofabricación digital para mejorar la reproducibilidad, la eficiencia y la esterilidad en los flujos de trabajo de producción. El muestreo automatizado facilita la monitorización continua, los procesos de alto rendimiento y el control de calidad en tiempo real, minimizando el error humano y ajustándose a las expectativas regulatorias globales. El aumento de las inversiones en productos biológicos de última generación, biosimilares y terapias avanzadas impulsa aún más la demanda, especialmente en los principales centros biofarmacéuticos de Asia-Pacífico, como Singapur, India y Australia, donde las grandes instalaciones están adoptando modelos de la Industria 4.0 y fábricas inteligentes.

- Por técnica

Según la técnica, el mercado se segmenta en técnicas de muestreo fuera de línea, en línea y aséptico en línea. El segmento de técnicas de muestreo fuera de línea representó la mayor participación (46,8 %) en 2024, ya que se utiliza ampliamente en procesos rutinarios de control de calidad, donde las muestras se extraen físicamente y se analizan por separado en laboratorios. Este método ofrece flexibilidad en los parámetros de prueba y se utiliza comúnmente en instalaciones más pequeñas de India, China y el Sudeste Asiático.

Se espera que el segmento de muestreo aséptico en línea registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,8 %, impulsada por el impulso hacia la monitorización continua de bioprocesos, la automatización y la reducción del riesgo de contaminación. Su adopción es significativa en la fabricación de productos biológicos de alto valor e inyectables estériles en los mercados avanzados de Asia-Pacífico.

- Por aplicación

Según la aplicación, el mercado se clasifica en procesos upstream y downstream. El segmento de procesos upstream lideró el mercado con una participación del 62,5 % en 2024, dado que el muestreo aséptico es crucial durante las etapas de cultivo celular y fermentación para garantizar la detección temprana de la contaminación y mantener la calidad del producto. Este segmento se beneficia de las crecientes inversiones en I+D biofarmacéutico y del aumento de la producción de productos biológicos en China, India y Corea del Sur.

Se prevé que el segmento de procesos downstream crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 8,9 %, entre 2025 y 2032, impulsado por la creciente complejidad de los procesos de purificación, filtración y formulación, que exigen frecuentes controles de calidad en condiciones estériles. La expansión de la producción de biosimilares en Asia-Pacífico también está impulsando la demanda en este segmento.

- Por el usuario final

En función del usuario final, el mercado se segmenta en fabricantes de biotecnología y productos farmacéuticos, organizaciones de fabricación por contrato (CMO), organizaciones de investigación por contrato (CRO), departamentos académicos y de I+D, entre otros. El segmento de fabricantes de biotecnología y productos farmacéuticos tuvo la mayor participación, con un 51,3 %, en 2024, gracias al uso generalizado del muestreo aséptico en las instalaciones de producción a gran escala de productos biológicos, vacunas y fármacos estériles. Se prevé que el aumento de las inversiones en plantas de fabricación de productos biológicos en India, China y Singapur mantenga el dominio del segmento.

Se proyecta que el segmento de organizaciones de fabricación por contrato (CMO) crecerá a la CAGR más rápida del 9,5 % entre 2025 y 2032, respaldado por la tendencia de subcontratación en la fabricación biofarmacéutica, donde los socios contractuales deben cumplir con rigurosos estándares de procesamiento aséptico.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitación directa, distribuidores externos y otros. El segmento de licitación directa dominó el mercado con una cuota de mercado del 47,1 % en 2024, dado que la contratación masiva por parte de grandes compañías farmacéuticas, CMO e instituciones gubernamentales de investigación es una práctica común en la región Asia-Pacífico. Este canal garantiza la rentabilidad y el cumplimiento de las políticas de contratación institucional.

Se espera que el segmento de distribuidores externos crezca a la CAGR más rápida del 10,1 % entre 2025 y 2032, impulsado por el aumento de distribuidores especializados en ciencias biológicas que ofrecen soporte técnico localizado, plazos de entrega más rápidos y soluciones de gestión de inventario personalizadas.

Análisis regional del mercado de muestreo aséptico en Asia-Pacífico

- Asia-Pacífico tuvo una participación de mercado del 22,6 % en el mercado mundial de muestreo aséptico en 2024, impulsada por la rápida expansión de la fabricación biofarmacéutica en la región, la creciente adopción de sistemas avanzados de monitoreo de procesos y el enfoque creciente en mantener la esterilidad en la producción de productos biológicos a gran escala.

- Marcos regulatorios sólidos, como los mandatos de cumplimiento de las BPM y el PIC/S, junto con el aumento de las inversiones en instalaciones de vacunas y biosimilares, están impulsando el crecimiento de las compañías farmacéuticas nacionales y multinacionales. Las alianzas público-privadas y los incentivos gubernamentales para la expansión de la capacidad biotecnológica están acelerando aún más la adopción de tecnologías de muestreo aséptico en la región.

- Además, Asia-Pacífico alberga varios fabricantes líderes de equipos de procesamiento aséptico y centros de I+D, lo que facilita la innovación continua de productos, mejoras en la validación de procesos y programas mejorados de capacitación de operadores.

Análisis del mercado de muestreo aséptico en China y Asia-Pacífico

El mercado chino de muestreo aséptico dominó el mercado de Asia-Pacífico, representando la mayor participación en los ingresos, con un 38,5 % en 2024. Este mercado fue impulsado por la capacidad de fabricación farmacéutica a gran escala, la rápida expansión de las instalaciones de producción de productos biológicos y vacunas, y las iniciativas gubernamentales para mejorar el cumplimiento de las BPM. La sólida presencia de fabricantes nacionales de equipos asépticos y el aumento de las colaboraciones tecnológicas con empresas occidentales están impulsando aún más las tasas de adopción. Además, el impulso de China hacia la autosuficiencia en equipos de bioprocesamiento de alto valor está impulsando la innovación local en sistemas de muestreo aséptico automatizados y de un solo uso.

Análisis del mercado de muestreo aséptico en Japón y Asia-Pacífico

El mercado japonés de muestreo aséptico representó el 19,2 % de la cuota de mercado de Asia-Pacífico en 2024, gracias a su sector farmacéutico altamente avanzado, sus sólidos estándares de validación de bioprocesos y la temprana adopción de sistemas de muestreo automatizados en la producción de terapias celulares y génicas. El fuerte enfoque del país en el control de calidad, la alta inversión en I+D en productos biológicos y la financiación gubernamental estratégica para la medicina regenerativa consolidan aún más su posición en el mercado.

Análisis del mercado de muestreo aséptico en India y Asia-Pacífico

Se proyecta que el mercado indio de muestreo aséptico registre la tasa de crecimiento anual compuesta (TCAC) más rápida del 12,85 % entre 2025 y 2032 en el mercado de Asia-Pacífico, impulsado por el rápido crecimiento de las exportaciones biofarmacéuticas, los incentivos gubernamentales del programa de Incentivos Vinculados a la Producción (PLI) y el aumento de las inversiones en infraestructura para salas blancas y procesamiento estéril. Los sectores en expansión de la fabricación por contrato y las organizaciones de investigación por contrato (CRO) del país también están creando nuevas oportunidades para la implementación de sistemas avanzados de muestreo aséptico, en particular plataformas de un solo uso y automatizadas que facilitan la producción de productos biológicos a gran escala.

Cuota de mercado del muestreo aséptico en Asia-Pacífico

La industria de muestreo aséptico de Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Sartorius AG (Alemania)

- KEOFITT A/S (Dinamarca)

- KIESELMANN GmbH (Alemania)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Grupo GEMU (Alemania)

- Flownamics (EE. UU.)

- Merck KGaA (Alemania)

- Advanced Microdevices Pvt. Ltd. (MDI) (India)

- Saint-Gobain (Francia)

- Grupo GEA Aktiengesellschaft (Alemania)

- Avantor, Inc. (EE. UU.)

- ALFA LAVAL (Suecia)

- WL Gore & Associates, Inc. (EE. UU.)

- Sistemas de muestreo QualiTru (EE. UU.)

- Aerre Inox Srl (Italia)

- Shanghai LePure Biotech Co., Ltd. (China)

- Joneng Valves Co., Limited (China)

- Burkle GmbH (Alemania)

- Dietrich Engineering Consultants (Suiza)

Últimos avances en el mercado de muestreo aséptico de Asia-Pacífico

- En marzo de 2023, Sartorius AG anunció una expansión estratégica de sus capacidades de producción de bioprocesamiento y servicio al cliente en Corea del Sur y en toda Asia-Pacífico, con el objetivo de respaldar la creciente demanda en biofarmacia y muestreo aséptico.

- En junio de 2022, Merck kGaA anunció una colaboración con Agilent Technologies para cubrir la necesidad de la industria en tecnologías analíticas de procesos para el procesamiento posterior. Esta colaboración contribuirá a un mayor aumento de los ingresos.

- En noviembre de 2021, Sartorius AG, un socio internacional líder en investigación de ciencias de la vida y la industria biofarmacéutica, anunció que había sido galardonado como "Mejor proveedor de bioprocesamiento general" en los Premios a la Excelencia en Bioprocesamiento de Europa 2021. Este premio ha ayudado a la empresa a obtener reconocimiento por su trabajo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.